Is TFBO safe?

Pros

Cons

Is Tfbo Safe or Scam?

Introduction

Tfbo, also known as Tom Ford Barnes Original, is a forex broker that has positioned itself primarily in the Chinese market while being registered in New Zealand. As the forex trading landscape continues to evolve, traders must exercise caution when evaluating brokers to ensure they are not falling prey to scams or unreliable platforms. The importance of thorough due diligence cannot be overstated, as the consequences of choosing an unregulated or poorly regulated broker can lead to significant financial losses. This article investigates the safety and legitimacy of Tfbo by examining its regulatory status, company background, trading conditions, customer experience, and overall risk profile. The evaluation is based on data gathered from reputable financial sources, user reviews, and regulatory databases.

Regulation and Legitimacy

The regulatory status of a forex broker is a crucial factor in determining its safety. Tfbo is classified as an unregulated broker, which poses a significant risk to traders. Operating without oversight from a recognized financial authority means that there are no guarantees regarding the protection of client funds or the fairness of trading practices. Below is a summary of Tfbo's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | New Zealand | Unregulated |

The lack of a valid regulatory license raises serious concerns about Tfbo's operations. In the forex industry, regulation is essential as it ensures that brokers adhere to strict standards of conduct, including transparency, financial stability, and the safeguarding of client funds. Without such oversight, traders are left vulnerable to potential fraud, unfair trading practices, and difficulties in recovering funds in the event of a dispute. Furthermore, the absence of regulatory history for Tfbo indicates that it may not have undergone the rigorous scrutiny that regulated brokers face, further complicating its legitimacy.

Company Background Investigation

Tfbo has been in operation for approximately 5 to 10 years, according to available data. However, the details surrounding its ownership structure and management team remain unclear. A lack of transparency in these areas can be a red flag for potential investors. The company's registered address in New Zealand does not provide any substantial information about its operational framework or the individuals behind its management.

The management team's background is vital in assessing the broker's reliability. A team with a strong track record in finance and trading can bolster a broker's credibility. Unfortunately, there is insufficient information regarding the qualifications and experience of Tfbo's management team. This absence of clear information on the company's leadership raises concerns about the firm's commitment to ethical business practices and customer service.

Moreover, the overall transparency of Tfbo's operations is questionable. Potential clients should be able to access comprehensive information about the broker's history, ownership, and management. The lack of such disclosures may indicate a reluctance to provide clients with the necessary information to make informed decisions, further heightening the need for caution when considering whether Tfbo is safe.

Trading Conditions Analysis

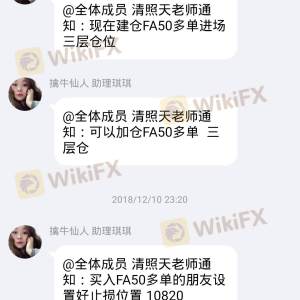

When evaluating a forex broker, the trading conditions they offer can significantly impact the overall trading experience. Tfbo claims to provide a variety of trading instruments, including forex pairs, CFDs on indices, precious metals, shares, and commodities. However, the lack of regulatory oversight raises questions about the reliability of these claims.

The overall fee structure at Tfbo appears to be competitive, with a minimum deposit requirement of around $100, which is relatively low compared to industry standards. However, traders should be wary of any hidden fees or unfavorable trading conditions that may not be explicitly stated. Below is a comparison of Tfbo's core trading costs with industry averages:

| Cost Type | Tfbo | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Starting from 0 pips | Varies (1-3 pips) |

| Commission Model | Not specified | Varies (0-10 USD) |

| Overnight Interest Range | Not disclosed | Varies (0.5%-3%) |

While Tfbo advertises ultra-low spreads starting from 0 pips, it fails to provide specific details on spreads for individual instruments. This lack of transparency can lead to unexpected costs for traders. Additionally, the potential for high leverage (up to 1:500) offered by Tfbo may amplify both profits and losses, making it essential for traders to understand the risks involved in trading with such high leverage, especially with an unregulated broker.

Customer Fund Security

The security of customer funds is paramount when evaluating a forex broker. Unfortunately, Tfbo's status as an unregulated broker raises serious concerns regarding its fund security measures. Without regulation, there are no mandated requirements for fund segregation, which means that client funds may not be held in separate accounts from the broker's operational funds. This lack of segregation increases the risk of loss in the event of the broker's insolvency.

