Huixin 2025 Review: Everything You Need to Know

Executive Summary

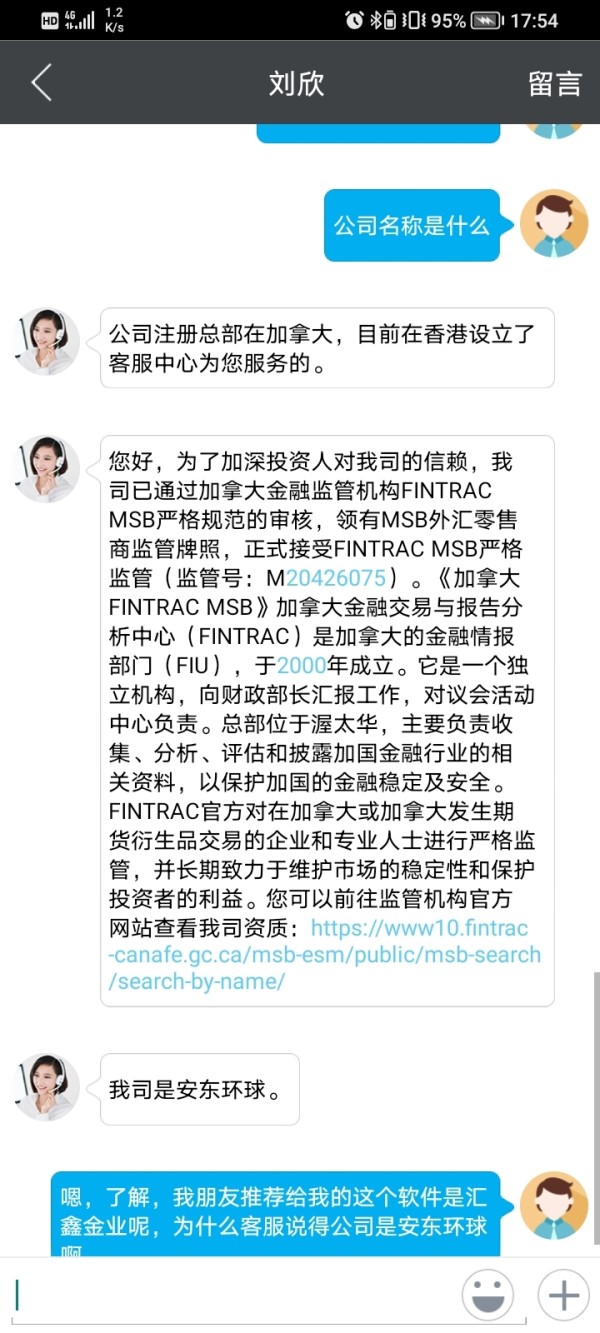

Huixin is a new forex broker that started in 2021. The company has its main office in Hong Kong and offers many trading products like forex, commodities, precious metals, and stocks. But this huixin review shows big problems with the broker's reputation and how reliable it is. WikiFX monitoring gives Huixin a very low rating of 1.43 out of 10. They have also marked it as a fake platform that tricks people. The broker gets users by offering many different assets and customer support in Chinese, but bad user reviews and fraud complaints have hurt its reputation badly.

The platform mainly targets forex traders and investors who want to trade many different types of assets. They especially focus on people who need Chinese language support. Even though the broker offers various trading tools, its track record shows many user complaints and bad reviews, which makes people question if it operates honestly. Traders should be very careful when thinking about using Huixin as their trading partner because there are many negative reviews and fraud claims on multiple review websites.

Important Notice

Huixin has its headquarters in Hong Kong, so regulatory protection can be very different depending on where you live. Users should check carefully to see what regulatory status applies to their area before working with this broker. This review looks at public information and user feedback from many sources in a complete way. The way we evaluate things uses data from WikiFX monitoring systems, user fraud reports, and information that is available about the broker. Since there is limited regulatory transparency and many fraud claims, people who might become clients should research very carefully before putting any money at risk.

Rating Framework

Broker Overview

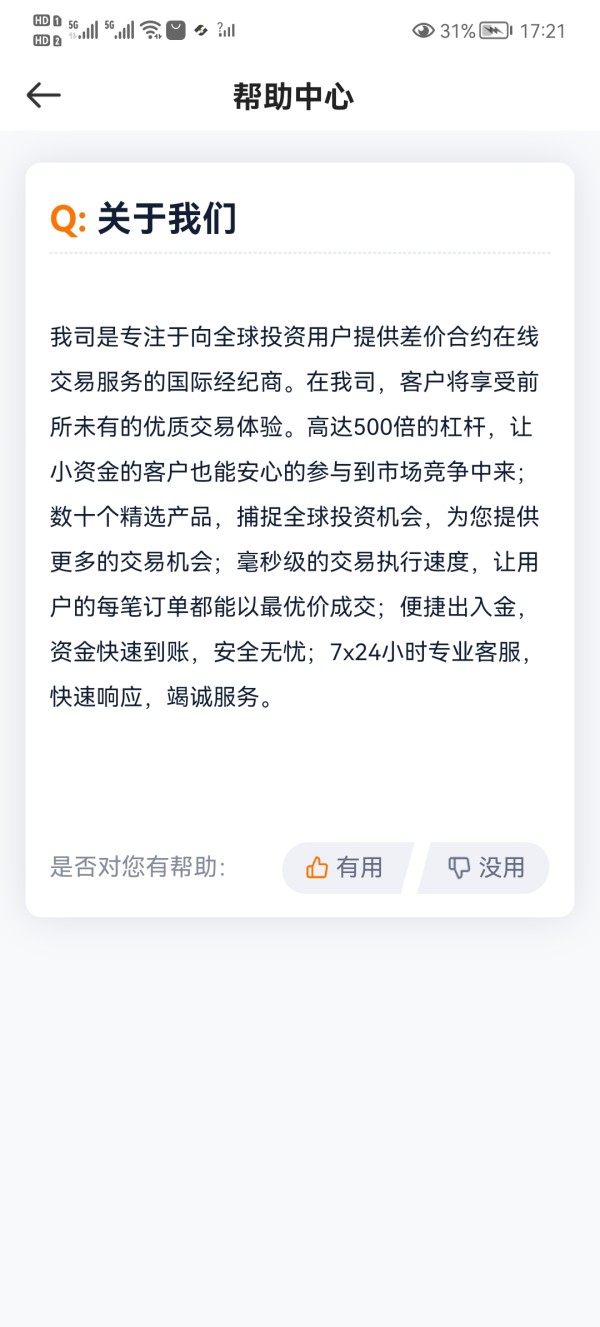

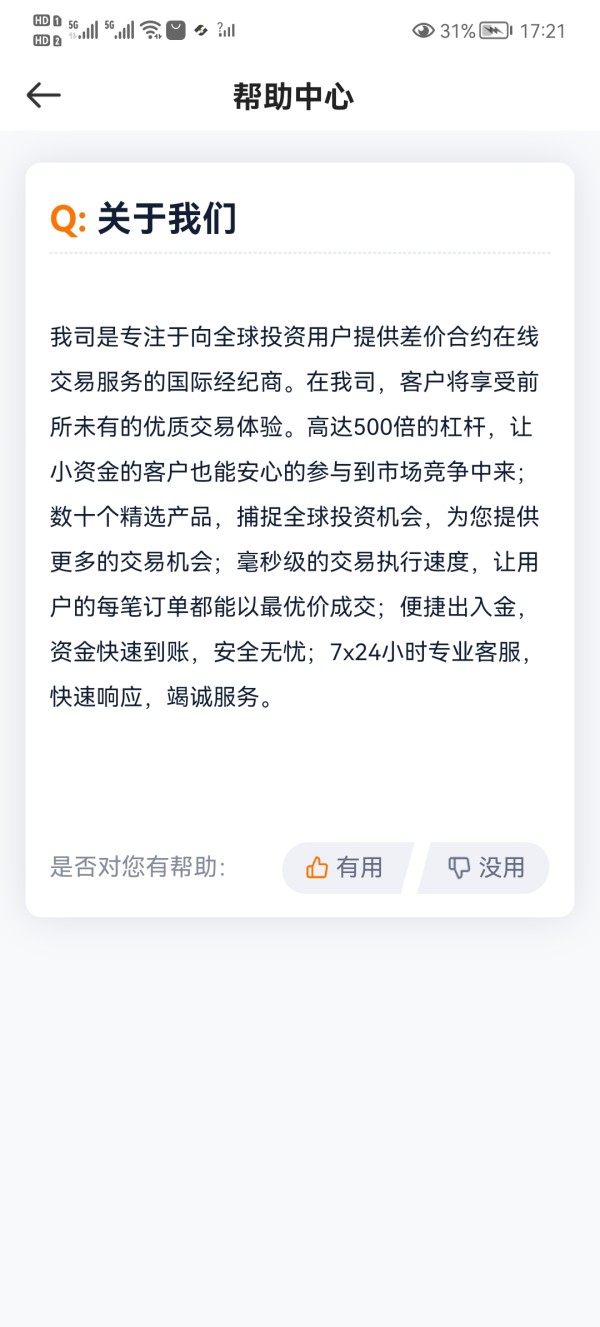

Huixin started in the forex trading world in 2021 as a Hong Kong-based financial services company. The company positioned itself to serve the growing demand for platforms that let people trade multiple types of assets. Huixin has focused its business on giving people access to various financial tools, including foreign exchange pairs, commodities, precious metals, and stock trading opportunities. Even though the company started recently, Huixin has tried to find its place in the competitive forex brokerage market by offering complete trading services and targeting Chinese-speaking traders through local customer support.

