Is Nk Market safe?

Pros

Cons

Is NK Market Safe or Scam?

Introduction

NK Market is a broker that has been gaining attention in the forex trading community. As with any financial trading platform, it is crucial for traders to conduct thorough research before committing their funds. The forex market is notorious for its lack of regulation and the presence of unscrupulous brokers, making it imperative for traders to carefully evaluate the legitimacy and safety of their chosen trading platforms. This article aims to provide a comprehensive analysis of NK Market, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment. The investigation is based on various online sources, user reviews, and industry reports, ensuring a balanced and informed evaluation.

Regulation and Legitimacy

When assessing the safety of any trading platform, the regulatory status is a key factor. Regulatory bodies enforce rules and standards that protect traders from fraud and malpractice. Unfortunately, NK Market does not appear to be regulated by any major financial authority, which raises significant concerns about its legitimacy and trustworthiness.

Here is a summary of the regulatory information available for NK Market:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation means that NK Market is not held accountable by any governing body, which can lead to potential risks for traders. Reputable brokers are typically overseen by well-established regulatory authorities such as the FCA (Financial Conduct Authority) in the UK, ASIC (Australian Securities and Investments Commission), or the SEC (Securities and Exchange Commission) in the U.S. Without such oversight, traders may find it more challenging to seek recourse in case of disputes or issues with fund withdrawals.

Company Background Investigation

NK Market's history and ownership structure are also crucial elements in determining its safety. Unfortunately, there is limited information available regarding the company's formation, ownership, and operational history. This lack of transparency can be a red flag for potential clients.

A thorough investigation into the management team and their professional backgrounds is essential for assessing the broker's credibility. If the management team lacks relevant experience in the financial sector, it may indicate a higher risk for traders. Furthermore, a broker's transparency regarding its operations and ownership can significantly impact its trustworthiness.

In the case of NK Market, the absence of clear information about its founders, management team, and operational history raises concerns about its overall reliability. A trustworthy broker typically provides detailed information about its team and operational practices, which can help build confidence among clients.

Trading Conditions Analysis

Understanding the trading conditions offered by NK Market is vital for evaluating its attractiveness as a trading platform. Traders should be aware of the overall fee structure, including spreads, commissions, and any hidden charges that may affect their profitability.

NK Market's fee structure is as follows:

| Fee Type | NK Market | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Model | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

The lack of specific data regarding NK Market's trading costs makes it challenging for potential clients to assess the overall value of trading with this broker. Traders should be cautious of any unusual or excessive fees that could erode their profits. A broker that is transparent about its fees and offers competitive rates is generally more trustworthy.

Client Fund Safety

One of the most critical aspects of evaluating a broker is the safety of client funds. Traders need to ensure that their money is protected from potential mismanagement or fraud. NK Market's measures for securing client funds should be thoroughly examined.

Key areas to consider include fund segregation, investor protection schemes, and negative balance protection policies. Segregation of client funds is essential, as it ensures that traders' money is kept separate from the broker's operational funds. This separation can provide a layer of protection in the event of the broker facing financial difficulties.

Additionally, investor protection schemes can offer some level of reimbursement in case a broker goes bankrupt. Negative balance protection ensures that traders cannot lose more money than they have deposited, which is vital for managing risk.

Unfortunately, there is limited information available regarding NK Market's policies on these critical aspects. The lack of clarity surrounding fund safety measures may indicate potential risks for traders.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing the overall quality of a broker. Analyzing user experiences can reveal common complaints and the broker's responsiveness to issues.

Common complaint types regarding NK Market include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | TBD |

| Poor Customer Support | Medium | TBD |

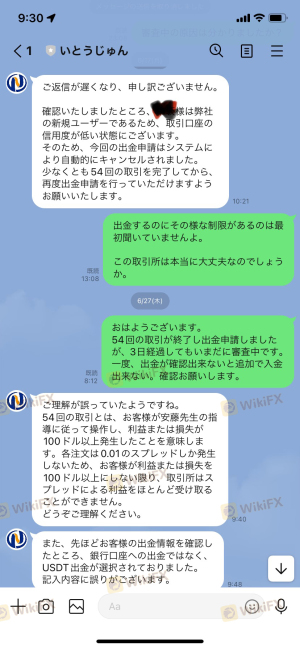

Several users have reported difficulties in withdrawing funds, which is a significant red flag for any broker. If a broker struggles to process withdrawals, it raises concerns about its financial stability and reliability. Additionally, the quality of customer support is crucial for resolving issues promptly and effectively.

Case studies of user experiences can provide further insights. For instance, one user reported being unable to access their account for an extended period, leading to frustration and loss of trading opportunities. Another user mentioned delayed responses from customer support, exacerbating their concerns.

Platform and Execution

The performance and reliability of NK Market's trading platform are essential factors for traders. A robust platform should offer stability, user-friendly features, and efficient order execution.

Evaluating order execution quality involves analyzing slippage rates and order rejection frequencies. Traders need to ensure that their orders are executed promptly and at the expected prices. Any signs of platform manipulation or excessive slippage can indicate potential issues with the broker's integrity.

Unfortunately, detailed information regarding NK Market's platform performance is scarce. Traders should be cautious and consider the potential risks associated with an unproven trading platform.

Risk Assessment

Using NK Market carries inherent risks that traders must be aware of. A comprehensive risk assessment can help identify potential pitfalls associated with trading through this broker.

Here is a summary of the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Safety Risk | Medium | Limited information on fund protection |

| Withdrawal Risk | High | Reports of withdrawal issues |

To mitigate these risks, traders should consider starting with a small deposit and thoroughly researching the broker's operations before committing significant funds. Additionally, staying informed about potential scams and fraudulent practices can help protect traders from falling victim to unscrupulous brokers.

Conclusion and Recommendations

In conclusion, the investigation into NK Market raises several concerns regarding its safety and legitimacy. The lack of regulatory oversight, limited information on company background, and reports of withdrawal issues make it imperative for traders to exercise caution when considering this broker.

While NK Market may offer some trading opportunities, the potential risks associated with using this platform outweigh the benefits. Traders should be particularly wary of the absence of regulation and the unclear policies regarding fund safety.

For those seeking a reliable trading experience, it is advisable to consider alternative brokers that are well-regulated and have a proven track record of customer satisfaction. Some reputable alternatives include brokers regulated by the FCA, ASIC, or other major financial authorities.

In summary, Is NK Market Safe? The evidence suggests that traders should approach with caution and consider other options to ensure their investments are protected.

Is Nk Market a scam, or is it legit?

The latest exposure and evaluation content of Nk Market brokers.

Nk Market Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Nk Market latest industry rating score is 1.32, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.32 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.