PlusMarkets Review 1

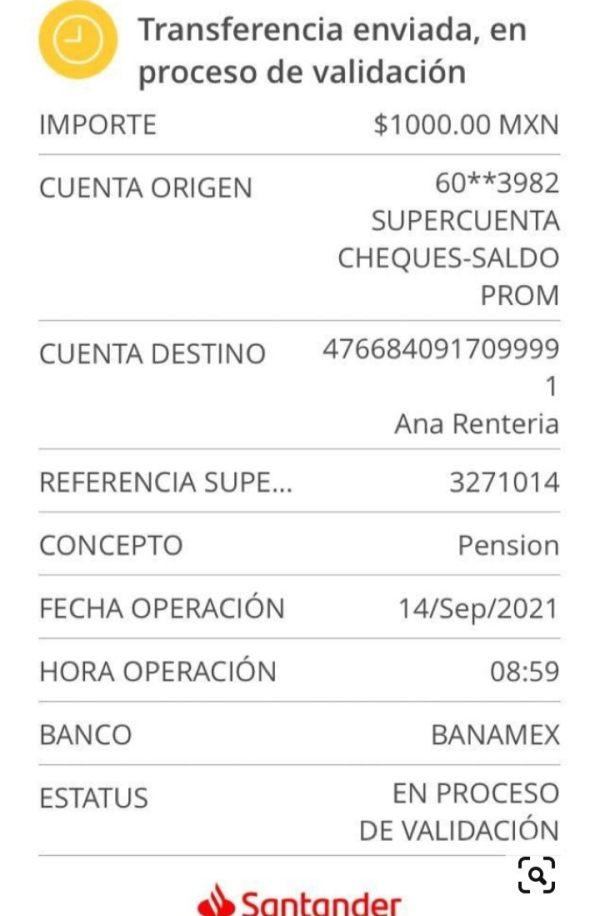

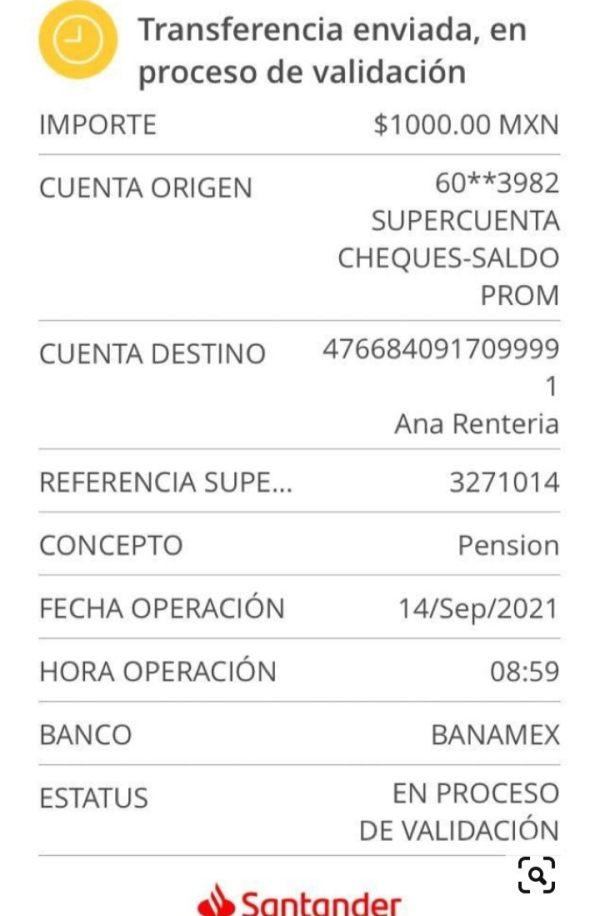

I want to say that they have not given me any money, supposedly a withdrawal of $500 came out but these are hours and nothing arrives. I want a solution, please. The broker is proven to be a scam and my deposit was 1000 pesos

PlusMarkets Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

I want to say that they have not given me any money, supposedly a withdrawal of $500 came out but these are hours and nothing arrives. I want a solution, please. The broker is proven to be a scam and my deposit was 1000 pesos

This plusmarkets review gives you a complete look at PlusMarkets, an online brokerage firm that calls itself a full-service trading platform. Our review of available information and regulatory documents shows that PlusMarkets has both good features and some concerns about transparency that you should know about.

