AM Markets 2025 Review: Everything You Need to Know

Executive Summary

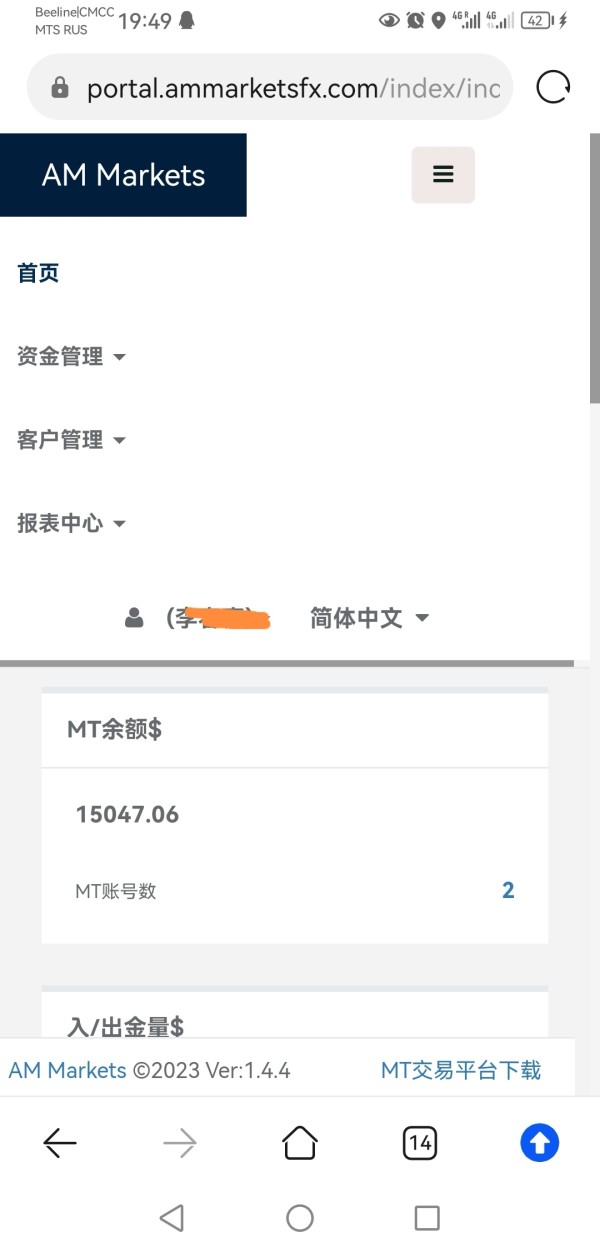

AM Markets is a clear and easy-to-use forex broker that helps traders around the world find different trading chances. This am markets review shows a Canadian broker that follows FINTRAC rules and lets traders work with many types of investments like forex pairs, commodities, market indices, stocks, and ETFs. The platform stands out because it gives leverage up to 1:500 and uses the popular MetaTrader 4 platform, which people trust for being reliable and having good trading tools.

The broker puts itself in a smart spot for global forex traders and investors who want many different trading tools. AM Markets focuses on being clear about its rules and keeps an easy-to-use interface that works well for both new and experienced traders. The platform promises to give many types of investments in one place, which makes it very attractive to traders who want to spread their money across more than just traditional forex pairs. The broker follows Canadian FINTRAC rules, which gives potential clients a solid foundation of trust.

Important Notice

AM Markets works under Canada's FINTRAC rules, which may be different from rules and protections in other places. Traders should know that rules change a lot between regions, and the level of investor protection may be different too. This am markets review uses public information and user feedback from many sources to give an objective look at the broker's services.

The review here shows information available as of 2025 and should be considered along with current market conditions and individual trading needs. Potential clients should do their own research and check all information directly with the broker before making any trading decisions.

Rating Framework

Broker Overview

AM Markets is a Canadian forex broker that focuses on giving complete trading solutions to clients around the world. The company has positioned itself as a specialized provider of multi-asset trading services. The broker's business model centers on offering diverse trading opportunities across various financial instruments, creating a one-stop platform for traders seeking exposure to different market sectors.

The company's work framework emphasizes easy access and transparency, with policies designed to help traders from various backgrounds and experience levels. AM Markets has built its reputation on providing straightforward access to major financial markets, supported by strong technology and regulatory compliance.