The broker's way of doing business centers on providing many different tradeable assets on one platform. This appeals to investors who want chances to diversify their portfolios. But the company's short history and the worrying feedback from the trading community have raised big questions about whether it can last long-term and maintain good operational standards. The platform's business model seems to focus on attracting regular traders through multi-asset offerings, though specific details about trading platforms, how they execute trades, and how they operate stay limited in the information that people can find publicly.

Regulatory Status: Available materials do not name specific regulatory authorities that oversee Huixin's operations, which is a big concern for potential traders who want regulated brokerage services.

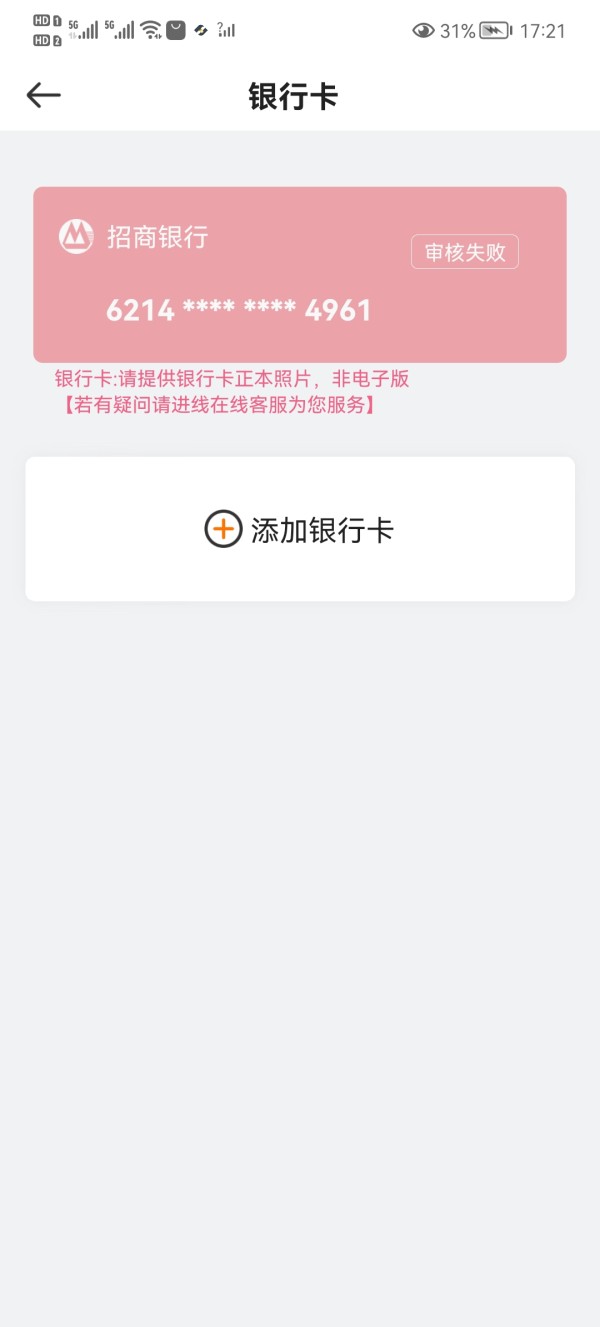

Deposit and Withdrawal Methods: Specific information about funding methods, processing times, and fees is not detailed in available documentation.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified in the available materials.

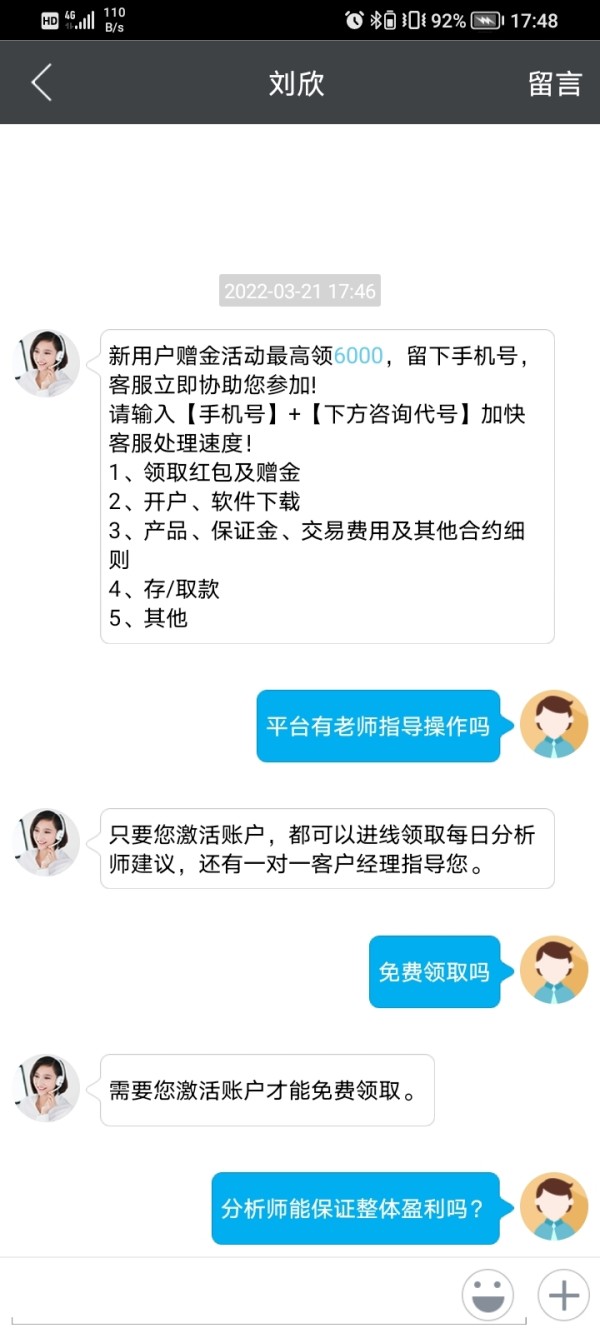

Bonus and Promotions: Information about promotional offers or bonus programs is not mentioned in available sources.

Tradeable Assets: Huixin offers access to forex currency pairs, commodities trading, precious metals, and stock market instruments. This provides a relatively diverse asset selection for traders.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not available in the source materials.

Leverage Ratios: Specific leverage offerings and maximum leverage limits are not mentioned in available documentation.

Platform Options: Trading platform types, software options, and technology details are not specified in available materials.

Geographic Restrictions: Information about country restrictions or regional limitations is not detailed in available sources.

Customer Service Languages: The broker provides customer support in Chinese, which helps Chinese-speaking traders and investors.

This huixin review shows the big lack of transparency about essential trading conditions and operational details. This should be a major concern for people who might become clients.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Huixin's account conditions faces big limitations because there is not enough detailed information in available materials. Standard account features like account types, minimum deposit requirements, and account opening procedures are not clearly explained in the broker's documentation. This absence of basic account information raises concerns about the broker's transparency and commitment to giving clear terms to potential clients.

Without specific details about different account levels, trading conditions, or special account features like Islamic accounts, it becomes hard for traders to make smart decisions about their account selection. The lack of clear account condition information also makes it difficult to compare Huixin's offerings with other brokers in the market. This lack of clarity in account structure and conditions is especially concerning given the broker's already questionable reputation.

The absence of detailed account information, combined with the broker's poor rating and fraud allegations, suggests that potential clients should be extremely careful. Professional traders usually need complete account condition details before making deposit decisions, and Huixin's failure to provide this information transparently reflects poorly on their operational standards and customer-focused approach.

This huixin review emphasizes that the lack of clear account condition information should be considered a major red flag for potential traders considering this broker.

Huixin's trading tools and resources offering appears limited based on available information. While the broker provides access to multiple asset classes including forex, commodities, precious metals, and stocks, specific details about trading tools, analytical resources, and educational materials are not clearly outlined in available documentation. This lack of detailed tool information makes it difficult to judge the quality and completeness of the broker's trading environment.

The absence of information about research and analysis resources, market commentary, economic calendars, or technical analysis tools suggests either a limited offering or poor communication of available resources. Educational resources, which are very important for trader development, are not mentioned in available materials, showing a potential gap in client support services.

Automated trading support, expert advisors, and advanced trading features are not specified in the broker's available documentation. This lack of information about sophisticated trading tools may show that Huixin targets mainly basic retail traders rather than professional or institutional clients who need advanced trading infrastructure.

The limited information about tools and resources, combined with the broker's poor reputation and fraud allegations, suggests that traders seeking complete analytical and educational support should consider alternative brokers with more transparent and strong offerings.

