Zora 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive zora review examines Zora's position as a decentralized NFT marketplace protocol. The platform has carved out a unique niche in the digital content trading ecosystem. Zora operates as a creator-led economy platform where users can mint, own, and trade digital content through its decentralized infrastructure. The platform has evolved beyond simple NFT trading to include social networking features. This positions it as a comprehensive ecosystem for digital creators and collectors.

Based on available user feedback and market observations, Zora receives a moderate rating. Users express mixed experiences about the platform's functionality and accessibility. The platform primarily attracts users interested in NFT trading and digital content creation. It offers a decentralized alternative to traditional centralized marketplaces. While Zora presents innovative features for digital content monetization, certain aspects regarding regulatory clarity and detailed trading conditions remain unclear. This information is not available in publicly accessible sources.

The platform's integration of social networking elements with NFT trading creates a distinctive user experience. However, comprehensive information about customer support, fee structures, and regulatory compliance requires further investigation for potential users seeking detailed operational transparency.

Important Notice

This evaluation is based on publicly available information, user feedback, and market observations current as of 2025. Given the rapidly evolving nature of decentralized platforms and NFT marketplaces, specific features, fees, and operational procedures may change. Potential users should verify current terms and conditions directly with Zora before engaging with the platform.

The assessment methodology incorporates user reviews from various sources. It also includes platform functionality analysis and industry standard comparisons where applicable. Due to the decentralized nature of Zora's operations, traditional regulatory frameworks may not apply in the same manner as conventional financial services platforms.

Rating Framework

Broker Overview

Zora operates as a decentralized NFT marketplace protocol designed to facilitate the creation, ownership, and trading of digital content. The platform distinguishes itself by focusing on creator empowerment and decentralized ownership models. This allows artists and content creators to maintain greater control over their digital assets. Unlike traditional centralized marketplaces, Zora's protocol-based approach aims to reduce intermediary control and provide more direct creator-to-collector relationships.

The platform has expanded its functionality beyond basic NFT trading to include social networking features. This creates what the company describes as a "creator-led economy." This integration allows users to not only trade digital assets but also build communities around their content. The Zora Network supports this ecosystem by providing the underlying infrastructure for these decentralized transactions and social interactions.

Zora's business model centers on empowering digital creators through decentralized tools and protocols. The platform's approach to NFT trading emphasizes community building and creator autonomy. This positions it as an alternative to more traditional, centralized digital marketplaces. However, specific details about the company's founding, corporate structure, and comprehensive operational procedures remain limited in publicly accessible information.

Regulatory Status: Specific regulatory oversight information is not detailed in available public materials. As a decentralized protocol, Zora may operate under different regulatory frameworks compared to traditional financial service providers.

Deposit and Withdrawal Methods: Detailed information about supported payment methods, deposit procedures, and withdrawal processes is not comprehensively outlined in available sources.

Minimum Deposit Requirements: Specific minimum deposit amounts or account funding requirements are not clearly specified in accessible platform documentation.

Promotional Offers: Information regarding bonuses, promotional campaigns, or special offers for new users is not detailed in available materials.

Available Assets: The platform primarily focuses on digital content and NFTs. It supports various forms of digital art, collectibles, and creator-generated content within its decentralized marketplace structure.

Fee Structure: Comprehensive information about trading fees, transaction costs, gas fees, or commission structures is not detailed in publicly available sources. This requires direct platform consultation for accurate pricing information.

Trading Leverage: As an NFT marketplace protocol, traditional trading leverage concepts do not typically apply to Zora's operational model.

Platform Technology: The platform operates on blockchain technology supporting NFT creation and trading. However, specific technical specifications are not comprehensively detailed in available sources.

Geographic Restrictions: Specific regional limitations or access restrictions are not clearly outlined in available public information.

Language Support: Details about supported languages for customer service or platform interface are not specified in accessible materials.

Account Conditions Analysis

The account conditions for Zora present several areas where information clarity could be improved. Available sources do not provide comprehensive details about different account types that may be available to users. This makes it difficult for potential users to understand what options might suit their specific needs. This lack of transparency regarding account variety represents a significant information gap for users seeking to make informed decisions about platform engagement.

