Oasis Prime Review 1

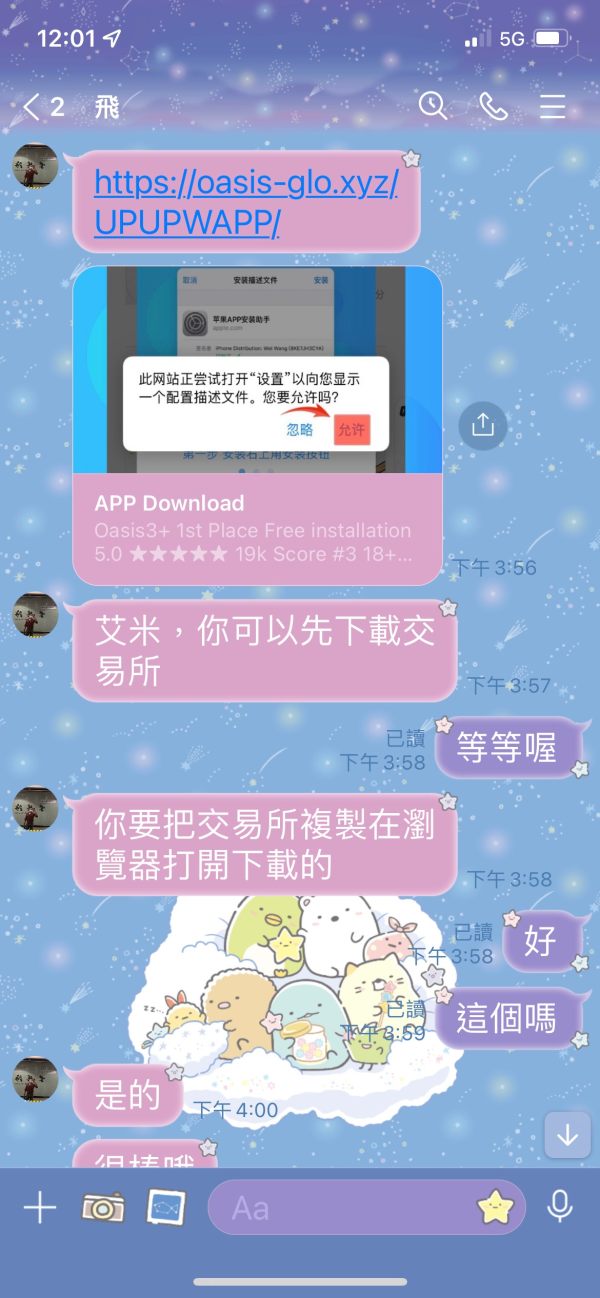

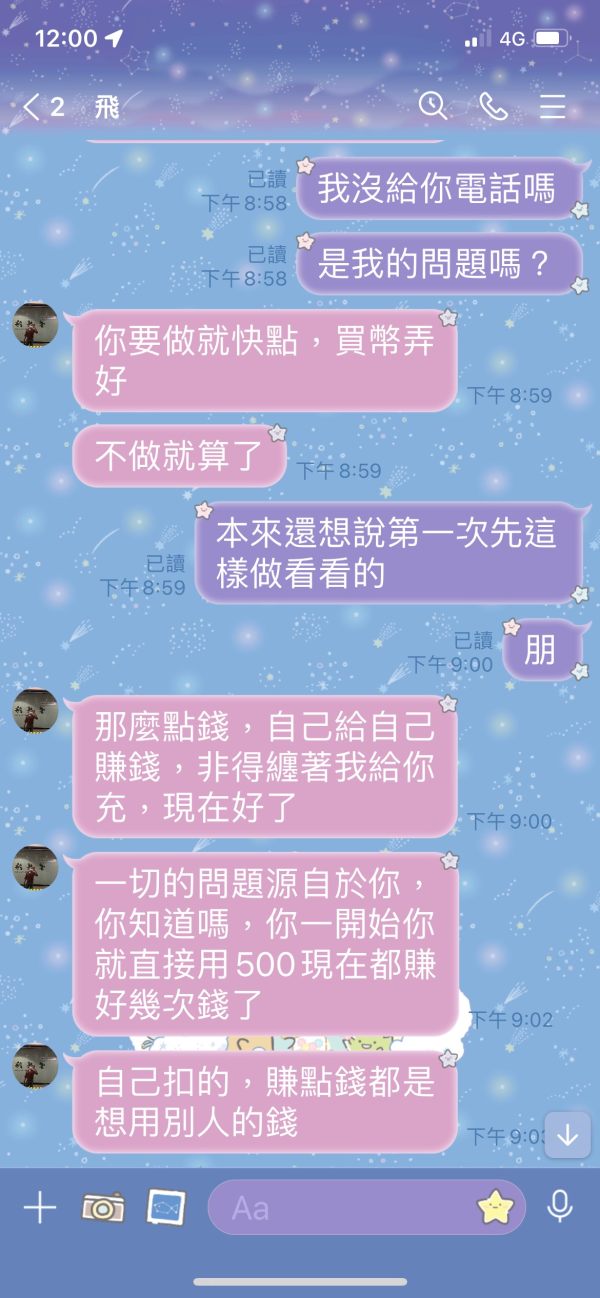

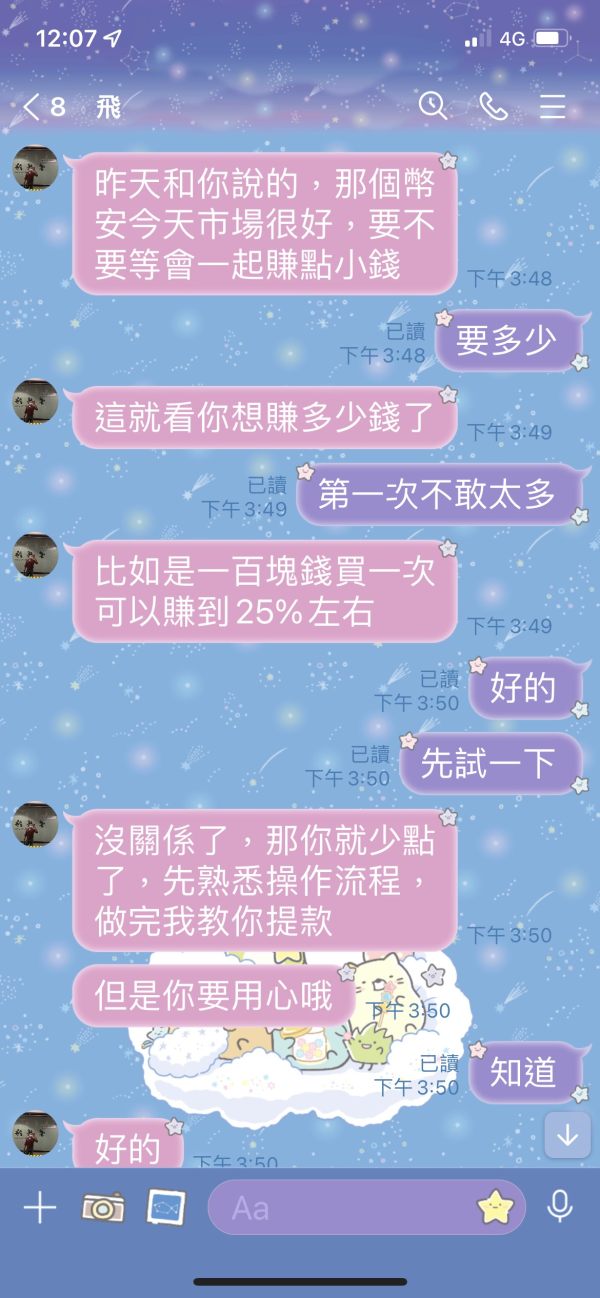

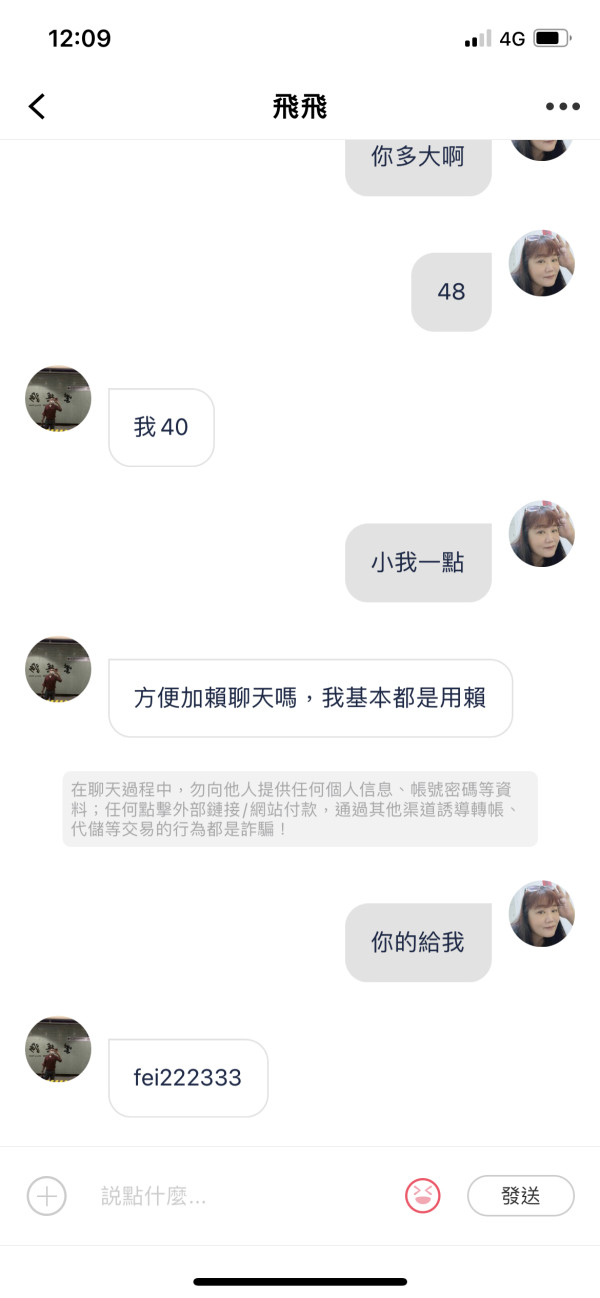

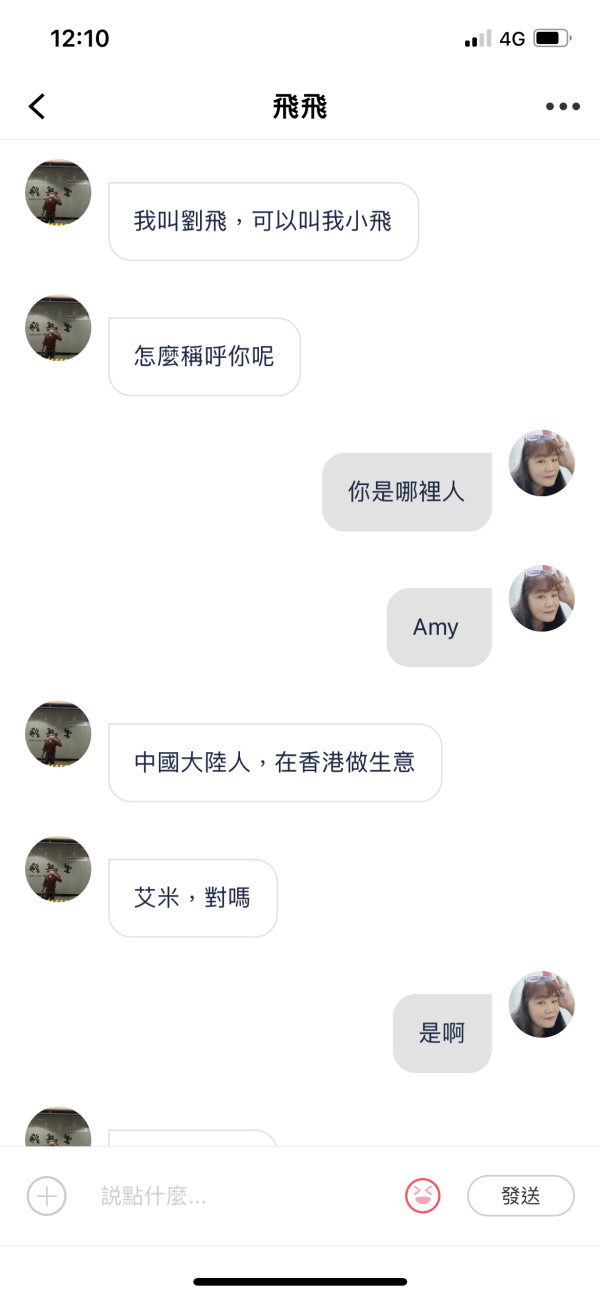

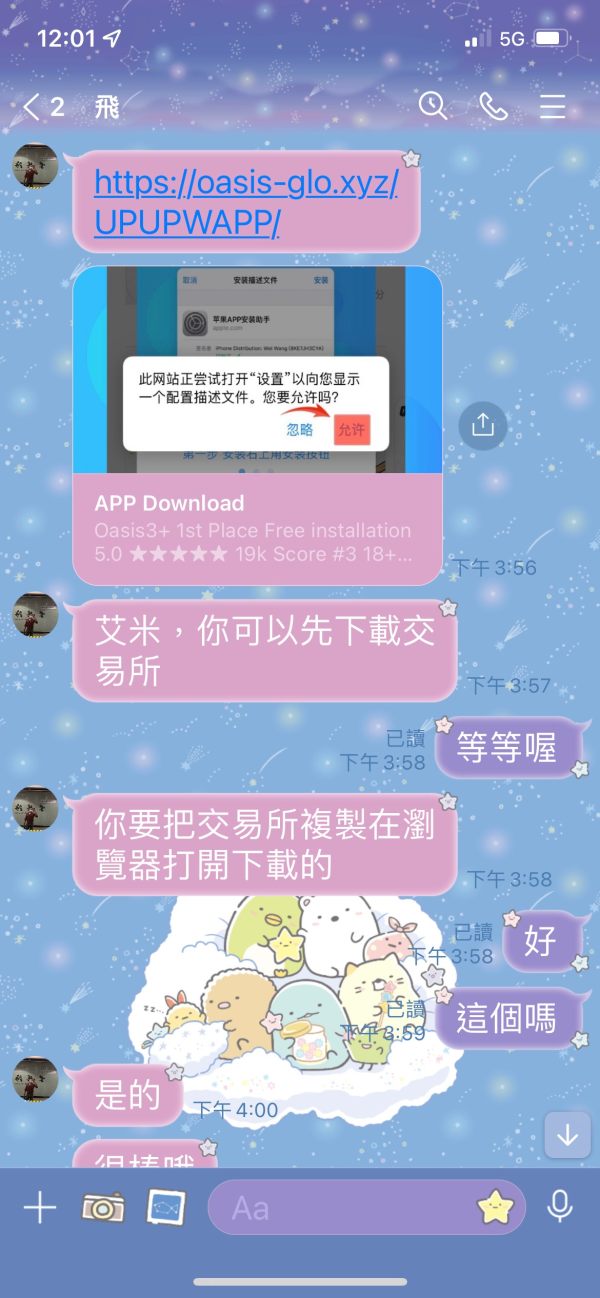

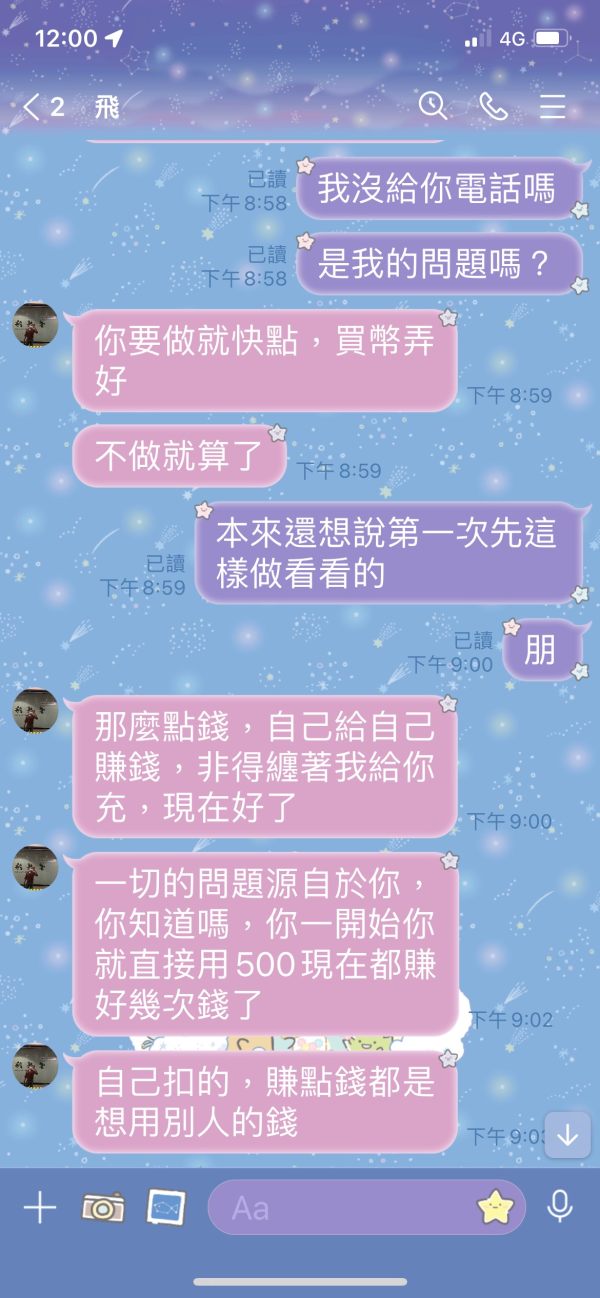

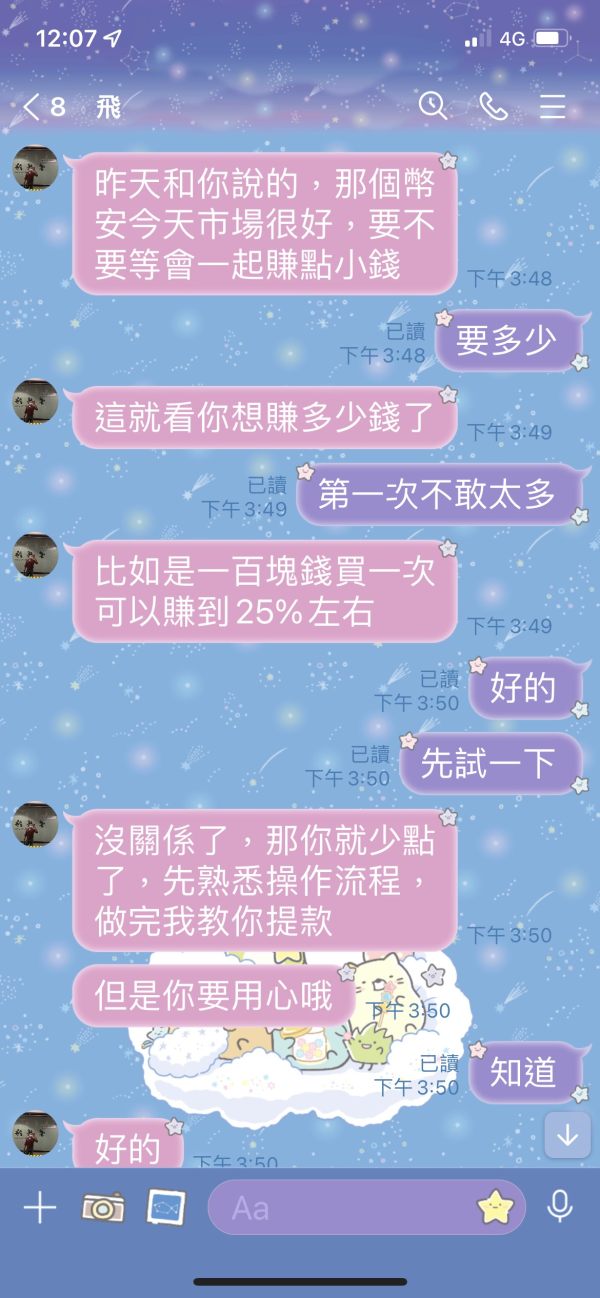

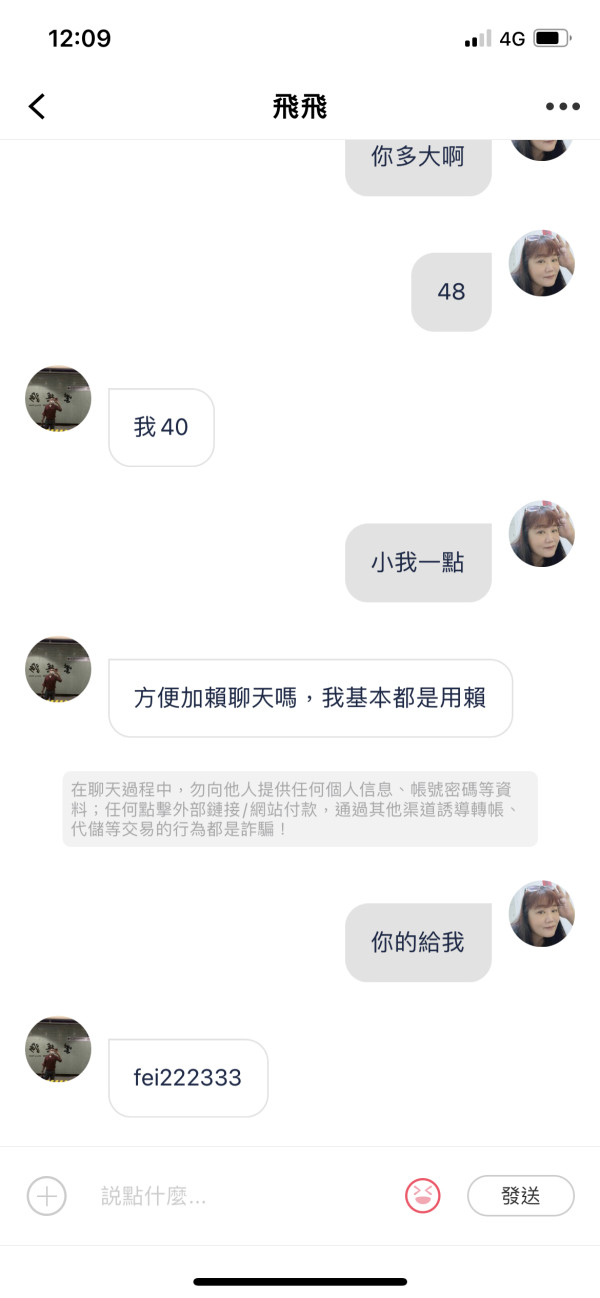

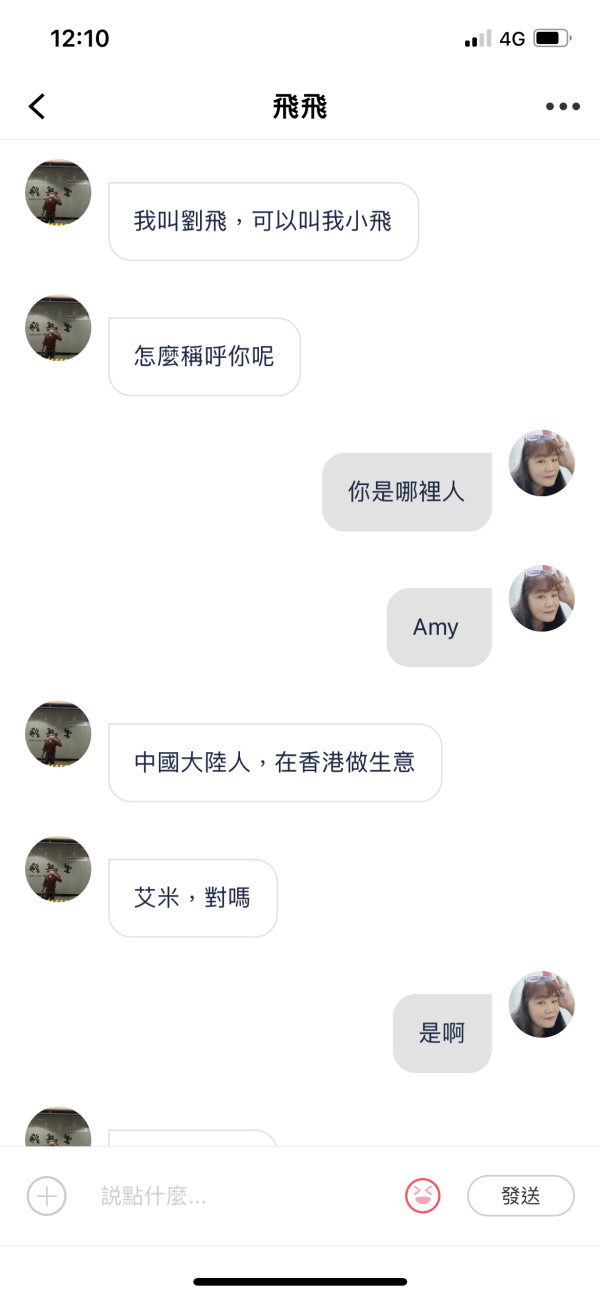

