Is PAXOS safe?

Pros

Cons

Is Paxos Safe or Scam?

Introduction

Paxos is a financial technology company that positions itself within the cryptocurrency and blockchain sectors, offering services such as crypto brokerage, stablecoin issuance, and asset tokenization. Founded in 2012 and headquartered in New York, Paxos aims to bridge the gap between traditional finance and the emerging digital asset economy. Given the volatile nature of the forex and cryptocurrency markets, it is crucial for traders to carefully evaluate the legitimacy and safety of their chosen brokers. This article investigates whether Paxos is a trustworthy trading platform or a potential scam by examining its regulatory status, company background, trading conditions, customer experience, and overall risk profile.

Regulation and Legitimacy

The regulatory environment surrounding financial service providers is essential for ensuring the safety of customer funds and maintaining market integrity. Paxos claims to operate under the oversight of the New York State Department of Financial Services (NYDFS), which is a significant regulatory body in the U.S. However, the absence of a broader regulatory framework can raise questions about the company's compliance and operational practices.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| NYDFS | N/A | New York, USA | Verified |

While Paxos is recognized as a regulated trust company, concerns have been raised regarding its compliance with various regulatory requirements. Some reports indicate that Paxos has faced scrutiny due to a lack of transparency in its operations and the nature of its services. The regulatory quality is crucial, as licensed brokers must adhere to strict guidelines designed to protect investors. Furthermore, historical compliance issues can indicate potential risks for traders.

Company Background Investigation

Paxos was founded by Charles Cascarilla and Rich Teo, who sought to create a regulated environment for digital asset transactions. Initially launched as the bitcoin exchange ItBit, the company rebranded to Paxos Trust Company in 2015, securing a trust charter from the NYDFS. This transition marked a significant milestone in its journey, allowing it to offer a wider range of financial services.

The management team at Paxos is composed of experienced professionals from both the financial and technology sectors, which adds credibility to the company. The founders and executives have backgrounds in finance, technology, and regulatory compliance, which is critical for a company operating in the highly regulated financial landscape. However, while Paxos has made strides in transparency, it still faces challenges related to information disclosure and customer communication.

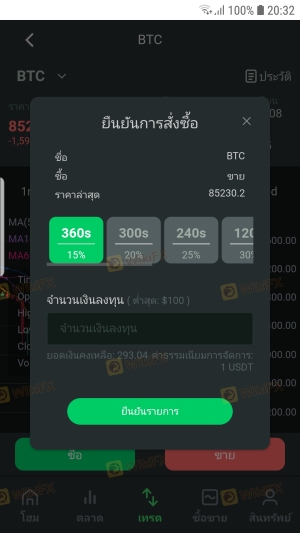

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for assessing its attractiveness and overall safety. Paxos provides various trading services, including cryptocurrency trading and stablecoin transactions. However, the fee structure and trading conditions can significantly impact the trading experience.

| Fee Type | Paxos | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Model | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

Paxos's fee structure has been a point of contention among users, with some reports highlighting hidden fees and unfavorable trading conditions. The lack of clarity regarding commissions and spreads can lead to frustration and mistrust among traders. Moreover, any unusual fees or practices can be red flags for potential scams, making it essential for traders to scrutinize the costs associated with trading on the platform.

Customer Funds Security

The security of customer funds is paramount in the forex and cryptocurrency markets. Paxos claims to implement various measures to safeguard client assets, including fund segregation and adherence to regulatory standards. The company states that customer assets are kept separate from its corporate funds, which is a fundamental practice in protecting investors.

However, historical controversies surrounding Paxos's security measures have raised concerns. Users have reported issues with fund withdrawals and customer service responsiveness, which can exacerbate fears regarding the safety of their investments. Furthermore, the lack of a comprehensive investor protection scheme may leave traders vulnerable in the event of a financial dispute.

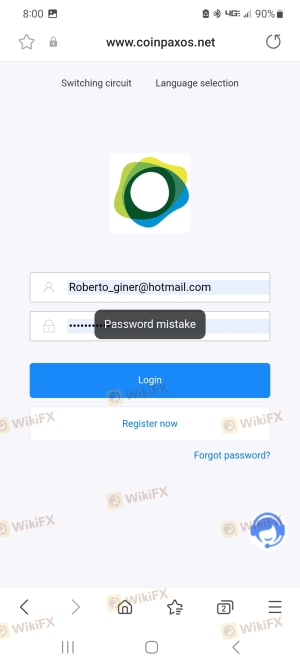

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing the reliability of any trading platform. Many traders have shared their experiences with Paxos, revealing a mixed bag of satisfaction and dissatisfaction. Common complaints include delays in fund withdrawals, unresponsive customer service, and a lack of transparency regarding fees.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Service Issues | Medium | Fair |

Several users have reported significant challenges when attempting to withdraw funds, leading to frustration and claims of potential scams. In some instances, users have described their experiences as "nightmarish," indicating a serious disconnect between the company's promises and actual service delivery. These complaints serve as a cautionary tale for prospective traders considering whether Paxos is safe.

Platform and Trade Execution

The performance of a trading platform directly affects the user experience and can influence traders' decisions. Paxos provides a digital asset exchange platform, which is designed to facilitate smooth transactions and efficient trade execution. However, reports of slippage and order rejections have surfaced, raising concerns about the platform's reliability.

Users have expressed dissatisfaction with the execution quality, citing instances of delayed order processing and unexpected slippage during volatile market conditions. Such issues can be detrimental to traders, particularly in fast-moving markets where timing is critical. Furthermore, any potential signs of platform manipulation can be alarming and warrant further investigation into Paxos's operational integrity.

Risk Assessment

Before engaging with any trading platform, it is essential to understand the associated risks. Paxos presents certain risks that traders should be aware of, particularly regarding its regulatory status and customer service challenges.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Unclear status and historical issues |

| Customer Service | Medium | Poor responsiveness to complaints |

| Fund Security | High | Concerns regarding fund segregation |

To mitigate risks, traders should conduct thorough due diligence before investing with Paxos. This includes reviewing customer feedback, understanding the fee structure, and assessing the company's regulatory compliance. Additionally, diversifying investments across multiple platforms can help reduce exposure to potential losses.

Conclusion and Recommendations

In conclusion, the investigation into Paxos reveals a complex picture. While the company operates under the oversight of the NYDFS and offers various financial services, significant concerns about its regulatory compliance, customer service, and fund security persist. The mixed customer feedback and historical challenges suggest that traders should approach Paxos with caution.

For those considering trading with Paxos, it is advisable to weigh the potential risks against the benefits carefully. Traders seeking a more secure environment may want to explore alternative platforms with robust regulatory oversight and a proven track record of customer service. As always, thorough research and vigilance are key to navigating the complexities of the forex and cryptocurrency markets.

Is PAXOS a scam, or is it legit?

The latest exposure and evaluation content of PAXOS brokers.

PAXOS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PAXOS latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.