Executive Summary

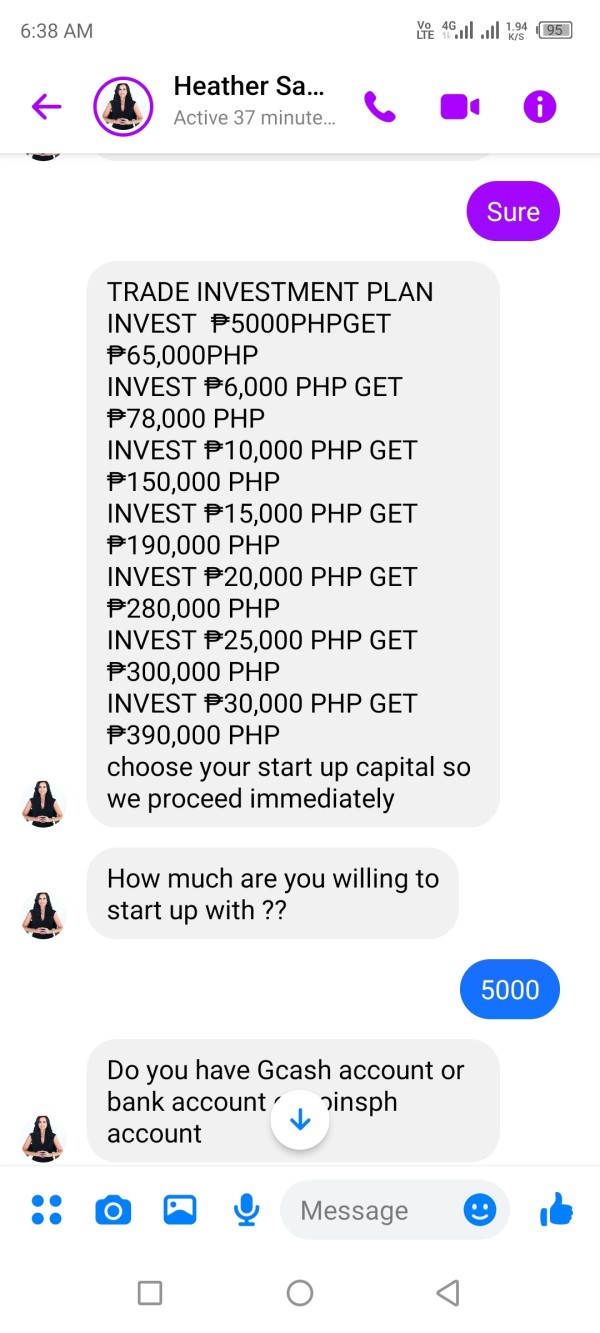

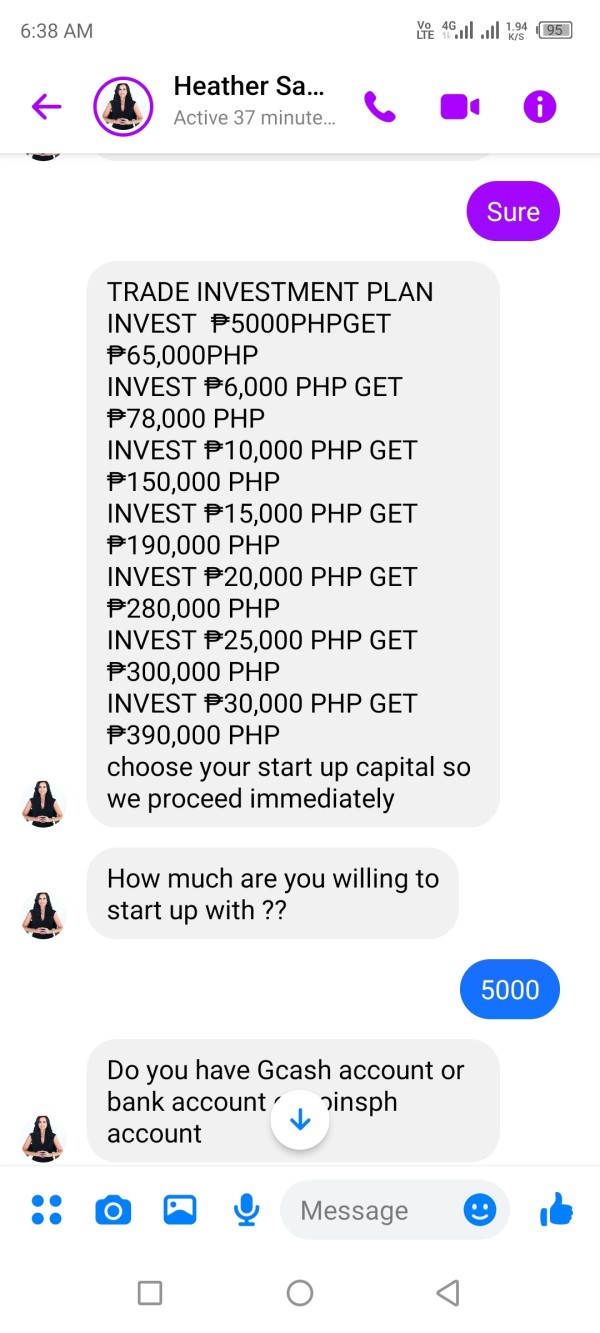

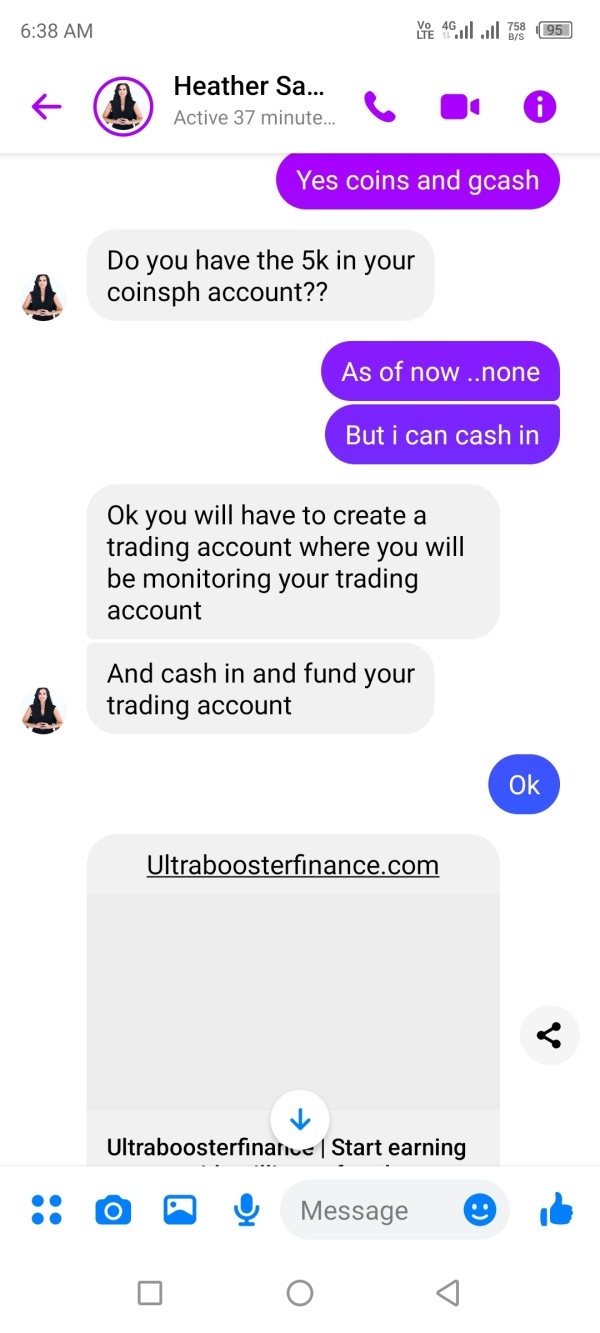

This ultra booster finance review gives you a complete look at a trading platform that has caught attention in the online trading world. Ultra Booster Finance works as an unregulated online trading platform that offers services in forex, cryptocurrency, and binary options markets, though the attention it receives is not always positive. Many reports from industry watchdogs show that this broker has serious fraud risks that potential investors should think about carefully.

