V7Markets 2025 Review: Everything You Need to Know

Executive Summary

V7Markets presents a complex case in the forex brokerage landscape. It operates as a Canadian-registered offshore social trading investment platform that raises several important concerns. This v7markets review reveals significant issues regarding the broker's regulatory status and legitimacy that potential traders must carefully consider before investing their money.

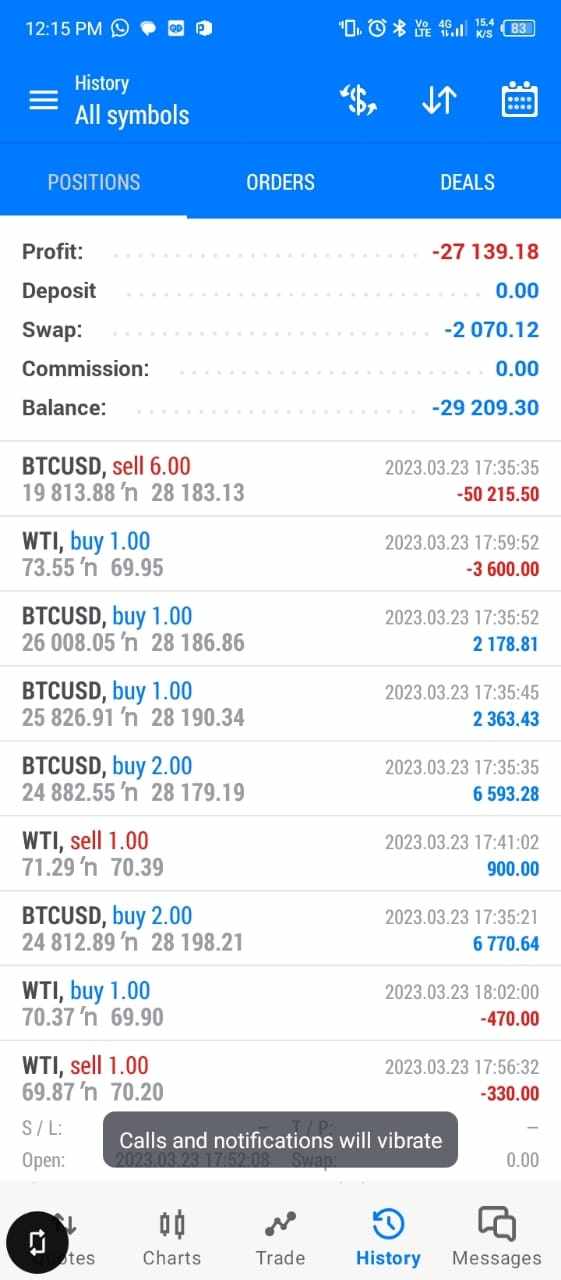

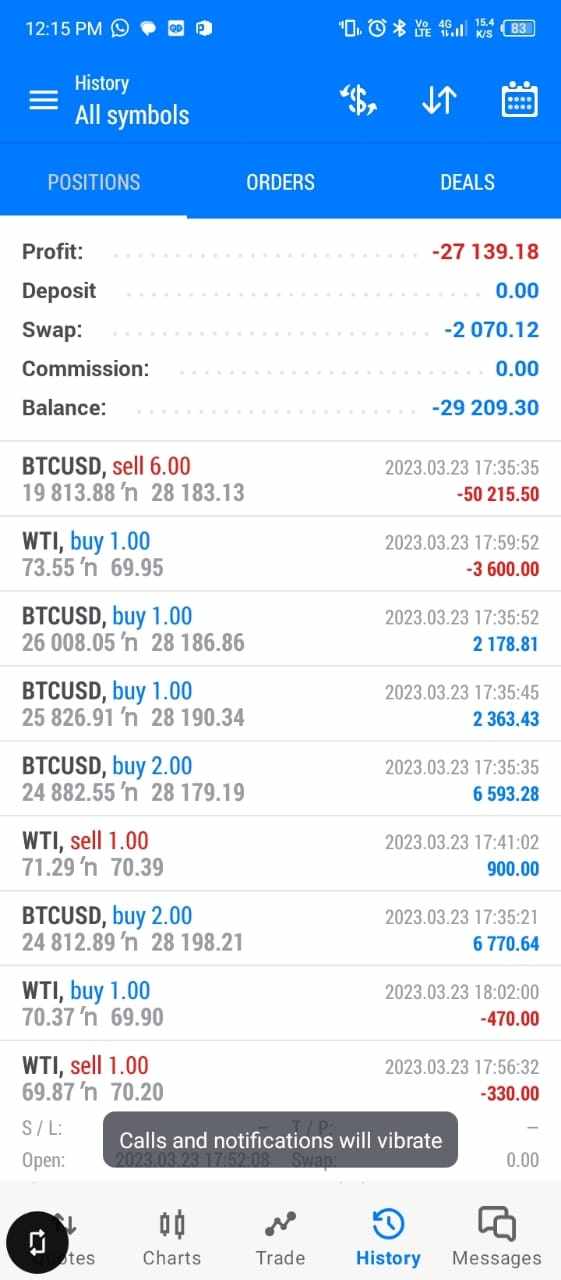

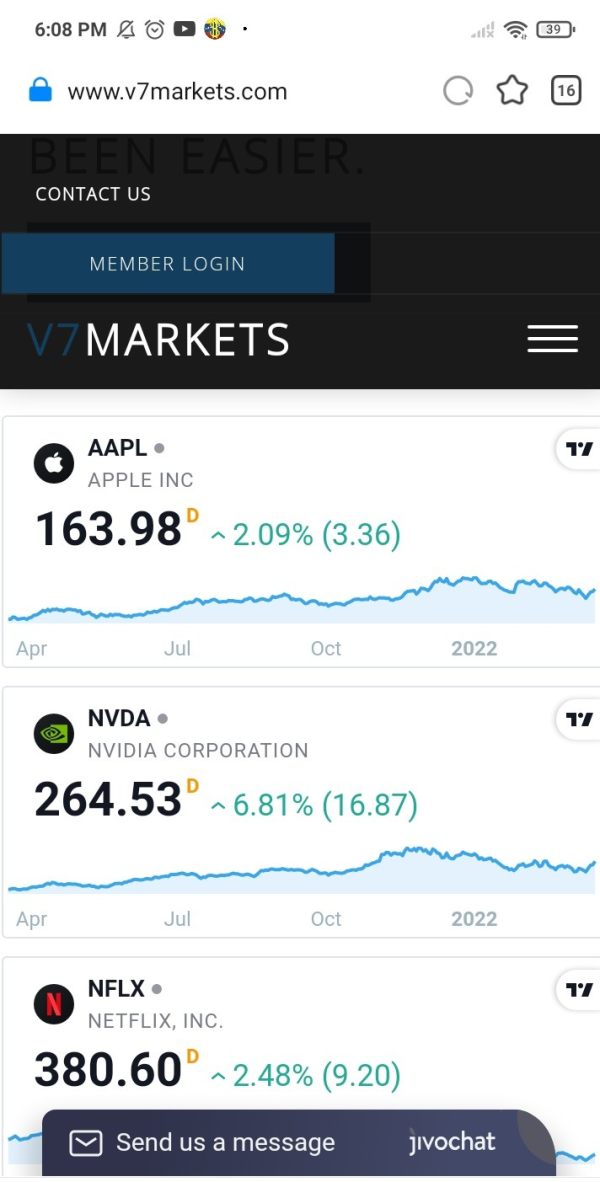

The company offers access to popular MetaTrader 4 and MetaTrader 5 platforms. These platforms provide trading opportunities across multiple asset classes including forex, individual stocks, commodities, precious metals, energy, and stock indices that appeal to many different types of traders.

Despite achieving a user rating of 7/10 in some assessments, V7Markets faces substantial credibility challenges due to its unregulated status. The broker lacks oversight from any government regulatory authority, which raises serious questions about investor protection and fund security that cannot be ignored. While the platform supports diverse trading instruments and established trading platforms, the absence of regulatory supervision makes it suitable primarily for traders with high risk tolerance.

These traders must understand the implications of trading with an unregulated entity before they commit any funds. This review examines all aspects of V7Markets' services to provide traders with comprehensive insights for informed decision-making.

Important Notice

Regional Entity Differences: V7Markets has been flagged as unregulated across multiple jurisdictions, and investors should exercise extreme caution when considering this broker. The company's lack of regulatory oversight means that standard investor protections may not apply to your investments.

Dispute resolution mechanisms may be limited or unavailable if problems arise with your account. Review Methodology: This assessment is based on comprehensive analysis of publicly available information, user feedback, and industry reports that we could verify.

Given the limited transparency from the broker itself, some information gaps exist that potential clients should investigate independently before making any investment decisions. We recommend contacting the broker directly to verify all important details about their services.

Rating Framework

Broker Overview

V7Markets operates as an offshore social trading investment platform registered in Canada. It positions itself in the competitive forex and CFD trading market with limited transparency about its operations.

