Executive Summary

This Meta Transaction review shows concerning findings about a forex broker that has been operating since 2007. The company currently faces serious credibility issues that affect its reputation in the trading community. According to multiple sources including WikiFX and regulatory databases, Meta Transaction has been flagged with a "SCAM" operating status, raising significant red flags for potential traders who might consider using their services. While the broker claims to offer secure, innovative, and reliable trading services under the regulatory oversight of the National Futures Association and the Commodity Futures Trading Commission, user feedback and independent assessments paint a drastically different picture.

The platform targets forex traders, particularly newcomers and less experienced individuals. These traders may be attracted by the relatively low minimum deposit requirement of $26, which seems accessible to those with limited starting capital. However, our comprehensive analysis reveals substantial issues across multiple operational areas, from customer service failures to withdrawal problems and questionable business practices that undermine trader confidence. The overwhelming negative user feedback and the broker's current classification as a fraudulent operation make it a high-risk choice for any trading activity. This Meta Transaction review aims to provide traders with essential information to make informed decisions about their trading partnerships and avoid potential financial losses.

Important Notice

Regional Entity Differences: Forex broker regulations vary significantly across different jurisdictions. These differences can substantially impact user experiences and legal protections available to traders in various regions. Traders should be aware that regulatory oversight in one region may not extend to operations in other areas, potentially affecting service quality and dispute resolution processes that could impact their trading outcomes.

Review Methodology: This evaluation is based on publicly available information, user feedback from multiple online platforms, and regulatory data from the NFA and CFTC. The assessment has not been conducted through direct verification or hands-on testing of the platform's services, which means some aspects may require further investigation. All information presented reflects the current available data and should be considered alongside independent research before making any trading decisions.

Rating Framework

Broker Overview

Meta Transaction presents itself as an established online trading platform. The company has been operating in the forex market since 2007, which gives it over a decade of claimed experience in the industry. The company positions itself as a provider of secure, innovative, and reliable trading services, specifically targeting the foreign exchange market where currency pairs are traded daily. According to available information, the broker has maintained its operations for over a decade, which initially might suggest stability and experience in the trading industry.

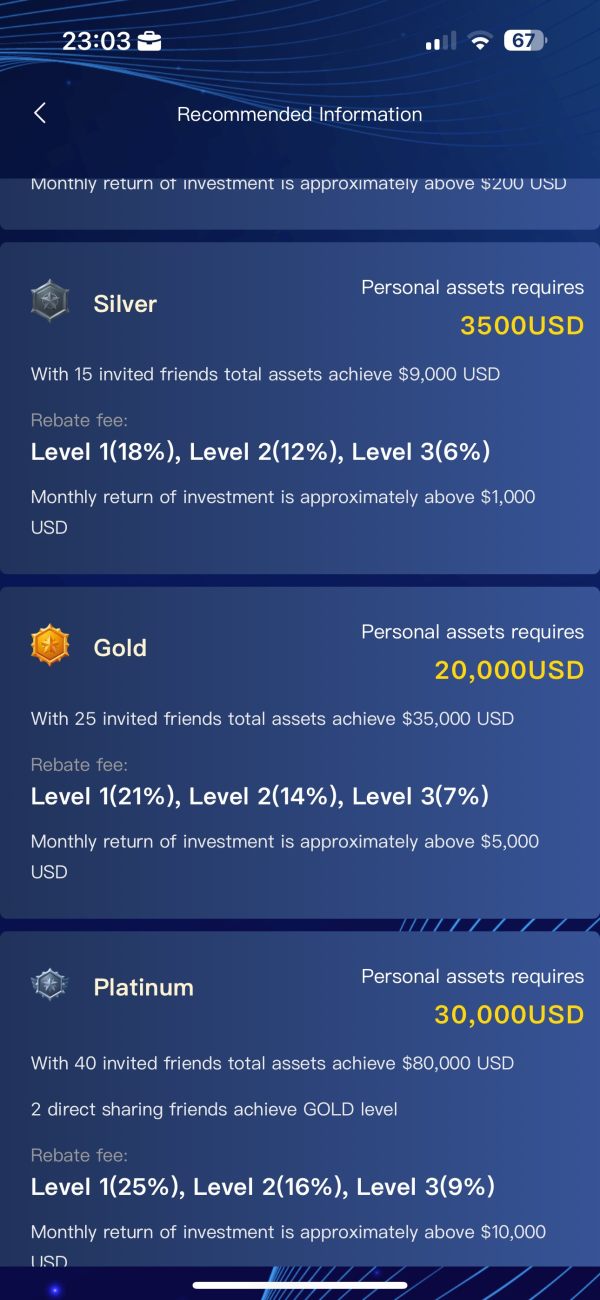

However, the longevity of operations does not necessarily translate to trustworthiness or quality service. This disconnect becomes evident when examining current regulatory concerns and actual user experiences with the platform. The broker's business model focuses primarily on forex trading services, claiming to offer a comprehensive trading environment for currency exchange activities that meet trader needs. Meta Transaction operates under the purported regulatory oversight of significant U.S. financial authorities, including the National Futures Association and the Commodity Futures Trading Commission.

