Is Warren Bowie & Smith safe?

Pros

Cons

Is Warren Bowie & Smith A Scam?

Introduction

Warren Bowie & Smith is a relatively new player in the online trading arena, having been established in 2020. As a brokerage firm based in Mauritius, it offers a variety of trading options, including forex, CFDs, cryptocurrencies, and ETFs. With the increasing popularity of online trading, it is crucial for traders to carefully assess the legitimacy and safety of their chosen brokers. The financial landscape is rife with scams and unregulated entities, making due diligence essential for protecting ones investments. This article aims to provide a comprehensive evaluation of Warren Bowie & Smith, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment. The analysis is based on a review of multiple sources, including user testimonials, regulatory bodies, and industry reports.

Regulation and Legitimacy

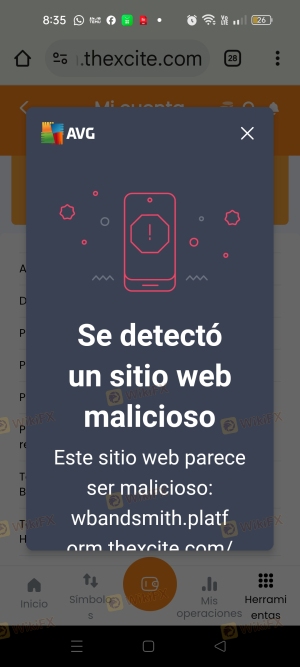

The regulatory framework surrounding a brokerage is one of the most critical factors in determining its legitimacy. Warren Bowie & Smith claims to be regulated by the Financial Services Commission (FSC) of Mauritius. However, the quality of regulation and the broker's adherence to compliance standards are vital for investor protection. Below is a summary of the broker's regulatory status:

| Regulatory Authority | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| FSC Mauritius | GB20025775 | Mauritius | Verified |

While the FSC does provide a regulatory framework, it is essential to note that the oversight may not be as stringent as that provided by more recognized regulators like the FCA (UK) or ASIC (Australia). Some reviews indicate that Warren Bowie & Smith has faced scrutiny regarding its compliance history, and there are concerns about the transparency of its operations. The absence of a robust regulatory environment can expose traders to higher risks, including the potential for fraud or mismanagement of funds.

Company Background Investigation

Warren Bowie & Smith was founded during a tumultuous period marked by the COVID-19 pandemic, which saw a surge in online trading activity as individuals sought alternative income sources. The company is reportedly owned by Securcap Securities (MU) Ltd, which is registered in Mauritius. However, details about the management team and their professional backgrounds are scarce, raising questions about the firms operational transparency.

The lack of publicly available information on the management team and their experience in the financial sector can be a red flag for potential investors. Transparency in company structure and leadership is crucial for building trust, especially in an industry notorious for scams and unregulated brokers. Furthermore, the firm's website does not provide sufficient information on its operational history or any prior regulatory issues, which can hinder potential clients from making informed decisions.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's profitability. Warren Bowie & Smith has a minimum deposit requirement of $200, which is relatively low compared to industry standards. However, the overall fee structure and potential hidden costs must be examined closely. Below is a comparison of the brokers core trading costs:

| Fee Type | Warren Bowie & Smith | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.5 pips | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | 0.02% | 0.01% |

While Warren Bowie & Smith claims to have competitive spreads, they are higher than the industry average, which could eat into traders' profits. Additionally, the absence of a commission model may seem attractive, but traders should be cautious of other fees that could apply, such as inactivity fees or withdrawal fees, which can add up over time. The broker's policy of charging an inactivity fee of up to $500 after three months of no trading activity is particularly concerning and could discourage traders from keeping their accounts open.

Customer Funds Security

The safety of customer funds is paramount in the trading industry. Warren Bowie & Smith claims to implement several measures to protect client funds, including segregated accounts, which ensure that clients' money is kept separate from the company's operational funds. This practice is essential for safeguarding investors assets in the event of insolvency.

Additionally, the broker adheres to KYC (Know Your Customer) and AML (Anti-Money Laundering) policies, which are designed to prevent fraudulent activities. However, there have been no significant reports of fund security issues or disputes, which may indicate a relatively stable operational history. Nonetheless, potential clients should remain cautious and consider the risks associated with trading with a broker that operates under a less stringent regulatory framework.

