ForexSP 2025 Review: Everything You Need to Know

Executive Summary

This detailed forexsp review shows a troubling picture of a forex broker that has received harsh criticism from traders. ForexSP gets mixed but mostly negative reviews, with an average rating of 6 out of 10 from 24 user reviews based on available feedback and analysis. The platform has some good points like easy-to-use design and what users call excellent customer support. However, these strengths cannot make up for serious concerns about whether the company is legitimate and how it does business.

The broker mainly focuses on individual retail investors who want to trade forex. Several user reviews have raised red flags, with many reviewers clearly warning that ForexSP works as a "scam and fraud company." This split in user feedback creates a tough situation for potential clients. Good experiences with platform ease and customer service clash sharply with claims of fraud and questionable business practices.

Given how serious these claims are and the lack of clear regulatory oversight information, future traders should be very careful when thinking about ForexSP as their trading partner.

Important Disclaimers

Users in different regions may face different levels of legal protection when dealing with ForexSP because specific regulatory information is missing from available materials. The regulatory landscape for forex brokers changes a lot across different areas. Without clear licensing details, traders cannot be sure of their options if disputes happen.

This review is based mainly on user feedback and public information since detailed regulatory audit processes were not available during research. Potential clients should do their own research and check any regulatory claims on their own before making investment decisions.

Rating Framework

Broker Overview

ForexSP works in the competitive forex brokerage space, though specific details about when it started and its corporate background remain unclear from available sources. The company seems to focus on giving forex trading services to individual investors. However, detailed information about its business model and how it operates is not easily available in public materials.

The broker seems to target retail traders who want accessible forex trading opportunities. But the lack of clear corporate information and regulatory details raises questions about whether the company operates legitimately and can survive long-term in the highly regulated financial services sector.

Trading platform details, types of assets offered, and regulatory oversight information are not clearly shown in available materials. This itself is a big concern for potential clients. This forexsp review stresses how important regulatory transparency is when choosing a broker, an area where ForexSP seems to fall short of industry standards.

Regulatory Jurisdiction: Specific regulatory oversight information is not available in accessible materials, which is a major red flag for potential clients seeking regulated trading environments.