Customer Service and Support Analysis

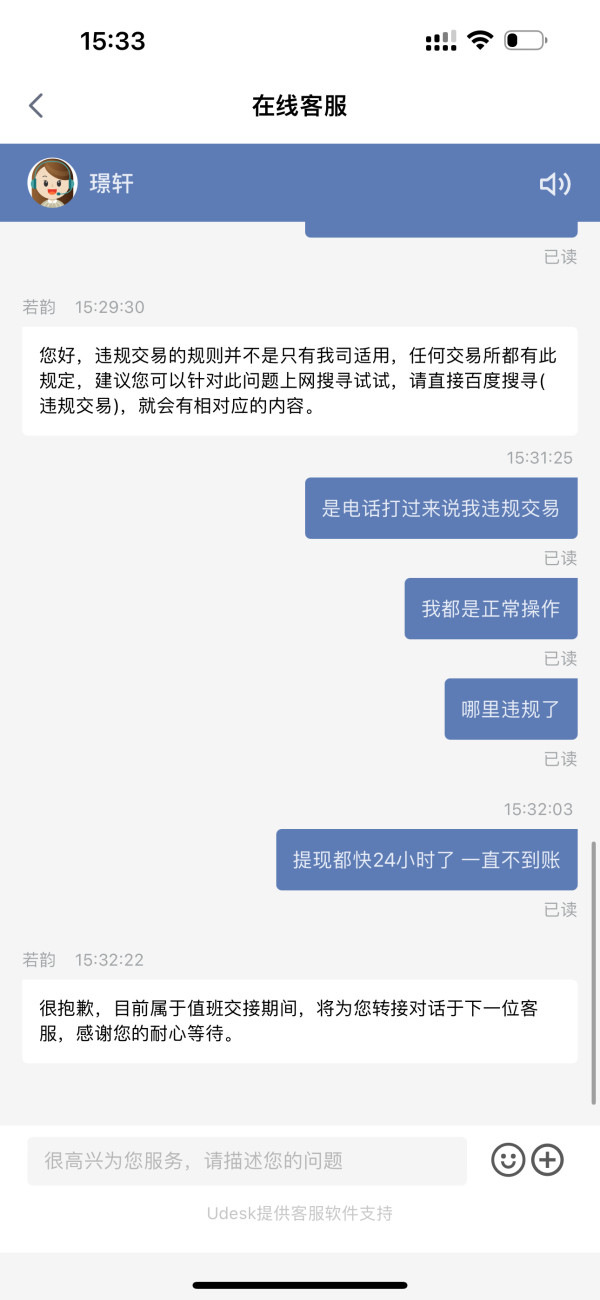

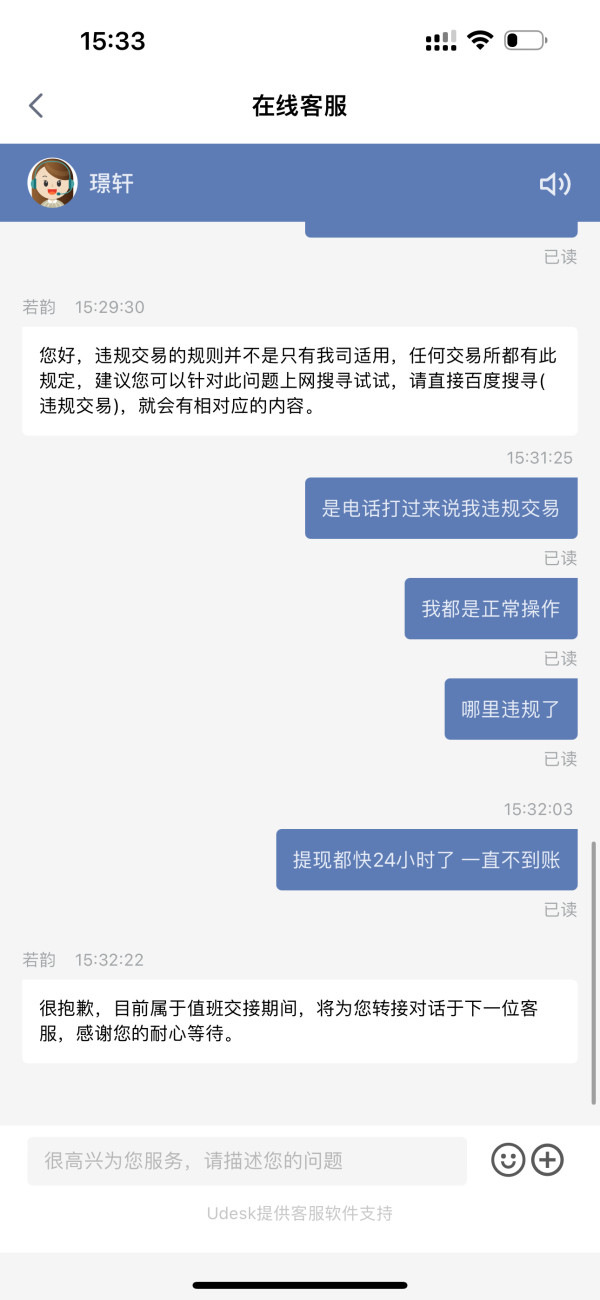

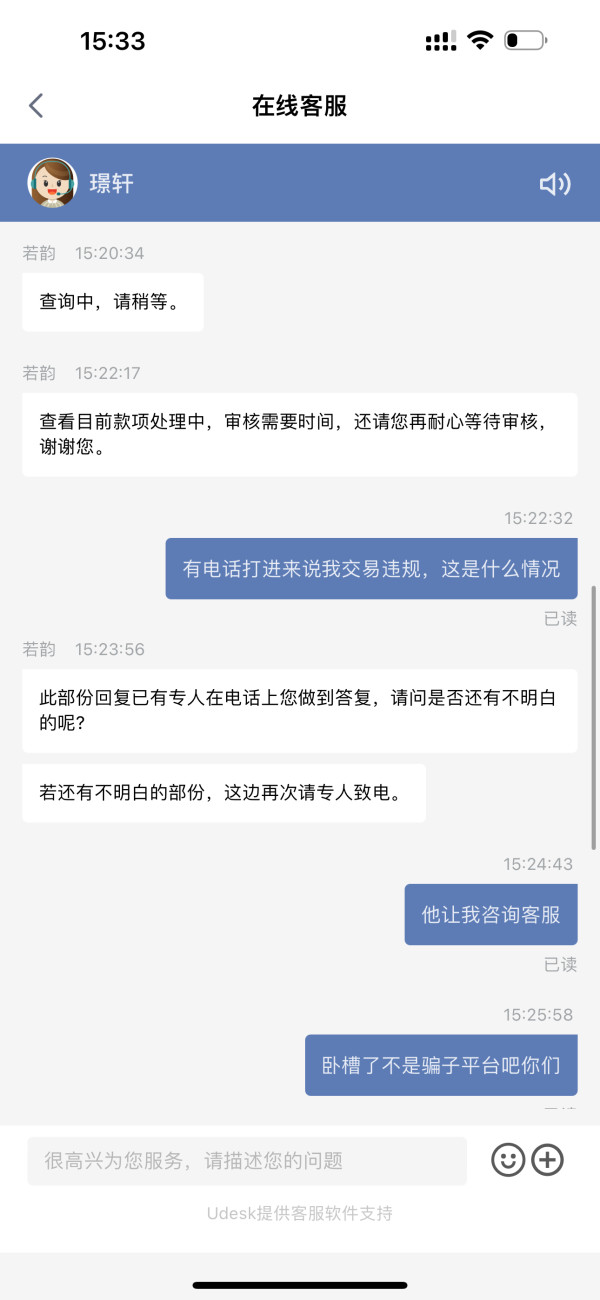

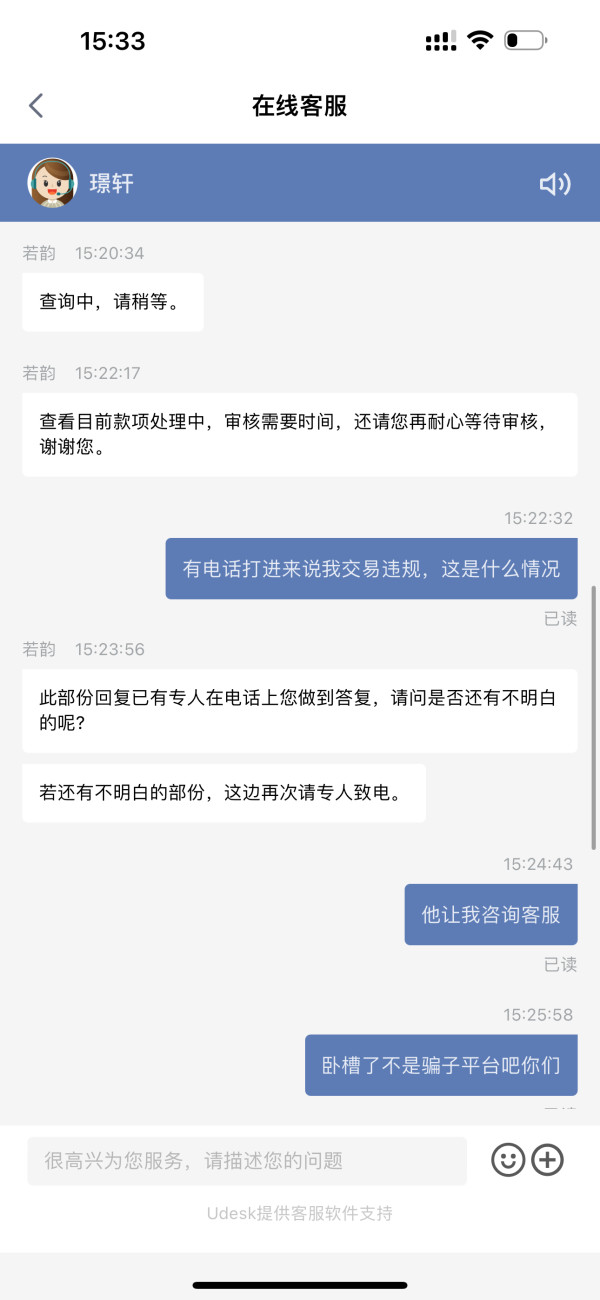

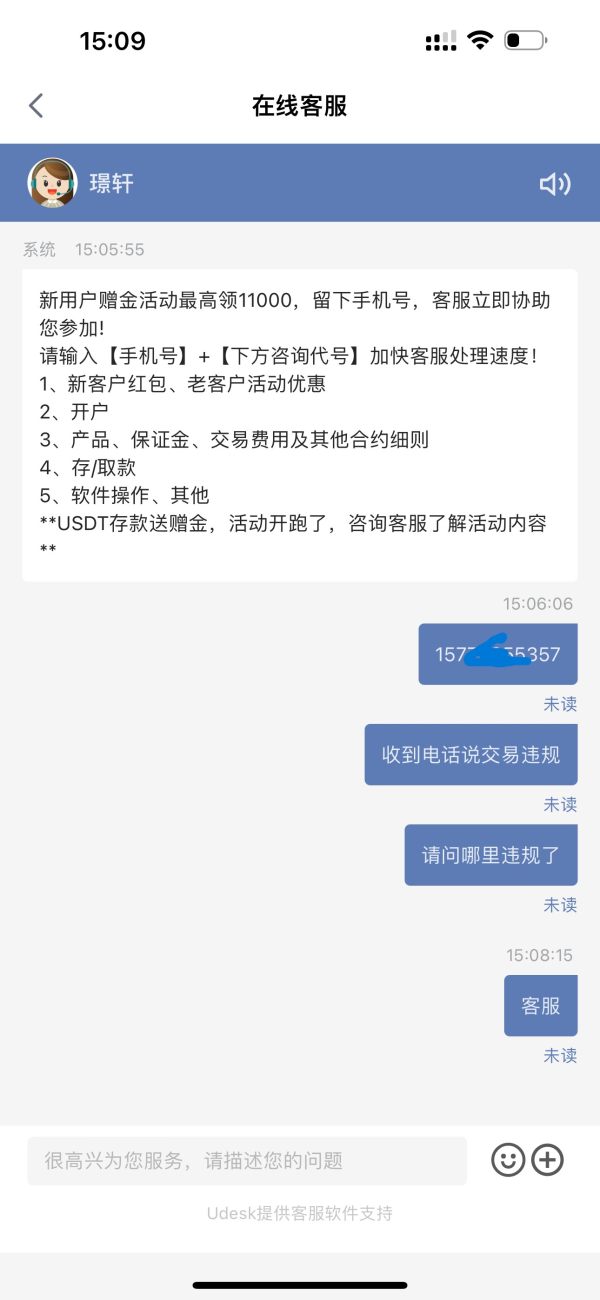

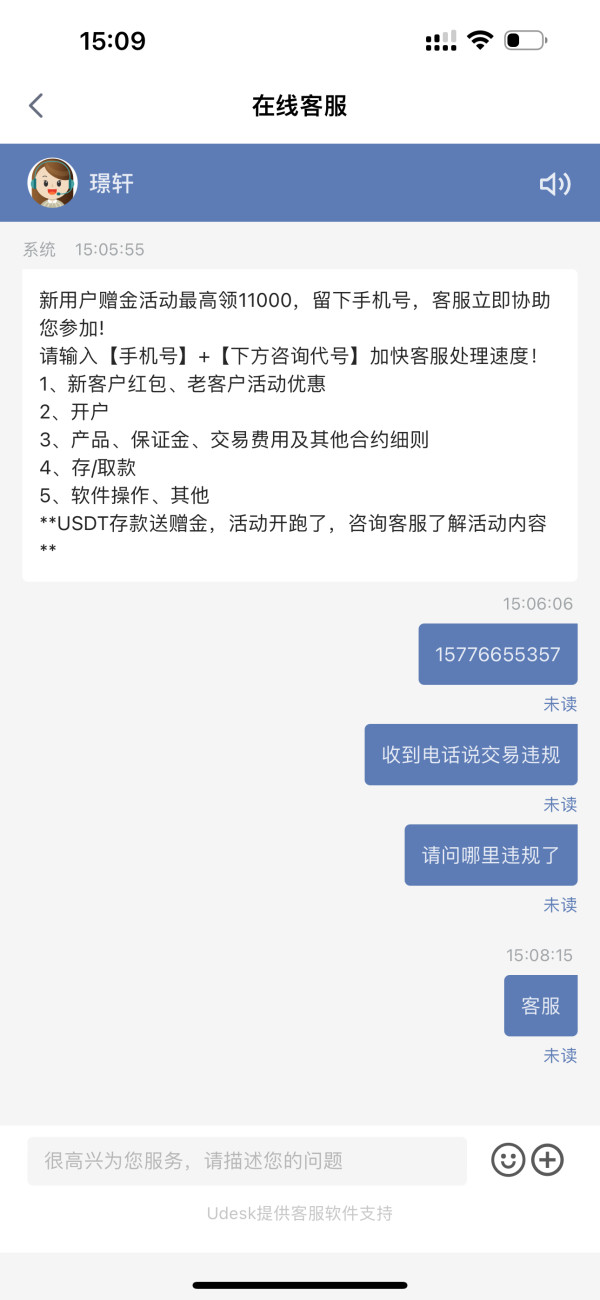

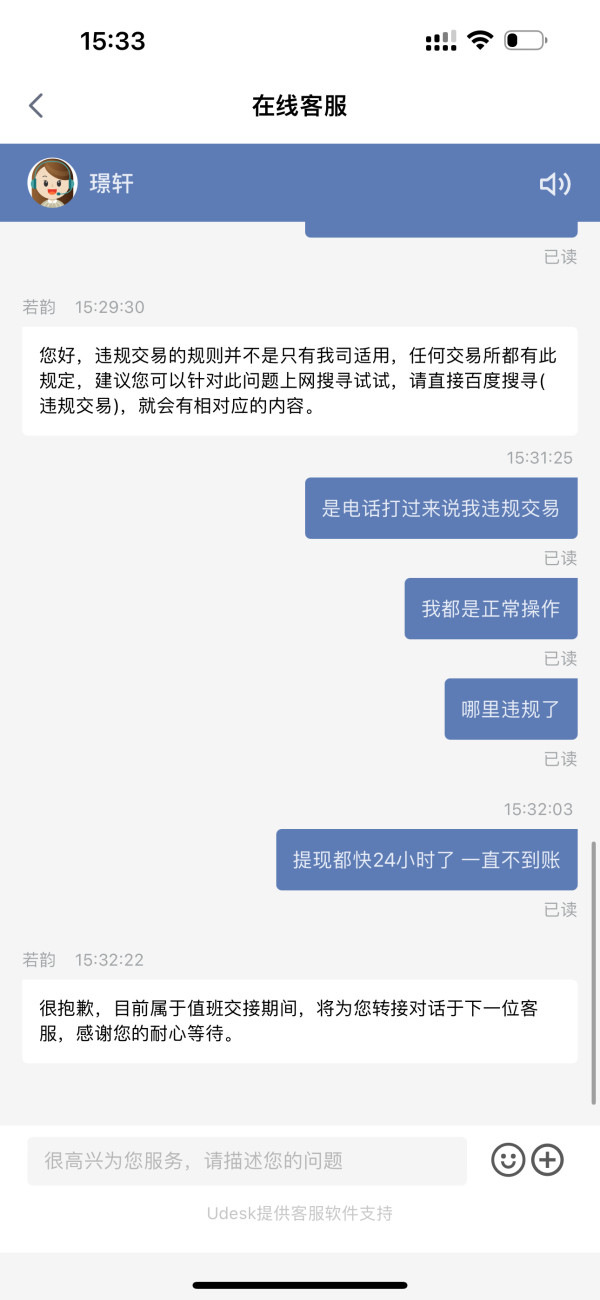

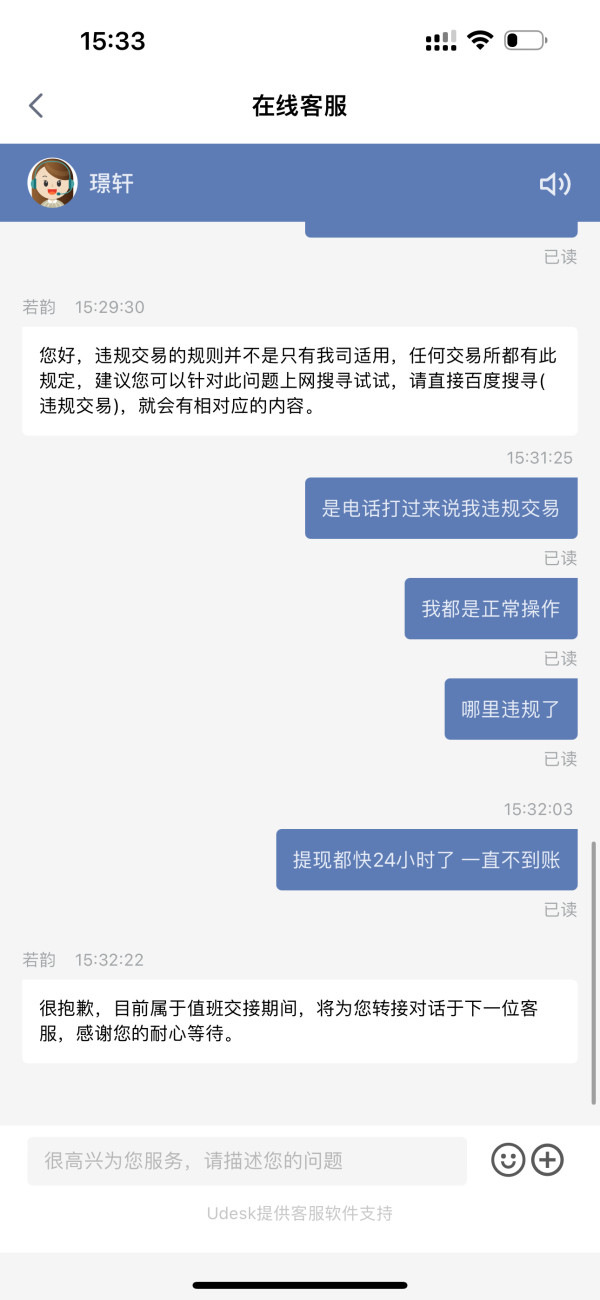

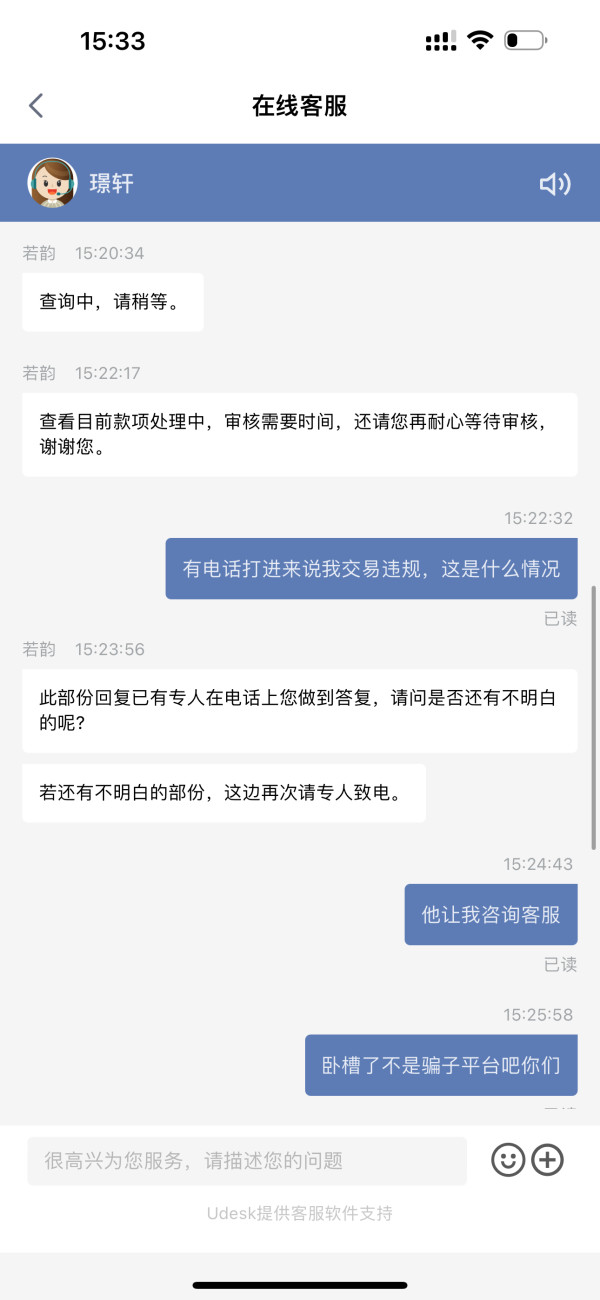

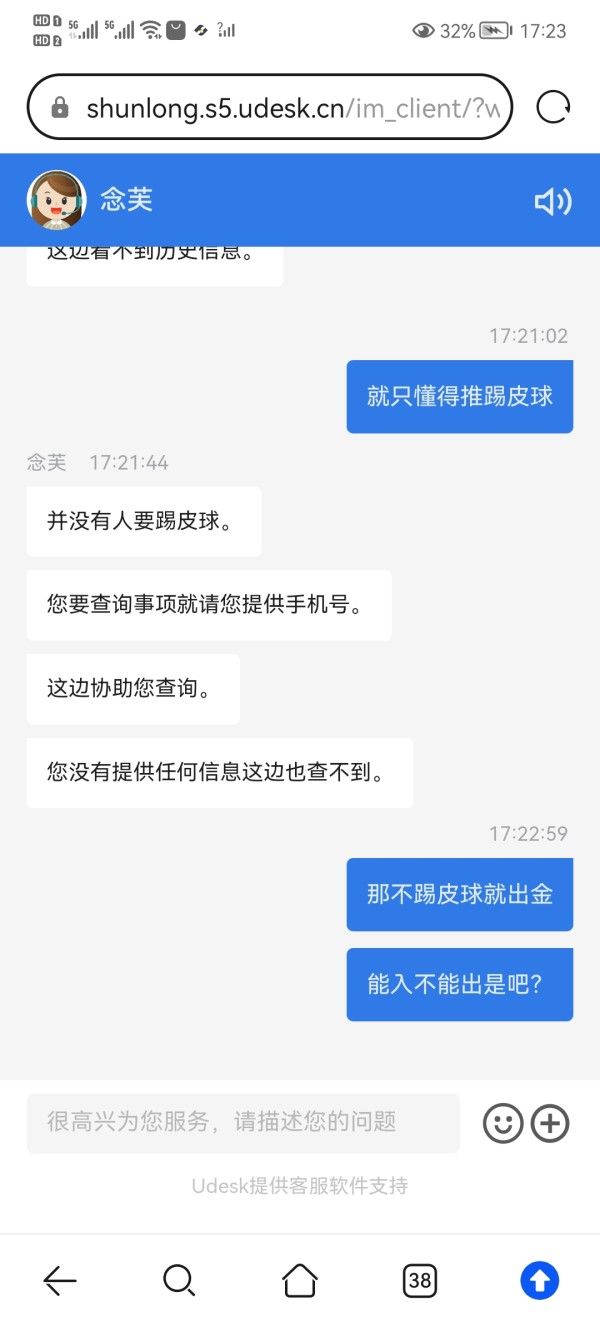

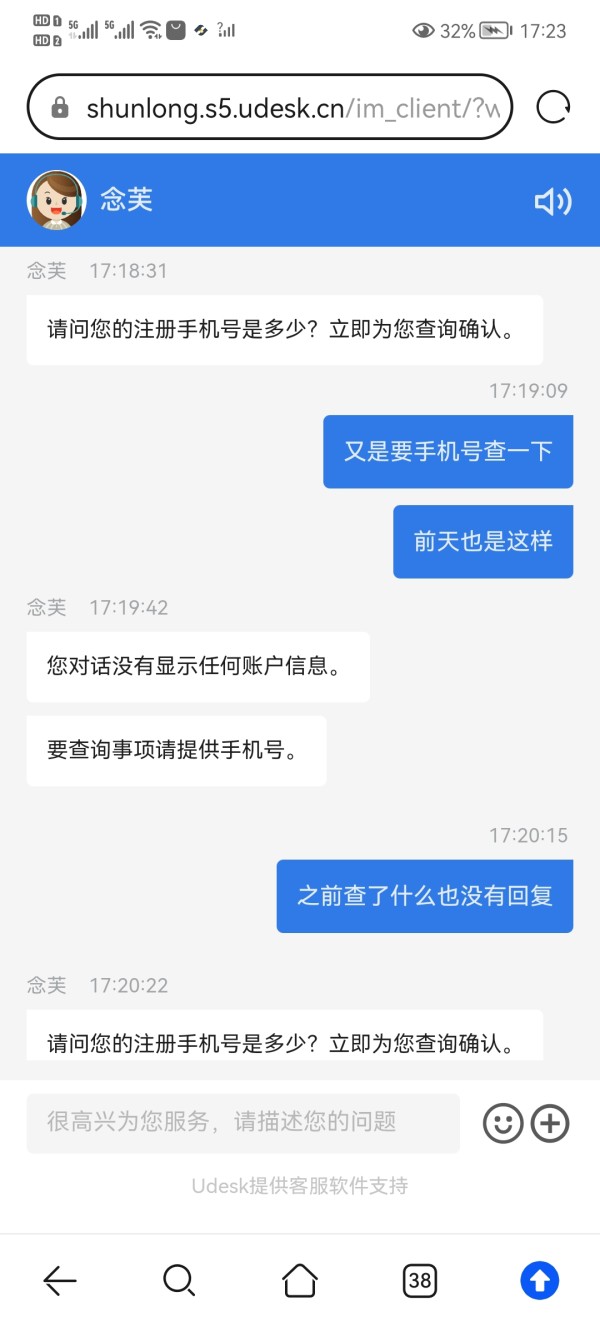

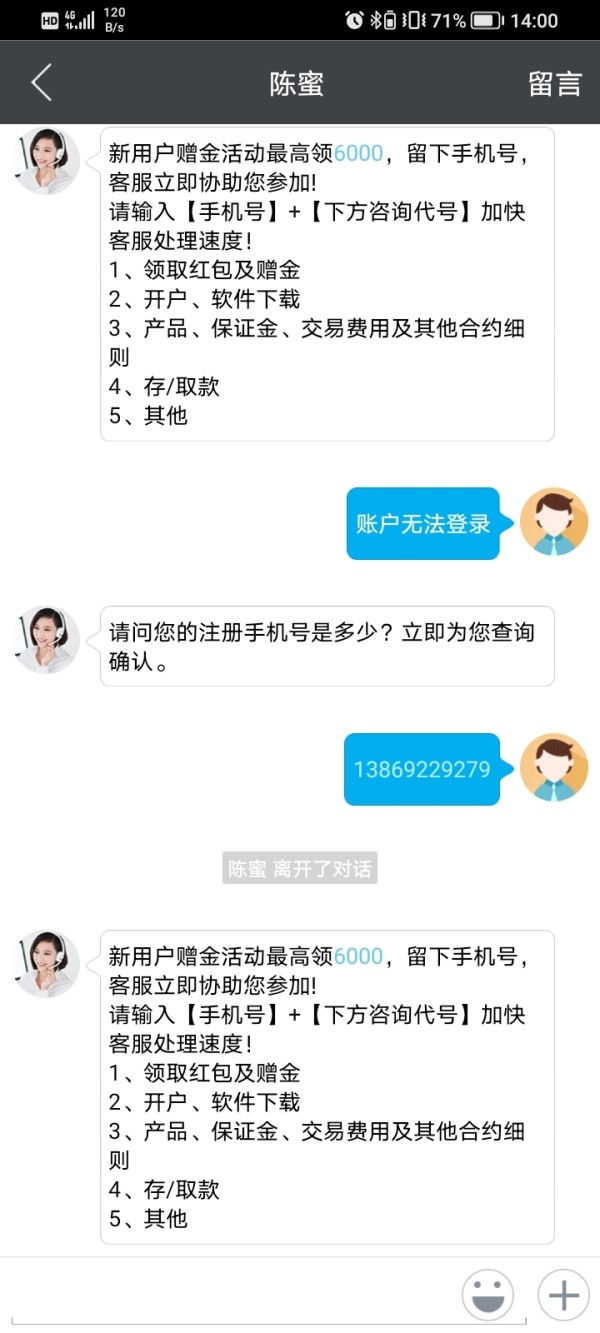

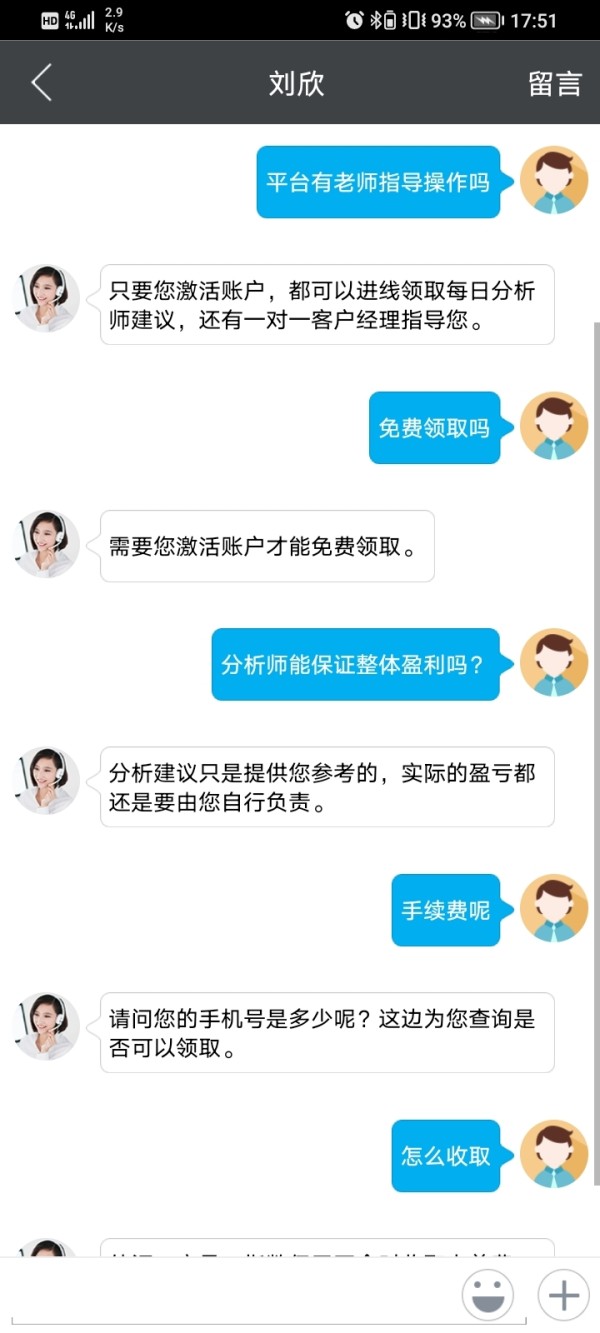

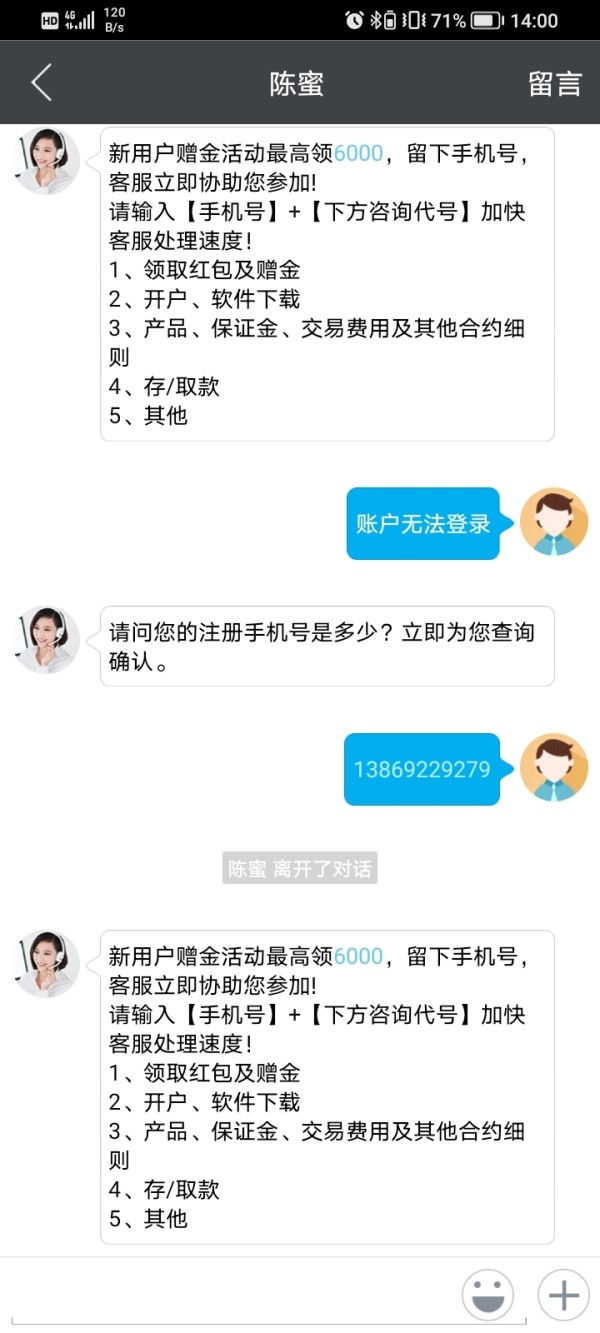

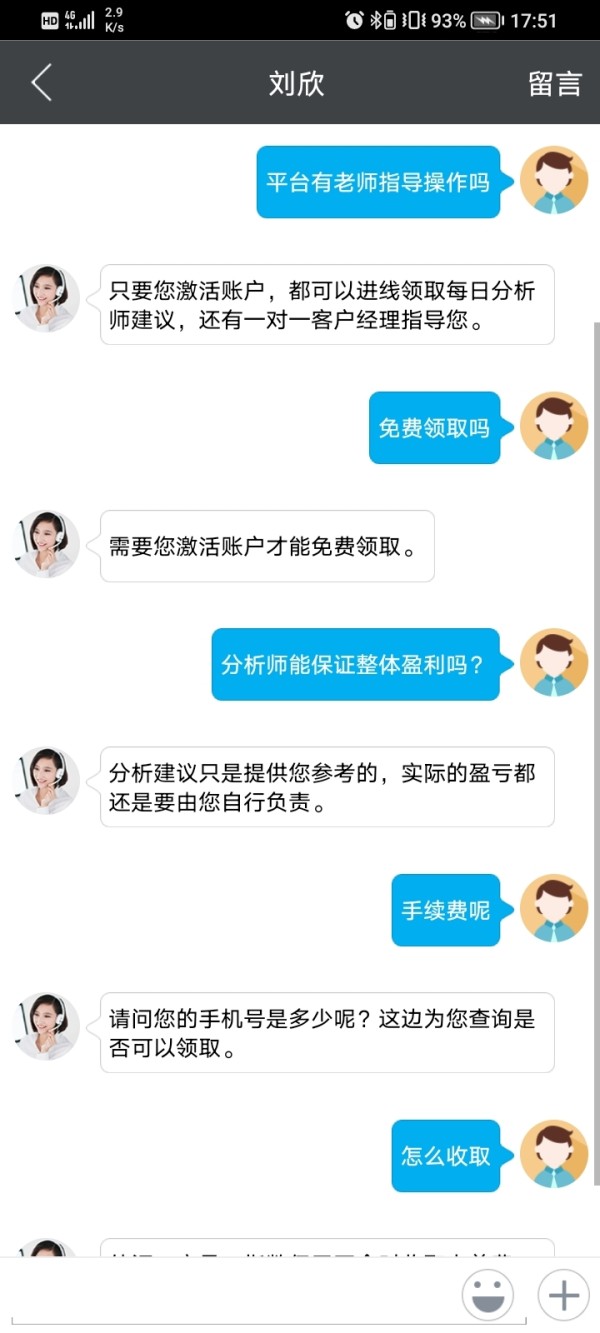

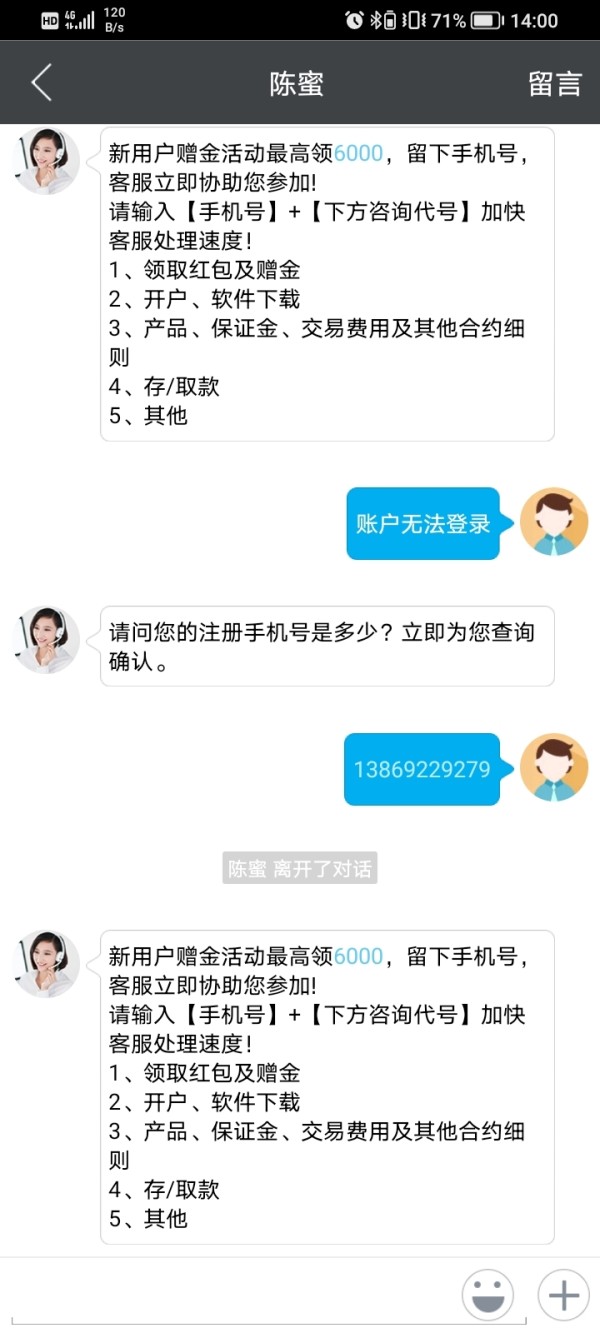

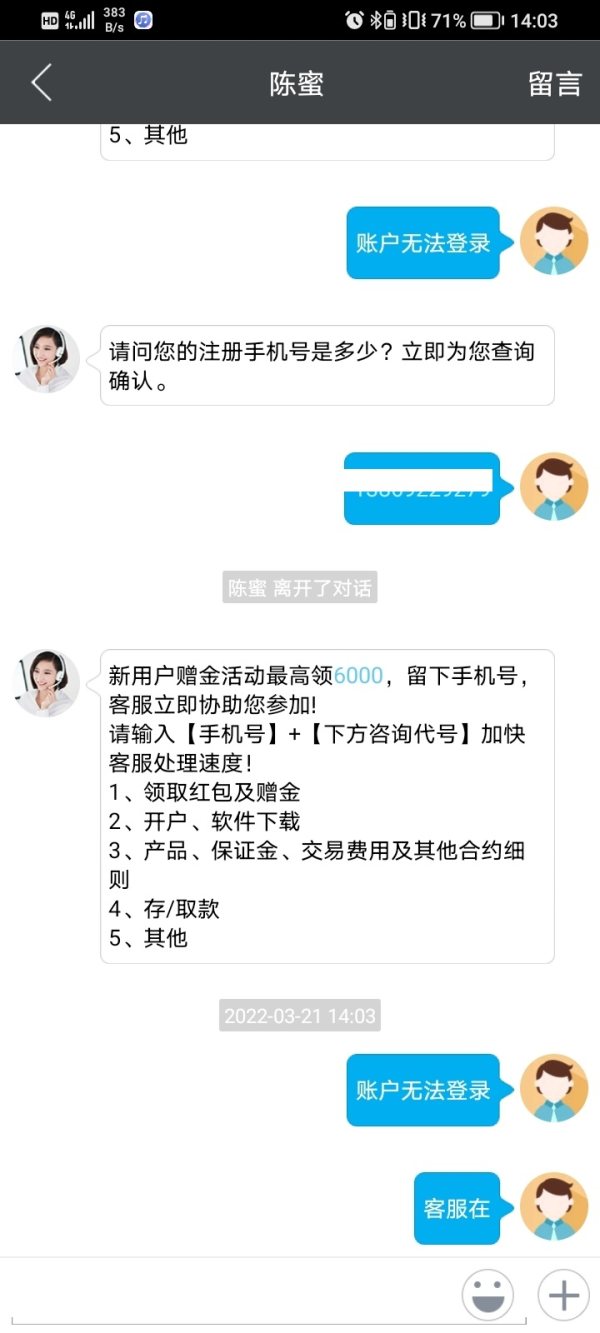

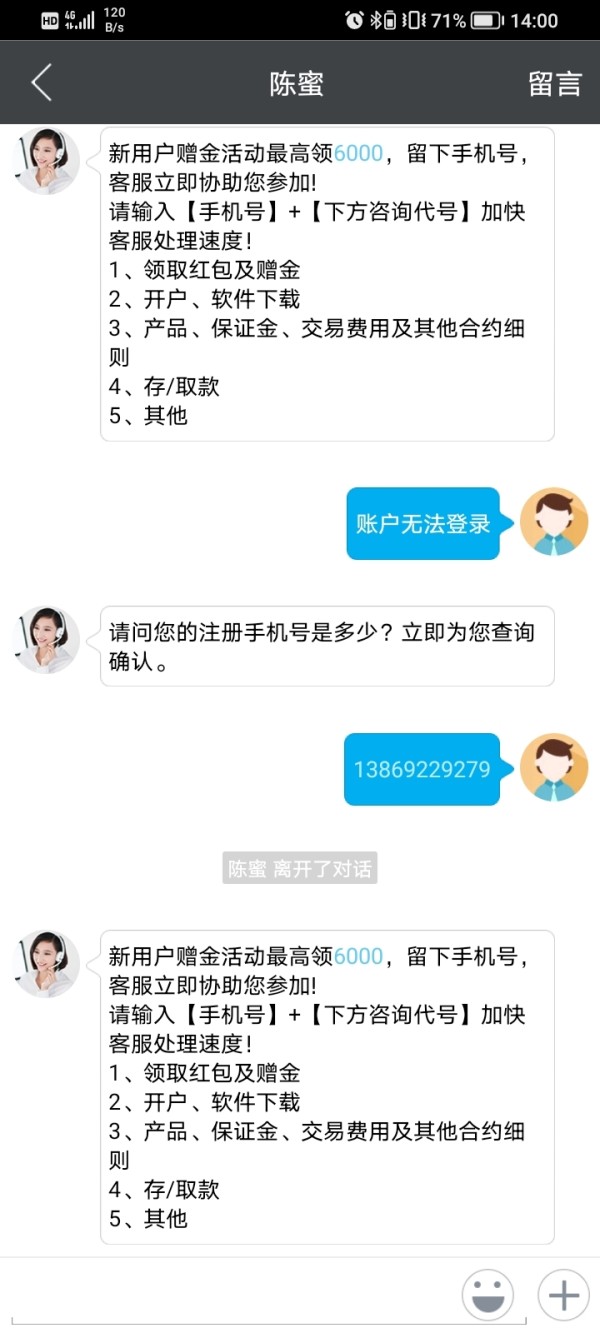

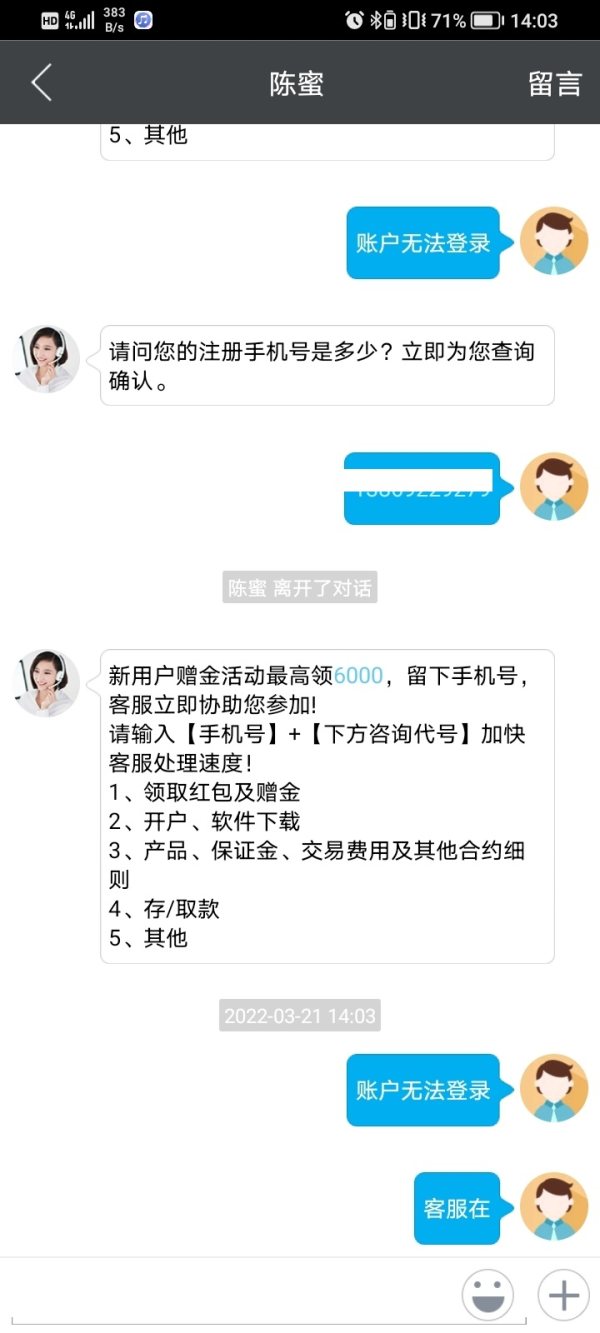

Customer service evaluation for Huixin reveals concerning patterns based on user feedback and available information. While the broker offers Chinese language customer support, which could be helpful for Chinese-speaking traders, the quality and effectiveness of this service appear to be significantly compromised based on user complaints and exposure reports documented across review platforms. The high number of user complaints and negative feedback suggests that customer service responsiveness and problem resolution capabilities are not good enough.

