Golden Trust 2025 Review: Everything You Need to Know

Summary: The Golden Trust brokerage has garnered significant scrutiny in the financial community, primarily due to its lack of regulation and negative user experiences. Many experts advise against using this broker, citing concerns over safety and trustworthiness. The absence of oversight from reputable financial authorities raises red flags for potential investors.

Notice: Its crucial to note that there are multiple entities operating under similar names, which can lead to confusion. This review focuses specifically on the Golden Trust broker operating in the UK, as identified in various sources.

Rating Overview

How We Rate Brokers: Our ratings are based on a comprehensive analysis of user feedback, expert opinions, and regulatory information.

Broker Overview

Golden Trust was established in 2020 and primarily operates out of the United Kingdom. The broker provides trading services through the MT4 platform, which is widely recognized for its user-friendly interface and extensive features. However, it is essential to highlight that Golden Trust is not regulated by any top-tier financial authority, which raises significant concerns regarding its legitimacy and the safety of client funds. The broker claims to offer a variety of trading assets, but its unregulated status casts doubt on the reliability of these offerings.

Detailed Breakdown

Regulatory Status

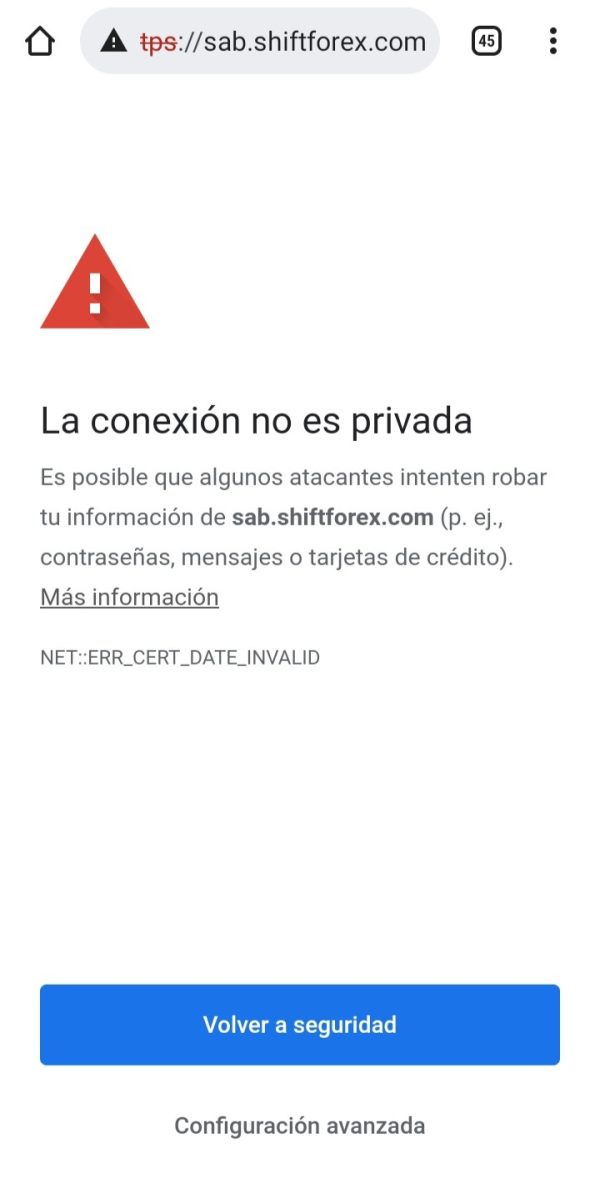

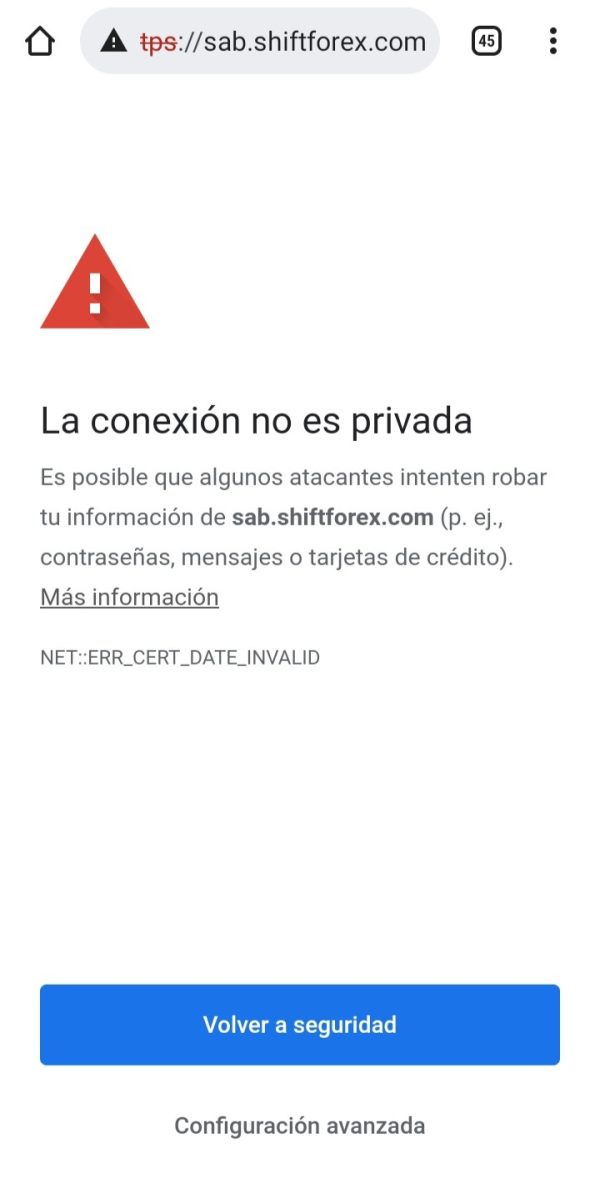

Golden Trust operates without oversight from any recognized regulatory body. According to multiple sources, including WikiFX and BrokerChooser, the broker is not registered with any top-tier financial authorities such as the FCA (Financial Conduct Authority) in the UK or the SEC (Securities and Exchange Commission) in the US. This lack of regulation is a significant warning sign for potential investors, as unregulated brokers often engage in dubious practices and provide minimal protection for clients.

