KDFX Review 3

Please report it together.

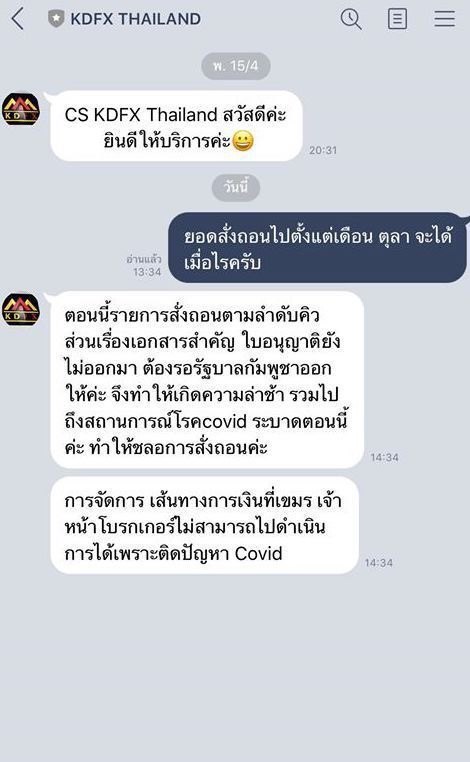

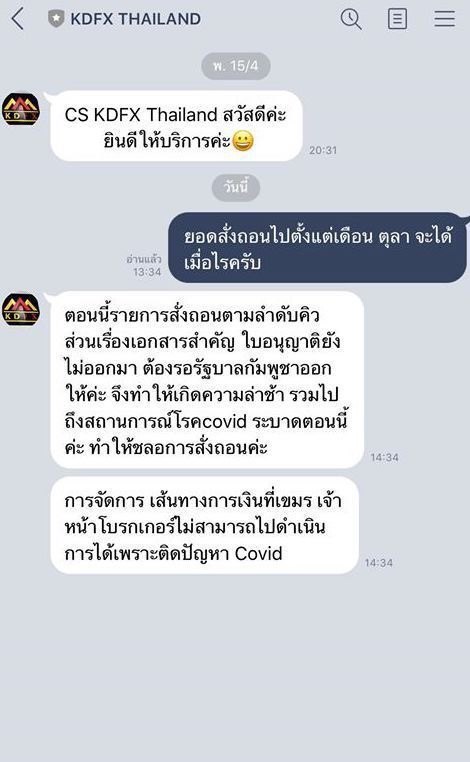

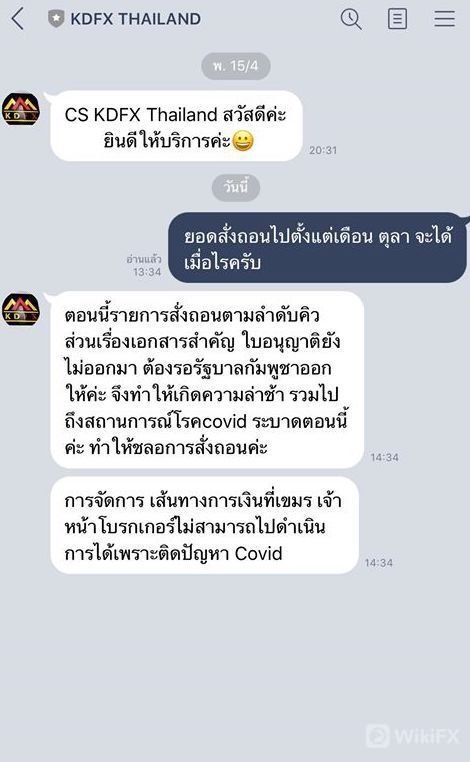

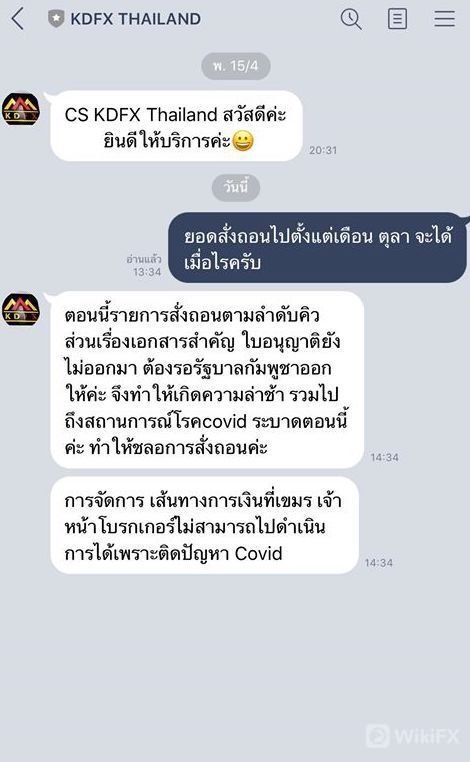

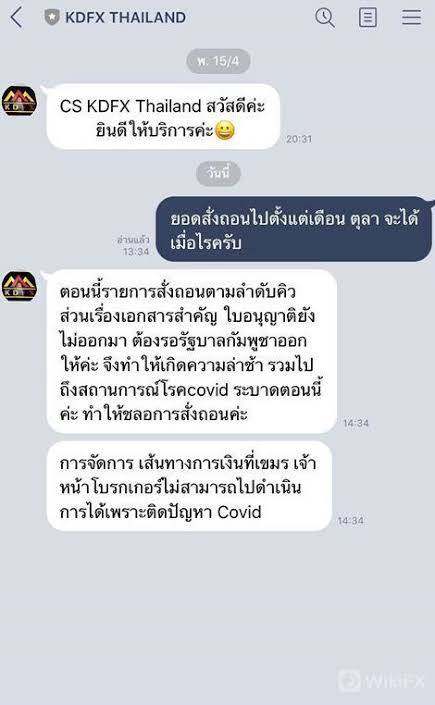

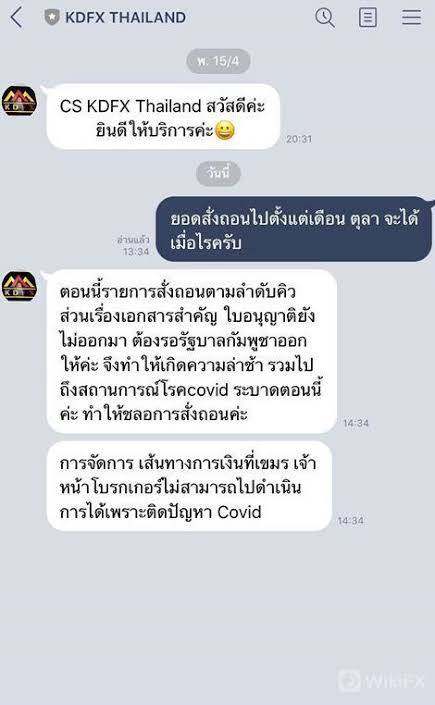

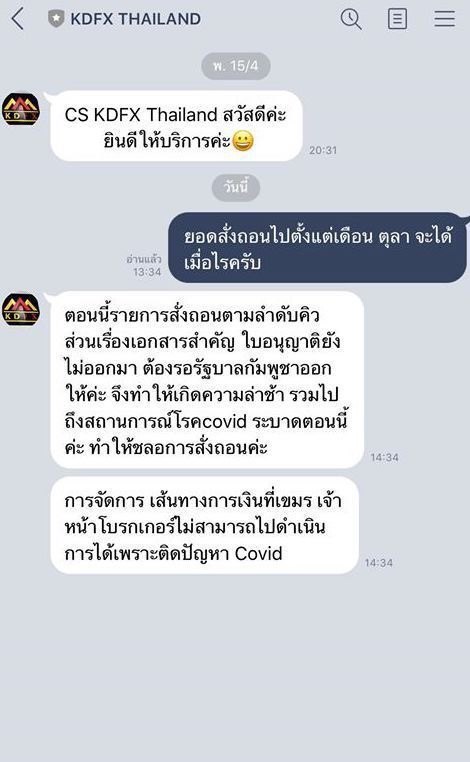

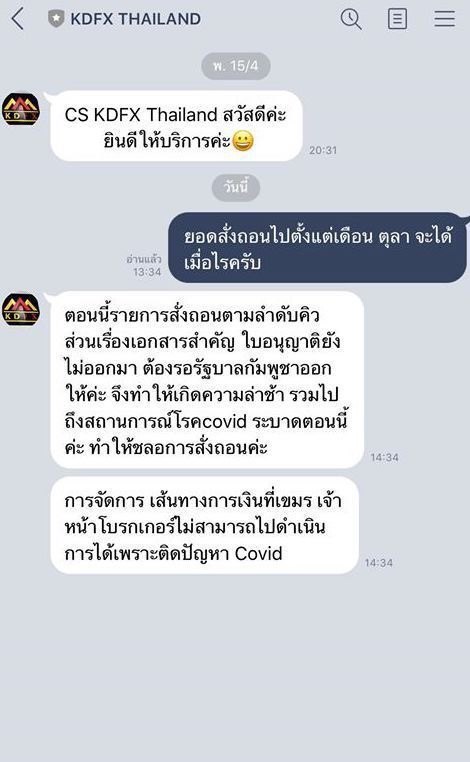

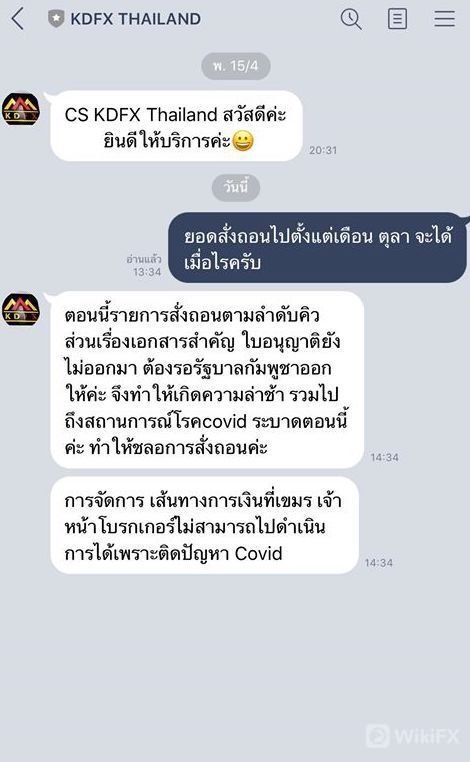

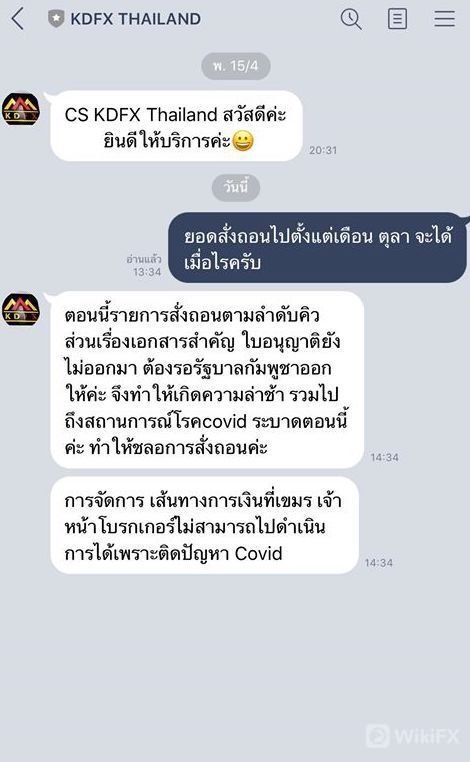

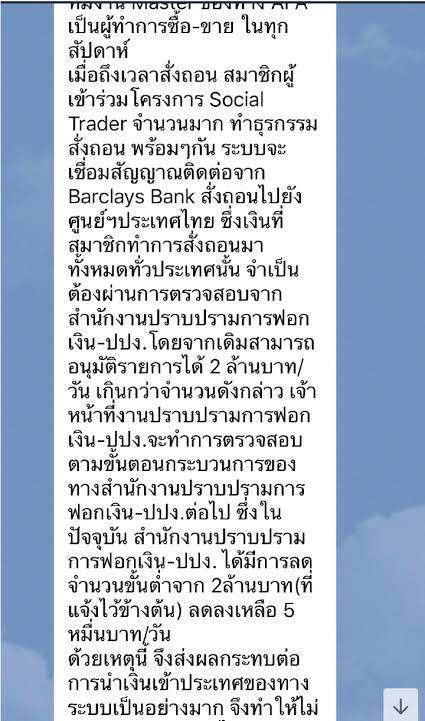

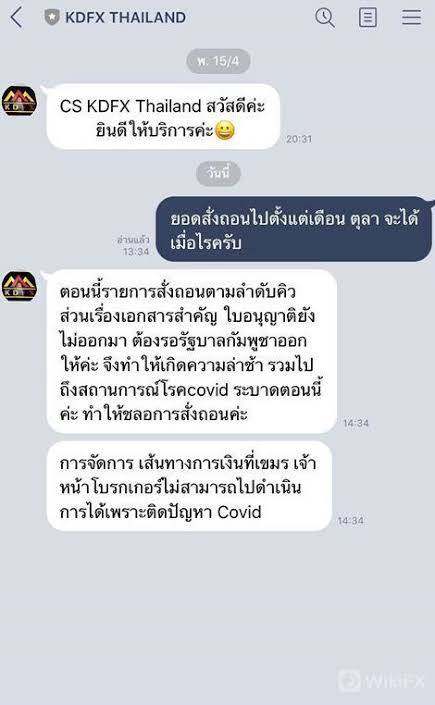

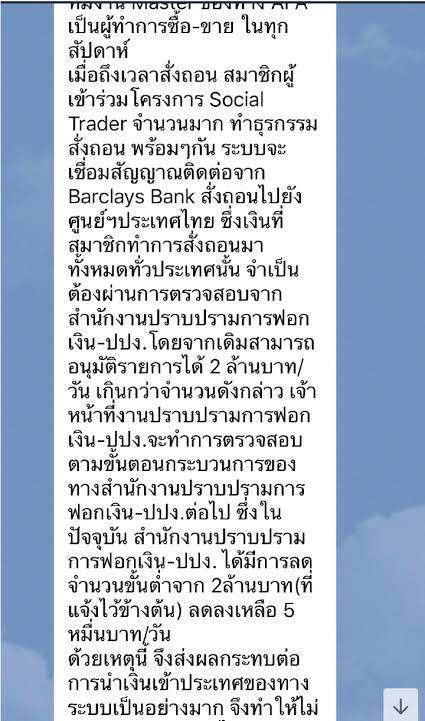

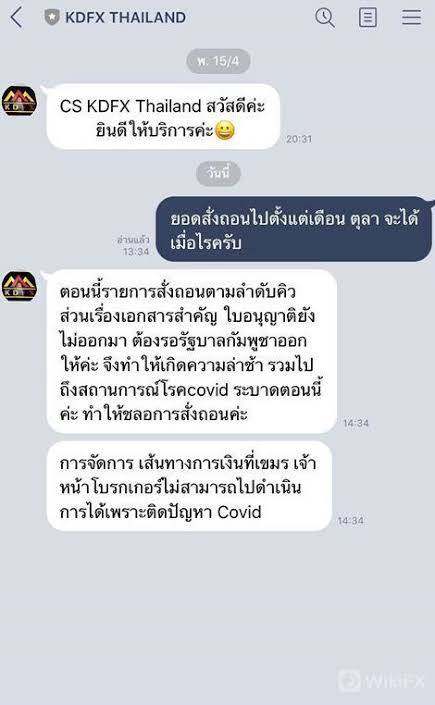

My withdrawals have been pending for two years

This broker won't let me withdraw money.

KDFX Forex Broker provides real users with * positive reviews, * neutral reviews and 3 exposure review!

Please report it together.

My withdrawals have been pending for two years

This broker won't let me withdraw money.

This comprehensive Kdfx review reveals concerning findings about this offshore broker. Potential investors must understand these issues before considering their services. KDFX has been consistently identified across multiple industry sources as an unregulated, low-credibility broker. The broker operates without proper oversight from recognized financial authorities.

The broker lacks transparency in fundamental areas including trading conditions, platform specifications, and operational details. These are standard expectations in the forex industry. Despite carrying a user rating of 4 points on some platforms, the underlying user feedback tells a different story. The reviews are predominantly negative and highlight issues with transparency, service quality, and overall reliability.

The absence of regulatory supervision raises significant red flags about fund safety and operational legitimacy. KDFX appears to target traders with high risk tolerance who may be attracted to unregulated offshore operations. This broker is fundamentally unsuitable for investors prioritizing security, regulatory compliance, and transparent trading conditions. The lack of detailed information about trading tools, educational resources, and customer support infrastructure further compounds concerns about this broker's credibility and operational standards.

