Rely 2025 Review: Everything You Need to Know

Executive Summary

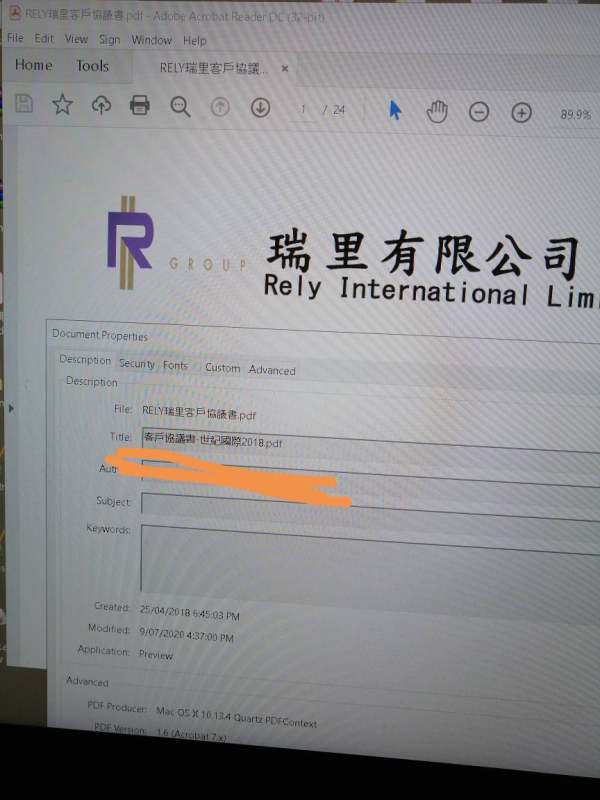

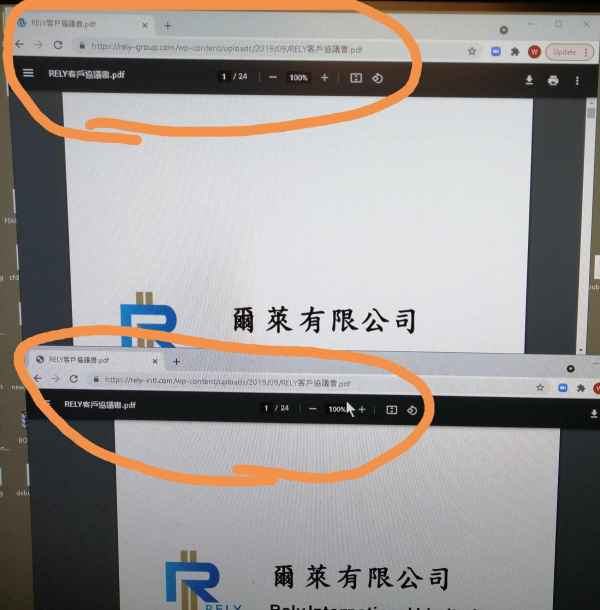

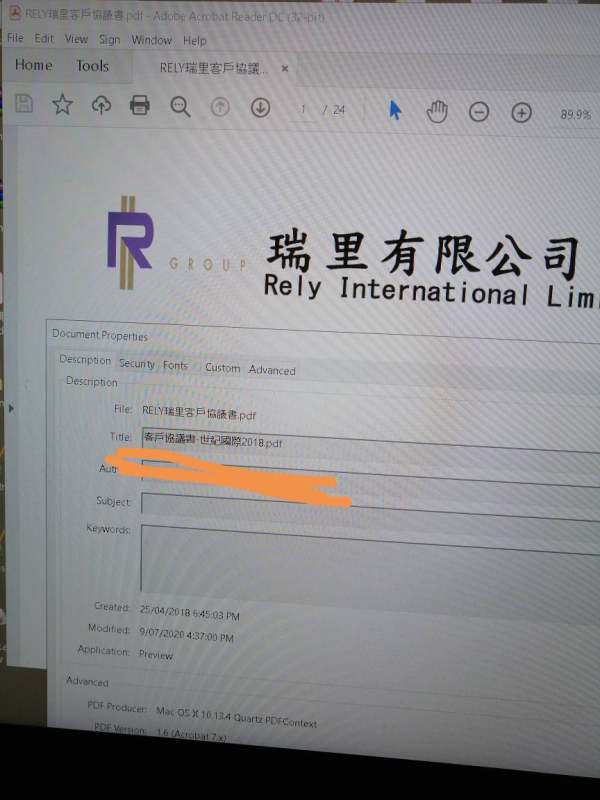

This comprehensive rely review examines a broker that has generated mixed signals in the trading community. Rely was established in 2019 and presents itself as an emerging forex broker attempting to carve out a niche in the competitive trading landscape. However, our analysis reveals significant transparency concerns that potential traders must carefully consider before making any commitments.