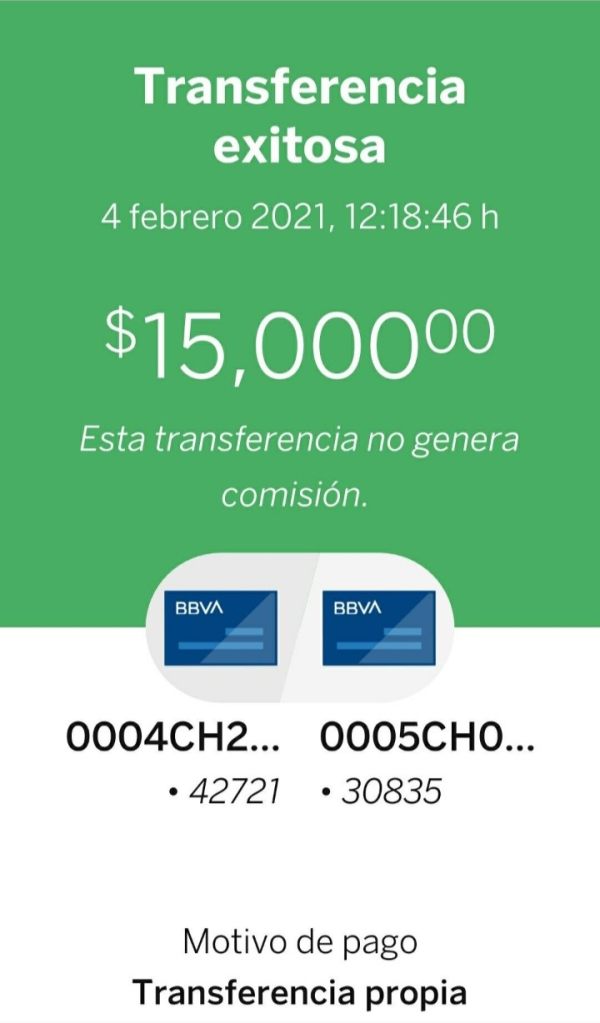

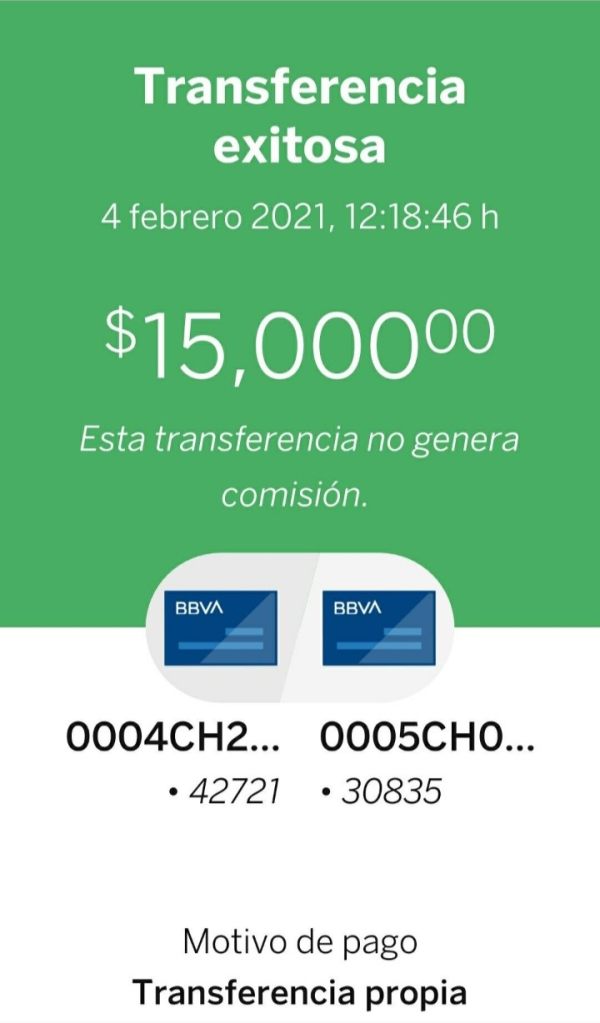

Deposit/Withdrawal Options

The broker reportedly allows deposits and withdrawals in various currencies, but specific details about supported cryptocurrencies are unclear. Additionally, the absence of a clear minimum deposit requirement raises further concerns. According to user feedback, the withdrawal process can be problematic, with some users reporting difficulties in accessing their funds after making requests.

There is little information available about any bonuses or promotions offered by Golden Trust. This lack of transparency may indicate that the broker does not prioritize attracting clients through competitive offers, which is often a red flag in the brokerage industry.

Asset Classes Available

Golden Trust claims to offer a range of tradable assets, including forex pairs, commodities, and possibly cryptocurrencies. However, without regulatory oversight, the quality and execution of these trades remain uncertain. Users have expressed concerns regarding the broker's trading environment, suggesting that there may be issues with execution speed and pricing.

Costs (Spreads, Fees, Commissions)

While specific fee structures are not well-documented, the general consensus among reviewers is that Golden Trust may impose unfavorable trading conditions. The lack of transparency regarding spreads and commissions is alarming, as it is crucial for traders to understand the costs associated with their trades.

Leverage

Information on leverage options provided by Golden Trust is sparse. However, unregulated brokers typically offer higher leverage, which can be attractive to traders but also poses significant risks. Users should be cautious when dealing with brokers that do not clearly outline their leverage policies.

Golden Trust primarily operates on the MT4 trading platform, which is known for its robust features and user-friendly design. However, the absence of a regulated environment raises questions about the reliability of the platform and the safety of users' data.

Restricted Regions

