CO Review 1

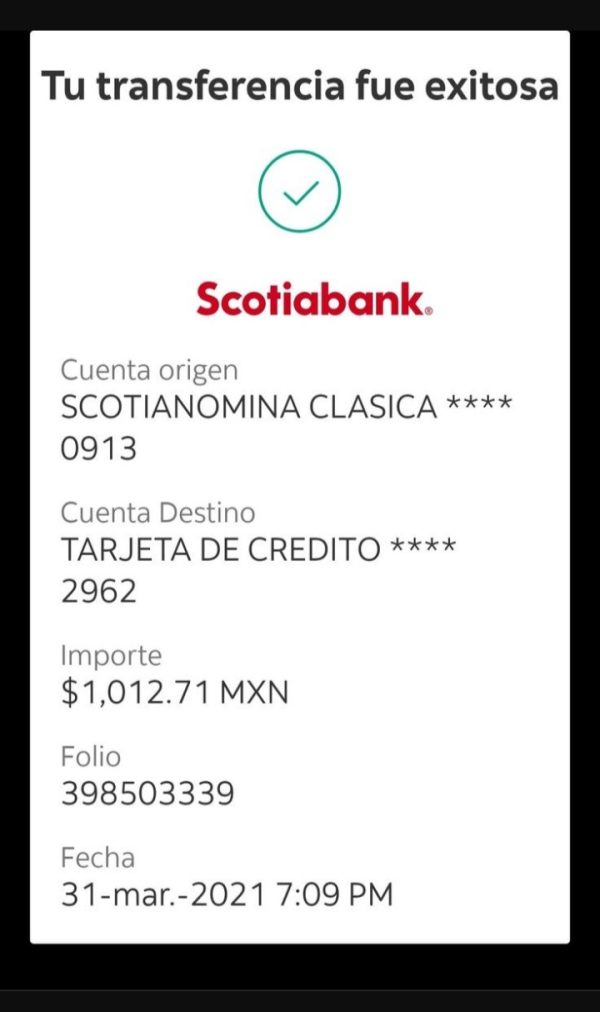

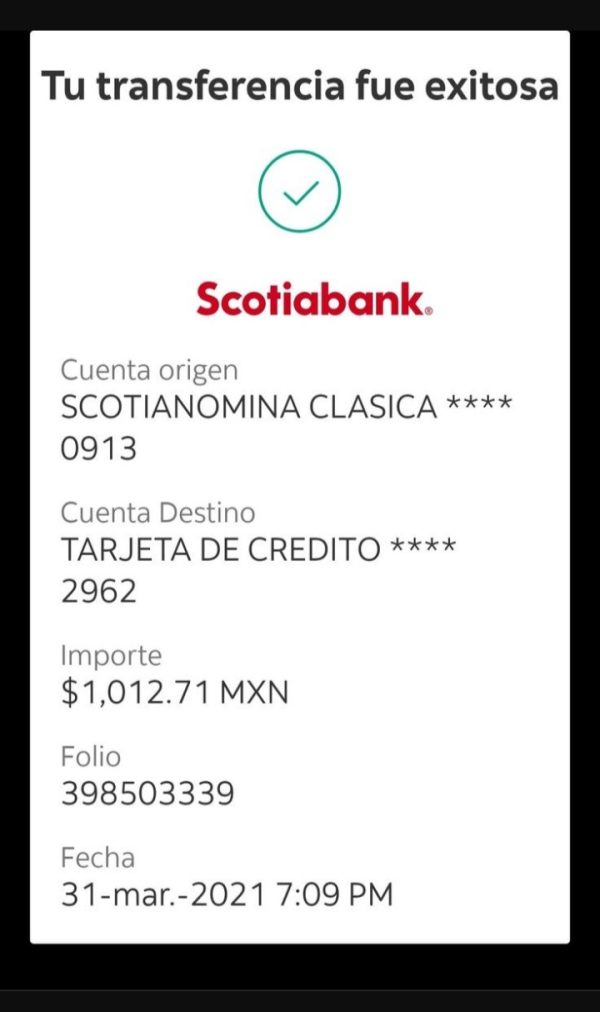

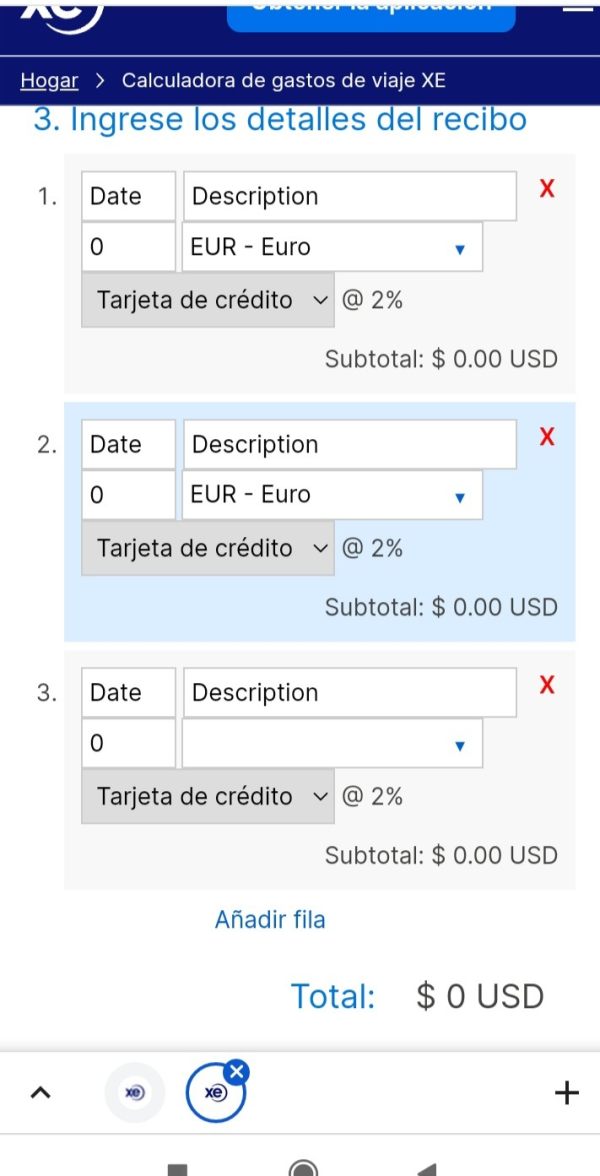

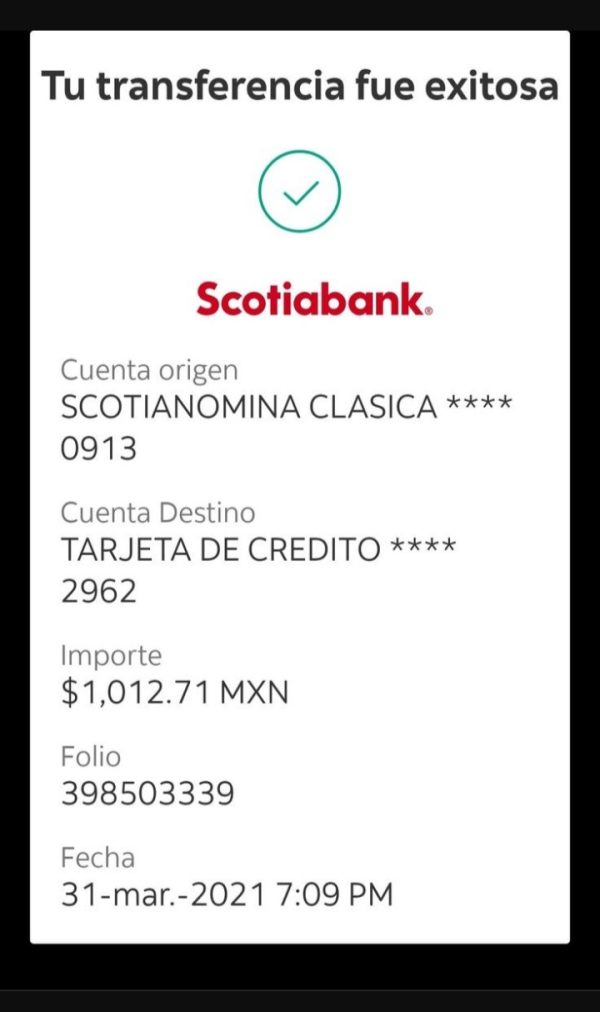

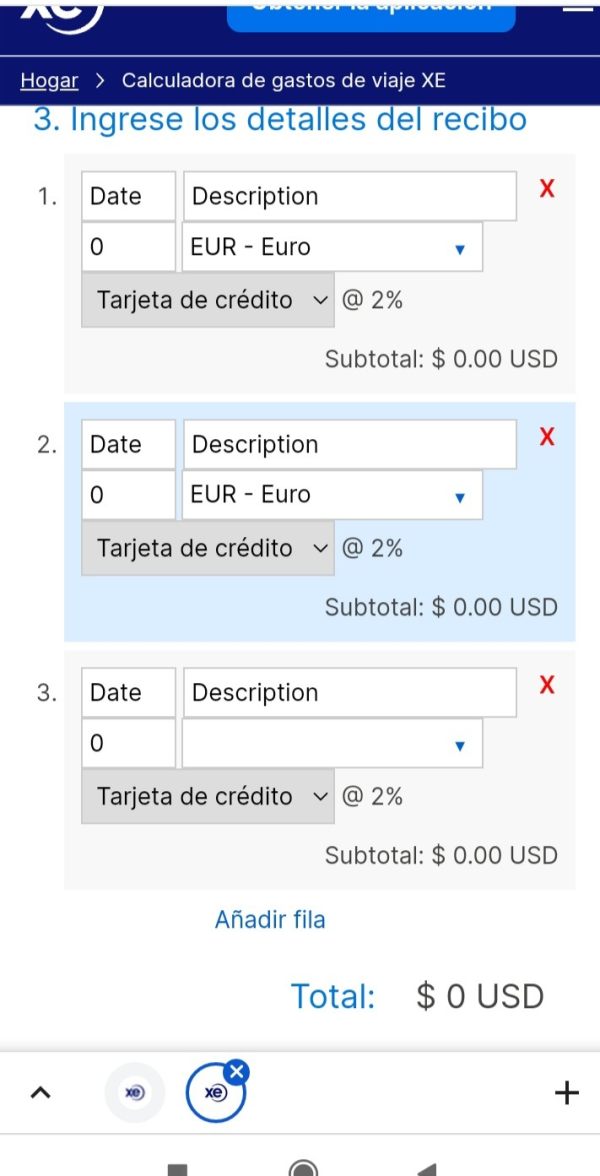

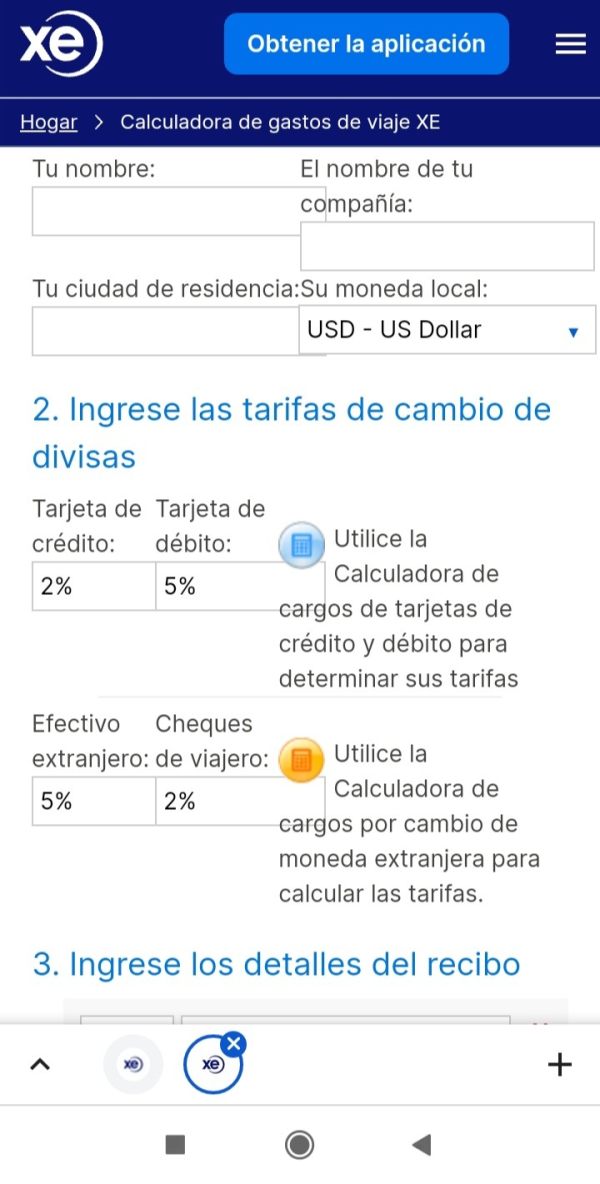

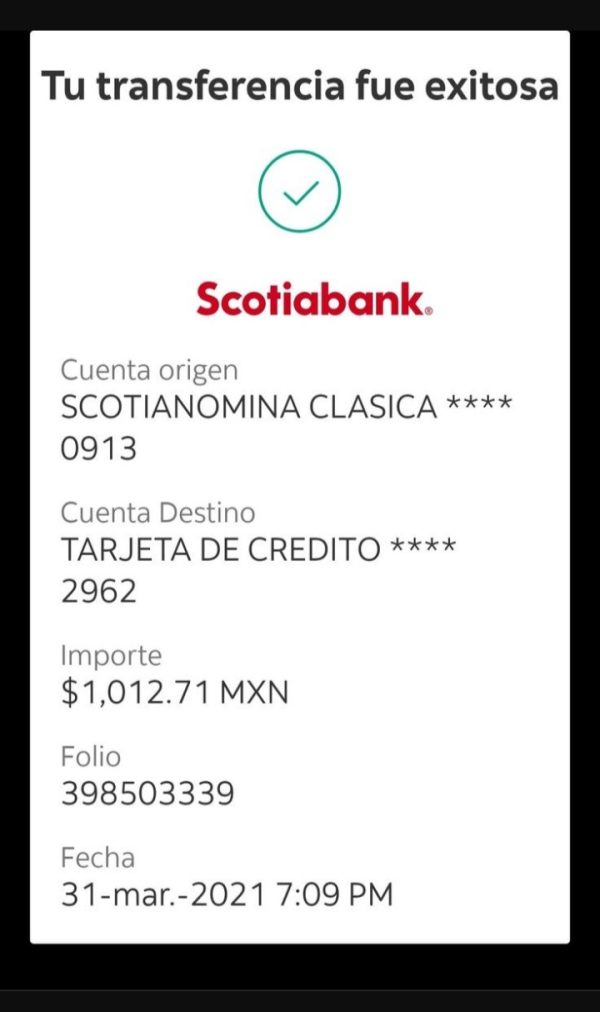

I was a victim of this platform which was a digital scammer. I lost more than 1000 pesos. It was dangerous that I provided personal information as they required in the pictures and I had no money.

CO Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

I was a victim of this platform which was a digital scammer. I lost more than 1000 pesos. It was dangerous that I provided personal information as they required in the pictures and I had no money.

This co review looks at a unique company in the financial services world that is very different from regular forex brokers. Co started in 1956, but it works mainly as a national literary magazine instead of a normal trading platform. The company publishes literary content four times a year, including short stories, creative nonfiction, book reviews, and poetry, serving writers, literary critics, and people who love literature.

