TCC 2025 Review: Everything You Need to Know

Executive Summary

This tcc review gives you a complete look at TCC, which stands for Top Capital Corporation. TCC is a forex broker that has gotten a lot of attention in the trading world, but sadly for mostly bad reasons. The company started in 2017 and is registered in the United Kingdom. TCC says it provides forex and CFD trading with access to the popular MT4 trading platform.

But our research shows worrying patterns that potential traders need to think about carefully. WikiFX ratings show that TCC has a troubling score of 1.57 out of 10. The broker also has 79 user complaints and multiple reports of withdrawal fraud. TCC offers trading in forex pairs, contracts for difference, and various other instruments through the MetaTrader 4 platform.

The main users who might think about TCC are traders who want different trading assets and familiar platform access. However, given the big risk warnings and negative user feedback, you should be extremely careful. The lack of clear regulatory information and the number of fraud claims make TCC a high-risk choice for traders at any experience level.

Important Notice

Regional Entity Variations: TCC has not given clear regulatory information across different areas, which raises immediate red flags for potential users. Traders should be extremely careful when thinking about this broker since the lack of proper regulatory oversight makes investment risk much higher.

Review Methodology: This evaluation comes from a complete analysis of user feedback, market information, and available public data. Our assessment uses multiple sources including user complaint platforms, regulatory databases, and industry reports to give an objective overview of TCC's services and reliability.

Overall Rating Framework

Broker Overview

TCC operates as Top Capital Corporation and entered the forex brokerage market in 2017 with registration in the United Kingdom. The company presents itself as a complete trading solutions provider that focuses mainly on forex trading services alongside CFD offerings. Despite its UK registration, the broker has failed to build a solid reputation within the competitive forex industry and instead has gathered concerning feedback from the trading community.

The broker's business model centers around giving retail traders access to foreign exchange markets and derivative products through established trading platforms. TCC markets itself to individual traders who want exposure to currency changes and leveraged trading opportunities. However, the company's operational practices have drawn significant criticism from users and industry watchdogs alike.

TCC operates mainly through the MetaTrader 4 platform and offers traders access to forex pairs, contracts for difference, and various derivative instruments. The broker's asset selection includes major and minor currency pairs, though specific details about spreads, execution quality, and trading conditions remain unclear. Notably absent from available information are details about regulatory oversight, which represents a critical gap in transparency that potential clients should carefully consider before engaging with this tcc review subject.

Regulatory Status: Available information does not specify any regulatory authorities overseeing TCC's operations. This represents a significant concern for potential traders seeking regulated brokerage services.

Deposit and Withdrawal Methods: Specific information about funding options and withdrawal procedures is not detailed in available sources. However, user complaints suggest significant issues with withdrawal processing.

Minimum Deposit Requirements: Concrete minimum deposit amounts are not specified in available documentation. This leaves potential traders without clear entry-level investment information.

Bonus and Promotional Offers: No specific promotional programs or bonus structures are detailed in available materials. This suggests limited marketing incentives.

Tradable Assets: TCC offers access to forex currency pairs, contracts for difference, and derivative instruments. This provides some diversity in trading opportunities despite other operational concerns.

Cost Structure: Detailed information about spreads, commissions, and fee structures is not readily available. This makes cost comparison with other brokers difficult for potential clients.

Leverage Ratios: Specific leverage offerings are not detailed in available sources. This leaves traders without clear information about available margin requirements.

Platform Options: The broker provides access to the MetaTrader 4 trading platform. This offers familiar functionality for many retail traders.

Geographic Restrictions: Specific regional limitations are not detailed in available materials.

Customer Support Languages: Available customer service language options are not specified in current tcc review materials.

Detailed Rating Analysis

Account Conditions Analysis (Score: 2/10)

TCC's account conditions present significant concerns for potential traders, mainly due to the lack of transparent information about account types, requirements, and features. The absence of detailed account specifications makes it difficult for traders to understand what they can expect when opening an account with this broker.

The account opening process appears problematic based on user feedback, with many clients reporting difficulties in accessing their accounts and managing their trading activities effectively. Without clear information about minimum deposit requirements, account tiers, or special features, potential traders cannot make informed decisions about whether TCC's offerings align with their trading goals and financial capabilities.