Users have reported difficulties in various aspects of their trading experience, though specific customer service channels, response times, and availability hours are not detailed in available materials. The broker's poor WikiFX rating of 1.43 and classification as a fraudulent platform directly reflect on customer service quality, as these ratings often include user experiences with support services. The multiple exposure reviews show that users have faced significant issues that customer service has apparently failed to resolve in a satisfactory way.

Given the fraud allegations and negative user feedback, potential clients should be extremely cautious about the level of support they might receive from Huixin's customer service team. The combination of poor ratings and user complaints suggests that customer service may not be good enough for addressing trading issues, account problems, or withdrawal requests.

Trading Experience Analysis

The trading experience evaluation for Huixin is severely limited by the lack of available information about platform stability, execution quality, and overall trading environment. Available materials do not provide details about trading platform types, execution speeds, order processing capabilities, or mobile trading applications, making it impossible to judge the technical quality of the trading experience. Platform stability and reliability are very important factors for successful trading, yet no information is available about system uptime, server performance, or technical infrastructure quality.

Order execution quality, including slippage rates, requote frequency, and execution speeds, are not documented in available materials, leaving potential traders without essential performance metrics. The absence of information about trading platform features, charting capabilities, order types, and mobile trading functionality suggests either limited offerings or poor communication of available features. Professional traders need detailed information about trading conditions and platform capabilities, which Huixin appears unable or unwilling to provide transparently.

Combined with the broker's poor reputation and fraud allegations, the lack of trading experience information should be considered a significant warning sign. This huixin review strongly suggests that traders seeking reliable and transparent trading conditions should consider well-established brokers with documented performance records and complete platform information.

Trustworthiness Analysis

Huixin's trustworthiness assessment reveals severe concerns that should alarm any potential trader. The broker's WikiFX rating of 1.43 out of 10 represents one of the lowest possible trust scores, showing significant operational and reliability issues. More critically, Huixin has been explicitly flagged as a fraudulent platform, which represents the most serious possible warning for retail traders.