As an offshore broker operating without regulatory oversight, KDFX may present inconsistent compliance standards across different jurisdictions. The regulatory landscape for offshore brokers varies significantly by region. Traders should be aware that KDFX's operational practices may not align with the protective standards established by major financial regulators such as the FCA, ASIC, or CySEC.

This evaluation is based on available user feedback, industry reports, and publicly accessible information about KDFX. Due to the broker's limited transparency and lack of comprehensive disclosure, there may be significant information gaps. These gaps could affect the completeness of this assessment. Potential clients should conduct additional due diligence before making any investment decisions.

| Evaluation Criteria | Score | Rating Justification |

|---|---|---|

| Account Conditions | 2/10 | No specific account types, minimum deposits, or terms disclosed; user feedback indicates lack of transparency |

| Tools and Resources | 1/10 | No trading tools, research materials, or educational resources mentioned; negative user experiences reported |

| Customer Service | 2/10 | Customer support quality unspecified; user feedback suggests inadequate service levels |

| Trading Experience | 3/10 | Poor user reviews regarding trading environment; platform information not available |

| Trust and Safety | 1/10 | Unregulated status with fraud risk warnings; classified as low-credibility broker |

| User Experience | 2/10 | Predominantly negative user feedback; overall dissatisfaction reported across reviews |

KDFX operates as an offshore forex broker without established regulatory credentials. The broker also lacks comprehensive transparency about its corporate structure. The available information suggests this broker has been active in the forex market. However, specific details about its founding date, corporate headquarters, or management team remain undisclosed.

This lack of fundamental business information immediately raises concerns about the broker's legitimacy and commitment to industry standards. The broker's business model appears to rely on attracting clients who may be less concerned about regulatory oversight. The broker potentially targets traders in regions with limited access to regulated brokers. However, this approach inherently increases risk for clients, as unregulated brokers operate without the consumer protections, fund segregation requirements, and operational standards mandated by legitimate financial authorities.

The absence of clear information about KDFX's operational framework further undermines confidence in its professional capabilities. This includes its trading execution model, liquidity providers, and risk management procedures. According to industry sources and user reports, KDFX lacks the transparency expected from legitimate forex brokers. The broker has not provided detailed information about available trading platforms, supported asset classes, or trading conditions. These are fundamental requirements for informed investment decisions.

This Kdfx review emphasizes that the broker's unregulated status positions it outside the protective frameworks that legitimate brokers must maintain.

Regulatory Status: KDFX operates as an unregulated offshore broker without supervision from recognized financial authorities. This status means the broker is not subject to standard industry oversight, capital adequacy requirements, or client protection measures.

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees has not been disclosed by KDFX. This creates uncertainty about fund management procedures.

Minimum Deposit Requirements: The broker has not published minimum deposit amounts for account opening. This makes it difficult for potential clients to understand entry requirements.

Promotional Offers: No information about bonuses, promotional campaigns, or special offers has been made available. This suggests either absence of such programs or lack of marketing transparency.

Tradeable Assets: KDFX has not specified which currency pairs, commodities, indices, or other financial instruments are available for trading through their platform.

Cost Structure: Critical information about spreads, commissions, overnight fees, and other trading costs remains undisclosed. This prevents traders from accurately assessing the true cost of trading with this broker.

Leverage Options: Maximum leverage ratios and margin requirements have not been specified. This leaves traders without essential risk management information.

Platform Selection: Details about trading platforms have not been provided. This includes whether MetaTrader 4, MetaTrader 5, or proprietary platforms are available.

Geographic Restrictions: The broker has not clarified which countries or regions are restricted from accessing their services.

Customer Support Languages: Available languages for customer support have not been specified in accessible materials.

This comprehensive Kdfx review highlights the significant information gaps that potential clients must consider when evaluating this broker.

The evaluation of KDFX's account conditions reveals substantial transparency deficiencies that should concern potential traders. Unlike established brokers who clearly outline their account types, features, and requirements, KDFX has failed to provide basic information about account structures. This lack of disclosure makes it impossible for traders to understand what services they would receive or what commitments they would be making.

User feedback consistently points to opacity in the account opening process. Several reports indicate confusion about terms and conditions. The absence of clearly defined account tiers, such as standard, premium, or VIP accounts, suggests either a simplified structure or concerning lack of professional organization.

Legitimate brokers typically offer detailed breakdowns of account features, minimum deposits, and associated benefits to help clients make informed decisions. The unavailability of information about specialized account options, such as Islamic accounts for Sharia-compliant trading, indicates limited accommodation for diverse client needs. Additionally, the lack of demo account information raises questions about whether KDFX provides risk-free testing environments that are standard in the industry.

Account verification procedures and documentation requirements remain unclear. This could lead to unexpected delays or complications during the onboarding process. The absence of transparent account condition information significantly undermines trader confidence and represents a major departure from industry best practices.

This Kdfx review emphasizes that these deficiencies in account transparency constitute a significant red flag for potential clients seeking professional forex trading services.

KDFX's offering of trading tools and resources appears to be virtually non-existent based on available information. This earns the lowest possible rating in this critical category. Professional forex brokers typically provide comprehensive suites of analytical tools, market research, and educational materials to support trader success.

KDFX has failed to demonstrate any meaningful commitment to these essential services. The absence of trading tools such as economic calendars, technical analysis indicators, market sentiment tools, or volatility calculators severely limits traders' ability to make informed decisions. Modern forex trading relies heavily on sophisticated analytical capabilities.

