Wisdom 2025 Review: Everything You Need to Know

Executive Summary

This wisdom review looks at a broker that has gotten a lot of attention in online trading communities. However, most of this attention isn't positive, and there are serious reasons to be concerned about this company's operations and legitimacy. Based on information from multiple sources, Wisdom appears to be operating under questionable circumstances that raise serious concerns about trader safety and legitimacy.

Financial review platforms have issued warnings about Wisdom Finance, flagging it as a potentially fraudulent operation. The broker's website (fxwisdom.com) and related companies have been subject to scam alerts from multiple industry watchdogs who monitor suspicious trading operations. The lack of proper regulatory oversight, combined with numerous red flags identified by financial analysts, suggests this platform may not provide the secure trading environment that retail and institutional traders require.

This comprehensive review aims to provide traders with essential information about Wisdom's operations, regulatory status, and overall trustworthiness. Given the serious concerns raised by industry experts and user reports, potential clients should exercise extreme caution when considering this broker for their trading activities.

Important Disclaimer

This review is based on publicly available information and user reports found across various financial platforms and regulatory databases. Different regional entities may operate under varying regulatory frameworks, so traders should verify current regulatory status independently before making any financial commitments.

Our evaluation methodology incorporates data from regulatory bodies, user feedback platforms, industry analysis reports, and official broker documentation where available. However, the limited reliable information available about Wisdom's operations significantly impacts the comprehensiveness of this assessment.

Broker Rating Framework

Broker Overview

Wisdom Finance presents itself as a trading platform, though establishing accurate information about its founding date, corporate structure, and legitimate business operations proves extremely challenging. The broker's website and promotional materials lack the transparency typically expected from regulated financial service providers.

Scam alert databases and financial watchdog reports indicate that Wisdom operates without proper regulatory authorization in major financial jurisdictions. The company's business model appears to focus on attracting deposits from unsuspecting traders rather than providing legitimate trading services, which is a major red flag for potential clients. This wisdom review reveals significant gaps in basic corporate information that licensed brokers typically provide transparently.

The platform's claimed trading services span multiple asset classes, though verification of actual trading capabilities remains impossible due to the broker's questionable operational status. Unlike established brokers that maintain clear regulatory relationships with authorities like the FCA, ASIC, or CySEC, Wisdom's regulatory standing remains unclear or non-existent, which should concern any serious trader.

Industry analysts have noted that Wisdom's operational patterns align more closely with fraudulent schemes than legitimate brokerage operations. This raises serious questions about the safety of client funds and the authenticity of trading services offered.

Regulatory Status: Available information suggests Wisdom operates without legitimate regulatory oversight from recognized financial authorities. No valid licensing information has been verified through official regulatory databases, which is a critical concern for trader safety.

Deposit and Withdrawal Methods: Specific payment methods remain undocumented in reliable sources, though scam reports suggest limited withdrawal options once deposits are made. This pattern is common among fraudulent brokers who make it easy to deposit but difficult to withdraw funds.

Minimum Deposit Requirements: Exact minimum deposit amounts are not clearly specified in available materials, which itself represents a red flag for potential traders. Legitimate brokers typically provide clear information about minimum deposit requirements and account structures.

Bonus and Promotions: Promotional offers, if any, are not documented in legitimate financial review sources, though fraudulent brokers often use unrealistic bonus schemes to attract victims. Traders should be wary of brokers that cannot provide clear information about their promotional terms and conditions.

Available Trading Assets: While the broker may claim to offer various trading instruments, verification of actual asset availability and trading execution remains impossible due to the platform's questionable status. This makes it difficult for traders to assess whether they can actually trade the instruments they're interested in.

Cost Structure: Trading costs, spreads, and commission structures are not transparently disclosed in verifiable sources, making cost comparison with legitimate brokers impossible. Transparent pricing is a hallmark of legitimate brokers, and its absence is concerning.

Leverage Options: Leverage ratios offered by Wisdom are not clearly documented in reliable sources, raising concerns about risk management and regulatory compliance. Proper leverage disclosure is required by most financial regulators and is essential for trader safety.