The broker works under the Cyprus Securities and Exchange Commission with license number 282/15. This gives it proper regulatory oversight. PlusMarkets stands out from other brokers because it offers zero-commission trading and requires no minimum deposit, which makes it easy for all types of traders to get started.

PlusMarkets targets new investors who want cheap access to financial markets. It also appeals to experienced traders who want commission-free trading. The platform uses Finance Central as its main trading system and lets you trade stocks, bonds, ETFs, mutual funds, and options. However, we found big gaps in public information about specific trading conditions, user experiences, and how the company actually operates.

The regulatory framework gives some confidence. But the limited transparency about key operations and lack of detailed user feedback lead to a neutral assessment of this brokerage platform.

Regional Entity Differences: PlusMarkets works under the Cyprus Securities and Exchange Commission with license number 282/15. You should know that regulatory protections and legal frameworks change a lot depending on where you live. The services and protections available may be different for clients in various regions, so you should check your local regulatory environment before using the platform.

Review Methodology Disclaimer: This review uses publicly available information, regulatory documents, and available user feedback sources. We have limited detailed information about specific operations, trading conditions, and complete user experiences, so this review may not cover all aspects of the brokerage's services. Potential clients should do additional research and verify current terms and conditions directly with the broker before making any trading decisions.

| Evaluation Criteria | Score | Rating Basis |

|---|---|---|

| Account Conditions | 8/10 | Zero minimum deposit requirement and commission-free trading structure create attractive entry conditions for new investors |

| Tools and Resources | 7/10 | Platform offers various advanced trading tools, though specific tool varieties and capabilities lack detailed documentation |

| Customer Service and Support | 6/10 | 24/7 support availability claimed, but absence of specific user feedback and service quality assessments limits evaluation |

| Trading Experience | 6/10 | Finance Central platform utilized, but detailed user experience descriptions and performance evaluations unavailable |

| Trust and Reliability | 7/10 | CySEC regulatory oversight provides foundation, but limited company establishment details and financial transparency information |

| User Experience | 6/10 | Limited availability of user ratings and detailed experience feedback constrains comprehensive assessment |

PlusMarkets works as a complete online brokerage platform. The company does not share specific details about when it was founded in available documents. The company says it is a full-service financial services provider that gives access to multiple asset classes and keeps customer support running 24/7. According to available information, PlusMarkets focuses on giving trading access across various financial instruments while using a business model that removes traditional commission structures.

The broker's operations center on giving access to stocks, bonds, ETFs, mutual funds, and options trading. This varied approach suggests they want to serve both conservative investors who want traditional investment options and more active traders who want diverse market opportunities. The platform's zero-commission structure is very different from traditional brokerage fee models and may appeal to cost-conscious traders and frequent market participants.

PlusMarkets operates under the supervision of the Cyprus Securities and Exchange Commission. It holds license number 282/15. This regulatory framework gives European Union-standard oversight and client protection measures. The broker uses the Finance Central trading platform as its main interface, though detailed information about platform capabilities, advanced features, and mobile access remains limited in available documents. This plusmarkets review shows the need for greater transparency about operational details and user experience metrics.

Regulatory Jurisdiction: PlusMarkets operates under Cyprus Securities and Exchange Commission regulation with license number 282/15. This gives EU-standard regulatory oversight and client protection frameworks within the European regulatory environment.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods, processing times, and fees has not been detailed in available documentation. This represents a significant transparency gap.

Minimum Deposit Requirements: The platform keeps a zero minimum deposit requirement. This removes entry barriers for new traders and allows account opening without initial capital commitments.

