bittra 2025 Review: Everything You Need to Know

Abstract

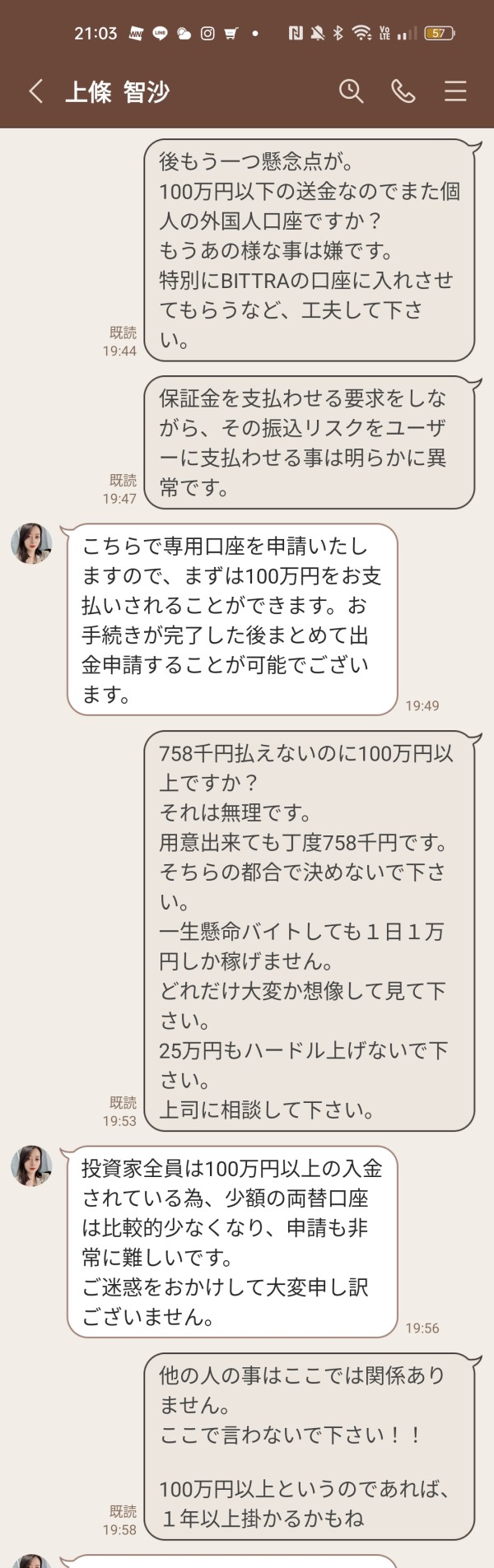

This bittra review looks at the new broker bittra. The firm started its work in late 2023, making it very new to the market. The review shows big concerns about how clear the company is and whether it follows proper rules. bittra claims to offer many types of investments like stocks, indices, commodities, bonds, and cryptocurrencies, but the information about regulations stays unclear and incomplete. This raises serious questions about whether the firm is real and trustworthy. While bittra tries to help traders who want many different investment choices, its unclear regulatory status and limited details create a bad overall impression. The company seems designed for investors who care more about having many products than having strict regulatory protections, which means it targets people who are okay with higher risks. The information summary shows little evidence of strong ways to protect client money. This makes the skeptical feelings in various reports even stronger. Because of these concerns, potential users should be very careful and do more research before thinking about trading with bittra.

Cautions and Notice

bittra's regulatory information is unclear. The firm may work under different legal rules in different regions, which creates confusion for potential users. This review uses only available information summaries and does not include insights from actual trading experience, so some details may be missing or incomplete. Details about account conditions, how to deposit and withdraw money, and customer support have not been checked through real testing. Users should know that differences between regions might change the broker's legal standing and how customers experience the service, which could affect their trading results. Potential traders should think about these limits when looking at the data provided here. Readers should look for more sources and current updates to understand everything better, as information can change quickly in this industry. As always, doing thorough personal research is recommended before working with bittra.

