Is MHF safe?

Pros

Cons

Is MHF Safe or Scam?

Introduction

MHF, a forex broker established in 2018, positions itself within the competitive landscape of the foreign exchange market by offering traders access to the popular MetaTrader 4 platform. As the forex market is rife with opportunities, it also presents considerable risks, making it essential for traders to conduct thorough evaluations of their chosen brokers. Ensuring a broker's credibility is vital, as it directly impacts the safety of traders' investments and the integrity of their trading experience. This article aims to provide an objective analysis of MHF's operations, regulatory status, and overall trustworthiness. Our investigation draws on multiple sources, including regulatory databases, user reviews, and industry analyses, to assess whether MHF is a safe option for traders or if it exhibits characteristics typical of a scam.

Regulation and Legitimacy

The regulatory environment is a cornerstone of trust in the forex trading industry. MHF claims to operate under the oversight of the Australian Securities and Investments Commission (ASIC), a reputable regulator known for its stringent standards. Regulation by a recognized authority is crucial for ensuring that brokers adhere to ethical practices and maintain a level of transparency that protects traders. Below is a summary of MHF's regulatory details:

| Regulator | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 277933 | Australia | Verified |

While MHF is regulated by ASIC, the broker has received a low score of 1.51 on WikiFX, indicating potential red flags regarding its operations. Additionally, despite being regulated, traders should be aware that regulatory oversight does not guarantee safety. The quality of regulation is paramount; thus, the fact that MHF operates under ASIC should be seen as a positive sign, albeit not a definitive assurance of safety. Historical compliance issues, if any, should also be a consideration when evaluating MHF's legitimacy.

Company Background Investigation

MHF was founded in 2018, positioning itself as a relatively new player in the forex market. The company is based in the United Kingdom, which adds an additional layer of scrutiny to its operations. Understanding the ownership structure and management team is essential for assessing the broker's credibility. MHF's management team includes professionals with backgrounds in finance and trading, which is typically a positive indicator of the broker's operational integrity. However, the limited information available about the company's history raises questions about its transparency and commitment to ethical trading practices.

Moreover, the level of information disclosure by MHF is crucial in establishing trust with potential clients. A broker that provides detailed information about its operations, management, and financial health is generally viewed as more trustworthy. In contrast, a lack of transparency can lead to concerns about the broker's intentions and reliability. Therefore, while MHF's establishment and regulatory compliance suggest a level of legitimacy, the overall opacity surrounding its operations warrants caution.

Trading Conditions Analysis

When evaluating whether MHF is safe, it's important to analyze its trading conditions, particularly its fee structure. MHF operates under a spread-based model, which is standard in the industry. However, any unusual fees or hidden costs can significantly impact a trader's profitability. Below is a comparison of MHF's core trading costs against industry averages:

| Fee Type | MHF | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Model | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

The absence of detailed information on spreads and commissions raises concerns about potential hidden fees that could affect trading outcomes. Traders should be wary of brokers that do not clearly disclose their fee structures, as this can be a tactic used by unscrupulous brokers to exploit clients. Additionally, any discrepancies between MHF's fees and industry standards should be carefully scrutinized to ensure that traders are not being subjected to unfair practices.

Client Funds Safety

The safety of client funds is a paramount concern for any trader. MHF claims to implement several measures to protect client investments, including segregated accounts and investor protection policies. Segregation of funds ensures that client money is kept separate from the broker's operational funds, providing a layer of security in case of financial difficulties. Furthermore, the presence of negative balance protection is crucial, as it prevents clients from losing more than their initial investment.

Despite these assurances, traders should investigate MHF's historical performance regarding client fund safety. Any past incidents involving fund mismanagement or client complaints about withdrawal issues could indicate deeper systemic problems. Therefore, it is imperative for potential clients to conduct thorough research and consider the broker's track record in handling client funds before making any commitments.

Customer Experience and Complaints

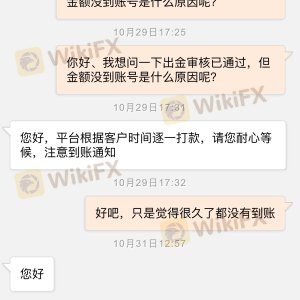

Customer feedback is an invaluable resource for assessing a broker's reliability. MHF has received mixed reviews from users, with some praising its trading platform and others highlighting significant issues. Common complaints include difficulties with withdrawals and unresponsive customer service. Below is a summary of the primary complaint types associated with MHF:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Responsiveness | Medium | Fair |

One notable case involved a trader who reported being unable to withdraw funds for an extended period, raising concerns about MHF's operational integrity. Such complaints, especially when they recur, can be indicative of a broker's overall reliability. It is essential for potential traders to weigh these experiences against the broker's regulatory status and operational claims.

Platform and Trade Execution

Evaluating the performance of MHF's trading platform is vital in determining whether it is safe for traders. MHF utilizes the widely recognized MetaTrader 4 platform, known for its user-friendly interface and robust features. However, the platform's performance, including order execution quality and slippage rates, can significantly impact the trading experience. Traders have reported varying levels of satisfaction with MHF's execution speed, with some experiencing delays during high volatility periods.

Additionally, any signs of platform manipulation, such as frequent rejections of orders or unexplained price changes, should raise red flags. A broker that engages in such practices is likely not safe for traders. Thus, potential clients should consider user reviews and performance analyses to gauge the reliability of MHF's trading platform.

Risk Assessment

Every broker comes with its inherent risks, and MHF is no exception. A comprehensive risk assessment can help traders make informed decisions. Below is a summary of the key risk areas associated with MHF:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | Medium | Limited transparency and low WikiFX score raise concerns. |

| Fund Safety | High | Mixed reviews on withdrawal issues and fund management. |

| Customer Service | Medium | Reports of unresponsive support can hinder trading experience. |

To mitigate these risks, traders should establish a clear understanding of MHF's practices and remain vigilant about their trading activities. It is advisable to start with a demo account or a small investment to gauge the broker's reliability before committing significant capital.

Conclusion and Recommendations

In conclusion, while MHF presents itself as a regulated forex broker with a solid platform, various factors suggest that potential traders should exercise caution. The low WikiFX score, mixed customer feedback, and reports of withdrawal difficulties raise concerns about whether MHF is genuinely safe. Traders are advised to conduct thorough research and consider alternative brokers with higher trust ratings and better customer service records.

For those seeking reliable forex trading options, brokers regulated by top-tier authorities like the FCA or ASIC, with transparent fee structures and strong customer support, are recommended. Ultimately, the decision to trade with MHF should be made with careful consideration of the associated risks and a clear understanding of the broker's operational practices.

Is MHF a scam, or is it legit?

The latest exposure and evaluation content of MHF brokers.

MHF Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MHF latest industry rating score is 1.59, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.59 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.