Vie finance Sey Review 1

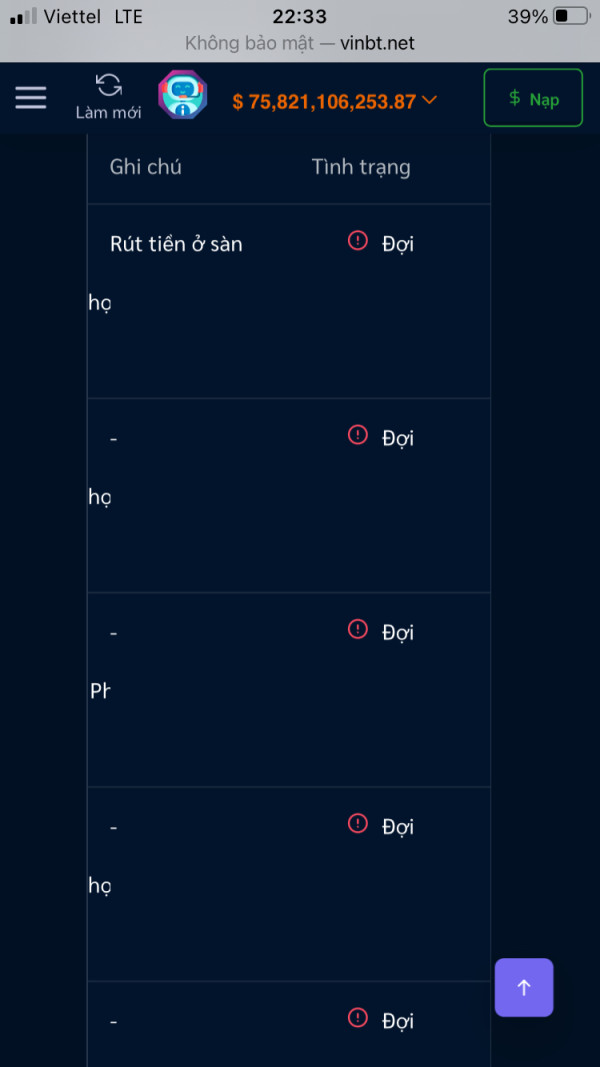

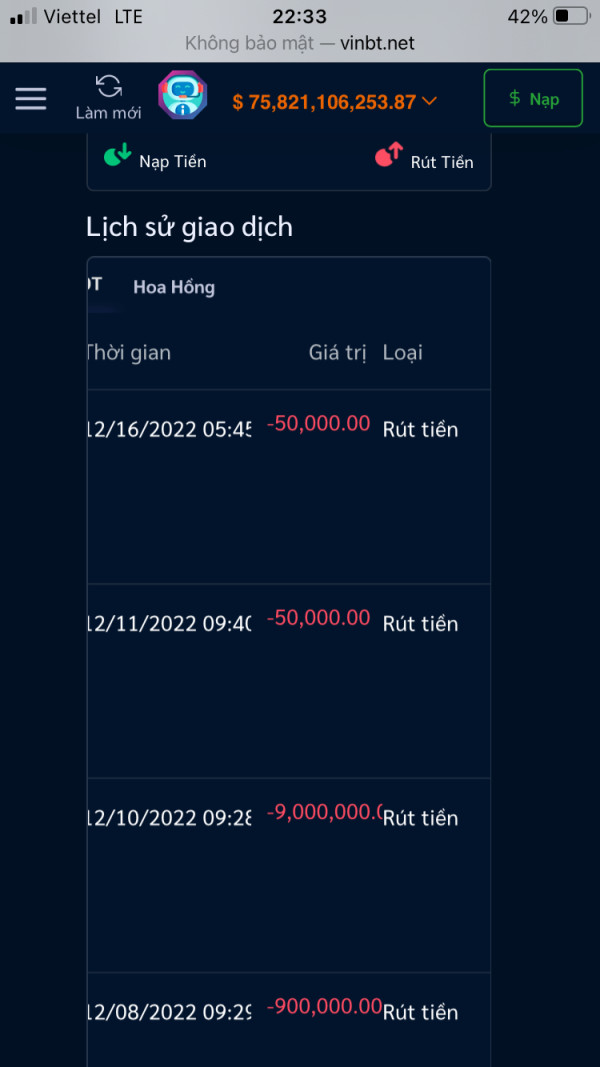

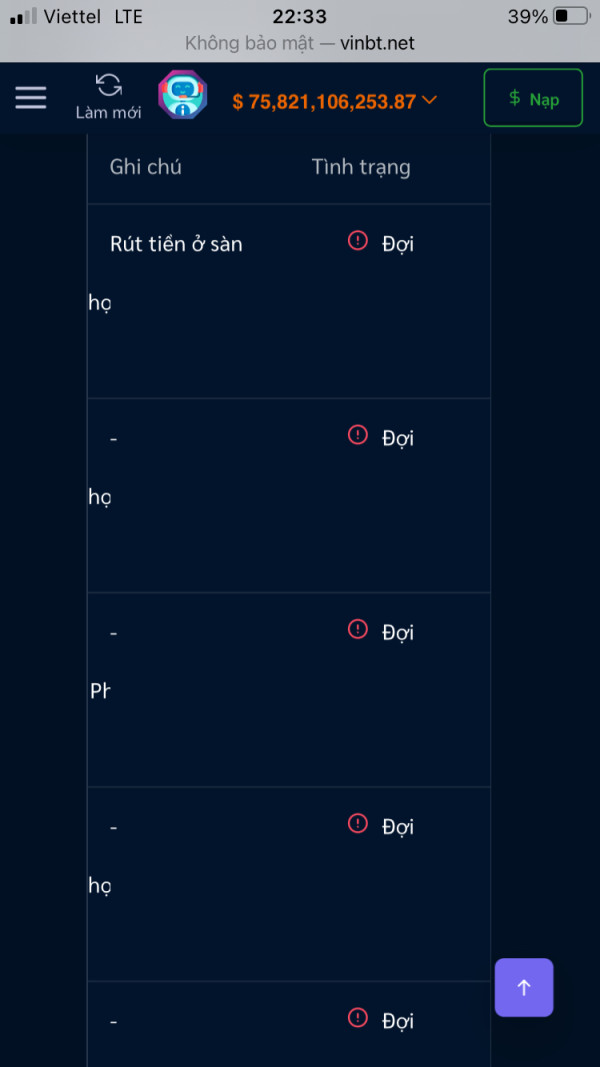

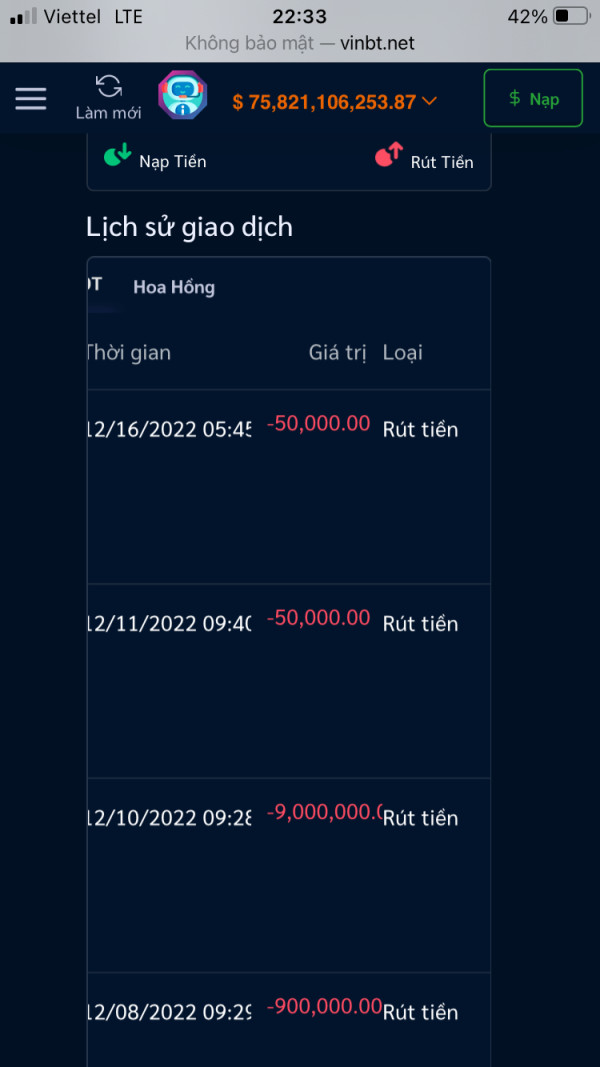

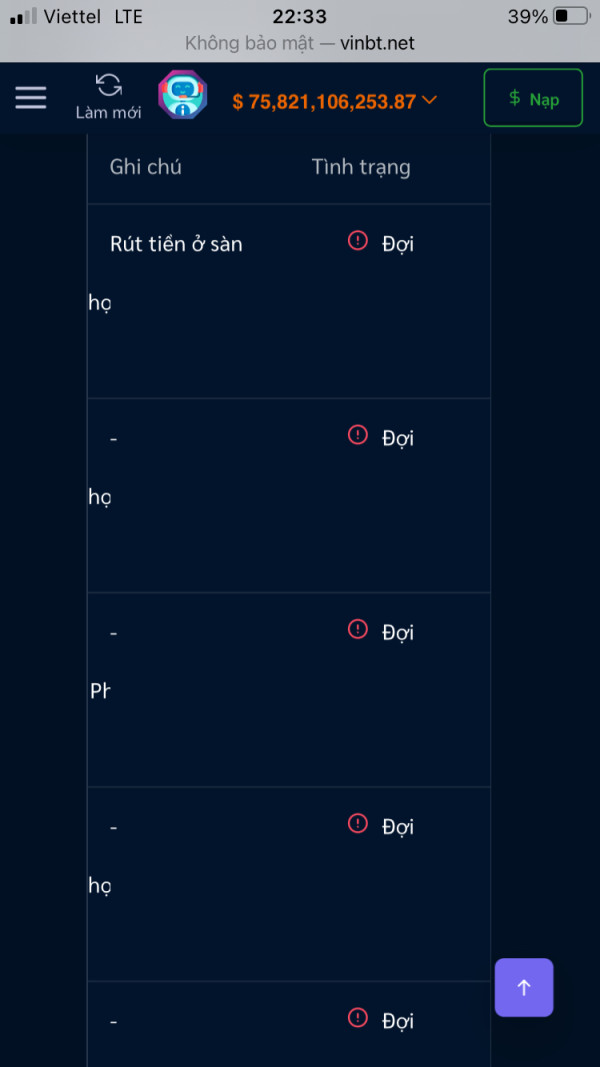

I can't withdraw money at the exchange

Vie finance Sey Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

I can't withdraw money at the exchange

This vie finance review shows concerning findings about the broker's operations and regulatory standing. Vie Finance operates under Polish Financial Supervision Authority oversight, but the company has faced significant regulatory scrutiny in 2024. On June 12, 2024, the KNF issued a public warning regarding VIE FINANCE A. This warning raises serious questions about the broker's compliance and operational integrity.

The broker presents a mixed profile with a Trust Score of 75. This score indicates moderate trustworthiness levels. However, user evaluations consistently highlight service quality concerns and operational deficiencies throughout the platform. According to Fundevity reports from