Moreover, the absence of investor protection schemes means that traders are left without recourse should the broker engage in fraudulent activities or mismanage funds. It is crucial for brokers to implement robust security measures, including negative balance protection and clear withdrawal processes, to ensure that clients can access their funds without undue delays or complications. Unfortunately, Tfbo does not provide sufficient information regarding its fund security policies, further heightening concerns about its reliability.

Customer Experience and Complaints

Customer feedback plays a critical role in assessing the overall reputation of a broker. A review of user experiences with Tfbo reveals a mix of opinions, with several complaints regarding withdrawal issues and poor customer service. The following table summarizes the primary types of complaints received:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Unresponsive |

| Poor Customer Support | Medium | Slow to resolve issues |

| Misleading Information | High | No clear response |

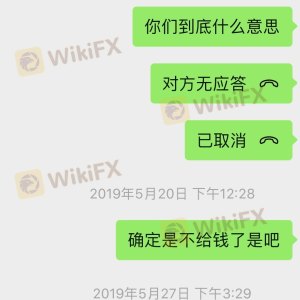

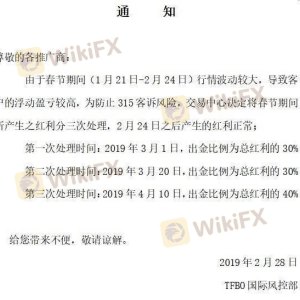

Common complaints include difficulties in withdrawing funds, which is a significant red flag for any broker. Traders have reported that Tfbo has delayed or denied withdrawal requests, raising concerns about the broker's financial practices and transparency. Furthermore, the slow response times from customer support indicate a lack of commitment to resolving client issues, which can lead to frustration and distrust among traders.

A typical case involved a trader who attempted to withdraw funds after achieving a profitable trade. The request was met with numerous delays and vague responses from Tfbo's support team, ultimately leading the trader to question the broker's integrity. Such experiences are detrimental to Tfbo's reputation and raise the question of whether Tfbo is safe for prospective clients.

Platform and Trade Execution

The trading platform is another critical aspect of a forex broker's offering. Tfbo utilizes the widely popular MetaTrader 4 (MT4) platform, which is known for its user-friendly interface and robust features. However, the performance and reliability of the platform are vital in ensuring a smooth trading experience.

User reports indicate that while MT4 is generally stable, there have been instances of slippage and execution issues on Tfbo's platform. Slippage can occur during periods of high volatility, leading to orders being executed at unfavorable prices. Additionally, any signs of potential platform manipulation or unfair trading practices can significantly undermine trader confidence.

Overall, while Tfbo offers a familiar trading platform, the execution quality and any potential issues related to order fulfillment should be carefully considered by traders assessing whether Tfbo is safe.

Risk Assessment

Using Tfbo as a forex broker presents several risks that potential clients should be aware of. Below is a risk scorecard summarizing the key risk areas associated with trading through Tfbo:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses significant risks to traders. |

| Financial Risk | High | Lack of fund protection increases vulnerability. |

| Customer Service Risk | Medium | Complaints regarding slow responses and withdrawal issues. |

| Execution Risk | Medium | Reports of slippage and execution delays. |

To mitigate these risks, traders should consider conducting thorough research before opening an account with Tfbo. Seeking out regulated brokers with strong reputations and transparent practices may provide a safer trading environment.

Conclusion and Recommendations

In conclusion, the investigation into Tfbo raises significant concerns regarding its safety and legitimacy as a forex broker. The lack of regulatory oversight, combined with numerous customer complaints about withdrawal issues and poor customer service, suggests that traders should exercise extreme caution. While Tfbo may offer attractive trading conditions, the associated risks may outweigh the potential benefits.

For traders seeking a reliable forex broker, it is recommended to consider alternatives that are regulated by reputable financial authorities, ensuring better protection for client funds and more transparent trading practices. Brokers such as [insert reliable brokers] offer robust regulatory frameworks and proven track records, making them safer choices for traders. Ultimately, when evaluating whether Tfbo is safe, the evidence suggests that caution is warranted, and potential clients should explore other options.

Is TFBO a scam, or is it legit?

The latest exposure and evaluation content of TFBO brokers.

TFBO Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TFBO latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.