The broker's limited regulatory disclosure and sparse trading condition information raise immediate red flags for serious traders. While some positive employee feedback exists on platforms like AmbitionBox, where Rely scored 3.3/5 overall with a notable 4.3/5 for job security, these workplace metrics don't translate directly to trading service quality. Our investigation found that Rely primarily targets traders willing to explore emerging market opportunities and those comfortable with higher risk tolerance.

However, the lack of comprehensive regulatory information, unclear trading conditions, and minimal platform details make it challenging to recommend this broker to mainstream retail traders. The company appears to have connections to real estate services, which may indicate diversified business interests beyond forex trading. For traders considering Rely, extreme caution is advised due to insufficient transparency regarding fund safety measures, trading costs, and regulatory compliance.

Important Notice

Regional Entity Differences: Due to limited regulatory information available in our research, traders in different jurisdictions may encounter varying levels of protection and service quality. The absence of clear regulatory framework disclosure means users cannot reliably assess the safety measures applicable to their specific region.

Review Methodology: This rely review is based on available public information, user feedback from employment platforms, and limited broker-related data. Our assessment does not include hands-on trading experience or direct platform testing, as comprehensive broker information was not accessible through standard channels.

Rating Overview

Broker Overview

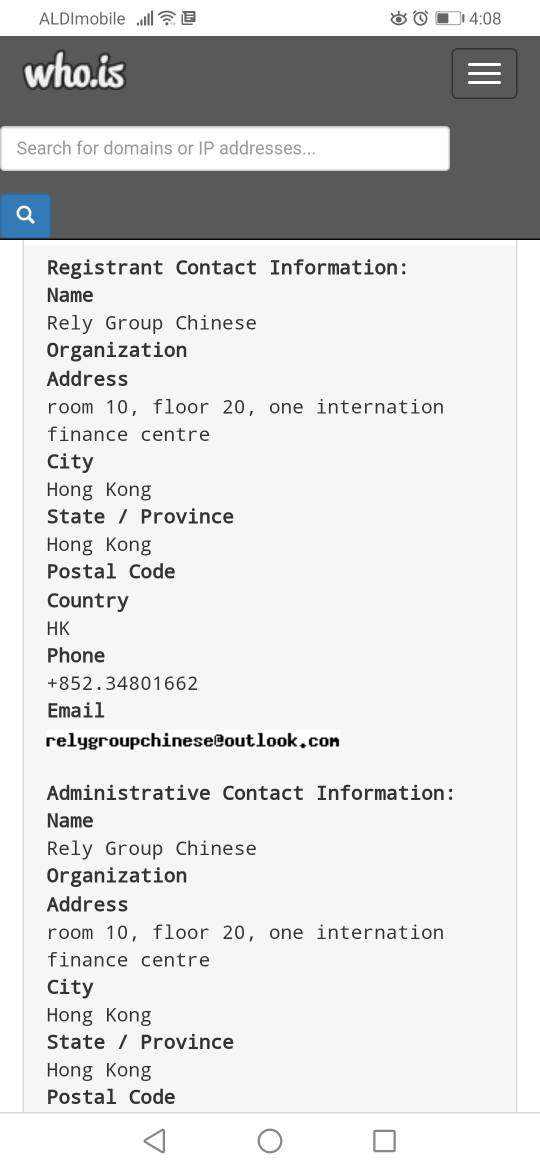

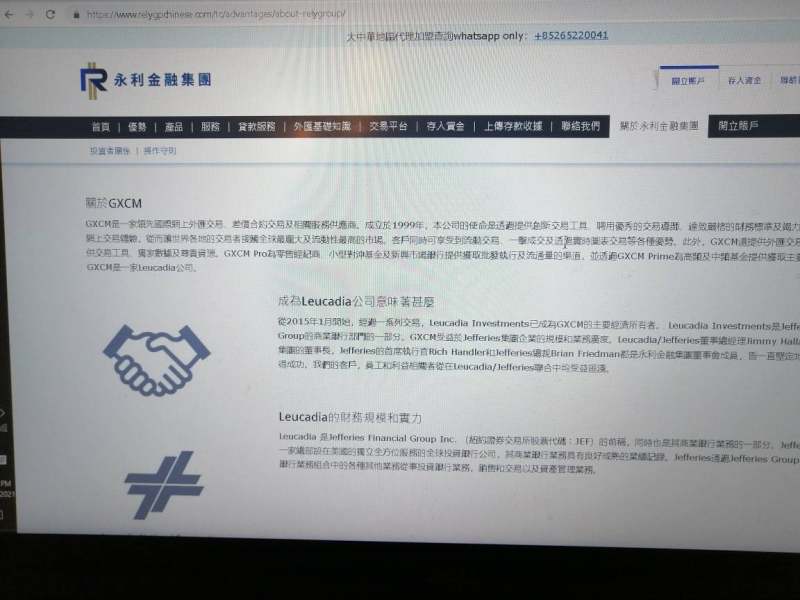

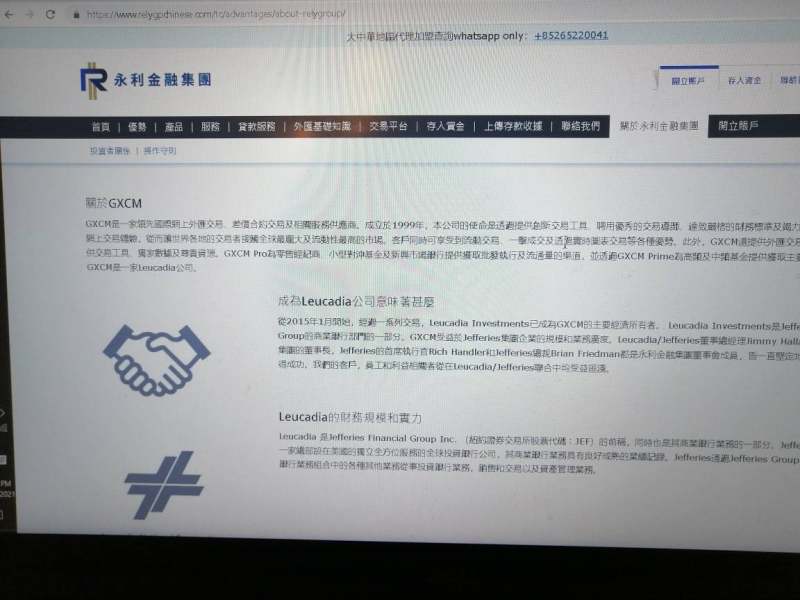

Rely emerged in the financial services landscape in 2019. The company initially positioned itself to provide tools and resources for real estate professionals in competitive markets. The broker's expansion into forex trading represents a diversification of their service offerings, though this transition appears to lack the comprehensive framework typically expected from established forex brokers.

The broker's business model remains somewhat unclear, with available information suggesting a focus on serving specific user demographics rather than broad market appeal. This targeted approach might appeal to niche trading communities. However, it also limits the broker's transparency and accessibility for mainstream retail traders seeking comprehensive trading solutions.

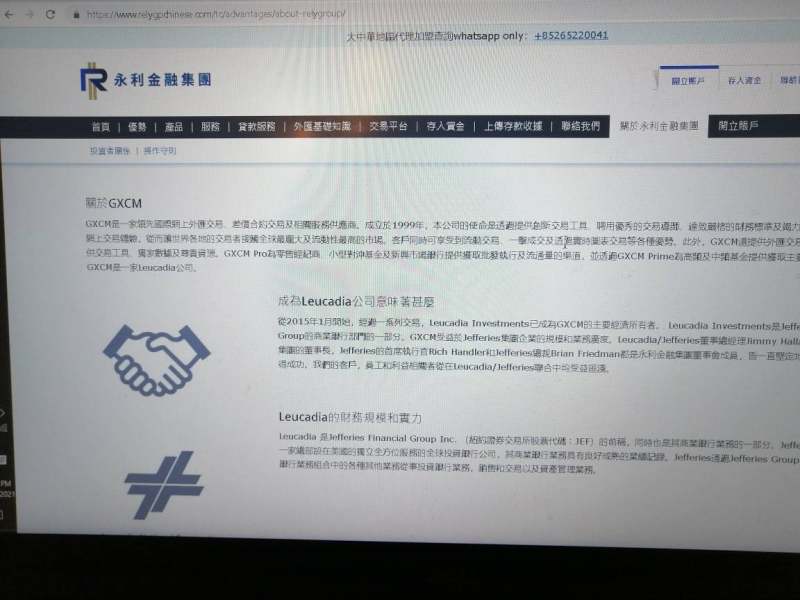

From a regulatory standpoint, this rely review uncovered concerning gaps in disclosure. Unlike established brokers that prominently display their regulatory credentials, Rely's regulatory status remains ambiguous. The absence of clear licensing information from recognized financial authorities represents a significant concern for potential clients prioritizing fund safety and regulatory protection.

