Regarding the legitimacy of Ueda Harlow forex brokers, it provides FSA and WikiBit, (also has a graphic survey regarding security).

Is Ueda Harlow safe?

Business

License

Is Ueda Harlow markets regulated?

The regulatory license is the strongest proof.

FSA Market Making License (MM)

Financial Services Agency

Financial Services Agency

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

上田ハーロー株式会社

Effective Date:

2007-09-30Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

東京都千代田区神田須田町1-1Phone Number of Licensed Institution:

03-5207-8631Licensed Institution Certified Documents:

Is Ueda Harlow Safe or a Scam?

Introduction

Ueda Harlow is a foreign exchange broker based in Japan, established in 1984, that has gained a foothold in the forex trading market. As the forex market continues to attract both novice and experienced traders, it's crucial for them to carefully evaluate the brokers they choose to work with. Given the potential for scams and fraudulent activities in the trading industry, assessing a broker's legitimacy, regulatory status, and overall reputation is paramount. This article aims to investigate whether Ueda Harlow is a safe trading platform or if it raises red flags that suggest it may be a scam. Our evaluation is based on a thorough analysis of regulatory compliance, company background, trading conditions, customer safety, and user experiences.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its safety. Ueda Harlow was previously regulated by Japan's Financial Services Agency (FSA), but it faced a revocation of its license, which raises significant concerns regarding its legitimacy. A revoked license indicates that the broker may have failed to adhere to regulatory standards, which can expose traders to risks.

Heres a summary of the core regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Services Agency (FSA) | 9010001037726 | Japan | Revoked |

The revocation of Ueda Harlow's license suggests that it may not be operating under the stringent oversight that is essential for protecting investors. Regulatory bodies serve as a safeguard against fraud and malpractice, and without proper regulation, traders may find themselves vulnerable to various risks, including the loss of funds. Therefore, the question of "Is Ueda Harlow safe?" becomes increasingly pertinent in light of its regulatory history.

Company Background Investigation

Ueda Harlow has a long history in the financial services sector, having been founded in 1984. Over the years, it has evolved into a significant player in the forex market. However, the company's ownership structure and management team are equally important in assessing its credibility. The management team consists of experienced professionals with backgrounds in finance and trading, which can be a positive indicator of the company's operational integrity.

Despite its long-standing presence, the lack of transparency regarding its ownership and management raises concerns. Transparency in company operations and ownership is crucial for building trust with clients. Furthermore, Ueda Harlow's decision to merge with Gaitame in 2021 has added another layer of complexity to its corporate structure. While mergers can enhance a company's capabilities, they can also cloud accountability, making it essential for traders to scrutinize the implications of such changes.

Trading Conditions Analysis

When evaluating whether Ueda Harlow is safe, analyzing its trading conditions is vital. The broker's fee structure, including spreads, commissions, and overnight interest rates, can significantly impact trading profitability. Ueda Harlow offers competitive spreads for major currency pairs, but it is essential to compare these with industry averages to ascertain their fairness.

Heres a comparison of core trading costs:

| Fee Type | Ueda Harlow | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | 0.3 pips | 0.5 pips |

| Commission Model | Variable | Fixed |

| Overnight Interest Range | 2% | 1.5% |

While Ueda Harlow's spreads appear competitive, the variable commission model may introduce unpredictability in trading costs. Traders should be wary of any hidden fees or unusual policies that could affect their trading experience. The question remains: Is Ueda Harlow safe in terms of trading conditions? The answer hinges on the broker's transparency regarding its fee structures and any potential additional costs that may not be immediately apparent.

Client Fund Safety

The safety of client funds is a crucial aspect of any broker's operations. Ueda Harlow claims to implement various measures to protect client funds, including segregated accounts and investor protection policies. Segregation of client funds ensures that traders' money is kept separate from the broker's operational funds, reducing the risk of loss in the event of financial difficulties.

However, the absence of a robust regulatory framework following the revocation of its FSA license raises concerns about the effectiveness of these safety measures. Additionally, any historical issues related to fund security or disputes should be thoroughly examined. Without proper oversight, even the best safety measures may fall short of protecting traders' investments. Therefore, the question of Is Ueda Harlow safe in terms of client fund security remains a significant consideration for potential users.

Customer Experience and Complaints

Understanding customer experiences is vital in evaluating a broker's reliability. Feedback from users can provide insights into the broker's responsiveness, service quality, and any recurring issues. Ueda Harlow has received some complaints, primarily concerning withdrawal difficulties and unclear fee structures.

Heres a summary of the main complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Fee Transparency | Medium | Inconsistent explanations |

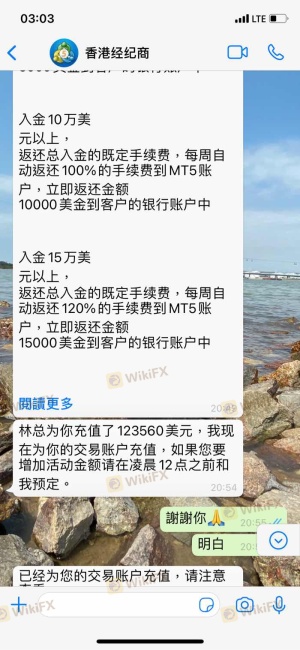

One notable complaint involved a user required to pay a percentage of their funds to "unfreeze" their account, which raises alarm bells about potentially deceptive practices. Such complaints can significantly impact a broker's reputation and raise questions about its operational integrity. Thus, while some users may have positive experiences, the frequency and severity of complaints suggest that Ueda Harlow's safety as a trading platform is questionable.

Platform and Trade Execution

The performance of a trading platform is another critical aspect of a broker's reliability. Ueda Harlow's trading platform is designed to offer a range of features, but user experiences have indicated occasional stability issues. Traders have reported instances of slippage and delayed order execution, which can adversely affect trading outcomes.

Moreover, any signs of platform manipulation, such as frequent rejections of orders or unexplained discrepancies in pricing, warrant serious concern. A broker's ability to provide a stable and efficient trading environment is essential for ensuring a positive trading experience. Therefore, the question of Is Ueda Harlow safe regarding platform performance and trade execution is a crucial factor for potential traders to consider.

Risk Assessment

Using Ueda Harlow comes with inherent risks that must be carefully evaluated. The combination of regulatory issues, customer complaints, and platform performance concerns suggests an elevated risk profile for traders considering this broker.

Heres a risk summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Revoked license raises concerns |

| Fund Safety | Medium | Segregation measures exist but lack oversight |

| Customer Service | Medium | Complaints indicate responsiveness issues |

To mitigate these risks, potential traders should conduct thorough due diligence, consider starting with a demo account, and only invest funds they can afford to lose. Being aware of these risks can help traders make informed decisions about their trading activities.

Conclusion and Recommendations

In conclusion, while Ueda Harlow has a long history in the forex market, several factors raise concerns about its safety and legitimacy. The revocation of its regulatory license, coupled with customer complaints and potential issues with fund security, suggests that traders should exercise caution.

For those considering trading with Ueda Harlow, it is advisable to proceed with vigilance and to explore alternative brokers that are well-regulated and have a proven track record. Reliable options include brokers regulated by top-tier authorities such as the FCA or ASIC, which provide enhanced safety measures for traders. Ultimately, the question of Is Ueda Harlow safe leans towards a cautious "no," and potential traders should prioritize their financial security by choosing brokers with a solid regulatory framework and positive customer feedback.

Is Ueda Harlow a scam, or is it legit?

The latest exposure and evaluation content of Ueda Harlow brokers.

Ueda Harlow Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Ueda Harlow latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.