Rating Framework

Broker Overview

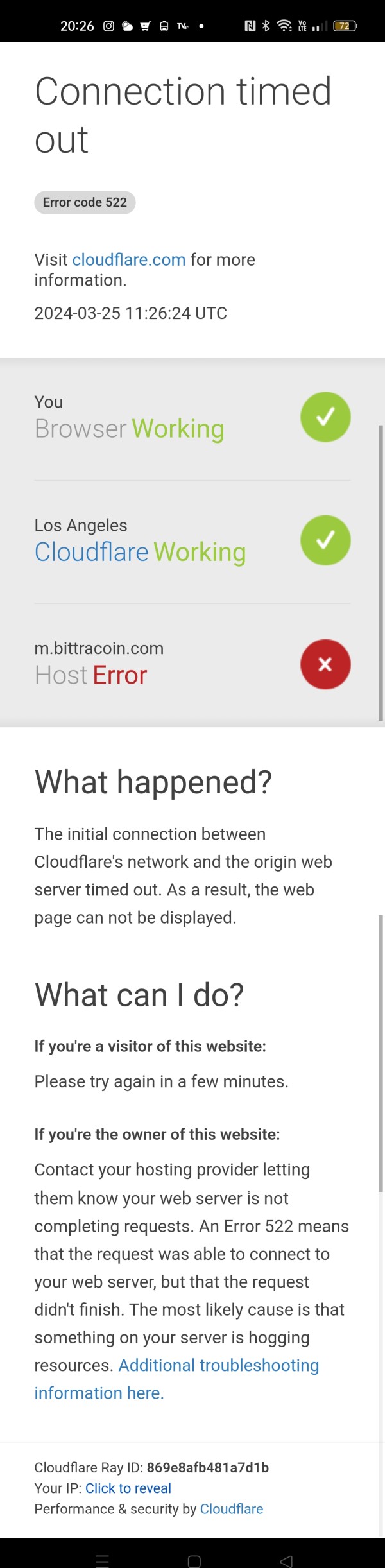

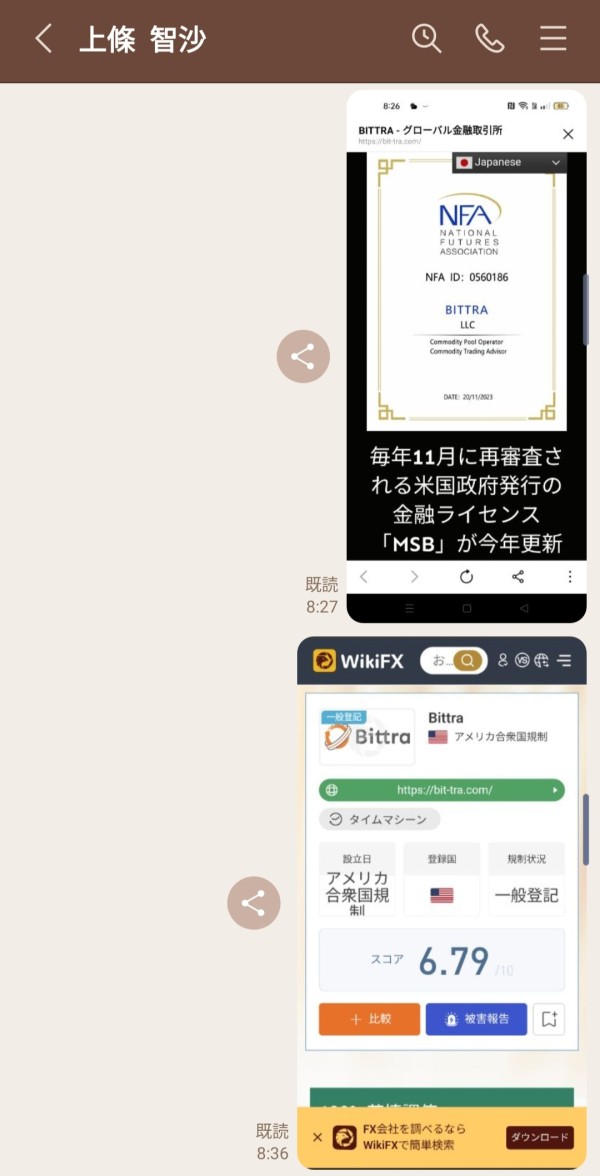

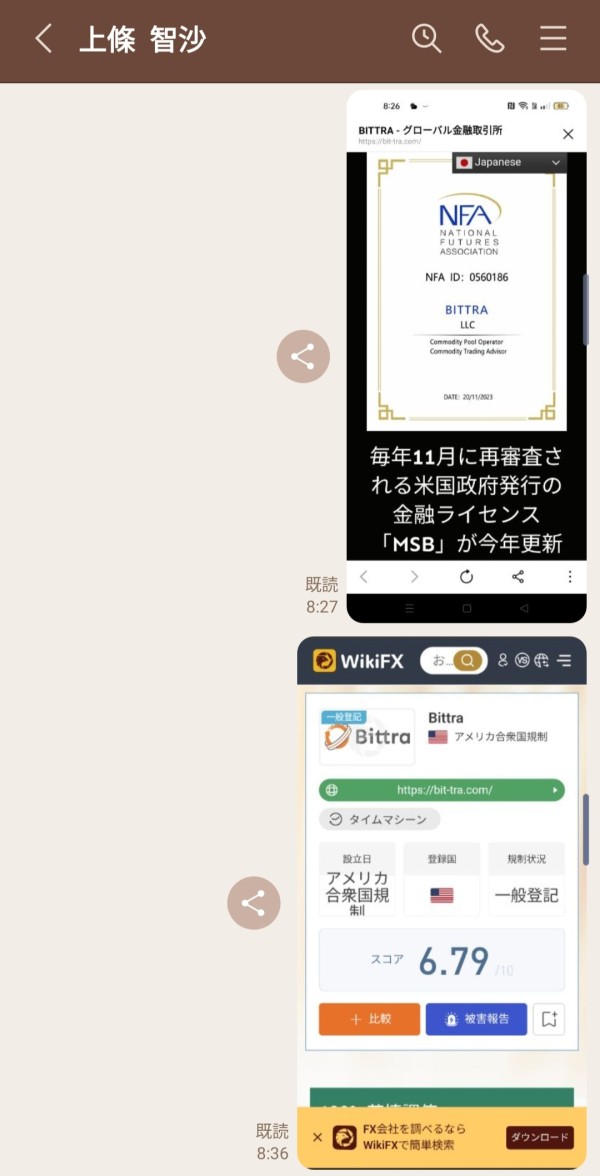

Bittra was officially registered on September 8, 2023. The company was formally established on November 13, 2023, which marked its entrance into the competitive financial services market. Headquartered in Los Angeles, California, the company says it provides multi-asset trading solutions for various types of investors. According to available information, bittra claims to offer access to many financial products including stocks, indices, commodities, bonds, and cryptocurrencies from a single trading platform, which sounds appealing to many traders. However, there is a big lack of detailed background on the firm's operational history. There is also very little concrete information about its licensing and regulatory approvals, which are crucial for any financial company. This basic lack of transparency has resulted in cautionary reviews from industry observers and potential clients alike, making many people worried about the company's legitimacy. While the promise of a diversified portfolio sounds good, the unclear regulatory and licensing status creates serious doubts about its offerings.

