MTFE 2025 Review: Everything You Need to Know

Summary

This comprehensive mtfe review presents a balanced assessment of MTFE (Metaverse Foreign Exchange), a trading platform that has generated mixed reactions within the forex community. Our evaluation reveals a broker that offers certain attractive features for entry-level traders. These features include a relatively low minimum deposit requirement of 50 euros and access to multiple asset classes including forex, commodities, stocks, and cryptocurrencies. However, significant concerns regarding regulatory transparency and polarized user feedback warrant careful consideration.

MTFE positions itself as an accessible trading platform. The platform particularly appeals to beginners and traders seeking low-barrier entry into financial markets. The platform's multi-asset approach allows traders to diversify their portfolios across various financial instruments. Nevertheless, our analysis indicates substantial gaps in regulatory information and concerning user reports regarding withdrawal processes and customer service quality. This results in a neutral overall assessment that requires potential users to proceed with heightened due diligence.

Important Notice

Regional Entity Variations: This review acknowledges that MTFE's regulatory status remains unclear across different jurisdictions. The absence of clearly disclosed regulatory information in available sources may result in varying user experiences depending on geographical location and local financial regulations. Potential traders should verify the platform's regulatory compliance in their specific region before engaging with the service.

Review Methodology: This assessment is primarily based on available user feedback, market information, and publicly accessible data. Our evaluation does not include direct field research or hands-on testing of the platform. Readers should consider this limitation when making trading decisions based on this review.

Rating Framework

Broker Overview

MTFE was established in 2015 and operates as an online trading platform headquartered in Canada. The company has positioned itself within the competitive forex and multi-asset trading space, offering services that span traditional foreign exchange markets alongside modern financial instruments including cryptocurrency trading. The platform's operational model focuses on providing accessible trading solutions with an emphasis on accommodating traders with varying experience levels and capital requirements.

The broker's business approach centers on delivering a comprehensive trading environment through its proprietary MTFE platform. According to available information, the company has maintained operations for nearly a decade. During this time, it has developed its service offerings to include forex pairs, commodities, equities, and digital assets. This diversified approach reflects current market trends toward multi-asset trading platforms that cater to evolving trader preferences and portfolio diversification strategies. However, this mtfe review notes that detailed information about the company's corporate structure and operational transparency remains limited in publicly available sources.

Regulatory Status: Available information does not specify MTFE's regulatory oversight or licensing details. This absence of clear regulatory disclosure represents a significant concern for potential traders seeking transparency in broker selection.