The platform shows off several attractive features like leverage up to 1:400 and commission-free trading. These features target traders with different experience levels and investment preferences, but they come with big warnings from regulatory bodies and industry analysts. The broker mainly targets investors who want opportunities in volatile markets such as forex, cryptocurrencies, and binary options. However, the lack of regulatory oversight creates serious concerns about trader protection and fund security.

Industry sources including ForexBrokerz and various scam reporting websites show that Ultra Booster Finance operates without proper regulatory authorization. This significantly impacts its credibility and safety profile for potential users.

Important Notice

Due to Ultra Booster Finance's unregulated status, trading environments and user experiences may vary significantly across different regions. Users bear full responsibility for risk assessment, and the platform's lack of regulatory oversight means that trader protections typically provided by licensed brokers may not be available.

This review uses key information from multiple industry sources and regulatory warnings to give users a comprehensive broker assessment. The evaluation looks at publicly available information, user reports, and industry analysis to present an objective overview of the platform's offerings and associated risks.

Rating Framework

Based on our comprehensive analysis, here are the ratings across six key dimensions:

Broker Overview

Ultra Booster Finance operates as an unregulated online trading platform that has attracted scrutiny from multiple industry watchdogs and regulatory warning services. Reports from Scams Report and other industry monitoring websites show that the platform presents potential fraud risks that require careful consideration from prospective traders.

The company's background and establishment details remain unclear in available documentation. This raises transparency concerns typical of unregulated entities in the trading space, and the platform positions itself as a provider of trading services across multiple asset classes, including forex markets, cryptocurrency trading, and binary options.

The lack of regulatory oversight means that standard investor protections and operational standards required by licensed brokers may not apply. This business model has prompted warnings from various industry sources, suggesting that potential users should exercise extreme caution when considering this platform. Reports show that Ultra Booster Finance operates without authorization from recognized financial regulatory bodies, which significantly impacts its legitimacy and safety profile.

This ultra booster finance review emphasizes the importance of understanding these regulatory gaps before making any investment decisions.