August 2024, Vie Finance maintains "decent service with tarnished reputation." This assessment reflects the impact of regulatory warnings on client confidence.

The platform primarily targets forex and CFD traders seeking moderate-to-high trust levels. Recent developments suggest potential clients should exercise heightened caution when considering this broker. Customer service records show notable deficiencies across multiple areas. User feedback indicates subpar support experiences that affect overall satisfaction. The regulatory warning from KNF particularly affects the broker's credibility among European traders. Regulatory compliance carries significant weight in broker selection decisions throughout Europe.

Regional Entity Differences: VIE FINANCE operates under Polish KNF regulation. This regulatory framework may significantly impact user trust levels across different geographical regions. The regulatory warning issued by KNF specifically affects the Polish entity. Implications may extend to broader operations depending on corporate structure arrangements.

Review Methodology: This evaluation draws from available public information, regulatory notices, and user feedback compiled through August 2024. Information completeness may vary due to limited disclosure from the broker regarding specific operational details. Trading conditions and service specifications remain unclear in many areas. Potential traders should conduct independent verification of current terms and conditions before engaging with the platform.

| Dimension | Score | Rating Basis |

|---|---|---|

| Account Conditions | N/A | Insufficient information available in source materials |

| Tools and Resources | N/A | Specific trading tools and resources not detailed in available data |

| Customer Service and Support | 4/10 | Poor user service records documented across multiple sources |

| Trading Experience | N/A | Trading platform performance data not specified in source materials |

| Trust and Security | 6/10 | Trust Score of 75 offset by KNF regulatory warning |

| User Experience | 5/10 | Mixed user evaluations with notable service quality concerns |