Despite these claimed regulatory relationships, the platform has encountered severe credibility issues. These problems have led to its classification as a fraudulent operation by independent monitoring services that track broker performance and legitimacy. This Meta Transaction review examines these discrepancies between claimed services and actual user experiences to provide a complete assessment of the broker's current standing in the forex trading industry.

Regulatory Jurisdiction: Meta Transaction claims regulatory oversight from the National Futures Association and the Commodity Futures Trading Commission. Both organizations are prominent U.S. financial regulatory bodies that typically ensure strict compliance standards for legitimate brokers operating in their jurisdiction.

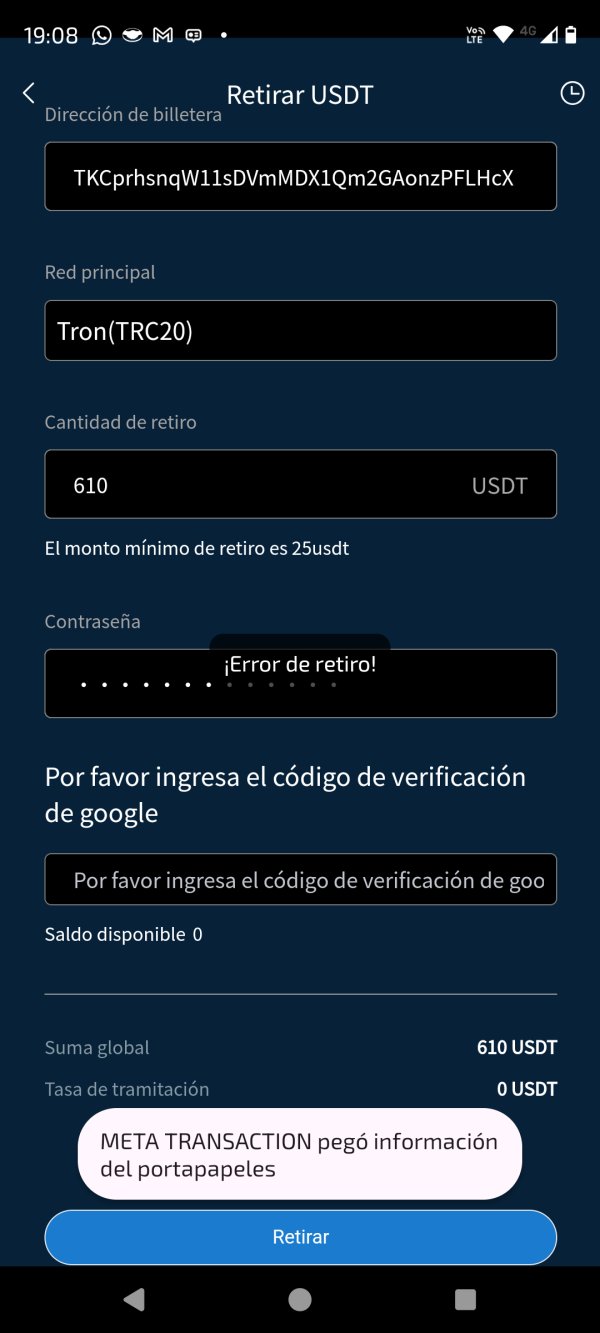

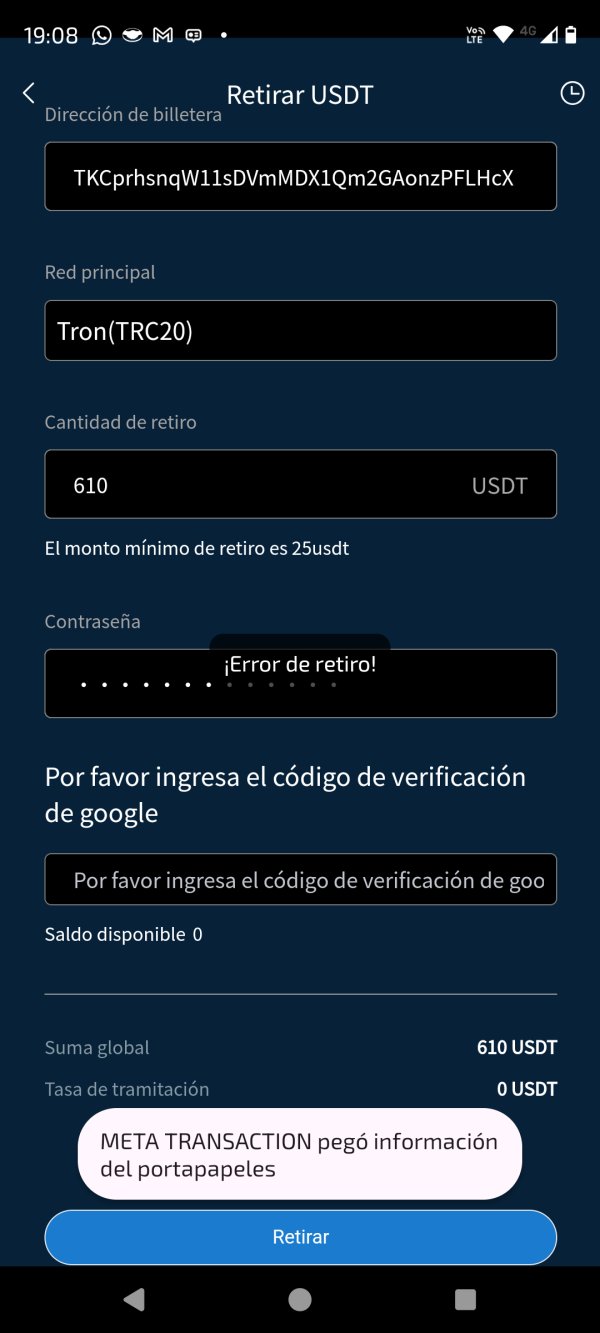

Deposit and Withdrawal Methods: Specific information regarding payment methods, processing times, and associated fees is not detailed in available documentation. This lack of transparency raises concerns for potential users who need to understand how they can fund their accounts and withdraw profits.

Minimum Deposit Requirements: The platform requires a minimum deposit of $26. This amount is relatively low compared to industry standards and may appeal to new traders with limited capital who want to start trading without significant upfront investment.

Bonus and Promotional Offers: No specific information about welcome bonuses, promotional campaigns, or incentive programs is mentioned in available sources. This absence suggests limited marketing initiatives or poor communication about available benefits for new and existing traders.

Tradeable Assets: The broker focuses primarily on forex trading, offering currency exchange services for various international currency pairs. However, specific currency pairs and market depth information is not clearly specified in available documentation, making it difficult to assess trading opportunities.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not provided in available documentation. This lack of transparency makes it difficult to assess the true cost of trading with this broker and compare it to industry alternatives.

Leverage Options: Specific leverage ratios and margin requirements are not mentioned in available sources. This omission is concerning given the importance of this information for risk management and trading strategy development.

Platform Selection: The trading platforms offered by Meta Transaction are not specified in available documentation. This gap leaves questions about technological capabilities and user interface quality that traders need to evaluate before choosing a broker.

Geographic Restrictions: Information about which countries or regions are restricted from using the platform's services is not clearly outlined. This lack of clarity can create problems for international traders who need to understand their eligibility before investing time and money.

Customer Support Languages: The specific languages supported by customer service representatives are not mentioned in available documentation. This Meta Transaction review highlights the lack of transparency in basic operational details that traders expect from professional brokers.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions offered by Meta Transaction present a mixed picture with significant information gaps. These gaps raise concerns about transparency and the broker's commitment to clear communication with potential clients. The most notable feature is the relatively low minimum deposit requirement of $26, which makes the platform accessible to traders with limited starting capital who want to enter the forex market without substantial upfront investment.

