Regarding the legitimacy of AM Markets forex brokers, it provides NBRB and WikiBit, (also has a graphic survey regarding security).

Is AM Markets safe?

Business

License

Is AM Markets markets regulated?

The regulatory license is the strongest proof.

NBRB Forex Trading License (EP)

National Bank of the Republic of Belarus

National Bank of the Republic of Belarus

Current Status:

RevokedLicense Type:

Forex Trading License (EP)

Licensed Entity:

AM Markets Capital Limited Liability Company

Effective Date:

2021-10-01Email Address of Licensed Institution:

info@ammarkets.bySharing Status:

No SharingWebsite of Licensed Institution:

www.ammarkets.byExpiration Time:

--Address of Licensed Institution:

220015, Minsk, Odoevski St. 117, office 19Phone Number of Licensed Institution:

+375296291277Licensed Institution Certified Documents:

Is AM Markets A Scam?

Introduction

AM Markets is a forex and CFD broker that has positioned itself within the competitive landscape of online trading. Established in 2019, it claims to offer a range of financial products, including forex pairs, precious metals, and indices. However, with the proliferation of online trading platforms, traders must exercise caution and perform thorough evaluations before committing their funds. The forex market is rife with both legitimate brokers and scams, making it imperative for traders to assess the credibility, regulatory compliance, and overall safety of any broker they consider. In this article, we will investigate the legitimacy of AM Markets through a comprehensive analysis that includes regulatory status, company background, trading conditions, customer safety, and user experiences.

Regulation and Legality

The regulatory status of a broker is a critical factor in determining its legitimacy. AM Markets claims to be regulated by the National Bank of the Republic of Belarus (NBRB) under license number 193583860. However, many traders question the effectiveness and credibility of this regulation, as it does not carry the same weight as licenses from more recognized regulatory bodies like the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NBRB | 193583860 | Belarus | Verified |

While AM Markets is regulated, the NBRB is often viewed as a less authoritative entity, leading to skepticism among potential clients. Furthermore, there are concerns regarding the lack of transparency in AM Markets' operations and their compliance history. The absence of a robust regulatory framework raises questions about the safety of funds and the recourse available to traders in case of disputes or financial misconduct.

Company Background Investigation

AM Markets is operated by Advanced Management Capital Limited, which is registered in Belarus. The company's history and ownership structure are somewhat obscure, with limited information available about its founders and management team. This lack of transparency can be a red flag for potential investors. A credible broker typically provides detailed information about its team, including their qualifications and experience in the financial industry.

The management team's background is crucial in assessing the trustworthiness of AM Markets. Without clear information regarding the expertise of those running the firm, traders may find it challenging to gauge the broker's reliability. Additionally, the company's website lacks comprehensive disclosures about its operational practices, which further complicates efforts to evaluate its legitimacy.

Trading Conditions Analysis

When considering whether AM Markets is safe, its essential to analyze its trading conditions, including fee structures and spreads. The broker offers a minimum deposit requirement of $100 and claims to provide competitive spreads starting from 1.6 pips for major currency pairs. However, there are concerns about hidden fees that may not be immediately apparent to traders.

| Fee Type | AM Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.6 pips | 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Not Specified | Varies |

AM Markets advertises a commission-free trading model, which can be appealing to new traders. However, the absence of clarity regarding overnight interest rates and other potential charges can lead to unexpected costs. Traders must be vigilant and read the fine print to avoid surprises that could impact their profitability.

Client Fund Safety

The safety of client funds is paramount when evaluating any broker. AM Markets claims to implement measures for fund security, including segregated accounts. However, the effectiveness of these measures is questionable, given the broker's lack of a robust regulatory framework.

Traders should inquire about investor protection schemes and negative balance protection policies. Such measures are critical in safeguarding traders' investments, especially in the volatile forex market. Unfortunately, AM Markets does not provide sufficient information on these aspects, which raises concerns about the safety of funds deposited with them.

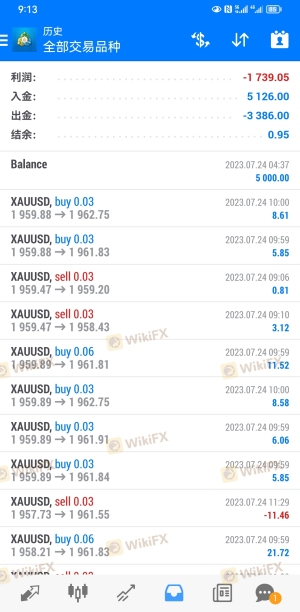

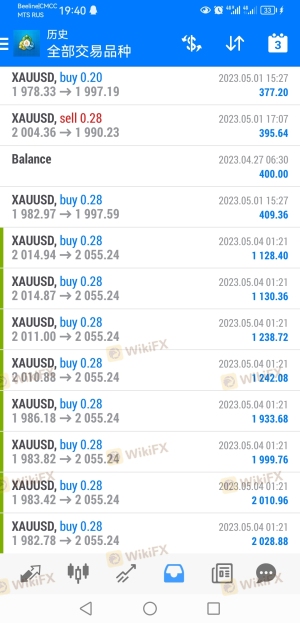

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability. Many users have reported negative experiences with AM Markets, particularly regarding withdrawal difficulties. Common complaints include delayed withdrawals, unresponsive customer service, and issues with account verification.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Difficulties | High | Slow |

| Customer Service Issues | Medium | Unresponsive |

| Account Verification | High | Inconsistent |

Several traders have shared their experiences of being unable to withdraw funds after making profits, leading to suspicions of a scam operation. Such patterns of behavior are concerning and warrant careful consideration by potential clients.

Platform and Trade Execution

The quality of the trading platform and execution is another critical factor in determining whether AM Markets is safe. The broker offers the widely-used MetaTrader 4 platform, known for its user-friendly interface and advanced features. However, issues have been reported regarding order execution quality, including slippage and rejections.

Traders should be aware of the potential for platform manipulation, which can occur if a broker has conflicts of interest. If AM Markets prioritizes its profits over the trader's interests, it could lead to unfair trading conditions.

Risk Assessment

Using AM Markets comes with a range of risks that traders should consider before opening an account.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unreliable regulation |

| Financial Risk | Medium | Potential hidden fees and costs |

| Operational Risk | High | Reports of withdrawal issues |

To mitigate these risks, traders should conduct thorough research and consider using a demo account to test the platform before committing real funds. It's also advisable to limit initial deposits until confidence in the broker's reliability is established.

Conclusion and Recommendations

In conclusion, while AM Markets presents itself as a regulated broker, the evidence suggests that potential clients should exercise caution. The broker's regulatory status, coupled with numerous complaints regarding withdrawal difficulties and a lack of transparency, raises significant concerns about its legitimacy.

For traders seeking a reliable forex broker, it is advisable to consider alternatives that offer more robust regulatory oversight and a solid reputation, such as brokers regulated by the FCA or ASIC. Ultimately, due diligence is essential for ensuring a safe trading experience.

In summary, is AM Markets safe? The answer remains uncertain, and potential clients should weigh the risks carefully before proceeding.

Is AM Markets a scam, or is it legit?

The latest exposure and evaluation content of AM Markets brokers.

AM Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AM Markets latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.