Platform Options: Trading platform availability and functionality cannot be verified through independent sources, as most analysis focuses on the broker's legitimacy concerns rather than technical features. This makes it impossible to assess whether the broker actually provides functional trading platforms.

Geographic Restrictions: Specific country restrictions are not clearly documented, though this wisdom review notes that the broker's questionable status makes geographic availability largely irrelevant for safety-conscious traders. Legitimate brokers typically provide clear information about where they can legally operate.

Customer Support Languages: Available support languages and communication channels are not reliably documented in legitimate review sources. This lack of transparency extends to basic customer service information that legitimate brokers readily provide.

Detailed Rating Analysis

Account Conditions Analysis (Score: 1/10)

The account conditions offered by Wisdom cannot be properly evaluated due to the fundamental concerns about the broker's legitimacy and operational status. Unlike regulated brokers that provide clear documentation about account types, minimum deposits, and trading conditions, Wisdom's account structure remains largely opaque, which should concern potential traders.

Reports from financial watchdog organizations indicate that the broker's account opening process may be designed to collect personal and financial information rather than establish legitimate trading relationships. The absence of proper regulatory oversight means that standard account protections, such as negative balance protection or segregated client funds, are likely unavailable, putting trader funds at significant risk.

This wisdom review finds that potential traders cannot access reliable information about account features, trading conditions, or client protections that would typically be available from licensed brokers. The lack of transparency in account conditions represents a significant red flag that aligns with patterns observed in fraudulent trading operations rather than legitimate business practices.

Industry experts consistently recommend avoiding brokers that cannot provide clear, verifiable information about their account structures and client protection measures. Wisdom's opaque approach is particularly concerning for potential traders who need to understand the terms and conditions of their trading accounts.

Verification of trading tools and educational resources provided by Wisdom proves impossible due to the broker's questionable operational status and lack of legitimate platform access. Regulated brokers typically offer comprehensive trading platforms, market analysis tools, and educational materials that can be independently verified and tested by potential clients.

The absence of verifiable trading tools raises serious questions about the broker's ability to provide actual trading services. Legitimate brokers invest significantly in platform development, market data feeds, and analytical tools to support client trading activities, none of which can be confirmed for Wisdom's operations, which suggests they may not be providing real trading services.

Educational resources, research capabilities, and automated trading support cannot be assessed due to the fundamental concerns about the broker's legitimacy. Industry standards require brokers to provide transparent access to their platform features and educational materials, which Wisdom fails to deliver to potential clients.

Financial experts note that the lack of verifiable trading infrastructure often indicates that a broker may not be providing actual market access. Instead, they may be operating as a scheme designed to collect deposits without delivering promised services.

Customer Service and Support Analysis (Score: 1/10)