This low barrier to entry might initially appear attractive to newcomers in the forex market. However, the lack of detailed information about account types, features, and conditions creates uncertainty about what traders actually receive for their investment and what limitations they might encounter. Available documentation does not specify the different account tiers, special features, or benefits associated with higher deposit levels, which makes it difficult for traders to understand their options.

This absence of clear account structure information makes it difficult for potential traders to understand what services they can expect. Traders also cannot determine how their trading experience might improve with larger investments or what additional features become available at different account levels. The account opening process, verification requirements, and timeline for account activation are also not detailed in available sources, creating additional uncertainty for prospective clients.

User feedback regarding account conditions has been predominantly negative. Traders express frustration about unclear terms and unexpected limitations discovered only after making their initial deposit and beginning to use the platform. This Meta Transaction review found that the lack of transparent account information, combined with negative user experiences, significantly undermines the appeal of the low minimum deposit requirement.

Meta Transaction's offering in terms of trading tools and educational resources appears severely limited. This limitation is concerning for a broker that claims to have been operating since 2007 and should have developed comprehensive support systems over time. No specific trading tools, analytical resources, or educational materials are mentioned in the platform's documentation, which creates significant gaps in trader support and market analysis capabilities.

The absence of detailed information about research capabilities, market analysis, technical indicators, or automated trading support suggests problems. These issues indicate either a lack of these essential features or poor communication about available resources that traders need for successful forex trading. Modern forex trading requires sophisticated analytical tools, real-time market data, and comprehensive educational resources to help traders make informed decisions in volatile currency markets.

Professional traders typically expect access to advanced charting tools, economic calendars, market sentiment indicators, and expert analysis. These resources support their trading strategies and help them navigate complex market conditions with greater confidence and analytical depth. Educational resources are particularly important for the broker's target audience of new and less experienced traders who need guidance and learning materials.

The complete lack of information about tutorials, webinars, trading guides, or mentorship programs indicates a significant gap. This absence means the broker fails in supporting trader development and education, which are crucial for long-term trading success. Without proper educational support and analytical tools, traders are left to navigate complex forex markets with minimal assistance, increasing their risk of losses and poor trading decisions.