The lack of such resources suggests either inadequate platform development or minimal investment in client success infrastructure. Educational resources, which are fundamental for both novice and experienced traders, appear to be completely absent from KDFX's offerings. There is no evidence of webinars, trading guides, market analysis reports, or educational video content that legitimate brokers routinely provide.

This absence is particularly concerning given that education is often considered a hallmark of reputable brokers who prioritize long-term client relationships. Research and analysis capabilities, including daily market commentary, expert insights, or fundamental analysis reports, have not been identified in connection with KDFX's services. The lack of these resources leaves traders without crucial market intelligence that could impact their trading decisions.

Automated trading support, including expert advisors or algorithmic trading capabilities, has also not been mentioned. This limits advanced trading strategies. User feedback regarding tool availability has been predominantly negative, with traders expressing frustration about the limited resources available for market analysis and trade planning.

Customer service quality represents another significant weakness in KDFX's operational framework. Available evidence suggests inadequate support infrastructure that fails to meet industry standards. Professional forex brokers typically maintain multiple communication channels, extended support hours, and multilingual capabilities to serve their global client base effectively.

The specific customer service channels available through KDFX remain unclear. There is no comprehensive information about phone support, live chat availability, or email response systems. This uncertainty about basic communication methods creates immediate concerns about accessibility when traders need assistance with urgent issues or account problems.

Response time performance, which is crucial in fast-moving forex markets, has not been documented by KDFX. User feedback suggests that support responsiveness may be problematic. Traders have reported difficulties in obtaining timely assistance, which can be particularly damaging when dealing with time-sensitive trading issues or technical problems.

Service quality assessments from actual users indicate predominantly negative experiences. Users complain about unhelpful responses and lack of resolution for reported problems. The absence of specialized support departments, such as technical assistance or account management teams, suggests a limited organizational structure that may struggle to address diverse client needs effectively.

Multilingual support capabilities have not been clearly established. This potentially creates barriers for non-English speaking traders who require assistance in their native languages. Operating hours for customer service have not been specified, leaving uncertainty about when support is available.

The lack of comprehensive customer service information and negative user experiences indicate that KDFX may not prioritize client support as a core business function. This is essential for legitimate forex brokers.

The trading experience offered by KDFX appears to be significantly below industry standards. User feedback indicates substantial problems with platform performance and overall trading environment quality. Professional forex trading requires stable, fast, and reliable platform infrastructure.

Available evidence suggests KDFX may not meet these fundamental requirements. Platform stability and execution speed are critical factors that directly impact trading profitability. Users have reported unsatisfactory experiences with KDFX's trading environment.

Issues with platform reliability can lead to missed trading opportunities, unexpected losses, and overall frustration that undermines trading success. The absence of detailed platform specifications makes it impossible to assess technical capabilities or performance benchmarks. Order execution quality, including concerns about slippage, requotes, and fill rates, has not been adequately documented by KDFX.

These factors are essential for traders to understand the true cost and reliability of trade execution. Negative user feedback suggests that execution quality may be problematic, which could significantly impact trading results and profitability. Platform functionality and feature completeness remain unclear due to the lack of comprehensive platform documentation.

Modern traders expect sophisticated charting capabilities, multiple order types, risk management tools, and customization options that may not be available through KDFX's trading infrastructure. Mobile trading capabilities, which are essential for contemporary forex trading, have not been adequately described or demonstrated. The absence of detailed mobile platform information suggests potential limitations in trading accessibility and flexibility.

User reviews consistently indicate disappointment with the overall trading environment. This suggests that KDFX may not provide the professional trading infrastructure that serious forex traders require. This Kdfx review emphasizes that platform quality is fundamental to trading success, and the reported deficiencies represent significant concerns for potential clients.