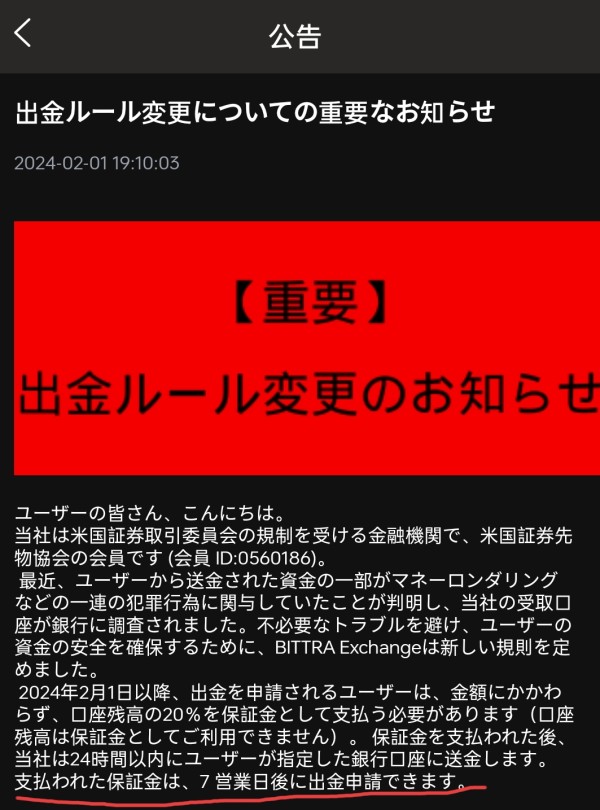

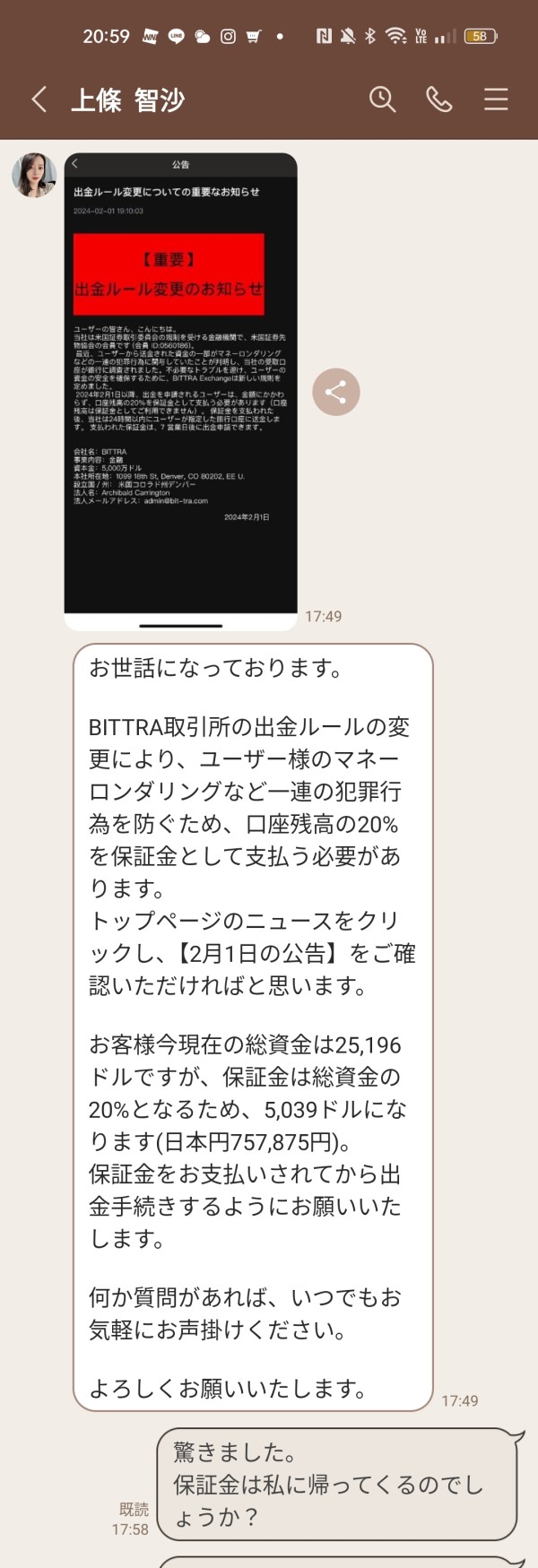

bittra appears to focus mainly on a mobile-based trading platform for its operations. The exact name and features of the platform are not disclosed, which leaves potential users guessing about what they would actually get. The broker promotes having multiple asset classes to attract many different types of investors and traders looking for diverse investment opportunities, which is a common marketing strategy. Despite these apparent offerings, there is no mention of established regulatory authorities or compliance measures, which is a major red flag for any financial service provider. The lack of clear regulatory oversight can hurt investor confidence and may expose clients to unexpected risks that they might not be prepared for. Different sources consistently point out that the broker's claims about licensing and operational security remain questionable at best. As such, while the product diversity might attract those willing to take risks, the overall trustworthiness and safety of bittra remain very doubtful.

Based on the current information summary:

- Regulatory Regions: Specific regulatory bodies or licensing information are not mentioned in the available data, which creates uncertainty about which jurisdictions bittra follows.

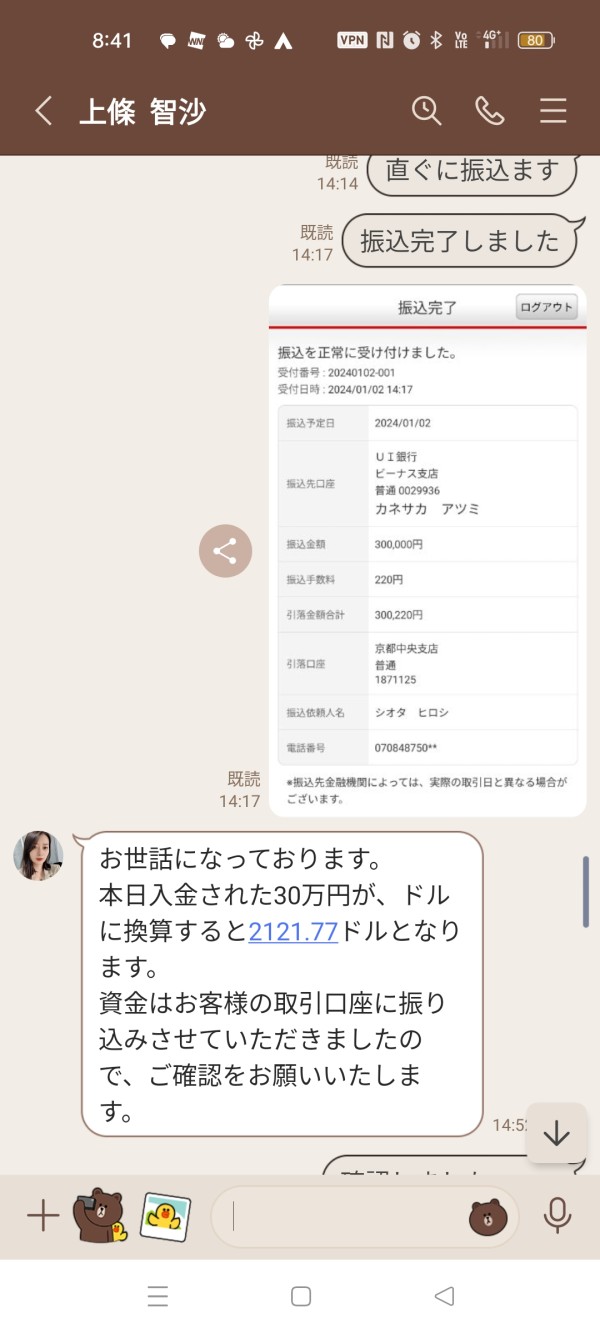

- Deposit and Withdrawal Methods: Detailed methods for deposits and withdrawals, including payment systems supported, are not outlined in the summary, leaving users without crucial financial information.

- Minimum Deposit Requirement: There is no mention of a required minimum deposit amount within the reviewed content.

- Bonus and Promotions: The available information does not reveal any bonus or promotional offers provided to new or existing clients, which might indicate limited marketing efforts.

- Tradable Assets: Bittra offers a range of assets including stocks, indices, commodities, bonds, and cryptocurrencies as their main selling point. These instruments are highlighted as the primary focus for traders seeking diverse investment opportunities across multiple markets.

- Cost Structure: The details about spreads, commissions, and other transaction costs remain undisclosed in the summary. No information is provided about competitive pricing or additional fees that might apply to trading activities.

- Leverage Ratios: There is no detailed discussion about the leverage ratios available to traders through bittra's platform.

- Platform Selection: Bittra's trading is conducted primarily on a mobile-based platform according to available information. However, details on the platform's usability, interface design, or additional web-based options are not provided to potential users.

- Regional Restrictions: There is no mention of any regional restrictions that might apply to bittra's services. This leaves it unclear which markets the broker legally serves and where clients can actually use their services.

- Supported Languages for Customer Service: The available resources do not indicate which languages are supported by bittra's customer service team.

This detailed breakdown shows significant gaps where crucial information is missing. The gaps are particularly concerning when it comes to regulations, client fund security, cost transparency, and overall operational details of bittra. These missing pieces make it challenging for potential investors to gauge the full spectrum of risks involved in working with this broker.

Detailed Rating Analysis

2.6.1 Account Conditions Analysis

The assessment of account conditions for bittra is notably poor and concerning. This bittra review finds very little in the way of detailed descriptions about account types, enrollment processes, or minimum deposit requirements that potential clients need to know. The absence of specified account conditions and related features leaves potential traders completely in the dark about what to expect when starting an account with the company. For example, whether the broker supports specialized accounts, such as Islamic accounts, or provides additional benefits for premium tiers remains completely unanswered by available documentation. Additionally, there is no information about the ease of account setup or verification processes. These are critical factors in evaluating user experience and accessibility for new traders who want to start quickly and efficiently. Various user reports have not highlighted any particular strengths or shortcomings in this area either. This further emphasizes the serious lack of information available to potential clients who need to make informed decisions. Compared to established brokers that offer detailed insights into account management, bittra currently fails to provide even basic information that traders expect and deserve. Overall, the lack of transparency and clear data in this area results in a very low rating of just 2 out of 10. This major shortfall directly impacts the broker's perceived credibility and operational effectiveness in the competitive trading market.

