Horizon Review 1

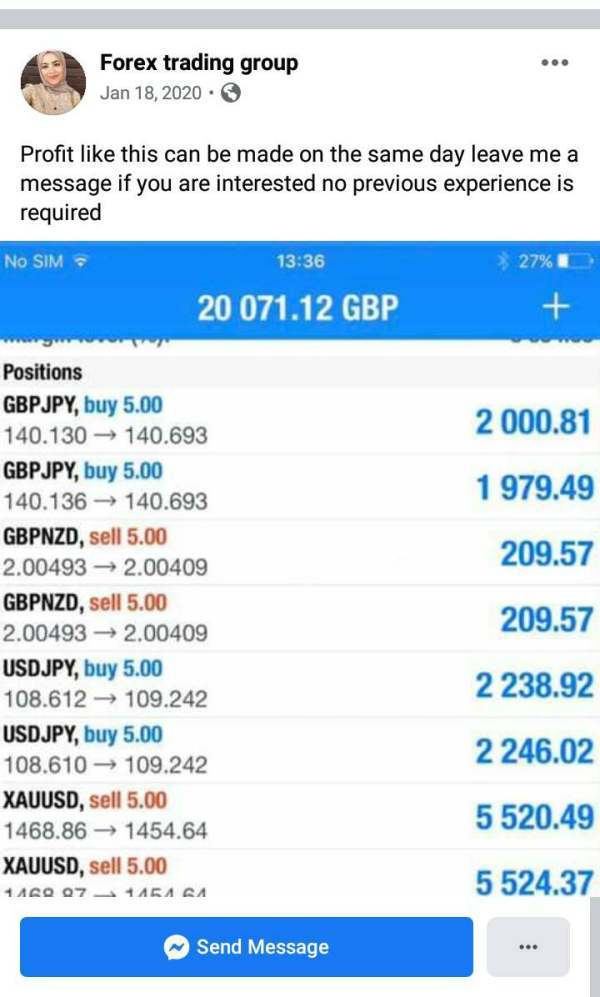

They scam people of their hard earned money. Do not trade with them. over 2000$ lost because of them. beware and be safe

Horizon Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

They scam people of their hard earned money. Do not trade with them. over 2000$ lost because of them. beware and be safe

This horizon review gives you a complete analysis of Horizon as a trading platform for 2025. Based on what we found, Horizon seems to focus mainly on software solutions for different industries like construction, facilities management, and human resources rather than traditional forex trading services. Our evaluation shows major gaps in information about specific trading conditions, rules, and platform features that forex traders need to know. We don't have detailed information about spreads, leverage options, account types, or regulatory oversight, so potential users should be careful when thinking about this platform. The limited data we found suggests this may not be a regular forex broker. This makes it unsuitable for traders who want established trading infrastructure and regulatory protection that major forex platforms typically provide.

This review uses limited publicly available information about Horizon. We don't have information about regulatory differences across regions from current sources. Potential users should check all claims and regulatory status on their own before making any financial commitments. Our evaluation method relies on accessible data sources and may not show the complete picture of Horizon's services or capabilities. Traders should strongly verify regulatory compliance and trading conditions directly with the platform before proceeding.

| Criteria | Score | Justification |

|---|---|---|

| Account Conditions | N/A | Insufficient information available about account types, minimum deposits, or trading conditions |

| Tools and Resources | N/A | No specific data regarding trading tools, research resources, or platform capabilities |

| Customer Service | N/A | Customer support information not detailed in available sources |

| Trading Experience | N/A | Platform performance and trading execution data unavailable |

| Trust and Regulation | N/A | Regulatory information and oversight details not specified |

| User Experience | N/A | User interface and overall experience data insufficient for evaluation |

Company Background and Business Model

According to available sources, Horizon Software provides different software solutions across multiple industries including construction, facilities management, human resources, legal management, manufacturing, medical services, and property management. The company seems to operate from Costa Mesa, California, with offices at 3187 Redhill Ave, Suite 125. However, we can't find a clear connection between this software company and forex trading services from current available information.

Trading Platform and Asset Coverage

The specific details about trading platforms, available asset classes, and market access are not detailed in accessible sources. Unlike traditional forex brokers that typically offer MetaTrader platforms, proprietary trading software, or web-based trading interfaces, Horizon's platform specifications remain unclear. We don't have clear information about currency pairs, CFDs, commodities, or other tradeable instruments, which raises questions about the platform's suitability for forex trading activities.

Regulatory Framework: Current sources don't provide specific information about regulatory oversight, licensing jurisdictions, or compliance with financial authorities such as FCA, CySEC, or ASIC.

Deposit and Withdrawal Methods: Available payment methods, processing times, and associated fees are not detailed in accessible information sources.

Minimum Deposit Requirements: Specific minimum deposit amounts for different account types are not specified in current documentation.

Promotional Offers: Information about welcome bonuses, trading incentives, or promotional campaigns is not available in reviewed sources.

Tradeable Assets: The range of available instruments including forex pairs, indices, commodities, and cryptocurrencies is not clearly outlined.

Cost Structure: Details about spreads, commissions, overnight fees, and other trading costs are not provided in available materials.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in current information sources.

Platform Selection: Specific trading platforms, mobile applications, and software options are not detailed in accessible documentation.

Geographic Restrictions: Information about restricted countries or regional limitations is not available in current sources.

Customer Support Languages: Available support languages and communication channels are not specified in reviewed materials.

This horizon review highlights the major information gaps that potential traders should consider when evaluating this platform.

The evaluation of account conditions for Horizon shows major information gaps that prevent a complete assessment. Traditional forex brokers typically offer multiple account types ranging from basic retail accounts to premium VIP tiers, each with different features, minimum deposits, and trading conditions. However, available sources don't specify whether Horizon offers standard account types such as micro, standard, or premium accounts.

