Alpha Markets 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Alpha Markets review examines a forex broker headquartered in the Marshall Islands. The company positions itself as a provider of competitive trading conditions for international investors. Alpha Markets markets itself with spreads as low as 0 PIPS and focuses primarily on forex market trading. The broker targets traders seeking low-cost entry points into currency markets.

However, our analysis reveals significant concerns that warrant careful consideration. While the broker advertises attractive trading conditions, there is a notable absence of clear regulatory information. This raises questions about oversight and compliance standards. User feedback presents a mixed picture, with some positive aspects regarding trading costs offset by concerning reports about customer service quality and unfulfilled promises.

The broker specifically excludes US investors from its services. This limits its accessibility to American traders. This geographical restriction, combined with the lack of transparent regulatory framework, suggests Alpha Markets may be better suited for experienced traders who prioritize low spreads over regulatory assurance. Our neutral assessment reflects both the potential benefits of competitive pricing and the substantial risks associated with unclear regulatory status and inconsistent customer support experiences.

Important Disclaimers

Regional Service Limitations: Alpha Markets explicitly states that it does not offer services to US investors. This significantly impacts American traders' ability to access their platform. This restriction may also extend to other jurisdictions with strict financial regulations, making it essential for potential clients to verify service availability in their region before considering this broker.

Review Methodology: This evaluation is based on comprehensive analysis of available market information, user feedback from various sources, and publicly accessible data about Alpha Markets' services and offerings. Given the limited regulatory transparency, some assessments rely on user-reported experiences and the broker's own marketing materials.

Rating Framework

Broker Overview

Alpha Markets operates as an online forex broker from its headquarters in the Marshall Islands. The company positions itself as a service provider for international forex trading. The company's business model centers on offering competitive spreads and access to multiple currency pairs, targeting traders who prioritize cost-effective trading conditions over extensive regulatory oversight.

The broker's marketing emphasizes "unmatched market conditions" and promotes spreads as low as 0 PIPS as a key differentiator. Alpha Markets appears to focus exclusively on forex trading rather than offering a diversified portfolio of asset classes. This may appeal to traders with specific currency market interests but could limit options for those seeking broader investment opportunities.

Despite its promotional materials highlighting competitive trading conditions, specific information about the company's establishment date, detailed corporate structure, and comprehensive business history remains limited in publicly available sources. This Alpha Markets review finds that while the broker markets itself to experienced traders looking to expand their portfolios, the lack of detailed corporate transparency may concern traders who prioritize regulatory clarity and corporate accountability in their broker selection process.

Regulatory Status: Alpha Markets' regulatory framework presents significant concerns. Specific information about oversight by recognized financial authorities is not clearly documented in available materials. This lack of regulatory transparency represents a substantial compliance gap that potential clients should carefully consider.

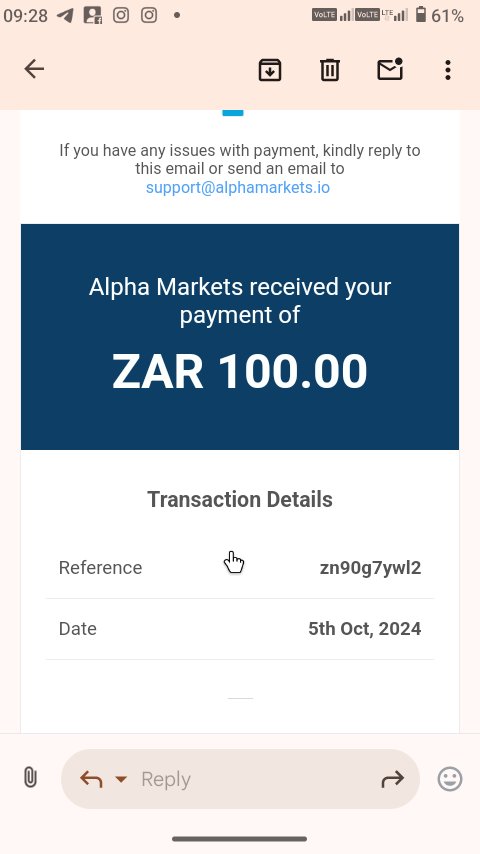

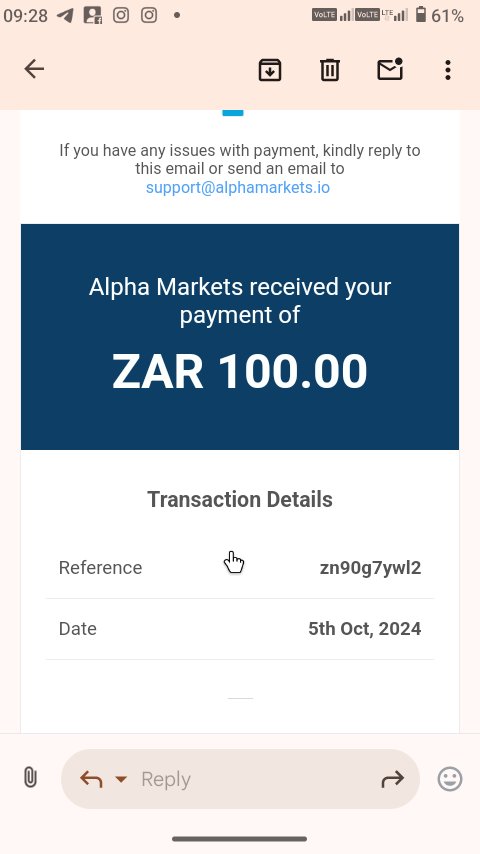

Deposit and Withdrawal Methods: Specific information about available payment gateways, processing times, and associated fees for deposits and withdrawals is not detailed in available documentation. The broker mentions "seamless payment gateways" in its marketing materials.