In evaluating the tools and resources offered by bittra, this review notes some positive and negative aspects. While the broker promotes a variety of trading instruments—including stocks, indices, commodities, bonds, and cryptocurrencies—the supporting educational and analytical resources remain very limited and inadequate for serious traders. There is no substantial evidence provided about the availability of advanced research tools, market analysis reports, or automated trading solutions. These are typically valued by professional traders who need comprehensive data to make informed decisions about their investments. From the perspective of technical analysis and market research, bittra appears to be offering only the bare minimum without the depth that experienced traders expect. The absence of comprehensive educational content, such as webinars, tutorials, or trading guides, further limits the ability of new users to navigate the platform efficiently and learn proper trading techniques. Additionally, there is no mention of third-party tools or integrations that can enhance trading strategies and improve overall performance. Given that informed decisions largely depend on robust research resources, this shortfall contributes significantly to the moderate rating of 6 out of 10 in this category. The oversight in providing clear and accessible trading tools makes it challenging for traders to develop and execute sophisticated strategies effectively, which could limit their success potential.

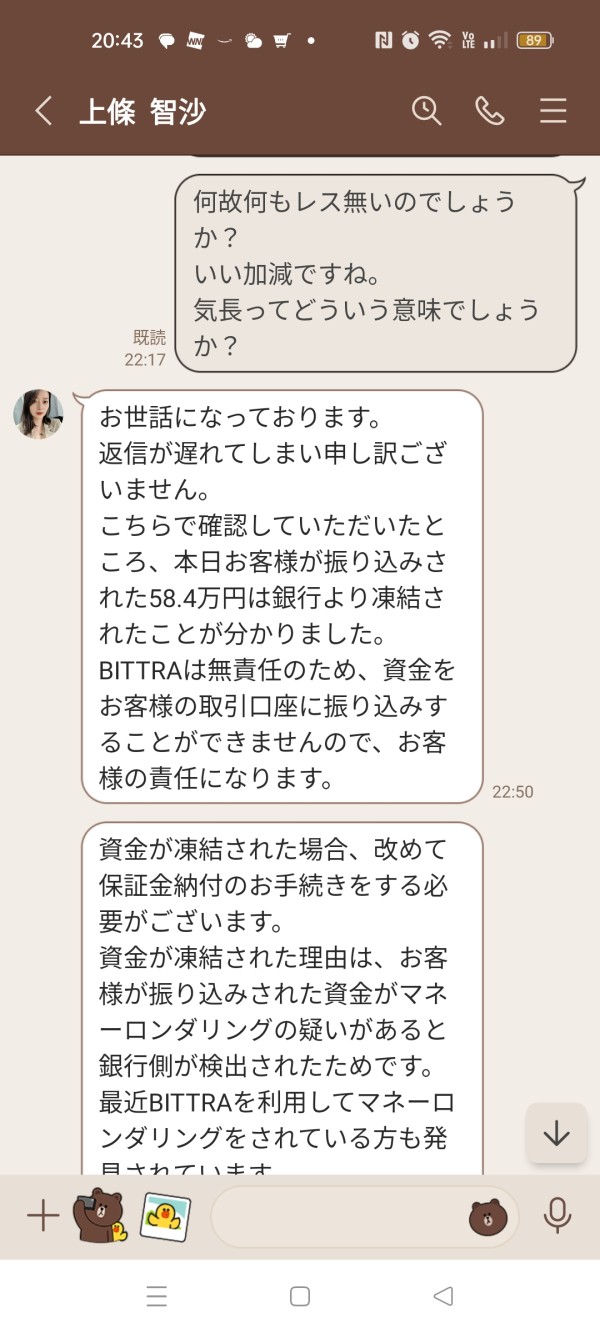

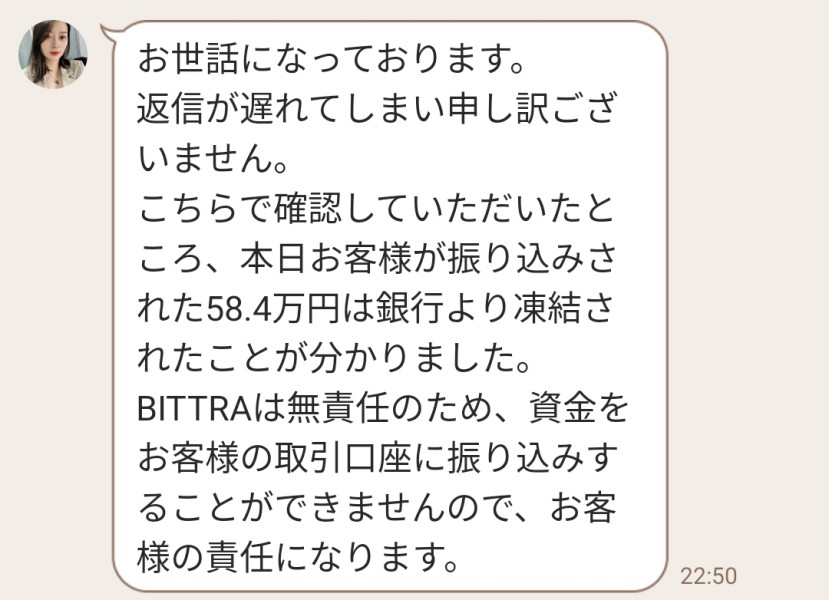

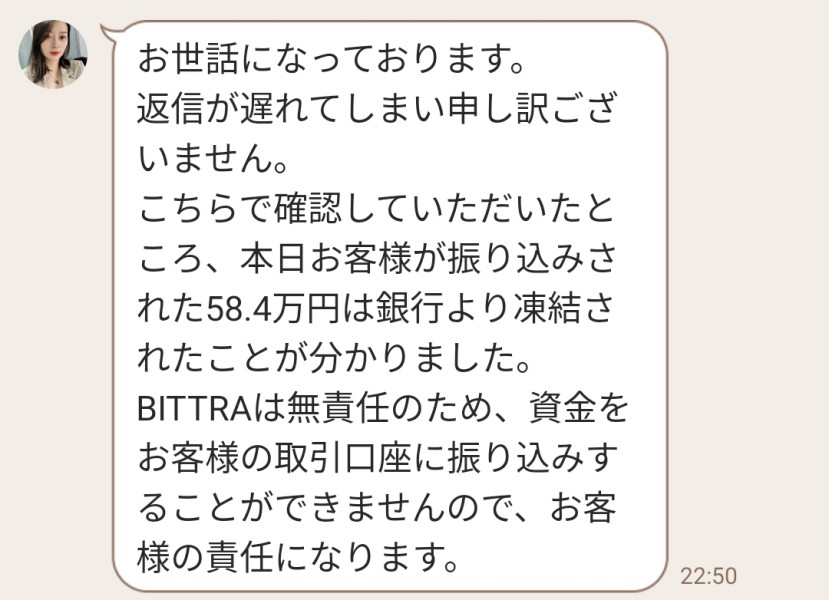

2.6.3 Customer Service and Support Analysis

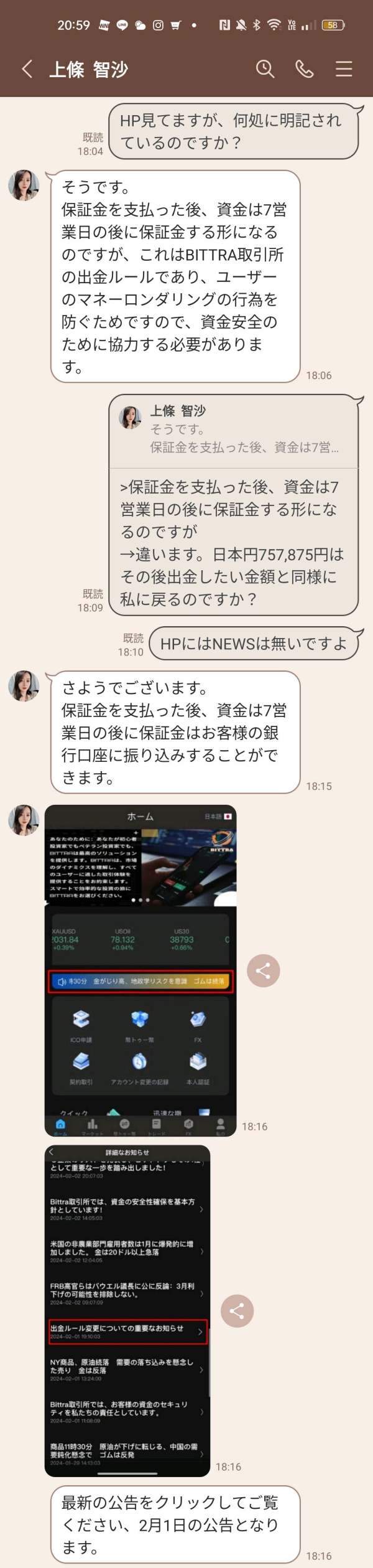

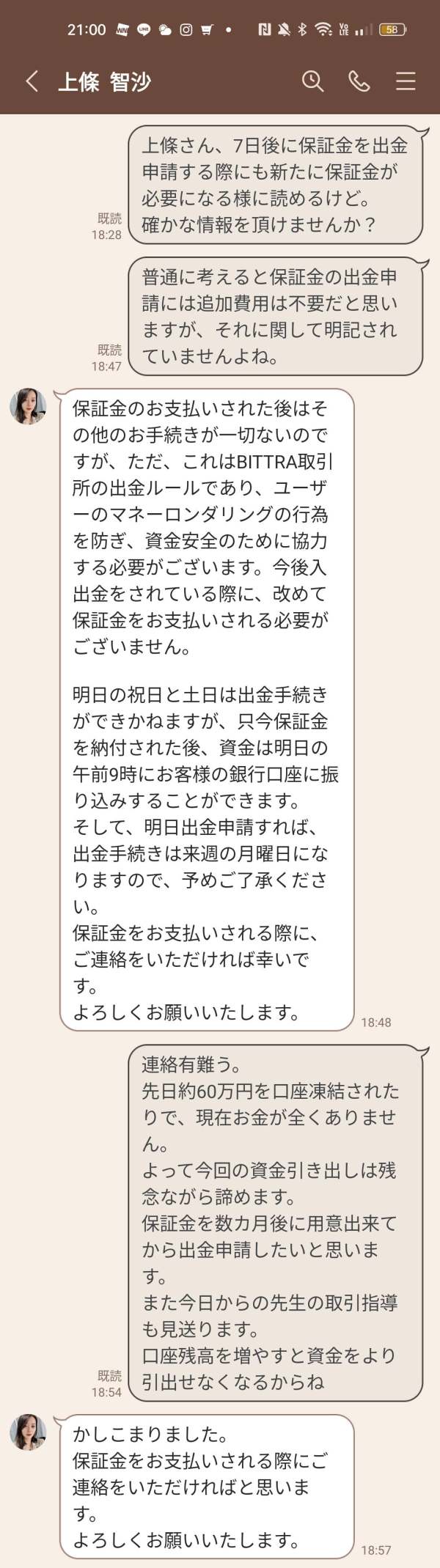

The customer service and support offered by bittra have raised several serious concerns among reviewers. This analysis finds that the available information does not detail the variety of customer support channels, such as live chat, email, or phone support that customers typically expect from financial service providers. There is also no data provided on the responsiveness or quality of these services, which are crucial for traders who may need quick help during market hours. According to accounts in the information summary, user feedback on customer service remains unclear and mixed at best. Some users have reported neutral experiences without notable efficiency, while others have seen no