TradeWill 2025 Review: Everything You Need to Know

Executive Summary

TradeWill is an online forex broker registered in Seychelles. This broker shows a mixed picture for potential traders who want to start trading. This tradewill review reveals a platform that serves beginners and small-to-medium-sized traders who want easy entry into the forex market. The broker operates under FSA (Seychelles) regulation with license number SD111. This provides basic regulatory oversight, though this may differ from stricter rules in other countries.

The platform's best features include good account conditions with spreads starting from 0 pips on standard accounts. TradeWill also has an easy minimum deposit requirement of just $50. The broker has shown commitment to customer engagement through various promotional activities. These activities offer users chances to join contests and win coupons and cash rewards. User feedback shows mixed but generally positive results, with the broker keeping a TrustScore of 2.76 and showing responsiveness by replying to 100% of negative reviews, usually within one week.

The broker offers multiple asset classes including forex, stocks, indices, commodities, and cryptocurrencies. This makes it suitable for traders seeking portfolio diversification. However, some areas lack detailed information, especially regarding specific trading platforms and complete fee structures. Potential clients should consider this when evaluating their options.

Important Notice

TradeWill operates under the regulatory framework of the Seychelles Financial Services Authority (FSA) with license number SD111. Traders should know that regulatory requirements and investor protection measures may vary greatly between Seychelles and other jurisdictions. This regulatory environment may offer different levels of protection compared to brokers regulated by authorities such as the FCA, ASIC, or CySEC.

This evaluation is based on comprehensive analysis of user feedback, publicly available regulatory information, and market data collected from multiple sources. The assessment aims to provide an objective overview while acknowledging that individual trading experiences may vary based on personal circumstances and market conditions.

Rating Framework

Broker Overview

TradeWill operates as an online forex broker based in Seychelles. The company positions itself as an easy entry point for retail traders seeking exposure to international financial markets. The company has built its business model around providing complete trading services across multiple asset classes. However, specific founding details and company history information remain limited in available documentation.

The broker's regulatory status under the Seychelles FSA provides a framework for operations. Traders should understand that this jurisdiction may offer different investor protection standards compared to more established regulatory environments. TradeWill's approach appears focused on making trading access easier through competitive conditions and promotional activities designed to engage both new and existing clients.

The platform supports trading across diverse asset categories including traditional forex pairs, global stock indices, individual equity positions, commodity markets, and emerging cryptocurrency markets. This wide offering suggests TradeWill's intention to serve as a one-stop trading solution for clients seeking portfolio diversification. The broker's regulatory license SD111 under FSA supervision provides the legal foundation for these operations. However, specific details about the company's operational history and management structure require further clarification from official sources.

Regulatory Jurisdiction: TradeWill operates under Seychelles FSA regulation with license number SD111. This provides basic regulatory oversight within this offshore jurisdiction's framework.

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal methods was not detailed in available documentation. This requires direct broker consultation.

Minimum Deposit Requirements: The broker maintains an accessible $50 minimum deposit requirement. This positions it as beginner-friendly compared to industry standards.

Promotional Offerings: TradeWill actively engages users through promotional activities including contests, coupon distributions, and cash reward programs. These enhance client engagement.

Tradeable Assets: The platform supports comprehensive asset trading including forex currency pairs, global stock markets, major indices, commodity markets, and cryptocurrency instruments.

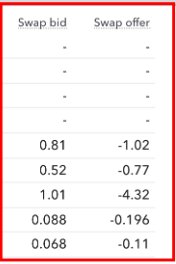

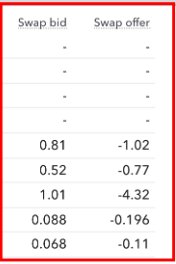

Cost Structure: Standard and trading accounts feature competitive 0-pip starting spreads. Professional accounts begin at 10-pip minimums. Additional fee information requires direct verification with the broker.

Leverage Information: Specific leverage ratios and margin requirements were not detailed in available documentation. These should be confirmed directly with TradeWill.

Platform Options: Detailed information about specific trading platforms offered by TradeWill was not comprehensively covered in available materials.

Geographic Restrictions: Information regarding geographic limitations or restricted territories was not specified in available documentation.

Customer Support Languages: Specific details about supported languages for customer service were not mentioned in available materials.

This tradewill review highlights areas where potential clients should seek additional clarification directly from the broker. This ensures complete understanding of service offerings.

Detailed Rating Analysis

Account Conditions Analysis (Score: 7/10)

TradeWill's account structure shows competitive positioning within the retail forex market. This is particularly true for traders seeking accessible entry conditions. The broker offers multiple account types including standard and professional options. Standard accounts feature attractive 0-pip starting spreads that can significantly impact trading costs for active traders.