Regulatory Status

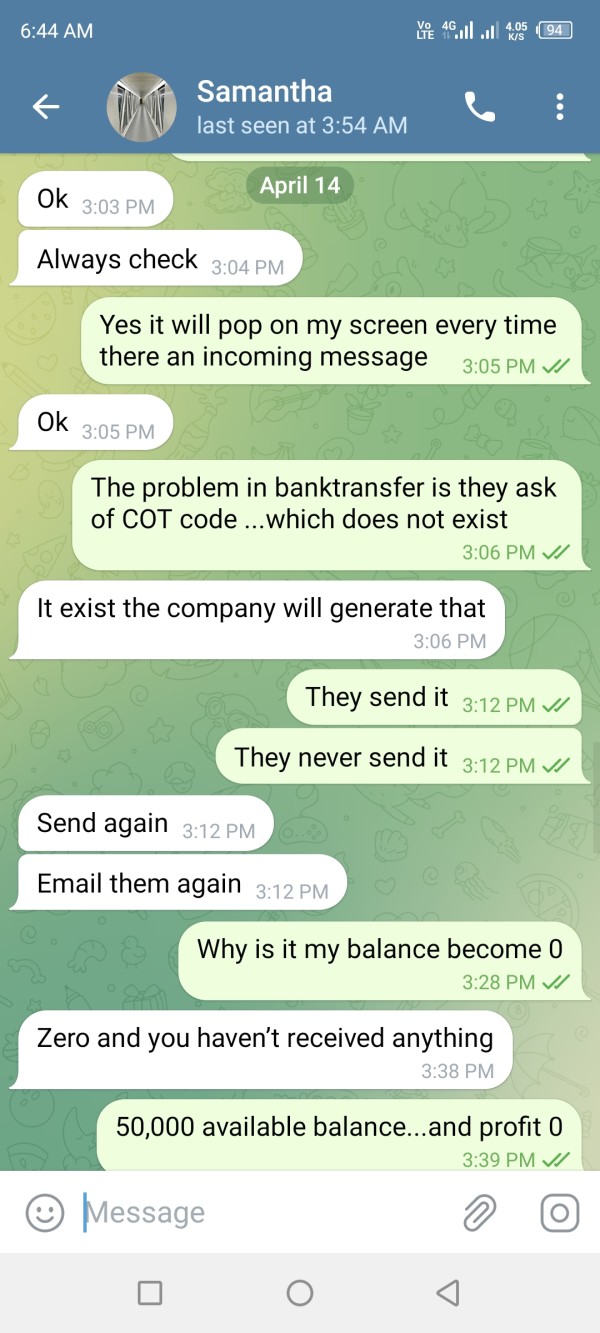

Available information suggests Ultra Booster Finance operates without proper regulatory authorization from recognized financial authorities. This unregulated status represents a significant red flag for potential traders because it means the platform is not subject to standard industry oversight, capital requirements, or trader protection measures.

Account Features

The platform advertises multiple account plans, though specific details about minimum deposits, account tiers, and associated benefits are not clearly outlined in available materials. This lack of transparency is concerning for potential account holders seeking to understand their options.

Trading Assets

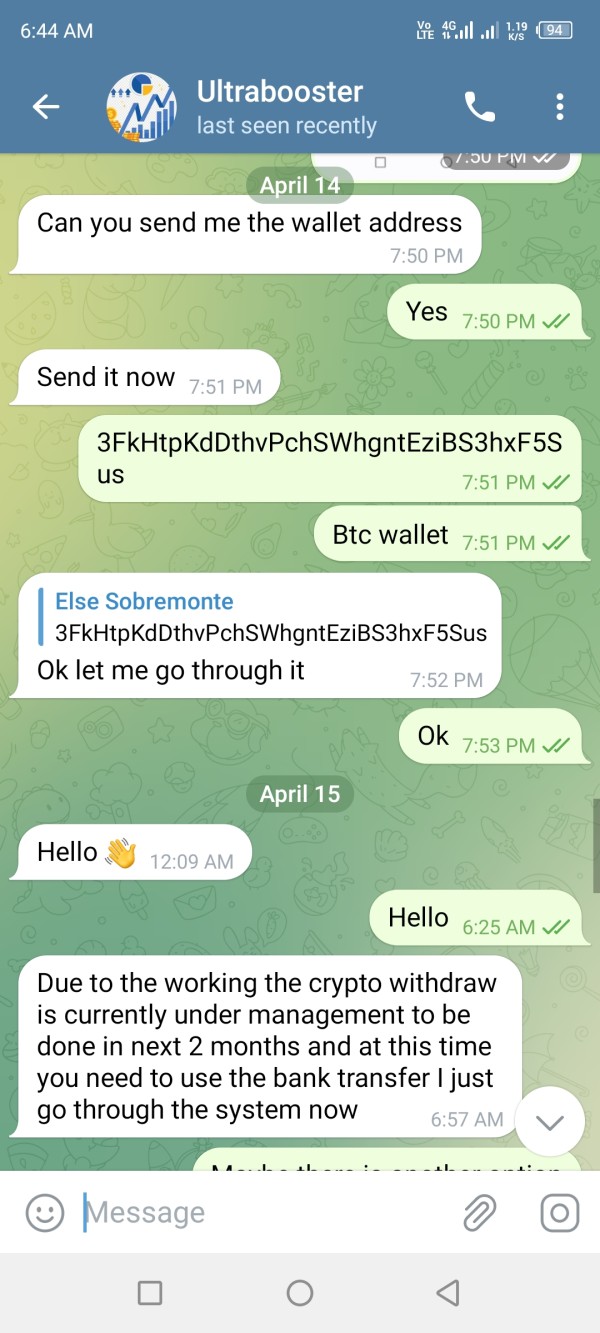

Ultra Booster Finance offers trading opportunities across forex markets, cryptocurrency assets, and binary options. While this diversification might appeal to traders seeking multiple market exposures, the unregulated nature of these offerings raises questions about execution quality and market access.

Cost Structure

The platform advertises commission-free trading as a key feature. Specific information about spreads, overnight fees, and other potential charges remains unclear in available documentation, and this lack of detailed cost information makes it difficult for traders to assess the true cost of trading.