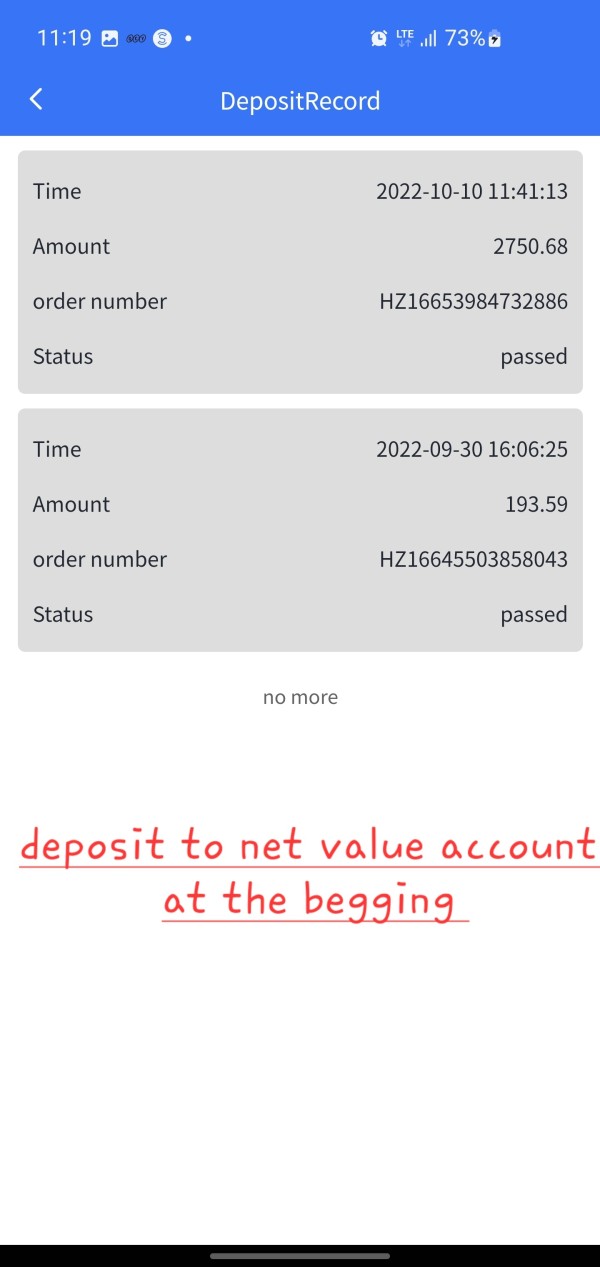

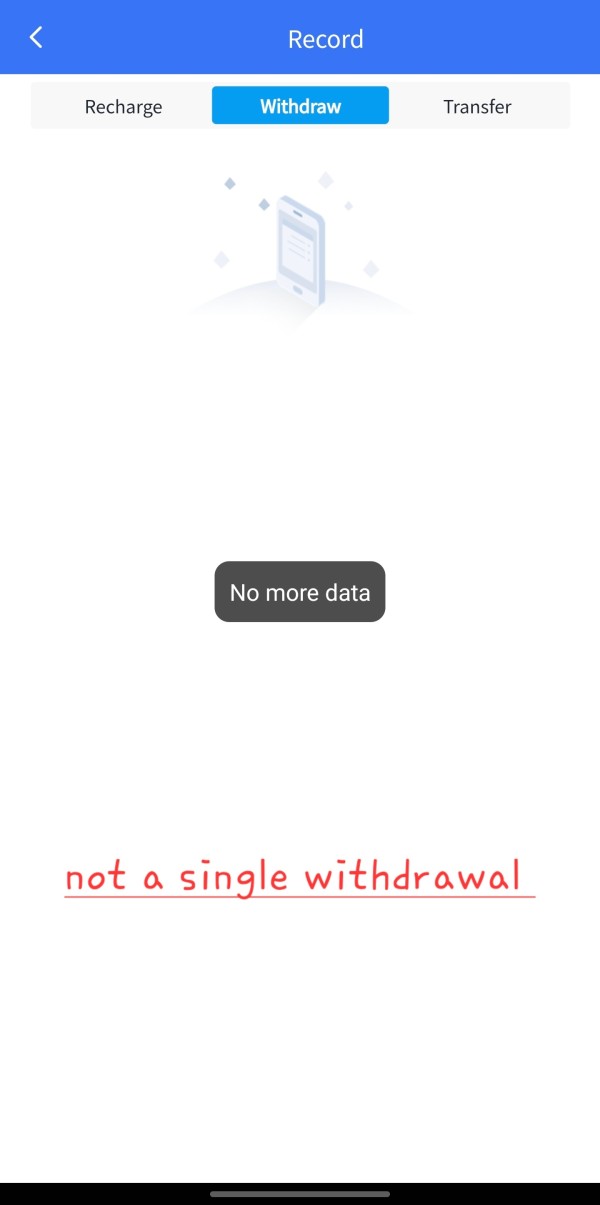

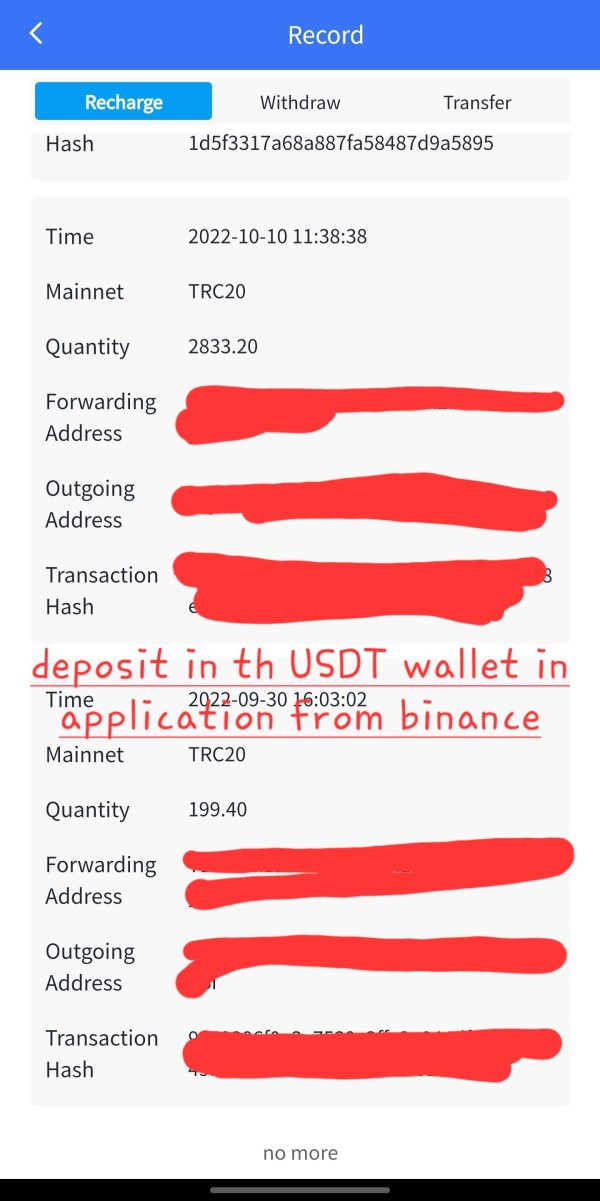

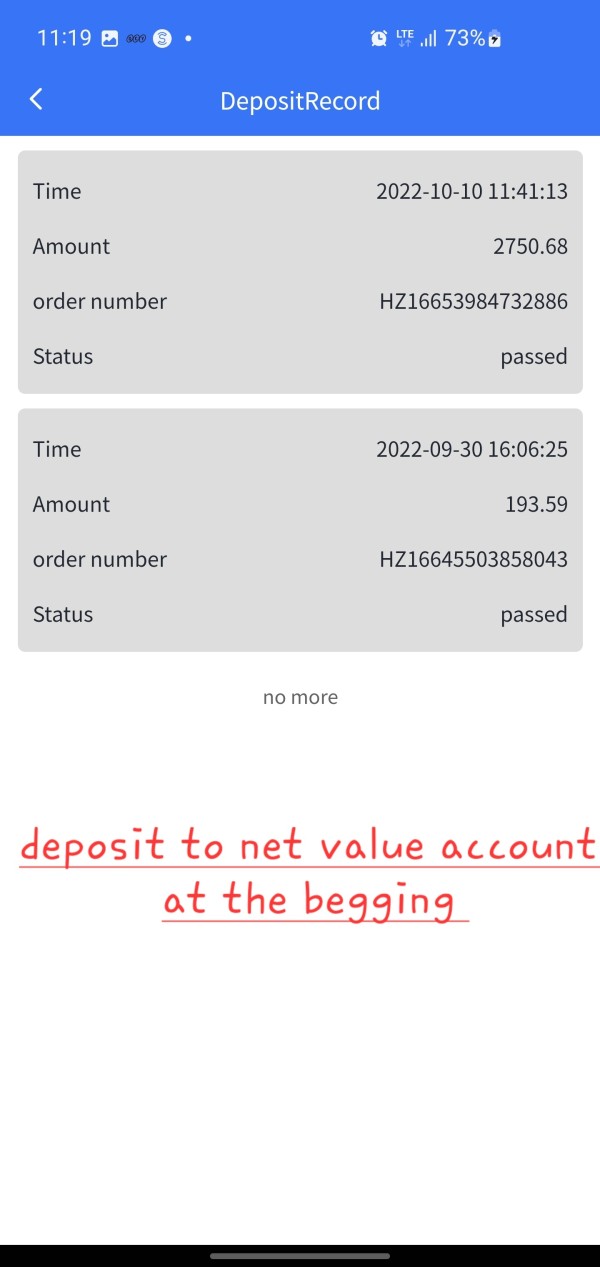

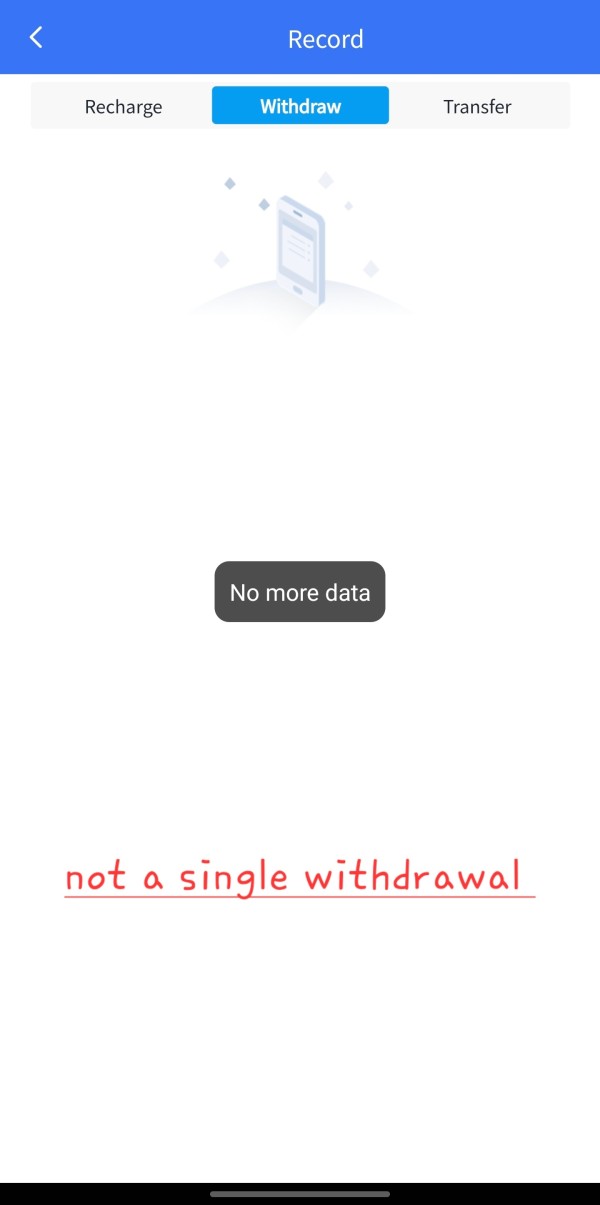

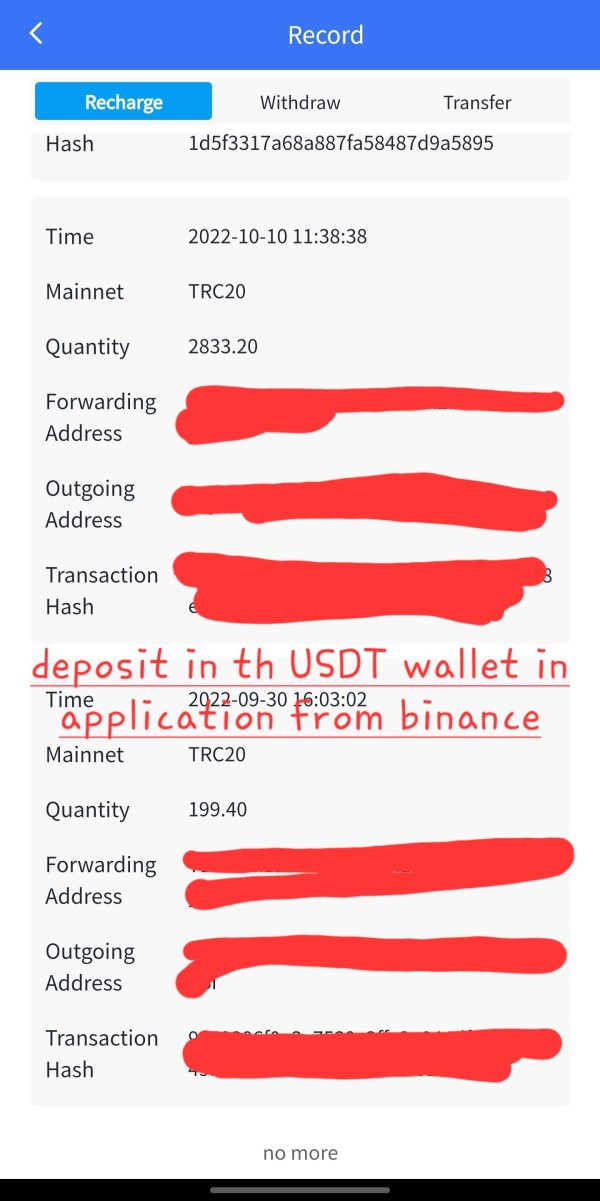

Deposit and Withdrawal Methods: Specific payment processing methods and withdrawal procedures are not detailed in available sources. User feedback suggests some challenges with withdrawal processing times.

Minimum Deposit Requirements: MTFE requires a minimum deposit of 50 euros. This positions it as accessible for entry-level traders and those testing new platforms with limited capital exposure.

Bonus and Promotional Offers: Current promotional structures and bonus programs are not specified in available documentation. This suggests either absence of such offerings or limited disclosure of promotional terms.