Induce to deposit, but cannot withdraw. They keep asking for deposit. This guy is called Liu Fei. Everyone be careful!

Oasis Prime Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Induce to deposit, but cannot withdraw. They keep asking for deposit. This guy is called Liu Fei. Everyone be careful!

In the ever-evolving world of forex and cryptocurrency trading, brokers abound, each claiming to offer favorable conditions for traders. Oasis Prime positions itself as an accessible option for beginner traders, featuring enticingly low minimum deposits and high leverage. However, lurking beneath this attractive façade are significant risks. Operating as an unregulated offshore broker since at least 2008, Oasis Prime presents a challenging trading environment that can potentially jeopardize investors' funds. The absence of regulatory oversight, coupled with a track record of opaque practices, raises serious questions about the safety of client funds. This review delves into the various aspects of Oasis Prime, illuminating the intricate dynamics that every potential trader should consider before embarking on their trading journey.

Before making any decisions regarding trading with Oasis Prime, it is crucial to consider the following risk signals:

Risk Statement: Engaging with Oasis Prime exposes traders to substantial risk, including the potential loss of funds due to the broker's lack of regulations and transparency.

Step-by-Step Guide for Self-Verification:

| Dimension | Rating (out of 5) | Justification |

|---|---|---|

| Trustworthiness | 1 | Oasis Prime operates without regulation and has a history of negative user feedback. |

| Trading Costs | 2 | While commissions may be low, there are unreported fees affecting overall trading costs. |

| Platforms & Tools | 3 | Offers popular platforms like MT4, but lacks advanced trading tools. |

| User Experience | 2 | Users report difficulties with account management and withdrawal processes. |

| Customer Support | 2 | Limited responsiveness and inadequate support based on user testimonials. |

| Account Conditions | 2 | The zero minimum deposit may attract users, but raises concerns about fund management practices. |

Company Background and Positioning

Oasis Prime has been purportedly active since 2008, operating from St. Vincent and the Grenadines, an offshore jurisdiction notorious for lax regulations. This status presents significant operational challenges and patronizes a perception of insecurity for potential clients. The broker does not have an established regulatory framework governing its operations, further forecasting a convoluted trading environment.