Leverage Offerings

Ultra Booster Finance advertises leverage ratios up to 1:400, which represents extremely high leverage that could amplify both profits and losses significantly. Such high leverage ratios, particularly from an unregulated provider, present substantial risk management concerns.

Customer Support

The platform offers 24-hour customer support according to available information. Specific details about support channels, response times, and service quality are not extensively documented in reviewed materials.

This ultra booster finance review highlights the limited transparency around many operational details. This is characteristic of unregulated platforms and raises additional concerns about the broker's legitimacy.

Detailed Rating Analysis

Account Conditions Analysis (6/10)

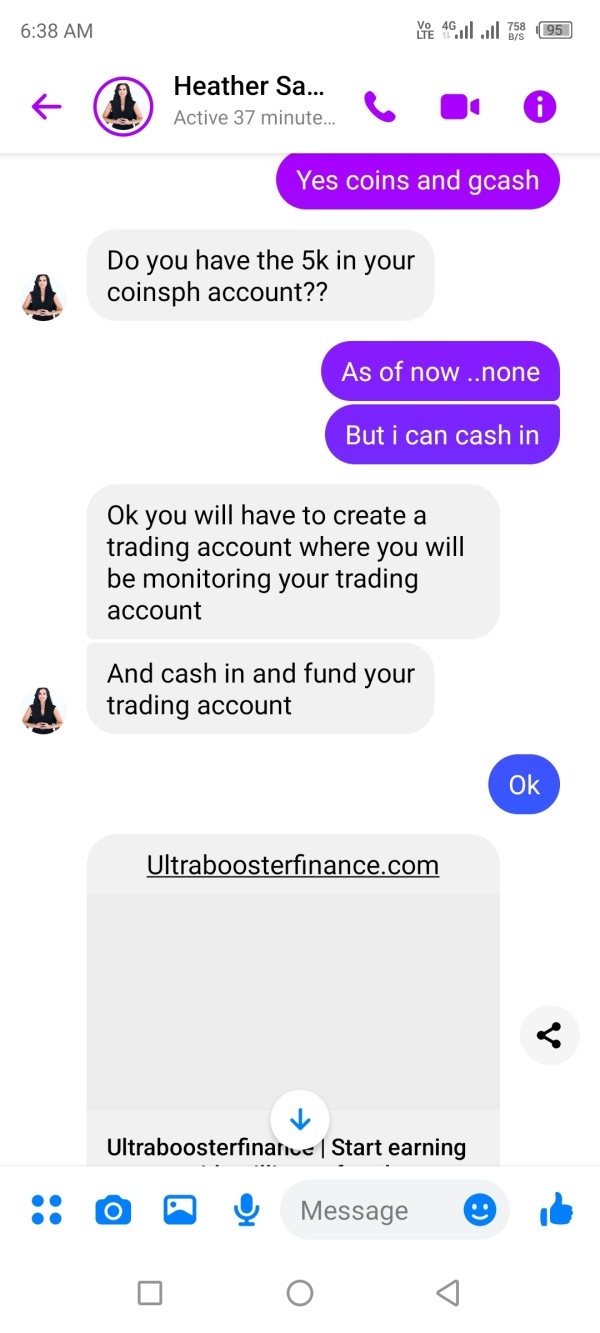

Ultra Booster Finance's account conditions receive a moderate rating primarily due to incomplete information transparency. While the platform advertises multiple account plans, the specific details that traders need to make informed decisions remain unclear, and the lack of clear information about minimum deposit requirements, account tier benefits, and withdrawal conditions represents a significant transparency issue.

The account opening process details are not adequately documented in available materials. This makes it difficult for potential traders to understand what documentation or verification steps might be required, and this opacity is particularly concerning given the platform's unregulated status, as traders cannot rely on standardized regulatory requirements that typically govern account opening procedures at licensed brokers.

The absence of detailed information about account features, trading conditions variations between account types, and any special functionalities makes it challenging for traders to assess whether the offered accounts meet their trading needs. This ultra booster finance review emphasizes that the limited account information transparency significantly impacts the platform's overall appeal to serious traders who require clear terms and conditions.

The trading tools and resources offered by Ultra Booster Finance receive a poor rating due to insufficient information about platform capabilities and analytical resources. Available documentation does not provide clear details about the trading platform technology, charting tools, technical indicators, or market analysis resources that traders would typically expect from a modern trading environment.