The company's business model focuses on providing access to global financial markets through established trading platforms, though specific details about its founding date and corporate history remain limited in available documentation. The broker attempts to serve international clients by offering trading services across multiple asset categories, though its operational transparency raises questions among industry observers who monitor broker activities.

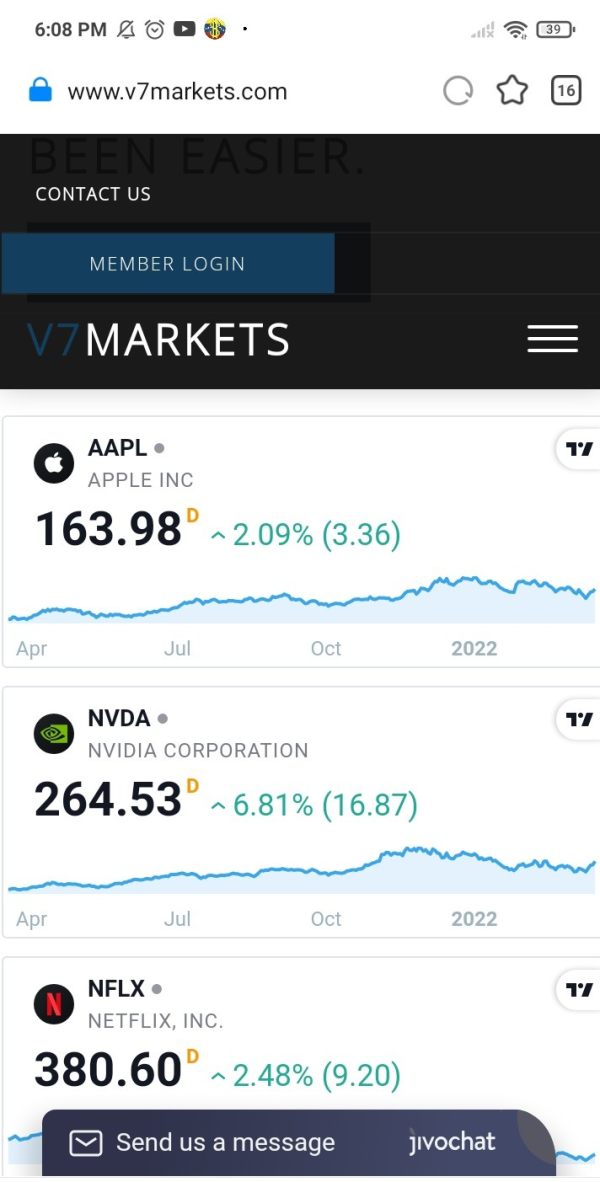

The platform's core offering centers around MetaTrader 4 and MetaTrader 5 access, two of the industry's most recognized trading platforms. V7Markets provides trading opportunities across six main asset categories: foreign exchange markets, individual stocks, commodities, precious metals, energy products, and stock indices that cover most major market sectors.

However, the broker's most significant challenge lies in its regulatory status - V7Markets currently operates without supervision from any recognized government regulatory authority. This v7markets review emphasizes that this regulatory gap represents a critical consideration for potential clients, as it means standard investor protections and dispute resolution mechanisms may not be available when needed.

Regulatory Status: V7Markets operates without regulation from any recognized government authority. This significantly increases investment risks for clients who choose to trade with this broker.

This unregulated status means traders lack standard protections typically provided by financial regulatory bodies around the world. Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not detailed in available sources.

Potential clients must contact the broker directly for clarification on supported payment systems and processing procedures that affect their trading. Minimum Deposit Requirements: Available information shows inconsistencies regarding minimum deposit requirements, with some sources indicating $200 while others suggest $0.

This discrepancy highlights the need for direct verification with the broker before opening any account. Bonus and Promotions: No specific information about bonus programs or promotional offers is available in current sources.

This suggests either absence of such programs or limited marketing transparency from the broker's side. Tradeable Assets: The broker offers access to six main categories: forex pairs, individual stocks, commodities, precious metals, energy products, and stock indices.

This provides reasonable diversification opportunities for traders who want to spread their risk across different markets. Cost Structure: Detailed information about spreads, commissions, and fee structures is not available in current sources.

Traders must make direct inquiry with the broker for accurate pricing information that affects their trading costs. Leverage Ratios: Specific leverage ratios and margin requirements are not detailed in available sources.

This necessitates direct communication with V7Markets for these crucial trading parameters that impact position sizing. Platform Options: V7Markets supports both MetaTrader 4 and MetaTrader 5 platforms.

These offer traders access to industry-standard trading environments with comprehensive analytical tools for market analysis. Geographic Restrictions: Specific information about geographic restrictions or prohibited jurisdictions is not available in current documentation.