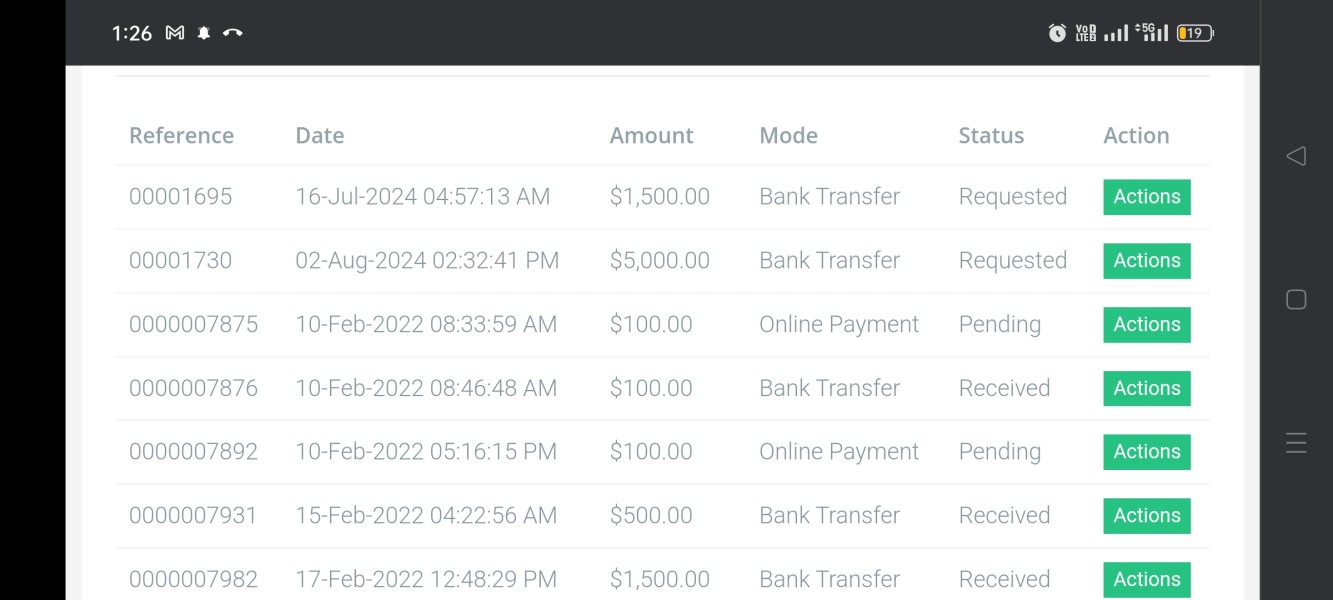

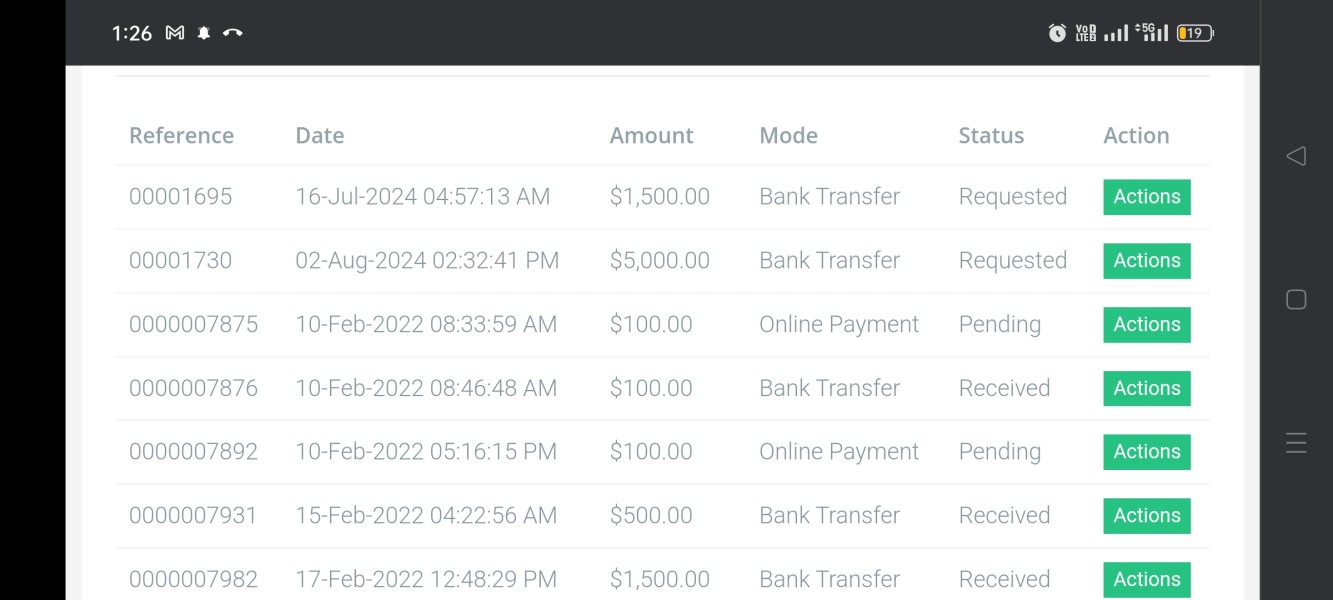

Deposit and Withdrawal Methods: Details about funding options and withdrawal procedures are not clearly specified in available documentation.

Minimum Deposit Requirements: Specific minimum deposit amounts are not disclosed in the materials reviewed.

Promotional Offers: Information about bonus structures and promotional campaigns is not available in current materials.

Trading Assets: The range of tradeable instruments and asset classes offered by ForexSP is not clearly documented.

Cost Structure: Specific information about spreads, commissions, and other trading costs is not available in reviewed materials.

Leverage Options: Details about maximum leverage ratios and margin requirements are not specified.

Platform Selection: Information about trading platform options and technical specifications is not available.

Geographic Restrictions: Specific details about regional availability and restrictions are not documented.

Customer Support Languages: Available language options for customer service are not specified in current materials.

This forexsp review highlights the worrying lack of transparency in basic service information. Legitimate brokers typically make this information easy to find.

Comprehensive Rating Analysis

Account Conditions Analysis (Score: 2/10)

The review of ForexSP's account conditions shows major information gaps that raise serious concerns about transparency and regulatory compliance. Standard industry practice involves clear disclosure of account types, minimum deposit requirements, and account opening procedures. Yet ForexSP fails to provide this basic information in accessible materials.

Account variety and special features that separate different trader groups are not documented. This makes it impossible for potential clients to understand what options are available to them. The lack of clear account opening procedures and verification requirements suggests either poor communication practices or potential regulatory problems.

Most worrying is the lack of information about account protection measures, separation of client funds, and other safety features that legitimate brokers typically highlight prominently. This forexsp review stresses that the absence of such critical information should be considered a major red flag for potential clients.

Without clear account structure information, traders cannot make informed decisions about whether the broker's offerings match their trading needs and risk tolerance levels.

The analysis of ForexSP's trading tools and educational resources shows another area of major concern due to the lack of available information. Professional forex brokers typically provide complete sets of analytical tools, market research, and educational materials to support their clients' trading activities.

