GMT Markets 2025 Review: Everything You Need to Know

Executive Summary

GMT Markets started in 2017 in Melbourne, Australia. This gmt markets review shows a mixed picture in the forex and CFD trading world. The broker works under Australian Securities and Investments Commission regulation, which gives traders some protection. But many users complain about high fees and trouble getting their money out.

The company says it puts customers first and offers forex and CFD trading. User experiences tell a different story though. The ASIC rules do provide some safety, but traders should think carefully about the reported problems. This review gives you the key facts to decide if GMT Markets fits your trading needs.

Important Disclaimers

Forex brokers work differently in different countries. GMT Markets operates under ASIC regulation with license number 400364 in Australia. Traders from other places should check what rules apply to them before using this platform.

This review looks at user feedback, regulatory info, and market data. We used many sources to give you a fair picture. But things can change, so do your own research before making any investment decisions.

Rating Framework

Broker Overview

GMT Markets joined the forex and CFD market in 2017. The company set up its main office in Melbourne, Australia, and wanted to focus on customer service. Even though it's fairly new, the broker has gotten attention for both good and bad reasons.

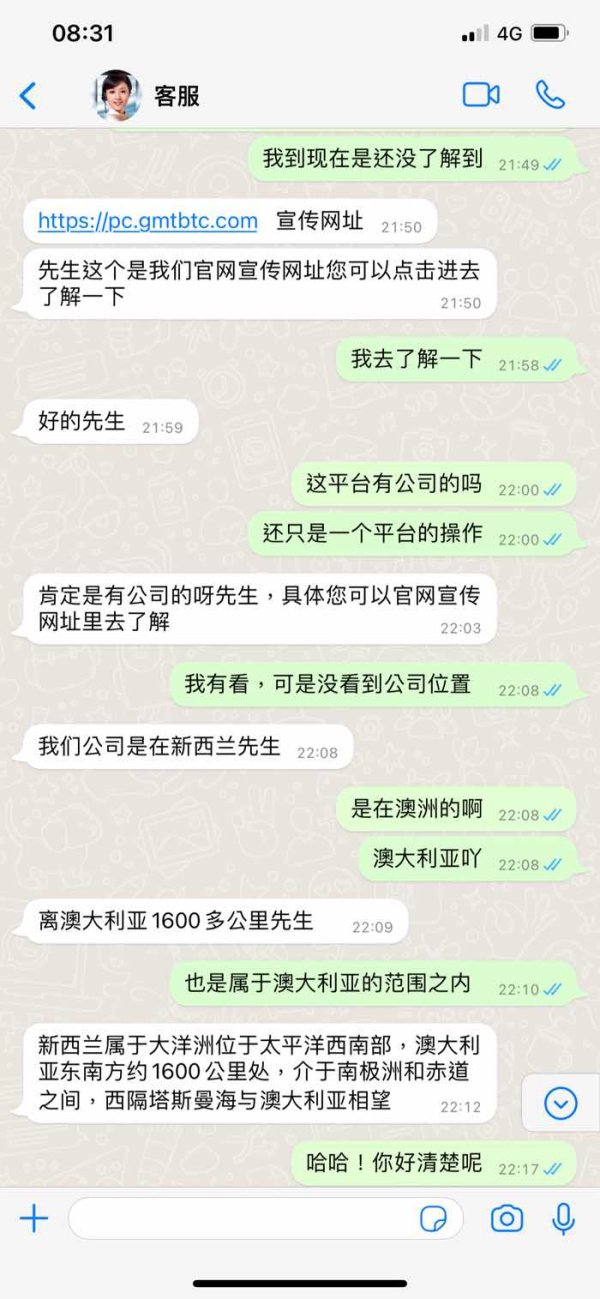

The company works as a market maker and offers forex and CFD trading. GMT Markets says it wants to provide reliable platforms and great customer support. But user reviews show mixed results in meeting these goals.

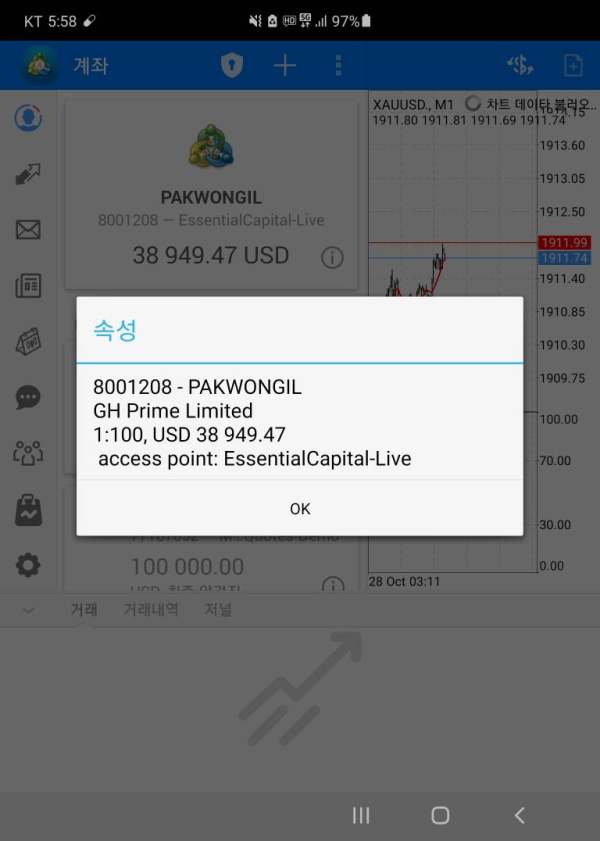

This gmt markets review shows the broker has proper ASIC licensing with number 400364. However, users report problems that hurt the overall experience. The company mainly serves retail traders who want to trade currencies and CFDs, though details about their technology are hard to find.

Regulatory Status: GMT Markets works under ASIC supervision with license number 400364. This means they must follow Australian financial rules and protect traders with separate client funds and ways to solve disputes.

Available Assets: The broker focuses on forex trading and CFDs. They offer major, minor, and exotic currency pairs plus CFDs on different assets. But they don't give complete details about all the instruments you can trade.