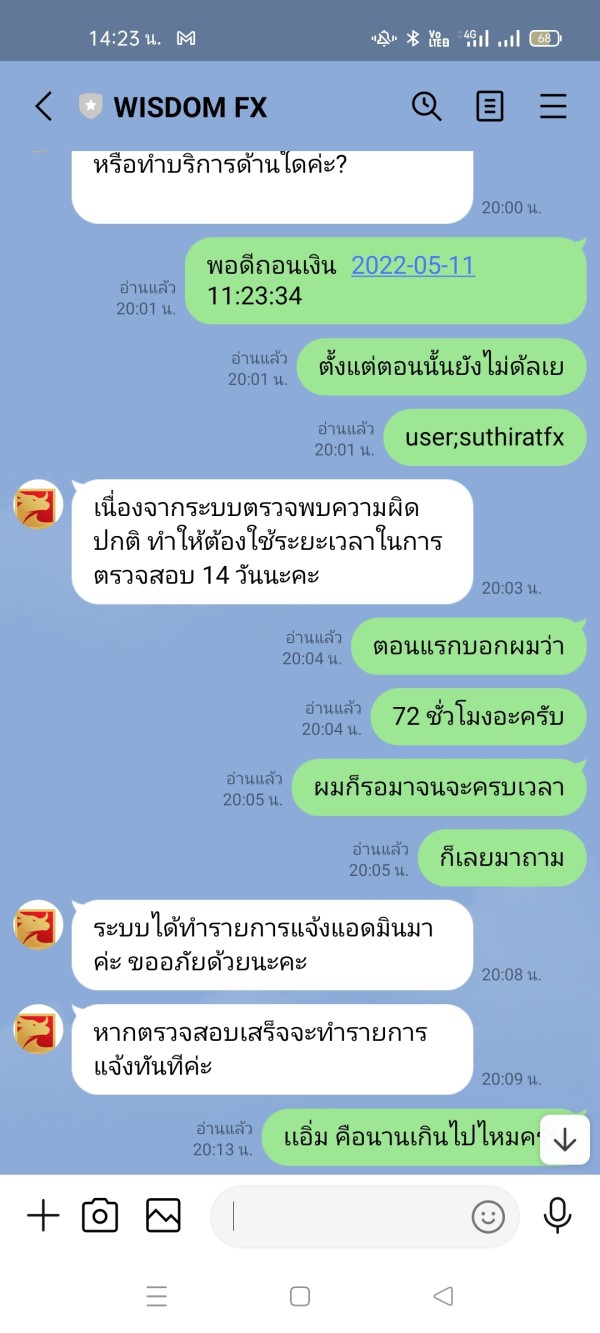

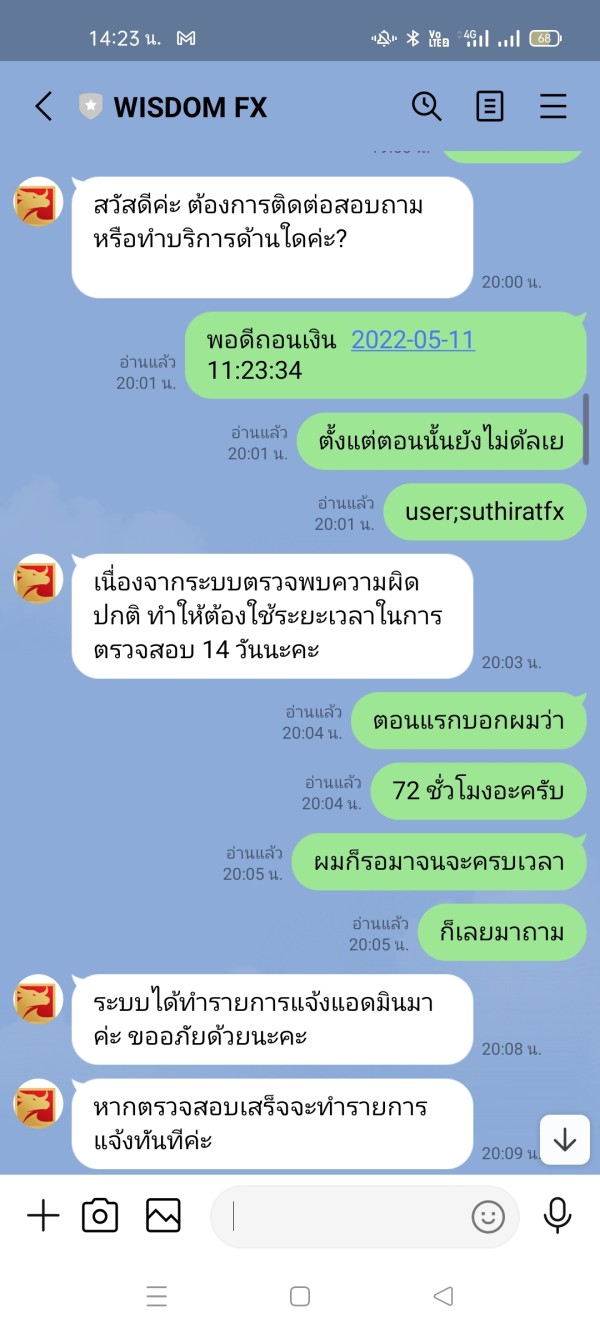

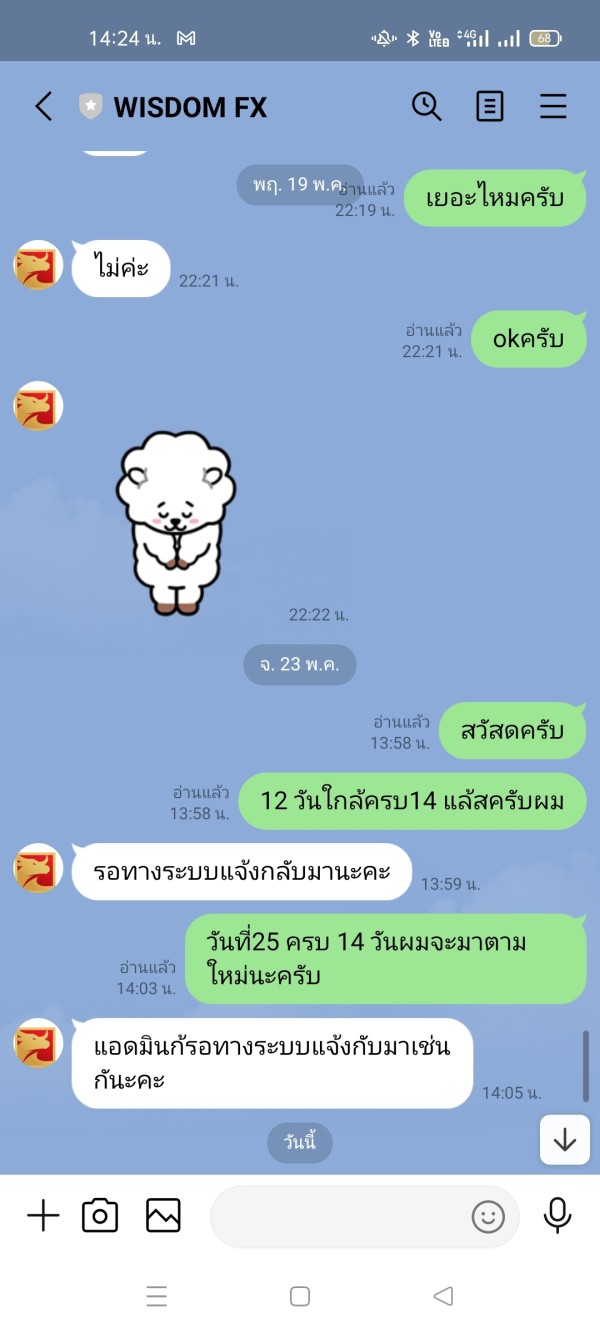

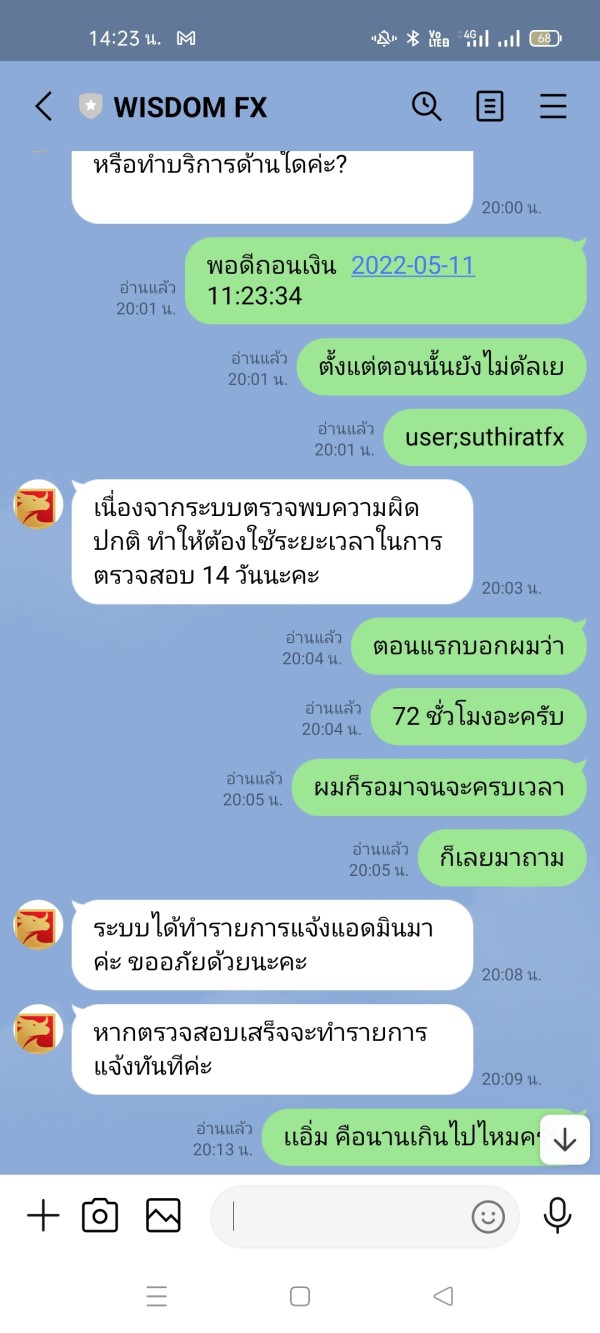

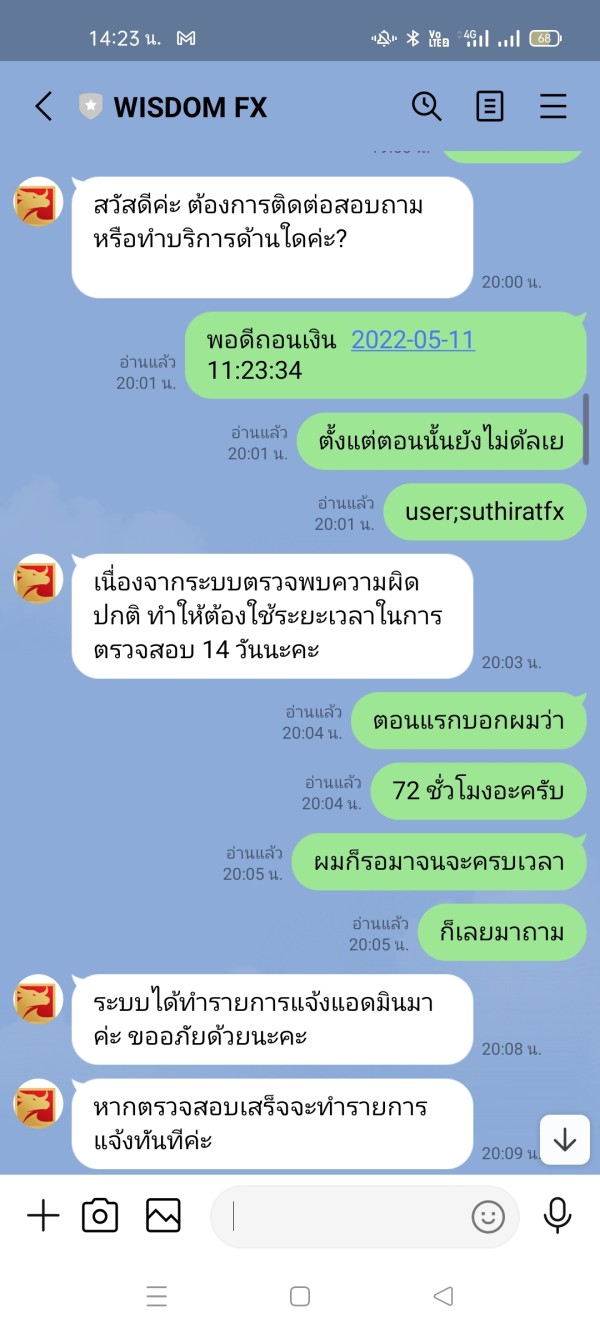

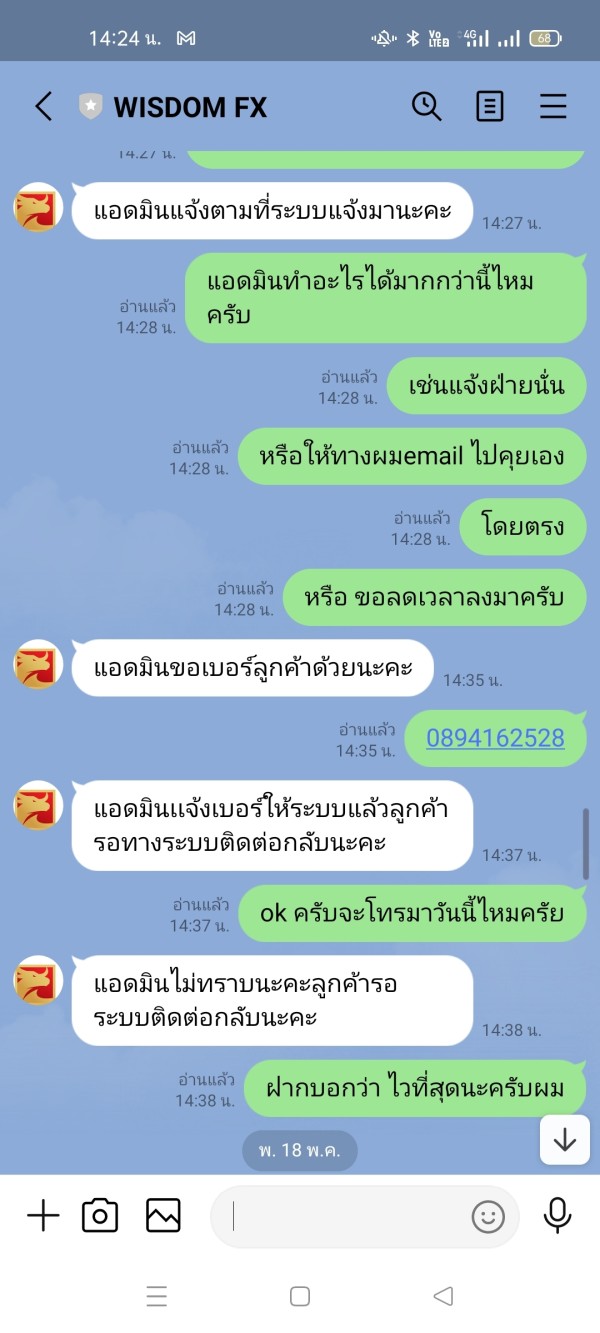

Customer service quality and availability cannot be properly assessed for Wisdom due to the numerous warnings about the broker's legitimacy and operational concerns. Reports from various sources suggest that communication with the broker becomes difficult or impossible, particularly when clients attempt to withdraw funds, which is a common pattern among fraudulent operations.

The availability of customer support channels, response times, and service quality are not documented in reliable