Is B Capital safe?

Pros

Cons

Is B Capital Safe or a Scam?

Introduction

B Capital, established in 2008, positions itself as a Swiss multi-family office and investment management firm catering primarily to high-net-worth individuals (HNWIs) and their families. With claims of operations in multiple global financial hubs such as Geneva, London, and the Cayman Islands, B Capital aims to provide tailored financial services and investment strategies. However, the absence of valid regulatory oversight and numerous customer complaints have raised significant concerns about its legitimacy. Given the increasing prevalence of scams in the forex market, it is crucial for traders to conduct thorough evaluations of brokers before engaging with them. This article employs a comprehensive investigation framework, analyzing B Capital's regulatory status, company background, trading conditions, customer experiences, and overall risk profile to determine whether B Capital is safe or a potential scam.

Regulatory and Legality

The regulatory status of a brokerage is one of the most critical factors in assessing its legitimacy. B Capital operates without any valid regulatory oversight, which is a significant red flag for potential investors. Regulation serves as a safeguard for traders, ensuring that brokers adhere to strict operational standards and providing a layer of protection for customer funds.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of a regulatory framework means that B Capital is not subject to any monitoring or accountability, which can expose investors to various risks, including potential fraud. Furthermore, multiple reports indicate that customers have faced difficulties in withdrawing funds, raising concerns about operational integrity. This lack of oversight and troubling reports about withdrawal issues suggest that B Capital may not be a safe option for traders.

Company Background Investigation

B Capital claims to be a well-established financial services firm, but its lack of regulatory oversight raises questions about its operational transparency. Founded in 2008, the company has positioned itself in the market as a provider of tailored investment solutions. However, the absence of a clear ownership structure and detailed information regarding its management team complicates the assessment of its credibility.

The management teams experience and qualifications are vital in determining a company's reliability. Unfortunately, B Capital does not provide sufficient information about its executives or their professional backgrounds, which diminishes its transparency. A firm that is unwilling to disclose its leadership's qualifications may be attempting to obscure potential issues.

Trading Conditions Analysis

When evaluating whether B Capital is safe, it is essential to analyze its trading conditions, particularly its fee structures. A transparent and reasonable fee structure is indicative of a legitimate broker. However, B Capital's trading conditions appear unclear and potentially unfavorable.

| Fee Type | B Capital | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5 - 1.5% |

The lack of clear information regarding spreads, commissions, and overnight interest rates raises concerns. Traders may encounter hidden fees or unfavorable trading conditions that could significantly impact their profitability. The absence of standard trading metrics makes it difficult for potential clients to assess the cost-effectiveness of trading with B Capital.

Client Fund Security

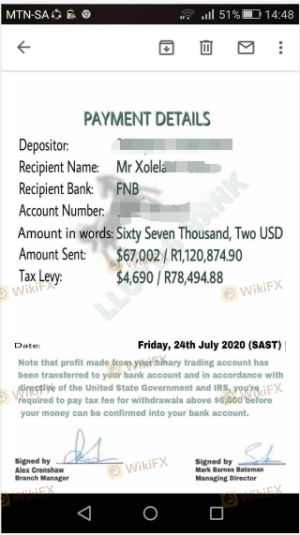

The security of client funds is paramount when assessing the safety of a brokerage. B Capital's lack of valid regulation raises significant concerns regarding its fund protection measures. Without regulatory oversight, there are no guarantees regarding the segregation of client funds or the existence of investor protection schemes.

Reports of customers facing difficulties in withdrawing their funds further exacerbate these concerns. If a broker does not provide adequate protection for client funds and lacks transparency in its financial practices, it raises the risk of potential fraud or mismanagement, leading to significant financial losses for traders.

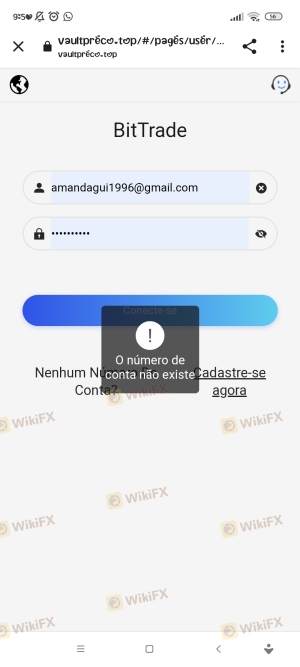

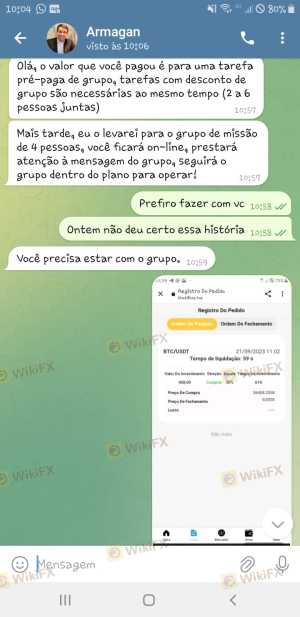

Customer Experience and Complaints

Customer feedback is a crucial indicator of a broker's reliability. Unfortunately, reviews and reports about B Capital reveal a troubling pattern of complaints. Many users have reported issues with fund withdrawals, citing difficulties in accessing their capital.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Unresponsive |

The severity of these complaints is concerning, particularly the high number of withdrawal issues reported by users. A broker that fails to address customer complaints adequately may indicate deeper operational problems. The lack of responsiveness from B Capital raises questions about its commitment to customer service and operational integrity.

Platform and Trade Execution

The performance and reliability of a trading platform are essential for a positive trading experience. However, B Capital does not provide clear information regarding its trading platform's features, stability, or execution quality.

Without access to critical metrics such as order execution speed, slippage rates, or rejection rates, it becomes challenging to assess the trading environment B Capital offers. Furthermore, the absence of a widely recognized trading platform (e.g., MetaTrader 4 or 5) may limit the trading tools and resources available to clients, further complicating the trading experience.

Risk Assessment

Given the findings from the previous sections, it is vital to assess the overall risk associated with using B Capital. The lack of regulation, poor customer feedback, and unclear trading conditions contribute to a heightened risk profile.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Financial Risk | High | Reports of withdrawal issues |

| Operational Risk | Medium | Lack of transparency and unclear fees |

To mitigate these risks, potential investors should exercise extreme caution. Conducting thorough due diligence, seeking independent financial advice, and considering alternatives with established regulatory oversight are prudent steps before engaging with B Capital.

Conclusion and Recommendations

In conclusion, the assessment of B Capital raises significant concerns regarding its safety and legitimacy. The lack of regulatory oversight, troubling customer feedback, and unclear trading conditions suggest that B Capital may not be a safe option for traders. The combination of these factors points towards potential fraud or operational issues that warrant caution.

For traders considering their options, it is advisable to explore established brokers with a solid regulatory framework and positive customer reviews. Some reliable alternatives include brokers regulated by top-tier authorities such as the FCA or ASIC, which offer greater security and transparency. Ultimately, protecting one's financial interests should be the top priority, and engaging with unregulated entities like B Capital poses unnecessary risks.

Is B Capital a scam, or is it legit?

The latest exposure and evaluation content of B Capital brokers.

B Capital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

B Capital latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.