Minimum Deposit Requirements: The exact minimum deposit amounts for different account types are not specified in the available information. This makes it difficult for potential traders to plan their initial investment requirements.

Promotional Offers: Details about bonus structures, promotional campaigns, or special offers for new clients are not mentioned in the available documentation from Alpha Markets.

Available Trading Assets: The broker primarily focuses on forex markets. It offers access to multiple currency pairs for trading. However, specific information about the exact number of currency pairs, exotic currencies availability, or other asset classes is not detailed in accessible materials.

Cost Structure: Alpha Markets advertises spreads as low as 0 PIPS as a primary competitive advantage. However, detailed information about commission structures, overnight fees, and other trading costs beyond spreads is not comprehensively documented in available sources.

Leverage Options: Specific leverage ratios available to traders are not mentioned in the available documentation. This represents important missing information for risk management planning.

Trading Platform Options: The specific trading platforms offered by Alpha Markets are not detailed in available materials. The broker mentions "intuitive platforms" in its promotional content.

Geographic Restrictions: Alpha Markets explicitly excludes US investors from its services. This is stated in their disclaimer materials.

Customer Support Languages: Information about multilingual support options is not specified in available documentation.

This Alpha Markets review highlights that many crucial details about trading conditions remain unclear. This may pose challenges for traders seeking comprehensive information before making platform decisions.

Detailed Rating Analysis

Account Conditions Analysis

Alpha Markets' account conditions present a mixed picture that earns a below-average rating due to limited transparency about essential account features. While the broker advertises competitive spreads as low as 0 PIPS, the absence of clear information about account types, minimum deposit requirements, and specific account features creates uncertainty for potential clients.

The lack of detailed information about different account tiers, their respective benefits, and qualification requirements makes it difficult for traders to understand what level of service they can expect. Without clear documentation of account opening procedures, verification requirements, or special account features such as Islamic accounts for Muslim traders, potential clients cannot make fully informed decisions about whether Alpha Markets meets their specific trading needs.

The broker's marketing materials mention account types "to suit your needs," but fail to provide the granular details that experienced traders typically require when evaluating account conditions. This opacity in account structure information contributes to the below-average rating, as transparency in account conditions is fundamental to establishing trust between brokers and clients. The Alpha Markets review process reveals that while competitive spreads are attractive, the lack of comprehensive account information significantly impacts the overall assessment of account conditions quality.

The tools and resources category receives a poor rating due to the significant lack of information about trading tools, analytical resources, and educational materials offered by Alpha Markets. Available documentation does not specify what research and analysis tools are provided to traders, what market analysis resources are available, or whether the broker offers any educational content to support trader development.

Modern forex trading requires access to comprehensive analytical tools, real-time market data, economic calendars, and technical analysis resources. The absence of detailed information about these essential trading resources suggests either a limited offering or poor communication about available tools. Additionally, there is no mention of automated trading support, API access, or advanced trading tools that experienced traders often require.

Educational resources, which are crucial for both new and experienced traders to stay updated with market developments and improve their trading strategies, are not detailed in available materials. The lack of information about webinars, market analysis reports, trading guides, or other educational content further contributes to the poor rating in this category.