mention of any problem-solving capabilities from the support team. Moreover, there is no evidence of multilingual support or extended service hours. These factors are crucial for an internationally oriented broker that claims to serve clients from different regions and time zones around the world. The lack of detailed information on customer support infrastructure negatively impacts the overall rating. Responsive and effective customer service is a key pillar in maintaining trader confidence and ensuring smooth operations when problems arise. Without verifiable service quality or documented cases of successful issue resolution, prospective clients are left feeling wary and uncertain about getting help when they need it most. The existing reports do not shed light on whether customer inquiries are handled with urgency and professionalism, which is a critical aspect that further diminishes user trust in the platform.

2.6.4 Trading Experience Analysis

An evaluation of the trading experience with bittra reveals several significant shortcomings that concern potential users. There is a notable absence of detailed user feedback on the stability, speed, and reliability of the trading platform during actual use. For many traders, platform performance—including order execution quality, interface responsiveness, and the seamlessness of mobile trading—is absolutely essential for success. However, the available reports and information summary do not address these crucial issues in any comprehensive way that would help potential users make informed decisions. While the broker promotes a mobile trading platform, specifics about its functionality, design, and overall performance remain completely unspecified. There is no detailed commentary on the level of technological innovation or the incorporation of advanced trading features. Features such as algorithmic trading support or risk management tools are not mentioned anywhere in the available documentation. This lack of specific information and practical usage data leads to serious questions about how the platform performs during high-volatility periods or under heavy trading volumes when traders need reliability most. As such, the trading experience remains a significant area of concern for anyone considering this broker. The low rating of 4 out of 10 reflects both the potential risks and the absence of concrete evidence supporting a positive trading environment that traders can rely on.

