Is KayaFX safe?

Pros

Cons

Is KayaFX Safe or a Scam?

Introduction

KayaFX is a forex broker that has positioned itself within the competitive landscape of online trading. Established in the UK, it claims to offer a wide range of trading services, including forex, commodities, and CFDs, through the popular MetaTrader 4 platform. However, the forex market is fraught with risks, and traders must exercise caution when selecting a broker. The potential for scams and unregulated entities is high, making it essential for investors to thoroughly evaluate the credibility and safety of a broker before committing their funds. This article investigates the legitimacy of KayaFX by analyzing its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

One of the critical factors in determining whether KayaFX is safe is its regulatory status. Regulation serves as a safeguard for investors, ensuring that brokers adhere to specific standards and practices that protect client funds. A lack of regulation can expose traders to higher risks, including the potential loss of their investments without recourse.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

KayaFX is not licensed by any recognized financial authority, such as the UK's Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC). The FCA has issued warnings against KayaFX, indicating that it operates without authorization and is potentially engaging in fraudulent activities. This lack of regulation is a significant red flag for potential investors.

The importance of regulatory oversight cannot be overstated. Regulated brokers are required to keep client funds in segregated accounts, provide transparent information about their services, and adhere to strict operational guidelines. The absence of such oversight with KayaFX raises serious concerns about the safety of client funds and the legitimacy of its operations.

Company Background Investigation

KayaFX claims to be owned by Alphatec Ltd, a company purportedly registered in the UK. However, investigations reveal inconsistencies in its corporate structure and ownership claims. The address listed for KayaFX appears to be associated with an accounting firm rather than a legitimate brokerage operation. This discrepancy raises questions about the transparency and reliability of the company.

The management team behind KayaFX has not been publicly disclosed, which further complicates the assessment of its credibility. A reputable broker typically provides information about its leadership and their professional backgrounds. In the case of KayaFX, the lack of such information hinders potential clients from making informed decisions about the safety of their investments.

Trading Conditions Analysis

When evaluating whether KayaFX is safe, it's essential to analyze its trading conditions, including fees and spreads. A broker's fee structure can significantly impact a trader's profitability and overall experience. KayaFX offers various account types, but the lack of transparency regarding its fee structure raises concerns.

| Fee Type | KayaFX | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | 3 pips | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

KayaFX's spreads for major currency pairs are notably higher than the industry average, which could eat into traders' profits. Additionally, the absence of clear information about commissions and overnight interest rates suggests a lack of transparency that could lead to unexpected costs for traders. Such practices are often associated with unregulated brokers, further questioning the safety of trading with KayaFX.

Client Fund Security

The security of client funds is paramount when assessing whether KayaFX is safe. Regulated brokers are required to implement measures such as segregated accounts and investor protection schemes to safeguard client deposits. However, KayaFX does not provide evidence of such protective measures.

The absence of information regarding fund segregation and negative balance protection raises alarms about the safety of traders' investments. Furthermore, the lack of a credible regulatory framework means that clients have little to no recourse if they encounter issues with withdrawals or if the broker defaults. Historical complaints and reports of clients being unable to withdraw their funds only add to the concerns surrounding KayaFX's financial security.

Customer Experience and Complaints

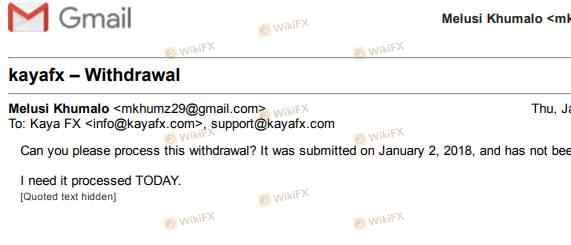

Customer feedback is a vital component in determining whether KayaFX is safe. A review of user experiences reveals a troubling trend of dissatisfaction and complaints. Many users report difficulties in withdrawing funds, with claims that the broker employs delaying tactics or outright refusal to process withdrawal requests.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Mismanagement | High | Poor |

Common complaints include users being pressured to deposit additional funds, with claims that their accounts were manipulated to incur losses. Such practices are often indicative of a scam operation. The lack of effective customer support and responsiveness to complaints further exacerbates the situation, leaving clients feeling abandoned and frustrated.

Platform and Trade Execution

The performance of the trading platform is another critical aspect to consider when evaluating whether KayaFX is safe. KayaFX utilizes the MetaTrader 4 platform, which is widely recognized for its user-friendly interface and robust trading features. However, reports of poor execution quality, including slippage and order rejections, have surfaced among users.

Traders have expressed concerns about the reliability of the platform, with claims of sudden disconnections and slow response times during crucial trading moments. Such issues can significantly impact a trader's ability to execute trades effectively, leading to potential financial losses. The presence of such complaints raises questions about the integrity of the trading environment provided by KayaFX.

Risk Assessment

In summary, the overall risk associated with trading with KayaFX is significant. The lack of regulation, poor customer feedback, and questionable business practices contribute to a high-risk profile.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Unregulated broker without oversight |

| Fund Security | High | No evidence of fund protection measures |

| Customer Support | High | Poor response to complaints and issues |

To mitigate these risks, potential traders are advised to conduct thorough research before engaging with KayaFX. It is essential to consider alternative brokers that are well-regulated and have a proven track record of reliability and transparency.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that KayaFX is not safe for trading. The lack of regulation, coupled with numerous complaints and a questionable operational history, indicates that traders should exercise extreme caution. There are clear signs of potential fraud, making it imperative for investors to seek alternative, reputable brokers.

For traders looking for reliable options, it is advisable to consider well-regulated brokers such as those licensed by the FCA or ASIC. These brokers typically offer better protection for client funds and adhere to industry standards that promote fair trading practices. In light of the findings, it is recommended that traders avoid KayaFX and prioritize their financial safety by choosing more trustworthy alternatives.

Is KayaFX a scam, or is it legit?

The latest exposure and evaluation content of KayaFX brokers.

KayaFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

KayaFX latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.