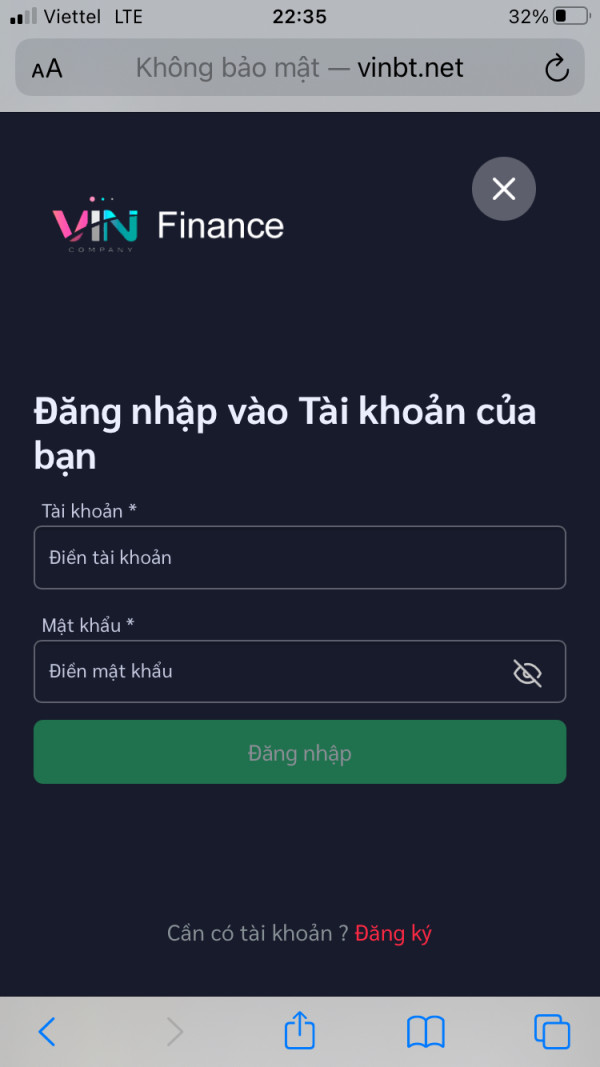

VIE FINANCE operates as a financial services provider focusing on forex and CFD trading markets. According to available documentation, the company maintains regulatory oversight through the Polish Financial Supervision Authority. Recent regulatory actions have cast shadows over its operational compliance. The broker's business model centers on providing trading access across multiple financial instruments. Specific details regarding company establishment date and founding background remain undisclosed in available source materials.

The platform's operational framework suggests involvement in standard forex and CFD trading services. The company targets retail traders seeking exposure to currency markets and derivative instruments. However, the vie finance review landscape reveals significant concerns about service delivery and regulatory compliance throughout the organization. The June 2024 KNF warning represents a critical development that potential clients must consider. This warning affects the broker's suitability for their trading requirements.

Regulatory positioning under KNF oversight traditionally provides European traders with confidence regarding operational standards. The framework also ensures client protection measures meet industry standards. However, the specific warning issued against VIE FINANCE A indicates potential compliance failures. These failures may affect overall service reliability and client fund security arrangements.

Regulatory Jurisdiction: VIE FINANCE operates under Polish Financial Supervision Authority regulation. The June 2024 public warning raises questions about ongoing compliance status and operational authorization.