Customer Service Languages: Available sources do not specify the range of languages supported by V7Markets customer service team.

This v7markets review section highlights the significant information gaps that potential clients must address through direct broker contact before making trading decisions.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

V7Markets' account conditions present several concerns that impact its overall rating in this category. The most significant issue lies in the inconsistent information regarding minimum deposit requirements, with different sources reporting varying amounts ranging from $0 to $200.

This inconsistency raises questions about the broker's transparency and communication standards, as potential clients cannot rely on consistent information from official sources. The lack of detailed information about account types represents another significant weakness that affects trader decision-making.

Available sources do not provide clear descriptions of different account tiers, their respective features, or any special account options such as Islamic accounts for traders requiring Sharia-compliant trading conditions. This information gap makes it difficult for traders to understand what account options might be available to meet their specific needs and trading requirements.

Account opening procedures and verification processes are not detailed in available documentation. This leaves potential clients uncertain about onboarding requirements and timelines for account activation.

The absence of clear information about account features, trading conditions, and special services significantly hampers the evaluation process for potential clients. User feedback regarding account conditions remains limited, though the general consensus points to concerns about the broker's overall legitimacy and transparency in their operations.

When compared to regulated brokers in the industry, V7Markets' account conditions appear significantly underdeveloped, particularly in terms of information transparency and client communication. This v7markets review finds that the account conditions category suffers primarily from lack of clear, consistent information rather than necessarily poor conditions themselves.

V7Markets achieves a moderate rating in tools and resources primarily due to its support for MetaTrader 4 and MetaTrader 5 platforms. These industry-standard platforms provide traders with comprehensive charting capabilities, technical analysis tools, automated trading support through Expert Advisors, and access to a wide range of custom indicators.

The availability of both MT4 and MT5 ensures that traders can choose their preferred platform based on their specific trading needs and preferences. The broker's asset coverage across six major categories provides reasonable diversification opportunities for traders seeking exposure to multiple markets.

This variety allows for portfolio diversification and different trading strategies across various asset classes, which represents a positive aspect of the broker's offering. However, significant gaps exist in research and educational resources that many traders expect from their brokers.

Available sources do not mention specific market analysis, daily reports, economic calendars, or educational materials that many established brokers provide to support their clients' trading decisions. The absence of detailed information about research capabilities, trading signals, or analytical support services limits the overall value proposition for traders who rely on broker-provided market insights.

User feedback regarding the quality and reliability of available tools remains limited. The use of established MT4 and MT5 platforms generally receives positive recognition from the trading community worldwide.

The lack of information about additional proprietary tools, mobile platform capabilities, or enhanced trading features represents missed opportunities for differentiation in a competitive market. Most successful brokers today offer additional resources beyond basic platform access to help their clients succeed.

Customer Service and Support Analysis (5/10)

Customer service and support evaluation for V7Markets faces significant challenges due to limited available information about service channels, response times, and support quality. Available sources do not provide specific details about contact methods, whether the broker offers live chat, phone support, email assistance, or other communication channels that traders typically expect from their service providers.

Response time information is notably absent from available documentation. This makes it impossible to assess whether V7Markets provides timely assistance when clients encounter issues or have questions about their trading accounts.

The lack of documented service level agreements or support availability hours further complicates the evaluation of their customer service commitment. Multilingual support capabilities remain unclear, with available sources indicating English language support but not specifying additional languages that might be available for international clients.

This limitation could impact traders from non-English speaking regions who prefer support in their native languages. User feedback regarding customer service experiences is limited in available sources, providing insufficient data to assess actual service quality or common issues that clients might encounter.

The absence of documented problem resolution cases or customer testimonials makes it difficult to evaluate the effectiveness of V7Markets' support systems. The overall customer service rating reflects these information gaps and the general uncertainty surrounding the broker's support capabilities.

Without clear documentation of service standards, availability, or quality metrics, potential clients cannot adequately assess whether V7Markets will provide adequate support for their trading activities.

Trading Experience Analysis (5/10)

The trading experience evaluation for V7Markets centers primarily around the MetaTrader 4 and MetaTrader 5 platforms. These generally provide reliable and comprehensive trading environments that most traders find familiar and functional.

These platforms offer stable performance, advanced charting capabilities, and extensive customization options that most traders find adequate for their trading needs. The availability of both platforms allows traders to choose based on their specific preferences and trading strategies.

However, critical information about execution quality, order processing speeds, and slippage rates is not available in current sources. These factors significantly impact trading experience, particularly for active traders who require fast execution and minimal slippage during market volatility.

