Regarding the legitimacy of Forex FS forex brokers, it provides ASIC and WikiBit, (also has a graphic survey regarding security).

Is Forex FS safe?

Business

License

Is Forex FS markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

FTX AUSTRALIA PTY LTD

Effective Date:

2008-07-01Email Address of Licensed Institution:

chris.chen@ftx.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Level 6, 228 Pitt Street, SYDNEY NSW 2000Phone Number of Licensed Institution:

90483838Licensed Institution Certified Documents:

Is Forex FS Safe or Scam?

Introduction

Forex FS is an online forex broker based in Australia, operational since 2008. It positions itself as a provider of trading services across various financial instruments, including currency pairs and commodities. As the forex market continues to grow, traders are increasingly cautious about selecting reliable brokers, given the prevalence of scams and fraudulent activities in the industry. This article aims to provide a comprehensive evaluation of Forex FS, focusing on its legitimacy, regulatory status, trading conditions, and overall safety for traders. To assess Forex FS, we will analyze various aspects, including regulatory compliance, company background, customer experiences, and risk factors, drawing on data from multiple credible sources.

Regulation and Legitimacy

Understanding the regulatory framework within which a broker operates is crucial for assessing its safety. Forex FS claims to be regulated by the Australian Securities and Investments Commission (ASIC), one of the most reputable regulatory bodies globally. The importance of regulatory oversight cannot be overstated, as it ensures that brokers adhere to strict financial standards and conduct fair trading practices.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 323193 | Australia | Verified |

ASIC requires brokers to maintain a minimum capital requirement of AUD 1 million and to keep client funds in segregated accounts. This regulatory structure aims to protect traders' interests and enhance the broker's transparency. However, it is essential to note that while Forex FS is regulated by ASIC, there have been concerns regarding its compliance history, with some reviews indicating a lack of transparency and responsiveness in addressing client complaints. This raises questions about whether Forex FS is truly safe for traders.

Company Background Investigation

Forex FS was established in 2008 and is operated by Forex Financial Services Pty Ltd. The company claims to provide a transparent trading environment with a focus on customer service. However, a deeper investigation into the company's ownership structure and management team reveals limited information. The lack of publicly available details about the management team raises concerns about the broker's accountability and operational transparency.

Furthermore, the company's history, including any past regulatory issues, is not well-documented, which could hinder potential traders from making informed decisions. A broker's transparency in sharing its operational history and management background is vital for building trust with its clients. The absence of such information may lead traders to question whether Forex FS is safe.

Trading Conditions Analysis

When evaluating a broker, it is crucial to consider the overall cost structure and trading conditions offered. Forex FS provides various account types with different fee structures. However, some users have reported unexpected fees and charges, which can be a red flag for potential traders.

| Fee Type | Forex FS | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.9 pips | 1.5 pips |

| Commission Structure | Varies | Standardized |

| Overnight Interest Range | Variable | Variable |

Forex FS offers a spread of 1.9 pips on major currency pairs, which is slightly above the industry average. Additionally, the commission structure can vary based on account type, which may confuse traders. Such inconsistencies in fee structures can lead to unexpected trading costs, making it essential for traders to fully understand the fee schedule before opening an account. This complexity may raise concerns about whether Forex FS is genuinely safe for trading.

Client Funds Security

The safety of client funds is a paramount concern for any trader. Forex FS claims to implement various security measures, including segregated accounts and SSL encryption, to protect clients' investments. Segregating client funds from the broker's operational funds is a critical practice that enhances the safety of traders' money.

However, it is important to note that Forex FS is not covered by any compensation schemes, unlike brokers based in the UK or Cyprus. This lack of additional protection can be a significant drawback for traders, as it means that they may not have recourse in the event of broker insolvency or fraud. Furthermore, there have been historical complaints regarding fund withdrawals and access to accounts, which raises questions about the broker's reliability in safeguarding clients' funds. Therefore, while Forex FS claims to prioritize client fund security, potential traders should carefully consider these factors when determining if Forex FS is safe.

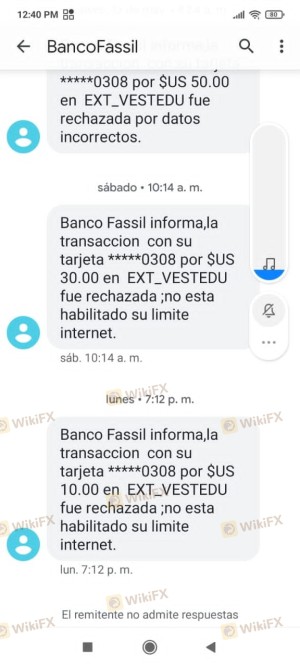

Customer Experience and Complaints

Analyzing customer feedback is essential for understanding a broker's reputation and reliability. Forex FS has received mixed reviews from clients. While some users report satisfactory trading experiences, others have raised concerns about poor customer service and withdrawal issues.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow Response |

| Customer Support Issues | Medium | Inconsistent |

Common complaints include delayed withdrawals and difficulty in reaching customer support. These issues can significantly impact a trader's experience and raise concerns about the broker's operational integrity. For instance, one user reported being unable to withdraw funds after multiple attempts, leading to frustration and distrust. Such negative experiences highlight the importance of evaluating customer service quality when determining whether Forex FS is safe for trading.

Platform and Trade Execution

The performance of the trading platform is another critical factor for traders. Forex FS utilizes the widely recognized MetaTrader 4 (MT4) platform, which offers various features and tools for traders. However, user feedback suggests that there may be issues with order execution, including slippage and order rejections.

Traders have reported experiencing significant slippage during volatile market conditions, which can lead to unexpected losses. Additionally, concerns about potential platform manipulation have been raised, further complicating the assessment of whether Forex FS is a safe trading environment. Therefore, while the platform itself is reputable, the execution quality may not meet the expectations of all traders.

Risk Assessment

When considering whether to trade with Forex FS, it is essential to evaluate the associated risks. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | Regulatory oversight exists, but concerns remain. |

| Fund Security | High | Lack of compensation scheme and historical issues. |

| Customer Service | Medium | Mixed reviews regarding responsiveness and effectiveness. |

| Trading Conditions | Medium | Fees and spreads may not align with industry standards. |

Given these risk factors, traders should approach Forex FS with caution. Implementing risk mitigation strategies, such as starting with a small investment and thoroughly understanding the fee structure, can help minimize potential losses.

Conclusion and Recommendations

In conclusion, while Forex FS presents itself as a legitimate broker regulated by ASIC, several factors warrant caution. The broker's mixed reviews, concerns regarding fund security, and inconsistent customer service raise questions about its overall safety. Therefore, traders should carefully evaluate their options before engaging with Forex FS.

For those seeking a safer trading environment, it may be wise to consider alternative brokers with stronger regulatory oversight, better customer service, and more transparent fee structures. Some reputable alternatives include brokers like Pepperstone and IC Markets, which offer competitive trading conditions and a solid reputation in the industry. Ultimately, thorough research and due diligence are essential for ensuring a safe trading experience in the forex market.

Is Forex FS a scam, or is it legit?

The latest exposure and evaluation content of Forex FS brokers.

Forex FS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Forex FS latest industry rating score is 1.59, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.59 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.