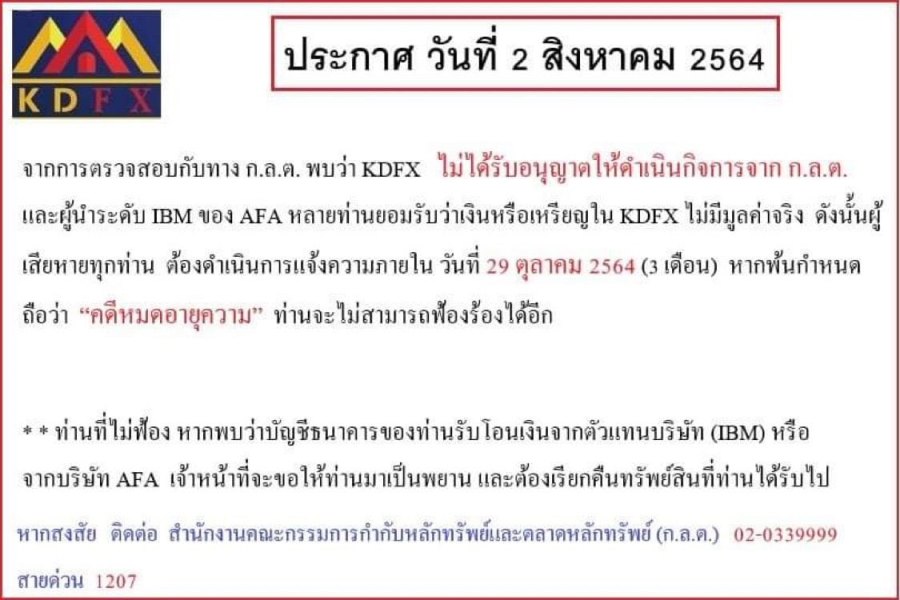

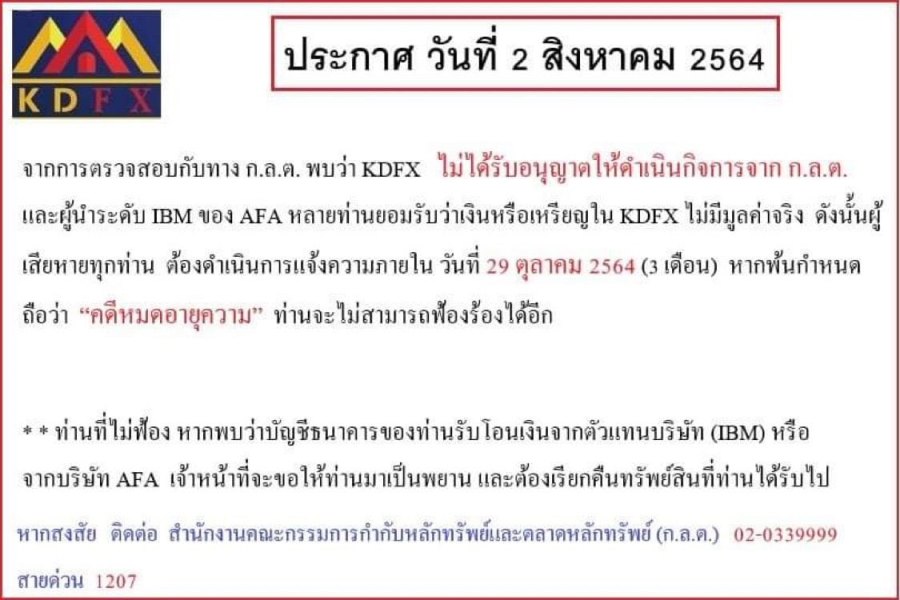

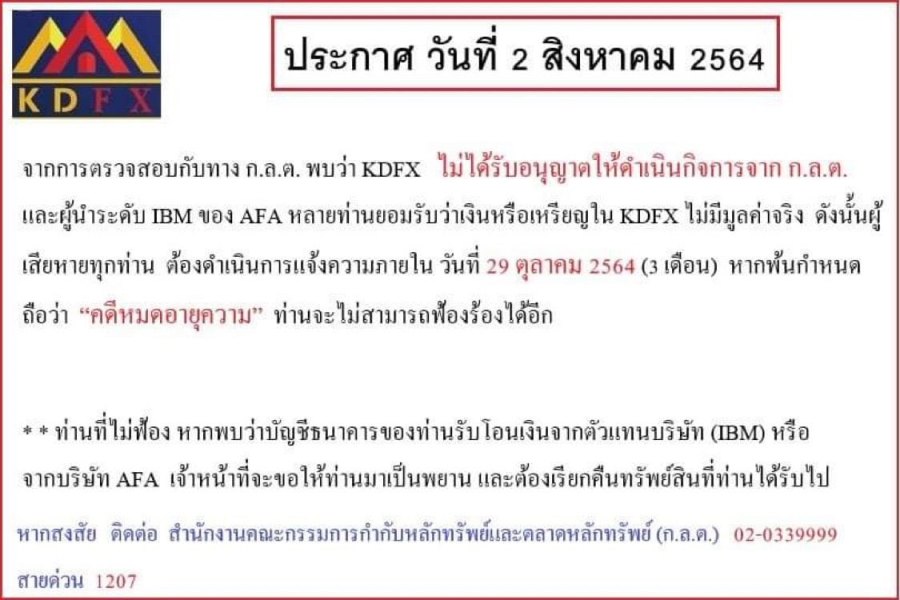

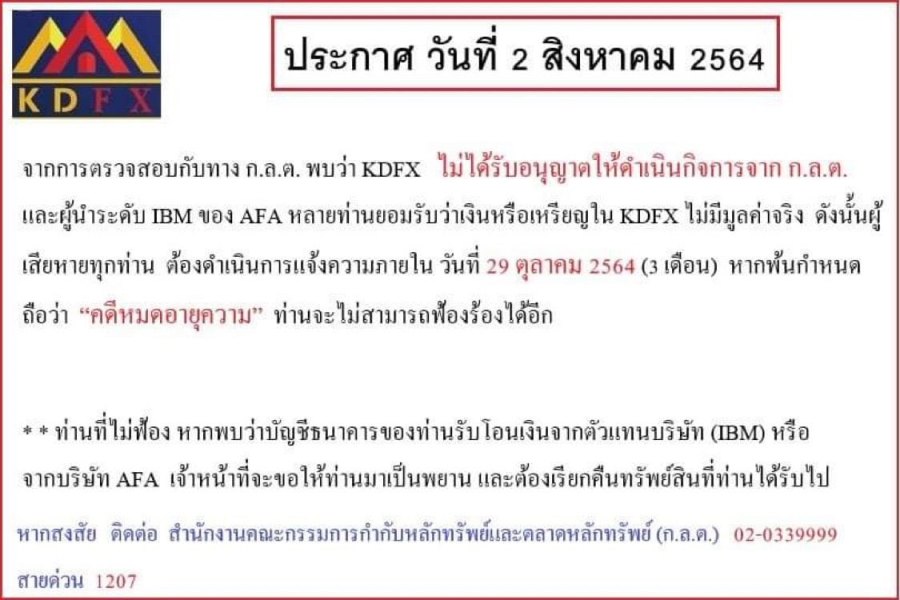

Trust and safety represent the most critical concerns regarding KDFX. Multiple red flags indicate substantial risks that potential clients must carefully consider. The broker's unregulated status immediately places it outside the protective frameworks that legitimate financial authorities establish to safeguard investor interests and maintain market integrity.

