Pugnax FX 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Pugnax FX Capital stands out as a UK-based foreign exchange broker uniquely positioned to cater to the personalized currency exchange needs of both individual and corporate clients. Founded in 2008 and headquartered in London, this broker offers competitive exchange rates and a focus on providing a private banking level of service. Ideal customers include small to medium-sized businesses engaged in international trade and individuals purchasing overseas properties or managing expatriation. Pugnax FX aims to save clients up to 4% compared to high street bank rates, but potential clients should approach with caution. Concerns regarding regulatory transparency and the reputation of withdrawal processes can overshadow its otherwise commendable offerings. Therefore, while Pugnax FX provides enticing low-cost services, the importance of thorough due diligence cannot be overstated.

⚠️ Important Risk Advisory & Verification Steps

Before using Pugnax FX, potential clients should be aware of important risks involved:

- Regulatory Compliance: Lack of detailed information about its regulatory status may lead to uncertainty.

- Withdrawal Process: Complaints regarding withdrawal experiences should be noted as potential red flags.

- User Reviews: A limited number of user reviews increases doubts about the brokers overall reputation.

How to Self-Verify:

To verify Pugnax FXs compliance and reputation:

- Consult the FCA: Check the Financial Conduct Authority (FCA) website for registration details of Pugnax FX.

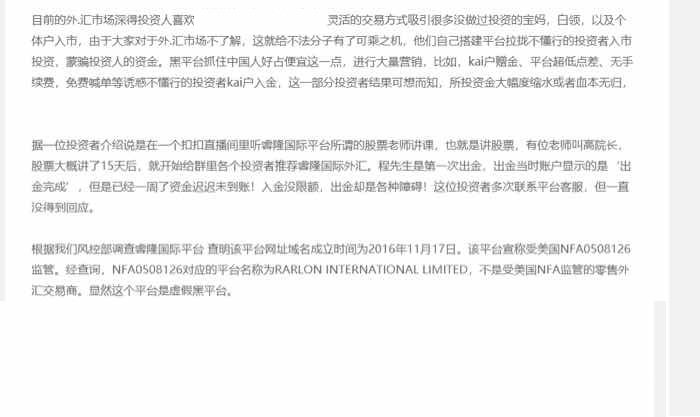

- Visit Regulatory Websites: Look into resources such as the NFA's BASIC database to ensure verification.

- Search User Reviews: Utilize financial forums and review platforms to assess user feedback.

- Contact Customer Support: Reach out directly for inquiries about their regulatory status and operational transparency.

Rating Framework

Broker Overview

Company Background and Positioning

Pugnax FX Capital Ltd is a foreign exchange broker established in 2008, located in Mayfair, London. Its approach emphasizes personalized service, making it distinct from more traditional high street banks. Focused on offering tailored currency exchange solutions, the broker carves a niche in serving both individuals and businesses engaged in international transactions. Pugnax FX is a privately held firm with a team experienced in operating across diverse market sectors, helping clients secure competitive rates and minimize risk in volatile forex markets.

Core Business Overview

Pugnax FX offers a comprehensive range of currency exchange services to its clients. These services permit access to all major international currencies, emphasizing its commitment to cost-effectiveness and transparency. Clients can benefit from no commissions or hidden fees on transactions, which is a significant advantage compared to the opaque cost structures often employed by banks. Notably, Pugnax FX is authorized by the Financial Services Authority (FSA) and complies with UK money laundering regulations, which ensures a basic level of trust and security for client transactions.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis: Teaching Users to Manage Uncertainty

The lack of clear information regarding Pugnax FX's regulatory standing introduces uncertainty for prospective clients. The company is regulated by several bodies, including the FCA, but the precise implications and stipulations are vague in public-facing documents.

To self-verify the broker's trustworthiness:

- Visit the FCAs official site to check the registration status.

- Consult online databases like the NFA's BASIC for compliance checkpoints.

- Look for testimonials on independent review sites.

Industry reputation remains mixed, with some users voicing concerns about fund safety.