Minimum deposit requirements, which are crucial for users planning their platform entry strategy, are not clearly specified in publicly available documentation. This absence of clear financial requirements creates uncertainty for potential users attempting to budget for platform participation. Additionally, the account opening process lacks detailed explanation. This leaves users without clear guidance on registration steps, verification requirements, or timeline expectations.

The platform does not provide specific information about specialized account features that might cater to different user types. These could include professional creators, institutional collectors, or casual users. This zora review finds that the lack of detailed account condition information may create barriers for users seeking to understand their options before committing to platform use. Potential users would benefit from more comprehensive account condition documentation to facilitate informed decision-making.

Zora's tools and resources focus primarily on its core functionality as a decentralized NFT marketplace protocol. The platform provides basic tools for minting, trading, and managing digital content. However, comprehensive descriptions of advanced trading tools or analytical resources are not readily available in public documentation. This limitation may affect users seeking sophisticated trading or analysis capabilities commonly found in traditional financial trading platforms.

The platform's integration of social networking features represents a unique resource for community building and creator engagement. However, detailed information about educational resources, tutorials, or comprehensive user guides is not extensively documented in available sources. This gap may present challenges for new users attempting to navigate the platform's features or understand optimal usage strategies.

Research and analysis tools specific to NFT market trends, pricing analytics, or portfolio management capabilities are not comprehensively described in accessible platform information. Users seeking advanced analytical capabilities may find the current tool offerings limited compared to more traditional trading platforms. The platform's focus on decentralized functionality may prioritize different tool categories than conventional trading environments. However, specific tool specifications require direct platform exploration for accurate assessment.

Customer Service and Support Analysis

Customer service information for Zora presents significant transparency gaps that may concern potential users. Available sources do not provide clear details about customer support channels. This includes whether users can access support through email, live chat, phone, or community forums. This lack of clarity regarding support accessibility creates uncertainty for users who may require assistance with platform navigation or issue resolution.

Response time expectations for customer inquiries are not specified in available documentation. This leaves users without clear service level expectations. The quality of customer service, including staff expertise and problem resolution effectiveness, cannot be adequately assessed based on publicly available information. This absence of service quality indicators may affect user confidence in the platform's ability to provide adequate support when needed.

Multi-language support capabilities and customer service operating hours are not detailed in accessible sources. For a platform serving a global user base, the lack of clear information about language support and service availability across different time zones represents a significant information gap. Users from various geographic regions may find it difficult to determine whether adequate support will be available in their preferred language or during their local business hours.

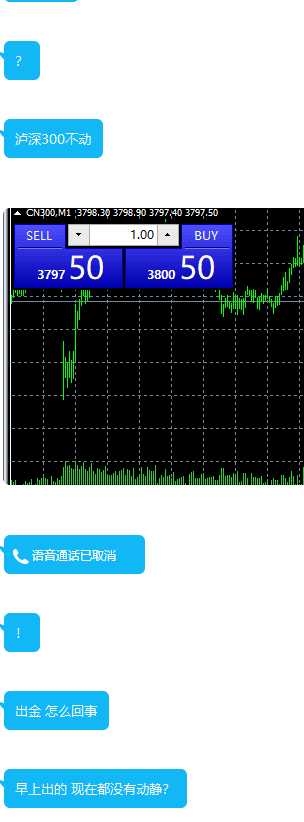

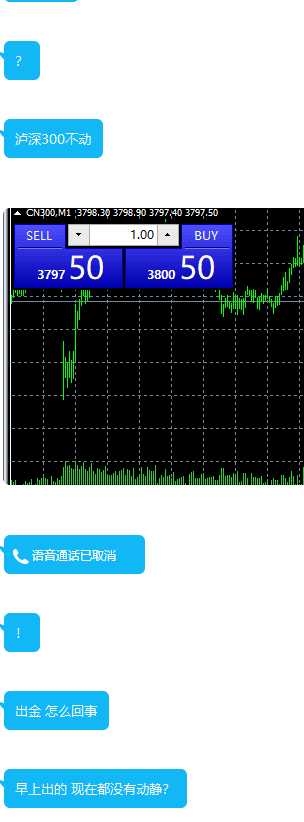

Trading Experience Analysis

The trading experience on Zora centers around NFT creation, buying, and selling within a decentralized marketplace environment. User feedback suggests mixed experiences with platform functionality. However, specific details about platform stability, transaction speed, or technical performance are not comprehensively documented in available sources. The decentralized nature of the platform may result in different performance characteristics compared to traditional centralized trading platforms.