The classification as a fraudulent platform suggests that WikiFX monitoring systems have identified patterns consistent with scam operations. This includes potential issues with fund security, withdrawal problems, or deceptive business practices. This designation is not given lightly and typically results from multiple user complaints, operational irregularities, or failure to meet basic industry standards. The absence of clear regulatory information makes the trustworthiness concerns worse, as legitimate brokers typically maintain transparent regulatory status and provide detailed compliance information.

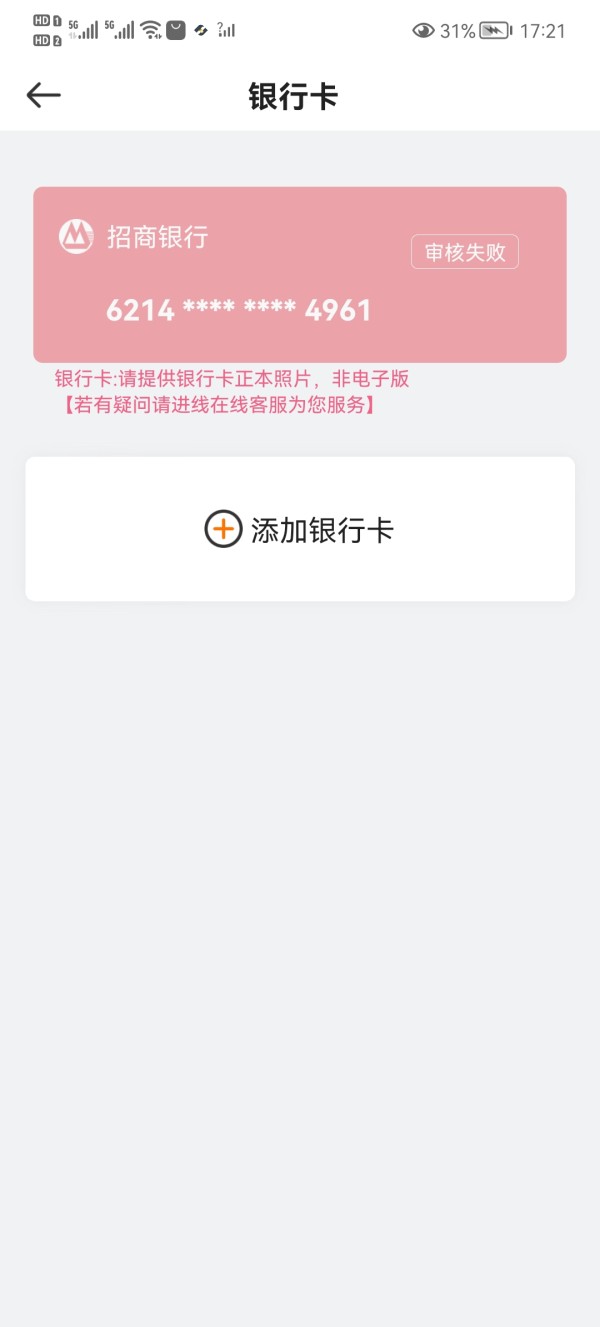

Without proper regulatory oversight, client funds lack essential protections, and dispute resolution mechanisms may be unavailable. The combination of fraud allegations, poor ratings, and multiple user exposure reports creates a clear pattern of trustworthiness issues that should disqualify Huixin from consideration by responsible traders. The documented negative feedback and exposure complaints show that previous clients have experienced significant problems, likely including financial losses or inability to withdraw funds.

User Experience Analysis