Bonus and Promotional Offerings: Current promotional structures, welcome bonuses, and ongoing incentive programs have not been specified in available materials. This limits assessment of additional value propositions.

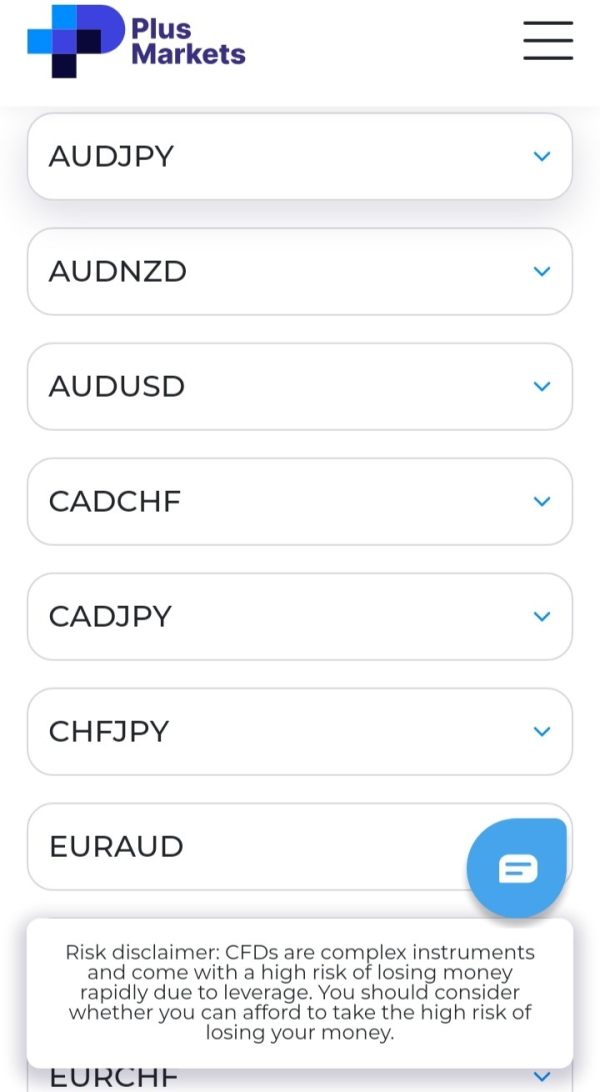

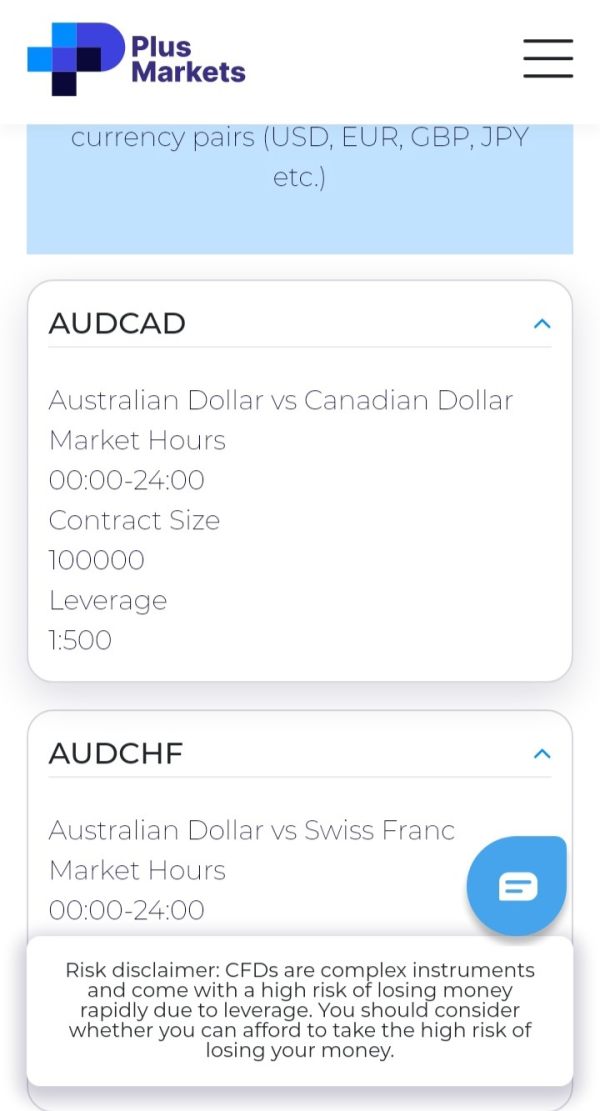