sources. However, scam alert databases contain complaints about unresponsive support when traders encounter difficulties, which aligns with fraudulent operations that prioritize acquiring deposits over providing ongoing client service.

Multilingual support capabilities and customer service hours cannot be verified through legitimate sources. Most available information focuses on warning potential clients about the broker's questionable status rather than evaluating service quality, which itself is telling about the broker's reputation.

Industry analysis suggests that legitimate brokers maintain transparent communication channels and responsive support systems. Fraudulent operations often become unresponsive once deposits are received, making Wisdom's unclear support structure particularly concerning for potential clients.

Trading Experience Analysis (Score: 1/10)

The actual trading experience provided by Wisdom cannot be evaluated due to fundamental concerns about the broker's legitimacy and operational capabilities. Platform stability, execution quality, and trading environment assessment requires access to legitimate trading infrastructure, which cannot be verified for this broker, raising serious questions about whether they provide actual trading services.

Order execution quality, platform reliability, and mobile trading capabilities are impossible to assess independently due to the warnings surrounding the broker's operations. Legitimate trading experience evaluation requires access to actual trading platforms and verifiable execution data, neither of which are available for Wisdom, which makes it impossible to determine if they can actually execute trades.

Technical performance metrics, such as execution speeds and platform uptime, cannot be measured or verified through reliable sources. This wisdom review notes that the absence of verifiable trading infrastructure raises serious questions about whether actual trading services are provided to clients.

Industry experts emphasize that legitimate brokers provide transparent access to their trading platforms for evaluation and testing. Questionable operations often restrict access or provide non-functional demonstration platforms that do not reflect actual trading conditions.