Our detailed study shows that Co's business focuses on literary publishing rather than financial trading services. The platform has kept its focus on great literature for almost seventy years, making itself a respected voice in academic and creative writing communities. But people looking for regular forex trading services should know that this co review finds little information about standard broker services like trading platforms, regulatory oversight, or financial tools.

Co's main audience includes literary professionals, creative writers, and academic schools rather than retail or institutional traders. This basic difference in business direction greatly affects how relevant traditional broker evaluation standards are for this particular company.

This co review talks about a company that works outside the normal forex broker sector. Readers should know that Co works as a literary publication rather than a financial services provider. The evaluation standards usually used for forex brokers may not apply directly to this organization's main operations.

Our assessment method recognizes the limited availability of traditional broker-related information in public sources. The review focuses on available organizational data while noting significant information gaps about trading conditions, regulatory compliance, and customer service metrics typically linked with financial services providers.

People seeking forex trading services should consider this basic business model difference when comparing Co against traditional broker options.

| Evaluation Criteria | Score | Status |

|---|---|---|

| Account Conditions | N/A | Information not available in source materials |

| Tools and Resources | N/A | Literary focus differs from trading tools |

| Customer Service | N/A | Service model information unavailable |

| Trading Experience | N/A | No trading platform information available |

| Trust and Reliability | N/A | Financial regulatory data not provided |

| User Experience | N/A | User feedback data not accessible |

The absence of traditional scoring shows the basic mismatch between Co's literary publishing focus and standard forex broker evaluation standards.

Co represents a unique company established in 1956 with a main focus on literary publishing rather than financial trading services. Based on available information, Colorado Review operates as a national-level literary magazine that has kept consistent publication schedules for almost seventy years. The organization's main mission involves showing contemporary literature through carefully chosen quarterly publications featuring new and established writers.

The publication model emphasizes quality literary content across multiple types, including short fiction, creative nonfiction, poetry, and critical book reviews. This co review notes that the organization has built its reputation within academic and literary circles rather than financial markets. The long operation since 1956 shows organizational stability, though this stability operates within the publishing sector rather than financial services.

Unlike traditional forex brokers that focus on currency trading, market analysis, and financial instruments, Co's business model centers on editorial excellence and literary merit. The organization serves writers, readers, and academic institutions seeking high-quality literary content. This basic difference in target audience and service offerings makes Co significantly different from conventional broker operations that serve traders and investors seeking market access and financial returns.

Regulatory Oversight: Available source materials do not specify financial regulatory authorities overseeing Co's operations, which aligns with its literary publishing focus rather than financial services provision.

Deposit and Withdrawal Methods: Traditional banking and payment processing information for trading accounts is not available in the provided materials, reflecting the organization's non-trading business model.

Minimum Deposit Requirements: Standard minimum deposit thresholds typically associated with trading accounts are not specified, as the organization operates outside conventional brokerage parameters.

Promotional Offers: Information regarding trading bonuses, deposit incentives, or promotional campaigns commonly offered by forex brokers is not available in source materials.

Tradeable Assets: The range of financial instruments, currency pairs, or other tradeable assets typically offered by brokers is not specified, consistent with Co's literary focus.

Cost Structure: Details regarding spreads, commissions, overnight fees, and other trading-related costs are not provided in available information sources.

Leverage Options: Leverage ratios and margin requirements commonly associated with forex trading platforms are not mentioned in the source materials.

Platform Selection: Information about trading platforms, software options, or technical analysis tools is not available, reflecting the organization's publishing orientation.

Geographic Restrictions: Specific information about regional limitations or service availability is not detailed in the provided materials.

Customer Support Languages: Multi-language support options for customer service are not specified in available documentation.

This co review emphasizes that the absence of traditional brokerage information reflects Co's fundamental business model differences rather than information deficiencies.