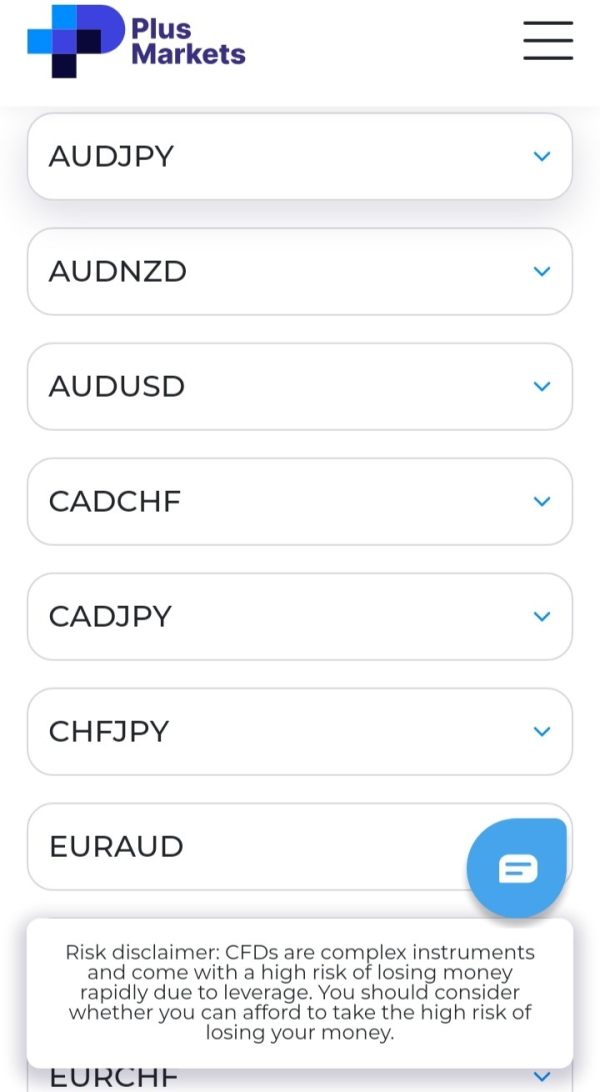

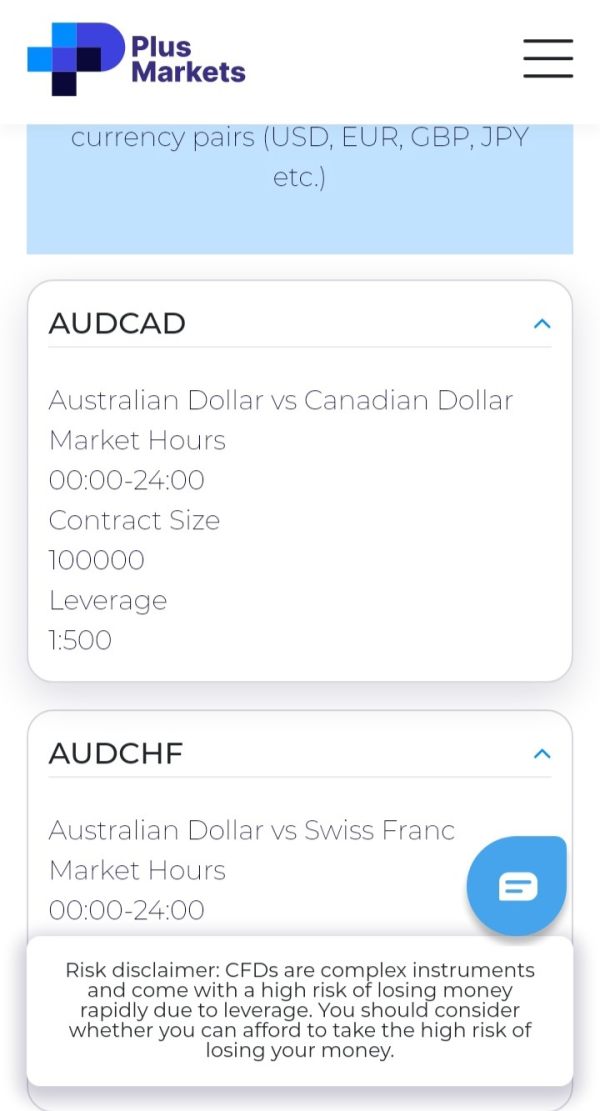

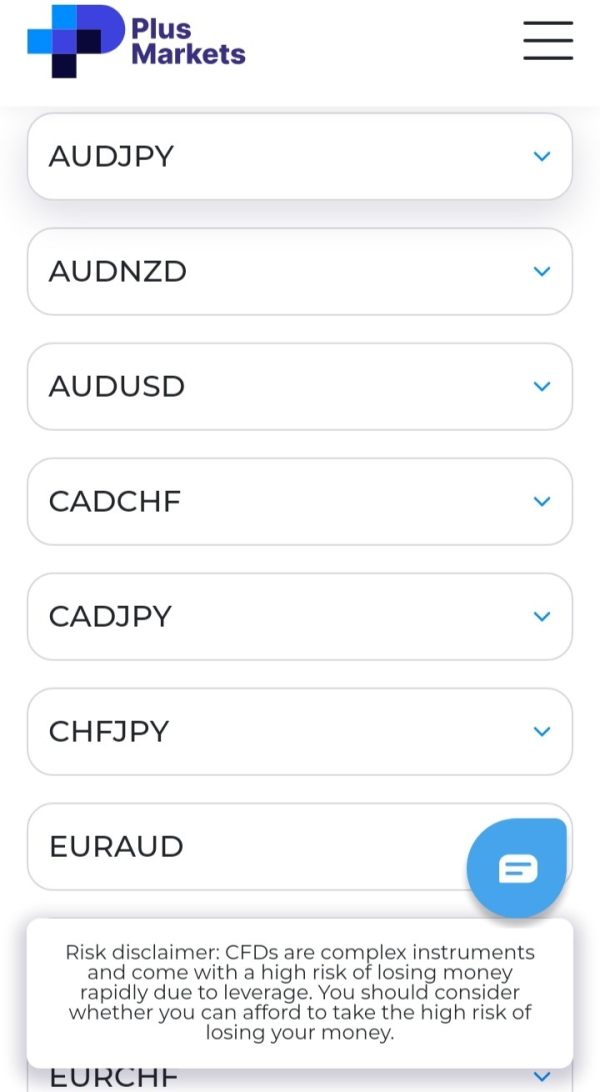

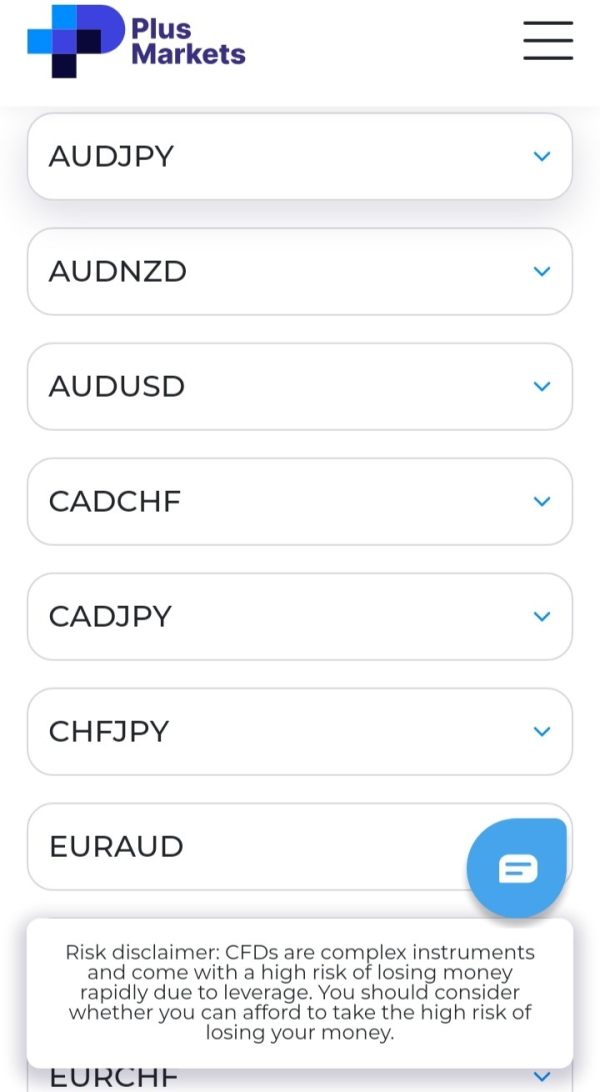

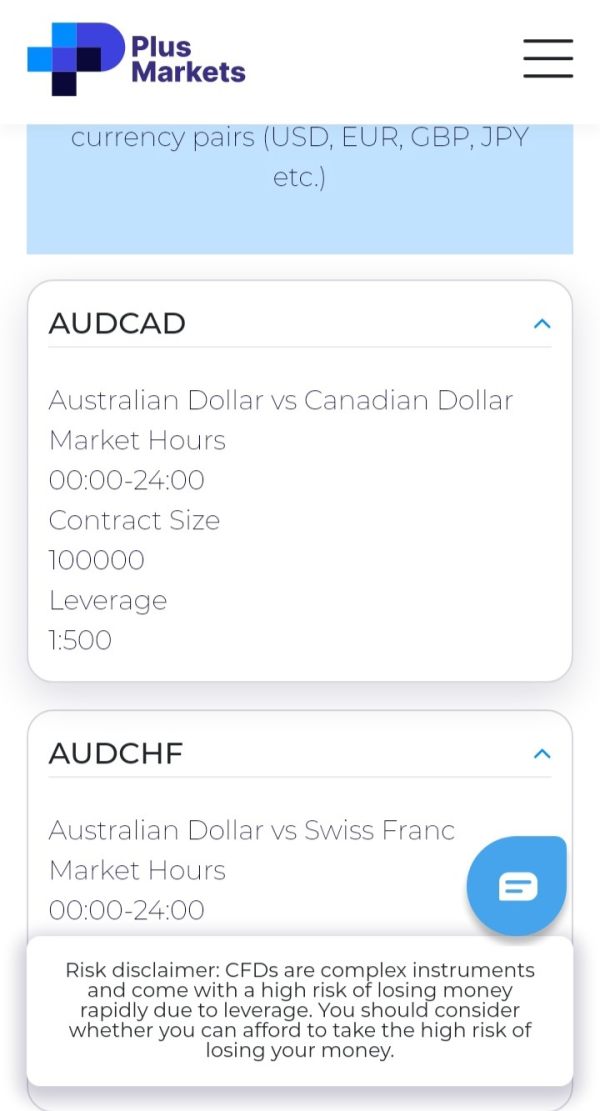

Tradeable Assets: PlusMarkets gives access to over 300 trading instruments across multiple asset classes. These include stocks, bonds, exchange-traded funds, mutual funds, and options contracts, offering diverse market exposure opportunities.

Cost Structure Analysis: The broker uses a zero-commission trading model. However, specific information about spreads, overnight financing costs, and other potential charges remains undisclosed in available documentation.

Leverage Ratios: Specific leverage offerings and margin requirements have not been detailed in accessible information sources. This limits evaluation of trading flexibility and risk management parameters.