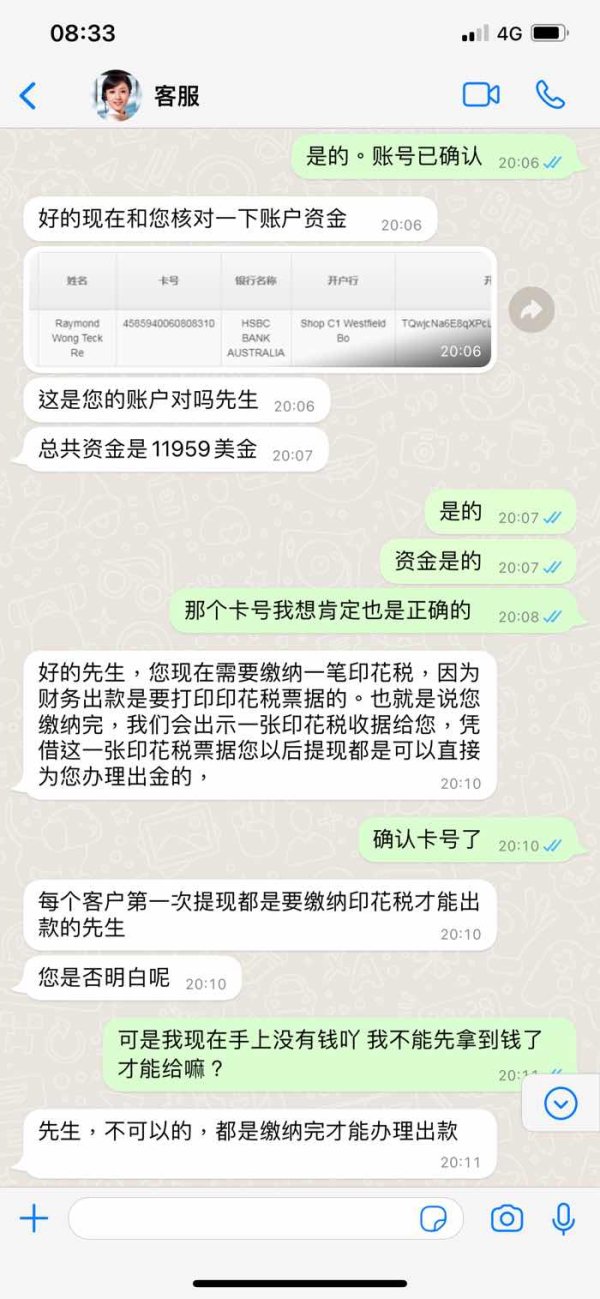

Cost Structure: Users often complain about high trading fees. The company doesn't share specific information about spreads, commissions, and other charges. The fee structure seems to be a big problem that makes clients unhappy.