Trustworthiness Analysis (Score: 1/10)

Trustworthiness assessment for Wisdom reveals significant concerns that make this broker unsuitable for serious traders. The absence of proper regulatory licensing from recognized financial authorities represents the most fundamental trust issue, as regulatory oversight provides essential client protections and operational standards that protect trader funds.

Fund safety measures cannot be verified due to the lack of regulatory compliance and transparent operational disclosure. Legitimate brokers typically maintain segregated client accounts and provide clear information about fund protection measures, none of which can be confirmed for Wisdom's operations, putting client funds at significant risk.

Corporate transparency is virtually non-existent, with basic company information, regulatory status, and operational details remaining unclear or unverifiable. Industry reputation assessment reveals multiple warnings and scam alerts from financial watchdog organizations, indicating serious concerns about the broker's legitimacy and operational practices.

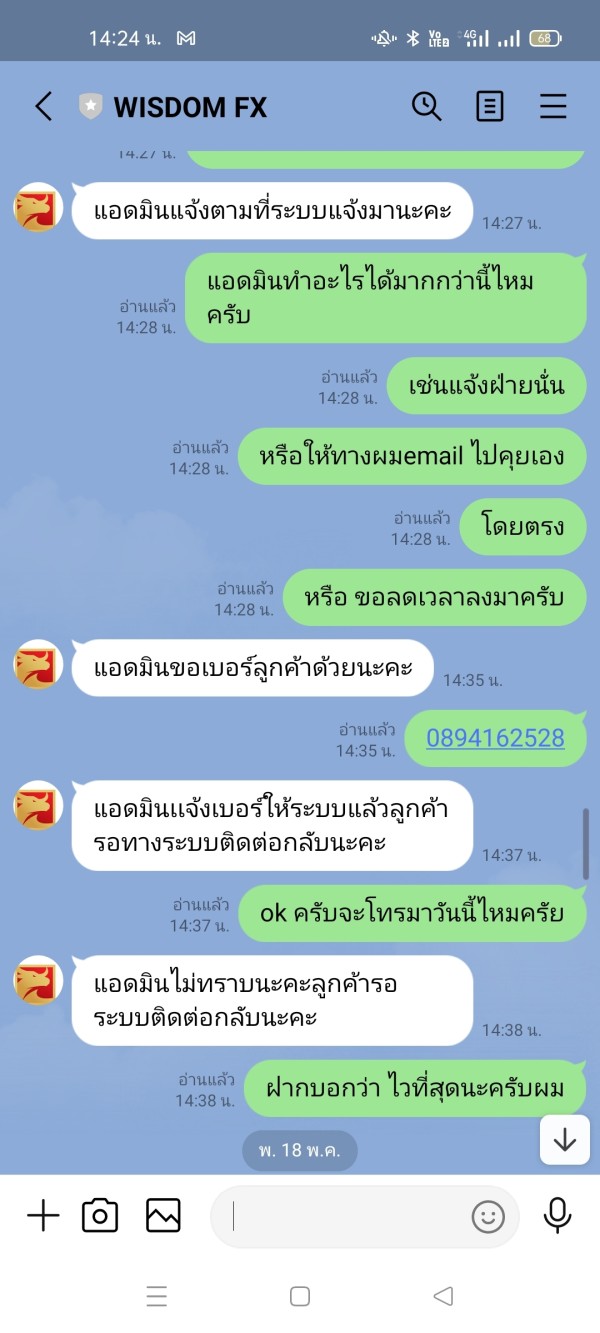

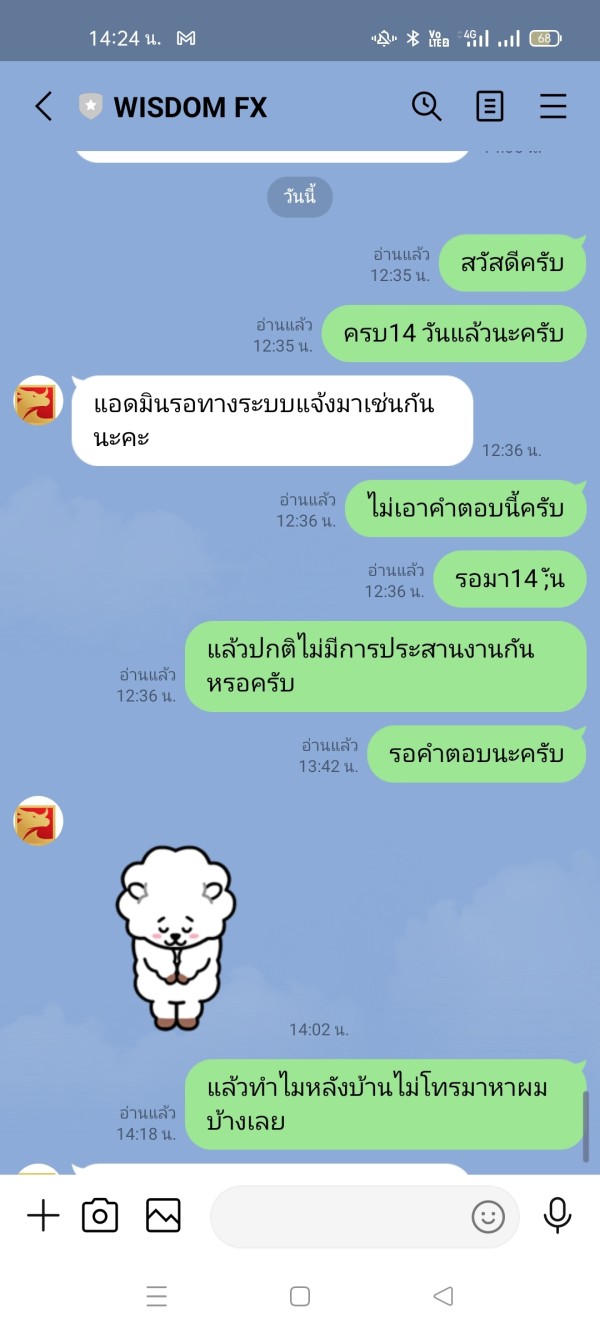

The handling of negative events and client complaints cannot be evaluated through legitimate channels. However, scam reporting databases contain numerous warnings about difficulties in fund withdrawal and communication, suggesting a pattern consistent with fraudulent operations rather than legitimate business practices.

User Experience Analysis (Score: 1/10)

User experience evaluation for Wisdom is severely limited by the fundamental concerns about the broker's legitimacy and the lack of reliable user feedback from legitimate trading activities. Available reports focus primarily on warning potential clients rather than evaluating actual platform usability or service quality, which suggests that few users have had positive experiences with this broker.