This am markets review shows that the platform works mainly through the MetaTrader 4 system, giving traders access to forex pairs, commodities, market indices, stocks, and ETFs. The broker's asset diversity sets it apart from more specialized platforms, allowing clients to use complex trading strategies across multiple markets. Under FINTRAC regulation, AM Markets follows Canadian financial standards, giving clients regulatory oversight and operational transparency that supports confident trading decisions.

Regulatory Jurisdiction: AM Markets operates under Canadian FINTRAC regulation, ensuring compliance with Canadian financial transaction reporting requirements and anti-money laundering standards.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods requires direct inquiry with the broker for complete payment options.

Minimum Deposit Requirements: Available materials do not specify minimum deposit requirements, suggesting potential flexibility or the need for direct consultation with account representatives.

Bonus and Promotional Offerings: Current promotional activities and bonus structures are not detailed in accessible information, indicating either absence of such programs or need for direct broker contact.

Tradeable Assets: The platform provides access to a complete range of financial instruments including major and minor forex pairs, commodity futures, global market indices, individual stocks, and exchange-traded funds.

Cost Structure: Detailed information about spreads, commissions, and other trading costs requires direct verification with the broker for accurate pricing.

Leverage Ratios: AM Markets offers leverage up to 1:500, providing traders with significant capital amplification capabilities while requiring appropriate risk management.

Platform Options: The primary trading platform is MetaTrader 4, featuring advanced trading tools, complete charting capabilities, and a user-friendly interface designed for both manual and automated trading.

Geographic Restrictions: Specific geographic limitations are not detailed in available materials, though regulatory compliance may restrict services in certain jurisdictions.

Customer Service Languages: Language support information requires direct inquiry for multilingual service availability.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

The account conditions at AM Markets present a mixed picture because of limited public information. While the broker offers access to multiple asset classes and flexible leverage options up to 1:500, the absence of detailed information about account types, minimum deposit requirements, and fee structures creates uncertainty for potential clients. This lack of transparency in basic account parameters represents a significant limitation in evaluating the broker's competitive positioning.

Available information suggests that AM Markets may offer multiple account configurations, but specific details about standard, premium, or professional account tiers remain unspecified. The account opening process and verification requirements are not detailed in accessible materials, making it difficult to assess the efficiency and user-friendliness of the onboarding experience. Special account features such as Islamic accounts for Sharia-compliant trading are not mentioned in available resources.

The regulatory framework under FINTRAC provides some assurance about operational standards, but the absence of detailed account terms and conditions limits the ability to make informed comparisons with other brokers. This am markets review finds that while the regulatory foundation is solid, the lack of transparent account information impacts the overall rating for this category, resulting in an average score that reflects both the regulatory credibility and information limitations.

AM Markets shows strength in its tools and resources offering, mainly through its use of the MetaTrader 4 platform. MT4 gives traders a complete suite of technical analysis tools, automated trading capabilities, and extensive charting options that meet professional trading standards. The platform's reputation for reliability and functionality contributes significantly to the broker's overall value proposition.

The diversity of tradeable assets, including forex pairs, commodities, market indices, stocks, and ETFs, provides traders with extensive opportunities for portfolio diversification and cross-market strategies. This multi-asset approach allows for sophisticated trading approaches and risk management techniques that single-market platforms cannot accommodate. User feedback shows positive reception of the platform's interface design and functionality.

However, specific information about research and analysis resources, educational materials, and market commentary is not detailed in available materials. The absence of information about proprietary research tools, market analysis, or educational content represents a gap in the comprehensive evaluation of the broker's resource offerings. Despite this limitation, the strong foundation provided by MT4 and asset diversity supports a good rating for this category, reflecting the platform's core strengths while acknowledging areas where information remains limited.

Customer Service and Support Analysis (Score: 7/10)

The customer service evaluation for AM Markets is based mainly on general user feedback about the broker's transparent policies and user-friendly approach. While specific details about customer service channels, response times, and support quality are not detailed in available materials, the broker's emphasis on transparency suggests a customer-focused approach to service delivery. The regulatory oversight by FINTRAC implies adherence to professional standards that typically include appropriate customer service protocols and complaint handling procedures.

However, without specific information about available support channels such as live chat, phone support, or email response times, it becomes challenging to provide a comprehensive assessment of service quality and accessibility. User feedback available in various sources suggests generally positive experiences with the broker's policies and operational transparency, indicating that customer interactions may be handled professionally. The absence of detailed negative feedback about customer service in accessible materials suggests adequate service levels, though the lack of specific performance metrics or service feature details prevents a higher rating.