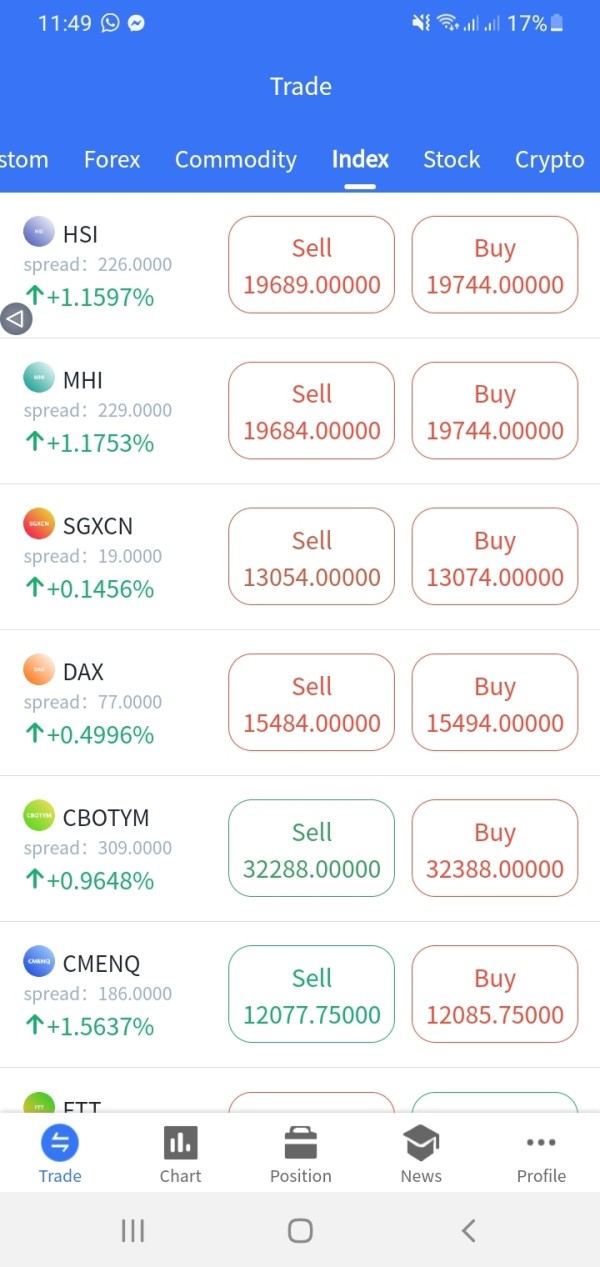

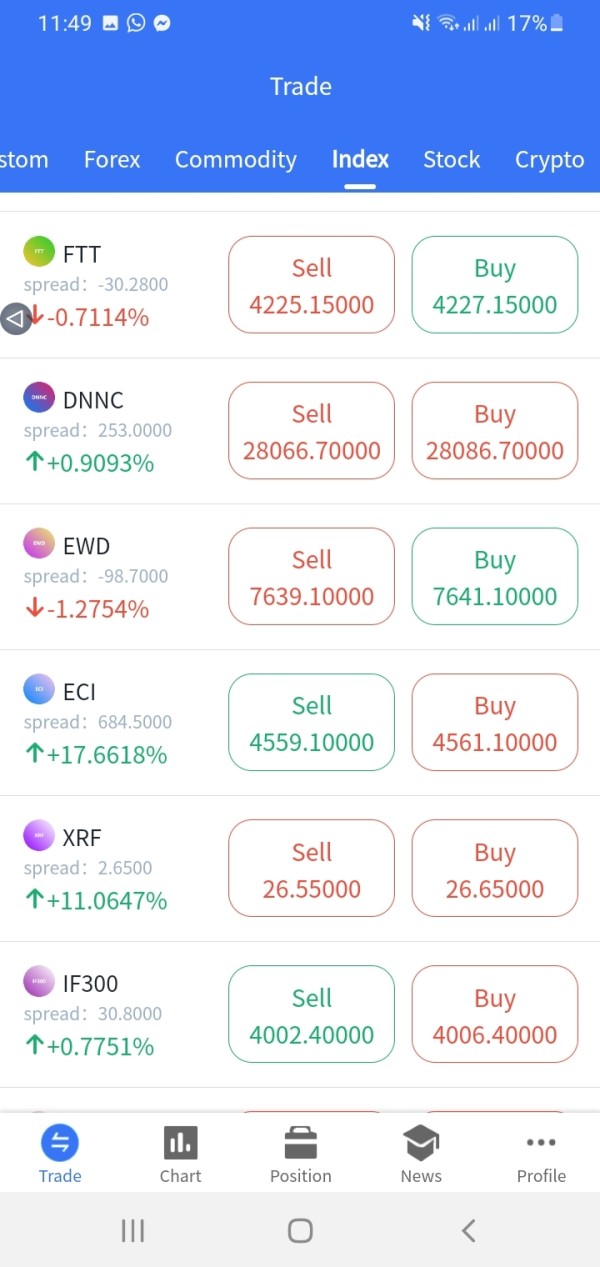

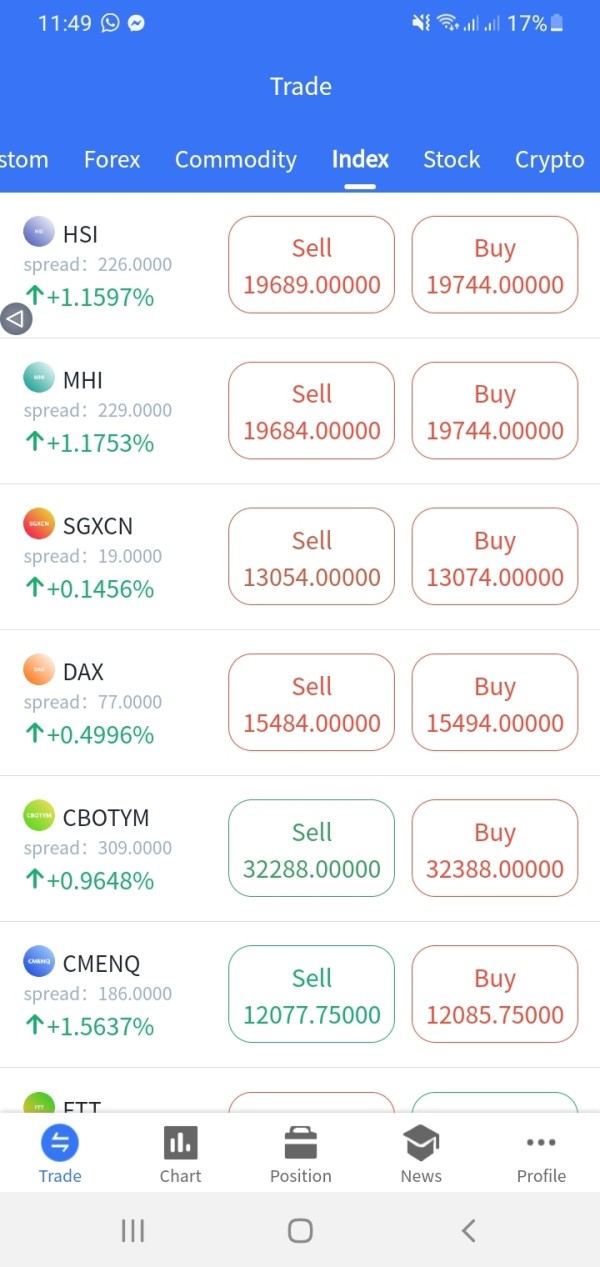

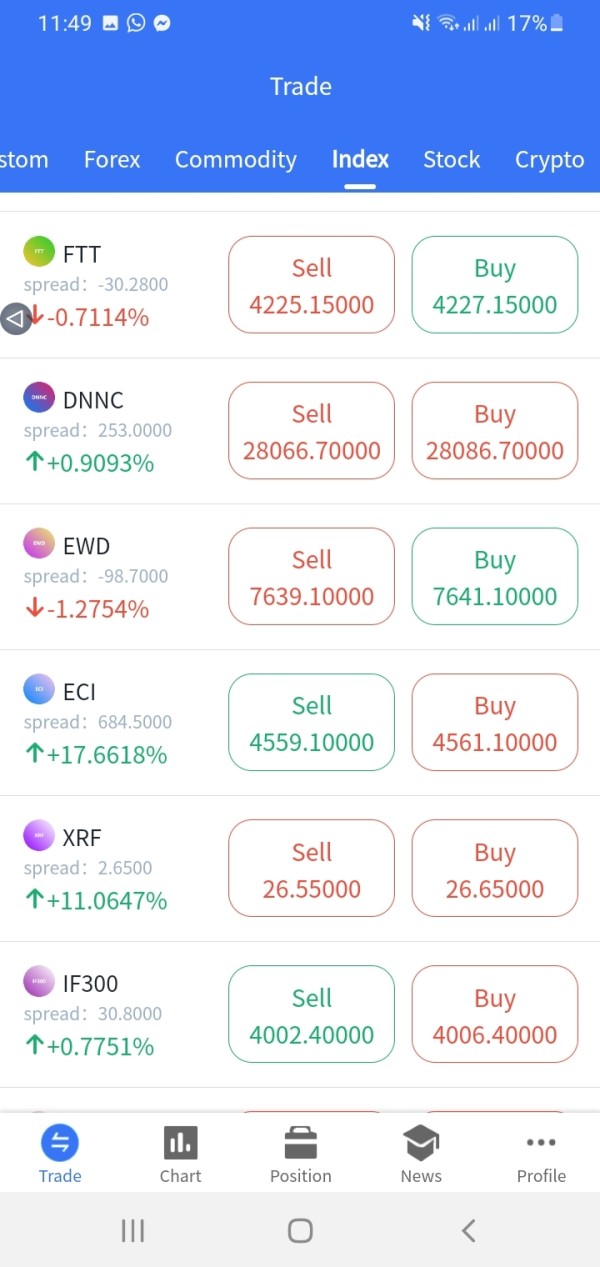

Tradeable Assets: The platform provides access to multiple asset classes including foreign exchange pairs, commodity markets, stock trading opportunities, and cryptocurrency instruments. This offers portfolio diversification options for traders.

Cost Structure: Detailed information regarding spreads, commissions, and fee structures is not comprehensively available in current sources. This limits cost comparison capabilities with competing platforms.

Leverage Options: Specific leverage ratios and margin requirements are not detailed in available information. This prevents accurate assessment of risk management parameters.

Platform Selection: MTFE operates through its proprietary trading platform. Technical specifications and platform capabilities require further investigation.

Geographic Restrictions: Regional availability and access limitations are not clearly specified in current documentation.

Customer Service Languages: Multi-language support capabilities are not detailed in available sources.

This mtfe review emphasizes that the limited availability of detailed operational information presents challenges for comprehensive broker evaluation. It may indicate areas where MTFE could improve transparency.

Detailed Rating Analysis

Account Conditions Analysis (6/10)

MTFE's account structure demonstrates both strengths and limitations that contribute to its moderate rating in this category. The platform's 50-euro minimum deposit requirement stands as its primary advantage. This creates accessibility for novice traders and those seeking to minimize initial capital exposure. This threshold compares favorably with many established brokers that require significantly higher initial investments, making MTFE potentially attractive for market entry-level participants.

However, available information lacks comprehensive details about account type variations, tier structures, or specialized account features that experienced traders often seek. The absence of information regarding Islamic accounts, professional trader classifications, or VIP service levels suggests either limited account diversity or insufficient disclosure of available options. Additionally, the account opening process specifics, verification requirements, and documentation procedures are not clearly outlined in accessible sources.

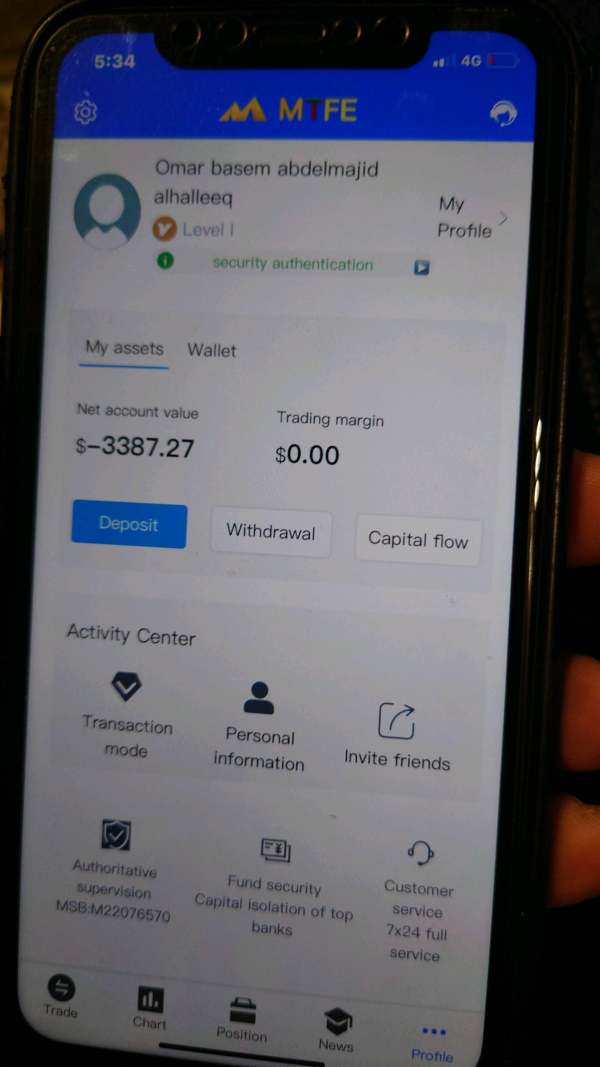

User feedback indicates mixed experiences with account management, particularly regarding withdrawal procedures and account maintenance. Some traders report satisfactory account functionality, while others express concerns about processing delays and communication challenges. The lack of detailed fee structures and account maintenance costs further complicates assessment of overall account value proposition. This mtfe review notes that while the low minimum deposit provides accessibility, the limited transparency regarding account features and conditions prevents a higher rating in this crucial evaluation area.

MTFE receives a favorable rating for tools and resources primarily due to its multi-asset trading capability. This provides traders with diversification opportunities across forex, commodities, stocks, and cryptocurrencies. This comprehensive asset selection represents a significant strength, allowing portfolio diversification within a single platform environment. The variety of tradeable instruments suggests the platform has invested in developing broad market access, which appeals to traders seeking exposure to different financial sectors.

The platform's proprietary trading system appears to support various asset classes effectively. However, specific technical analysis tools, charting capabilities, and automated trading features are not detailed in available documentation. The absence of information regarding research resources, market analysis provision, educational materials, and trading signal services limits comprehensive evaluation of the platform's resource depth.

User experiences with available tools show mixed feedback, with some traders appreciating the asset variety while others seek more sophisticated analytical resources. The platform's resource offering appears suitable for basic to intermediate trading needs, but advanced traders may find limitations in specialized tools and research capabilities. Without detailed information about mobile applications, API access, or third-party tool integration, it's challenging to assess the platform's technological sophistication fully. The rating reflects the positive aspect of diverse asset access while acknowledging the need for more comprehensive tool documentation and user feedback regarding resource quality.

Customer Service and Support Analysis (5/10)