Customer Service and Support Analysis

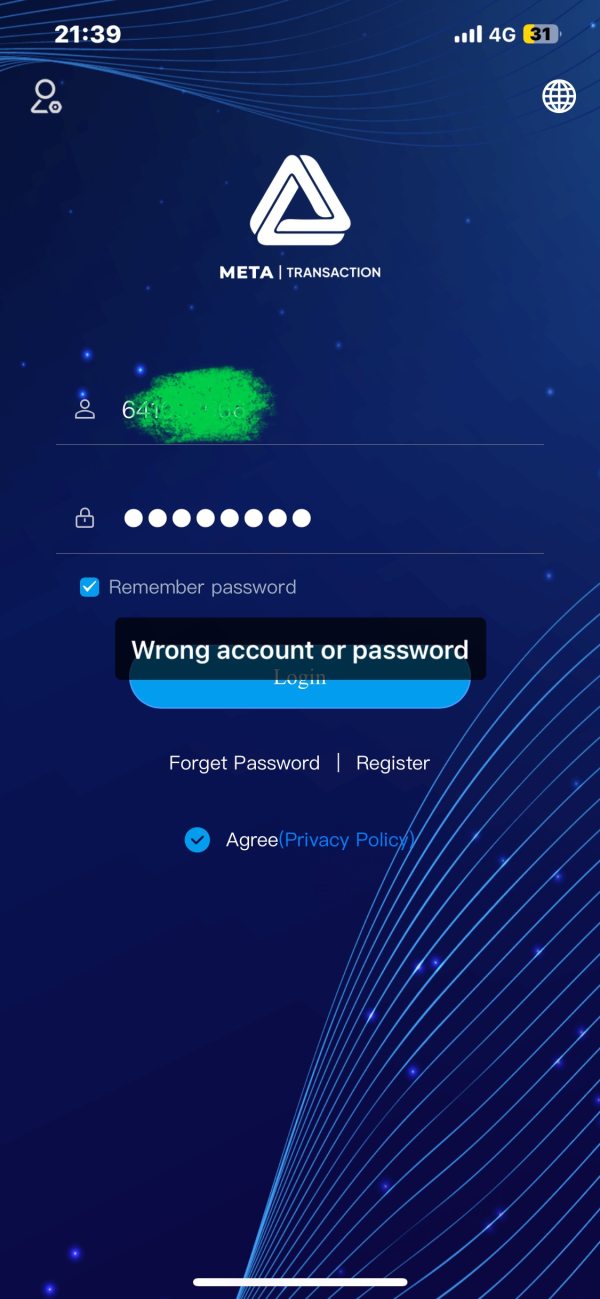

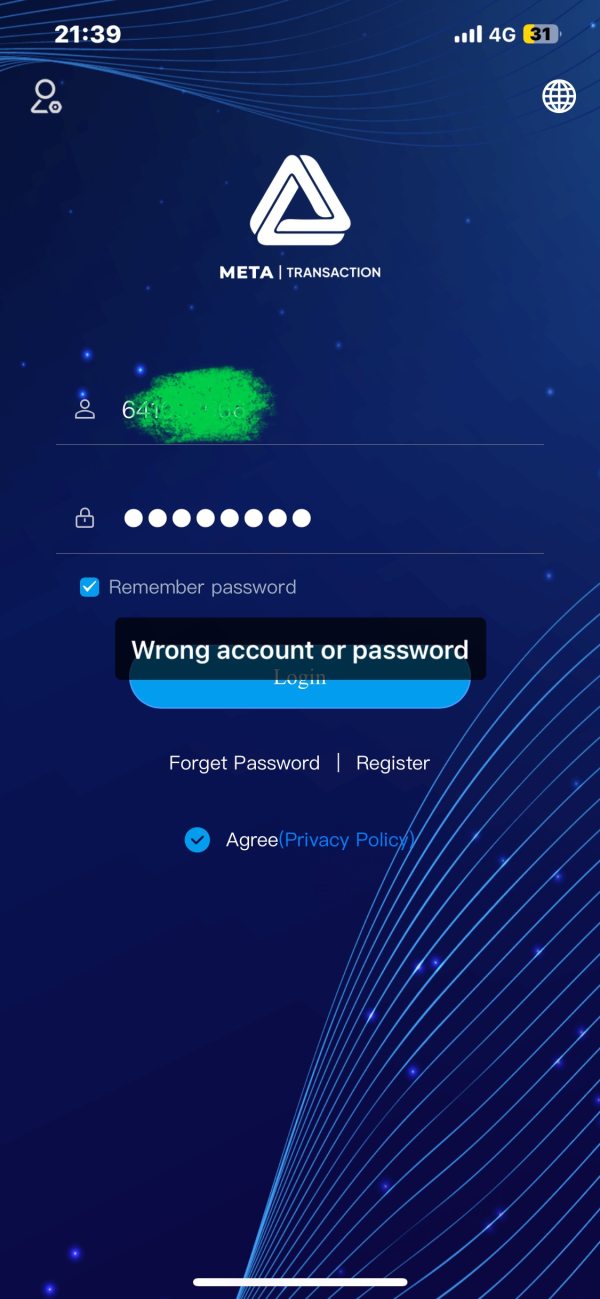

Customer service quality emerges as one of Meta Transaction's most significant weaknesses. This assessment is based on user feedback and available information that consistently points to poor support experiences across multiple areas of customer interaction. Multiple sources indicate that users have experienced poor response times, inadequate support quality, and difficulty reaching customer service representatives when issues arise, particularly during urgent situations.

