OTM Trade 2025 Review: Everything You Need to Know

Executive Summary

OTM Trade presents itself as a forex and multi-asset trading broker offering various account types and trading instruments. This otm trade review evaluates the broker's overall performance. The assessment is neutral based on available information and user feedback. The broker provides three distinct account types - Standard, Execution, and Professional accounts. Each type has different spread and commission structures designed to cater to diverse trading preferences.

Key features include access to multiple asset classes such as forex, metals, commodities, indices, US stocks, and European stocks through the MT5 trading platform. The broker offers 24×5 customer service support. It maintains competitive pricing structures with spreads starting from 0 pips on Professional accounts. However, regulatory information remains unclear. Some sources suggest potential trust concerns that require careful consideration.

The platform targets forex and multi-asset traders seeking cost-effective trading solutions. It particularly appeals to those who prioritize low spreads and diverse trading instruments. While the broker demonstrates competitive account conditions and trading tools, significant gaps in regulatory transparency and trust-related warnings impact its overall assessment.

Important Notice

This review is based on publicly available information and user feedback as of 2025. Due to the absence of clear regulatory information in available sources, users should exercise caution and conduct thorough due diligence before engaging with OTM Trade. Regional regulatory differences may apply. Potential clients should verify the broker's compliance with local financial regulations in their jurisdiction.

The evaluation methodology incorporates user testimonials, platform features, cost structures, and available service information. However, the lack of comprehensive regulatory details and presence of trust-related concerns in some sources necessitate careful consideration by prospective clients.

Rating Framework

Broker Overview

OTM Trade operates as a multi-asset trading platform focusing on forex and related financial instruments. According to available information from BrokersView and other sources, the company operates under OT Markets Limited. Specific establishment dates and comprehensive company background details are not clearly documented in accessible materials. The broker positions itself as a service provider for traders seeking diverse asset exposure with flexible account structures.

The platform emphasizes customer support and trading resources. It promotes its 24×5 customer service as a key differentiator. However, detailed company history, founding information, and executive background remain limited in publicly available documentation. This may concern traders seeking comprehensive transparency about their chosen broker's background and operational history.

The broker's primary business model centers on providing access to global financial markets through the popular MetaTrader 5 platform. OTM Trade offers trading opportunities across six major asset categories. These include foreign exchange pairs, precious metals, commodities, global indices, US equities, and European stock markets. The platform structure suggests targeting both retail and potentially professional traders through its tiered account system.

Platform infrastructure relies on MT5 technology. This provides advanced charting capabilities, technical analysis tools, and automated trading support. The broker's asset diversity indicates an intention to serve as a comprehensive trading solution rather than specializing in a single market segment. Specific platform customizations or proprietary tools are not detailed in available sources.

Regulatory Status: Available documentation does not specify particular regulatory authorities overseeing OTM Trade's operations. This represents a significant information gap for potential clients seeking regulatory assurance.

Deposit and Withdrawal Methods: Specific payment processing options are not detailed in accessible sources. These include supported banks, e-wallets, or cryptocurrency methods.

Minimum Deposit Requirements: Entry-level funding requirements for account activation are not specified in available broker information.

Promotional Offers: Current bonus structures, welcome incentives, or ongoing promotional campaigns are not documented in reviewed materials.

Trading Assets: The platform provides access to forex currency pairs. It also offers precious metals including gold and silver, commodity markets, international indices, US stock markets, and European equity markets across multiple exchanges.

Cost Structure: Standard accounts feature spreads beginning at 1.2 pips with zero commission. Execution accounts offer tighter 1.0 pip spreads, also commission-free. Professional accounts provide raw spreads starting from 0 pips with a $3 commission per standard lot traded.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in available broker documentation.

Platform Access: Trading operations utilize the MetaTrader 5 platform. This provides comprehensive charting, technical analysis, and order management capabilities.

Geographic Restrictions: Specific country limitations or regional service availability are not clarified in accessible information.

Customer Support Languages: Supported communication languages beyond English are not specified in available materials.

This otm trade review identifies significant information gaps. Potential clients should address these through direct broker communication before account opening.

Account Conditions Analysis

OTM Trade's account structure demonstrates flexibility through three distinct account types. Each targets different trader preferences and experience levels. The Standard account serves entry-level traders with 1.2 pip spreads and zero commission structure. This makes it accessible for those prioritizing simplicity in cost calculation. The Execution account offers improved spreads at 1.0 pips while maintaining commission-free trading. It represents a middle-ground option for active traders.