Core Business Overview

Oasis Prime primarily offers access to forex trading and cryptocurrencies, allowing users to trade a variety of currency pairs. The broker provides the notepad standard MetaTrader 4 platform, which includes critical tools for analysis but lacks more sophisticated options that competitive brokers offer. The brokers website claims to provide up to 1:100 leverage, which is considered excessive by many regulatory bodies today. However, with minimal disclosed fees and a lack of segregated accounts for client funds, traders face increased uncertainty regarding the safety of their investments.

| Quick-Look Details | |

|---|---|

| Regulation | None |

| Minimum Deposit | $0 |

| Leverage | Up to 1:100 |

| Major Fees | Unclear (hidden costs possibly existing) |

| Trading Platforms | MetaTrader 4 (MT4) |

| Accepted Deposits | Wire transfers, Bitcoin payments |

Regulatory Information Conflicts

Oasis Prime claims operational longevity yet fails to adhere to the regulatory norms expected of credible brokers. The absence of reputable licenses reinforces suspicions regarding fund security. Users are advised to be skeptical of platforms that boast low entry costs while failing to provide adherent oversight mechanisms.

User Self-Verification Guide

Industry Reputation Summary

“Oasis Prime, an offshore broker, has received critical reviews due to its unregulated status, leading to concerns over fund safety and reliability.” - Forex Brokerz review

Advantages in Commissions

Oasis Prime claims to feature low commissions aimed at attracting beginner traders; however, the lack of transparency raises eyebrows. Potential traders should be wary of the fine print that can complicate cost calculations.

The “Traps” of Non-Trading Fees

Many users have expressed frustration with undisclosed fees, stating:

"I was charged fees I wasnt aware of, making even profitable trades seem unprofitable." - User complaint.

Cost Structure Summary

For beginners, the allure of low commissions is tempting, but the possible hidden costs can undermine profitability, especially for those unfamiliar with the trading landscape.

Platform Diversity

Oasis Prime offers users access to MT4, allowing a comfortable experience for those familiar with its interface. However, the absence of additional platforms diminishes its appeal in an increasingly competitive market.

Quality of Tools and Resources

While MT4 is known for its robust charting capabilities, feedback indicates the broker offers little in terms of educational materials or advanced trading tools, limiting user potential.

Platform Experience Summary

"The interface is standard, offering basic features but lacking in more sophisticated options expected from competitive brokers." - User sentiment.

Onboarding Process

Users generally report a straightforward onboarding process, but many face hurdles as they begin trading, especially with fund withdrawals.

Withdrawal Experience

I had to jump through hoops to withdraw my funds; its as if they wanted me to give up." - User testimony.

Overall Usability Summary

Traction is lost in user experience due to support inefficiencies and the worries tied to withdrawal logistics, leading to dissatisfaction among clients.

Accessibility of Support Channels

Oasis Primes client support has been criticized for being unresponsive, with users noting:

“Support takes ages to respond, and when they do, its often unhelpful.” – User feedback.

Resolution Effectiveness

The effectiveness of customer support to resolve issues is also in question, with many users expressing frustration at their concerns being left unaddressed.

Support Summary

While support channels are available, the responsiveness and effectiveness of customer service remain critical areas needing improvement.

Minimum Deposits and Account Types

Oasis Prime features no minimum deposit, making it appear appealing to novice traders. They have diverse account types but lack competitive advantages compared to regulated brokers.

Risk of High Leverage

Offering leverage of up to 1:100 poses potential risks, especially for inexperienced traders who may not fully understand the implications of leverage on trading performance.

Account Flexibility Summary

While the lack of a minimum deposit is an attractive feature, the implications of unchecked leverage underscore potential dangers to uninformed traders.

Oasis Primes offerings may appear enticing at first glance, especially for emerging traders looking for a low entry point into the forex market. However, the grave concerns surrounding regulatory compliance, transparency in fees, and user experiences present significant red flags for any potential investor. Engaging with such an unregulated broker may lead to a precarious trading journey marked by uncertainties.

When considering platforms for trading, it is paramount to opt for those that are properly licensed and govern their operations with transparency and integrity. As the financial space is filled with pitfalls, ensuring that your trading partner prioritizes client safety over profit should remain a cornerstone of an informed trading strategy.

FX Broker Capital Trading Markets Review