Customer Service and Support Analysis

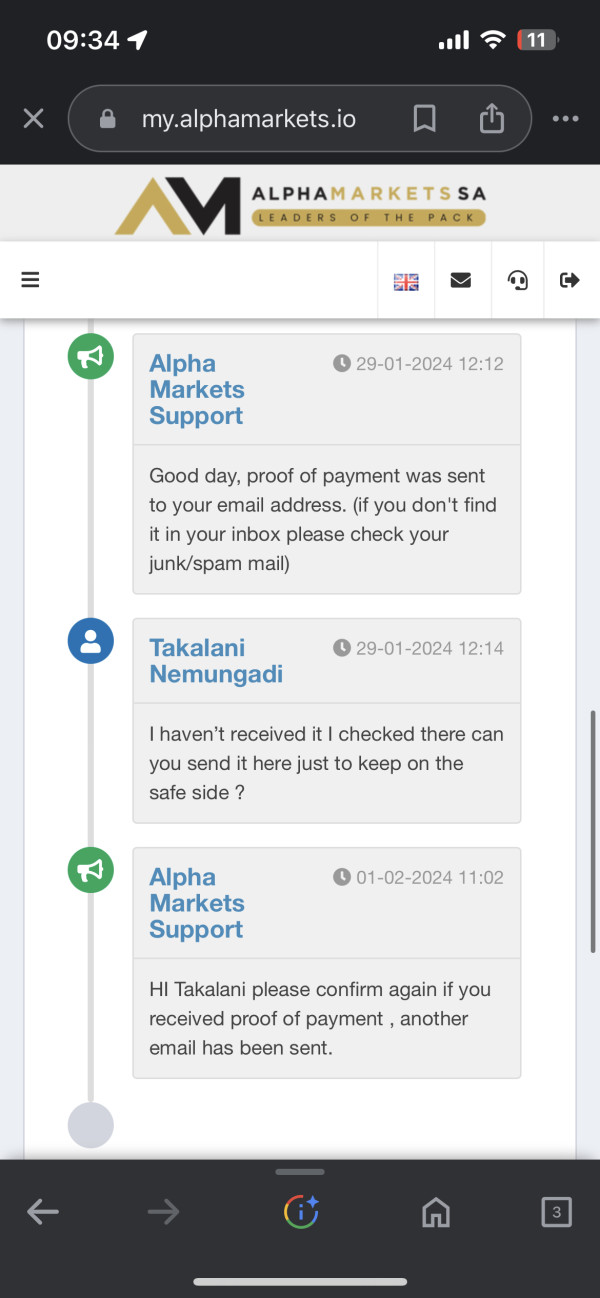

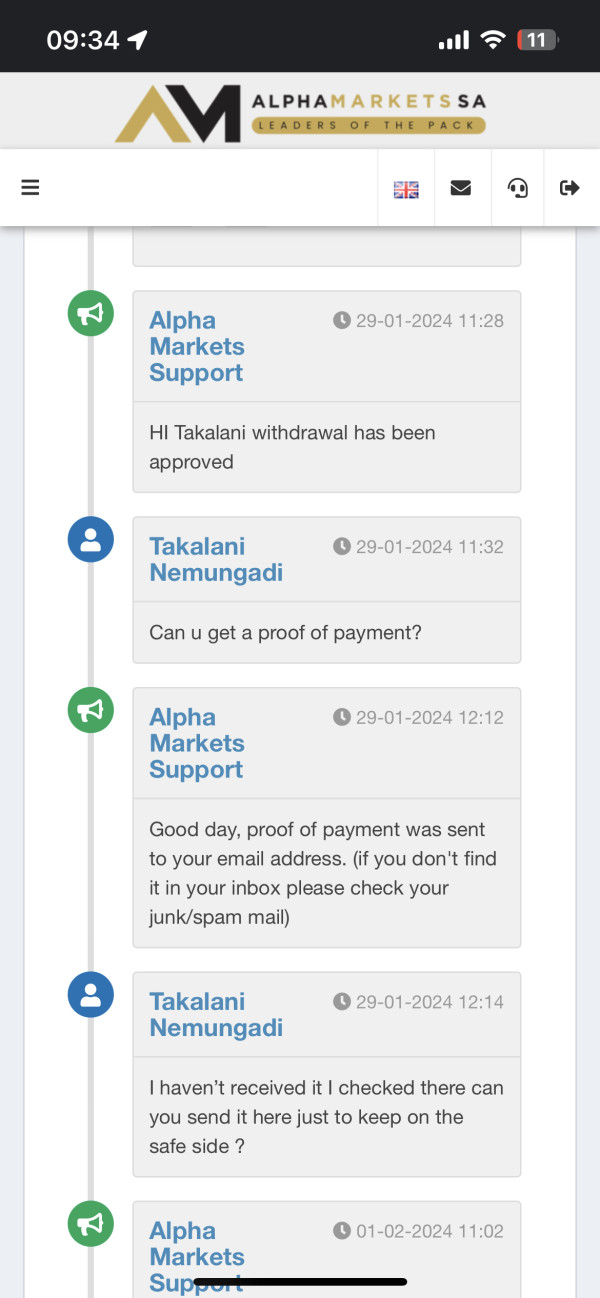

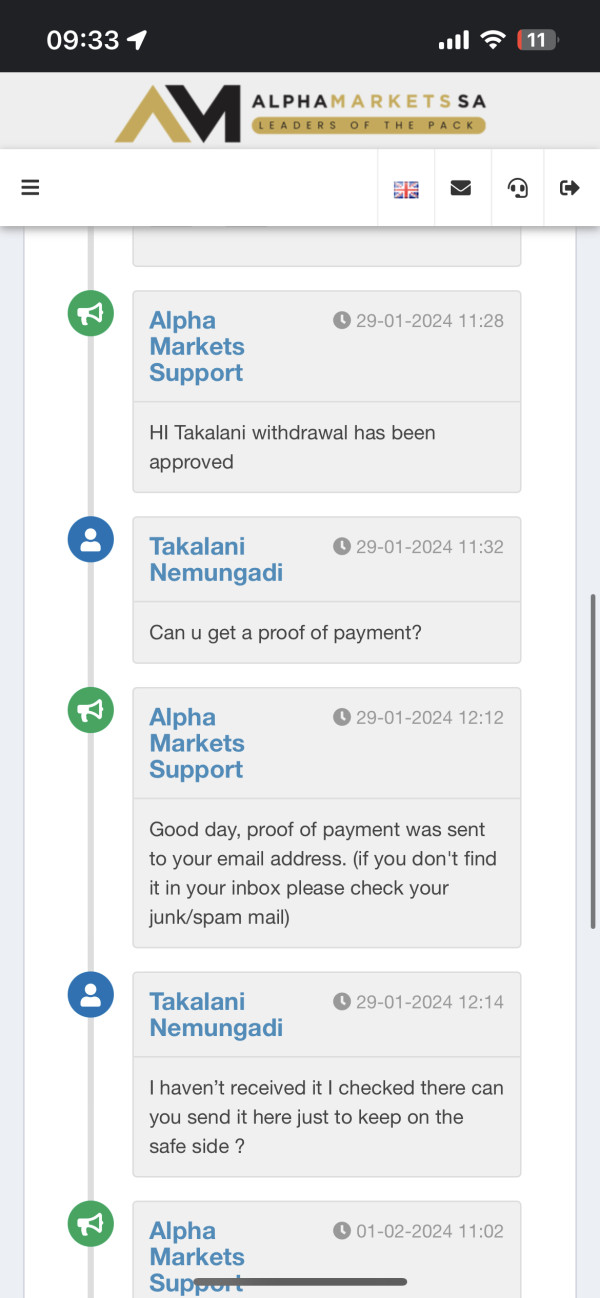

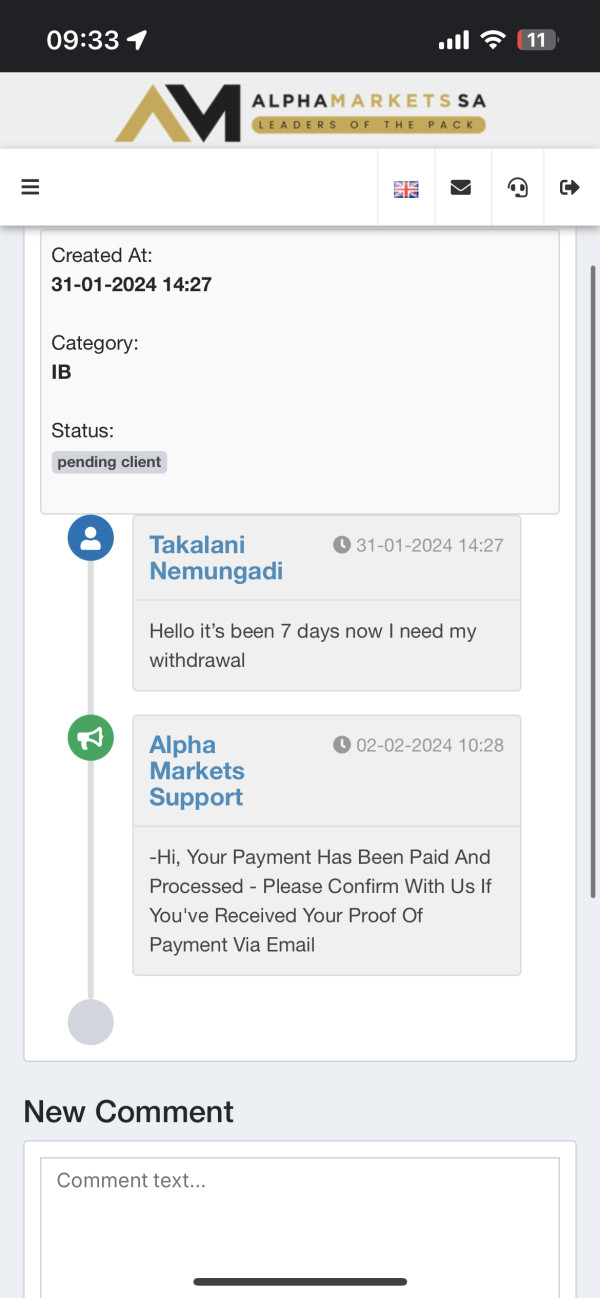

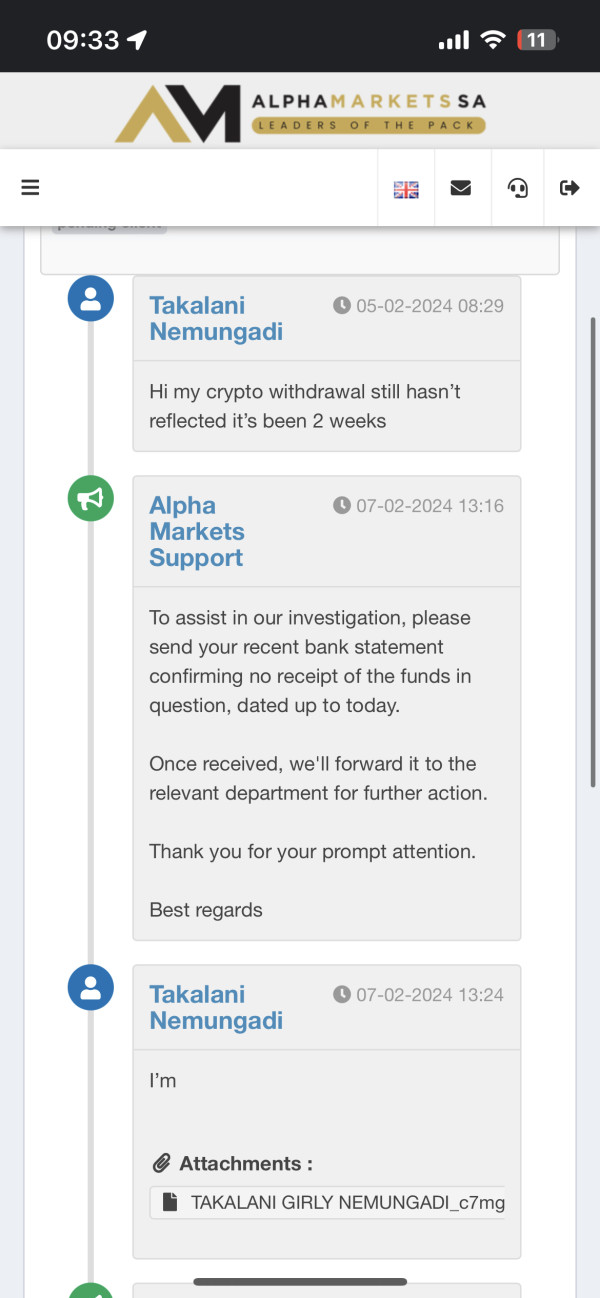

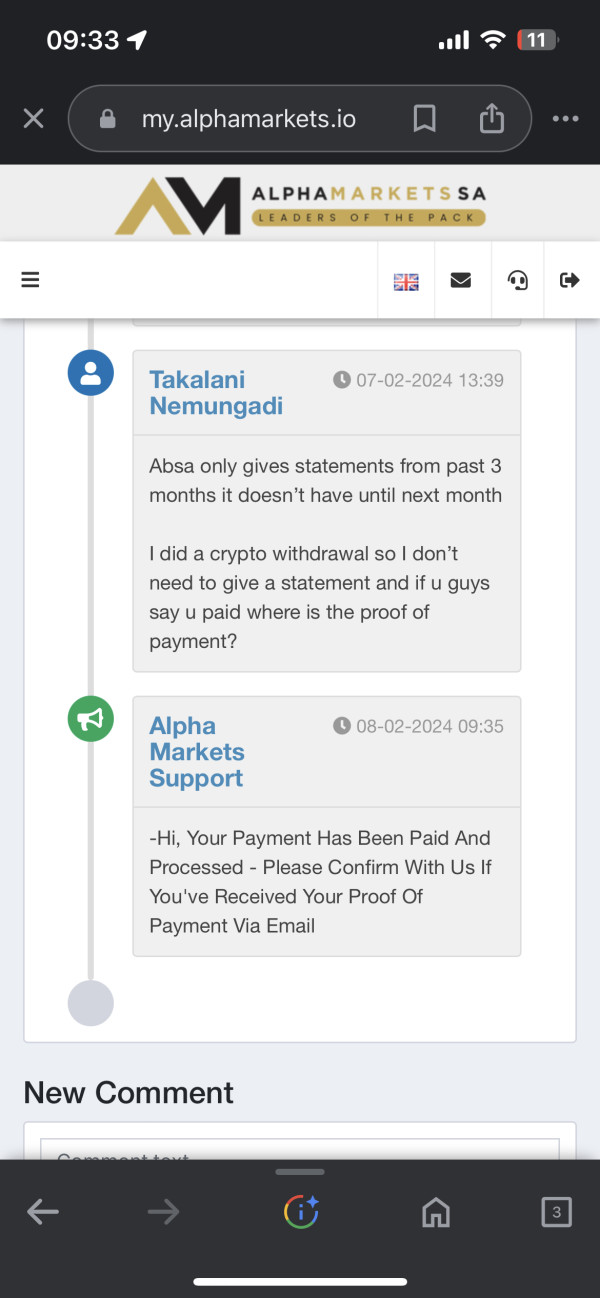

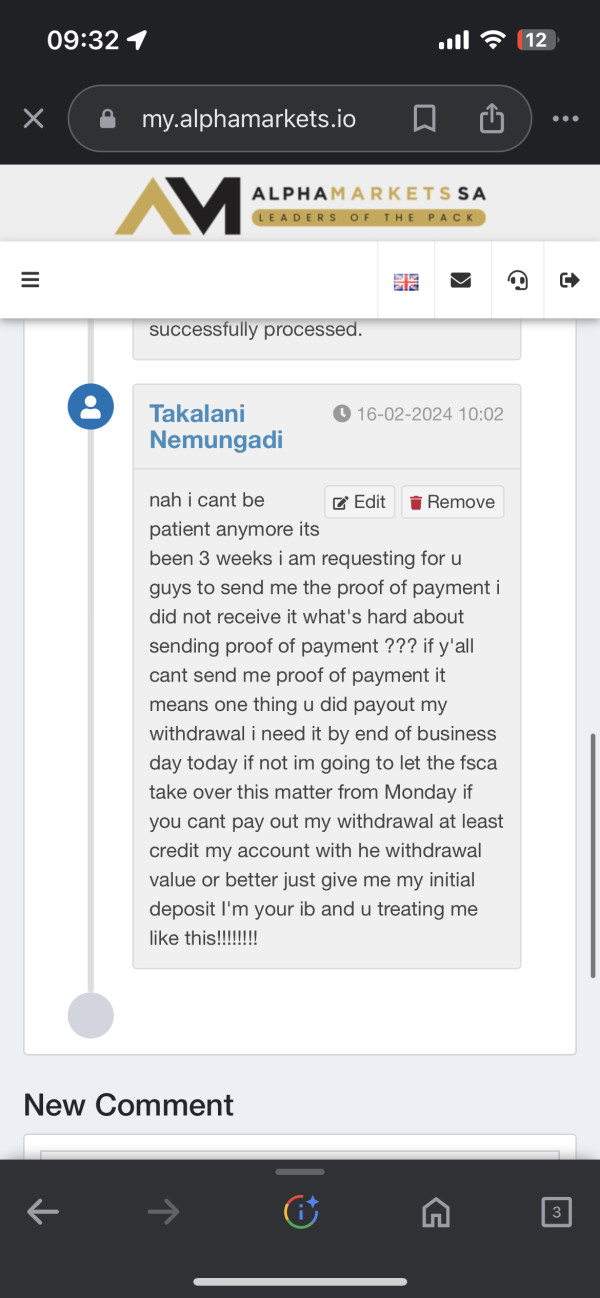

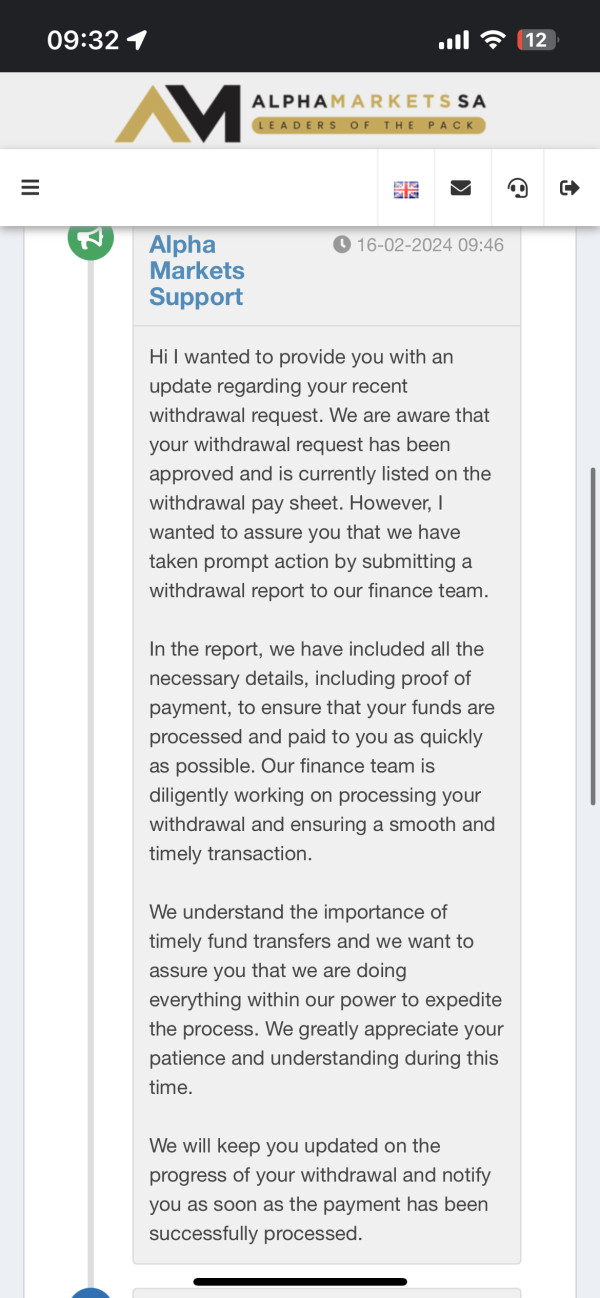

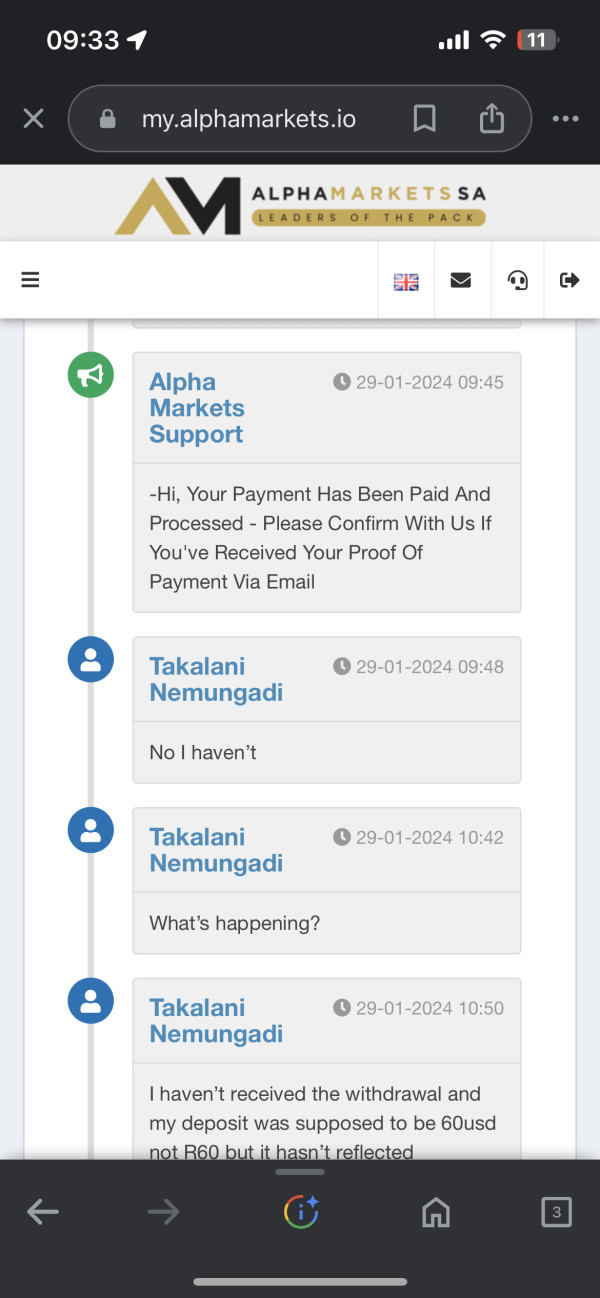

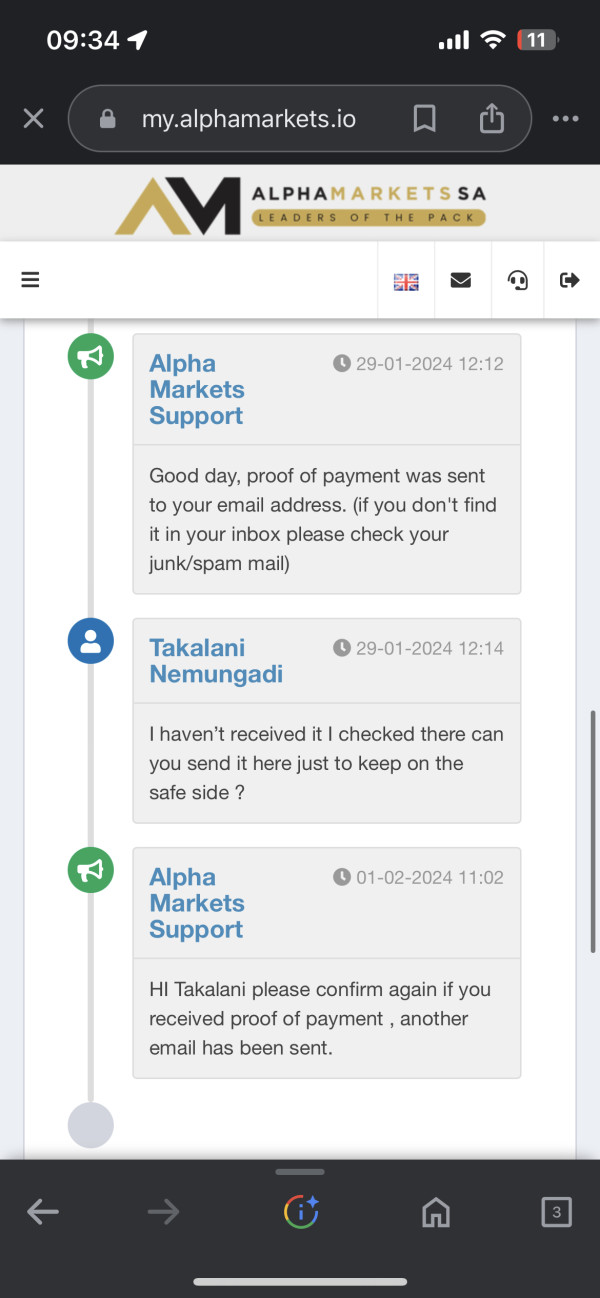

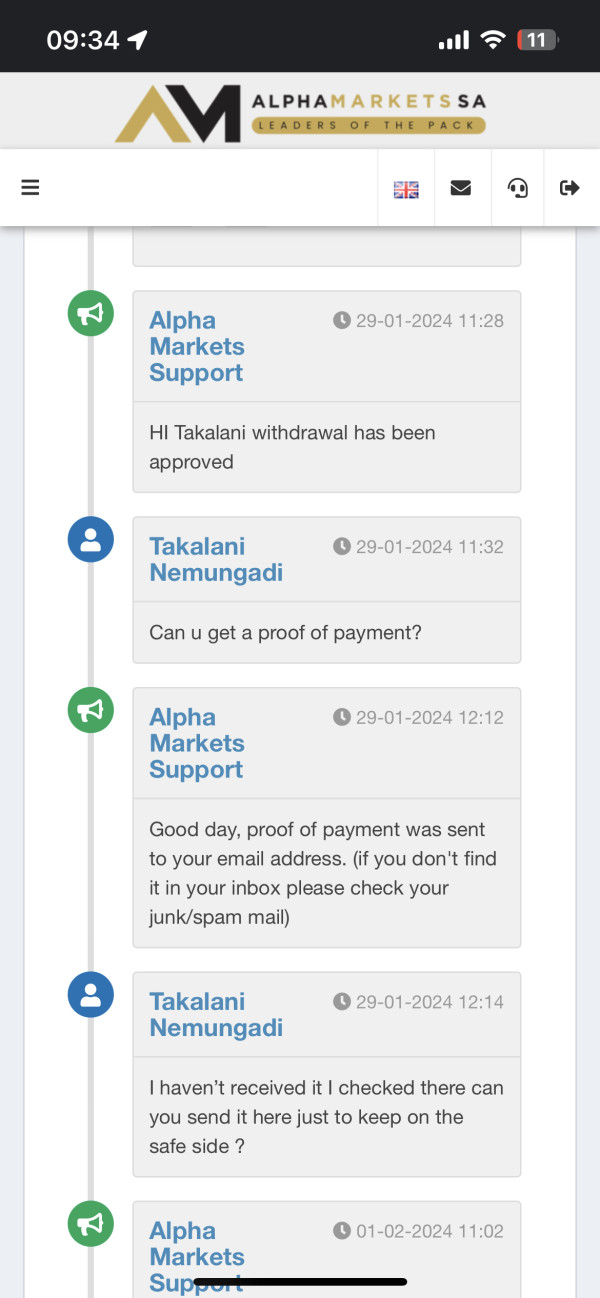

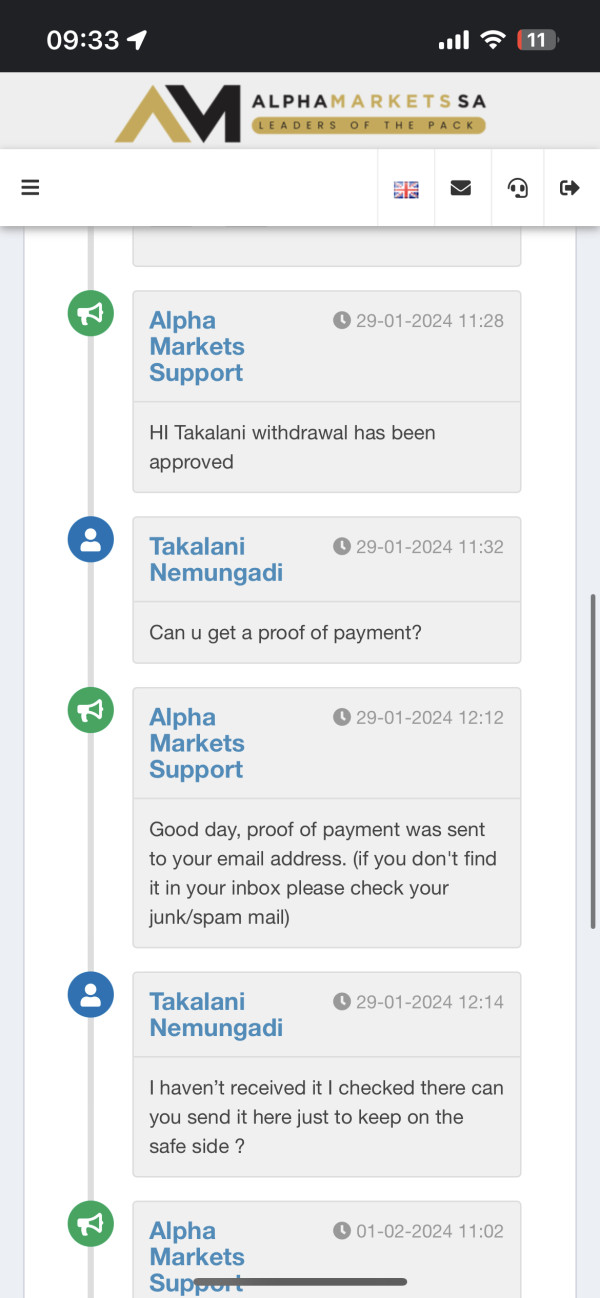

Customer service and support receive a poor rating based on available user feedback that specifically mentions inadequate customer support and issues with false promises. This represents a critical weakness for Alpha Markets, as reliable customer service is essential for trader confidence and problem resolution.

User reports indicating poor customer service quality suggest potential challenges in reaching support representatives, receiving timely responses to inquiries, or obtaining satisfactory resolutions to