This customer service problem is particularly concerning in forex trading. Market conditions can change rapidly, and timely support is crucial for resolving urgent trading issues that could affect profitability and risk management. The available documentation does not specify customer service channels, operating hours, or response time guarantees, which suggests a lack of structured support systems that professional traders expect from legitimate brokers.

Users have reported frustration with slow responses to inquiries. These delays are particularly problematic regarding withdrawal requests and account-related problems that require immediate attention to prevent financial losses or missed trading opportunities. The absence of comprehensive customer service information raises questions about the broker's commitment to supporting its clients effectively and maintaining professional standards in client relations.

Language support options are not clearly outlined in available documentation. This lack of clarity could create additional barriers for international traders seeking assistance in their native languages or preferred communication methods. The lack of detailed customer service information, combined with consistently negative user feedback about support experiences, indicates that Meta Transaction has significant deficiencies in this critical operational area that directly impacts trader satisfaction and problem resolution.

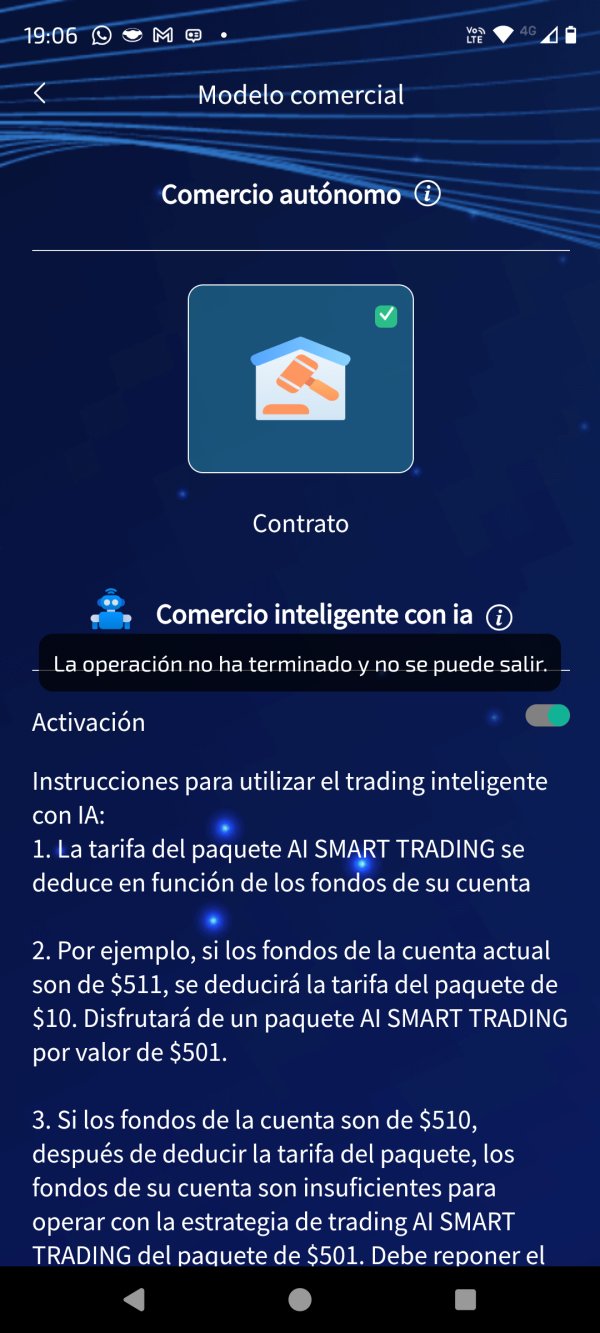

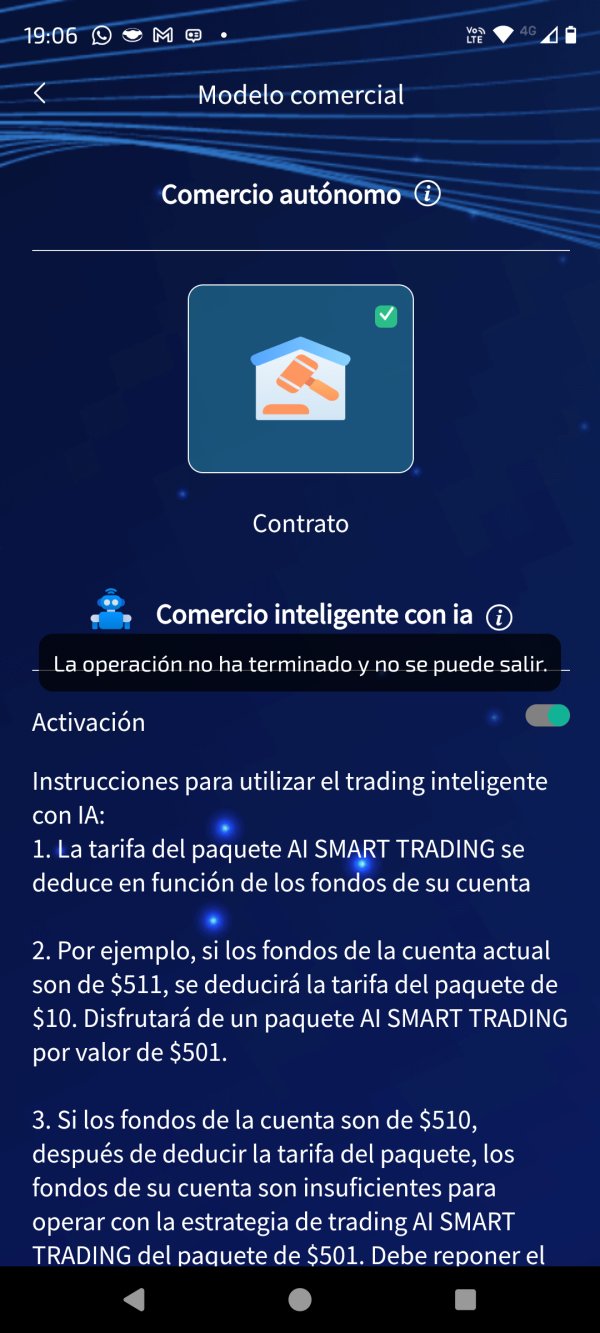

Trading Experience Analysis

The trading experience provided by Meta Transaction has received mixed to negative feedback from users. User reports focus particularly on concerns about platform stability and order execution quality that can significantly impact trading performance and profitability. User reports indicate issues with platform reliability, including connectivity problems and system instability during critical trading periods when market volatility is high and reliable access is essential.