Customer Experience and Complaints

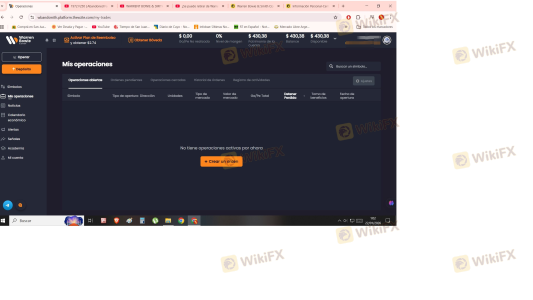

Customer feedback plays a crucial role in assessing a broker's reliability and service quality. Reviews of Warren Bowie & Smith reveal a mixed bag of experiences. While some users appreciate the user-friendly platform and responsive customer service, others have reported issues related to withdrawal delays and difficulty in reaching customer support during peak times.

Common complaints include:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response times |

| Customer Support Issues | Medium | Inconsistent support |

In particular, some users have expressed frustration over prolonged withdrawal processes, suggesting that the broker may not have efficient systems in place to handle fund transfers. This could be a significant deterrent for potential clients who prioritize quick access to their funds. A few anecdotal accounts indicate that users have had to provide extensive documentation for larger withdrawals, which can be a hassle and raises concerns about the broker's operational efficiency.

Platform and Trade Execution

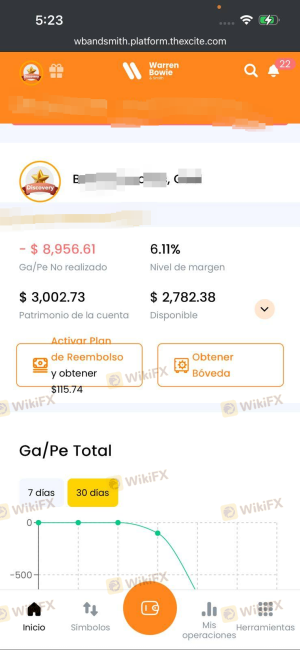

The trading platform provided by Warren Bowie & Smith is known as "Profit." This web-based platform aims to offer a seamless trading experience without the need for downloads. While it is designed to be user-friendly, some traders may find it lacks the advanced features available on industry-standard platforms like MetaTrader 4 or 5.

In terms of order execution, user reviews indicate that while the platform performs adequately under normal conditions, there have been occasional reports of slippage and rejected orders. These issues can significantly impact trading outcomes, especially in fast-moving markets. Traders should be aware of these potential pitfalls and assess whether the platform meets their individual trading needs.

Risk Assessment

Using Warren Bowie & Smith presents several risks that potential clients should consider. Below is a summary of the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Operates under less stringent regulation. |

| Fund Security | Medium | Segregated accounts but limited oversight. |

| Withdrawal Issues | High | Reports of delays and complications. |

| Trading Costs | Medium | Higher spreads than industry average. |

To mitigate these risks, traders are advised to conduct thorough research before opening an account. It may also be beneficial to start with a smaller investment to gauge the broker's reliability and service quality before committing larger sums.

Conclusion and Recommendations

In conclusion, while Warren Bowie & Smith presents itself as a legitimate trading platform with various features and a user-friendly interface, there are several red flags that potential traders should be aware of. The broker's regulatory status is questionable, with concerns about compliance and transparency. Additionally, customer feedback indicates issues with withdrawal processes and customer support.

For traders considering engaging with Warren Bowie & Smith, it is crucial to weigh these risks against the potential benefits. New traders may want to explore more established and regulated brokers to ensure a safer trading experience. Recommended alternatives include brokers regulated by reputable authorities such as the FCA or ASIC, which offer more robust investor protections and transparency. Always prioritize safety and due diligence when selecting a trading partner.

Is Warren Bowie & Smith a scam, or is it legit?

The latest exposure and evaluation content of Warren Bowie & Smith brokers.

Warren Bowie & Smith Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Warren Bowie & Smith latest industry rating score is 1.44, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.44 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.