Regulatory oversight provides essential protections including fund segregation requirements, capital adequacy standards, and dispute resolution mechanisms. These are absent when dealing with unregulated brokers like KDFX. The lack of supervision from recognized authorities such as the FCA, ASIC, CySEC, or other legitimate regulators means that clients have limited recourse if problems arise with their accounts or funds.

Fund safety measures, which are fundamental to broker trustworthiness, have not been adequately disclosed by KDFX. Legitimate brokers typically maintain segregated client accounts, provide deposit insurance, and submit to regular audits to ensure financial stability. The absence of such protections creates significant risk for client funds and raises questions about the broker's financial management practices.

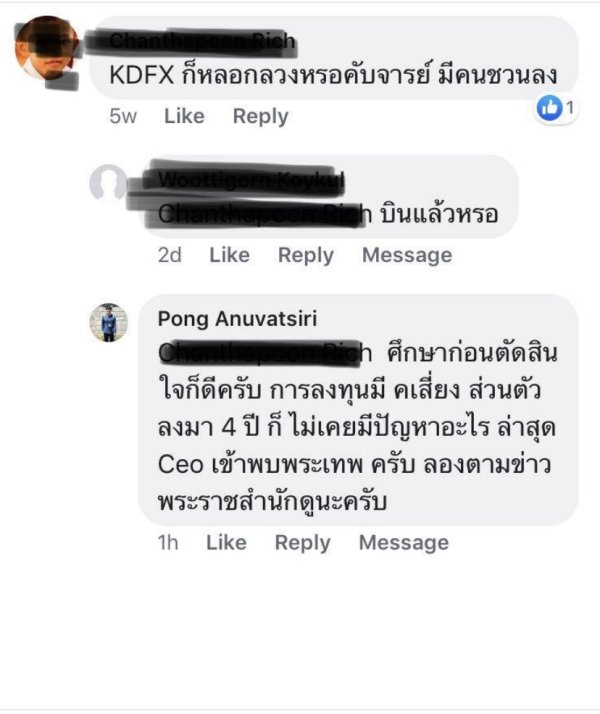

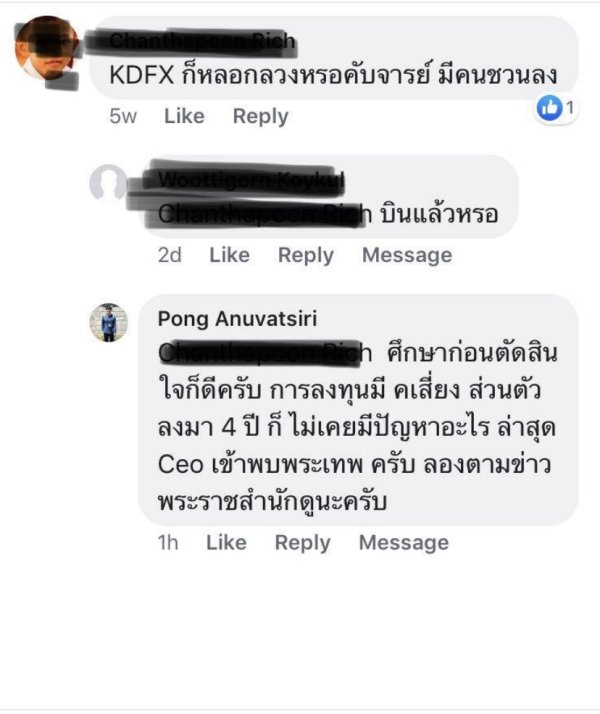

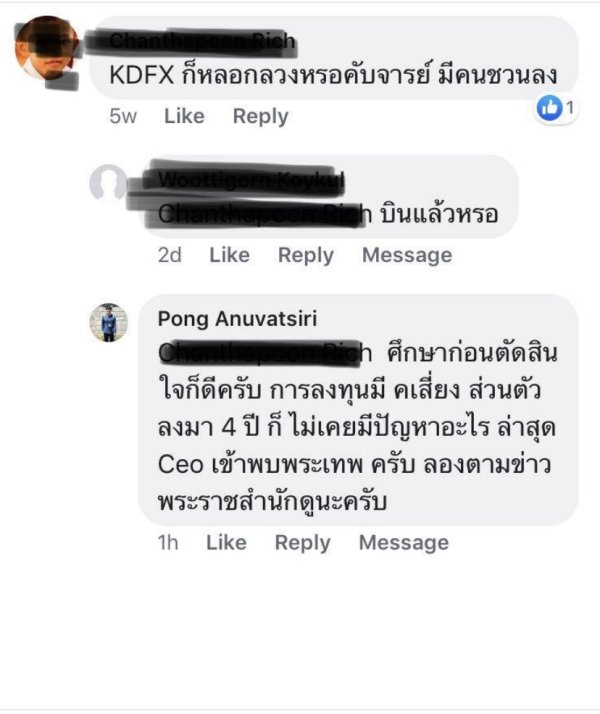

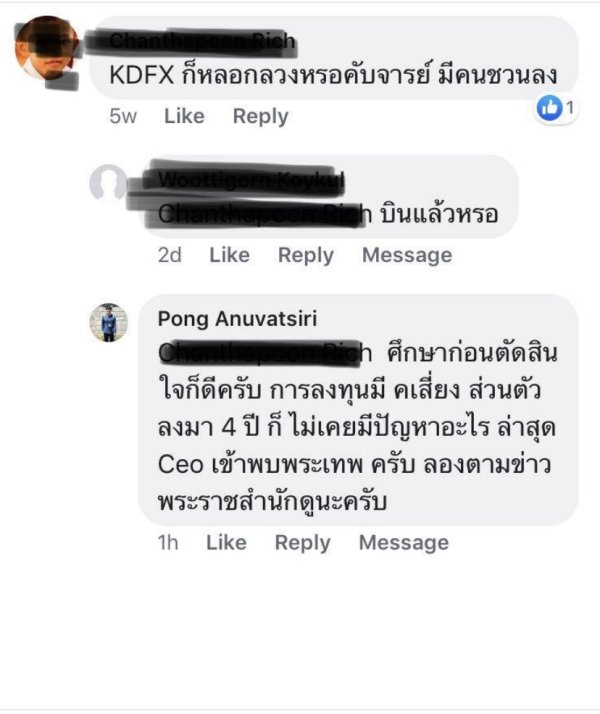

Corporate transparency, including detailed company information, management backgrounds, and operational disclosures, is notably lacking in KDFX's public materials. This opacity makes it difficult for potential clients to assess the broker's legitimacy, financial stability, and commitment to professional standards. Industry reputation assessments from multiple sources consistently classify KDFX as a low-credibility broker with potential fraud risks.

These warnings from industry watchdogs and review platforms should be taken seriously by anyone considering this broker. User feedback frequently mentions concerns about scam-like behavior and questionable business practices that further undermine trust in this broker's operations.

User experience evaluation reveals widespread dissatisfaction among traders who have engaged with KDFX's services. Feedback consistently highlights problems across multiple aspects of the broker's operations. Overall satisfaction levels appear to be significantly below industry standards.

Users express regret about choosing this broker for their trading activities. Interface design and usability information has not been comprehensively documented, but user comments suggest that platform navigation and functionality may be problematic. Modern traders expect intuitive, well-designed interfaces that facilitate efficient trading.

The lack of positive feedback about KDFX's user interface design raises concerns about platform quality. Registration and verification processes have been sources of confusion and frustration according to user reports. Traders experience unclear requirements and unexpected complications during account setup.