These technical issues can significantly impact trading performance. Platform instability creates additional risks for traders attempting to execute time-sensitive strategies that depend on precise timing and reliable market access for success. Order execution quality appears to be another area of concern, with users reporting problems including slippage and requoting, which can negatively affect trading profitability and create unexpected costs for traders.

The platform's liquidity provision seems insufficient to handle order flow effectively. This inadequacy leads to execution delays and price discrepancies that disadvantage traders and create unfavorable trading conditions compared to more established brokers. These execution issues are particularly problematic in the fast-moving forex market where price accuracy and execution speed are crucial for maintaining competitive trading performance.

The lack of detailed information about the trading platform's features, mobile accessibility, and advanced trading capabilities makes assessment difficult. Traders cannot properly evaluate the overall technological sophistication of the trading environment before committing their funds to the platform. User feedback suggests that the platform does not meet modern standards for forex trading technology, with limited functionality and poor performance reliability. This Meta Transaction review indicates that traders seeking a professional-grade trading experience may find the platform inadequate for their needs.

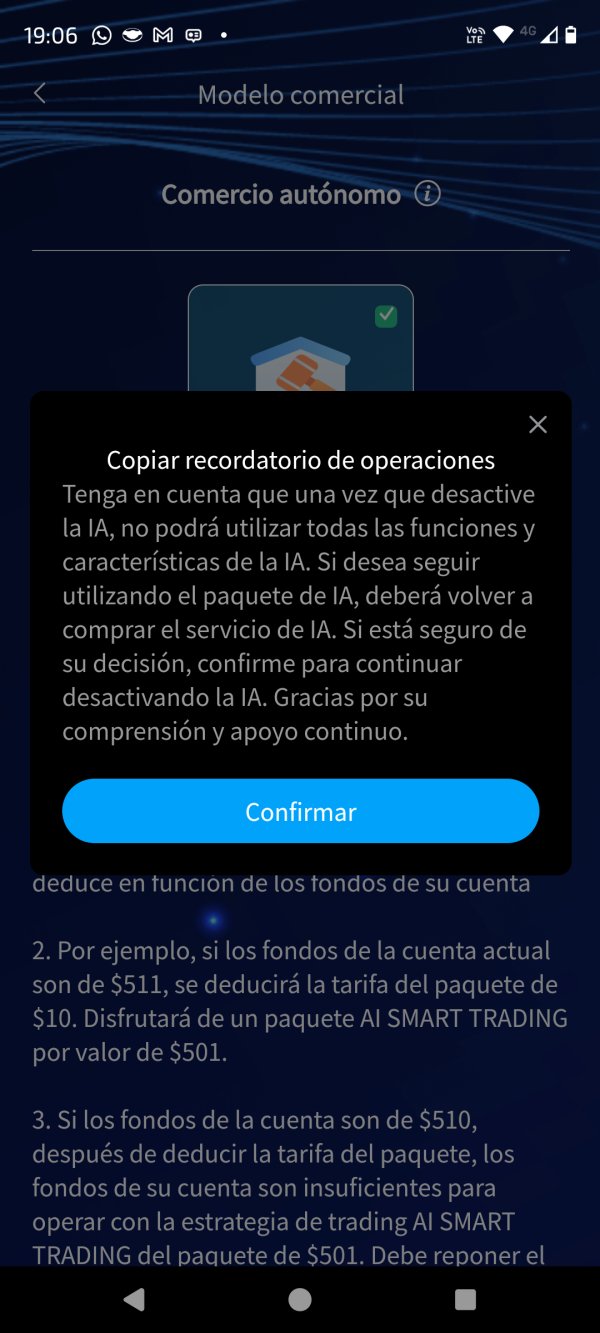

Trust and Security Analysis

Trust and security represent Meta Transaction's most critical failure area. The broker has received a "SCAM" classification from independent monitoring services that track broker legitimacy and performance across the industry. This severe rating indicates serious concerns about the platform's legitimacy and operational integrity that should alarm potential traders considering the platform.

