Regarding the legitimacy of iFX Brokers forex brokers, it provides FSCA and WikiBit, .

Is iFX Brokers safe?

Pros

Cons

Is iFX Brokers markets regulated?

The regulatory license is the strongest proof.

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

IFX BROKERS HOLDINGS (PTY) LTD

Effective Date: Change Record

2017-06-06Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

32 BLAAUKRANS STREETFOUNTAINS BUSINESS ESTATEJEFFREY?S BAY6630Phone Number of Licensed Institution:

087 9447273Licensed Institution Certified Documents:

Is IFX Brokers A Scam?

Introduction

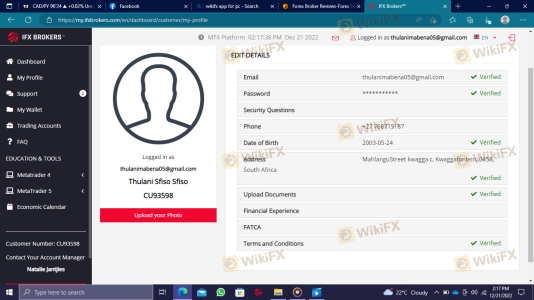

IFX Brokers is a South African forex broker that has carved a niche in the competitive trading market by offering a wide range of trading instruments and services. Established in 2018, it aims to provide a transparent and user-friendly trading experience for both retail and institutional clients. As the forex market continues to grow rapidly, it becomes increasingly crucial for traders to carefully evaluate brokers before committing their funds. The potential for scams and fraudulent activities is ever-present, making due diligence a vital part of the trading process. This article employs a comprehensive approach to assess IFX Brokers, examining its regulatory status, company background, trading conditions, client safety measures, customer experiences, platform performance, and associated risks.

Regulation and Legitimacy

One of the most critical factors in determining a broker's reliability is its regulatory status. IFX Brokers is regulated by the Financial Sector Conduct Authority (FSCA) of South Africa, which ensures that it adheres to certain standards aimed at protecting traders. Regulation plays a crucial role in establishing a broker's legitimacy, as it provides a framework for accountability and transparency.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSCA | 48021 | South Africa | Verified |

The FSCA is recognized as a tier-2 regulatory authority, which, while not as stringent as tier-1 regulators like the FCA or ASIC, still imposes significant requirements on brokers. These include maintaining segregated accounts for client funds and regular financial reporting. Despite being regulated, IFX Brokers has faced scrutiny regarding its compliance history, with mixed reviews from clients about its operational practices. Therefore, while the regulatory framework is in place, potential traders should remain vigilant and conduct their own research.

Company Background Investigation

IFX Brokers Holdings (Pty) Ltd operates as the parent company of IFX Brokers, based in Jeffreys Bay, South Africa. Founded in 2018, the company has positioned itself as a player in the forex trading space, targeting both local and international clients. The management team consists of professionals with extensive backgrounds in finance and trading, which adds a layer of credibility to the company. However, the lack of detailed information about the ownership structure raises questions about transparency.

The companys commitment to transparency is evident in its public disclosures regarding regulatory compliance and operational standards. However, the absence of independent reviews or awards can make potential clients wary. A comprehensive understanding of a broker's history and ownership structure is vital for assessing its reliability and trustworthiness.

Trading Conditions Analysis

The trading conditions offered by IFX Brokers are a mixed bag, with competitive features alongside some concerns. The broker provides various account types, each with different minimum deposit requirements and trading conditions. The overall fee structure includes spreads, commissions, and overnight interest rates, which can significantly impact profitability.

| Fee Type | IFX Brokers | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.5 pips | 0.3 - 0.7 pips |

| Commission Model | $6 per lot | $3 - $5 per lot |

| Overnight Interest Range | Varies | Varies |

While the spreads on major currency pairs are competitive, they tend to be higher than some industry averages, particularly for standard accounts. The commission structure is also noteworthy; while some accounts are commission-free, others charge a fee that could deter cost-sensitive traders. Overall, the trading conditions appear reasonable, but potential clients should be aware of the fees involved.

Client Fund Safety

Ensuring the safety of client funds is paramount for any trading broker. IFX Brokers adheres to the FSCA's requirements, which include maintaining segregated accounts for client funds. This practice ensures that client money is kept separate from the broker's operational funds, providing a layer of protection in case of insolvency. Additionally, IFX Brokers claims to offer negative balance protection, which limits client losses to their deposited amounts.

However, the absence of an investor compensation fund raises concerns about the extent of protection available to traders. Historically, IFX Brokers has not reported any major issues regarding fund security, but the lack of a dedicated compensation scheme could be a red flag for some traders.

Customer Experience and Complaints

Customer feedback is an essential component in evaluating a broker's reputation. Reviews of IFX Brokers reveal a mixed bag of experiences. While some clients praise the broker for its user-friendly platform and responsive customer service, others report issues related to withdrawals and account management.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Account Management Issues | Medium | Moderate response |

Common complaints include delays in processing withdrawals and difficulties in managing accounts. For instance, some users have reported that their withdrawal requests took longer than expected, leading to frustration. The companys response to these issues has been varied, with some clients noting satisfactory resolutions while others felt their concerns were not adequately addressed.

Platform and Trade Execution

The trading platform is a critical factor in a trader's experience. IFX Brokers offers both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both of which are well-regarded in the trading community for their advanced features and user-friendly interfaces. The platforms provide robust charting tools, technical indicators, and support for automated trading.

However, concerns have been raised regarding order execution quality, with some users reporting instances of slippage and rejected orders. While IFX Brokers claims to maintain a high execution speed, the reported issues suggest that traders should be cautious and monitor their trades closely.

Risk Assessment

Engaging with IFX Brokers carries certain risks, which potential traders should evaluate carefully. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | Regulated but not tier-1 |

| Fund Security | Medium | Segregated accounts, no compensation fund |

| Trading Costs | Medium | Higher spreads and commissions compared to competitors |

| Customer Support | Medium | Mixed reviews on responsiveness |

To mitigate these risks, traders are advised to start with a demo account, familiarize themselves with the platform, and only invest funds they can afford to lose. Additionally, maintaining regular communication with customer support can help address any issues that arise during trading.

Conclusion and Recommendations

Based on the comprehensive analysis presented, IFX Brokers does not appear to be a scam, but potential traders should exercise caution. The broker is regulated by the FSCA, which adds a layer of legitimacy, yet its tier-2 status and the absence of an investor compensation fund may be concerning for some. While trading conditions are competitive, the higher-than-average spreads and commission fees warrant careful consideration.

For traders seeking a reliable broker, it may be beneficial to explore alternatives with stronger regulatory oversight and better customer feedback. Brokers such as FXTM or IG Markets, which offer a wider range of services and have a solid reputation in the industry, could be viable options. Ultimately, traders should conduct thorough research, utilize demo accounts, and remain vigilant to ensure a positive trading experience.

Is iFX Brokers a scam, or is it legit?

The latest exposure and evaluation content of iFX Brokers brokers.

iFX Brokers Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

iFX Brokers latest industry rating score is 5.75, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.75 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.