User experience analysis for Huixin reveals mostly negative feedback patterns that should concern potential traders. Based on available information, the broker has received multiple exposure reviews and complaints, showing widespread user dissatisfaction with various aspects of the trading experience. The overall user satisfaction appears significantly below industry standards, with negative feedback outweighing positive experiences.

The WikiFX monitoring data showing fraud allegations and poor ratings directly reflects user experiences, as these platforms typically gather real user feedback and complaints. The presence of multiple exposure reviews suggests that users have encountered serious problems, potentially including withdrawal difficulties, account access issues, or trading condition disputes. While the broker offers Chinese language support, which could theoretically improve user experience for Chinese-speaking traders, this advantage is overshadowed by the fundamental operational and trustworthiness issues documented in user feedback.

The negative user sentiment shows that language support alone cannot make up for underlying service quality problems. Common user complaints appear to center around reliability and trustworthiness issues, though specific interface design, registration processes, and funding operation experiences are not detailed in available materials. The pattern of negative feedback suggests that users have faced significant challenges that have not been adequately addressed by the broker's support systems.

Conclusion

This comprehensive huixin review reveals a broker that presents significant risks to potential traders despite offering multiple asset classes for trading. Huixin's establishment in 2021 and Hong Kong headquarters initially suggest a legitimate operation, but deeper analysis reveals concerning patterns that should disqualify it from serious consideration by responsible traders. The broker's WikiFX rating of 1.43 and explicit classification as a fraudulent platform represent severe warning signs that cannot be overlooked.

Combined with multiple user complaints and exposure reviews, these indicators suggest that Huixin may pose significant financial risks to clients, including potential loss of deposited funds or inability to withdraw profits. While the broker offers trading in forex, commodities, precious metals, and stocks with Chinese language customer support, these advantages are completely overshadowed by trustworthiness concerns and negative user feedback. The lack of transparent regulatory information, unclear operational details, and poor reputation make Huixin unsuitable for traders seeking reliable and secure trading environments.

Potential investors should consider well-established, properly regulated brokers with proven track records and positive user feedback instead of risking their capital with platforms that have documented fraud allegations and consistently poor ratings.