Is AMTO safe?

Pros

Cons

Is Amto Safe or a Scam?

Introduction

Amto is a relatively new player in the forex market, positioning itself as a broker providing access to a wide range of trading instruments, including forex, commodities, and cryptocurrencies. In an industry rife with both reputable and dubious brokers, it is crucial for traders to exercise caution and thoroughly assess the legitimacy of their chosen trading platforms. This article aims to investigate whether Amto is a safe broker or if it exhibits signs of being a scam. The evaluation will be based on a combination of regulatory status, company background, trading conditions, customer feedback, and the overall safety of client funds.

Regulation and Legitimacy

One of the primary factors in determining the safety of a forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to strict standards of conduct and transparency. Unfortunately, Amto is currently unregulated, which raises significant concerns about its legitimacy and the safety of client funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulatory oversight is a major red flag. Regulatory bodies such as the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US enforce rules that protect traders from fraud and malpractice. Without such oversight, traders may find themselves with little recourse in the event of disputes or financial loss. Furthermore, the lack of a verified history of compliance raises questions about Amto's operational integrity and reliability.

Company Background Investigation

Amtos company history is another critical area of concern. Established only recently, it operates under the name Amto Global Limited and claims to be registered in Hong Kong. However, the lack of detailed information regarding its ownership structure and management team diminishes the trustworthiness of the broker.

The management teams background is essential in assessing a broker's credibility. Unfortunately, there is limited publicly available information about the individuals behind Amto, which further complicates the evaluation of its legitimacy. Transparency in company operations and management is crucial for building trust with clients, and Amto's lack of information in this area raises additional concerns.

Trading Conditions Analysis

Examining the trading conditions offered by Amto reveals a mixed picture. While the broker advertises competitive spreads and high leverage, the overall fee structure is somewhat opaque.

| Fee Type | Amto | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.2 pips | 1.0 pips |

| Commission Model | Zero Commission | Varies |

| Overnight Interest Range | Not Specified | 1.5% - 3.0% |

While zero commission sounds attractive, it is essential to consider other potential costs that may not be immediately apparent. For instance, the absence of clear information about overnight interest rates and withdrawal fees can lead to unexpected expenses for traders. This lack of transparency in fees can be indicative of a broker that might not have the best interests of its clients at heart.

Client Fund Safety

The safety of client funds is paramount when considering a forex broker. Unfortunately, Amto does not provide sufficient information regarding its fund safety measures. There is no indication of whether client funds are held in segregated accounts, which is a critical requirement for protecting traders' investments.

Additionally, the absence of investor protection schemes raises significant concerns. In many jurisdictions, regulated brokers are required to participate in compensation schemes that protect clients in the event of broker insolvency. Without such protections, traders using Amto could face total loss of their investments should the broker encounter financial difficulties.

Customer Experience and Complaints

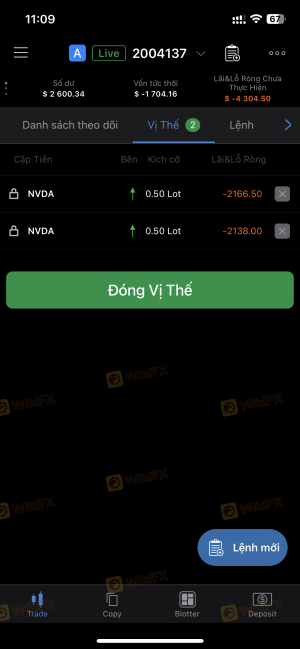

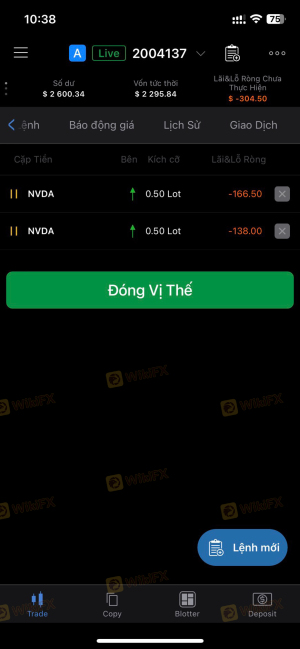

Customer feedback is an essential aspect of evaluating a broker's reliability. Reviews of Amto indicate a mixed bag of experiences, with several users reporting difficulties in withdrawing funds and a lack of responsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Unresponsive |

Common complaints include the inability to withdraw funds and slow response times from customer service. These issues are particularly concerning, as they suggest a lack of accountability and support for clients. In one case, a user reported being unable to access their funds for several weeks, leading to frustration and distrust in the broker.

Platform and Trade Execution

The performance and reliability of the trading platform are critical for a positive trading experience. Amto claims to offer a user-friendly trading interface; however, reports suggest that users have experienced issues with order execution and slippage.

Traders have noted instances of significant slippage during volatile market conditions, which can adversely affect trading outcomes. Additionally, there are concerns about the overall stability of the platform, with some users reporting frequent outages or slow response times. These factors can significantly impact a trader's ability to execute trades effectively, leading to potential financial losses.

Risk Assessment

Using Amto presents several risks that potential traders should consider carefully.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Financial Risk | High | Lack of investor protection and fund segregation. |

| Operational Risk | Medium | Reports of poor customer service and platform issues. |

To mitigate these risks, it is advisable for traders to approach Amto with caution. Conducting thorough research, starting with a small investment, and being vigilant about withdrawal processes can help minimize potential losses.

Conclusion and Recommendations

In conclusion, the evidence suggests that Amto raises several red flags that warrant concern. The lack of regulation, transparency, and poor customer feedback indicate that traders should exercise caution when considering this broker. While Amto may offer attractive trading conditions on the surface, the underlying risks associated with its operation could outweigh the benefits.

For traders seeking a more secure trading environment, it is advisable to consider alternatives that are regulated by reputable authorities and have a proven track record of customer satisfaction. Brokers such as IG, OANDA, or Forex.com may provide more reliable options for traders looking to navigate the forex market safely. Ultimately, the question remains: Is Amto Safe? Given the current evidence, it appears that traders should be wary and consider other, more reputable options.

Is AMTO a scam, or is it legit?

The latest exposure and evaluation content of AMTO brokers.

AMTO Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AMTO latest industry rating score is 1.32, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.32 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.