The broker's trading infrastructure details are similarly sparse. Information about supported trading platforms, whether MetaTrader 4/5 or proprietary solutions, was not readily available. This lack of platform transparency makes it difficult for traders to assess whether Rely's technological offerings meet their trading requirements and expectations.

Regulatory Status: Available information does not specify regulatory oversight from recognized financial authorities, representing a significant transparency gap for potential traders.

Deposit and Withdrawal Methods: Specific funding options and processing procedures are not detailed in accessible broker information. This limits traders' ability to assess transaction convenience.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified in available documentation. This prevents accurate cost assessment for potential clients.

Bonus and Promotions: Current promotional offerings and incentive programs are not detailed in publicly available information.

Tradeable Assets: The range of available trading instruments, including forex pairs, CFDs, and other financial products, is not comprehensively outlined in accessible materials.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not readily available. This makes cost comparison difficult.

Leverage Ratios: Maximum leverage offerings and risk management parameters are not specified in available broker documentation.

Platform Options: Specific trading platform availability and technical specifications are not detailed in accessible information.

Geographic Restrictions: Regional availability and service limitations are not clearly outlined in available materials.

Customer Support Languages: Supported communication languages for client assistance are not specified in accessible documentation.

Detailed Rating Analysis

Account Conditions Analysis

Our rely review of account conditions reveals significant information gaps that concern potential traders. The broker's website and available materials do not provide clear details about account tier structures, minimum balance requirements, or specific features associated with different account types. This transparency deficit makes it impossible for traders to make informed decisions about which account might suit their trading style and capital requirements.

The absence of information about Islamic accounts, professional trader designations, or special account features further compounds these concerns. Established brokers typically provide comprehensive account comparison charts, fee schedules, and clear eligibility criteria. Rely's lack of such fundamental information suggests either incomplete service development or deliberate opacity that disadvantages potential clients.

Account opening procedures and verification requirements are similarly unclear. Without transparent onboarding information, traders cannot anticipate the documentation needed, processing timeframes, or potential complications during account establishment. This uncertainty creates barriers for traders seeking efficient account setup processes.

The scoring of 4/10 for account conditions reflects these substantial information gaps rather than necessarily poor service quality. Insufficient data prevents accurate quality assessment.

Trading tools and analytical resources represent critical components of modern forex trading. Our investigation found minimal information about Rely's offerings in this area. The broker does not appear to provide detailed information about charting capabilities, technical indicators, economic calendars, or market analysis resources that traders typically require for informed decision-making.

Educational resources, including webinars, tutorials, trading guides, and market commentary, are not prominently featured in available materials. This absence is particularly concerning for novice traders who rely on broker-provided education to develop their trading skills and market understanding. Established brokers typically offer comprehensive learning centers with progressive educational content.

Automated trading support, including Expert Advisor compatibility, signal services, and algorithmic trading tools, is not addressed in accessible information. Modern traders increasingly rely on automation to execute strategies and manage risk. This makes this information gap particularly relevant for technically sophisticated users.

Research capabilities, including fundamental analysis, technical analysis tools, and market sentiment indicators, are not detailed in available documentation. Professional traders require robust analytical frameworks to support their trading decisions. The absence of such information raises questions about the broker's commitment to serious trading professionals.