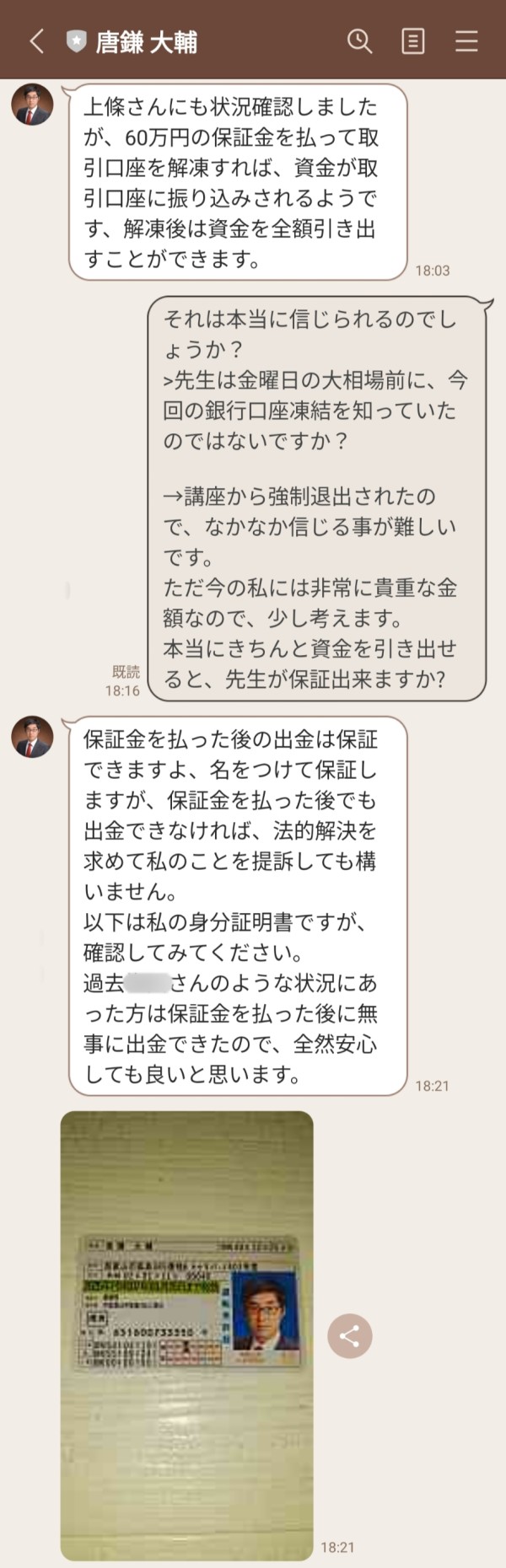

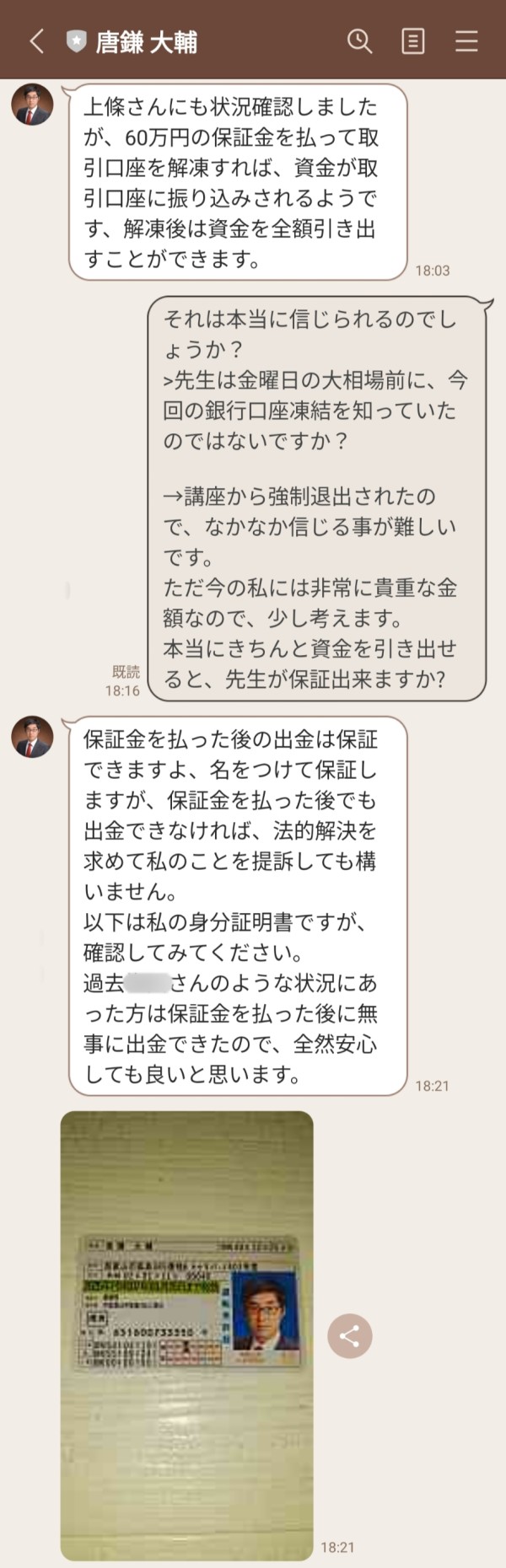

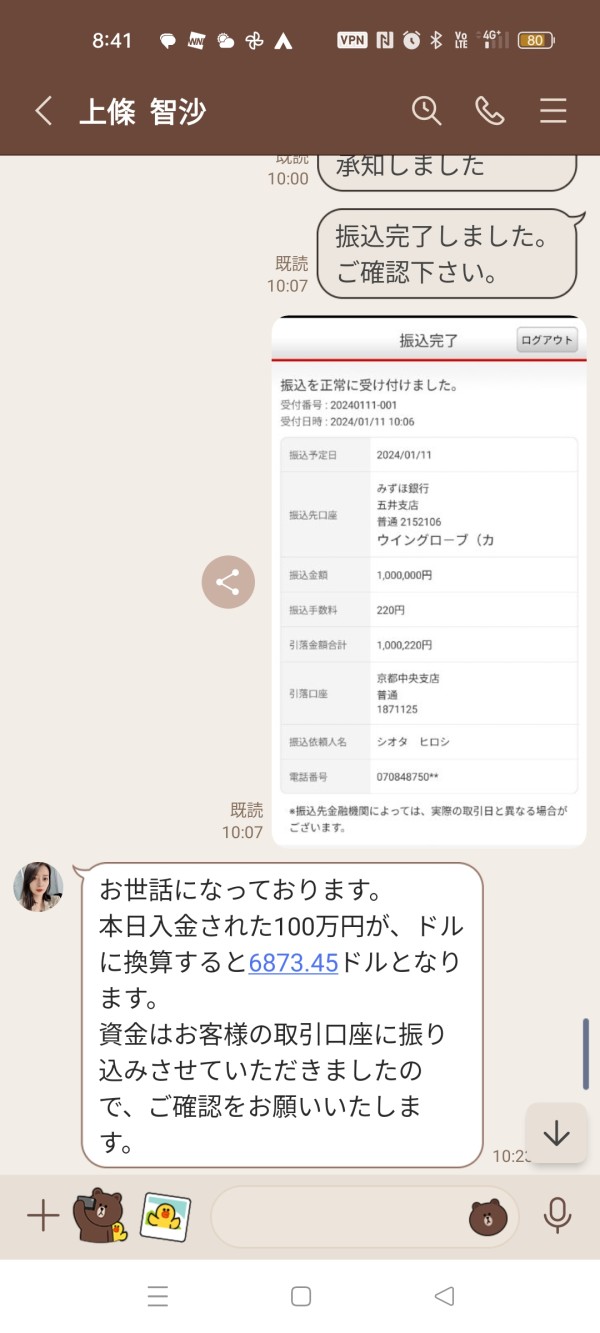

2.6.5 Trustworthiness Analysis

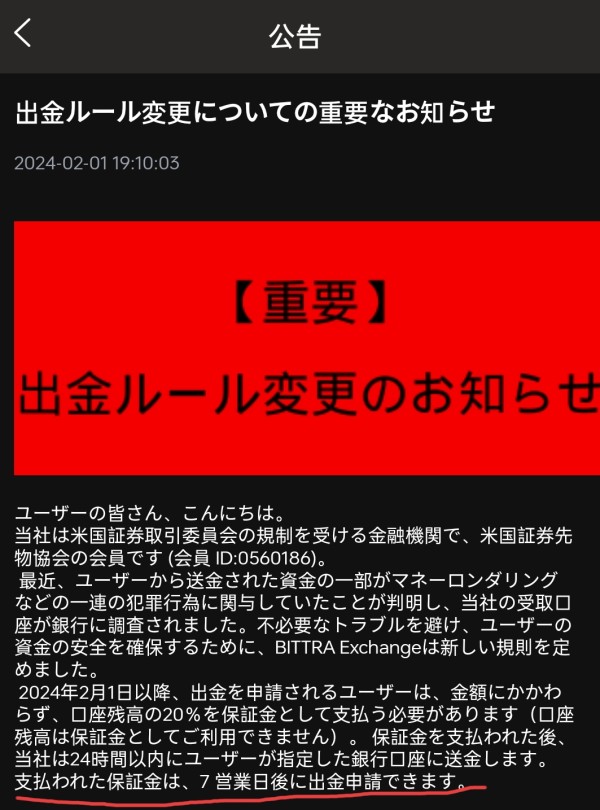

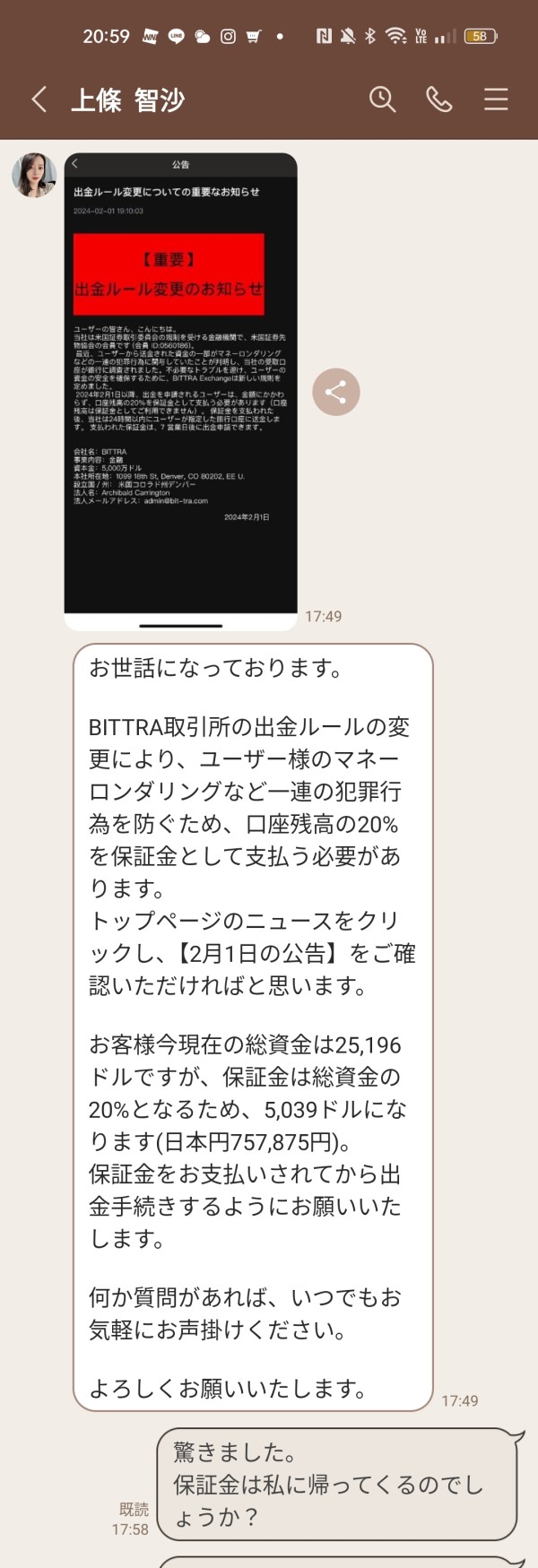

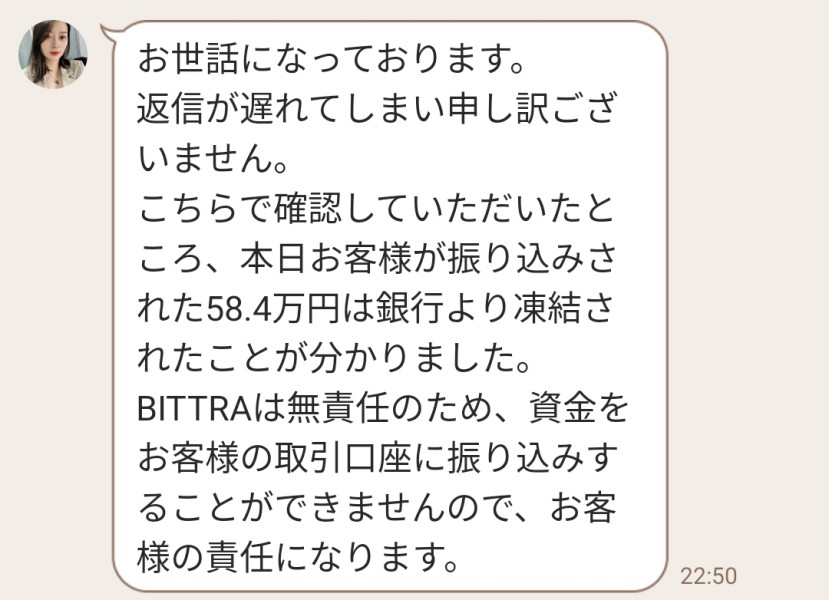

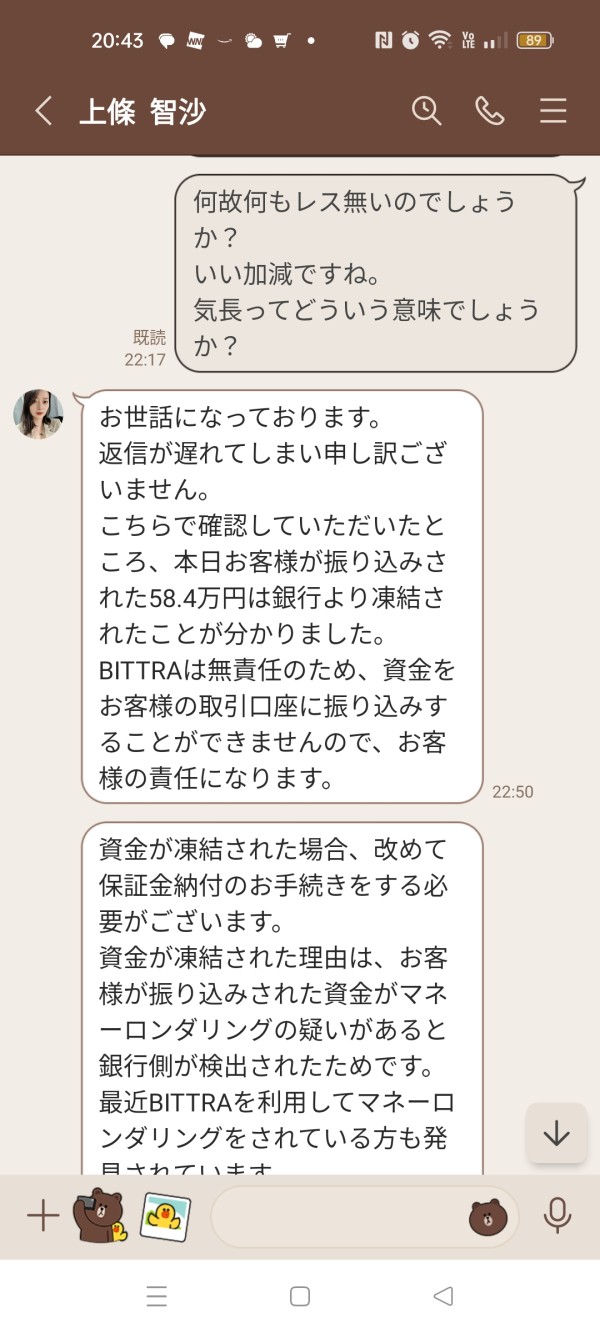

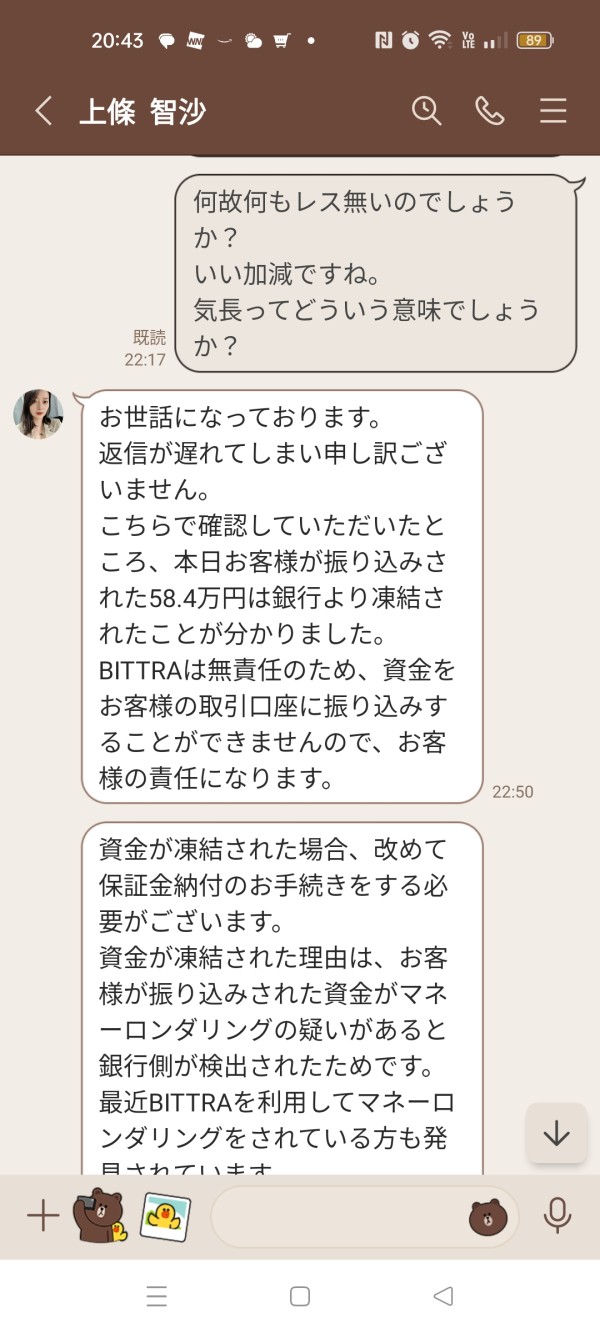

Trust is a critical factor for any financial trading entity, and in the case of bittra, this aspect is extremely problematic. The current bittra review highlights that the broker claims to operate with proper licenses and regulatory approval. However, there is no verifiable evidence to support this claim, as exact regulatory bodies and licensing numbers are not disclosed anywhere in their materials. The sparse regulatory oversight mentioned in multiple reports and the notable absence of robust transparency measures have significantly damaged the broker's reputation in the industry. The lack of clarity about funds security and the handling of client money further increases the risk profile of bittra for potential investors. Furthermore, negative mentions in various industry reports, including allegations of operating as a suspicious entity, contribute substantially to an exceptionally low trust rating that reflects serious concerns. Compared to reputable brokers that typically provide