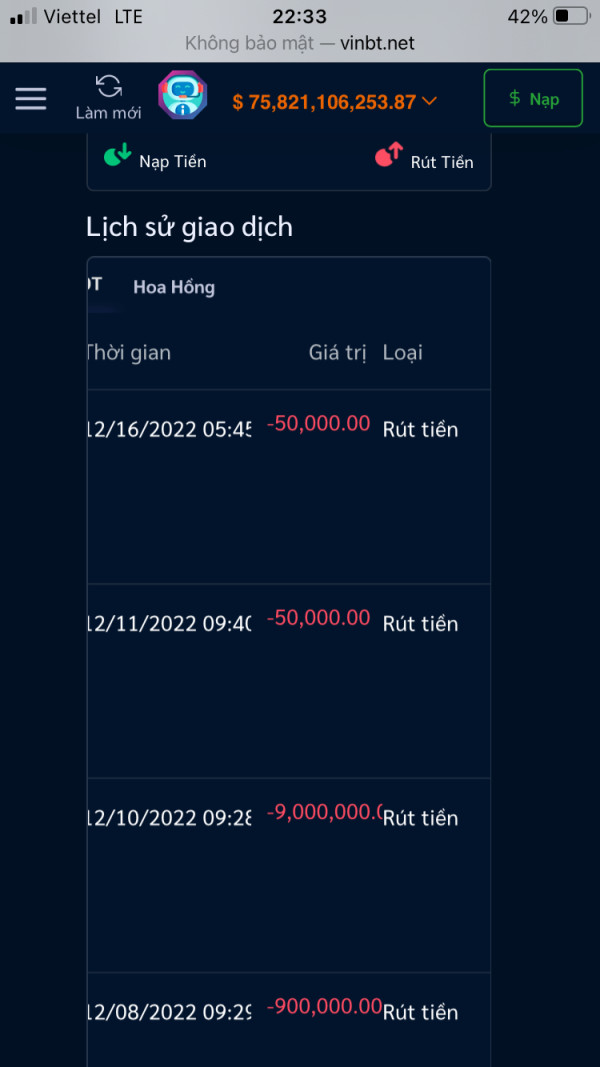

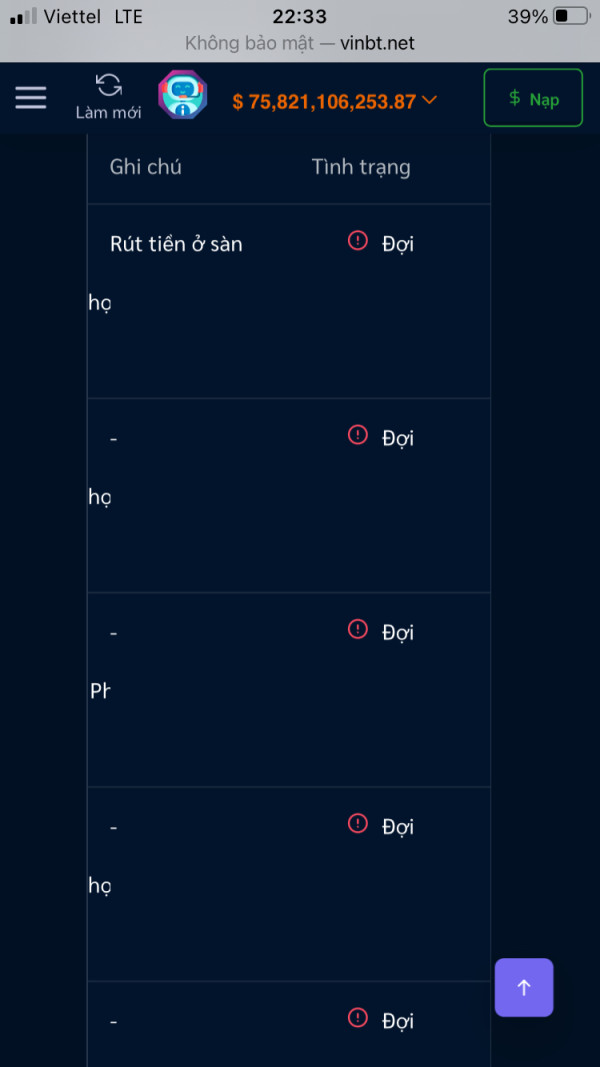

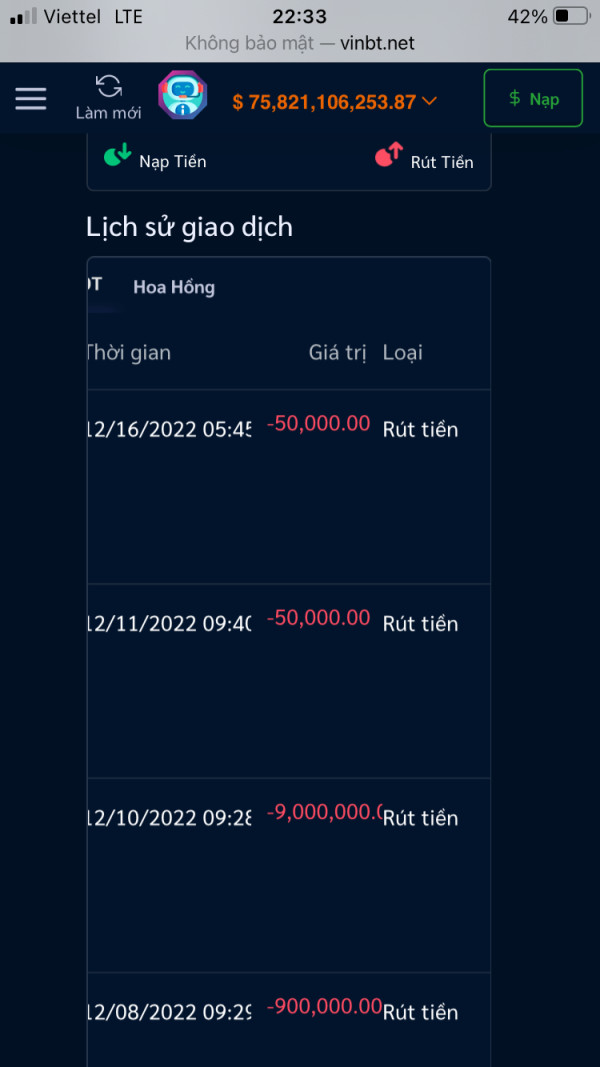

Deposit and Withdrawal Methods: Specific information regarding payment processing options remains unavailable. Supported currencies and transaction procedures are not detailed in available source materials.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified. Account funding thresholds remain unclear in accessible documentation.

Bonus and Promotional Offers: Details regarding welcome bonuses and trading incentives are not disclosed. Promotional programs remain unspecified in available source materials.

Tradeable Assets: The platform appears to focus on forex and CFD instruments. Comprehensive asset listings and specific market coverage details remain unspecified in source documentation.

Cost Structure: Spread configurations and commission rates are not detailed. Overnight financing charges and additional fee structures remain unclear in available materials for this vie finance review.

Leverage Ratios: Maximum leverage offerings are not specified. Margin requirements remain unclear in accessible source documentation.

Platform Options: Specific trading platform software details are not disclosed. Mobile applications and technology infrastructure information remain unavailable in accessible materials.

Geographic Restrictions: Regional availability limitations are not detailed. Jurisdiction-specific access restrictions remain unclear in source documentation.

Customer Support Languages: Available language support options are not specified. Communication channels remain unclear in accessible materials.

The evaluation of VIE FINANCE's account conditions faces significant limitations due to insufficient disclosure in available source materials. Standard broker evaluations typically examine account type varieties, minimum deposit requirements, and account opening procedures. They also review specialized account features such as Islamic trading accounts. However, this vie finance review cannot provide comprehensive account condition analysis due to limited information availability.