trading-related issues. The mention of false promises in user feedback raises additional concerns about the reliability of information provided by customer service representatives and the broker's commitment to honoring its stated policies and procedures.

The absence of detailed information about customer service channels, availability hours, response time commitments, or multilingual support options further compounds the poor rating. Professional forex brokers typically provide multiple contact methods, extended support hours, and clear service level commitments, none of which are clearly documented for Alpha Markets.

Trading Experience Analysis

The trading experience category receives an average rating, primarily supported by the broker's advertised low spreads starting at 0 PIPS. This can contribute to cost-effective trading conditions. However, this positive aspect is significantly limited by the lack of detailed information about other crucial trading experience factors.

Platform stability, execution speed, and order processing quality are fundamental elements of trading experience that remain undocumented in available materials. Without information about slippage rates, execution speeds, or platform uptime statistics, traders cannot fully assess the quality of the trading environment they might expect.

The absence of information about mobile trading capabilities, platform features, and user interface design also impacts the assessment. Modern traders expect comprehensive platform functionality, mobile accessibility, and intuitive interfaces, but Alpha Markets provides limited details about these important trading experience components. This Alpha Markets review finds that while competitive spreads provide some trading advantage, the overall trading experience assessment is limited by insufficient information about platform performance and features.

Trust and Reliability Analysis

Trust and reliability receive a very poor rating due to fundamental concerns about regulatory oversight and negative user feedback. The absence of clear regulatory information represents a significant red flag, as regulatory oversight provides essential protections for trader funds and ensures adherence to industry standards.