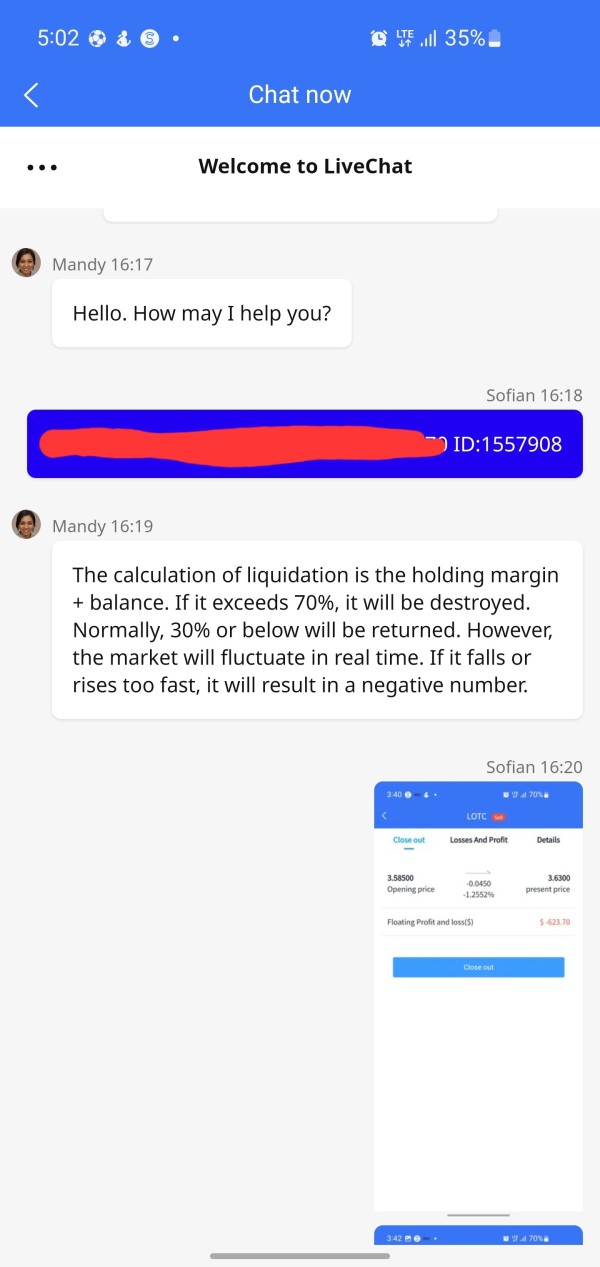

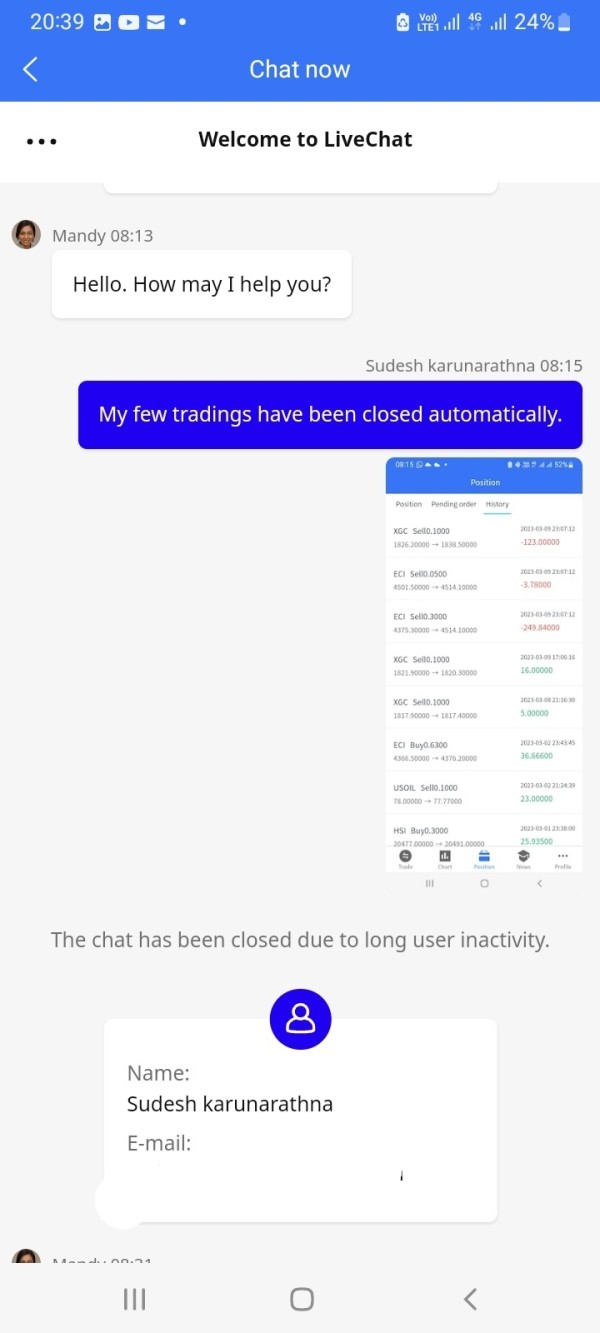

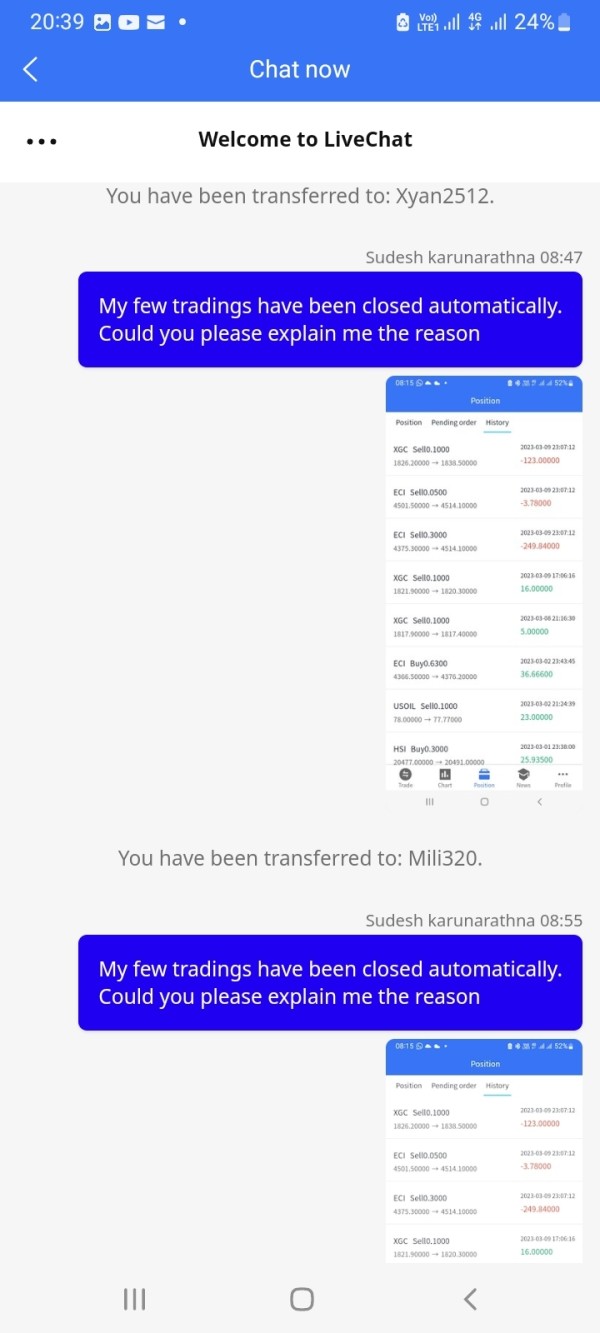

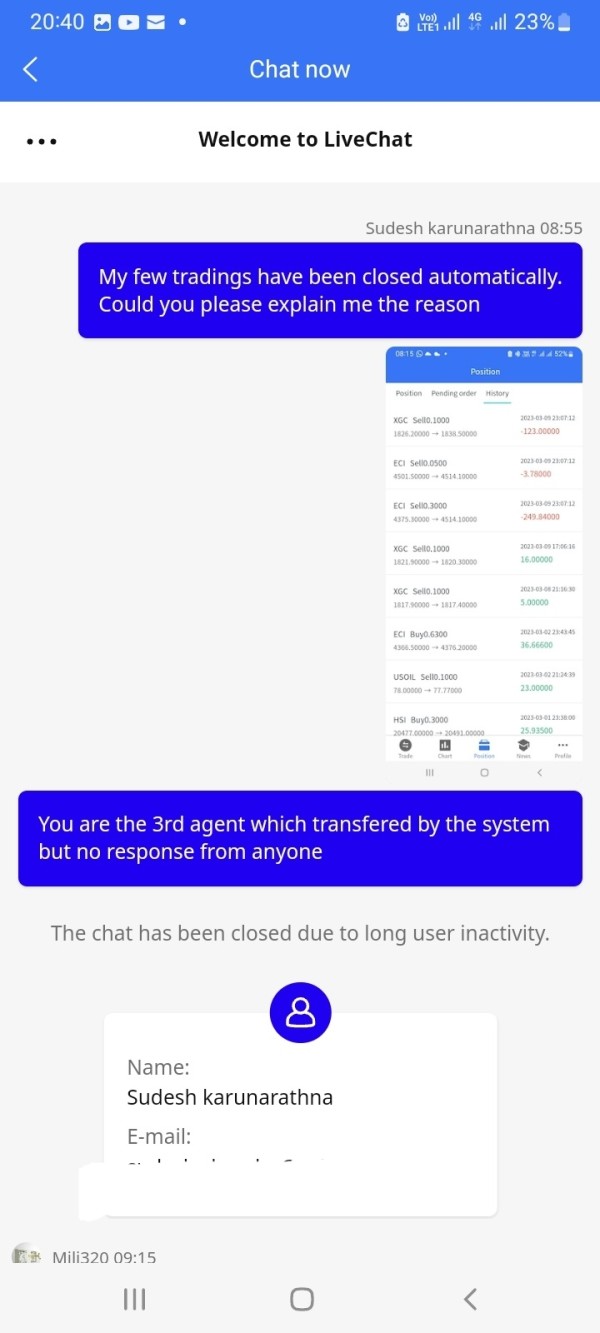

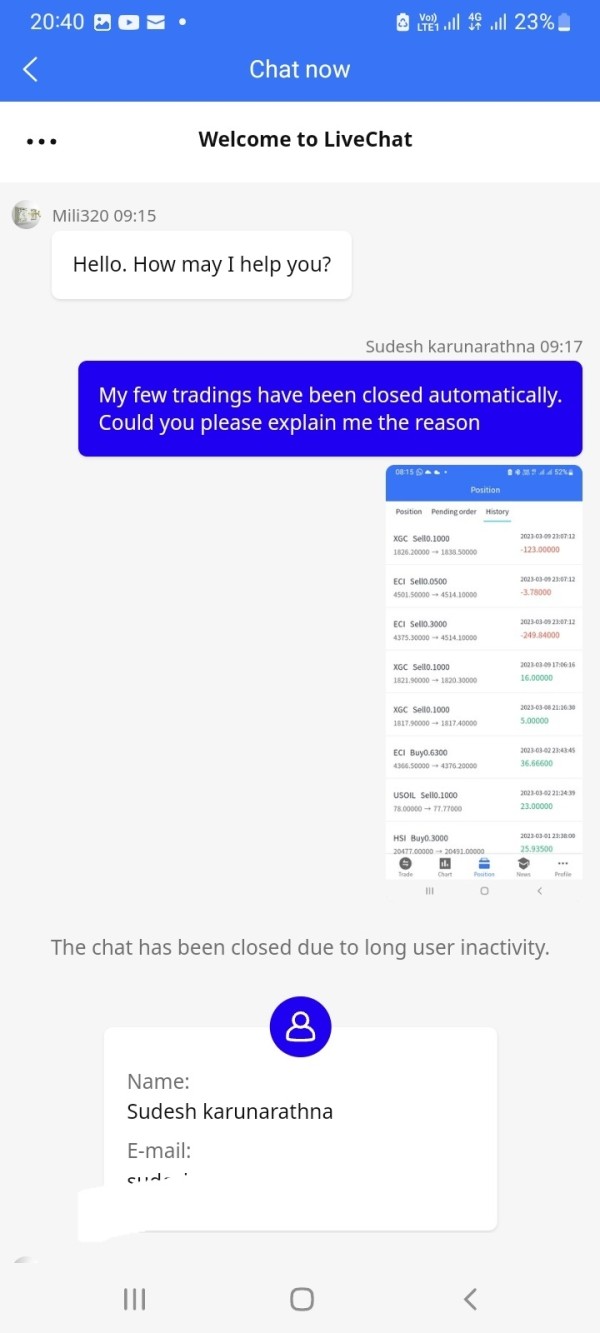

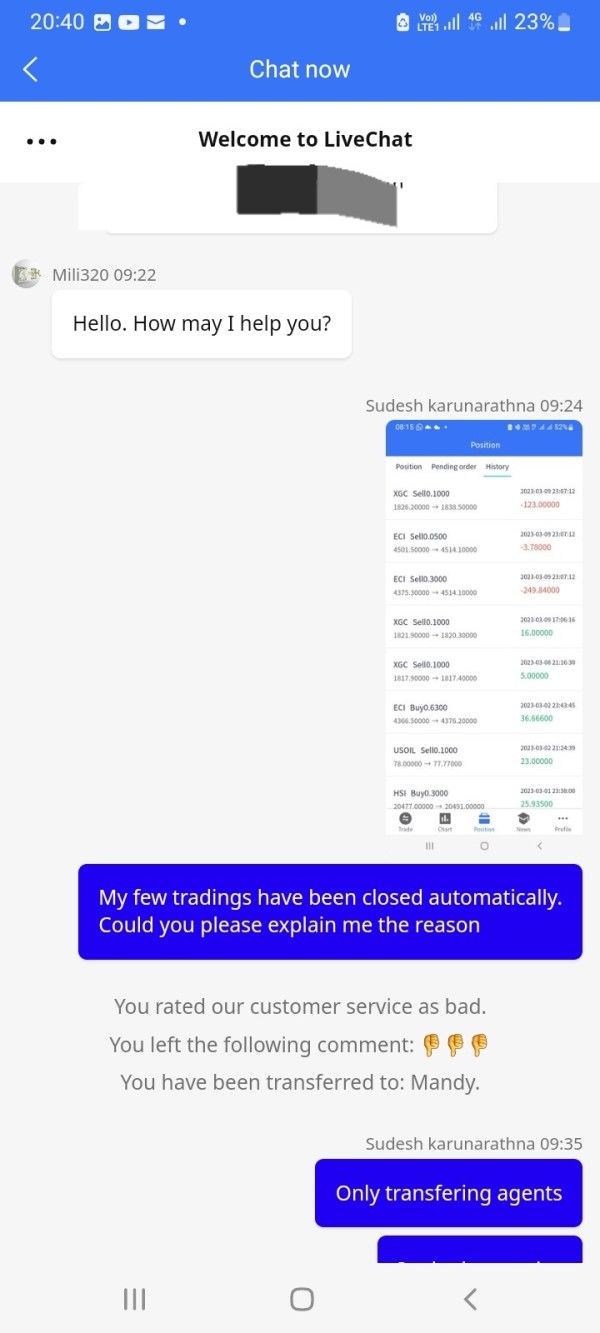

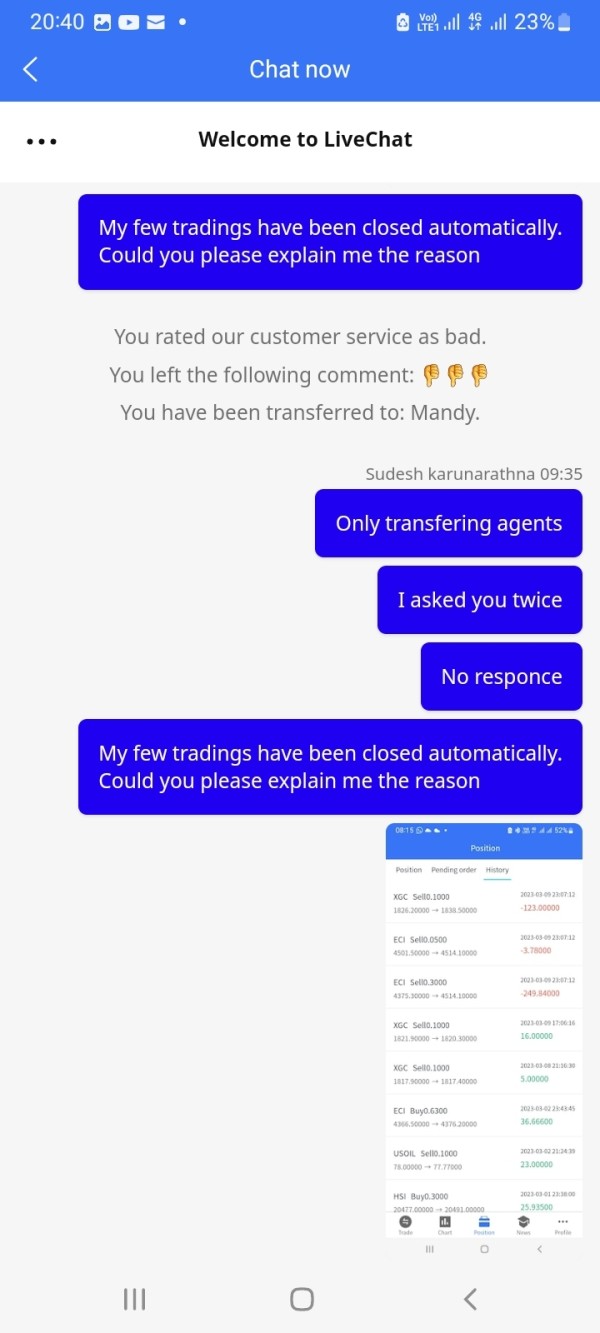

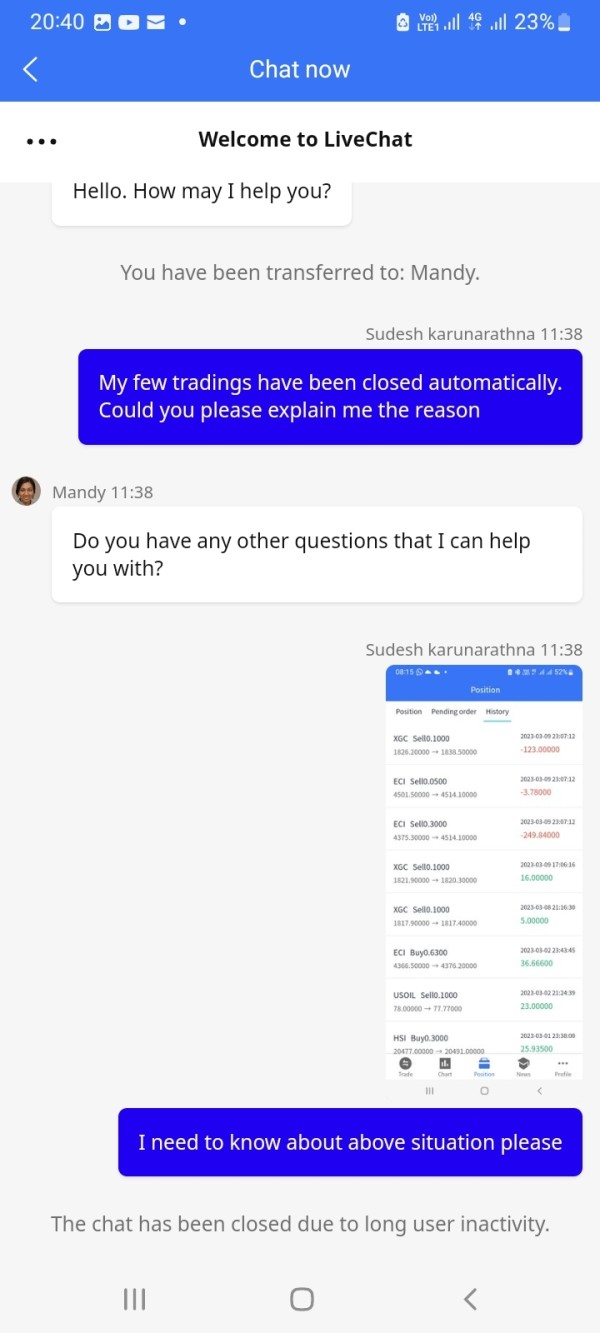

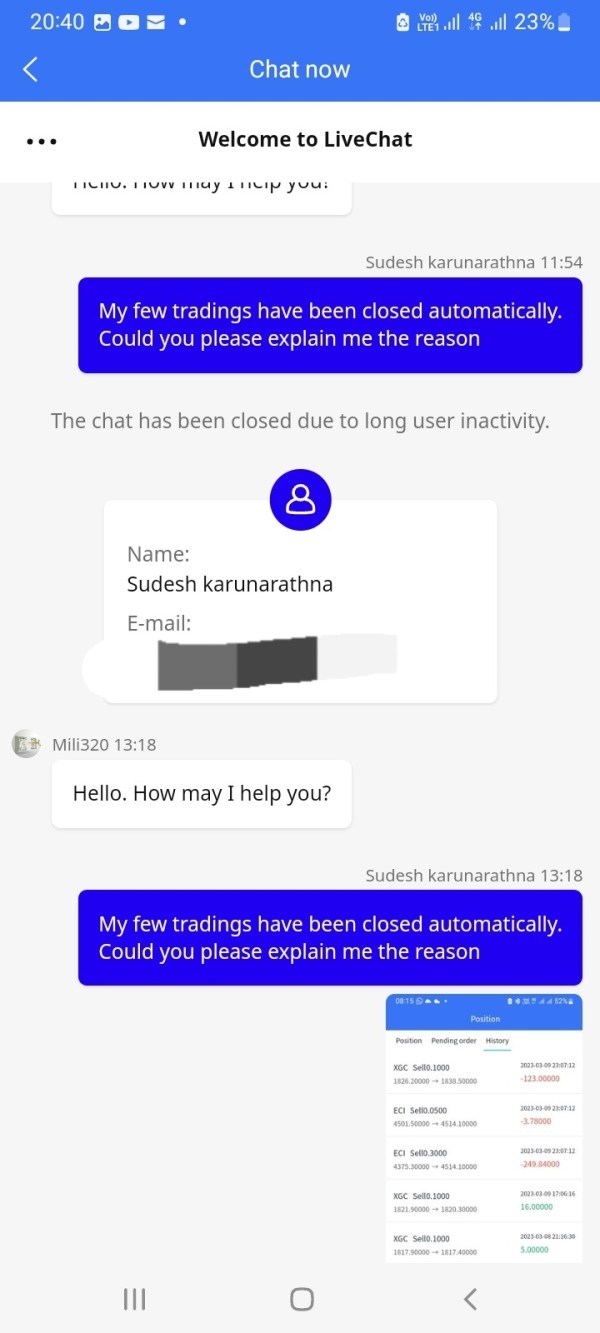

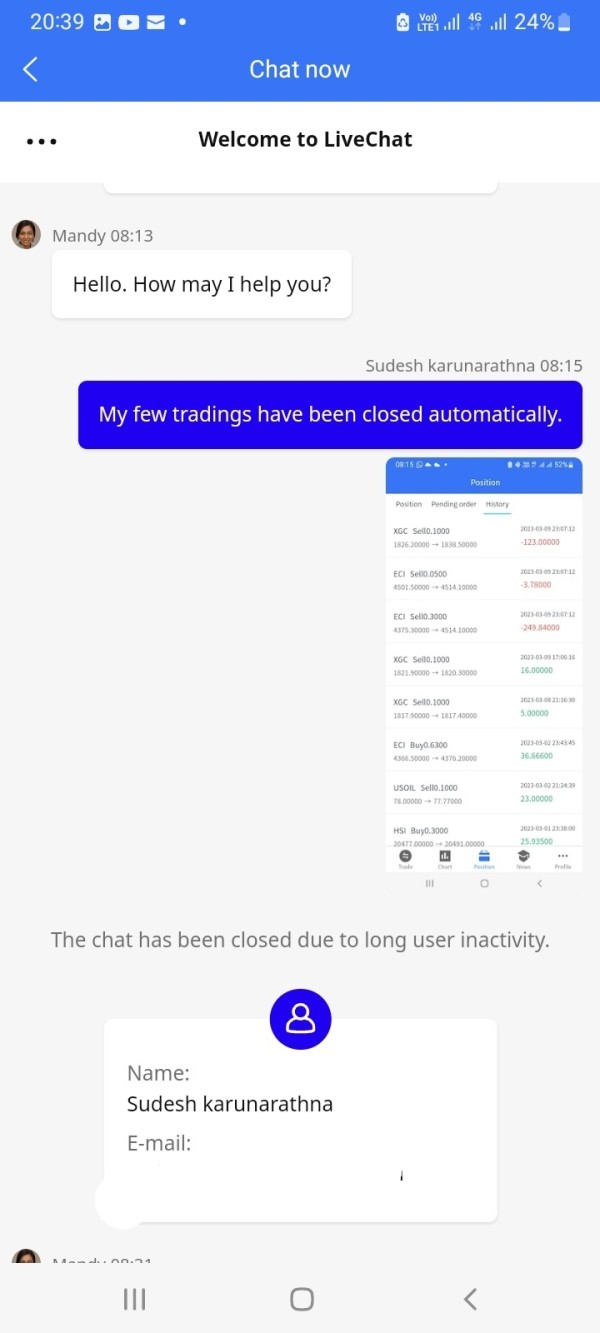

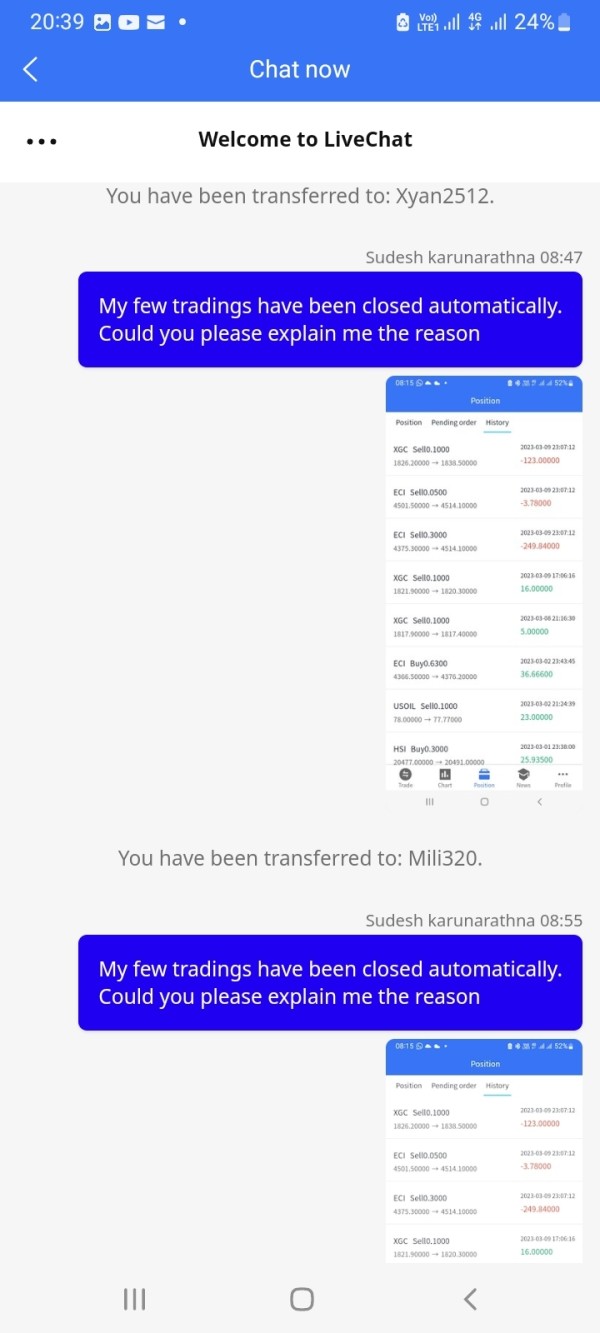

Customer service represents a significant concern area for MTFE. User feedback indicates inconsistent support quality and response times. Available user reports suggest that customer service responsiveness falls below industry standards, with some traders experiencing delays in receiving assistance for account-related inquiries and technical issues. This performance gap particularly affects user confidence when dealing with time-sensitive trading matters or urgent account concerns.