Educational resources, which are crucial for trader development, are not mentioned in available materials. The absence of comprehensive learning materials, webinars, market analysis, or trading guides suggests a limited commitment to trader education and development, and this is particularly concerning for newer traders who rely on broker-provided educational content to improve their trading skills.

Research and analysis capabilities are not detailed in available information. This leaves traders uncertain about access to market news, economic calendars, expert analysis, or other research tools essential for informed trading decisions, and the lack of information about automated trading support, API access, or advanced trading tools further diminishes the platform's appeal to more sophisticated traders.

Customer Service and Support Analysis (7/10)

Customer service receives a relatively higher rating based on the advertised 24-hour support availability. However, this rating is tempered by the lack of detailed information about support channels, response quality, and problem resolution effectiveness.

While round-the-clock availability is a positive feature, the actual quality and effectiveness of support services remain unclear. The availability of multiple contact channels, response time commitments, and multilingual support capabilities are not clearly documented in reviewed materials, and this lack of detailed support information makes it difficult for potential traders to assess whether they would receive adequate assistance when needed, particularly given the platform's unregulated status which may limit recourse options for unresolved issues.

User feedback about support experiences is not extensively available in reviewed sources. This makes it challenging to verify the actual quality of customer service beyond the basic availability claims, and the absence of detailed support policies and escalation procedures represents a transparency gap that could impact user experience.

Trading Experience Analysis (5/10)

The trading experience receives an average rating due to limited information about platform stability, execution quality, and overall trading environment. Without clear details about the trading platform technology, order execution speeds, or system reliability, it's difficult to assess the actual trading experience that users might encounter.

Platform functionality details, including available order types, trading tools integration, and interface design, are not comprehensively covered in available materials. The absence of information about mobile trading capabilities, platform customization options, and advanced trading features suggests potential limitations in the trading experience offered.

Execution quality metrics, such as slippage rates, order fill speeds, and price accuracy, are not documented in reviewed sources. This lack of performance data makes it challenging for traders to assess whether the platform can deliver the execution quality needed for effective trading strategies, particularly in volatile market conditions.

