Ecfx 2025 Review: Everything You Need to Know

Executive Summary

ECFX is a newer broker in the forex market. Finding detailed information about this broker is hard because there are not many public sources available. This Ecfx review will give traders an honest look at what we know based on current data and user feedback from different platforms.

The broker seems to offer trading in multiple types of assets. However, we need to learn more about their services, rules they follow, and how they operate. Some customer review websites like FeaturedCustomers mention ECFX, but we don't know much about how happy their users are or how many people use their services.

ECFX appears to target regular traders who want different trading options. Without clear details about their accounts or services, it's hard to know which traders they help best. This review looks at six important areas to give traders the best assessment we can with the information we have.

Important Notice

This review uses limited public information about ECFX from 2025. The broker doesn't appear much on major review sites or regulatory databases, which makes this review less complete. Traders should do extra research before choosing this broker because detailed information about their operations, regulatory status, and user experiences is hard to find through normal industry sources.

Our review method uses available information from legal directories, software review platforms, and customer testimonials. However, detailed trading information is still limited in public sources.

Rating Framework

Broker Overview

ECFX works in the financial services industry. We don't know when they started, where their main office is, or how their company is set up because this information isn't easy to find in public sources. Professional directories and review platforms mention the broker, but we don't know how big their services are or what exactly they offer.

We don't know exactly how ECFX runs their business because they don't share this information publicly. Most brokers like this probably offer forex and CFD trading to regular people, but we can't confirm this without official information from regulatory files or company announcements. The lack of clear information makes us question who they want as clients and how they position themselves in the market.

Various professional service directories mention ECFX, including legal and software review platforms. These mentions don't give much detail about their trading services, rule compliance, or how they operate. This Ecfx review must point out the big information gaps about this broker's basic business operations.

We can't find clear information about what rules ECFX follows. Unlike well-known brokers with clear regulatory documentation, we can't easily verify ECFX's compliance status and oversight through standard regulatory database searches or official communications.

Regulatory Status: We can't find clear documentation about ECFX's regulatory authorization and oversight in available public sources. This lack of clear regulatory information is a big concern for potential clients who want verified compliance credentials.

Account Types and Requirements: We don't have detailed information about account structures, minimum deposit requirements, and specific account features in current public documentation. This missing basic account information makes it hard for traders to assess if the broker is suitable for them.

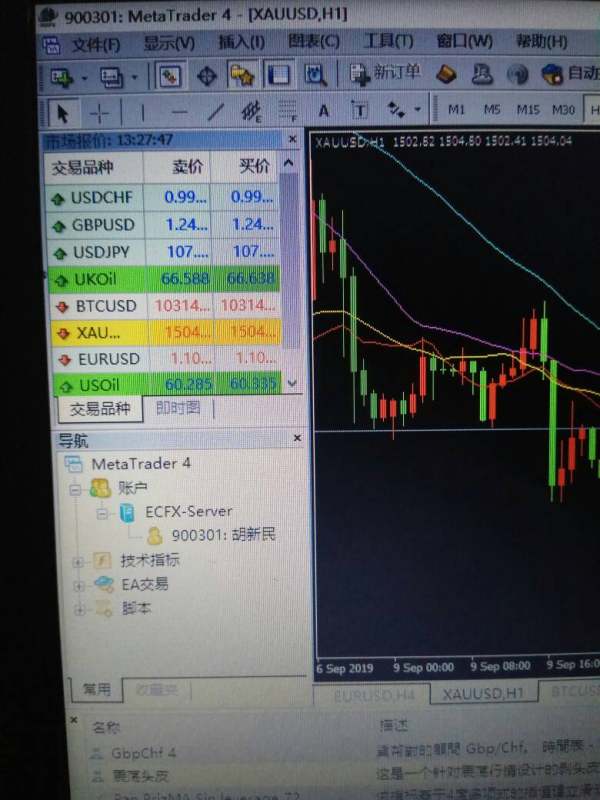

Trading Platforms: Available sources don't detail the specific trading platforms ECFX offers. We can't confirm through accessible documentation whether they use standard industry platforms like MetaTrader 4/5 or their own solutions.

Asset Coverage: Some references suggest they offer multiple assets, but public sources don't comprehensively document specific instruments, markets, and trading conditions for this Ecfx review.

Cost Structure: Available public information doesn't detail spread configurations, commission structures, and fee schedules. This lack of pricing transparency significantly impacts traders' ability to evaluate cost-effectiveness.

Funding Methods: Currently available documentation doesn't specify deposit and withdrawal options, processing times, and associated fees. Payment method availability remains unclear for potential clients.

Detailed Rating Analysis

Account Conditions Analysis (Score: 3/10)

Evaluating ECFX's account conditions is difficult because there's limited publicly available information. Most brokers typically offer multiple account levels for different trader experience levels and capital requirements, but accessible sources don't detail ECFX's specific offerings.

Available materials don't clearly outline account opening procedures, verification requirements, and documentation standards. This lack of transparency about basic account setup creates uncertainty for potential clients who want to understand onboarding requirements.

Current public documentation doesn't specify minimum deposit thresholds, which are crucial decision factors for retail traders. Without this basic information, traders can't effectively assess whether ECFX's account structures match their available capital and trading goals.

