OlympusFX 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

In the dynamic realm of forex trading, OlympusFX has positioned itself as a broker presenting enticing trading conditions, including high leverage and a diversity of financial instruments. This can be especially appealing for experienced traders willing to take on substantial risks in pursuit of potentially high rewards. However, this review uncovers alarming concerns that underpin the allure of OlympusFX. The absence of regulatory oversight, compounded by multiple user complaints regarding fund withdrawals and customer support issues, casts significant doubts on the broker's legitimacy and reliability. For prospective traders, weighing the lure of high leverage against the inherent risks is paramount.

⚠️ Important Risk Advisory & Verification Steps

Key Risks Associated with OlympusFX:

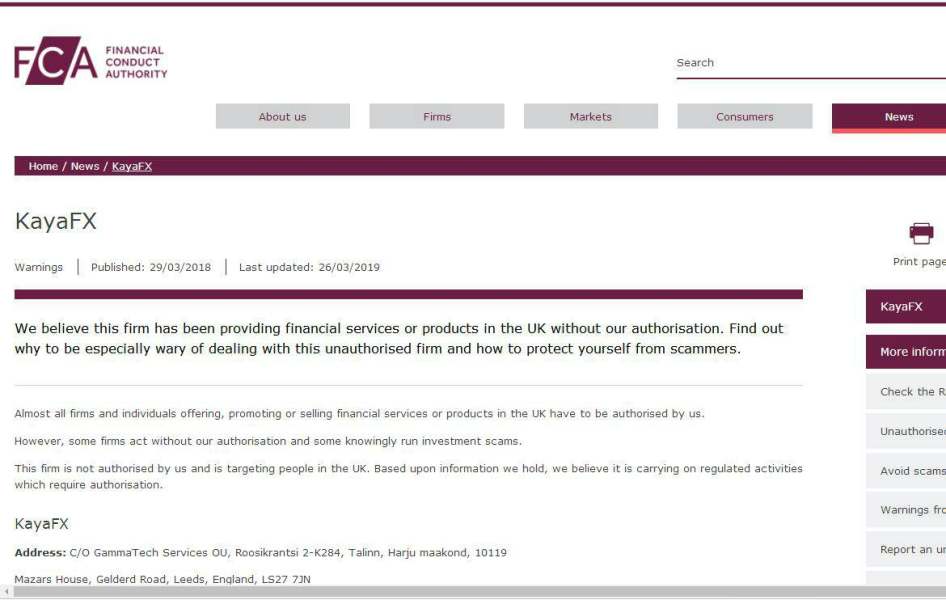

- No Regulatory Framework: OlympusFX operates without valid regulatory oversight. This lack of transparency and scrutiny poses serious risks to users' investment security.

- Withdrawal Complications: Many users have reported challenges withdrawing their funds, signaling possible fraudulent practices.

- Negative User Experiences: Numerous complaints highlight a troubling trend of ineffective customer support and platform reliability issues.

Self-Verification Steps:

- Research OlympusFX on reputable regulatory websites to confirm its licensing status.

- Search for recent user reviews and complaints on platforms such as Trustpilot and Forex Peace Army.

- Verify the existence of a reliable customer support channels and their responsiveness before registering an account.

Rating Framework

Broker Overview

Company Background and Positioning

Established in 2014, Olympus Financial Group Limited, the parent company of OlympusFX, is registered in Saint Vincent and the Grenadines. Despite claiming to be an STP and ECN broker, OlympusFX lacks adherence to regulatory standards that govern reputable brokers globally. This offshore registration without additional regulatory validation raises serious concerns about the protection of client funds and overall operational integrity.

Core Business Overview

OlympusFX positions itself as a multi-asset trading service provider, claiming to offer over 100 tradable instruments across forex, commodities, and cryptocurrencies. The broker attracts traders with enticing features such as high leverage (up to 1:500) and competitive spreads starting from 0.6 pips on major currency pairs like EUR/USD. However, potential clients should exercise caution, as the broker does not fall under any recognized regulatory authority, making it difficult to ensure the safety of client funds.

Quick-Look Details Table

In-Depth Analysis of Each Dimension

Trustworthiness Analysis

Teaching users to manage uncertainty.

OlympusFX's regulatory status raises significant concerns. There are no valid licenses associated with the broker, as confirmed by multiple user reviews and assessments from industry regulators.

Regulatory Conflicts: Users should be aware of the discrepancies in regulatory information. OlympusFX touts a commitment to transparency while remaining unregulated. This inconsistency heightens the risk profile for investors.

User Self-Verification Guide:

Search for OlympusFX on government financial regulatory websites like the NFA or CySEC.

Check for warnings or alerts associated with the broker on industry watchdog websites.

Look for user reviews discussing fund safety and withdrawal experiences.

Industry Reputation and Summary:

"OlympusFX has received a low score of 1.77/10 on WikiFX, indicating high risk!"

Trading Costs Analysis

The double-edged sword effect.

Advantages in Commissions: OlympusFX offers competitive commission structures that may initially attract traders. Average spreads for the EUR/USD, for instance, start at 0.6 pips, which could be perceived as favorable compared to other brokers.

The "Traps" of Non-Trading Fees: While initial trading costs appear advantageous, many users have reported high withdrawal fees that undermine overall profitability. For example, one user noted a withdrawal fee of $30, which significantly reduces their withdrawal amount.

Cost Structure Summary: OlympusFX offers a blend of low-cost trading components attracting seasoned traders; however, the high withdrawal fees are major downsides that need to be considered.

Professional depth vs. beginner-friendliness.

Platform Diversity: OlympusFX offers popular platforms such as MetaTrader 4 and MetaTrader 5. However, the functionality and reliability of these platforms are often questioned, with reports of slippage and execution delays being common.

Quality of Tools and Resources: Reviews indicate that while the platforms have customizable trading features, the lack of educational resources or advanced analytical tools limits the trading experience, particularly for novice traders.

Platform Experience Summary: User feedback generally reflects dissatisfaction with the platform's performance:

"The withdrawal process became slower, indicating potential manipulations in trading activities."

User Experience Analysis

User experience with OlympusFX is clouded by a series of complaints highlighting significant dissatisfaction. While OlympusFX claims to provide a smooth trading experience, user reports suggest a stark contrast involving poor support and unreliable platform functionality.

Customer Support Analysis

Customer support is an area of particular concern for OlympusFX. Reviews often point to unresponsive customer service, leading to frustration among traders needing assistance.

Conclusion

This comprehensive review of OlympusFX, indicates a broker operating under troubling conditions without proper regulatory oversight. With numerous user complaints regarding withdrawal difficulties and opaque trading practices, the risks associated with trading through OlympusFX significantly outweigh the potential benefits. Traders seeking a reliable and secure trading experience should consider legitimate, regulated alternatives instead of engaging with OlympusFX. As always, potential users must conduct extensive research before committing any capital to trading platforms.