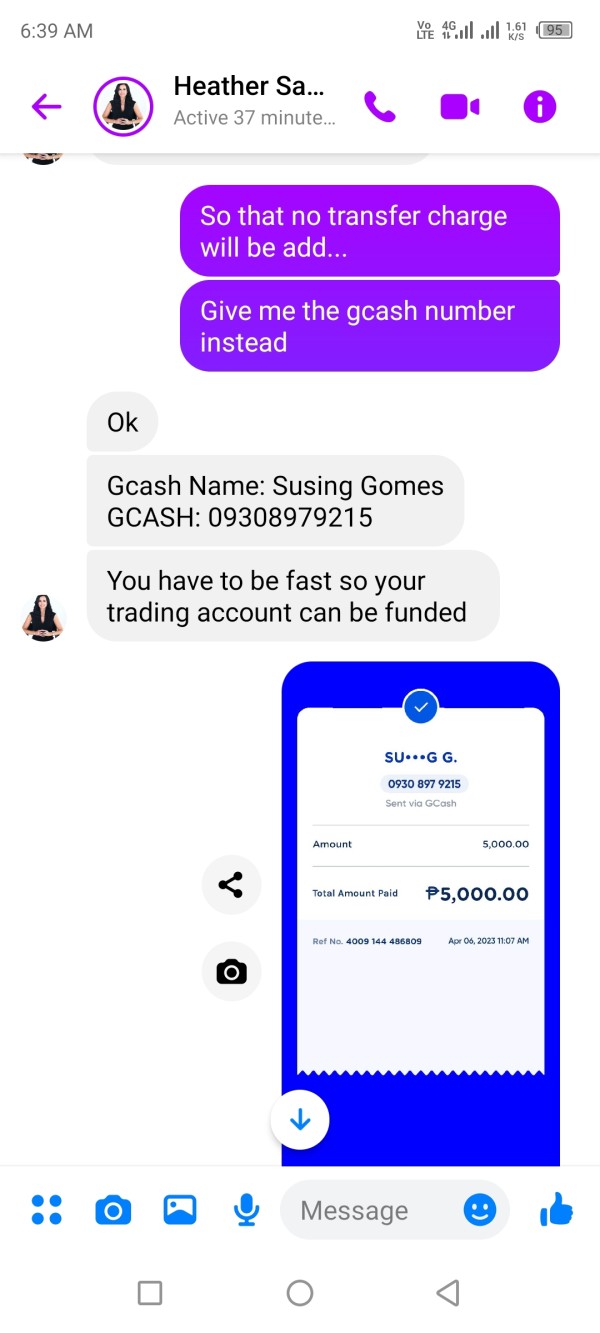

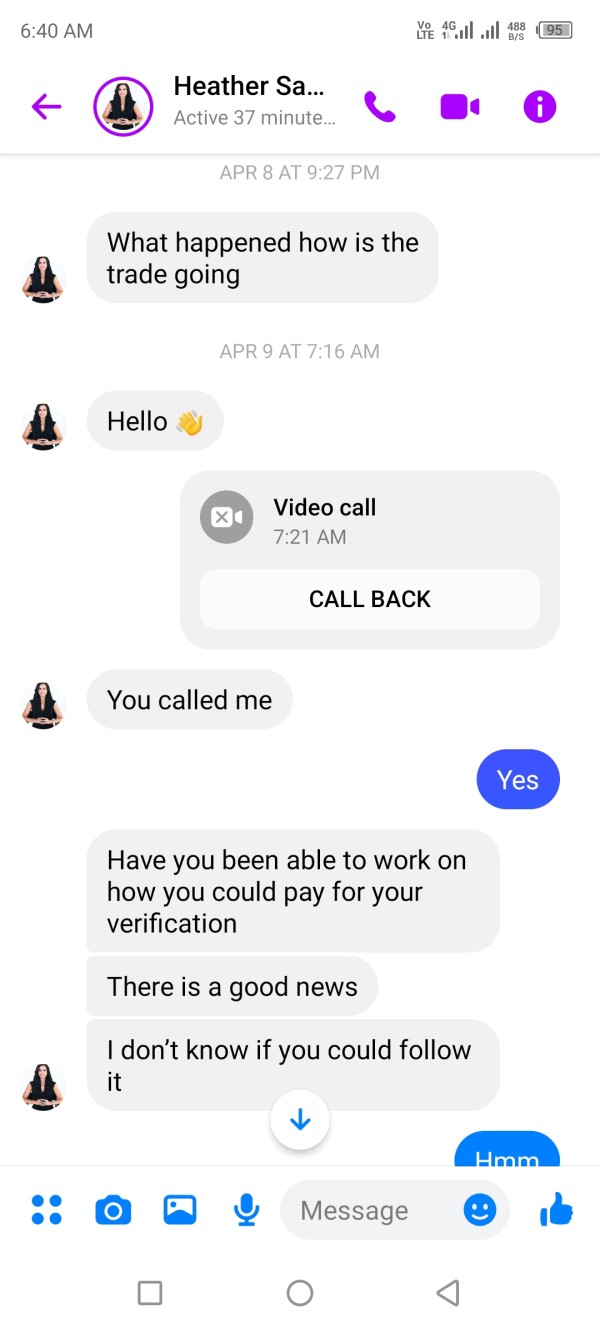

Trust and Reliability Analysis (3/10)

Trust and reliability receive the lowest rating due to the platform's unregulated status and associated fraud risk warnings from industry sources. The lack of regulatory oversight means that standard investor protections, segregated fund requirements, and operational standards do not apply, significantly impacting the platform's trustworthiness.

Multiple industry sources, including scam reporting websites, have flagged Ultra Booster Finance as potentially fraudulent. This represents a serious red flag for potential users, and the absence of regulatory authorization means that traders have limited recourse options if issues arise, and fund security measures may not meet industry standards.

Company transparency is severely limited, with basic corporate information, licensing details, and operational transparency not adequately provided. This lack of transparency, combined with regulatory warnings, creates a high-risk environment that serious traders should approach with extreme caution, and this ultra booster finance review strongly emphasizes these trust concerns as primary considerations for potential users.