Order execution quality, including transaction confirmation times and network congestion effects, may vary based on underlying blockchain network conditions rather than platform-specific factors. Users should be aware that decentralized platforms often depend on broader network performance, which can affect transaction timing and costs. However, specific performance metrics or user satisfaction data regarding execution quality are not detailed in accessible information.

The platform's integration of social features with trading functionality creates a unique user experience that differs from traditional trading environments. Mobile application performance and feature availability are not comprehensively detailed in available sources. However, the platform's focus on creator communities suggests mobile accessibility may be important for user engagement. This zora review notes that comprehensive trading experience assessment requires direct platform interaction due to limited detailed performance information in public sources.

Trust and Security Analysis

Trust and security considerations for Zora present several areas requiring careful evaluation. The platform's regulatory status and oversight arrangements are not clearly detailed in available public information. This may affect user confidence in the platform's compliance with applicable financial regulations. For users accustomed to traditional regulated financial services, this regulatory uncertainty may represent a significant consideration in platform selection.

Fund security measures, including wallet security protocols, smart contract auditing, and user asset protection mechanisms, are not comprehensively detailed in accessible sources. Given the decentralized nature of NFT trading and the irreversible nature of blockchain transactions, understanding security measures becomes particularly important for user asset protection. The absence of detailed security information may concern users prioritizing asset safety.

Company transparency regarding corporate structure, financial backing, and operational governance is limited in publicly available information. Industry reputation indicators, such as awards, certifications, or third-party security assessments, are not prominently featured in accessible documentation. The platform's handling of security incidents or dispute resolution procedures is not clearly outlined. This creates uncertainty about user recourse options in case of issues.

User Experience Analysis

User experience on Zora reflects the challenges and opportunities inherent in decentralized marketplace design. Available user feedback suggests moderate satisfaction levels. Users appreciate the platform's creator-focused approach while noting areas for improvement in accessibility and ease of use. The platform's integration of social networking features with NFT trading creates a distinctive user journey that differs from traditional marketplaces.

Interface design and usability information is not comprehensively detailed in available sources. However, the platform's focus on creator communities suggests emphasis on visual presentation and community interaction features. Registration and verification processes are not thoroughly documented. This potentially creates uncertainty for new users attempting to join the platform. This lack of clear onboarding information may represent a barrier to user adoption.

Fund management experiences, including deposit, withdrawal, and transaction processes, are not extensively detailed in accessible user feedback. The decentralized nature of the platform may require users to have greater familiarity with cryptocurrency wallets and blockchain transactions compared to traditional platforms. User education and support for these technical requirements are not comprehensively addressed in available information. This potentially affects user experience quality for less technically experienced individuals.

Conclusion

This zora review reveals a platform that offers innovative approaches to NFT trading and creator empowerment through decentralized protocols. However, it faces transparency challenges that may affect user confidence. Zora's focus on creator-led economies and integration of social networking features distinguishes it from traditional NFT marketplaces. This appeals particularly to users interested in community-driven digital content creation and trading.

The platform appears most suitable for users with existing familiarity with cryptocurrency and blockchain technologies who value decentralized approaches over traditional centralized marketplaces. However, the limited availability of detailed information regarding fees, customer support, and regulatory compliance may present challenges for users seeking comprehensive platform transparency before engagement.

Key advantages include the platform's innovative approach to creator empowerment and community building. Primary limitations center on information transparency and the technical knowledge requirements inherent in decentralized platform usage. Potential users should conduct direct platform research and consider their comfort level with decentralized technologies before engaging with Zora's services.