Customer Service and Support Analysis

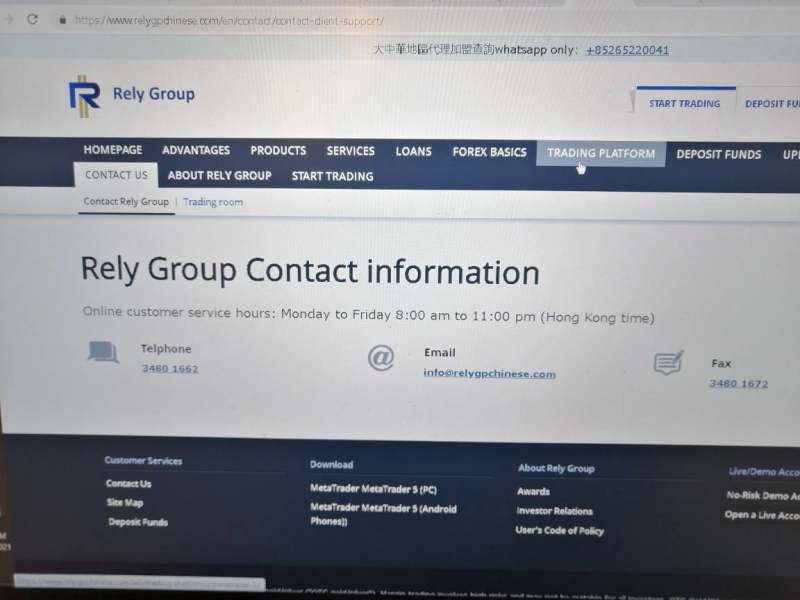

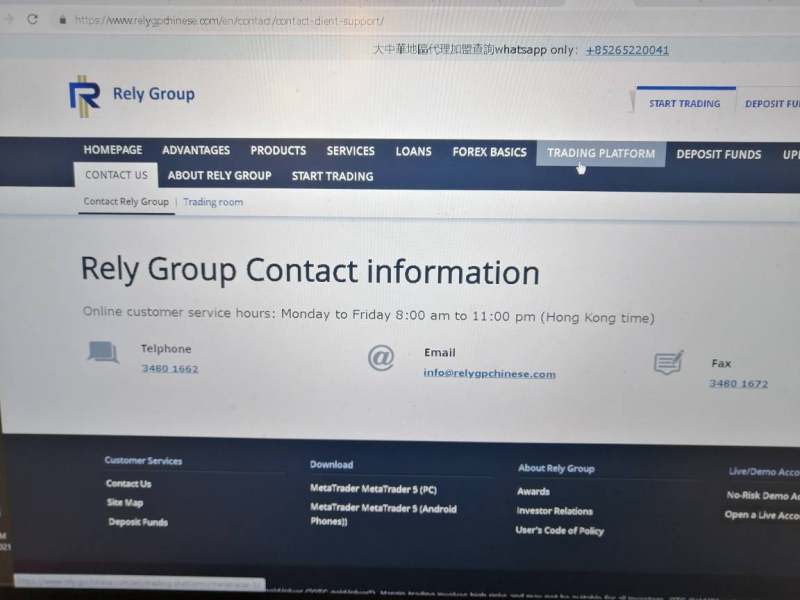

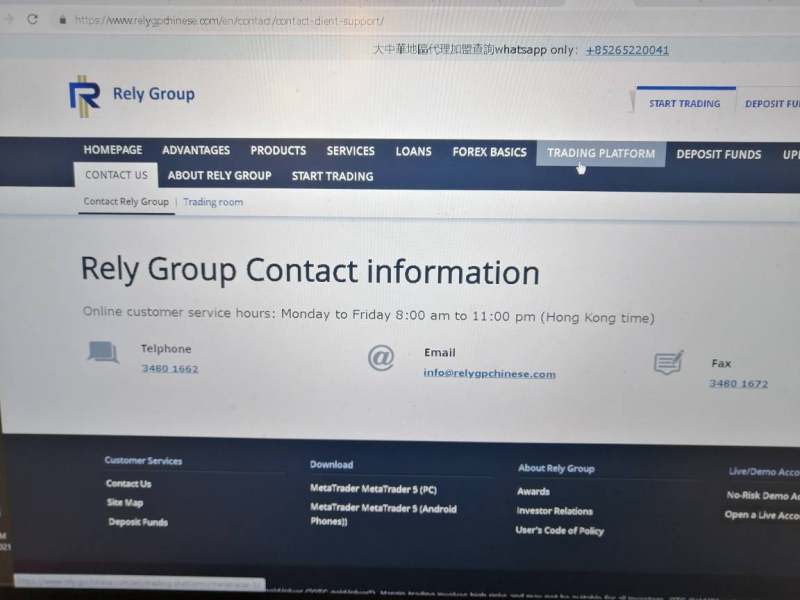

Customer service quality assessment proves challenging due to limited available information about Rely's support infrastructure. The broker does not clearly outline available communication channels, whether including live chat, telephone support, email assistance, or social media engagement options that modern traders expect from professional service providers.

Response time commitments and service level agreements are not specified in accessible materials. Traders require reliable support, particularly during volatile market conditions when technical issues or account problems can result in significant financial impact. The absence of clear service standards makes it impossible to assess whether Rely meets professional support expectations.

Multilingual support capabilities remain unclear, which could limit accessibility for international traders. Global forex brokers typically provide support in multiple languages to serve diverse client bases effectively. Without clear language support information, traders cannot determine whether they'll receive assistance in their preferred communication language.