Despite claims of regulatory oversight from the NFA and CFTC, the broker's actual regulatory status remains questionable. Available evidence suggests that compliance with financial industry standards may not meet the requirements expected from legitimate brokers operating under proper regulatory supervision. The transparency level maintained by Meta Transaction is insufficient for building trader confidence and establishing the trust necessary for successful broker-client relationships.

Limited disclosure about company ownership, financial backing, and operational procedures creates additional concerns. Professional traders expect transparency in these areas to assess the stability and legitimacy of their chosen broker before entrusting significant funds to the platform. Users have expressed significant doubts about the platform's legitimacy, with many questioning whether their funds are secure and whether the broker operates as a legitimate financial services provider.

The broker's reputation within the forex industry has been severely damaged. The fraud classification and negative user experiences have created a pattern of distrust that affects the broker's standing among both individual traders and industry professionals. The lack of clear information about fund protection measures, segregated accounts, and insurance coverage for client deposits creates additional security concerns that compound existing trust issues.

The absence of third-party audits or independent verification of the broker's financial stability further undermines confidence. These verification measures are standard practice among legitimate brokers and help establish credibility in the competitive forex industry where trust is essential for long-term success.

User Experience Analysis

Overall user satisfaction with Meta Transaction is notably low. This dissatisfaction is evidenced by widespread negative feedback and complaints across multiple review platforms where traders share their experiences with different brokers. Users consistently report disappointment with various aspects of their trading experience, from initial registration through ongoing platform usage and particularly during withdrawal attempts when they try to access their funds.

The cumulative effect of these negative experiences has created a pattern of user dissatisfaction. This pattern spans multiple operational areas and suggests systemic problems rather than isolated issues that could be easily resolved through minor improvements. While specific details about interface design and platform usability are not extensively documented, user feedback suggests that the platform fails to meet modern standards for user-friendly design and intuitive navigation.