Interface design and platform usability cannot be assessed due to questions about whether functional trading platforms actually exist. Registration and verification processes are not documented in reliable sources, though industry experts warn that fraudulent brokers often use simplified onboarding to quickly collect deposits and personal information from unsuspecting traders.

Fund operation experiences cannot be evaluated through legitimate user feedback. However, scam alert databases contain reports suggesting difficulties with withdrawals and account access, which are serious red flags for any trading platform.

Common user complaints available through warning databases focus on communication difficulties and fund access issues rather than typical trading-related concerns. This suggests that users may not be receiving actual trading services despite making deposits with the broker.

Conclusion

This comprehensive wisdom review reveals that Wisdom Finance presents significant risks to potential traders and cannot be recommended for legitimate trading activities. The absence of proper regulatory oversight, combined with multiple scam warnings from financial watchdog organizations, indicates that this broker operates outside acceptable industry standards and poses serious risks to trader funds.

The broker appears unsuitable for any trader category, whether beginner or experienced, due to fundamental concerns about legitimacy and client fund safety. The lack of verifiable trading infrastructure, transparent corporate information, and regulatory compliance makes Wisdom a high-risk choice that prudent traders should avoid at all costs.

Primary concerns include the absence of regulatory licensing, unverified trading capabilities, and multiple fraud warnings from industry sources. Potential traders are strongly advised to choose properly regulated brokers with transparent operations and verifiable track records instead of risking their capital with questionable operations like Wisdom Finance.