Operating hours for customer support services are not specified. This creates uncertainty about availability during different trading sessions.

Trading Experience Analysis

Platform stability and execution quality represent fundamental aspects of trading experience. Specific performance data about Rely's trading infrastructure is not readily available. Information about server uptime, execution speeds, slippage rates, and requote frequencies - all critical factors for active traders - is not provided in accessible materials.

Order execution quality, including fill rates, partial fill handling, and price improvement statistics, is not detailed in available documentation. Professional traders require transparent execution statistics to assess whether a broker's infrastructure meets their performance requirements, particularly for scalping and high-frequency trading strategies.

Platform functionality assessment is hampered by limited information about available features, charting capabilities, order types, and risk management tools. Modern trading platforms offer sophisticated functionality including advanced charting, multiple order types, risk management features, and customization options that serious traders require.

Mobile trading experience details are not provided, despite mobile platforms becoming increasingly important for traders who need market access while away from desktop computers. The absence of mobile app information, including feature parity with desktop platforms and user interface quality, represents another significant information gap in this rely review.

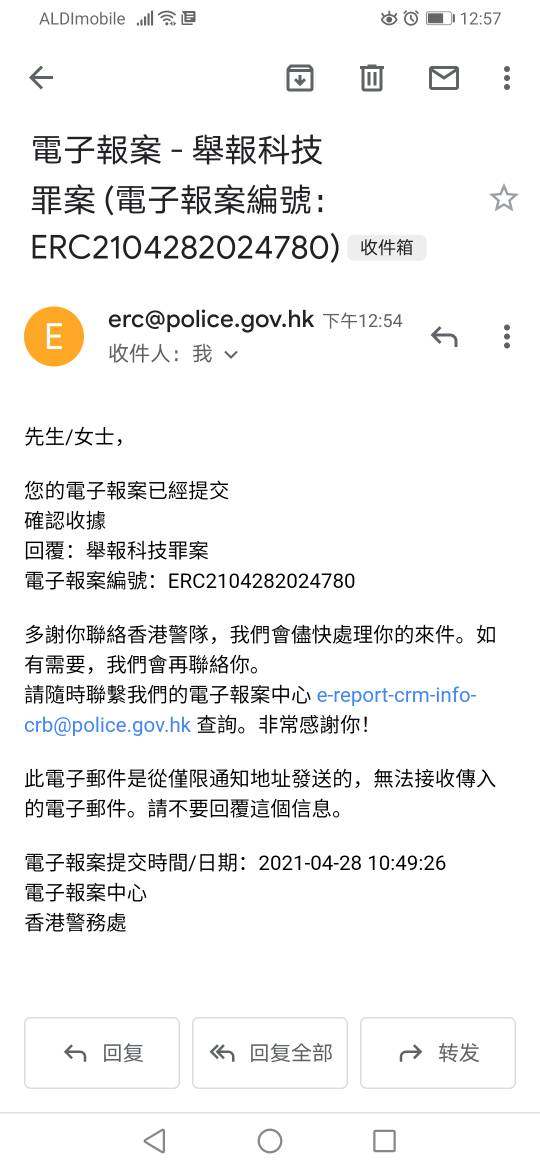

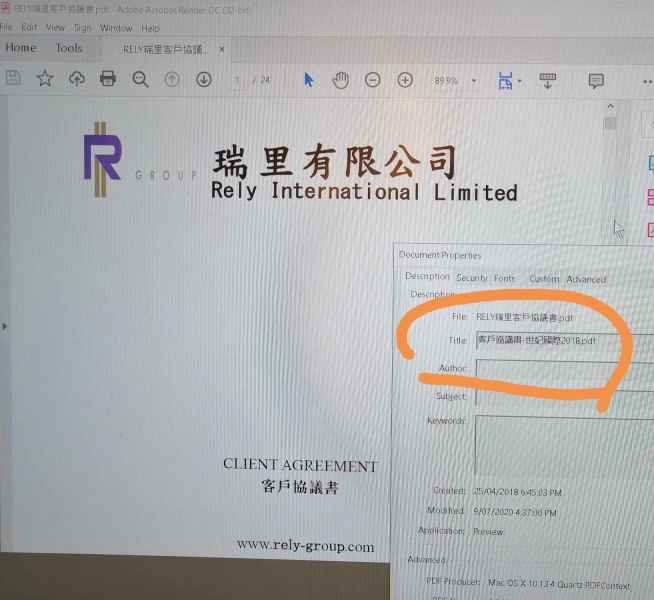

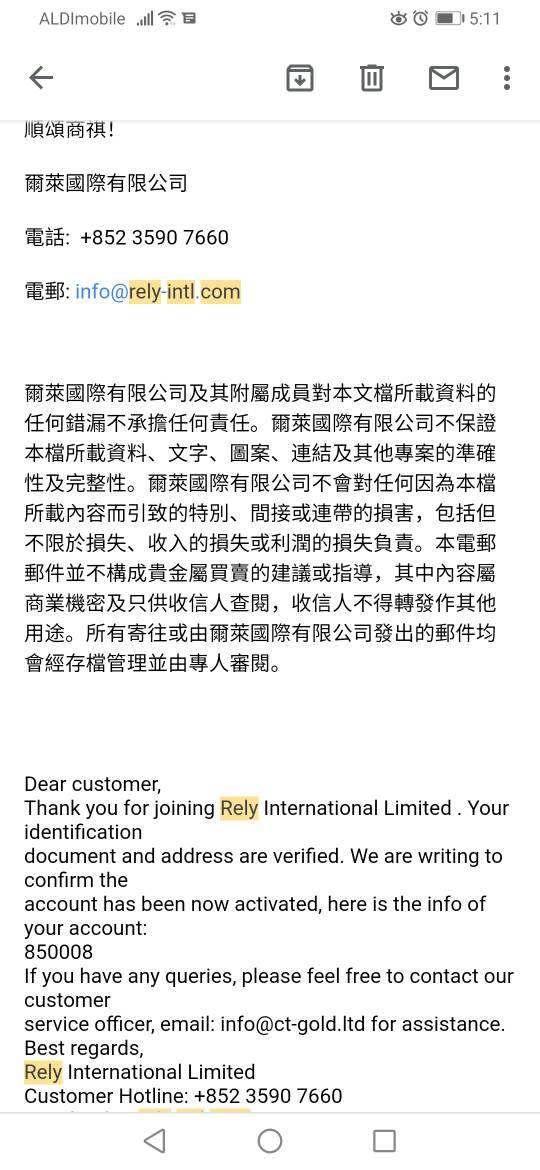

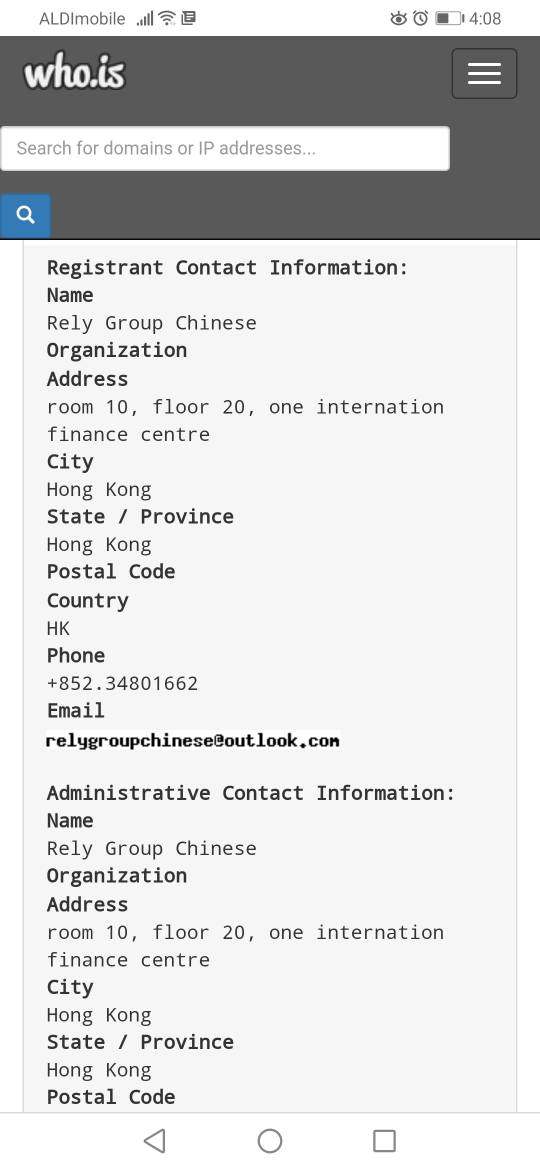

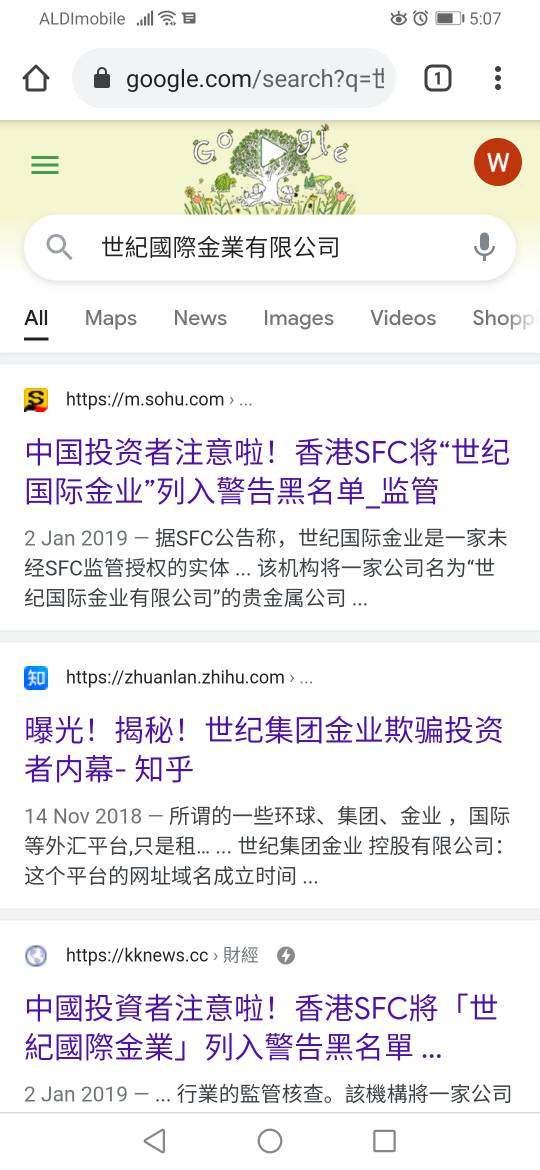

Trust Factor Analysis