Without documented regulatory authority oversight, traders cannot verify that Alpha Markets operates under established financial regulations, maintains segregated client accounts, or follows industry best practices for fund security. This regulatory uncertainty creates substantial risk for potential clients who prioritize fund safety and regulatory protection.

User feedback mentioning false promises further undermines trust and reliability. This suggests potential issues with the broker's commitment to honoring its stated terms and conditions. The combination of regulatory uncertainty and negative user experiences regarding reliability creates substantial concerns about the broker's trustworthiness.

User Experience Analysis

User experience receives a poor rating despite some positive elements, reflecting the mixed nature of available feedback about Alpha Markets. While the broker targets both new and experienced traders with promises of easy-to-use features and tools for informed trading decisions, user reports suggest significant gaps between marketing promises and actual service delivery.

The poor customer service feedback directly impacts user experience, as responsive support is crucial for positive trader interactions with their broker. Reports of false promises suggest that users may experience frustration when actual services do not match advertised expectations, leading to disappointing user experiences.

Additionally, the lack of detailed information about platform usability, registration processes, and fund management procedures makes it difficult for users to anticipate their experience with Alpha Markets. The absence of comprehensive user interface information, account management features, and overall platform navigation details contributes to uncertainty about the actual user experience quality that traders can expect from this broker.

Conclusion

This Alpha Markets review reveals a broker with mixed characteristics that require careful consideration by potential clients. While Alpha Markets offers attractive spreads as low as 0 PIPS and focuses on forex trading services, significant concerns about regulatory compliance, customer support quality, and overall transparency substantially impact its overall assessment.

The broker appears most suitable for experienced international traders who prioritize low trading costs over regulatory assurance and comprehensive support services. However, the lack of clear regulatory oversight, combined with negative feedback about customer service and reliability issues, makes Alpha Markets a high-risk choice that requires careful evaluation.

The primary advantages include competitive spread offerings and focus on forex markets, while major disadvantages encompass regulatory uncertainty, poor customer support feedback, and limited transparency about essential trading conditions. Traders considering Alpha Markets should carefully weigh these factors against their individual risk tolerance and trading requirements before making platform decisions.