Minimum deposit requirements, which are important for trader accessibility, remain unclear in current documentation. Competitive forex brokers usually provide clear deposit thresholds ranging from $10 for basic accounts to $10,000 or more for premium services. The account opening process, including verification requirements, document submission procedures, and approval timeframes, is not detailed in accessible sources.

Special account features such as Islamic swap-free accounts for Muslim traders, managed accounts, or copy trading options are not mentioned in available information. The absence of clear account condition details makes it difficult for potential users to assess whether Horizon meets their specific trading requirements and financial capabilities.

Without concrete information about spreads, commissions, or trading conditions associated with different account tiers, this horizon review cannot provide clear guidance on account suitability for various trader profiles.

The assessment of trading tools and resources available through Horizon faces major problems due to the lack of detailed information in current sources. Professional forex platforms typically provide complete analytical tools including technical indicators, charting packages, economic calendars, and market research resources. However, specific details about Horizon's tool offerings remain unavailable.

Educational resources, which are essential for trader development, are not detailed in accessible documentation. Established brokers usually offer webinars, tutorials, trading guides, and market analysis to support client education. We cannot confirm the availability of such resources through Horizon based on current information.

Automated trading support, including Expert Advisor compatibility, algorithmic trading capabilities, or social trading features, is not specified in reviewed sources. Modern traders often require sophisticated automation tools for strategy implementation and portfolio management.

Research and analysis resources, including fundamental analysis, technical research reports, and market commentary, are not detailed in available materials. Without access to complete analytical tools and educational content, traders may find it challenging to make informed trading decisions through this platform.

Customer service evaluation for Horizon faces major limitations due to insufficient information about support infrastructure and service quality. Professional forex brokers typically maintain multiple communication channels including live chat, phone support, email assistance, and complete FAQ sections. However, specific details about Horizon's customer service channels are not available in current sources.

Response times, which are critical for trading-related inquiries and technical issues, are not specified in accessible documentation. Competitive brokers usually provide 24/5 or 24/7 support with response times ranging from immediate live chat assistance to email responses within 24 hours.

Service quality metrics, including customer satisfaction ratings, issue resolution effectiveness, and support team expertise, are not detailed in available information. Multi-language support capabilities, essential for international client bases, remain unclear in current documentation.

Customer service hours, regional support availability, and escalation procedures for complex issues are not outlined in accessible sources. Without concrete information about support infrastructure and service standards, potential users cannot assess whether Horizon provides adequate assistance for their trading needs.

The evaluation of trading experience through Horizon faces severe constraints due to the absence of detailed platform information and user feedback in available sources. Critical aspects such as platform stability, execution speed, and order processing quality cannot be assessed based on current documentation. Professional trading platforms typically maintain uptime rates above 99.5% and execution speeds measured in milliseconds.

Order execution quality, including fill rates, slippage statistics, and requote frequency, is not detailed in accessible information. These metrics are essential for evaluating platform performance during various market conditions, particularly during high volatility periods or major economic announcements.

Platform functionality assessment requires information about charting capabilities, order types, risk management tools, and interface customization options. However, such details are not available in current sources, preventing a complete evaluation of trading capabilities.

Mobile trading experience, increasingly important for modern traders, cannot be evaluated due to insufficient information about mobile applications, features, and performance. Without concrete data about platform performance and user experience metrics, this horizon review cannot provide clear conclusions about trading quality.

The trust and regulatory assessment of Horizon reveals concerning information gaps that are fundamental to broker evaluation. Regulatory oversight is the cornerstone of broker credibility, yet current sources don't provide specific information about licensing jurisdictions, regulatory compliance, or oversight by established financial authorities.

Traditional forex brokers maintain licenses from reputable regulators such as the Financial Conduct Authority, Cyprus Securities and Exchange Commission, or the Australian Securities and Investments Commission. The absence of clear regulatory information raises questions about investor protection and fund security measures.

Client fund segregation, compensation schemes, and regulatory reporting requirements are not detailed in available documentation. These protections are essential for trader security and are typically required by legitimate regulatory frameworks.

Company transparency, including ownership structure, financial reporting, and corporate governance, is not adequately addressed in current sources. The lack of complete regulatory and transparency information significantly impacts the trust assessment for potential users considering this platform.

User experience evaluation for Horizon faces major challenges due to limited feedback and interface information in available sources. Complete user experience assessment typically requires analysis of interface design, navigation efficiency, feature accessibility, and overall platform usability across different devices and user skill levels.

Registration and account verification processes, which form the first impression for new users, are not detailed in current documentation. Streamlined onboarding procedures are essential for user satisfaction and platform adoption. The absence of specific information about these processes prevents adequate evaluation.

Fund management experience, including deposit and withdrawal procedures, transaction processing times, and fee structures, cannot be assessed based on available information. These operational aspects significantly impact user satisfaction and platform utility.

User satisfaction metrics, common complaints, and improvement suggestions from actual platform users are not available in current sources. Without access to genuine user feedback and complete interface analysis, this evaluation cannot provide clear conclusions about the overall user experience quality.

This horizon review reveals major information gaps that prevent a complete evaluation of the platform's suitability for forex trading. The lack of detailed information about regulatory oversight, trading conditions, platform features, and user experiences raises major concerns for potential users. Based on available evidence, Horizon appears to focus primarily on software solutions for various industries rather than traditional forex trading services. Traders seeking established forex brokers with clear regulatory frameworks, transparent trading conditions, and proven track records should consider well-documented alternatives with complete regulatory oversight and detailed service information.

FX Broker Capital Trading Markets Review