Is MegaMillion safe?

Business

License

Is Megamillion Safe or Scam?

Introduction

Megamillion is a forex broker that has recently gained attention in the trading community. Positioned as a platform that offers a variety of trading instruments, including forex, commodities, and cryptocurrencies, Megamillion aims to cater to both novice and experienced traders. However, with the rise in popularity of online trading platforms, it has become increasingly important for traders to carefully evaluate the legitimacy and safety of these brokers. This article aims to assess whether Megamillion is a scam or a safe trading option. Our investigation is based on a thorough analysis of the brokers regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

The regulatory status of a broker is paramount in determining its legitimacy and safety. A well-regulated broker is typically subject to stringent oversight, which enhances the protection of traders' funds. In the case of Megamillion, there appears to be a lack of valid regulatory information. According to various sources, Megamillion operates without any recognized licenses, raising significant concerns regarding its credibility.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Not Applicable | N/A | N/A | Not Verified |

The absence of regulatory oversight from reputable authorities such as the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the US indicates that Megamillion may not adhere to industry standards. This lack of regulation is a red flag for potential traders, as it implies a higher risk of fraudulent activities or mismanagement of funds. Historical compliance records show that brokers without regulatory oversight often face allegations of scams and misconduct. Therefore, it is crucial for traders to be cautious and consider these factors when evaluating whether Megamillion is safe or a scam.

Company Background Investigation

Understanding the companys history and ownership structure is essential in assessing the credibility of a broker. Megamillion does not provide comprehensive information about its establishment, ownership, or operational history, which raises questions about its transparency. A legitimate broker typically shares details about its founding, mission, and management team to build trust with potential clients.

The lack of information regarding the management teams background and professional experience is concerning. A strong management team with relevant industry experience is often indicative of a broker's reliability. Furthermore, without transparency in its operations, it becomes challenging for traders to hold the broker accountable in case of disputes or issues.

In summary, the limited information available about Megamillions company background and management suggests a lack of transparency, which is a crucial element for any trader considering whether Megamillion is safe or a scam.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience and profitability. Megamillion claims to provide competitive spreads and various trading accounts. However, the absence of detailed information on its fee structure raises concerns.

| Fee Type | Megamillion | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | $0-$10 per lot |

| Overnight Interest Range | N/A | Varies |

Without clear information on spreads, commissions, and overnight fees, traders may face unexpected costs that could erode their profits. Additionally, the lack of transparency regarding any unusual or problematic fee policies is alarming. Traders should be wary of hidden fees that are not disclosed upfront, as these can lead to significant financial losses.

In conclusion, the ambiguous trading conditions presented by Megamillion further contribute to the uncertainty surrounding its legitimacy. It is essential for traders to scrutinize the fee structure and ensure they fully understand the costs associated with trading on the platform before deciding whether Megamillion is safe or a scam.

Client Fund Safety

The safety of client funds is a critical aspect of any trading platform. Reputable brokers implement robust measures to ensure the protection of their clients' funds, including segregating client accounts and offering investor protection schemes. However, there is little information available regarding Megamillion's fund safety measures.

A thorough analysis of Megamillion's policies regarding fund segregation, investor protection, and negative balance protection is necessary. Without these safeguards, traders risk losing their funds in the event of the broker's insolvency or mismanagement. Furthermore, any historical issues related to fund safety or disputes can serve as indicators of the broker's reliability.

In summary, the lack of clarity surrounding Megamillion's client fund safety measures raises significant concerns. Traders should prioritize platforms that offer comprehensive protection for their funds to ensure their investments are secure.

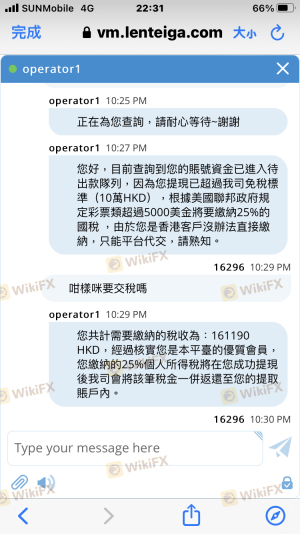

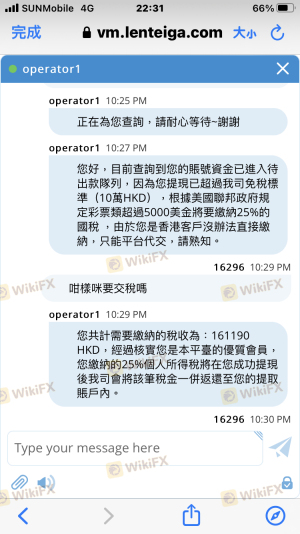

Client Experience and Complaints

Customer feedback is a valuable resource for assessing the reliability of a broker. Analyzing user experiences can provide insights into the quality of service, responsiveness, and overall satisfaction. In the case of Megamillion, there are several reports of client complaints regarding withdrawal issues and unresponsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Support Issues | Medium | Poor |

| Misleading Information | High | Unresolved |

The severity of these complaints indicates a pattern of dissatisfaction among clients, which is a significant warning sign for potential traders. A broker that fails to address customer concerns effectively may not be trustworthy. Typical cases include clients reporting difficulties in withdrawing their funds or receiving inadequate support when issues arise.

By examining these complaints, it becomes evident that Megamillion may not prioritize customer satisfaction, further contributing to the skepticism surrounding its safety. Traders must consider these factors when evaluating whether Megamillion is safe or a scam.

Platform and Execution

The performance and stability of a trading platform are crucial for ensuring a smooth trading experience. Traders expect reliable execution, minimal slippage, and a user-friendly interface. However, there have been reports of execution issues and platform instability associated with Megamillion.

In addition to performance concerns, any indications of potential platform manipulation should be investigated thoroughly. If a broker engages in practices that compromise trade execution quality, it raises serious ethical concerns.

In conclusion, the mixed reviews regarding platform performance and execution quality add to the uncertainty surrounding Megamillion. Traders should seek platforms with a proven track record of reliable execution and positive user experiences to mitigate risks.

Risk Assessment

Using Megamillion as a trading platform presents several risks that potential traders should be aware of.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of regulation increases fraud risk. |

| Fund Safety Risk | High | Unclear fund protection measures. |

| Execution Risk | Medium | Reports of execution issues and slippage. |

| Customer Support Risk | High | Poor response to client complaints. |

Given these risks, it is crucial for traders to implement risk mitigation strategies. This includes conducting thorough research on the broker, utilizing demo accounts to test the platform, and being cautious with the amount of capital invested.

Conclusion and Recommendations

In conclusion, the evidence gathered raises significant concerns regarding the safety and legitimacy of Megamillion. The lack of regulatory oversight, transparency in company operations, ambiguous trading conditions, and numerous client complaints suggest that Megamillion may not be a safe trading option.

For traders seeking reliable platforms, it is advisable to consider alternatives that are well-regulated and have positive reputations in the trading community. Brokers such as [insert reputable brokers here] offer safer trading environments with comprehensive protection for client funds.

In summary, while some may still consider using Megamillion, it is crucial to approach with caution and weigh the potential risks involved. The question of "Is Megamillion safe?" leans toward skepticism, and traders should prioritize their financial safety above all else.

Is MegaMillion a scam, or is it legit?

The latest exposure and evaluation content of MegaMillion brokers.

MegaMillion Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MegaMillion latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.