The evaluation of account conditions for Co presents unique challenges due to the organization's literary publishing focus rather than traditional financial services provision. Standard account types commonly offered by forex brokers, such as standard, premium, or VIP trading accounts, are not applicable to Co's business model. The organization's operational framework centers on publication subscriptions and literary submissions rather than trading account hierarchies.

Minimum deposit requirements, a critical factor in traditional brokerage evaluations, do not apply to Co's operational structure. Instead of trading capital requirements, the organization likely operates on subscription-based revenue models typical of literary publications. Account opening procedures would presumably involve subscription processes rather than financial verification and regulatory compliance checks required by licensed brokers.

Special account features such as Islamic accounts, which comply with Sharia law principles in forex trading, are not relevant to Co's publishing operations. The organization's account management likely focuses on subscriber services, submission tracking, and editorial communications rather than trading account functionality. This co review notes that traditional account condition metrics cannot be meaningfully applied to evaluate Co's services, as the fundamental service delivery model operates outside financial trading parameters.

The absence of conventional account tiers, deposit requirements, and trading-specific features reflects the organization's commitment to literary excellence rather than financial market participation.

Co's approach to tools and resources differs fundamentally from traditional forex brokerage offerings. While conventional brokers provide trading platforms, technical analysis tools, and market research capabilities, Co's resource allocation focuses on literary and editorial tools supporting creative writing and publication processes. The organization's toolkit likely emphasizes manuscript management systems, editorial workflows, and publication scheduling rather than trading algorithms or market analysis software.

Research and analysis resources in Co's context would center on literary criticism, contemporary writing trends, and editorial market analysis rather than financial market research. The organization's educational resources presumably support aspiring writers and literary professionals through workshops, submission guidelines, and publication best practices rather than trading education and market analysis training.

Automated trading support, a significant feature in modern forex brokerages, is not applicable to Co's operational model. Instead, the organization might utilize automated submission management systems, editorial tracking software, and publication distribution systems. These tools serve the literary community's needs rather than trader requirements for algorithmic trading capabilities.

The resource evaluation for Co must acknowledge that the organization's tools serve creative and editorial purposes rather than financial trading objectives. This fundamental difference in resource allocation reflects the organization's specialized focus on literary excellence and publication quality rather than market analysis and trading execution capabilities.

Customer service evaluation for Co requires consideration of the organization's literary publishing focus rather than traditional brokerage support metrics. While forex brokers typically provide 24/7 trading support, real-time chat assistance, and urgent technical support, Co's customer service model likely operates within standard business hours serving writers, subscribers, and literary professionals with different urgency requirements.

Response time expectations for Co would align with publishing industry standards rather than financial market demands. Literary submissions, editorial inquiries, and subscription services operate on longer timeframes compared to trading support requirements. The organization's support quality likely emphasizes editorial expertise, submission guidance, and publication information rather than technical trading assistance or market access troubleshooting.

Multi-language support capabilities, while valuable in both sectors, serve different purposes for Co compared to international forex brokers. The organization's language support would facilitate literary submissions and international writer engagement rather than global trading access. Customer service hours for Co presumably align with editorial and administrative schedules rather than global market trading sessions.

This co review recognizes that traditional customer service metrics such as trade execution support, platform technical assistance, and real-time market guidance are not applicable to Co's operational model. The organization's support framework serves the literary community's unique needs, requiring specialized knowledge of publishing processes, editorial standards, and creative writing industry practices rather than financial market expertise.

The trading experience evaluation for Co presents fundamental challenges due to the organization's literary publishing orientation rather than financial trading platform provision. Platform stability and execution speed, critical metrics for forex brokers, are not applicable to Co's operational framework. Instead of trading platform performance, the organization's technical infrastructure likely focuses on manuscript submission systems, editorial workflow management, and publication distribution efficiency.

Order execution quality, a cornerstone of trading experience assessment, does not translate to Co's business model. The organization's execution quality would relate to editorial decision-making, publication scheduling, and content delivery rather than trade order processing. Platform functionality completeness for Co would encompass submission tracking, editorial communication tools, and subscriber management rather than trading features such as charting tools, order types, or risk management functions.