The $50 minimum deposit requirement represents one of TradeWill's strongest competitive advantages. This is particularly true when compared to industry standards that often require much higher initial investments. This low barrier to entry makes the platform particularly suitable for beginning traders or those testing new strategies without significant capital commitment. The accessibility factor extends TradeWill's appeal to emerging markets and smaller retail traders who might otherwise be excluded from forex trading.

However, the account opening process details and specific account features such as Islamic account availability remain unclear from available documentation. Professional accounts begin with 10-pip spreads, suggesting a tiered structure that may offer additional benefits for qualifying traders. However, specific qualification criteria and enhanced features require clarification. The lack of detailed information about account verification procedures, documentation requirements, and account upgrade pathways represents an area where potential clients should seek direct communication with the broker.

User feedback regarding account conditions appears mostly positive. Traders appreciate the low entry requirements and competitive spread offerings. However, the sustainability of 0-pip spreads and potential markup on other trading costs should be carefully evaluated by prospective clients. This tradewill review suggests that while account conditions appear favorable, comprehensive fee disclosure would strengthen the broker's transparency profile.

TradeWill's analytical capabilities center around providing detailed analysis tools and charting functionality. However, the specific scope and sophistication of these offerings require further clarification. According to available information, the broker emphasizes analytical support for traders. This represents a positive foundation for informed decision-making in volatile forex markets.

The platform's analytical tools appear designed to support both technical and fundamental analysis approaches. However, specific details about indicator availability, charting packages, and market research provisions remain limited in current documentation. This gap in detailed tool specification makes it challenging for traders to fully evaluate whether TradeWill's offerings meet their analytical requirements. This is particularly true for more sophisticated trading strategies.

Educational resource availability represents another area where information remains sparse. Comprehensive educational support, including webinars, tutorials, market analysis, and trading guides, has become increasingly important for broker differentiation. This is particularly true when serving beginning traders. The absence of detailed educational resource information in available materials suggests either limited offerings or inadequate marketing of existing resources.

Automated trading support, including Expert Advisor compatibility, algorithmic trading capabilities, and API access for advanced users, was not specifically addressed in available documentation. Given the increasing importance of automated trading solutions in modern forex markets, this information gap may concern technically oriented traders seeking comprehensive platform capabilities.

User feedback suggests satisfaction with available analytical tools. This indicates that TradeWill's current offerings provide adequate support for typical retail trading activities. However, specific feature comparisons with industry-leading platforms would strengthen the evaluation framework.

Customer Service and Support Analysis (Score: 8/10)

TradeWill shows exceptional commitment to customer service through its documented response rate of 100% to negative reviews. The company typically provides responses within one week. This level of engagement suggests a customer-focused approach that prioritizes issue resolution and client satisfaction. This represents a significant strength in the competitive broker landscape.

The broker's proactive approach to addressing negative feedback indicates strong internal processes for monitoring client satisfaction and implementing corrective measures when issues arise. This responsiveness can be particularly valuable for traders experiencing technical difficulties, account-related questions, or trading disputes that require prompt resolution. Quick responses help minimize potential losses or frustrations.

However, specific details about customer service channels, availability hours, and direct contact methods remain unclear from available documentation. Modern traders typically expect multiple communication options including live chat, telephone support, email assistance, and potentially social media engagement. TradeWill's specific offerings in these areas require clarification.

Multilingual support capabilities represent another important consideration for international brokers. This is particularly true given TradeWill's positioning in global markets. The availability of customer service in multiple languages can significantly impact user experience for non-English speaking traders. However, specific language support information was not detailed in available materials.

The one-week typical response time, while showing consistency, may be considered slow for urgent trading-related issues that require immediate resolution. Traders dealing with time-sensitive problems such as platform access issues, withdrawal delays, or execution disputes typically expect faster response times. This is particularly true during active trading sessions.

User feedback regarding customer service quality appears positive overall. Clients express satisfaction with the responsiveness and problem-solving capabilities of TradeWill's support team. This contributes to the strong rating in this category.

Trading Experience Analysis (Score: 7/10)

TradeWill's trading environment appears optimized for execution speed. User reports indicate fast order processing that can be crucial for traders operating in volatile market conditions. Fast execution becomes particularly important during high-impact news events or rapid market movements where delays can significantly impact trading outcomes and profitability.

The stability of spread offerings receives positive user feedback. This suggests that TradeWill maintains consistent pricing even during market stress periods. Spread stability represents a crucial factor for trading cost predictability and strategy implementation. This is particularly true for scalping or high-frequency trading approaches that depend on tight, consistent spreads.

However, detailed information about specific trading platforms, platform stability metrics, and advanced trading features remains limited in available documentation. Modern traders increasingly expect sophisticated platform capabilities including advanced charting, one-click trading, multiple order types, and comprehensive risk management tools. TradeWill's specific offerings in these areas require further investigation.