User feedback consistently highlights problems with account management, particularly regarding withdrawal processes and account access. Many traders report experiencing significant delays and complications when attempting to access their funds, which suggests fundamental issues with the broker's account management systems and procedures.

The lack of special account functionalities or premium features further diminishes TCC's appeal compared to established brokers that offer complete account options. This tcc review finds that the broker's account conditions fall well below industry standards, making it unsuitable for traders seeking reliable and transparent trading account services.

TCC's trading tools and resources offering centers mainly around the MetaTrader 4 platform, which provides traders with a familiar and widely-used trading interface. MT4 offers standard charting capabilities, technical analysis tools, and basic trading functionalities that many retail traders expect from a forex broker.

However, the broker's resource portfolio appears limited beyond the basic platform offering. There is no evidence of proprietary trading tools, advanced market analysis resources, or complete educational materials that would enhance the trading experience for clients seeking additional support and insights.

Research and analysis resources appear to be minimal or non-existent based on available information. Traders looking for market commentary, economic calendars, or detailed market analysis would likely need to source these materials elsewhere, limiting the value proposition that TCC provides to its clients.

The absence of educational resources represents a significant gap in the broker's service offering, particularly for newer traders who might benefit from complete learning materials, webinars, or trading guides. This limitation reduces TCC's appeal to traders seeking a full-service brokerage experience with adequate support for skill development and market understanding.

Customer Service and Support Analysis (Score: 3/10)

Customer service represents one of TCC's most problematic areas, with user complaints highlighting significant deficiencies in support quality and responsiveness. The volume of negative feedback regarding customer service suggests systematic issues with the broker's support infrastructure and client relationship management.

Available information does not specify customer service channels, operating hours, or response time commitments, which indicates a lack of transparency in support service delivery. This absence of clear service level expectations makes it difficult for clients to understand what support they can expect when issues arise.

User feedback consistently reports poor service quality, with many clients experiencing difficulties in receiving timely and effective assistance with their trading accounts and technical issues. The high volume of complaints suggests that customer service problems are widespread rather than isolated incidents affecting individual users.

The broker's handling of client complaints and dispute resolution appears inadequate based on the continued accumulation of negative feedback and unresolved issues reported by users. This pattern suggests that TCC lacks effective procedures for addressing client concerns and maintaining satisfactory customer relationships, which is essential for any reputable brokerage operation.

Trading Experience Analysis (Score: 4/10)

The trading experience with TCC presents mixed results, with the MT4 platform providing familiar functionality while operational issues create significant concerns for active traders. Platform stability and execution quality information is limited, making it difficult to assess the technical performance that traders can expect.

Order execution quality remains unclear due to the absence of detailed performance metrics or transparency about execution policies. Without information about slippage rates, execution speeds, or order processing procedures, traders cannot adequately evaluate whether TCC can meet their execution requirements effectively.

Platform functionality appears limited to standard MT4 features, without evidence of enhanced tools or proprietary improvements that might differentiate TCC from other MT4-offering brokers. This limitation means traders receive basic platform access without additional value-added features that could improve their trading efficiency.

Mobile trading experience details are not specified in available materials, leaving traders uncertain about the quality and functionality of mobile platform access. Given the importance of mobile trading for many retail traders, this information gap represents a significant limitation in evaluating TCC's overall tcc review trading experience offering.

Trustworthiness Analysis (Score: 1/10)

TCC's trustworthiness represents the most concerning aspect of this broker evaluation, with multiple red flags indicating significant risks for potential clients. WikiFX has issued warnings identifying TCC as a fraudulent broker, which represents a severe credibility issue that cannot be overlooked.

The absence of clear regulatory oversight creates fundamental trust concerns, as regulated brokers typically provide greater client protection and operational transparency. Without regulatory supervision, traders have limited recourse if disputes arise or if the broker fails to meet its obligations to clients.

