Ixxen 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Ixxen, a Canadian brokerage, presents itself as a contemporary trading platform tailored for those seeking diverse trading options, including forex, CFDs, and cryptocurrencies. However, its lack of regulatory oversight raises significant concerns for potential investors. While the platform appeals to traders seeking low fees and modern functionalities, it appears more suited for those willing to accept high levels of risk. Individuals who prioritize safety and regulatory compliance should consider alternatives. Ixxen's high minimum deposit requirements and reports of withdrawal difficulties further illuminate the risks associated with this broker. This review aims to furnish potential customers with a thorough insight into the broker's operations, including its platform, costs, and user experiences, while stressing the inherent risks involved.

⚠️ Important Risk Advisory & Verification Steps

WARNING: Trading with Ixxen involves substantial risks! Before proceeding, consider the following:

- Regulatory Status: Ixxen operates without any recognized licenses from regulatory bodies, making it imperative for traders to understand the legal implications of using this platform.

- Fund Security Risks: The absence of regulatory scrutiny can lead to a lack of protection for your investments, risking the total loss of funds.

- High Minimum Deposit: The broker's minimum deposit is listed as $500 but requires as much as $2,500 for the lowest account tier, which could compromise accessibility for new traders.

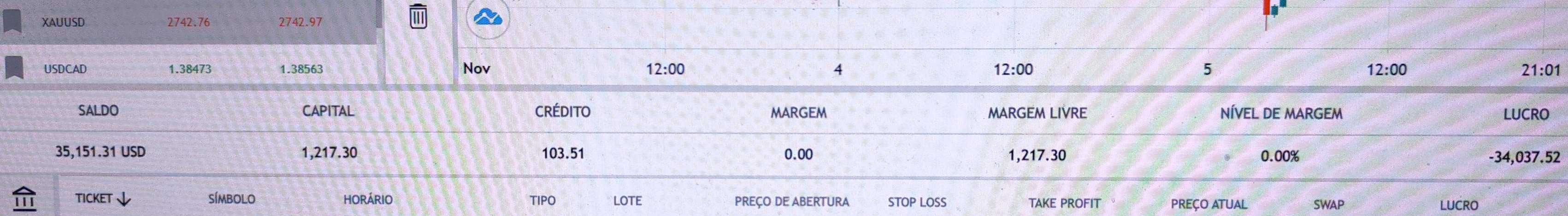

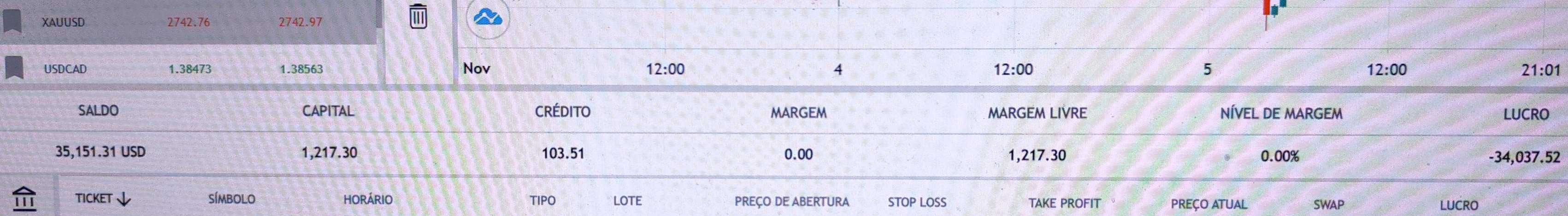

- Withdrawal Issues: Numerous complaints about problematic withdrawals signal potential fraud; be vigilant and read user experiences.

Self-Verification Steps:

- Check Regulatory Registries: Look for the broker in credible registries, such as the Investment Industry Regulatory Organization of Canada (IIROC).

- Scrutinize User Reviews: Investigate forums and review sites to gather insights about fellow traders experiences with ease of withdrawals and platform reliability.

- Contact Customer Support: Evaluate responsiveness and transparency by reaching out with queries about their services and practices.

Rating Framework

Broker Overview

Company Background and Positioning

Ixxen was founded in 2020 and is headquartered in Surrey, British Columbia, Canada. Despite presenting itself as a modern broker catering to a wide array of traders, Ixxen operates without recognizable regulatory oversight, which is a crucial red flag in the brokerage industry. The platform markets itself as a versatile option for various trading styles, including forex, CFDs, and cryptocurrencies. However, the opacity regarding its operational practices raises concerns among potential users.