Mobile trading experience, which has become essential for modern traders seeking flexibility and market access regardless of location, was not specifically addressed in available materials. The quality of mobile applications, feature parity with desktop platforms, and mobile-specific functionality can significantly impact overall trading experience satisfaction.

Order execution quality metrics such as slippage rates, requote frequency, and execution statistics would provide valuable insight into TradeWill's trading environment quality. However, such detailed performance data was not available in current documentation. The absence of specific technical performance metrics makes it challenging for traders to fully evaluate execution quality compared to industry benchmarks.

This tradewill review indicates that while basic trading experience appears satisfactory based on user feedback, comprehensive platform information would enhance trader confidence in the broker's technical capabilities.

Trust and Security Analysis (Score: 6/10)

TradeWill's regulatory status under Seychelles FSA supervision with license number SD111 provides a foundation for operational legitimacy. However, the level of investor protection may differ significantly from more established regulatory jurisdictions. The Seychelles regulatory environment, while legitimate, typically offers less comprehensive investor protection compared to authorities such as the UK's FCA or Australia's ASIC.

The broker's medium-risk trust score of 67 reflects balanced market perception. This suggests adequate but not exceptional confidence levels among industry observers and users. This moderate trust rating indicates that while TradeWill operates legitimately, potential areas for trust enhancement may exist through increased transparency, stronger regulatory positioning, or enhanced client protection measures.

TradeWill's commitment to addressing negative feedback shows transparency in handling client concerns. This positively contributes to trust building. The 100% response rate to negative reviews suggests management awareness of reputation importance and willingness to engage with client issues publicly. This can enhance overall trustworthiness perception.

However, detailed information about client fund protection measures, segregated account policies, insurance coverage, and financial reporting transparency was not comprehensively available in current documentation. These factors represent crucial trust elements for traders seeking assurance about fund safety and operational transparency.

The absence of detailed information about company ownership, management team backgrounds, and financial stability metrics limits the ability to conduct comprehensive due diligence. Established brokers typically provide extensive corporate information to enhance client confidence. However, TradeWill's current disclosure level appears limited in available materials.

Third-party verification of claims, independent audits, and industry certifications would strengthen the trust profile. However, specific information about such validations was not available in current documentation.

User Experience Analysis (Score: 7/10)

TradeWill's overall user satisfaction, reflected in a TrustScore of 2.76, indicates moderate client satisfaction levels with room for improvement. While this score suggests generally acceptable service delivery, it also highlights potential areas where enhanced user experience could drive higher satisfaction ratings and competitive positioning.

The broker's promotional activities, including contests and reward programs, show efforts to enhance client engagement beyond basic trading services. These value-added features can significantly improve user experience by providing additional earning opportunities and community engagement. This is particularly appealing to recreational traders seeking entertainment value alongside trading activities.

However, specific information about user interface design, platform navigation ease, and registration process efficiency was not detailed in available documentation. Modern traders increasingly expect intuitive, responsive interfaces that facilitate efficient trading operations without technical barriers or learning curves that impede trading effectiveness.

Account verification and onboarding process details remain unclear. However, streamlined procedures have become increasingly important for user experience optimization. Lengthy or complicated verification processes can significantly impact initial user impressions and overall satisfaction. This is particularly true for traders eager to begin market participation.

The mixed nature of user feedback, while generally positive, suggests variability in experience quality that may depend on specific use cases, trading styles, or individual expectations. Understanding the source of negative feedback and addressing common pain points could enhance overall user satisfaction and competitive positioning.

Deposit and withdrawal experience, platform reliability during peak usage periods, and customer service accessibility represent crucial user experience factors. These require additional clarification for comprehensive evaluation of TradeWill's service delivery quality.

Conclusion

TradeWill presents a good option for beginning and intermediate traders seeking accessible entry into forex markets. The broker shows particular strength in low minimum deposits and responsive customer service. The broker's regulatory status under Seychelles FSA provides basic operational legitimacy. However, traders should understand the implications of this jurisdiction's investor protection framework compared to more established regulatory environments.

The platform appears most suitable for new traders attracted to the $50 minimum deposit requirement and those seeking engagement through promotional activities and contests. Additionally, traders prioritizing customer service responsiveness will find value in TradeWill's documented commitment to addressing client concerns promptly and comprehensively.

However, potential clients should note significant information gaps regarding specific trading platforms, comprehensive fee structures, and detailed service offerings. These may require direct broker consultation before account opening. While user feedback trends generally positive, the moderate trust scores and limited transparency in certain operational areas suggest careful evaluation of individual risk tolerance and trading requirements before commitment.