The Professional account stands out with raw spreads starting from 0 pips. However, it incorporates a $3 commission per standard lot. This structure appeals to high-volume traders and scalpers who prioritize tight spreads over commission-free trading. The tiered approach allows traders to select accounts matching their trading frequency, strategy requirements, and cost preferences.

Critical account information remains unavailable. This includes minimum deposit requirements, maximum leverage ratios, and account opening procedures. The absence of Islamic account options or other specialized account types may limit accessibility for certain trader demographics. Additionally, account maintenance fees, inactivity charges, and currency conversion costs are not specified in available documentation.

User feedback suggests generally positive account conditions. One review notes satisfactory account features. However, the limited scope of user testimonials and absence of detailed account terms and conditions documentation present challenges for comprehensive evaluation. Compared to industry standards, the spread and commission structure appears competitive. The lack of complete account specifications limits thorough comparison with other otm trade review assessments.

The broker's trading infrastructure centers on MetaTrader 5. This provides access to advanced charting capabilities, technical indicators, and automated trading functionality. MT5's comprehensive toolkit includes multiple timeframes, drawing tools, and extensive technical analysis options suitable for various trading strategies from scalping to long-term position trading. The platform's multi-asset capabilities align with OTM Trade's diverse instrument offerings across forex, commodities, and equity markets.

Asset diversity represents a significant strength. Trading opportunities span six major categories. Foreign exchange pairs likely include major, minor, and exotic currency combinations, while metals trading covers precious metals like gold and silver. Commodity access extends to energy and agricultural products. This is complemented by international index exposure and equity markets from US and European exchanges.

Specific research and analysis resources remain undocumented in available sources. Educational materials, market commentary, economic calendars, and fundamental analysis tools are not detailed. This may disadvantage traders seeking comprehensive market insights. The absence of proprietary research or third-party analysis partnerships limits the platform's educational value for developing traders.

Automated trading support through MT5 enables Expert Advisor implementation. However, specific algorithmic trading resources or strategy development tools are not highlighted. User feedback acknowledges the trading tool diversity positively. This suggests adequate platform functionality for most trading requirements. The MT5 foundation provides industry-standard capabilities. Additional proprietary tools or enhanced features are not documented in this evaluation.

Customer Service and Support Analysis

OTM Trade advertises 24×5 customer service availability. This covers standard market hours throughout the trading week. This service schedule aligns with global forex market operations, ensuring support accessibility during active trading periods. However, specific communication channels are not detailed in available documentation. These include phone support, live chat, email ticketing systems, or social media support.

Response time commitments and service level agreements remain unspecified. This limits expectations management for potential clients. The quality of support interactions, technical expertise of representatives, and problem resolution effectiveness are not documented through comprehensive user feedback or third-party service evaluations.

User testimonials include neutral feedback suggesting room for improvement in customer service response times. This indicates potential service delivery challenges. However, the limited scope of available user reviews prevents comprehensive service quality assessment. The absence of multiple language support confirmation may limit accessibility for international clients seeking native language assistance.

Support resource availability is not documented in reviewed materials. This includes FAQ sections, knowledge bases, video tutorials, or self-service portals. The lack of detailed support infrastructure information contrasts with industry leaders who typically provide comprehensive support documentation and multiple communication channels. Enhanced transparency regarding support capabilities would strengthen client confidence and service expectations.

Trading Experience Analysis

MetaTrader 5 serves as the primary trading platform. It provides industry-standard functionality and reliability recognized throughout the forex industry. The platform's stability record, order execution speed, and technical performance generally meet professional trading requirements. Specific performance metrics for OTM Trade's implementation are not documented in available sources.