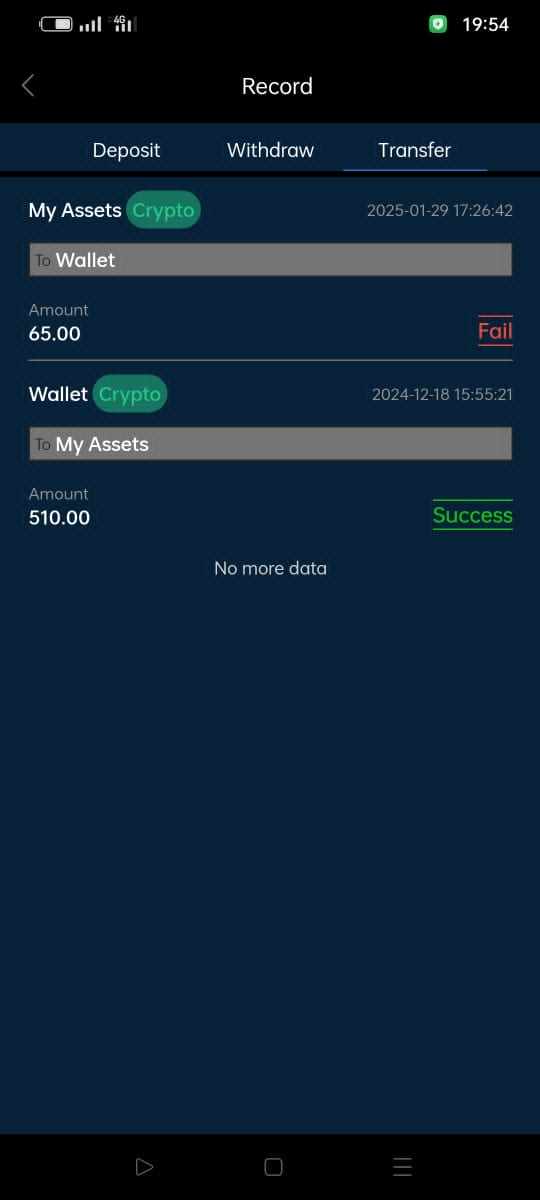

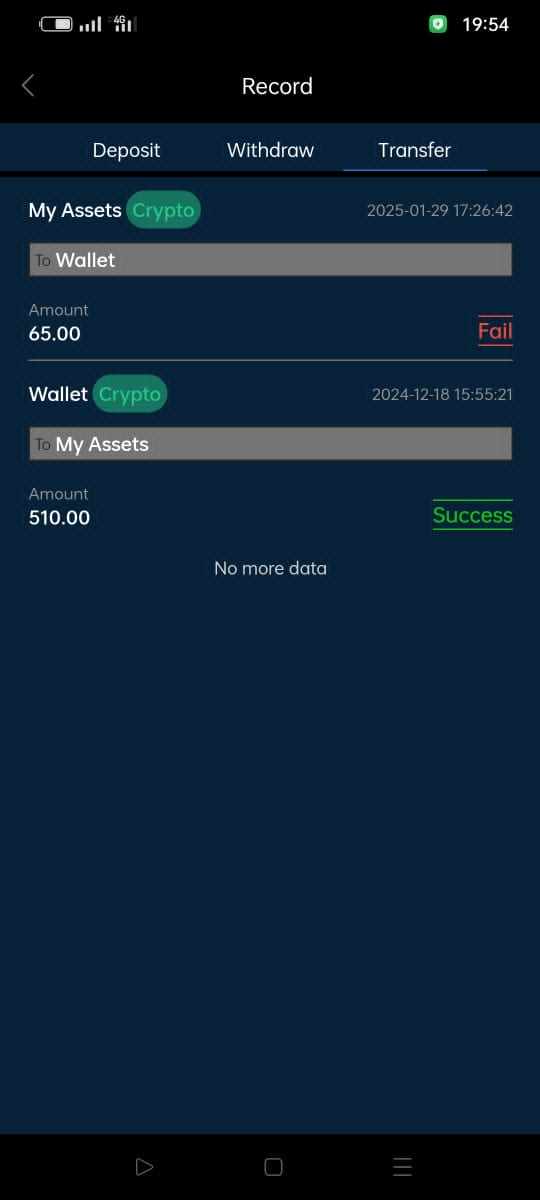

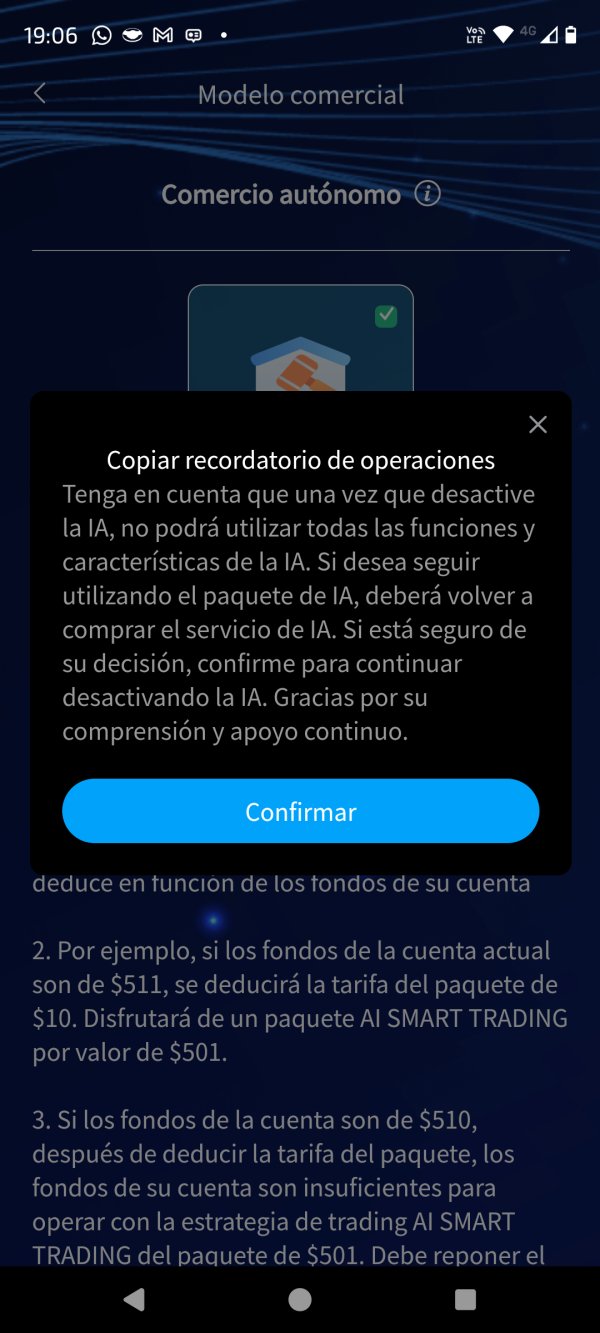

The registration and account verification processes appear to lack clarity and efficiency. These initial problems contribute to user frustration from the earliest stages of engagement with the platform and set a negative tone for the overall trading relationship. The most significant user experience issues center around fund withdrawal problems, with multiple reports of delays, complications, and difficulties in accessing deposited funds that should be readily available to account holders.

These withdrawal issues have become a primary source of user complaints. They contribute significantly to the broker's poor reputation and create serious concerns about fund security and the broker's commitment to honoring withdrawal requests in a timely manner. The concentration of negative feedback on fundamental issues like fund access and platform legitimacy indicates systemic problems that affect the core user experience rather than minor operational inconveniences that could be overlooked.

Conclusion

This comprehensive Meta Transaction review reveals a forex broker that fails to meet basic industry standards. The platform shows deficiencies in safety, reliability, and service quality that make it unsuitable for serious forex trading activities. While the platform's 2007 establishment date might initially suggest experience and stability, the current "SCAM" classification and overwhelming negative user feedback indicate serious operational and ethical deficiencies.

The broker is not recommended for any trader category. This recommendation applies particularly to newcomers who might be attracted by the low $26 minimum deposit requirement but could face significant risks and losses. The primary advantage of accessibility through low minimum deposits is completely overshadowed by significant disadvantages including fraud classification, withdrawal problems, poor customer service, and questionable business practices that compromise trader safety and success.

Traders seeking a secure and reliable forex trading environment should consider alternative brokers. Better options include brokers with proper regulatory standing and positive user feedback that demonstrate commitment to professional standards and client protection in the competitive forex industry.