The absence of specific performance metrics makes it difficult to assess how V7Markets compares to other brokers in terms of execution quality. Platform stability and server reliability information is not detailed in available sources, though user feedback suggests generally acceptable performance without major technical issues reported.

The lack of specific uptime statistics or technical performance data limits the ability to fully evaluate platform reliability during different market conditions. Mobile trading experience details are not provided in available documentation, leaving questions about mobile platform functionality, features, and performance.

In today's trading environment, mobile platform quality significantly impacts overall trading experience, making this information gap particularly relevant for modern traders. Spread competitiveness and liquidity information is notably absent, preventing assessment of trading costs and market depth.

These factors directly impact trading profitability and overall experience quality. This v7markets review finds that while the platform foundation appears solid through MT4/MT5 support, the lack of detailed performance and cost information limits the overall trading experience evaluation.

Trust and Reliability Analysis (2/10)

Trust and reliability represent V7Markets' most significant weakness, earning the lowest rating in this comprehensive evaluation. The primary concern stems from the broker's unregulated status, as it operates without oversight from any recognized government regulatory authority.

This absence of regulation means that standard investor protections, compensation schemes, and dispute resolution mechanisms that regulated brokers must provide are not available to V7Markets clients. Regulatory verification confirms that V7Markets does not hold licenses from major financial regulatory bodies such as the FCA, CySEC, ASIC, or other recognized authorities.

This regulatory gap creates substantial risks for traders, as their funds lack the protection typically provided by regulatory frameworks that require segregated client accounts, regular audits, and compliance with strict operational standards. Company transparency presents additional concerns, with limited publicly available information about corporate structure, ownership, financial statements, or operational history.

The lack of detailed company background information makes it difficult for potential clients to assess the broker's stability and long-term viability. Third-party evaluations and industry recognition are notably absent, with V7Markets not appearing in major broker comparison sites or receiving recognition from established financial industry organizations.

User feedback consistently highlights concerns about legitimacy and safety, with multiple sources questioning the broker's credibility. The handling of negative events or client complaints is not documented in available sources, raising questions about how V7Markets addresses client concerns or disputes.

Without established regulatory oversight or clear complaint resolution procedures, clients may have limited recourse in case of problems with their trading accounts or fund withdrawals.

User Experience Analysis (4/10)

User experience evaluation for V7Markets reveals mixed feedback, with some users providing a 7/10 rating while simultaneously expressing concerns about the broker's legitimacy. This contradiction suggests that while some platform features may function adequately, underlying trust issues significantly impact overall user satisfaction and confidence in the service.

Interface design and platform usability benefit from the MetaTrader 4 and MetaTrader 5 platforms, which offer familiar and intuitive trading environments for most traders. These platforms provide comprehensive functionality that users generally find accessible, though specific customization options or unique interface enhancements from V7Markets are not documented in available sources.

Registration and account verification processes are not detailed in available documentation. This makes it unclear how streamlined or user-friendly the onboarding experience might be for new clients.

The lack of information about required documentation, verification timelines, or account activation procedures represents a significant gap in user experience evaluation. Fund management experience, including deposit and withdrawal processes, remains undocumented in available sources.

These operations significantly impact user satisfaction, as traders need reliable and efficient methods to manage their account funding. The absence of clear information about processing times, supported payment methods, or fee structures creates uncertainty for potential users.

Common user complaints center around legitimacy concerns and questions about the broker's regulatory status rather than specific platform functionality issues. This pattern suggests that while technical aspects may function reasonably well, the broader trust and security concerns significantly impact overall user experience.

The user profile analysis indicates that V7Markets might be suitable only for traders with high risk tolerance who fully understand the implications of trading with an unregulated broker.

Conclusion

This comprehensive v7markets review reveals a broker with significant regulatory and transparency challenges that overshadow its technical capabilities. While V7Markets offers access to established MetaTrader platforms and multiple asset classes, the absence of regulatory oversight creates substantial risks that most traders should carefully consider before engaging with this broker.

V7Markets may be suitable only for experienced traders with high risk tolerance who fully understand the implications of trading with an unregulated entity. These traders must be prepared to accept the associated risks that come with unregulated trading environments.

The broker's main advantages include platform variety and asset diversification, while its critical disadvantages center on regulatory absence, limited transparency, and user trust concerns. For most traders, especially those prioritizing safety and regulatory protection, exploring regulated alternatives would be advisable.

The significant information gaps and legitimacy concerns identified in this review suggest that V7Markets requires substantial improvements in transparency and regulatory compliance before it can be considered a reliable option for serious traders seeking secure trading environments.