The specific customer service channels, availability hours, and multi-language support capabilities are not clearly documented in available sources. This makes it difficult for potential users to understand support accessibility. User feedback indicates frustration with communication quality and problem resolution effectiveness, suggesting that customer service training and resource allocation may require improvement.

Response time issues appear particularly problematic for users attempting to resolve withdrawal-related inquiries and technical platform problems. Some user reports indicate that customer service representatives lack sufficient knowledge to address complex trading questions or account issues effectively. The absence of clearly defined escalation procedures and senior support access compounds these challenges.

However, some users report satisfactory interactions with customer support. This indicates inconsistency rather than universal service failure. The mixed feedback suggests that MTFE's customer service quality may depend on specific inquiry types, timing, or individual representative capabilities. This variability in service quality contributes to the moderate rating, as reliable customer support represents a crucial element for trader confidence and platform usability.

Trading Experience Analysis (6/10)

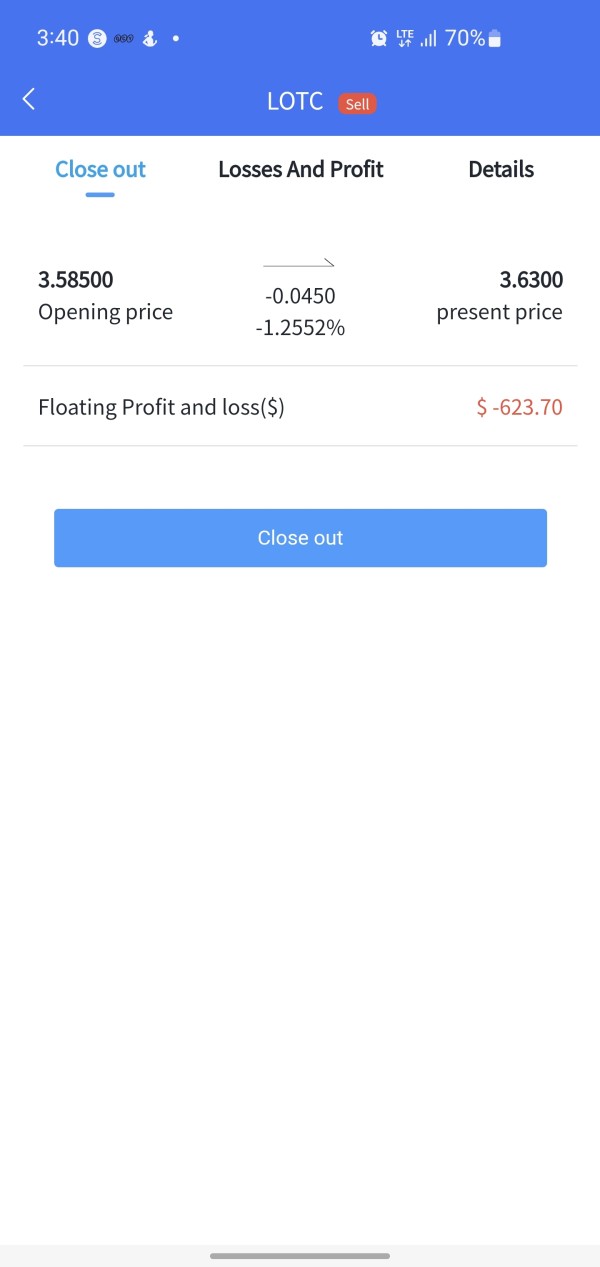

The trading experience on MTFE presents a mixed picture with both positive elements and areas requiring improvement. User feedback indicates that the platform generally provides stable trading execution for basic trading activities. Some traders report satisfactory order processing and market access. The multi-asset trading capability enhances the trading experience by allowing portfolio diversification and cross-market opportunities within a single platform environment.