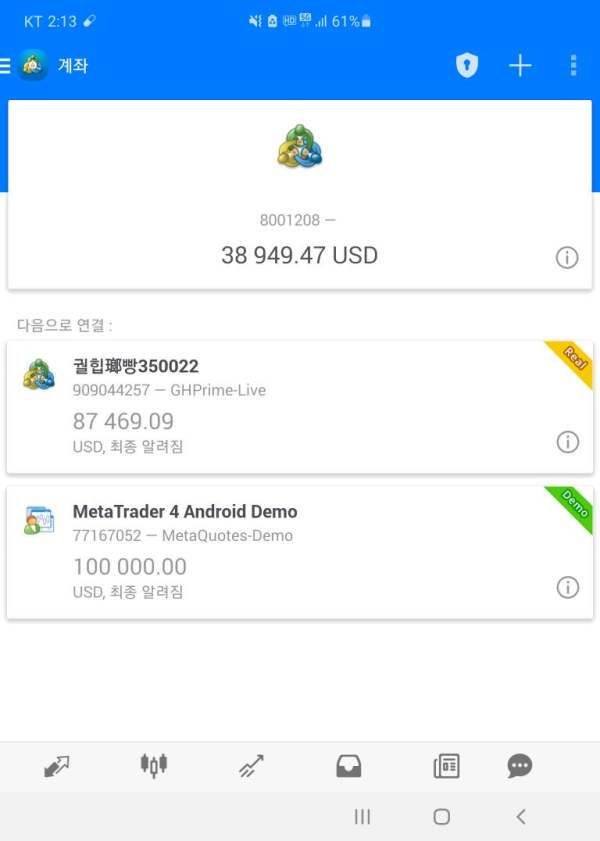

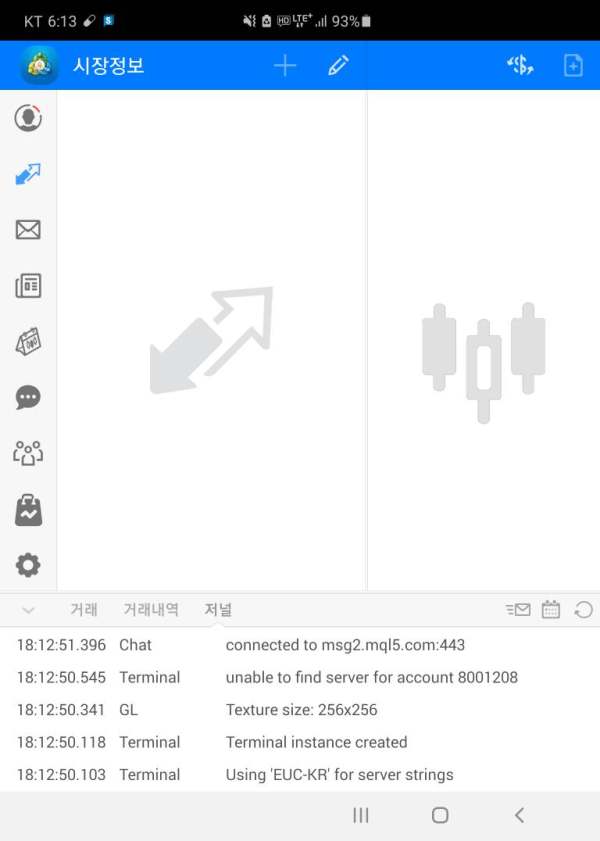

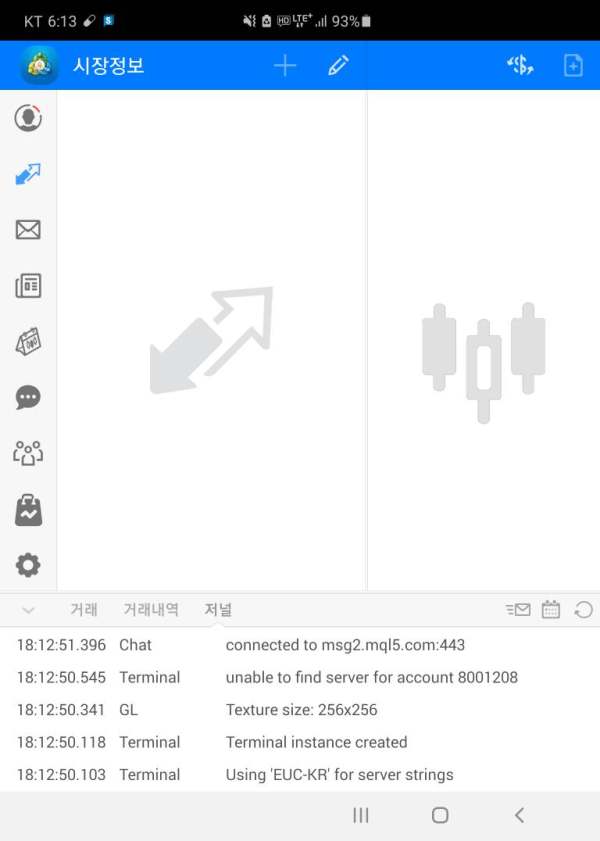

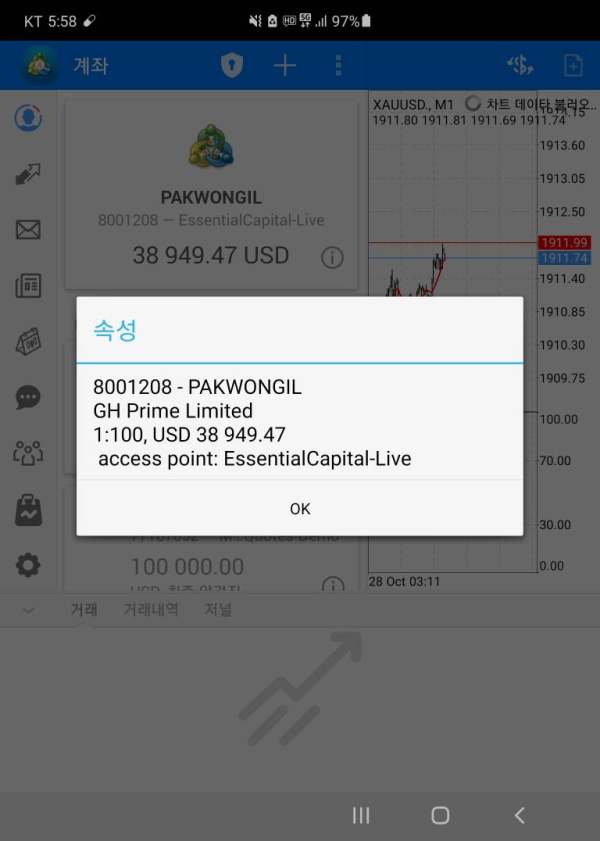

Trading Platforms: We couldn't find clear details about what trading platforms GMT Markets offers. It's not clear if they use their own technology or third-party solutions like MetaTrader.