The absence of detailed account specification information raises concerns about transparency in client onboarding processes. Professional forex brokers typically provide clear documentation regarding account tiers and associated benefits. They also outline qualification requirements for different account types. The lack of readily available account condition details may indicate communication deficiencies. These deficiencies could affect client experience throughout the trading relationship.

Without specific information about account opening procedures, potential clients face uncertainty. Verification requirements and account management features remain unclear across the platform. This information gap compounds concerns raised by the KNF regulatory warning. The uncertainty contributes to overall concerns surrounding the broker's operational transparency.

Assessment of VIE FINANCE's trading tools and educational resources proves challenging due to limited information disclosure. Standard broker evaluations examine trading tool varieties, research capabilities, and market analysis resources. They also review educational content quality across different learning formats. However, comprehensive analysis remains impossible without detailed platform specifications.

Professional trading environments typically offer chart analysis tools and economic calendars. They also provide market research reports and educational webinars for client development. The absence of specific information about VIE FINANCE's tool offerings creates uncertainty about platform capabilities. This uncertainty particularly affects the platform's ability to support serious trading activities.

The lack of detailed resource information compounds concerns about the broker's commitment to client success. Professional development support remains unclear across the platform. Without clear understanding of available tools and educational support, potential clients cannot adequately assess platform suitability. They cannot determine whether the platform meets their trading requirements and skill development needs.

Customer service evaluation reveals significant concerns based on available user feedback and service record documentation. According to Fundevity reports from August 2024, VIE FINANCE demonstrates "not quite spotless service record." This assessment indicates consistent service quality issues affecting client satisfaction levels.