Golden Trust does not provide clear information on restricted regions, which could be problematic for traders from certain jurisdictions. Engaging with an unregulated broker can lead to complications, especially for clients seeking legal recourse in the event of disputes.

Available Customer Service Languages

According to various reviews, Golden Trust offers customer service in multiple languages, including English. However, users have reported long wait times and unresponsive support, which can be frustrating for traders seeking assistance.

Rating Overview (Revisited)

Detailed Analysis of Ratings

Account Conditions (2/10)

The account conditions at Golden Trust are far from favorable. The absence of regulatory oversight significantly diminishes the trustworthiness of the broker, as clients have reported issues with account management and fund accessibility.

While Golden Trust utilizes the MT4 platform, the lack of additional trading tools or resources limits the overall trading experience. Users have expressed a desire for more educational content and market analysis.

Customer Service and Support (4/10)

Customer service has received mixed reviews. Although support is available in multiple languages, many users have reported slow response times and inadequate assistance when issues arise.

Trading Setup (3/10)

The trading setup is marred by the broker's unregulated status, which raises concerns about execution quality and pricing transparency. Users have reported delays and discrepancies in trade execution.

Trustworthiness (1/10)

The trustworthiness of Golden Trust is severely compromised due to its lack of regulation and numerous negative user experiences. Many sources recommend avoiding this broker altogether.

User Experience (2/10)

Overall user experience has been unfavorable, with many traders expressing frustration over withdrawal issues and the broker's lack of transparency regarding fees and trading conditions.

In conclusion, the Golden Trust review paints a concerning picture of a broker that lacks the necessary regulatory oversight to ensure a safe trading environment. Potential investors are strongly advised to consider alternatives that offer robust regulatory frameworks and transparent trading conditions.