This results in a good rating that reflects the positive indicators while acknowledging the information limitations that prevent a more definitive assessment.

Trading Experience Analysis (Score: 7/10)

The trading experience at AM Markets centers around the MetaTrader 4 platform, which provides a solid foundation for both new and experienced traders. User feedback shows appreciation for the platform's user-friendly interface, which helps smooth navigation and efficient order management. The MT4 platform's proven track record for stability and functionality contributes positively to the overall trading experience.

The availability of leverage up to 1:500 provides traders with flexibility in position sizing and capital utilization, though this also requires appropriate risk management awareness. The multi-asset trading environment allows for diverse trading strategies and portfolio approaches, enhancing the overall trading experience for clients seeking market diversification. However, specific information about order execution quality, platform performance metrics, and mobile trading capabilities is not detailed in available materials.

The absence of concrete data about execution speeds, slippage rates, or platform downtime makes it difficult to assess the technical performance aspects of the trading experience. This am markets review finds that while the fundamental platform infrastructure appears solid based on MT4's reputation and user feedback, the lack of detailed performance information limits the ability to provide a more comprehensive evaluation, resulting in a good rating that reflects both strengths and information gaps.

Trust and Security Analysis (Score: 6/10)

AM Markets' trust and security profile is anchored by its regulation under Canadian FINTRAC, which provides oversight for financial transaction reporting and anti-money laundering compliance. This regulatory framework offers a foundation of credibility and operational oversight that supports client confidence in the broker's legitimacy and operational standards. The broker's emphasis on transparent policies, as indicated in user feedback, suggests a commitment to clear communication and straightforward business practices.

This transparency approach typically correlates with higher levels of client trust and satisfaction, indicating positive intentions regarding client relationships and business conduct. However, detailed information about specific security measures, client fund segregation, investor compensation schemes, or additional regulatory licenses is not available in accessible materials. The absence of information about data protection protocols, cybersecurity measures, or third-party audits represents a significant gap in the comprehensive security assessment.

Additionally, the lack of detailed information about the company's operational history, management team, or industry reputation limits the ability to conduct a thorough trust evaluation, resulting in an average rating that reflects both the regulatory foundation and the information limitations.

User Experience Analysis (Score: 8/10)

The user experience at AM Markets receives positive recognition mainly because of the user-friendly interface design and transparent policy approach that appeals to global traders. Feedback shows that the platform's interface helps easy navigation and efficient trading operations, contributing to overall user satisfaction with the trading environment. The broker's positioning as suitable for global traders suggests an inclusive approach that accommodates diverse user needs and preferences.

The transparency in policies, as noted in user feedback, creates a more comfortable trading environment where clients can understand terms and conditions clearly, reducing uncertainty and enhancing confidence in platform usage. The MetaTrader 4 implementation provides users with a familiar and well-documented trading environment, reducing the learning curve for traders transitioning from other platforms. The platform's extensive customization options and automated trading capabilities enhance the user experience for traders seeking advanced functionality.

However, specific information about the registration process, account verification procedures, funding operations, and common user concerns is not detailed in available materials. The absence of detailed user journey mapping or specific user satisfaction metrics limits the comprehensive evaluation of the overall user experience. Despite these information gaps, the positive feedback about interface design and policy transparency supports a good rating that reflects the platform's user-focused approach while acknowledging areas where more detailed information would enhance the assessment.

Conclusion

This am markets review reveals a forex broker that shows strengths in platform technology and user interface design while facing challenges related to information transparency and detailed service specifications. AM Markets positions itself as a transparent and user-friendly option for global traders seeking access to diverse financial instruments through the reliable MetaTrader 4 platform.

The broker appears most suitable for traders who value multi-asset trading capabilities and prefer the familiar MT4 environment, particularly those who prioritize regulatory oversight and transparent business practices. The availability of high leverage up to 1:500 and diverse asset classes makes it potentially attractive for experienced traders seeking portfolio diversification opportunities. The main advantages include the robust MT4 platform implementation, regulatory oversight by Canadian FINTRAC, user-friendly interface design, and comprehensive asset class availability.

However, significant limitations include the lack of detailed information about fees, account conditions, customer service specifics, and security measures, which may concern traders seeking complete transparency before committing to a platform.