Is Tradeway safe?

Pros

Cons

Is Tradeway Safe or a Scam?

Introduction

Tradeway is a relatively new player in the forex trading market, positioning itself as a platform that offers various trading instruments, including forex, CFDs, and cryptocurrencies. As the financial landscape continues to evolve, traders are increasingly faced with a plethora of choices, making it imperative for them to carefully evaluate the legitimacy and reliability of their chosen brokers. This article aims to provide an objective analysis of Tradeway, focusing on its safety, regulatory standing, and overall credibility. Our investigation involved reviewing multiple sources, including user feedback, regulatory filings, and industry reports, to create a comprehensive evaluation framework.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its safety. A regulated broker is subject to oversight by financial authorities, which helps ensure that they adhere to industry standards and protect client funds. Unfortunately, Tradeway operates without a significant regulatory license, raising concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

The absence of a regulatory framework means that Tradeway is not bound by any external compliance checks, which can leave traders vulnerable. Historically, unregulated brokers are often associated with higher risks, including possible fraud and mismanagement of funds. The lack of oversight could also lead to questionable business practices, making it essential for potential users to be cautious.

Company Background Investigation

Tradeways company history reveals a lack of transparency that is often concerning for potential investors. Although the platform claims to have been operational since 2011, there is limited information about its ownership structure and management team. This opacity raises red flags regarding accountability and trustworthiness.

The management team‘s background is crucial in assessing the company’s reliability. If the leaders have a history of working in reputable financial institutions, it can enhance the broker's credibility. However, without publicly available information, it is challenging to gauge the expertise and experience of Tradeway‘s management. Furthermore, the company’s website does not provide clear disclosures about its operational practices or financial health, which is a significant disadvantage for potential clients.

Trading Conditions Analysis

When evaluating whether Tradeway is safe, it is essential to analyze its trading conditions, including fees and spreads. A broker's fee structure can significantly impact a trader's profitability. Tradeway advertises competitive spreads and low commissions, but the lack of transparency regarding its fee structure raises concerns.

| Fee Type | Tradeway | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | 1.0 - 1.5 pips |

| Commission Model | TBD | Varies |

| Overnight Interest Range | TBD | 0.5% - 2.0% |

The absence of clear information about these fees can lead to unexpected costs for traders, which is a common complaint among users of unregulated brokers. If Tradeway employs hidden fees or charges, it could significantly diminish the overall trading experience and profitability.

Client Fund Security

Client fund security is another vital aspect to consider when assessing whether Tradeway is safe. Reputable brokers typically implement measures such as segregated accounts, investor protection schemes, and negative balance protection to safeguard clients' assets. Unfortunately, Tradeways lack of clear information on these security measures raises concerns.

The absence of segregated accounts means that client funds could be at risk if the broker faces financial difficulties. Moreover, without negative balance protection, traders could potentially lose more than their initial investment, leading to significant financial distress.

Customer Experience and Complaints

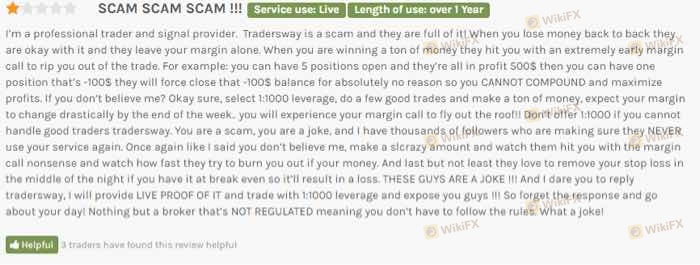

User feedback is an invaluable resource for understanding a broker's reliability. A review of customer experiences with Tradeway reveals a mixed bag of opinions. While some users report satisfactory service, others have voiced serious complaints regarding fund withdrawals and customer support responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Customer Support | Medium | Average |

| Misleading Fee Structure | High | Poor |

For instance, several users have reported issues with delayed withdrawals, which can be a significant red flag for any broker. Delays in accessing funds can indicate potential liquidity issues or, worse, a lack of integrity in business practices.

Platform and Trade Execution

The performance and reliability of a trading platform are critical for a successful trading experience. Tradeway claims to offer a user-friendly interface and robust trading tools, but user reviews suggest that the platform may have stability issues.

Order execution quality is another area of concern. Users have reported instances of slippage and order rejections, which could affect trading outcomes. Such issues can lead to significant losses, particularly in volatile market conditions.

Risk Assessment

Using Tradeway comes with inherent risks that potential traders must consider. The lack of regulation, unclear fee structure, and mixed user experiences all contribute to a higher risk profile.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No oversight from financial authorities. |

| Financial Risk | Medium | Potential for hidden fees and withdrawal issues. |

| Operational Risk | High | Stability issues with the trading platform. |

To mitigate these risks, traders should conduct thorough research, consider using lower amounts for initial deposits, and remain vigilant about withdrawal processes.

Conclusion and Recommendations

In summary, while Tradeway presents itself as an appealing option for forex trading, the evidence suggests that it may not be a safe choice. The lack of regulation, unclear fee structures, and mixed customer experiences all point to potential risks that traders should carefully consider.

For those seeking a reliable trading environment, it may be prudent to explore alternatives that are well-regulated and have established reputations, such as brokers licensed by the FCA or ASIC. In conclusion, exercising caution and conducting thorough due diligence is essential when considering whether Tradeway is safe for trading activities.

Is Tradeway a scam, or is it legit?

The latest exposure and evaluation content of Tradeway brokers.

Tradeway Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Tradeway latest industry rating score is 1.59, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.59 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.