Mobile experience evaluation for Co would focus on accessibility for writers and readers rather than mobile trading capabilities. The organization's mobile presence likely emphasizes content access, submission portals, and editorial communications rather than real-time trading functionality. The trading environment assessment, typically covering market access and execution conditions, is not relevant to Co's literary publication environment.

This co review acknowledges that traditional trading experience metrics cannot meaningfully evaluate Co's services. The organization's user experience centers on literary engagement, editorial processes, and publication access rather than financial market participation and trading execution capabilities.

Trust and reliability assessment for Co requires evaluation criteria appropriate for literary publishing organizations rather than regulated financial services providers. Traditional regulatory credentials from financial authorities such as the FCA, CySEC, or CFTC are not applicable to Co's publishing operations. Instead, the organization's credibility likely stems from editorial reputation, literary community recognition, and publication quality standards maintained over decades of operation.

Financial security measures typically evaluated for brokers, such as segregated client funds, investor compensation schemes, and regulatory capital requirements, do not apply to Co's business model. The organization's security focus would center on intellectual property protection, manuscript confidentiality, and subscriber data privacy rather than trading capital protection and financial regulatory compliance.

Company transparency for Co would involve editorial policies, submission guidelines, and publication criteria rather than trading condition disclosure and regulatory reporting. The organization's industry reputation within literary circles differs significantly from financial market standing, requiring evaluation based on editorial excellence, writer development, and literary community contribution rather than trading performance and regulatory compliance history.

Negative event handling for Co would address editorial disputes, publication issues, or community concerns rather than trading-related problems, regulatory violations, or financial losses. The organization's crisis management capabilities serve literary community needs rather than trader protection and financial market stability requirements.

User experience evaluation for Co must consider the organization's literary publishing focus rather than trading platform usability. Overall user satisfaction for Co would relate to writer experiences with submission processes, editorial feedback quality, and publication opportunities rather than trading performance, platform reliability, or customer support responsiveness typically associated with forex brokers.

Interface design and usability assessment for Co would focus on submission portals, content accessibility, and editorial communication systems rather than trading platform navigation, charting tools, or order placement interfaces. The organization's user interface priorities emphasize literary content presentation, submission management, and editorial workflow rather than real-time market data display and trading execution capabilities.

Registration and verification processes for Co likely involve writer profile creation, submission portfolio development, and editorial communication setup rather than financial verification, regulatory compliance checks, and trading account activation procedures required by licensed brokers. The onboarding experience serves creative professionals rather than traders and investors.

Funding operations experience, a critical aspect of brokerage evaluation, is not applicable to Co's operational model. Instead of deposit and withdrawal processes, the organization's financial interactions likely involve subscription payments, publication fees, or editorial service charges. Common user complaints for Co would address editorial decisions, publication timelines, or submission feedback rather than trading conditions, platform technical issues, or customer service problems typically associated with forex brokerages.

This co review reveals that Co operates fundamentally outside the traditional forex brokerage sector, focusing on literary publishing rather than financial trading services. The organization's nearly seven-decade history since 1956 demonstrates operational stability within the publishing industry, though this experience does not translate to financial market expertise or regulatory compliance in trading services.

The evaluation process highlights significant information gaps regarding traditional brokerage criteria such as regulatory oversight, trading conditions, and customer service metrics. These gaps reflect Co's literary publishing focus rather than deficiencies in available information. Potential users seeking forex trading services should recognize that Co's business model, target audience, and service offerings align with literary professionals rather than traders and investors.

The organization appears well-suited for writers, literary critics, and academic institutions seeking quality publication opportunities and literary content. However, individuals seeking forex trading capabilities, market analysis tools, or financial investment services would need to consider traditional licensed brokers that specialize in financial market access and regulatory compliance rather than literary publishing excellence.

FX Broker Capital Trading Markets Review