detailed disclosures, regular audits, and clear regulatory affiliations, none of these standard practices are evident in bittra's case. In summary, the absence of verifiable regulatory credentials and the serious ambiguity surrounding its operational transparency have led to a trustworthiness score of only 1 out of 10. This marks trustworthiness as a significant drawback for potential investors who value security and regulatory protection.

2.6.6 User Experience Analysis

The overall user experience associated with bittra appears to be inconsistent and largely unsatisfactory based on available information from various sources. The user interface specifics, including clear navigation, ease of registration, and intuitive design of the mobile platform, are not well documented anywhere. Feedback indicates that while some users have encountered a straightforward registration process, others have expressed significant frustration over the lack of clear instructions and difficulty in verifying their accounts properly. Furthermore, the absence of efficient deposit and withdrawal procedures adds to the overall negative sentiment among users who have tried to use the platform. Although there are occasional positive remarks concerning the variety of tradable instruments available, such praise is heavily overshadowed by complaints about the lack of comprehensive support and slow response times from customer service representatives. The inconsistent quality in user interactions, combined with a serious lack of clear operational guidance, leaves much to be desired for anyone considering this platform. Consequently, the user experience has been rated at 3 out of 10. This rating reflects both the sporadic positive notes and the overriding negative aspects highlighted by current user feedback data from multiple sources.

Conclusion

In summary, bittra—a broker established in late 2023—exhibits critical flaws that make it a risky choice for most traders. The main problems come from its lack of clear regulatory transparency and incomplete disclosure of key operating details that clients need to know. This bittra review shows that while the firm presents an appealing range of tradable assets and promises diversified investment options, its overall credibility is severely damaged by the absence of verified licensing and robust client safeguards. As a result, bittra might only be suitable for traders who are less concerned about regulatory oversight and are willing to take much higher risks for the sake of product diversity. Prospective users should proceed with extreme caution and conduct thorough additional research before engaging with this platform, as the risks may outweigh any potential benefits.