Is Oasis Prime safe?

Pros

Cons

Is Oasis Prime Safe or a Scam?

Introduction

Oasis Prime is a relatively obscure player in the forex market, often regarded as an offshore broker. In a landscape filled with both reputable and dubious trading platforms, it is crucial for traders to conduct thorough due diligence before committing their funds. The forex market, while offering lucrative opportunities, also presents significant risks, especially when dealing with unregulated brokers. This article aims to assess the safety and legitimacy of Oasis Prime through a comprehensive evaluation of its regulatory status, company background, trading conditions, client fund security, customer experiences, and overall risk profile.

To gather insights for this evaluation, we analyzed information from various reputable financial sources, including regulatory databases, expert reviews, and user feedback. Our assessment framework focuses on key areas that determine the credibility of a forex broker, helping traders make informed decisions.

Regulation and Legitimacy

The regulatory status of a broker is a fundamental aspect that determines its legitimacy. A regulated broker is typically subject to stringent oversight, which helps protect clients' funds and ensures fair trading practices. Unfortunately, Oasis Prime operates without any regulatory oversight, raising significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

Oasis Prime is based in Saint Vincent and the Grenadines, a jurisdiction known for its lax regulatory environment. This lack of regulation means that there are no guarantees regarding the safety of client funds or the integrity of trading practices. Furthermore, the absence of a regulatory framework makes it difficult for clients to seek recourse in case of disputes. The lack of transparency regarding Oasis Primes operations and its failure to secure a license from a reputable authority are strong indicators that traders should exercise extreme caution when considering this broker.

Company Background Investigation

Oasis Prime claims to have been operational since 2008, but its history is shrouded in obscurity. The company does not provide comprehensive information about its ownership structure or management team, which raises additional red flags. A reputable broker typically shares detailed information about its founders and key personnel, including their professional backgrounds and experience in the financial industry.

The lack of transparency surrounding Oasis Prime's management and operational history further complicates the assessment of its credibility. Without clear information about who is running the company and their qualifications, it becomes challenging to trust Oasis Prime as a legitimate trading platform. The absence of verifiable information about its operations should lead potential clients to question the broker's reliability.

Trading Conditions Analysis

Oasis Prime offers a variety of trading conditions, including a leverage of up to 1:100 and no minimum deposit requirement, which may appear attractive to novice traders. However, the overall trading conditions are subpar compared to industry standards. The absence of clear information on fees and commissions, along with hidden costs, can lead to unexpected expenses for traders.

| Fee Type | Oasis Prime | Industry Average |

|---|---|---|

| Spread on Major Pairs | 2.5 pips | 1.0-1.5 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The spread offered by Oasis Prime on major currency pairs is significantly higher than the industry average, indicating that traders may face higher costs when executing trades. Additionally, the lack of a clear commission structure raises concerns about potential hidden fees that could further erode trading profits. Traders should be wary of brokers that do not provide transparent information about their fee structures, as this can be a sign of unethical practices.

Client Fund Security

The security of client funds is paramount when evaluating a forex broker. Oasis Prime does not appear to implement any effective measures to safeguard client funds. There is no indication of segregated accounts or investor protection schemes, which are standard practices among regulated brokers.

The absence of these fundamental safety features means that clients' funds could be at risk in the event of financial difficulties faced by the broker. Furthermore, the lack of negative balance protection means that traders could potentially lose more than their initial investment, exposing them to significant financial risks. Historical complaints and reports of fund mismanagement from unregulated brokers further highlight the dangers of trading with platforms like Oasis Prime.

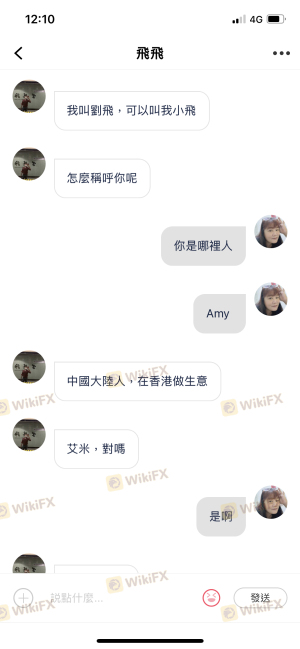

Customer Experience and Complaints

Customer feedback is an essential component of evaluating a broker's reputation. Reviews regarding Oasis Prime are mixed, with several users reporting issues related to withdrawals and customer support. Common complaints include difficulty in accessing funds, slow response times from customer service, and a lack of transparency regarding account management.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Slow |

| Transparency Concerns | High | Unresponsive |

One notable case involved a trader who experienced significant delays in processing a withdrawal request, ultimately leading to frustration and dissatisfaction. This type of experience is not uncommon among users of unregulated brokers, further reinforcing the notion that traders should approach Oasis Prime with caution.

Platform and Trade Execution

The trading platform provided by Oasis Prime is based on the popular MetaTrader 4, which is known for its robust features. However, the platform's overall performance and execution quality have been called into question. Reports of slippage, rejected orders, and connectivity issues have surfaced, suggesting that traders may face challenges when executing trades.

The potential for platform manipulation is another area of concern. Unregulated brokers often have the ability to manipulate prices and execution conditions, which can lead to unfair trading experiences for clients. It is essential for traders to consider whether a broker has established a reputation for fair trading practices or if there are indications of market manipulation.

Risk Assessment

Engaging with Oasis Prime presents several risks that traders must consider. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns |

| Fund Security Risk | High | Lack of segregation and protection |

| Trading Cost Risk | Medium | High spreads and potential hidden fees |

| Execution Risk | High | Reports of slippage and order rejections |

Traders are advised to implement risk mitigation strategies, such as limiting the amount of capital allocated to trading with Oasis Prime and considering alternative brokers that offer better regulatory oversight and client protection.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that Oasis Prime is not a safe trading option. The lack of regulation, transparency, and client fund security raises significant red flags. Traders should be cautious when considering this broker, as it may expose them to unnecessary risks and potential financial losses.

For those seeking to engage in forex trading, it is advisable to choose brokers that are regulated by reputable authorities, providing a safer trading environment with better protections for client funds. Reliable alternatives include brokers regulated by the FCA, ASIC, or other top-tier authorities that offer transparent trading conditions and robust security measures.

In summary, is Oasis Prime safe? The answer is a resounding no. Traders are encouraged to prioritize their financial safety by opting for established and regulated brokers in the forex market.

Is Oasis Prime a scam, or is it legit?

The latest exposure and evaluation content of Oasis Prime brokers.

Oasis Prime Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Oasis Prime latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.