Regulatory compliance represents the most significant concern in our trust factor assessment. The absence of clear regulatory disclosure from recognized financial authorities creates substantial uncertainty about client protection measures, dispute resolution procedures, and operational oversight that regulated brokers must maintain.

Fund safety measures, including segregated client accounts, deposit insurance, and negative balance protection, are not detailed in available information. These protections are fundamental for retail traders. Their absence or unclear status significantly impacts the broker's trustworthiness for potential clients prioritizing capital safety.

Corporate transparency, including company ownership, financial reporting, management team information, and business registration details, is not comprehensively provided. Legitimate brokers typically offer detailed corporate information to build client confidence and demonstrate operational legitimacy.

Industry recognition through awards, certifications, or professional associations is not evident in available materials. Established brokers often highlight industry acknowledgments as trust indicators. The absence of such recognition may indicate limited industry standing or newer market presence.

User Experience Analysis

Overall user satisfaction assessment is complicated by limited feedback availability specifically related to trading services. While some employment-related feedback exists on platforms like AmbitionBox, this information pertains to workplace conditions rather than trading service quality. This limits its relevance for potential trading clients.

Interface design and usability information is not available for assessment, preventing evaluation of platform navigation, feature accessibility, and user-friendly design elements that contribute to positive trading experiences. Modern traders expect intuitive interfaces that facilitate efficient trade execution and account management.

Registration and verification processes are not clearly outlined. This creates uncertainty about onboarding complexity and timeline expectations. Streamlined account opening procedures are increasingly important for traders seeking quick market access, and unclear processes may deter potential clients.

Funding operation experiences, including deposit processing speeds, withdrawal procedures, and transaction fee structures, are not detailed in available materials. Efficient fund management is crucial for active traders. The absence of clear funding information represents a significant service transparency gap.

Conclusion

This comprehensive rely review reveals a broker with significant transparency challenges that potential traders must carefully consider. While Rely shows some positive indicators in employment feedback, suggesting decent workplace conditions, the substantial gaps in trading-related information disclosure raise serious concerns about service readiness for serious forex traders.

The broker appears most suitable for traders comfortable with higher risk tolerance and those willing to explore emerging market opportunities despite limited transparency. However, mainstream retail traders seeking comprehensive regulatory protection, clear trading conditions, and transparent fee structures should exercise extreme caution when considering Rely.

The primary advantages appear to be the company's relatively recent establishment, which might offer growth potential, and some positive workplace feedback. However, these benefits are significantly outweighed by critical disadvantages including absent regulatory disclosure, unclear trading conditions, limited platform information, and insufficient transparency about fund safety measures that are fundamental requirements for professional forex trading services.