"Withdrawing funds has been quite a hassle. I felt uneasy about the safety of my investments." - Anonymous User

Trading Costs Analysis: The Double-Edged Sword Effect

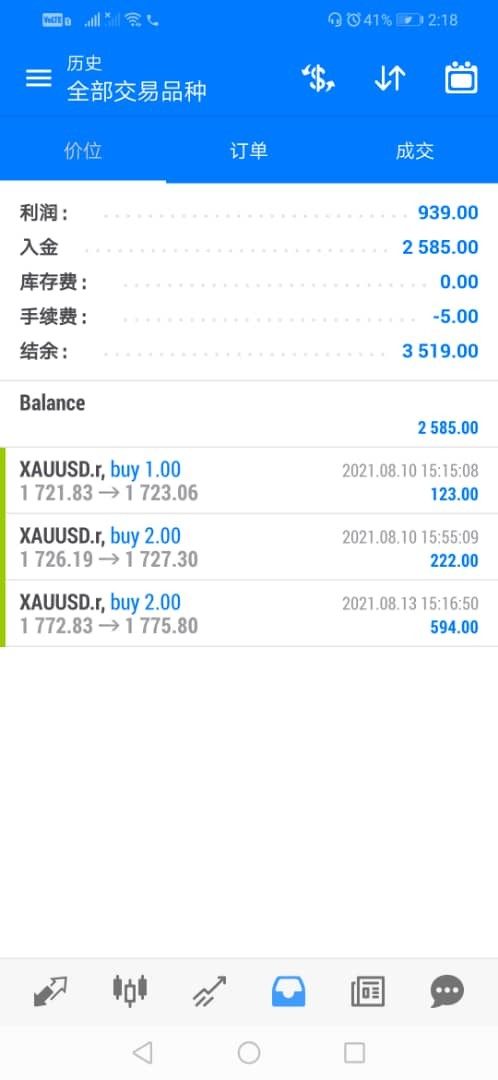

Pugnax FX boasts attractive commission structures that appeal primarily to businesses and frequent currency users. Clients can save significantly compared to traditional banks, typically achieving savings of up to 4%.