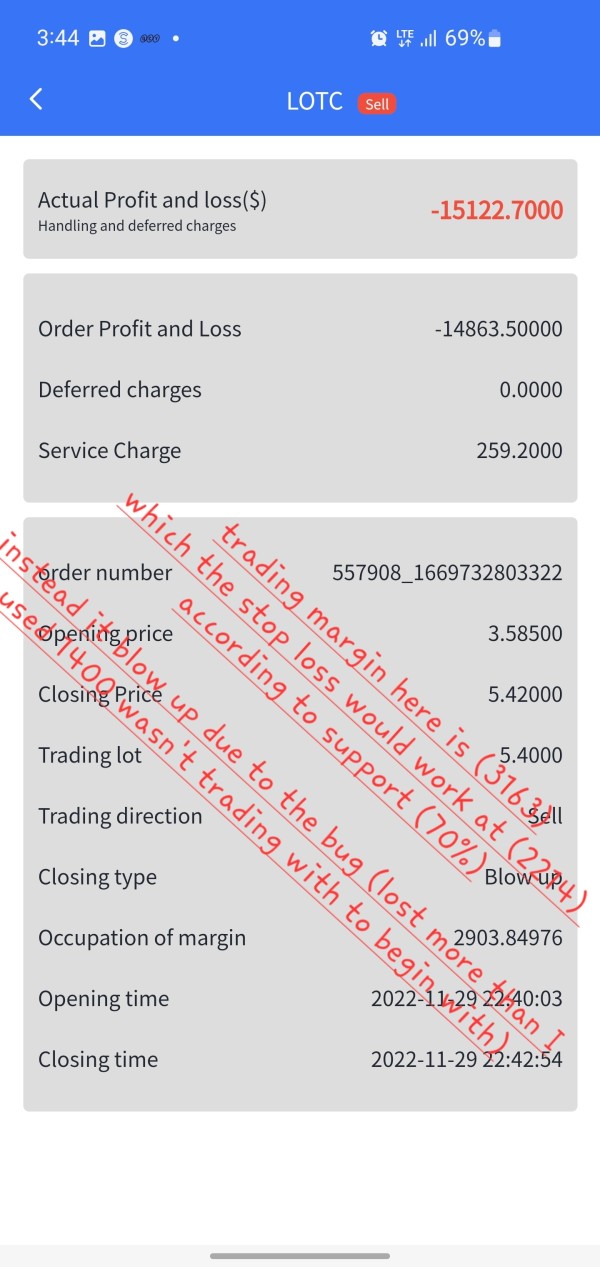

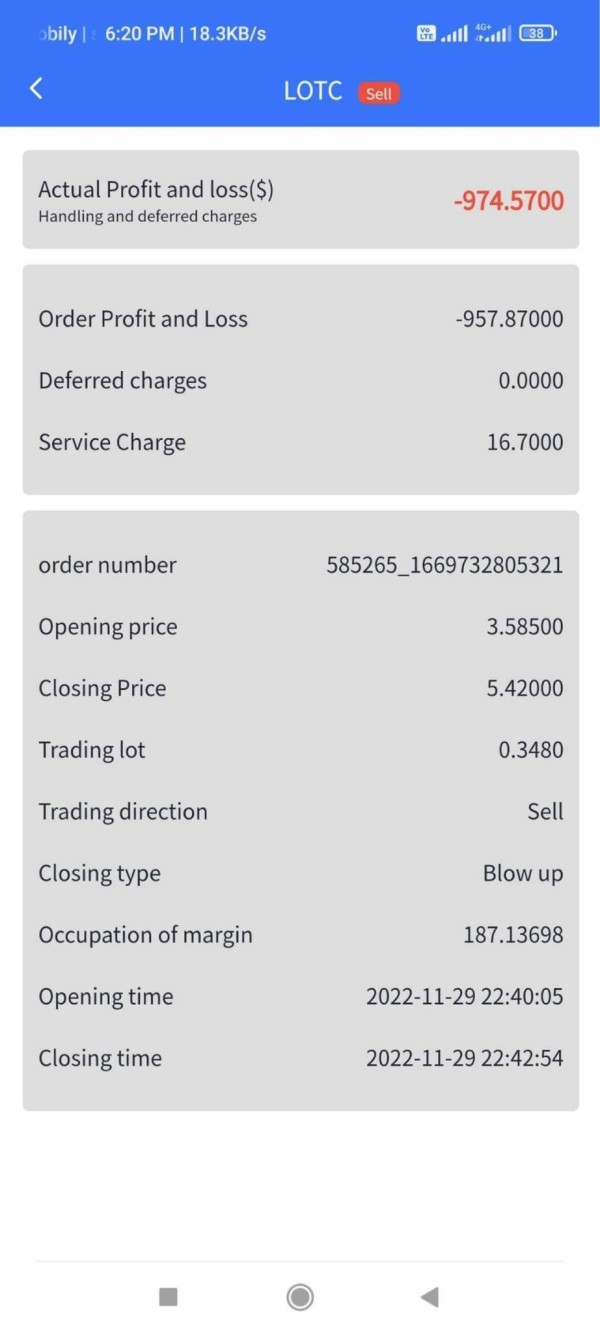

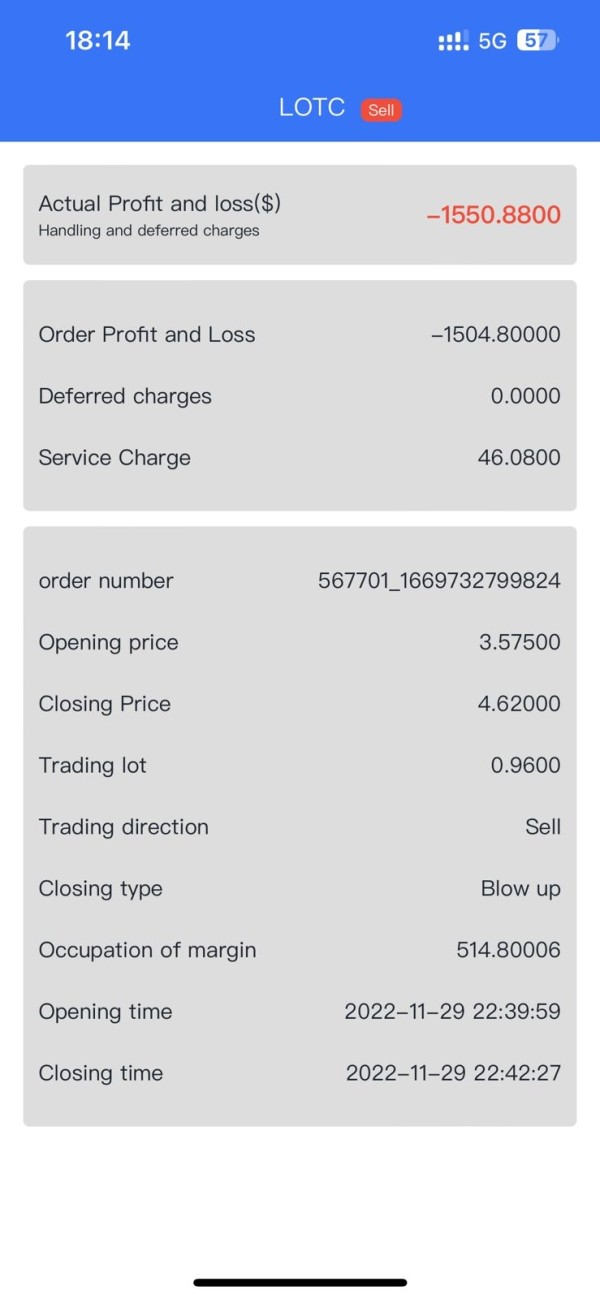

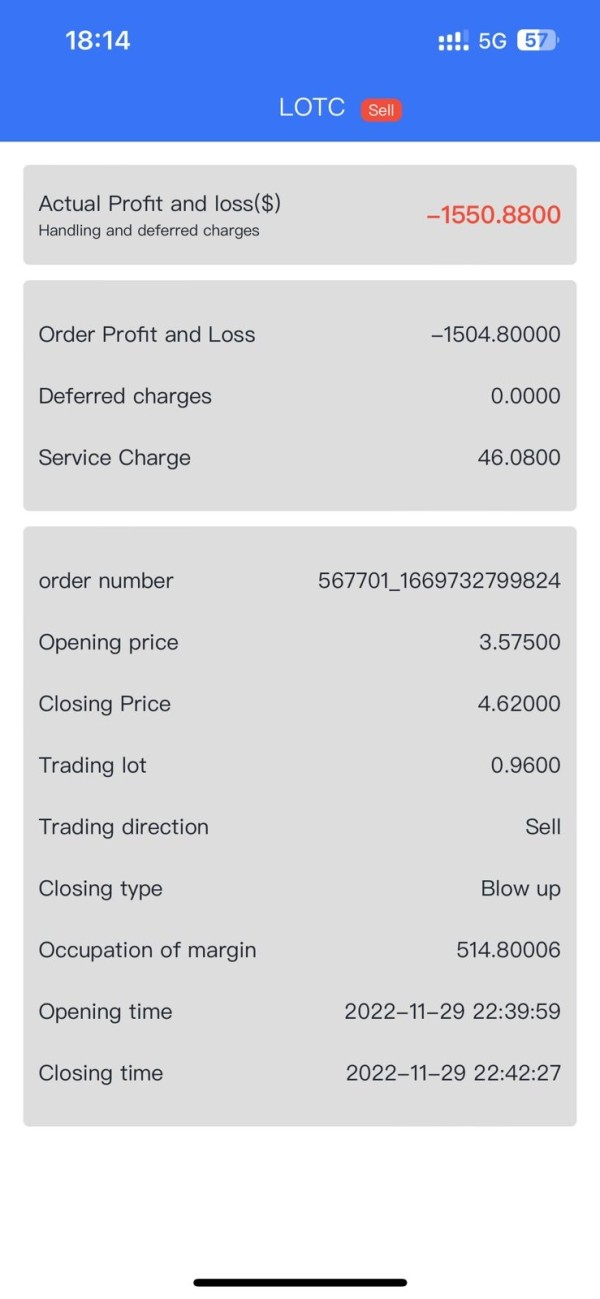

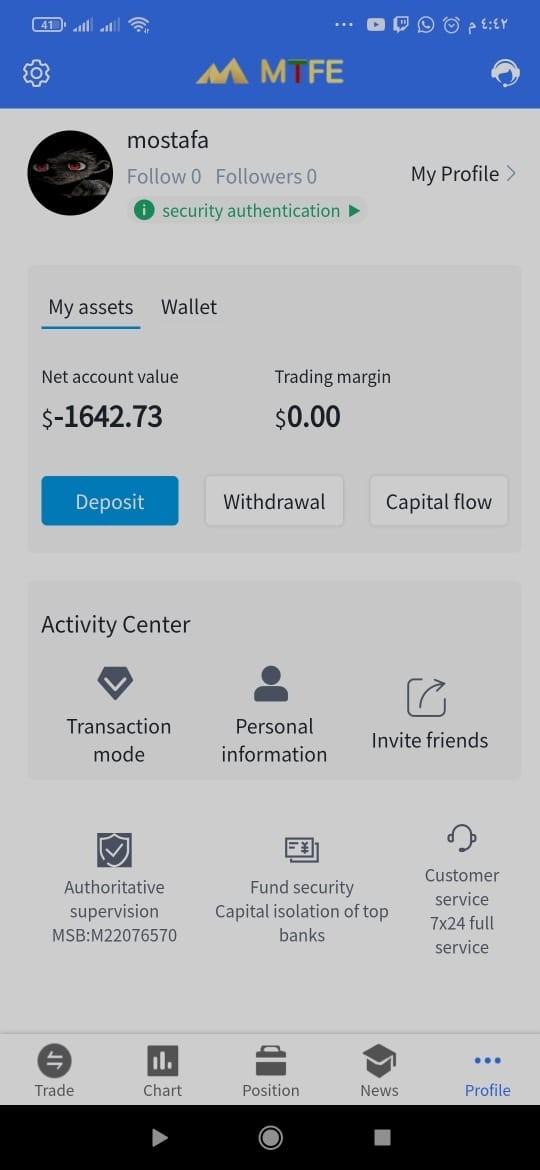

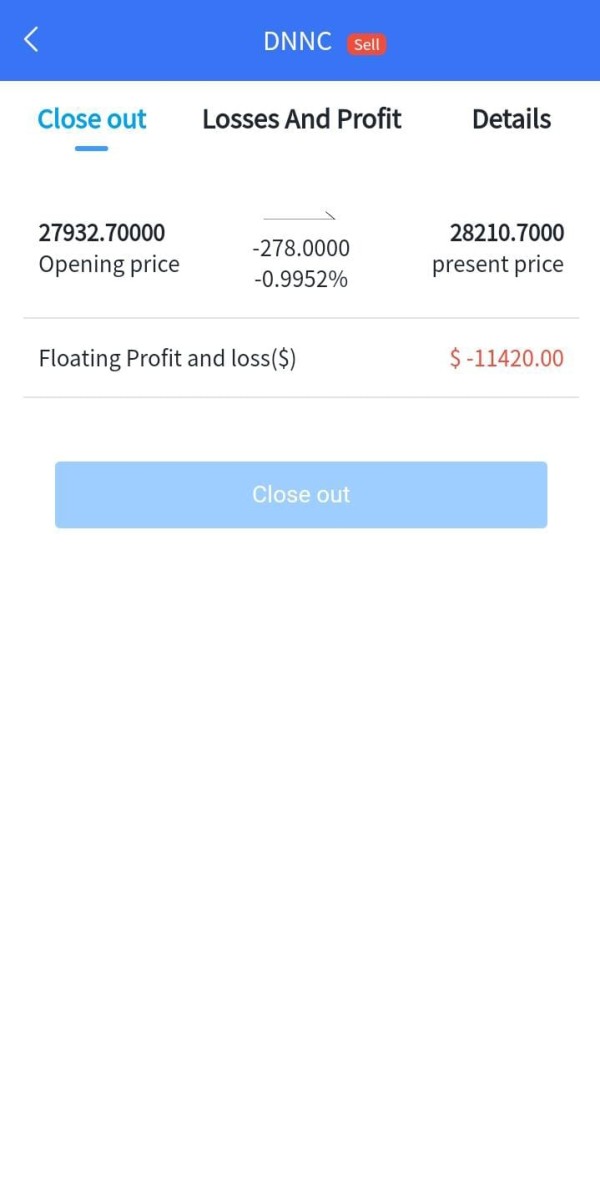

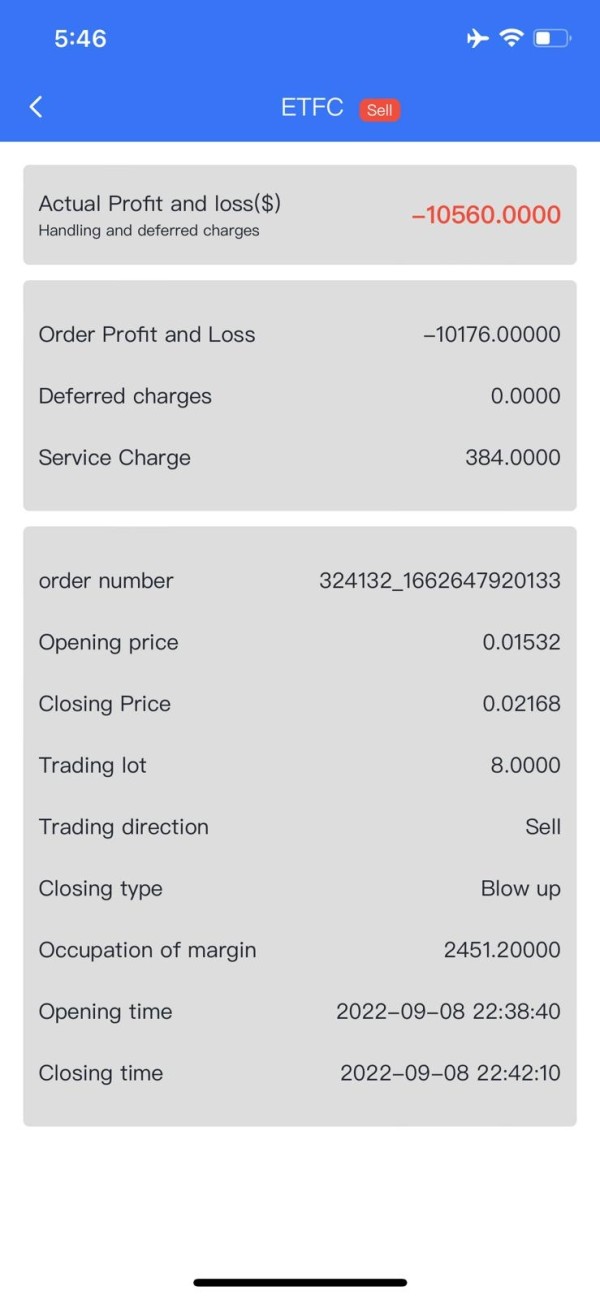

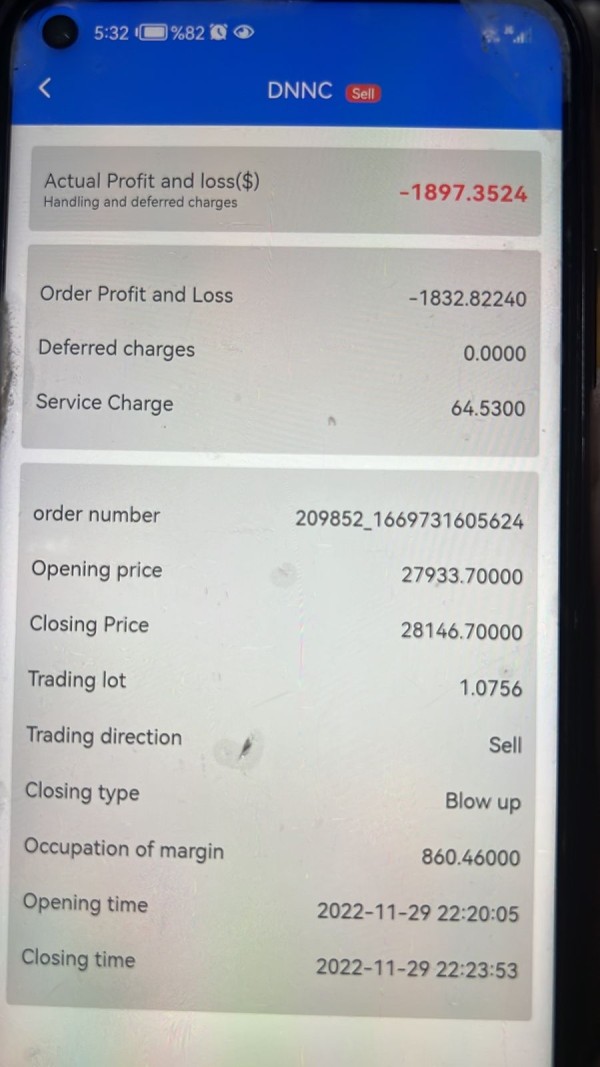

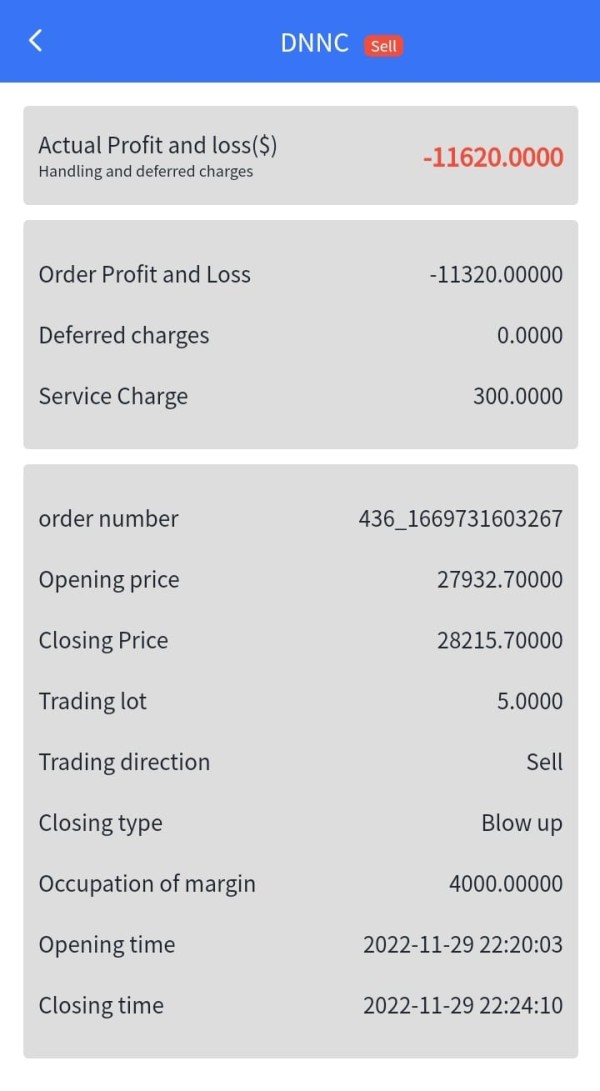

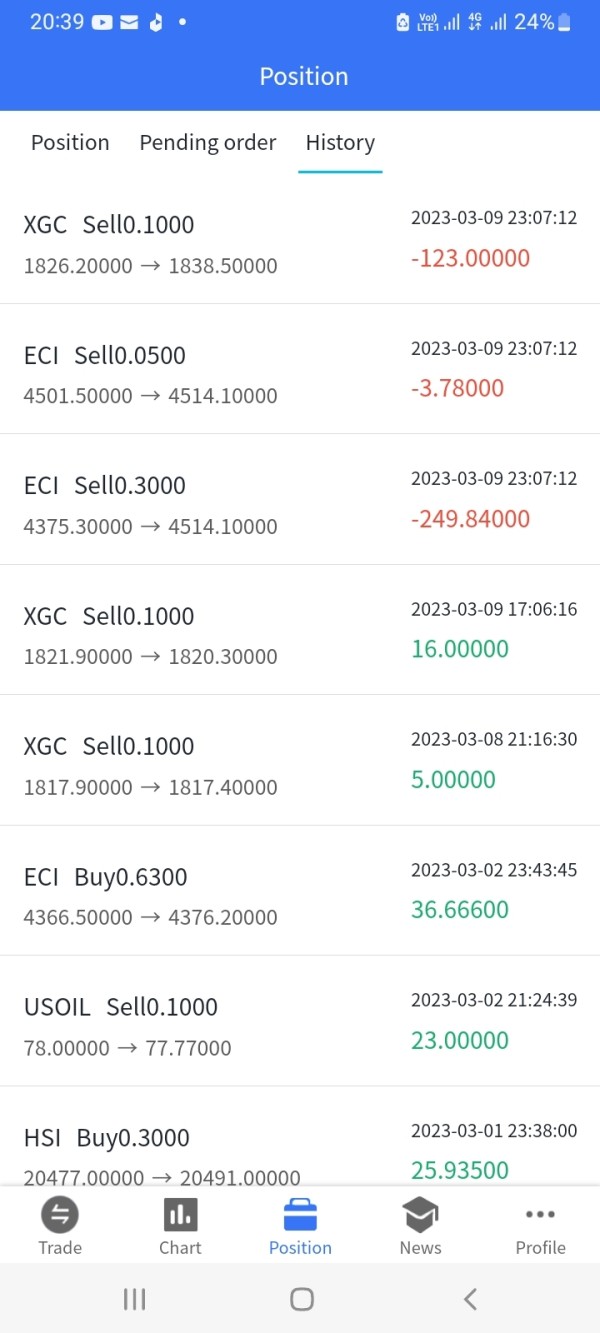

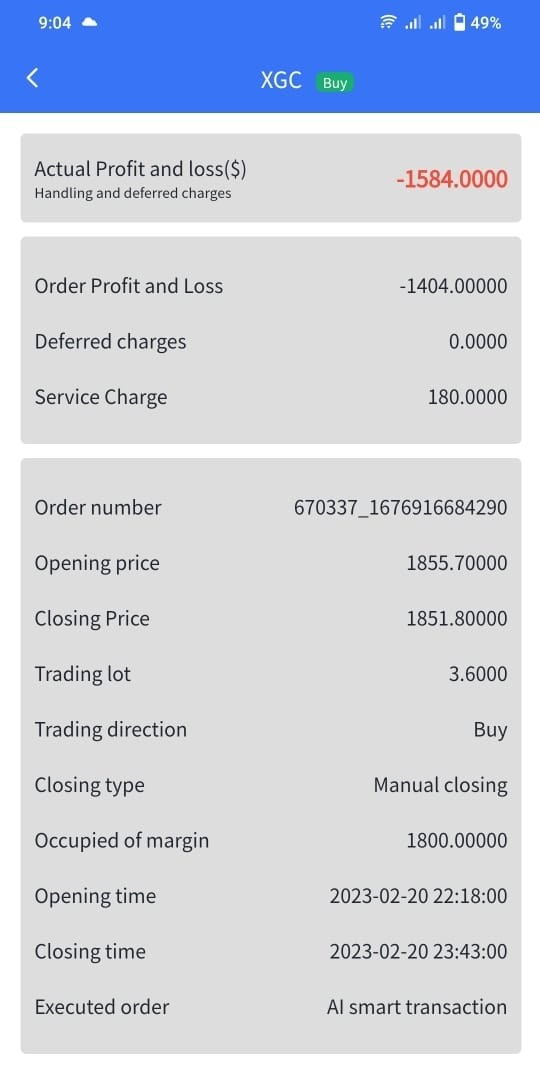

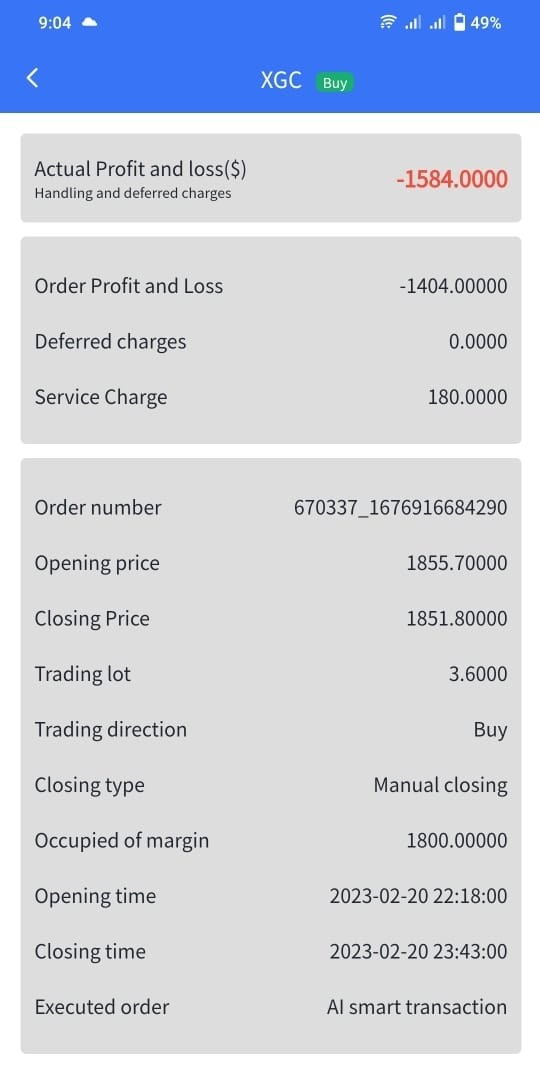

However, significant concerns emerge regarding withdrawal processing and fund management procedures. Multiple user reports indicate difficulties with withdrawal requests, including processing delays and communication challenges during fund retrieval attempts. These issues substantially impact overall trading experience quality, as efficient fund management represents a fundamental requirement for trader confidence and operational effectiveness.

Platform stability appears adequate for routine trading activities. However, specific performance metrics such as execution speeds, slippage rates, and system uptime are not documented in available sources. The absence of detailed technical performance data limits comprehensive assessment of platform reliability during volatile market conditions or high-volume trading periods.

Mobile trading capabilities and platform accessibility across different devices are not clearly specified. This potentially limits trading flexibility for users requiring mobile access. The user interface design and navigation efficiency receive limited feedback in available sources, making it difficult to assess platform usability comprehensively. This mtfe review notes that while basic trading functionality appears operational, the withdrawal processing concerns and limited technical transparency prevent a higher rating in this critical evaluation area.

Trust and Security Analysis (4/10)

Trust and security represent MTFE's most significant weakness, earning the lowest rating among all evaluated dimensions. The absence of clearly disclosed regulatory information raises substantial concerns about oversight, compliance standards, and investor protection measures. Without transparent regulatory disclosure, potential users cannot verify the platform's adherence to financial industry standards or assess available recourse mechanisms in case of disputes.

User warnings regarding potential fraudulent activities, including allegations of Ponzi scheme characteristics, severely impact trust assessment. While such allegations require careful verification, their presence in user feedback indicates serious reputation concerns that potential traders must consider. The lack of regulatory verification mechanisms makes it difficult to address or validate these concerns effectively.

Fund security measures, client money segregation procedures, and insurance coverage details are not documented in available sources. This prevents assessment of financial protection standards. The absence of third-party security audits, compliance certifications, or industry association memberships further compounds transparency concerns.

Company financial reporting, operational transparency, and corporate governance information are not readily accessible. This limits ability to verify business legitimacy and operational sustainability. The platform's handling of negative user feedback and complaint resolution procedures are not clearly established, suggesting inadequate reputation management and user protection protocols.