Core Business Overview

Ixxen provides trading access to over 900 instruments, including various currency pairs, metals, commodities, indices, and cryptocurrencies. However, the platform's functionality and reliability remain scrutinized due to the absence of an effective user feedback mechanism and an unclear fee structure. The broker emphasizes modern trading capabilities, including its proprietary web-based trading platform, while also lacking a demo account option that is essential for new traders seeking to familiarize themselves with the brokerage services.

Quick-Look Details Table

In-Depth Analysis of Each Dimension

Trustworthiness Analysis

Ixxen's credibility is severely undermined by its non-existing regulatory framework. As the absence of an operating license presents a clear risk to potential investors, users must be keenly aware of the implications:

- Despite its claimed Canadian base, a check through the IIROC registries reveals that Ixxen is not a registered entity, indicating illegal operations. Consequently, clients have no formal recourse in the event of disputes.

- To verify regulatory status, users should:

- Visit national or regional regulatory websites.

- Cross-check with public registries to determine licensing outcomes.

- User feedback captured a concerning sentiment about fund safety:

"I had significant struggles withdrawing my money. There appears to be no clear process or support to assist."

Trading Costs Analysis

The cost structure of Ixxen presents both advantages and pitfalls that traders should weigh carefully:

- Advantages in Commissions: Ixxen promotes lower costs compared to traditional brokers, targeting fee-sensitive traders.

- The 'Traps' of Non-Trading Fees: Allegations have surfaced regarding hidden costs, particularly related to withdrawals. Users have reported:

"There are unexplained charges when trying to withdraw... I was charged fees not mentioned anywhere previously."

- Cost Structure Summary: For cost-conscious traders, the brokers low commissions may be attractive, yet the unclarity surrounding potential withdrawal fees can be problematic.

Ixxen touts a proprietary platform designed for diverse trading styles, but its actual performance is questionable:

- Platform Diversity: Users can access capabilities via web and mobile formats, but specific features, such as fully-fledged trading bots or advanced charting tools, are reportedly lacking, leading to dissatisfaction among more experienced users.

- Quality of Tools and Resources: While the platform claims low transaction costs, traders have found it isn't as intuitive or user-friendly as competitive solutions available in the industry.

- Platform Experience Summary: User reviews suggest a combination of positive initial impressions contrasted by frustrations:

"The platform looked good initially, but it's filled with bugs; I faced issues just trying to place an order."

User Experience Analysis

When examining the user experience, a mixed picture emerges:

- Account Opening Experience: Some reports indicate a cumbersome process, with several users unable to register accounts properly.

- User Interface and Accessibility: While the brokers site is designed to be user-friendly, some users commented on:

"Navigating the site felt convoluted, and certain features were masked or difficult to locate."

- Overall User Experience Summary: The reception from the user base leans towards dissatisfaction, especially regarding transparency and account opening.

Customer Support Analysis

Ixxen provides limited support channels, and while accessible, it raises concerns regarding effectiveness:

- Availability of Support Channels: Options include an email address and a phone number, but complaints about slow response times are prevalent.

- Quality of Customer Service: Many users emphasized that customer service lacks timely support, which can be frustrating:

"I barely got a response when I reached out for help; it felt like I was shouting into a void."

- Support Experience Summary: With feedback indicating long wait times, potential users may find themselves underserved when urgent queries arise.

Account Conditions Analysis

Ixxen presents a variety of account types but imposes steep initial deposits, creating considerable barriers for new traders.

- Overview of Account Types: The broker offers several tiers:

-

Minimum Deposit Requirements: A stark contrast exists between the advertised minimum ($500) and the reality of high deposit thresholds.

Account Conditions Summary: Overall, users should deliberate well before committing to Ixxen due to its stringent deposit requirements and the absence of a demo account.

Conclusion

In summation, while Ixxen markets itself as a modern trading broker with a broad offering, the substantial lack of regulatory oversight presents formidable risks for traders. Its confusing fee structure, high minimum deposit requirements, and frequent user complaints regarding withdrawal issues reflect inadequate operational transparency. This broker may appeal to risk-tolerant traders seeking a diverse asset class, but the overall environment appears to be riddled with potential pitfalls. Prospective users are strongly advised to conduct thorough due diligence before engaging with Ixxen, as the stakes in the online trading landscape continue to rise.