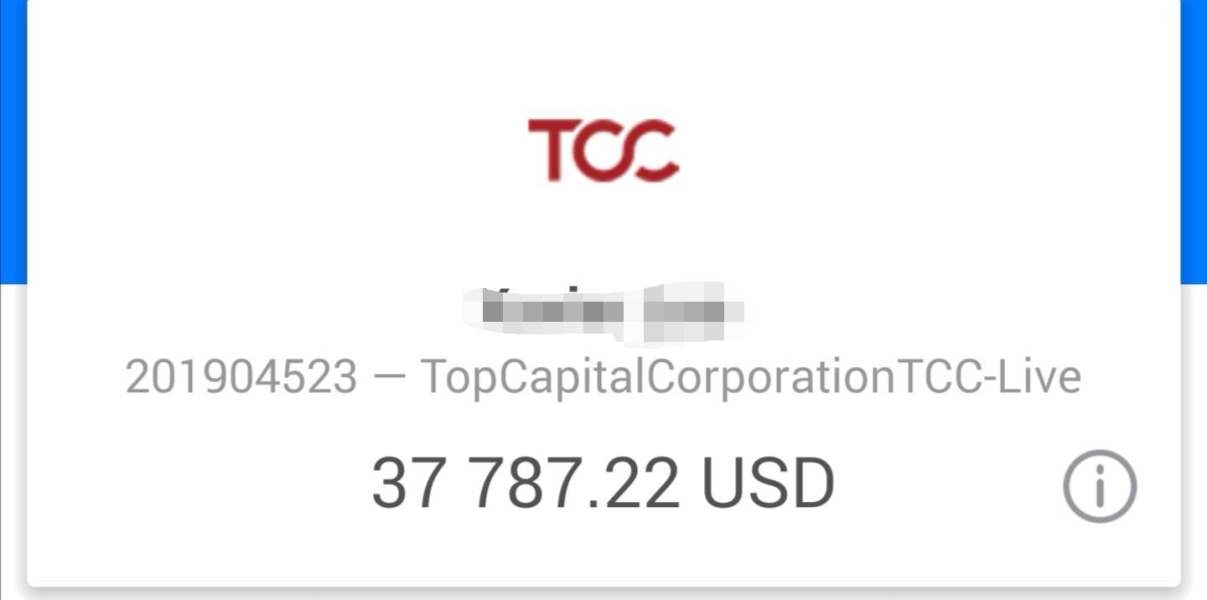

The high volume of user complaints, particularly regarding withdrawal fraud, indicates systematic issues with the broker's operational integrity. These complaints suggest that TCC may not be fulfilling its basic obligations to clients, particularly regarding fund security and withdrawal processing.

Company transparency is severely lacking, with minimal information available about company leadership, financial status, or operational procedures. This opacity makes it impossible for potential clients to conduct adequate due diligence before entrusting their funds to the broker, which represents an unacceptable risk for serious traders.

User Experience Analysis (Score: 2/10)

Overall user satisfaction with TCC is mostly negative, based on the substantial volume of complaints and negative feedback from actual clients. The user experience appears compromised by operational issues, poor customer service, and concerns about fund security that significantly impact client satisfaction.

Interface design and platform usability information is limited to the standard MT4 offering, which provides basic functionality but lacks the enhanced user experience features that many modern brokers provide. This limitation means users receive a basic trading interface without the improvements that could enhance their overall experience.

The registration and account verification process appears problematic based on user feedback, with many clients reporting difficulties in completing account setup and verification procedures. These operational issues create immediate friction for new users and suggest inadequate onboarding processes.

Fund management represents the most significant user experience concern, with withdrawal problems being the primary source of negative feedback. Users consistently report difficulties accessing their funds, which represents a fundamental failure in meeting basic client expectations and creates severe trust issues that affect the overall user experience evaluation in this complete tcc review.

Conclusion

This complete evaluation reveals that TCC presents substantial risks that far outweigh any potential benefits for forex traders. The combination of regulatory concerns, user complaints, and operational transparency issues makes TCC unsuitable for traders seeking reliable and secure brokerage services.

While TCC offers access to the familiar MT4 platform and basic forex trading capabilities, these limited benefits cannot compensate for the significant trust and operational concerns identified in this analysis. The broker's poor track record and negative user feedback suggest that traders would be better served by choosing established, regulated alternatives that provide greater security and transparency.

Traders considering TCC should exercise extreme caution and carefully consider the substantial risks involved before proceeding with this broker.