Platform Selection: The Finance Central trading platform serves as the primary interface and offers various advanced trading tools. However, specific feature sets and technological capabilities require further clarification.

Geographic Restrictions: Information about regional restrictions and service availability limitations has not been specified in available documentation.

Customer Service Languages: Specific language support options for customer service interactions have not been detailed in accessible materials. This plusmarkets review identifies this as an area requiring additional transparency for international clients.

PlusMarkets shows strong performance in account accessibility through its zero minimum deposit requirement. This effectively removes traditional barriers that often prevent new traders from entering financial markets. This approach particularly benefits new investors who may want to explore trading without significant initial capital commitments. The absence of minimum deposit requirements allows for gradual account funding and risk management learning without pressure to commit substantial funds immediately.

The zero-commission trading structure represents another significant advantage in account conditions. It can potentially save active traders considerable costs over time. Traditional brokerage models often impose per-transaction fees that can add up substantially for frequent traders, making PlusMarkets' approach financially attractive for various trading strategies.

However, the evaluation is limited by the absence of detailed information about different account types, tier structures, or special features that might be available to different client categories. The account opening process, verification requirements, and timeline for account activation remain undocumented in available materials. Additionally, information about specialized account options such as Islamic accounts for clients requiring Sharia-compliant trading has not been specified.

Despite these information gaps, the fundamental account conditions of zero deposits and zero commissions create a compelling foundation for new and experienced traders alike. This plusmarkets review recognizes these features as significant competitive advantages, though complete evaluation requires additional transparency about account management procedures and specialized offerings.

PlusMarkets claims to provide various advanced trading tools through its Finance Central platform. This suggests a commitment to supporting traders with sophisticated market analysis capabilities. The availability of multiple trading instruments across different asset classes indicates a complete approach to market access, allowing traders to diversify portfolios and implement various investment strategies within a single platform environment.

The broker's offering of over 300 trading instruments shows substantial market coverage. This potentially provides opportunities across different sectors, geographic regions, and investment styles. This breadth of available assets can support both conservative long-term investment approaches and more active trading strategies requiring diverse market exposure.

However, the evaluation is significantly limited by the lack of specific details about the nature and quality of available trading tools. Information about charting capabilities, technical analysis features, automated trading support, risk management tools, and market research resources remains largely undocumented. The absence of details about educational resources, market commentary, or analytical support materials limits assessment of the platform's value proposition for developing traders.

Additionally, no information has been identified about third-party tool integration, API access for algorithmic trading, or advanced order types that sophisticated traders might require. The lack of user feedback about tool effectiveness and reliability further limits evaluation of this critical aspect of the trading experience.

PlusMarkets advertises 24/7 customer support availability. This represents a positive foundation for client service, particularly important for traders operating across different time zones or requiring assistance outside traditional business hours. Round-the-clock support availability can be crucial for addressing urgent trading issues, technical problems, or account-related concerns that may arise during global market hours.

However, the evaluation of customer service quality is severely limited by the absence of specific information about support channels, response times, and service quality metrics. Available documentation does not specify whether support is available through phone, email, live chat, or other communication methods, making it difficult for potential clients to understand how to access assistance when needed.

The lack of user feedback and testimonials about customer service experiences represents a significant gap in evaluation capability. Without insights into actual response times, problem resolution effectiveness, or customer satisfaction levels, it becomes challenging to assess the practical quality of support services beyond the basic availability claim.

Furthermore, information about multilingual support capabilities, specialized support for different account types, or escalation procedures for complex issues remains undocumented. The absence of details about support team expertise, training levels, or specialization in different trading areas limits assessment of service depth and effectiveness.

PlusMarkets uses the Finance Central platform as its primary trading interface. However, detailed user experience descriptions and performance evaluations are notably absent from available documentation. The platform's stability, execution speed, and overall reliability remain largely unassessed due to limited user feedback and technical performance data availability.

