Is Morning Sky safe?

Pros

Cons

Is Morning Sky Safe or Scam?

Introduction

In the ever-evolving world of forex trading, brokers play a crucial role in facilitating transactions and providing traders with the necessary tools to succeed. Morning Sky is one such broker that has emerged in recent years, claiming to offer a diverse range of trading instruments and a user-friendly platform. However, the question remains: Is Morning Sky safe or a scam? This article aims to provide a comprehensive analysis of Morning Sky by evaluating its regulatory status, company background, trading conditions, customer safety measures, and user experiences. By examining these aspects, traders can make informed decisions about whether to engage with this broker.

The forex market is rife with potential pitfalls, and traders must exercise caution when selecting a broker. An unregulated or poorly regulated broker can expose traders to significant risks, including the loss of funds and lack of recourse in the event of disputes. Therefore, it is essential to conduct thorough research before committing any capital. This investigation will utilize data from various reputable sources, including regulatory bodies and user reviews, to assess the legitimacy and reliability of Morning Sky.

Regulation and Legitimacy

One of the most critical factors to consider when evaluating a forex broker is its regulatory status. Regulatory bodies are responsible for overseeing brokers' activities and ensuring they adhere to specific standards designed to protect traders. In the case of Morning Sky, the broker claims to be registered with the National Futures Association (NFA) in the United States. However, upon further investigation, it becomes evident that this claim is misleading as the license is unauthorized.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0544940 | United States | Unauthorized |

The lack of valid regulation raises significant concerns about Morning Sky's legitimacy. Without proper oversight, traders have no assurance that their funds are safe or that the broker operates transparently. Moreover, the absence of a regulatory framework can lead to potential fraudulent activities, making it imperative for traders to be cautious.

Company Background Investigation

Understanding the background of a broker is essential in assessing its reliability. Morning Sky is reportedly based in the United Kingdom, with its headquarters located at 64a Cumberland St, Edinburgh. However, the broker's operational history is relatively short, having been active for only 2-5 years. This limited experience may not inspire confidence among potential clients.

The management team behind Morning Sky is another critical aspect to consider. Information regarding the qualifications and expertise of the management team is scarce, which raises questions about the broker's operational integrity. Transparency in ownership and management is vital for building trust with clients. Unfortunately, the lack of information on these fronts makes it difficult to evaluate the broker's credibility adequately.

Trading Conditions Analysis

When assessing a broker's suitability, it is essential to examine its trading conditions, including fees and spreads. Morning Sky offers a minimum deposit of $50, which is relatively low compared to industry standards. However, traders should be wary of any hidden fees that may not be immediately apparent.

| Fee Type | Morning Sky | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.5 pips | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | N/A | Varies |

While the spreads offered by Morning Sky appear competitive, the absence of a clear commission structure could indicate hidden costs that may arise during trading. Traders should be vigilant in reading the fine print to avoid unexpected charges.

Customer Funds Safety

The security of customer funds is paramount when evaluating a broker's trustworthiness. Morning Sky's website lacks detailed information about its fund safety measures, such as fund segregation and investor protection policies. This absence of information is concerning, as it leaves traders uncertain about how their funds are handled.

Additionally, there are no indications that Morning Sky offers negative balance protection, which can leave traders vulnerable to significant losses. The historical lack of transparency regarding fund safety measures raises red flags about the broker's reliability and commitment to safeguarding clients' investments.

Customer Experience and Complaints

Analyzing customer feedback is crucial in gauging a broker's performance and reliability. Reports about Morning Sky indicate a mix of experiences, with several users expressing concerns about withdrawal issues and the overall reliability of the platform.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Unresponsive Support | Medium | Average |

| Trading Platform Glitches | High | Poor |

Several users have reported difficulties in withdrawing their funds, which is a significant concern for any trader. Additionally, the lack of responsive customer support further exacerbates the issue, as clients may find themselves unable to resolve their concerns in a timely manner.

Platform and Trade Execution

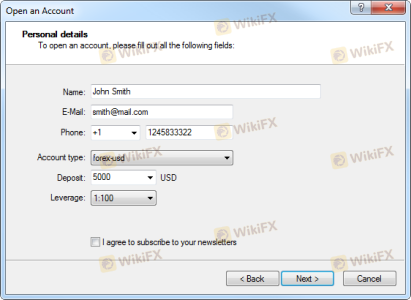

The trading platform offered by Morning Sky is MetaTrader 4 (MT4), a widely used platform known for its robust features and user-friendly interface. However, the overall performance of the platform, including order execution quality and slippage rates, remains a critical concern for traders.

Users have reported instances of slippage during high volatility, which can significantly impact trading outcomes. The absence of transparent information regarding execution quality and potential manipulation raises questions about the broker's operational integrity.

Risk Assessment

Engaging with Morning Sky entails various risks that traders must consider. The combination of unregulated status, withdrawal issues, and lack of transparency creates a precarious trading environment.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Fund Safety Risk | High | Lack of information on fund protection |

| Customer Service Risk | Medium | Reports of poor support and withdrawal issues |

To mitigate these risks, traders should consider using a demo account to test the platform's functionality before committing real funds. Additionally, diversifying investments and avoiding high leverage can help manage potential losses.

Conclusion and Recommendations

In conclusion, the evidence suggests that Morning Sky is not a safe trading option. The lack of valid regulation, coupled with numerous complaints regarding fund withdrawals and customer support, raises significant concerns about the broker's integrity. Traders should exercise extreme caution and consider alternative options that offer a higher level of regulatory oversight and customer protection.

For those seeking reliable forex brokers, consider reputable alternatives such as IronFX or Windsor Brokers, which are known for their robust regulatory frameworks and positive user experiences. Ultimately, making informed decisions is crucial in navigating the complexities of the forex market.

Is Morning Sky a scam, or is it legit?

The latest exposure and evaluation content of Morning Sky brokers.

Morning Sky Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Morning Sky latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.