User Experience Analysis (5/10)

User experience receives an average rating primarily due to limited available feedback and unclear interface design standards. Without comprehensive user reviews or detailed platform demonstrations, it's challenging to assess the actual user experience quality that traders might encounter when using the platform.

Registration and verification processes are not clearly outlined in available materials. This makes it difficult for potential users to understand what steps would be required to begin trading, and the lack of clear onboarding information could lead to confusion and frustration for new users attempting to access the platform.

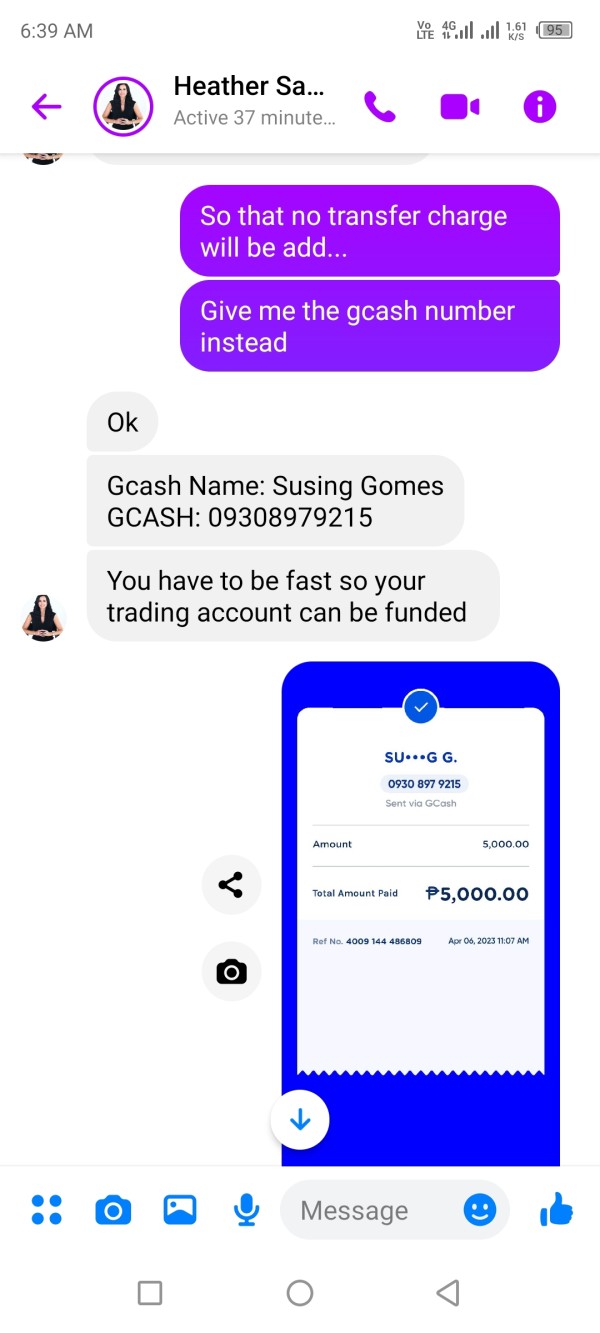

Fund operation procedures, including deposit and withdrawal processes, are not comprehensively documented in reviewed sources. This lack of clarity about financial transactions represents a significant user experience concern, particularly given the platform's unregulated status which may impact fund security and processing reliability.

Conclusion

This comprehensive ultra booster finance review reveals significant concerns about the platform's legitimacy and safety for traders. While Ultra Booster Finance advertises attractive features such as high leverage ratios up to 1:400 and commission-free trading, the platform's unregulated status and associated fraud warnings from industry watchdogs present substantial risks that outweigh potential benefits.

The platform may appeal to high-risk tolerance investors seeking opportunities in forex and cryptocurrency markets. However, the lack of regulatory oversight, limited transparency, and industry warnings make it unsuitable for most traders, and the primary advantages of high leverage and zero commissions are overshadowed by significant disadvantages including lack of regulation, limited transparency, and potential fraud risks that could result in complete loss of invested funds.

Potential traders should exercise extreme caution and consider regulated alternatives that provide proper investor protections and regulatory oversight before engaging with Ultra Booster Finance.