The zero-commission structure potentially enhances the trading experience by reducing transaction costs. This can be particularly beneficial for active traders who execute multiple transactions regularly. This cost structure may allow traders to implement strategies that would be less viable under traditional commission-based models, potentially expanding strategic flexibility.

However, critical aspects of the trading experience remain inadequately documented. Information about order execution quality, slippage rates, requote frequency, and platform responsiveness during high-volatility periods is not available in accessible sources. The absence of details about mobile trading capabilities, offline functionality, or platform customization options limits evaluation of user experience quality.

Additionally, no information has been identified about platform uptime statistics, technical support for trading issues, or backup systems for ensuring continuous market access. The lack of user testimonials specifically addressing trading experience quality, platform reliability, or execution satisfaction limits complete assessment of this crucial aspect. This plusmarkets review identifies the need for greater transparency about actual trading performance and user satisfaction metrics.

PlusMarkets operates under the regulatory oversight of the Cyprus Securities and Exchange Commission with license number 282/15. This provides a foundation of regulatory supervision that aligns with European Union standards for financial services providers. CySEC regulation includes requirements for client fund segregation, capital adequacy, and operational transparency that contribute to overall client protection frameworks.

The regulatory framework provides certain assurances about operational standards and client protection measures. This includes potential access to investor compensation schemes that may protect client funds up to specified limits in case of broker insolvency. However, detailed information about specific fund protection measures, insurance coverage, or additional security protocols implemented by PlusMarkets remains undocumented in available sources.

The evaluation of trust and reliability is limited by limited information about company establishment history, ownership structure, financial transparency, and track record in the industry. The absence of detailed company background information, including founding dates, management team profiles, or corporate governance structures, limits assessment of institutional stability and long-term reliability.

Furthermore, no information has been identified about independent audits, financial reporting practices, or third-party security certifications that might provide additional confidence in the broker's operational integrity. The lack of documented handling of past issues, regulatory actions, or client dispute resolution procedures also limits complete trust assessment.

The assessment of user experience is significantly limited by the absence of complete user feedback, satisfaction ratings, and detailed experience testimonials in available documentation. While PlusMarkets positions itself as suitable for both new and experienced investors, specific user experience metrics and satisfaction data remain largely undocumented.

The zero minimum deposit and commission-free trading structure potentially creates positive user experience elements by reducing entry barriers and ongoing costs. These features may particularly benefit new traders who are learning market dynamics without significant financial pressure or experienced traders seeking to minimize transaction costs across diverse trading strategies.

However, critical aspects of user experience remain inadequately assessed due to information limitations. Details about account registration processes, verification procedures, platform navigation ease, and overall user interface design are not available in accessible sources. The absence of information about common user complaints, satisfaction surveys, or retention rates limits complete experience evaluation.

Additionally, no specific information has been identified about user onboarding processes, educational support for new traders, or advanced features for experienced users. The lack of documented user feedback about platform functionality, customer service interactions, or overall satisfaction levels limits the ability to provide meaningful user experience assessment based on actual client experiences.

This plusmarkets review reveals a brokerage platform with both attractive features and significant transparency limitations. PlusMarkets offers compelling account conditions through its zero-commission trading structure and absence of minimum deposit requirements, making it potentially suitable for cost-conscious traders and those seeking accessible market entry. The CySEC regulatory oversight provides a foundation of institutional credibility and client protection within European standards.

However, the evaluation is limited by substantial information gaps about specific trading conditions, detailed user experiences, platform capabilities, and operational transparency. The limited availability of user feedback, technical performance data, and complete service documentation makes it challenging to provide a complete assessment of the broker's practical performance and reliability.

PlusMarkets may be most suitable for new traders seeking cost-effective market entry and experienced investors prioritizing commission-free trading. However, potential clients should conduct additional due diligence about specific trading conditions, platform capabilities, and service quality before making commitment decisions. The broker would benefit significantly from enhanced transparency about operational details, user experience metrics, and complete service documentation to support informed client decision-making.

FX Broker Capital Trading Markets Review