User evaluations consistently highlight poor service experiences across multiple interaction points. These reports suggest systemic problems in customer support delivery throughout the organization. The combination of regulatory warnings and negative service feedback creates a concerning pattern. Potential clients must carefully consider these issues before engaging with the platform.

Professional forex trading requires reliable customer support, particularly during market volatility or technical difficulties. The documented service quality problems extend beyond isolated incidents throughout the platform. They appear to represent ongoing operational challenges affecting multiple client interaction areas. Without specific information about support channels, response times, or service improvement initiatives, clients face uncertainty. They cannot expect adequate assistance when needed during critical trading situations.

Evaluation of VIE FINANCE's trading experience faces limitations due to insufficient platform performance data. Standard assessments typically examine platform stability, execution speed, and order processing quality. They also review mobile trading capabilities and overall trading environment characteristics. However, comprehensive trading experience analysis remains impossible without detailed performance specifications.

Professional trading requires reliable platform performance and fast order execution. Stable connectivity during market hours is essential for successful trading operations. The absence of specific performance data creates uncertainty about VIE FINANCE's ability to deliver professional-grade trading experiences. This information gap particularly affects active traders who depend on platform reliability.

Without user testimonials about platform performance or documented uptime statistics, potential clients cannot adequately assess trading environment quality. The lack of vie finance review content focusing on actual trading experiences compounds concerns. These gaps raise questions about operational transparency and client communication standards throughout the organization.

Trust and security evaluation reveals mixed signals requiring careful consideration by potential clients. VIE FINANCE maintains a Trust Score of 75, indicating moderate trustworthiness levels within industry standards. However, this positive indicator faces significant challenges from the KNF regulatory warning issued on June 12, 2024.

The Polish Financial Supervision Authority warning represents a serious regulatory concern. This warning directly impacts broker trustworthiness assessments across the industry. KNF warnings typically indicate compliance failures or operational irregularities requiring immediate attention. The specific nature of the warning against VIE FINANCE A suggests potential issues affecting client protection.

According to WikiFX evaluations and industry monitoring sources, the regulatory warning significantly impacts VIE FINANCE's industry reputation. Client confidence levels have declined following the regulatory action. The combination of moderate trust scores with active regulatory warnings creates a complex risk profile. Potential clients must carefully evaluate these factors before engaging with the platform.

User experience evaluation reveals concerning patterns based on available feedback and service record documentation. Overall user satisfaction levels appear compromised by service quality issues and operational concerns. Multiple source materials highlight these problems throughout the platform. The August 2024 Fundevity assessment describing "decent service with tarnished reputation" captures the complex user experience landscape surrounding VIE FINANCE.

Available user feedback consistently points to service delivery problems affecting overall platform satisfaction. While specific interface design details and registration process information remain unavailable, documented service quality concerns suggest systemic challenges. These user experience problems extend beyond isolated technical issues throughout the platform.

The target user profile appears suited for traders with higher risk tolerance levels. These users can navigate potential service quality inconsistencies more effectively than average traders. However, the combination of regulatory warnings and documented service problems makes VIE FINANCE unsuitable for beginning traders. The platform also fails to meet requirements for those needing consistent, high-quality customer support throughout their trading journey.

This comprehensive vie finance review reveals a broker facing significant regulatory and operational challenges. Potential clients must carefully consider these issues before opening accounts with the platform. VIE FINANCE's moderate Trust Score of 75 cannot offset the serious concerns raised by regulatory warnings. Consistently poor user service evaluations documented throughout 2024 compound these concerns.

The broker appears unsuitable for beginning traders or those prioritizing reliable customer service. Regulatory compliance represents another significant concern for potential clients. The platform might accommodate experienced traders with high risk tolerance levels who can navigate regulatory uncertainties. These users can also handle service quality inconsistencies more effectively than average traders. However, the combination of regulatory warnings and documented service problems creates substantial risks. Most traders should avoid this platform due to these significant concerns.

Primary advantages include moderate industry trust scores in certain evaluation frameworks. Significant disadvantages encompass regulatory warnings, poor service quality records, and limited operational transparency throughout the organization. Potential clients should exercise extreme caution when considering this broker for their trading needs. They should consider alternative brokers with stronger regulatory standing and superior service records.

FX Broker Capital Trading Markets Review