However, some users report positive experiences and successful trading activities. This indicates that the platform does maintain operational functionality for certain users. The polarized user feedback suggests that experiences may vary significantly, though the prevalence of trust-related concerns and regulatory transparency issues warrant serious consideration before platform engagement.

User Experience Analysis (5/10)

User experience on MTFE demonstrates significant polarization, with feedback ranging from satisfaction to serious concerns. This results in an average rating. Some users report positive experiences with the platform's accessibility, particularly appreciating the low minimum deposit requirement and straightforward account setup process. These users find the multi-asset trading capability valuable and report successful trading activities without major technical difficulties.

Conversely, substantial user complaints focus on withdrawal processing challenges, customer service responsiveness, and communication quality. These operational issues significantly impact overall user satisfaction and create frustration for traders attempting to manage their accounts effectively. The withdrawal processing concerns particularly affect user confidence, as fund accessibility represents a fundamental platform requirement.

Interface design and platform navigation receive limited specific feedback in available sources. However, the absence of widespread usability complaints suggests adequate basic functionality. The learning curve for new users and platform educational resources are not well-documented, potentially limiting support for inexperienced traders despite the platform's apparent targeting of entry-level participants.

User demographic analysis suggests the platform attracts primarily beginning traders and those seeking low-barrier market entry. However, the mixed feedback indicates that user satisfaction may depend significantly on individual trading patterns, fund management needs, and customer service interaction requirements.

The overall user experience appears suitable for basic trading activities but may not meet expectations for comprehensive platform features, responsive customer support, or efficient administrative procedures. Improvement in customer service quality and withdrawal processing efficiency could significantly enhance user satisfaction levels.

Conclusion

This comprehensive mtfe review reveals a trading platform with both appealing features and significant limitations that potential users must carefully consider. MTFE's strengths include accessible entry requirements with a 50-euro minimum deposit and diverse asset class availability spanning forex, commodities, stocks, and cryptocurrencies. These features make the platform potentially suitable for beginning traders and those seeking low-barrier market access with portfolio diversification opportunities.

However, substantial concerns regarding regulatory transparency, customer service quality, and withdrawal processing efficiency significantly impact the platform's overall assessment. The absence of clear regulatory disclosure and mixed user feedback regarding fund management create trust issues that experienced traders and risk-conscious individuals should carefully evaluate.

MTFE appears most appropriate for entry-level traders willing to accept higher risk levels in exchange for accessible trading conditions and diverse asset access. However, traders prioritizing regulatory transparency, responsive customer service, and efficient fund management may find better alternatives among more established, well-regulated brokers. Potential users should conduct thorough due diligence and consider starting with minimal capital exposure while evaluating platform performance for their specific trading requirements.