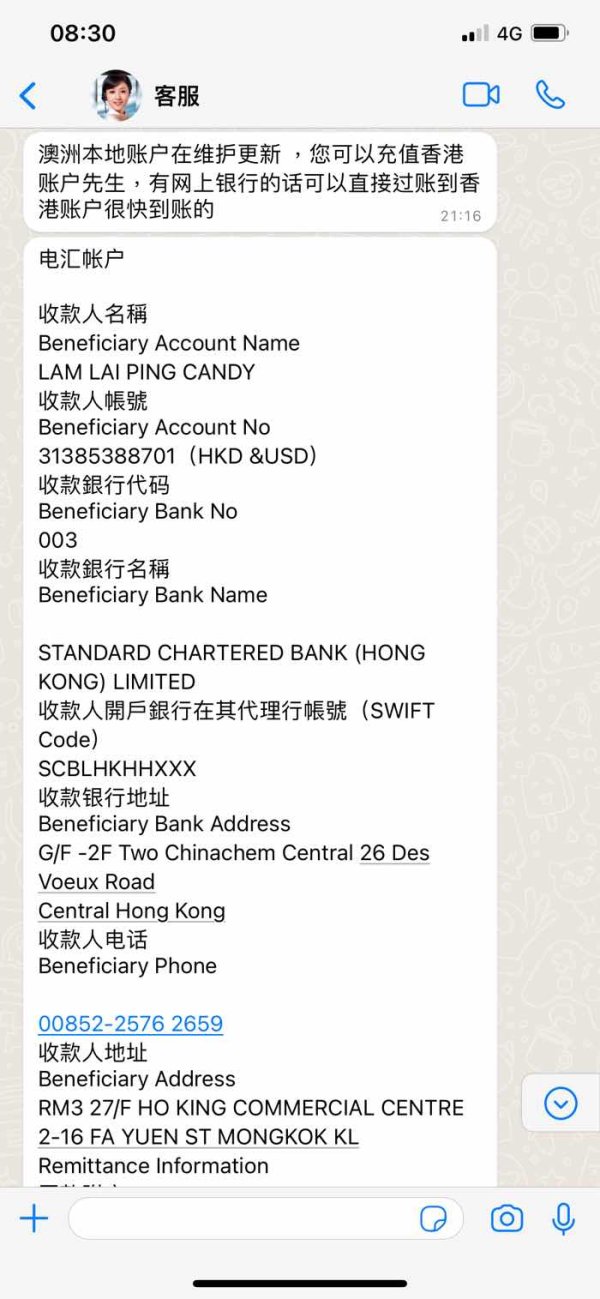

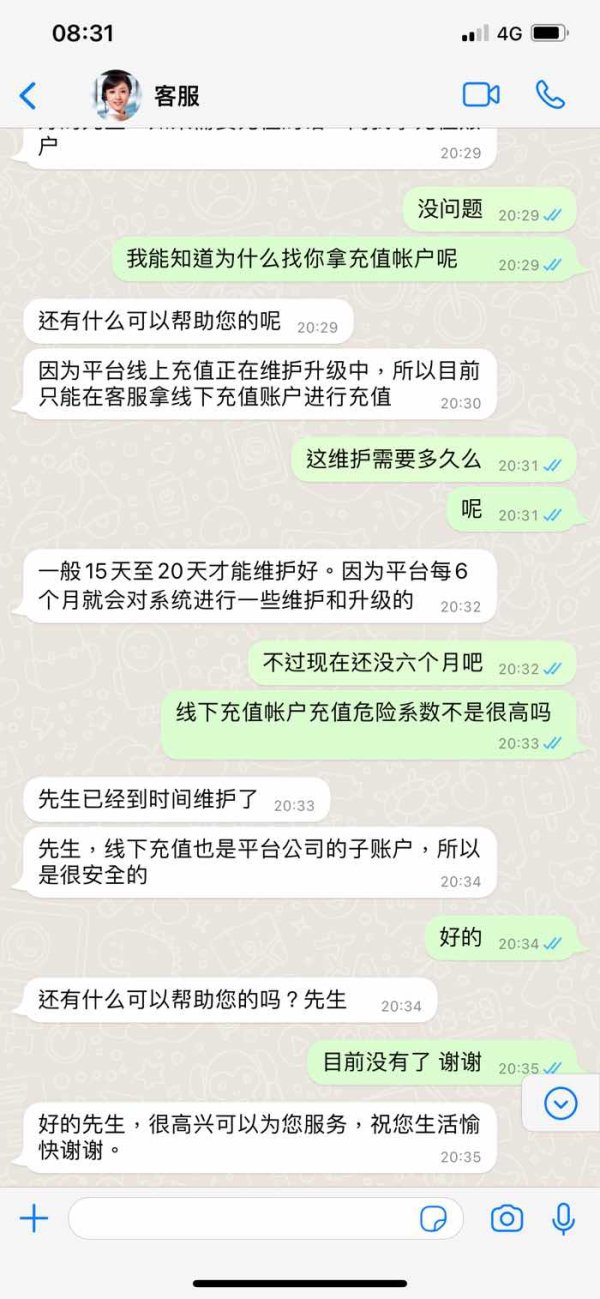

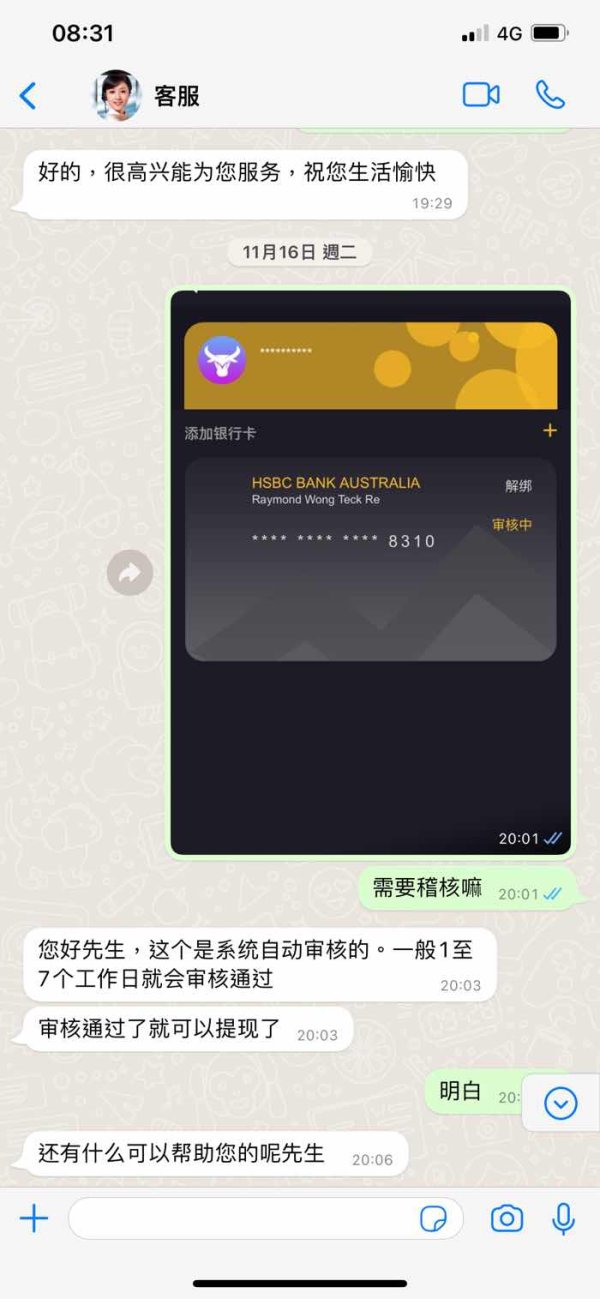

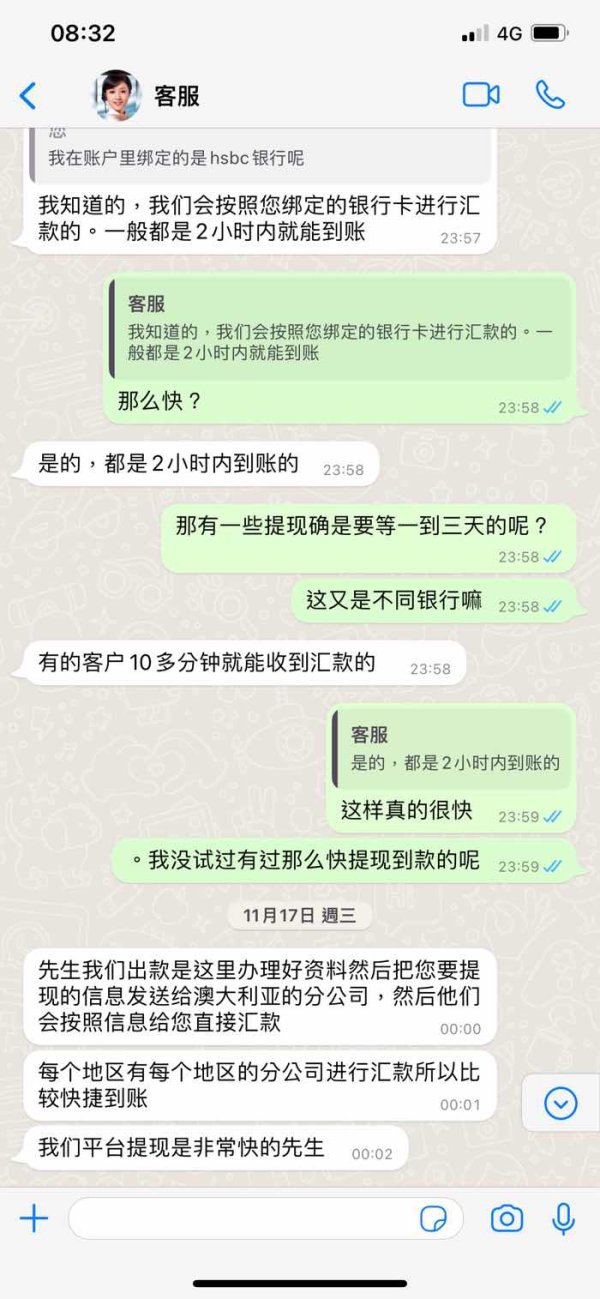

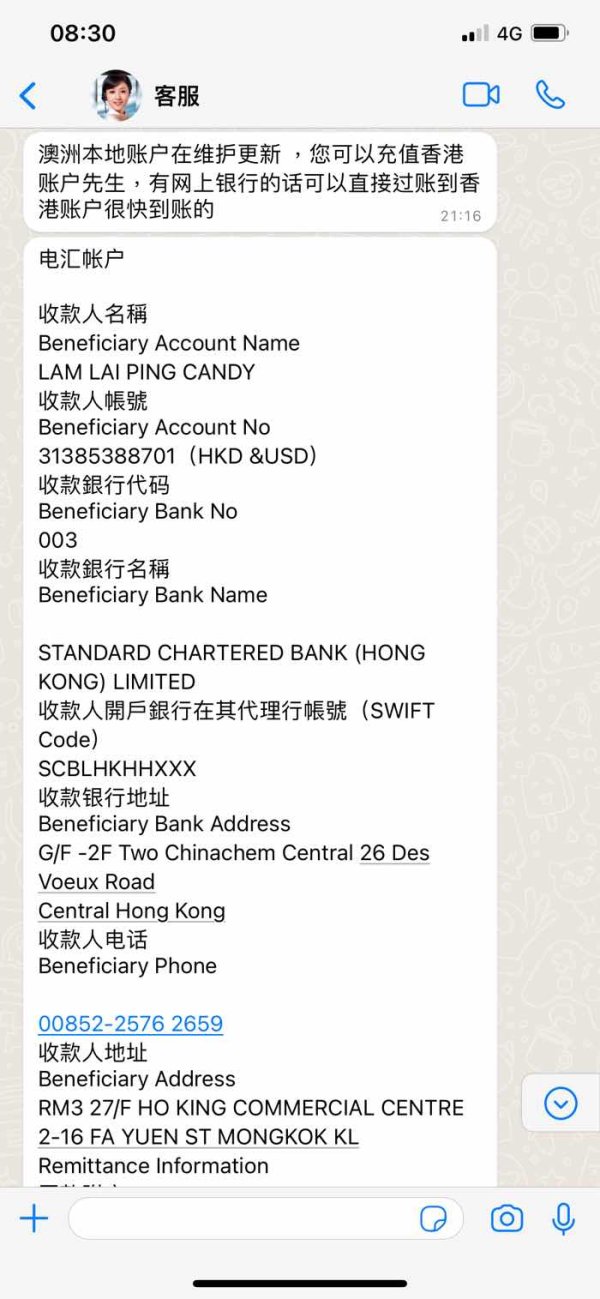

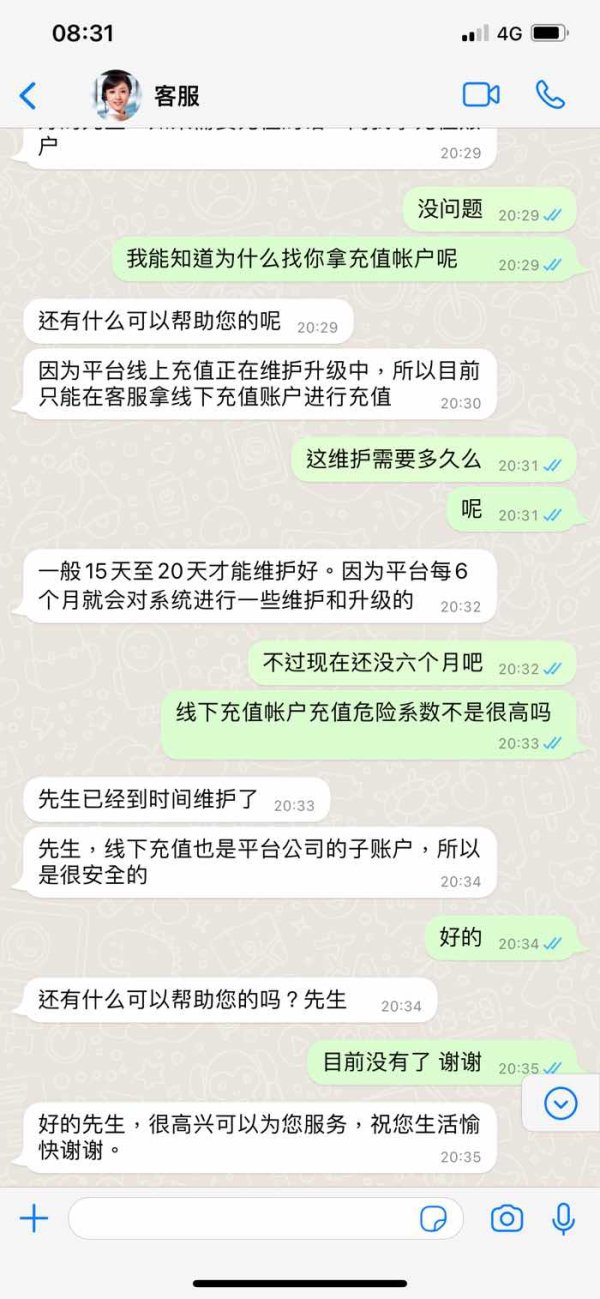

Deposit and Withdrawal Methods: The company doesn't share specifics about funding options, processing times, or minimum deposits. User complaints about withdrawal problems suggest issues with getting money out.

Leverage and Margin: Details about maximum leverage and margin requirements aren't available. This is a big information gap for traders trying to evaluate the broker.

This gmt markets review shows the broker lacks transparency about key trading conditions. This might explain why users are unhappy and have concerns.