Available sources don't document special account features like Islamic accounts, professional trader classifications, or institutional services. This Ecfx review can't provide guidance on specialized account options that may be relevant for specific trader groups.

The missing detailed account condition information significantly impacts the overall evaluation. This results in a low score that reflects uncertainty rather than confirmed service quality problems.

Trading tools and analytical resources are critical parts of any comprehensive brokerage offering. However, available public sources don't document ECFX's specific capabilities in this area well. Industry standards typically include charting packages, technical indicators, economic calendars, and market analysis features.

Accessible ECFX documentation doesn't detail educational resources, which serve as important value-added services for retail traders. Current public sources can't confirm the availability of webinars, tutorials, market analysis, or trading guides.

Available materials don't specify research capabilities, including fundamental analysis, technical studies, and market commentary. These services often help brokers stand out in competitive markets, but ECFX's offerings remain unclear.

Accessible sources don't document platform-specific tools like automated trading capabilities, custom indicator support, or advanced order types. Without detailed platform specifications, traders can't assess how sophisticated the available trading tools are.

The limited information about trading tools and educational resources results in a moderate-low score. This reflects uncertainty rather than confirmed problems with service offerings.

Customer Service Analysis (Score: 3/10)

Customer support quality and accessibility are fundamental aspects of broker evaluation. However, available public sources don't detail specific information about ECFX's support infrastructure. Standard industry practices include multiple communication channels, extended support hours, and multilingual capabilities.

Accessible materials don't document response time expectations, support ticket resolution procedures, and escalation processes. These operational details significantly impact user experience, especially during market volatility or technical issues.

Current public documentation can't confirm support channel availability, including live chat, telephone, email, or social media support. The missing clear communication options creates uncertainty for potential clients about assistance accessibility.

Available sources don't specify multilingual support capabilities, which serve increasingly important roles in global retail trading markets. Language support often determines broker accessibility for diverse international client bases.

The lack of comprehensive customer service information available for this Ecfx review results in a low evaluation score. This reflects data limitations rather than confirmed service quality assessments.

Trading Experience Analysis (Score: 4/10)

Available sources don't document platform performance characteristics about ECFX, including execution speed, server stability, and order processing efficiency. These technical factors significantly impact trading outcomes, especially for active traders using short-term strategies.

Accessible public documentation doesn't detail order execution quality, slippage rates, and requote frequency, which are crucial performance metrics. Without this information, traders can't assess trade execution reliability under various market conditions.

Available sources don't specify mobile trading capabilities, which have become essential for modern retail traders. The quality and functionality of mobile platforms often determine user satisfaction and trading flexibility.

Current public materials don't document platform customization options, workspace configurations, and user interface design elements. These features significantly impact daily trading experience and operational efficiency.

The missing detailed trading experience data results in a moderate-low score. This acknowledges the uncertainty created by limited available information rather than confirmed platform problems.

Trust and Reliability Analysis (Score: 2/10)

Regulatory compliance verification represents the foundation of broker trustworthiness. However, accessible public sources don't clearly document ECFX's specific regulatory status. Established brokers typically maintain transparent regulatory relationships with recognized financial authorities.

Available documentation doesn't detail client fund protection measures, including segregated account structures, deposit insurance, or compensation schemes. These protections serve as critical safety nets for trader capital security.

Corporate transparency appears limited based on publicly accessible information, including company ownership, financial reporting, and operational disclosure. Established brokers typically maintain comprehensive public documentation about their corporate structure and financial standing.

Assessing industry reputation and peer recognition is difficult given ECFX's limited presence across major review platforms and industry publications. Established brokers typically maintain visible profiles across multiple independent evaluation sources.

The combination of limited regulatory transparency, unclear corporate documentation, and minimal independent verification sources results in a low trust evaluation score for this Ecfx review.

User Experience Analysis (Score: 3/10)

Overall user satisfaction assessment faces significant challenges because there's limited available feedback from verified ECFX clients. Established brokers typically maintain substantial user review databases across multiple independent platforms, but such feedback appears minimal for ECFX.

We can't adequately assess interface design quality, navigation efficiency, and platform usability without detailed user testimonials or platform demonstrations. These factors significantly impact daily trading experience and operational satisfaction.

Accessible public documentation doesn't detail registration and account verification processes. Streamlined onboarding procedures often determine initial user impressions and long-term client retention.

We can't identify common user concerns, feature requests, and satisfaction trends because of limited available feedback sources. This missing user voice significantly impacts the ability to assess real-world experience quality.

The limited availability of comprehensive user feedback results in a low experience evaluation score. This reflects data constraints rather than confirmed service quality issues.

Conclusion

This Ecfx review reveals significant information limitations that impact comprehensive broker evaluation. While ECFX maintains some presence across professional directories and review platforms, the missing detailed operational information, regulatory transparency, and user feedback creates substantial uncertainty for potential clients.

The consistently low evaluation scores across all assessment criteria primarily reflect data availability constraints rather than confirmed service problems. Traders considering ECFX should do enhanced research, seeking direct communication with the broker to get crucial information about regulatory status, account conditions, and service offerings.

Based on available information, ECFX may work best for traders willing to invest significant time in independent research and direct broker communication. However, the lack of transparent operational documentation suggests that traders seeking established, well-documented brokerage relationships may find better alternatives in the competitive forex market landscape.