Is We One Limited safe?

Business

License

Is We One Limited Safe or Scam?

Introduction

We One Limited is an online forex broker that has positioned itself within the competitive landscape of the foreign exchange market. With a focus on providing a range of trading assets, it claims to cater to both novice and experienced traders. However, the importance of thoroughly evaluating forex brokers cannot be overstated. Given the prevalence of scams and unregulated entities in the trading industry, traders must exercise due diligence before committing their funds. This article aims to assess the safety and legitimacy of We One Limited by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and associated risks. The insights presented are derived from a comprehensive review of various sources, including user feedback, regulatory data, and industry analysis.

Regulation and Legitimacy

The regulatory status of a forex broker is paramount in determining its safety and reliability. We One Limited operates without substantial regulatory oversight, which raises significant concerns. The broker claims to be registered in Vanuatu but lacks recognition from reputable regulatory bodies. Below is a table summarizing its regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission | 0531950 | Vanuatu | Unverified |

The absence of a credible regulatory framework is a major red flag for potential investors. Legitimate brokers typically display their regulatory licenses prominently, ensuring transparency and accountability. In contrast, We One Limited does not provide clear information regarding its regulatory compliance, which is often indicative of unlicensed brokers. This lack of oversight means that investors' funds are not protected by any legal framework, making it crucial for traders to question the safety of their investments with We One Limited.

Company Background Investigation

We One Limited was founded in 2018 and is registered in Vanuatu. However, the company's history and ownership structure are not well-documented, leading to concerns about transparency. Information regarding the management team and their professional backgrounds is scarce, which raises questions about the company's operational integrity. Transparency in a broker's management is essential, as it reflects the firm's commitment to ethical practices and customer service.

Moreover, the limited information available about We One Limited's operational history and its leadership team hinders an accurate assessment of its credibility. Traders should be wary of brokers with vague or incomplete disclosures, as this can often be an indicator of potential issues down the line. Overall, the lack of historical data and information about the company's leadership creates an environment of uncertainty regarding the legitimacy of We One Limited.

Trading Conditions Analysis

The trading conditions offered by We One Limited are another critical aspect to consider. The broker's fee structure appears to be less competitive compared to industry standards, which may deter potential clients. Below is a comparison of core trading costs:

| Fee Type | We One Limited | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 0.6 pips | 0.2-0.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Moderate |

While We One Limited claims to offer flexible leverage options and a diverse range of trading assets, the higher-than-average spreads and potential hidden fees could significantly impact trading profitability. Traders should be cautious of any unusual fees that may not be clearly outlined, as this can lead to unexpected costs. The overall fee structure suggests that We One Limited may not provide the most favorable trading conditions, which is essential for traders to consider when evaluating the broker's safety.

Client Fund Security

Client fund security is a critical factor in determining a broker's reliability. We One Limited's approach to fund safety raises several concerns. The broker does not provide clear information regarding the segregation of client funds, which is a standard practice among reputable brokers. Segregated accounts ensure that client funds are kept separate from the broker's operating funds, providing an additional layer of protection.

Furthermore, the absence of investor protection schemes, such as those offered by regulatory bodies in more reputable jurisdictions, indicates that traders may be at risk of losing their investments without any recourse. Historical data does not reveal any significant fund security issues with We One Limited; however, the lack of transparency regarding their security measures and policies is concerning. Therefore, potential investors should carefully consider the risks associated with entrusting their funds to We One Limited.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability. Reviews of We One Limited indicate a mixed bag of experiences, with several users reporting difficulties in withdrawing funds and receiving timely customer support. Below is a summary of common complaints:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Support Quality | Medium | Inconsistent |

| Transparency of Fees | Medium | Lacking Clarity |

Many users express frustration over delays in fund withdrawals, which is a significant concern for any trader. The quality of customer support is also frequently mentioned, with reports of slow response times and inadequate assistance. These issues suggest that We One Limited may not prioritize customer service, which can lead to a negative trading experience. Additionally, the lack of transparency surrounding fees contributes to dissatisfaction among clients, further highlighting the need for potential investors to approach this broker with caution.

Platform and Trade Execution

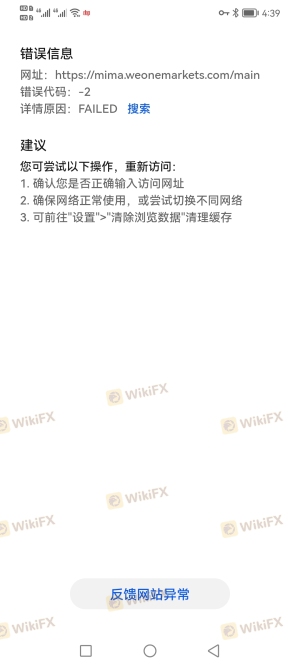

The trading platform offered by We One Limited is another crucial aspect of its overall reliability. The broker provides access to the widely-used MetaTrader 4 platform, which is known for its user-friendly interface and robust trading tools. However, the performance and stability of the platform are essential for ensuring a smooth trading experience. Users have reported instances of slippage and execution delays, which can significantly impact trading outcomes.

Moreover, there are concerns regarding the possibility of platform manipulation, a serious issue that can undermine trust in a broker. The execution quality, including order rejection rates and slippage occurrences, should be closely monitored by traders. A reliable broker should provide transparent information regarding platform performance, enabling traders to make informed decisions. Overall, while We One Limited offers a popular trading platform, the reported issues with execution quality raise questions about its overall safety.

Risk Assessment

Using We One Limited presents several risks that potential traders should carefully evaluate. Below is a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Fund Security Risk | High | Lack of transparency in fund protection measures. |

| Customer Support Risk | Medium | Reports of slow response and inadequate support. |

| Trading Cost Risk | Medium | Higher spreads and potential hidden fees. |

Given the high regulatory and fund security risks, traders should proceed with caution. To mitigate these risks, it is advisable to conduct thorough research, avoid investing large sums initially, and consider using a demo account to test the platform's functionality before committing real funds.

Conclusion and Recommendations

In conclusion, We One Limited raises several red flags that indicate it may not be a safe trading option. The lack of credible regulatory oversight, concerns regarding fund security, and mixed customer feedback suggest that traders should be wary. While the broker offers a range of trading assets and access to a popular trading platform, the overall assessment points towards significant risks associated with trading through We One Limited.

For traders seeking a reliable forex broker, it is advisable to consider alternatives that are regulated by reputable authorities and demonstrate a commitment to transparency and customer support. Brokers with strong regulatory frameworks, positive user reviews, and robust security measures should be prioritized to ensure a safer trading environment. Ultimately, conducting thorough research and exercising caution is essential when evaluating the safety of any forex broker, including We One Limited.

Is We One Limited a scam, or is it legit?

The latest exposure and evaluation content of We One Limited brokers.

We One Limited Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

We One Limited latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.