Account Conditions Analysis

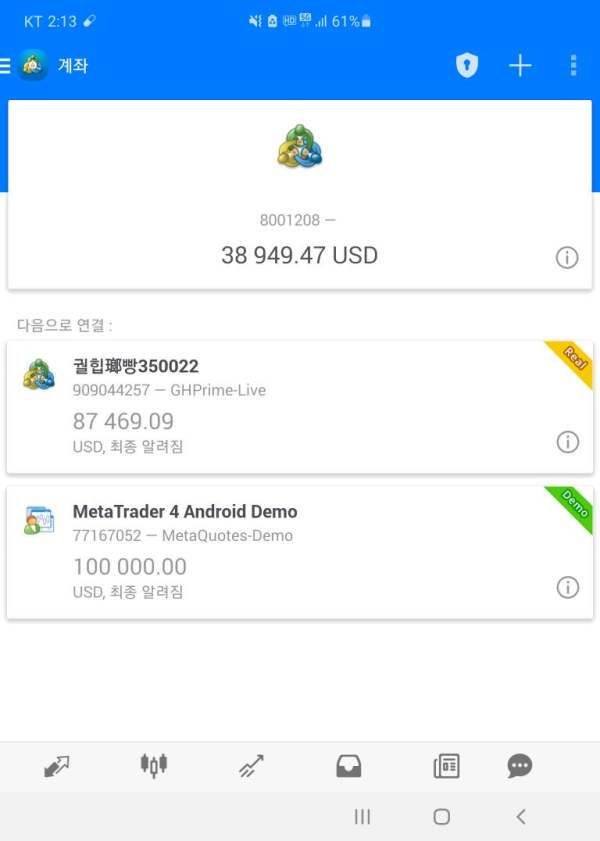

GMT Markets' account setup has several problem areas based on user feedback. The company doesn't clearly explain account types or their features. Users say the fee structure really hurts the value for traders. Not knowing minimum deposits, account levels, and benefits creates confusion for potential clients.

Opening an account seems to follow normal industry steps. But specific requirements and verification steps aren't detailed anywhere. Users say account setup might go smoothly at first, but then problems with fees and withdrawals create headaches.

User complaints about high fees suggest the broker costs more than competitors. This gmt markets review finds that unclear fee schedules make users unhappy and raise questions about transparency. The lack of info about Islamic accounts or other special account types also limits appeal to different trading groups.

GMT Markets has big information gaps when it comes to trading tools and resources. Available info doesn't give details about trading platforms, analysis tools, or research resources for clients. This lack of transparency about technology and support tools is a major weakness.

Educational resources are important for retail traders, but aren't detailed anywhere. No information about webinars, tutorials, market analysis, or educational content suggests limited offerings or poor communication. Details about automated trading, API access, or advanced charts are also missing.

Market research and analysis tools are essential for smart trading decisions. But there's no info about economic calendars, market commentary, or technical analysis resources. This further hurts the broker's value for traders who want complete trading support.