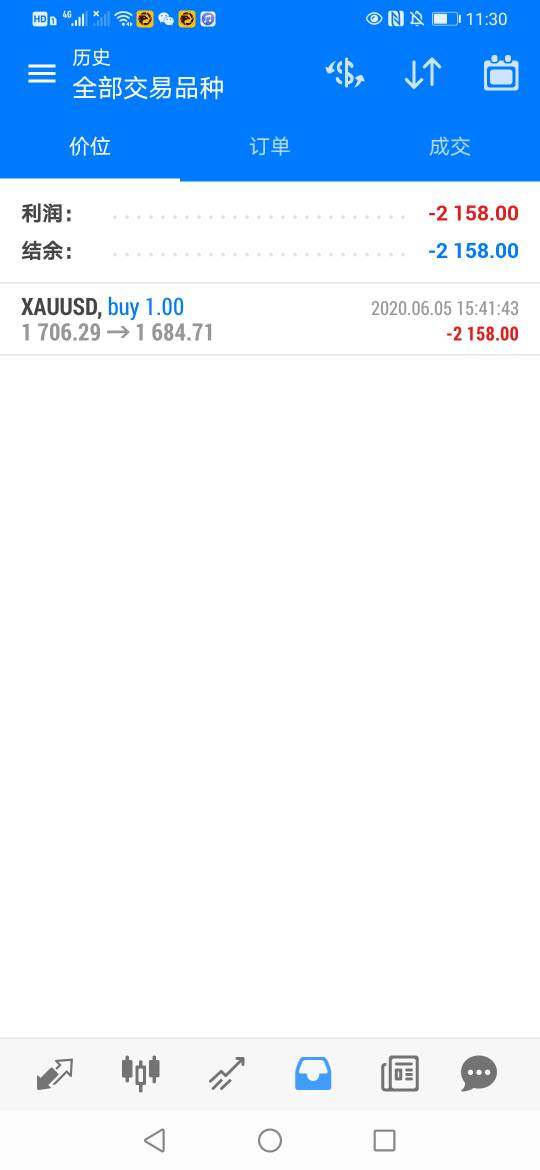

Order execution quality lacks detailed documentation or independent testing results. This includes slippage rates, requote frequency, and fill ratios. The absence of execution statistics limits assessment of trading environment quality. This is particularly important for scalpers and high-frequency traders who require optimal execution conditions.

Platform functionality encompasses comprehensive charting with multiple timeframes. It includes extensive technical indicator libraries and drawing tools suitable for various analysis approaches. MT5's native features include depth of market display, economic calendar integration, and one-click trading capabilities that enhance trading efficiency for active traders.

Mobile trading experience through MT5 mobile applications provides on-the-go market access. However, specific mobile platform optimizations or proprietary mobile features are not highlighted. The standard MT5 mobile implementation typically offers core trading functionality with chart analysis and position management capabilities.

User feedback includes positive trading experience assessments. This suggests adequate platform performance for typical trading requirements. However, the limited scope of user testimonials prevents comprehensive trading environment evaluation. Spread stability and consistency during volatile market conditions remain undocumented. These represent important considerations for this otm trade review assessment.

Trust and Reliability Analysis

Regulatory oversight represents the most significant concern in OTM Trade's trust assessment. Available documentation does not specify regulatory authorities, license numbers, or compliance frameworks governing the broker's operations. This regulatory transparency gap raises substantial concerns for traders seeking regulated broker relationships and investor protection mechanisms.

Fund security measures are not documented in accessible sources. These include client fund segregation, deposit insurance coverage, and negative balance protection. The absence of detailed fund safety protocols contrasts sharply with regulated brokers who typically provide comprehensive client protection information and regulatory compliance documentation.