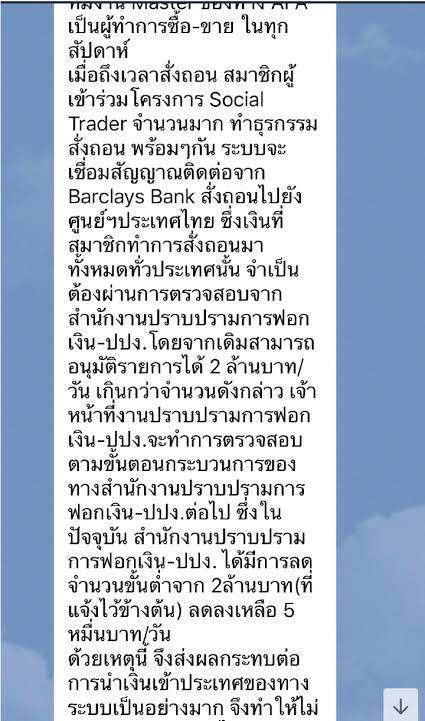

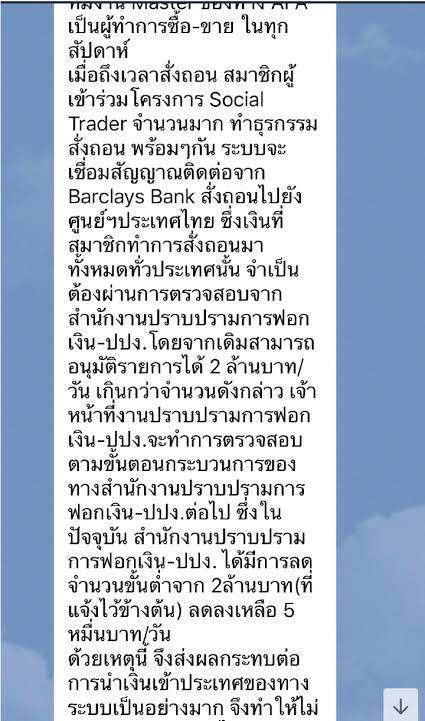

Professional brokers typically streamline these processes to minimize friction while maintaining necessary compliance standards. Fund management experiences, including deposit and withdrawal procedures, have generated negative feedback from users who report difficulties with transaction processing and unclear procedures. Efficient fund management is essential for trader confidence, and problems in this area can significantly impact the overall user experience.

Common user complaints center around lack of transparency, poor communication, inadequate support, and concerns about fund safety. These consistent themes across multiple user reviews suggest systemic problems with KDFX's operational approach rather than isolated incidents. The user demographic that might find KDFX appealing appears to be limited to traders with extremely high risk tolerance who prioritize access over security and regulation.

However, even within this niche, the negative feedback suggests that KDFX may not deliver satisfactory services. Based on user feedback patterns, improvements in transparency, service quality, platform reliability, and customer support would be necessary to address the widespread dissatisfaction reported by existing clients.

This comprehensive Kdfx review reveals significant concerns that should deter most traders from engaging with this unregulated offshore broker. KDFX's lack of regulatory oversight, transparency deficiencies, and predominantly negative user feedback create a risk profile that is unsuitable for traders prioritizing security, reliability, and professional service standards.

The broker is not recommended for investors seeking regulated, transparent, and accountable forex trading services. The absence of clear information about trading conditions, platform capabilities, and corporate structure, combined with warnings about potential fraud risks, make KDFX an inappropriate choice for serious forex trading activities. The primary disadvantages include unregulated status, lack of transparency, poor user satisfaction, absence of disclosed trading tools and resources, and significant trust and safety concerns.

No clear advantages have been identified that would offset these substantial risks and deficiencies in professional standards.

FX Broker Capital Trading Markets Review