Customer Service and Support Analysis

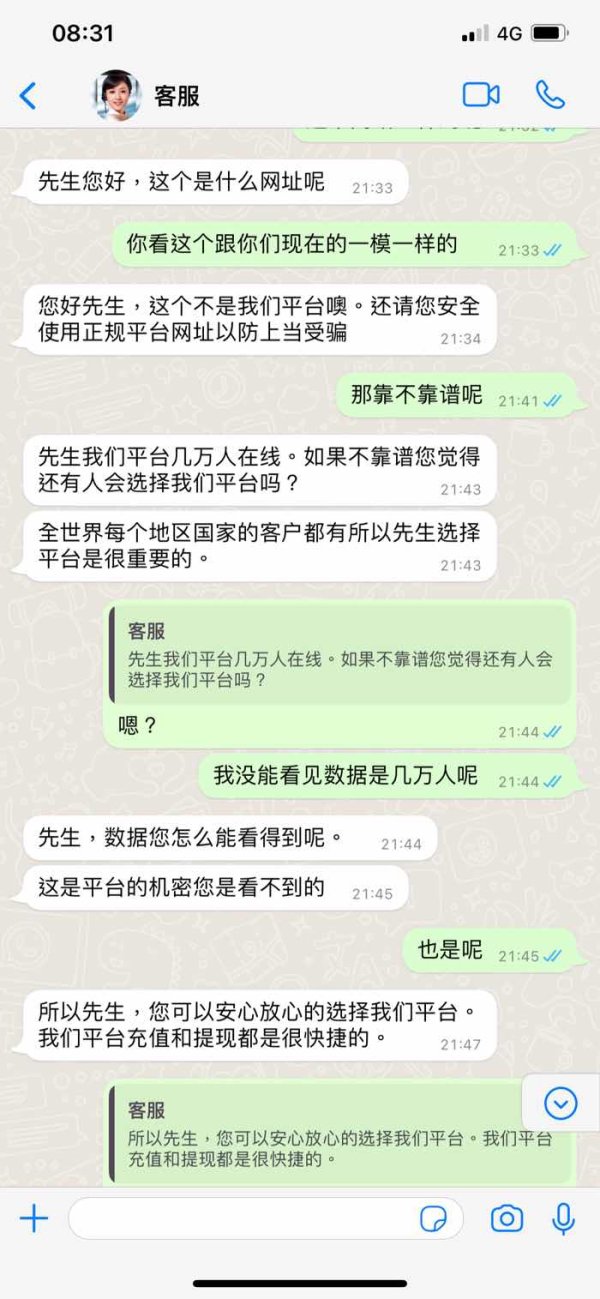

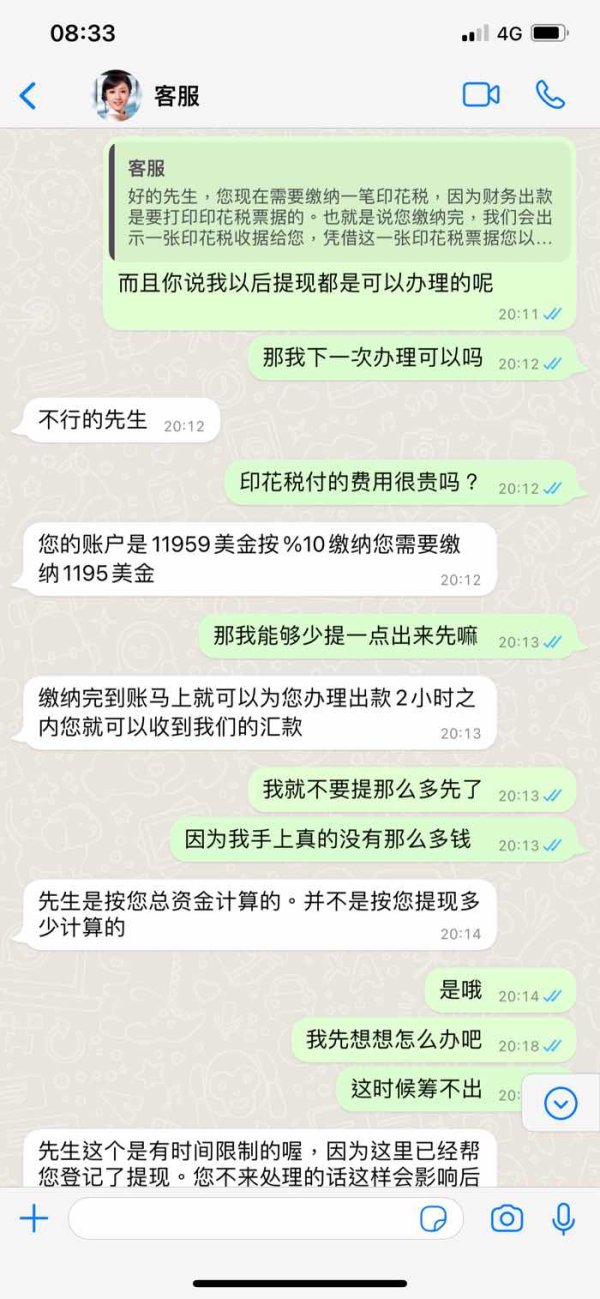

Customer service quality is a big concern with GMT Markets. Users consistently report problems with support response and problem solving, especially with withdrawals and fee questions. Multiple user complaints suggest system-wide issues with customer service that hurt client satisfaction.

Response times and service quality seem problematic based on feedback. But specific details about support channels, hours, or language support aren't documented. The lack of transparency about customer service raises questions about the broker's commitment to client support.