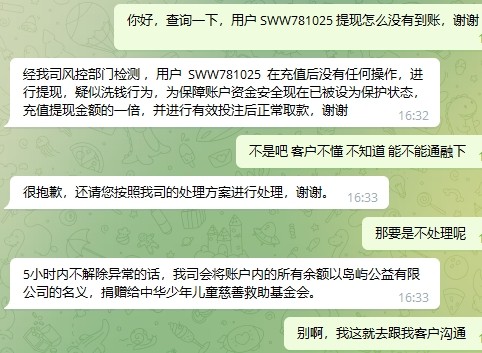

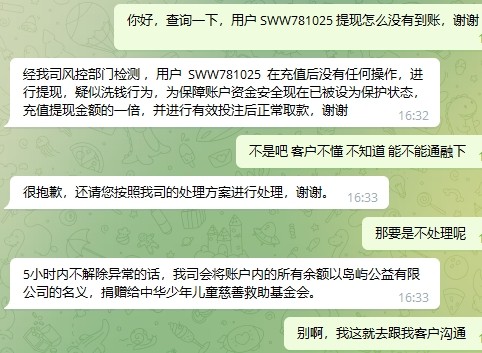

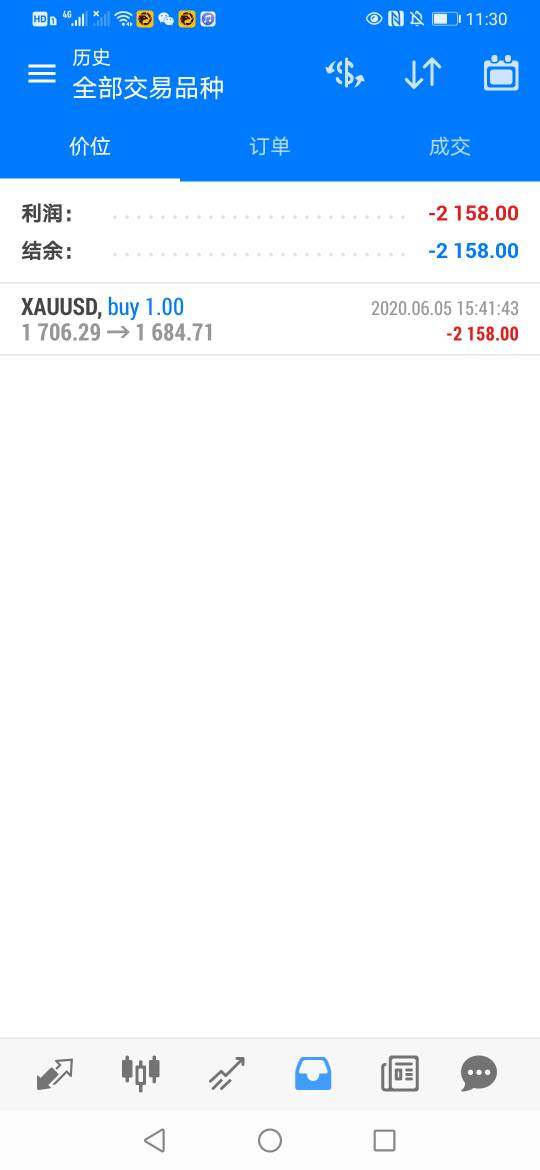

Industry reputation assessment reveals concerning information. Some sources suggest potential scam-related warnings and fund recovery recommendations. These trust-related concerns require serious consideration by potential clients, particularly given the lack of regulatory clarity and limited operational transparency.

Company transparency metrics are not publicly available in reviewed sources. These include audited financial statements, regulatory reporting, and operational disclosure. The absence of third-party verification or independent auditing information further compounds trust assessment challenges.

Negative event handling and dispute resolution mechanisms are not documented. This limits understanding of client protection procedures and complaint resolution processes. The combination of regulatory uncertainty and trust-related warnings significantly impacts the broker's reliability assessment. This necessitates extreme caution by potential clients considering OTM Trade services.

User Experience Analysis

Overall user satisfaction appears mixed based on available feedback. Testimonials range from positive to neutral assessments. The limited scope of user reviews prevents comprehensive satisfaction measurement. No significant negative complaints are documented in reviewed sources. This neutral feedback profile suggests adequate service delivery without exceptional performance in key areas.

Interface design and usability rely primarily on MetaTrader 5's standard implementation. This provides familiar navigation and functionality for experienced MT5 users. The platform's user-friendly interface design supports both novice and experienced traders. Specific customizations or user experience enhancements by OTM Trade are not documented.

Registration and account verification processes remain undocumented in available sources. This prevents assessment of onboarding efficiency and know-your-customer procedures. Streamlined account opening and verification processes significantly impact initial user experience. Specific procedural details are not available for evaluation.

Fund management experience lacks detailed documentation or user feedback. This includes deposit processing times, withdrawal procedures, and payment method efficiency. These operational aspects critically impact user satisfaction, particularly regarding fund access and transaction processing reliability.

Common user concerns identified include customer service response time improvements and trust-related considerations. The feedback suggests adequate core functionality with room for enhancement in support service delivery and transparency measures. User demographic analysis indicates suitability for forex and multi-asset traders seeking diverse trading opportunities. Regulatory concerns may deter risk-averse clients.

Conclusion

OTM Trade demonstrates competitive account conditions and comprehensive trading tools through its MT5 platform implementation and diverse asset offerings. The broker's three-tiered account structure provides flexibility for different trader types. Cost structures remain competitive within industry standards. However, significant deficiencies in regulatory transparency and trust-related concerns substantially impact the overall assessment.

The platform suits traders seeking multi-asset exposure with cost-effective trading conditions. It particularly appeals to those comfortable with unregulated broker relationships. Active traders may appreciate the Professional account's tight spreads. Beginners can utilize Standard accounts for straightforward trading experiences.

Key advantages include competitive spreads starting from 0 pips, diverse asset selection across six major categories, and established MT5 platform reliability. Primary disadvantages encompass unclear regulatory status, limited transparency regarding fund security measures, and trust-related warnings that require serious consideration. Potential clients should conduct thorough due diligence and consider regulated alternatives before committing funds to OTM Trade services.