Regarding the legitimacy of MET forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is MET safe?

Pros

Cons

Is MET markets regulated?

The regulatory license is the strongest proof.

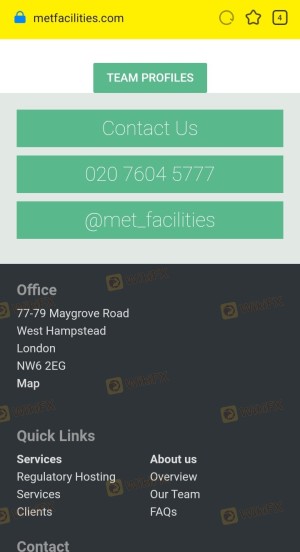

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

MET Facilities LLP

Effective Date: Change Record

2013-01-14Email Address of Licensed Institution:

jcallender@pecandco.com, info@metfacilities.comSharing Status:

No SharingWebsite of Licensed Institution:

www.metfacilities.comExpiration Time:

--Address of Licensed Institution:

Panos Eliades Franklin & Co Olympia House Armitage Road London Barnet NW11 8RQ UNITED KINGDOMPhone Number of Licensed Institution:

+442072808873Licensed Institution Certified Documents:

Is MET Safe or a Scam?

Introduction

MET is a forex brokerage that has positioned itself in the competitive landscape of online trading since its establishment in 2017. Operating primarily from the United Kingdom, MET offers a range of trading services and financial products to traders worldwide. However, the forex market is fraught with risks, making it crucial for traders to thoroughly evaluate the legitimacy and safety of any broker they consider. This article aims to provide a comprehensive analysis of MET, examining its regulatory status, company background, trading conditions, customer safety measures, and overall user experience. The investigation is based on a review of multiple credible sources, including regulatory databases, customer reviews, and expert analyses.

Regulation and Legitimacy

The regulatory status of a brokerage is one of the most significant indicators of its reliability. MET claims to be regulated by the Financial Conduct Authority (FCA) in the UK, which is known for its stringent regulatory standards. However, scrutiny reveals that MET's actual standing is more complex.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Conduct Authority (FCA) | 587084 | United Kingdom | Active, but with concerns |

While the FCA is a reputable regulator, the low score of 1.56 on WikiFX raises alarms about MET's operational practices. Moreover, complaints about the lack of physical office presence in the UK and insufficient customer service responses suggest potential regulatory shortcomings. The importance of regulatory oversight cannot be overstated, as it ensures that brokers adhere to strict compliance standards, protecting investors from fraudulent activities.

Company Background Investigation

Founded in 2017, MET has a relatively short history in the forex market. The company's ownership structure and management team lack transparency, as detailed information about key personnel is scarce. This opacity raises questions about the firm's operational integrity and experience.

The absence of a verifiable physical office in the UK, as reported by multiple sources, further complicates the picture. A field survey conducted by WikiFX found no trace of MET's purported office, which is a significant red flag. In assessing the transparency and information disclosure levels, it is evident that MET does not meet the expectations associated with reputable brokers. This lack of transparency could be indicative of underlying issues, making it essential for potential clients to exercise caution.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions is paramount. MET's fee structure appears competitive at first glance, but a deeper dive reveals potential concerns.

| Fee Type | MET | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.2 pips |

| Commission Model | None | Varies (typically $5 per lot) |

| Overnight Interest Range | 0.5% | 0.3% |

The spreads offered by MET are higher than the industry average, which could eat into traders' profits. Additionally, the absence of a clear commission structure raises questions about hidden fees that could be applied. Such discrepancies make it essential for traders to read the fine print and understand all potential costs before engaging with MET.

Customer Fund Safety

The safety of customer funds is a critical aspect of any brokerage. MET claims to implement various measures to protect clients' investments, including fund segregation and negative balance protection. However, the effectiveness of these measures is called into question given the regulatory concerns surrounding the broker.

Historically, there have been complaints regarding fund withdrawals and the overall responsiveness of customer service. Reports of difficulties in accessing funds suggest that while MET may have policies in place, their implementation may not be reliable. This situation poses a significant risk for traders, as the inability to access funds can lead to substantial financial losses.

Customer Experience and Complaints

Customer feedback is a vital component in assessing a broker's reliability. An analysis of reviews reveals a mixed bag of experiences from MET users.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Average |

| Misleading Promotions | High | None |

Common complaints include withdrawal issues, where clients report difficulties in accessing their funds. The severity of these complaints is concerning, as they indicate potential operational failures. Additionally, the company's response to customer grievances has been criticized as inadequate, further eroding trust among existing and potential clients.

Platform and Execution

The trading platform's performance is another crucial factor in determining a broker's reliability. MET utilizes a proprietary trading platform that, while functional, has received mixed reviews regarding stability and execution quality. Users have reported instances of slippage and order rejections, which can significantly impact trading outcomes.

Concerns about platform manipulation have also been raised, particularly regarding the use of virtual dealer plugins that could potentially alter displayed data. Such practices, if true, would indicate a severe breach of trust and could categorize MET as a scam.

Risk Assessment

Engaging with MET presents several risks that traders should be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of clear regulatory compliance and oversight. |

| Financial Risk | High | Complaints regarding withdrawal issues and fund access. |

| Operational Risk | Medium | Concerns about platform stability and execution quality. |

To mitigate these risks, traders should consider conducting thorough due diligence before investing with MET. This includes seeking out verified reviews, understanding the full fee structure, and being cautious with the amount of capital allocated to this broker.

Conclusion and Recommendations

In conclusion, while MET presents itself as a legitimate forex broker, there are multiple red flags that suggest it may not be entirely safe for traders. The combination of regulatory concerns, a lack of transparency, and numerous customer complaints indicates potential risks that could jeopardize investors' funds.

For traders seeking reliable alternatives, it is advisable to consider brokers regulated by top-tier authorities such as the FCA, ASIC, or SEC, which offer better protections and transparency. Ultimately, due diligence is essential, and traders should remain vigilant to avoid potential scams in the forex market.

In summary, IS MET SAFE? The evidence suggests that caution is warranted when engaging with this broker.

Is MET a scam, or is it legit?

The latest exposure and evaluation content of MET brokers.

MET Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MET latest industry rating score is 5.17, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.17 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.