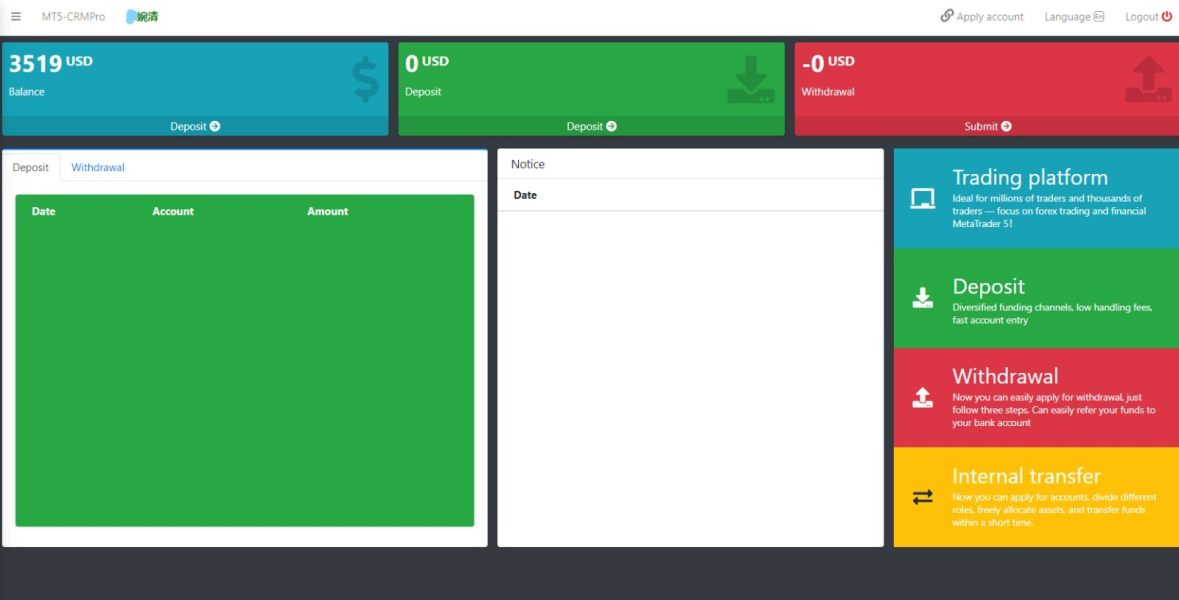

However, there are hidden costs to watch for. Clients have reported £30 withdrawal fees that could erase the savings achieved through lower exchange rates.

Overall, Pugnax FX represents a compelling offering for frequent currency users but could impose penalties through withdrawal and inactivity charges.

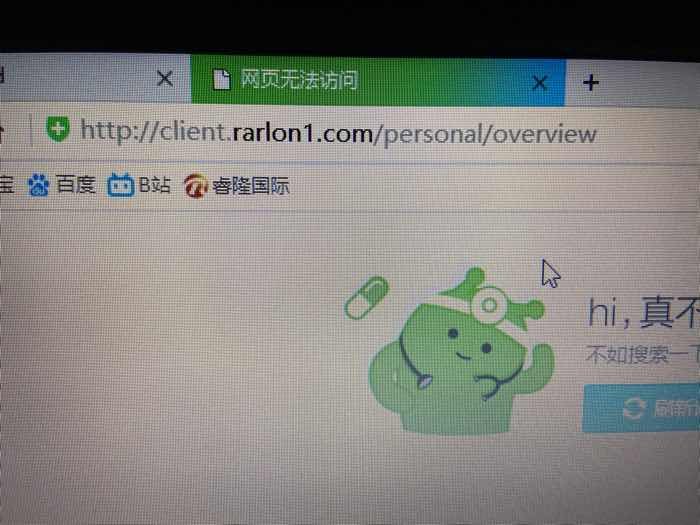

Pugnax FX offers access to advanced trading platforms, notably MT5, known for extensive analytical tools and charting options. Nevertheless, while this professional depth caters to experienced users, beginners may find the options overwhelming.

Feedback regarding usability presents mixed findings. Some users appreciate the platform features, while others indicate a learning curve that may deter new traders.

"While I love the tools available on the platform, it took me a while to really get the hang of using them efficiently." - Experienced User

User Experience Analysis: Navigating the User Journey

The user onboarding process is designed to be straightforward, but initial steps may pose challenges due to occasional service inconsistencies.

General user feedback indicates average satisfaction levels, with some clients appreciating the personalized account management style, while others express frustration over slow response times.

To improve the experience, user-suggested improvements include simplifying the onboarding process and enhancing the clarity of communication regarding fees.

Customer Support Analysis: Support as a Lifeline

Pugnax FX provides multiple support channels, including phone, email, and live chat, with reported responsiveness varying among users. While many celebrate the proactive customer service, others have indicated inconsistency in response times and the quality of assistance.

Overall, customer support is generally viewed favorably but could benefit from more standardized response protocols.

Account Conditions Analysis: Flexibility and Restrictions

Clients can expect flexible account options tailored to suit their currency exchange needs. Withdrawal processes, however, can be a point of contention, with some users citing unexpected fees when withdrawing funds.

On a positive note, the absence of commission charges and the ability to lock in exchange rates for up to two years provide substantial benefits for users engaging in long-term international transactions.

Conclusion

Pugnax FX Capital offers a competitive and personalized foreign exchange service highly suitable for individuals and businesses alike. Its capacity to provide savings and a high level of service can be very appealing. However, potential clients are advised to conduct thorough due diligence and consider the possible risks associated with limited regulatory transparency and service inconsistencies. By carefully evaluating these risks, clients can better discern whether Pugnax FX is the right choice for their foreign exchange needs. Always verify information independently to ensure the best possible trading experience with Pugnax FX.