Research capabilities, market analysis resources, and educational content are not documented in available materials. This suggests either minimal investment in client support infrastructure or poor communication of available resources. Advanced trading tools, automated trading support, and integration with third-party platforms are similarly undocumented.

The absence of clear information about available trading tools makes it difficult for potential clients to assess whether the broker can support their analytical and execution needs. Professional traders typically require access to advanced charting, technical indicators, and market news feeds. None of these are clearly documented for ForexSP.

This lack of transparency in tool availability represents a major disadvantage compared to established brokers who typically provide detailed information about their technological capabilities and resource offerings.

Customer Service Analysis (Score: 7/10)

Customer service represents one of the few areas where ForexSP receives positive feedback from users. Multiple reviewers have specifically praised the quality of customer support, describing it as "excellent" and highlighting responsive assistance when issues arise.

The positive customer service feedback suggests that ForexSP invests in maintaining adequate support staff and training. This shows some level of operational professionalism. Users report satisfactory response times and helpful assistance with platform-related questions and concerns.

However, specific details about support channels, availability hours, and multilingual capabilities are not clearly documented. While user praise for customer service quality is encouraging, the lack of detailed information about support infrastructure limits the ability to fully evaluate this aspect of the service.

The positive customer service feedback stands in stark contrast to other areas of concern. This creates a puzzling contradiction that potential clients should carefully consider when evaluating the broker's overall reliability and professionalism.

Trading Experience Analysis (Score: 4/10)

User feedback regarding trading experience with ForexSP presents a mixed picture with concerning negative elements. Several users have reported issues with slippage and requoting, which are critical factors that directly impact trading profitability and execution quality.

Platform stability and execution speed concerns have been raised by users. However, specific performance metrics and technical specifications are not available for independent verification. The reported issues with order execution quality suggest potential problems with the broker's trading infrastructure or liquidity provision.

Mobile trading capabilities and platform functionality details are not clearly documented. This makes it difficult for potential clients to assess whether the trading environment meets their technical requirements. The absence of detailed platform specifications and performance data represents a major transparency gap.

This forexsp review notes that trading experience issues, combined with the lack of technical transparency, create substantial concerns about the broker's ability to provide professional-grade trading services that meet industry standards.

Trust and Reliability Analysis (Score: 1/10)

Trust and reliability represent the most concerning aspects of ForexSP's profile. Multiple users explicitly warn about fraudulent behavior and questionable business practices. The absence of clear regulatory licensing information makes these concerns much worse.

Several user reviews specifically label ForexSP as a "scam and fraud company." These are serious allegations that cannot be ignored in any complete evaluation. The lack of regulatory oversight information makes it impossible to verify the broker's compliance with financial services regulations.

Industry reputation appears to be severely damaged by these fraud allegations. The company's response to such serious accusations is not documented in available materials. The absence of regulatory protection means that clients may have limited options in case of disputes or problems.

Fund security measures, client money separation, and other standard protection protocols are not clearly documented. This represents a fundamental failure to meet basic industry standards for client protection and regulatory compliance.

User Experience Analysis (Score: 5/10)

Overall user satisfaction with ForexSP presents a split picture. Positive feedback about platform usability contrasts sharply with serious concerns about business practices. Some users appreciate the user-friendly interface design and ease of navigation.

The registration and account verification processes are not clearly documented. However, some users report satisfactory experiences with initial platform setup. But the positive interface feedback is overshadowed by more serious concerns about the broker's legitimacy and business practices.

Common user complaints center around the basic question of whether ForexSP operates as a legitimate business or fraudulent scheme. This represents a much more serious concern than typical user experience issues like interface design or feature availability.

The target user profile appears to be individual retail investors seeking forex trading opportunities. However, the serious fraud allegations make it impossible to recommend this broker to any user category without significant risk warnings and cautions about potential financial losses.

Conclusion

This complete forexsp review reveals a broker with major concerns that far outweigh any positive aspects. ForexSP shows some strengths in customer service quality and platform usability. However, these advantages are completely overshadowed by serious allegations of fraudulent behavior and the absence of regulatory oversight.

The broker may initially appear suitable for individual retail investors seeking forex trading opportunities. But the multiple fraud allegations and lack of regulatory protection create unacceptable risks for any potential client. The positive aspects of customer service and user-friendly platform design cannot make up for basic questions about business legitimacy.

Primary advantages include responsive customer support and accessible platform design. Critical disadvantages include fraud allegations, absence of regulatory information, and lack of transparency in basic service details. Based on this analysis, potential clients should exercise extreme caution and consider alternative brokers with clear regulatory oversight and positive industry reputations.