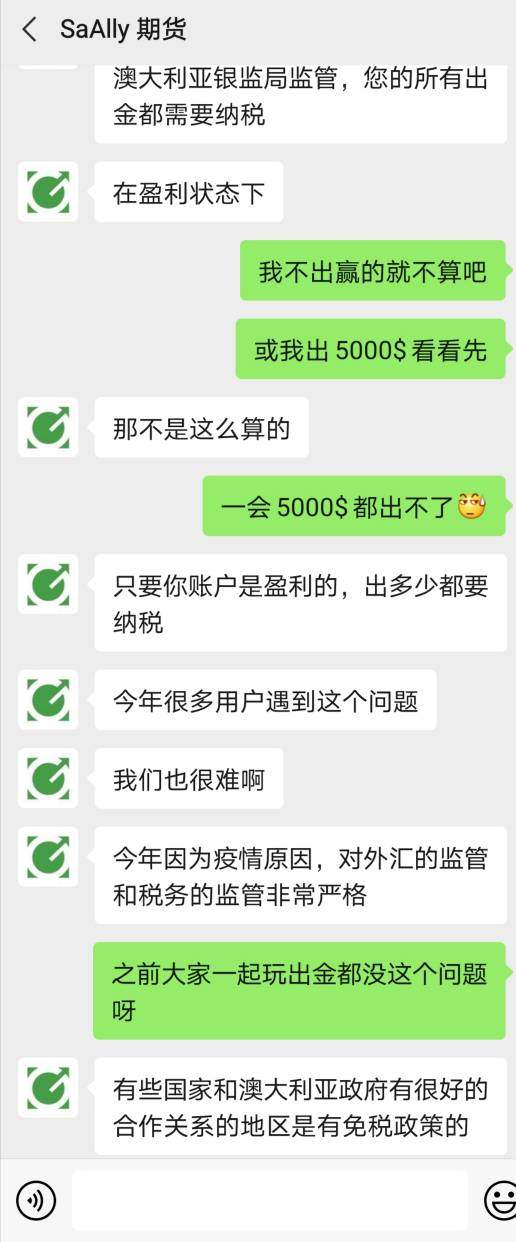

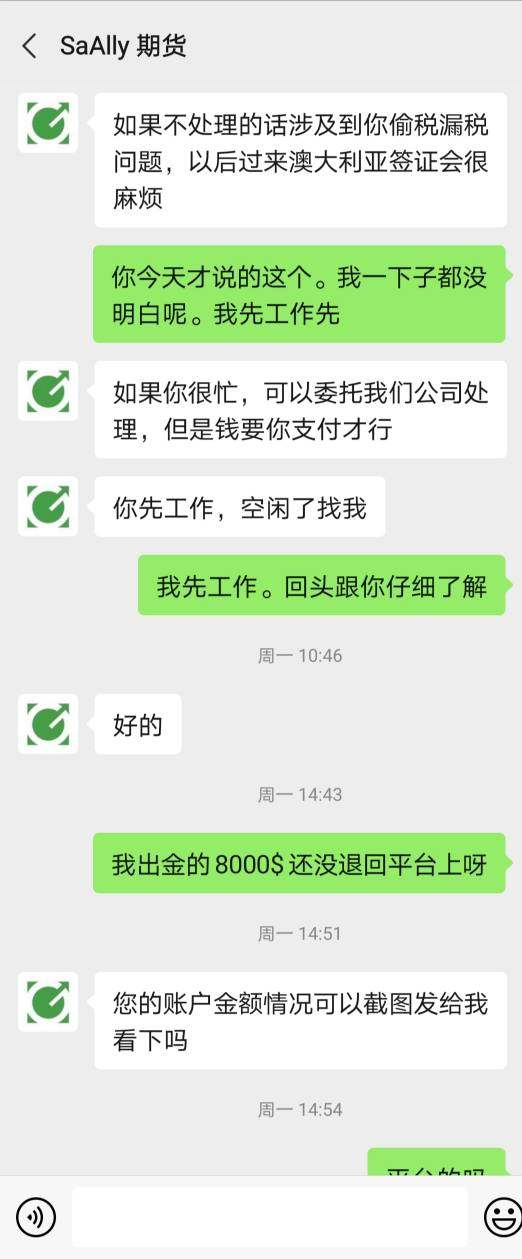

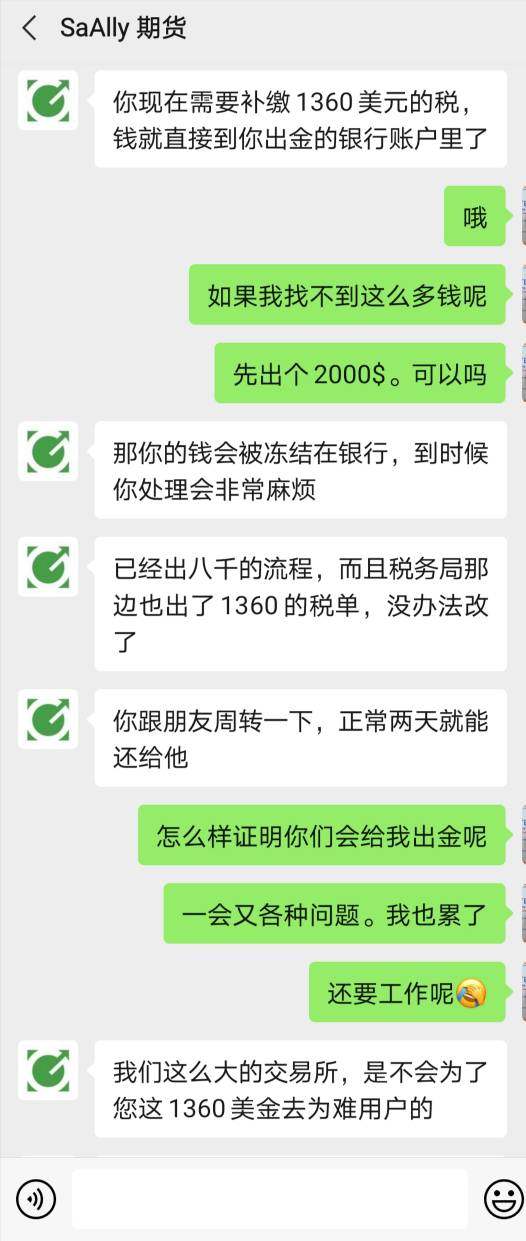

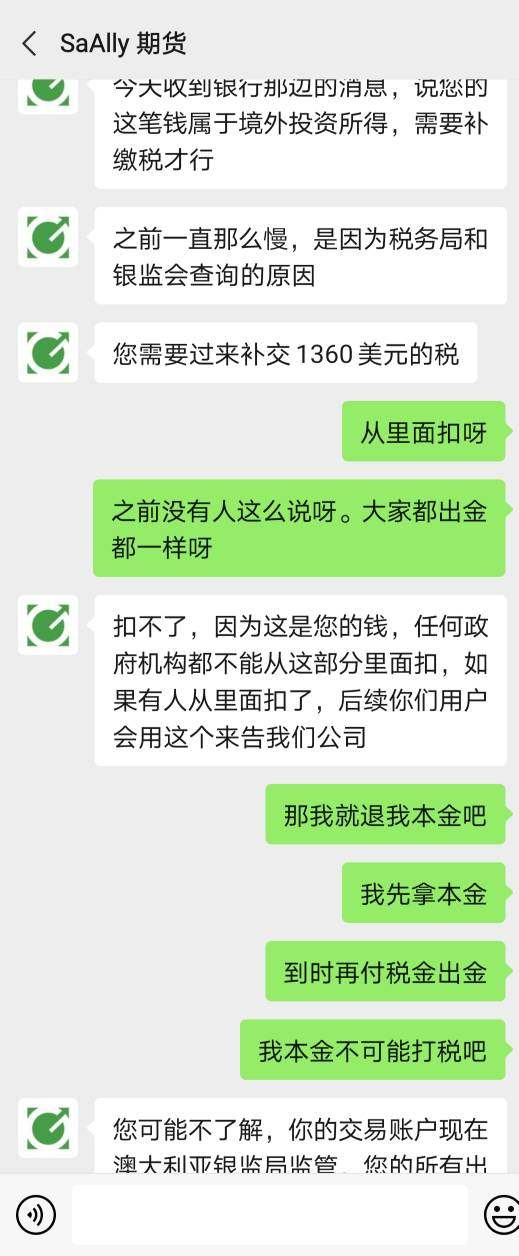

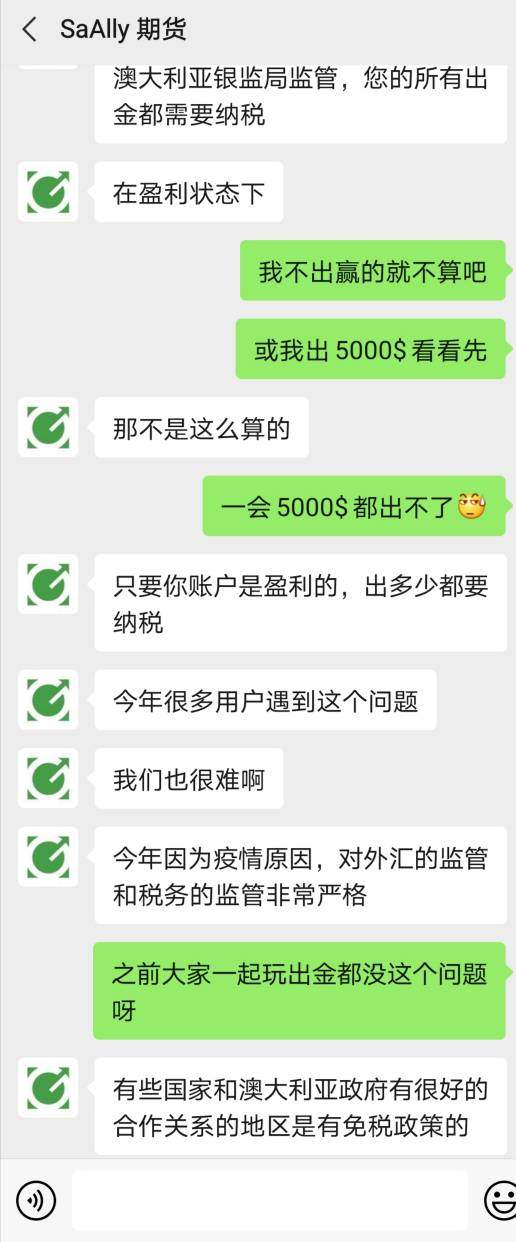

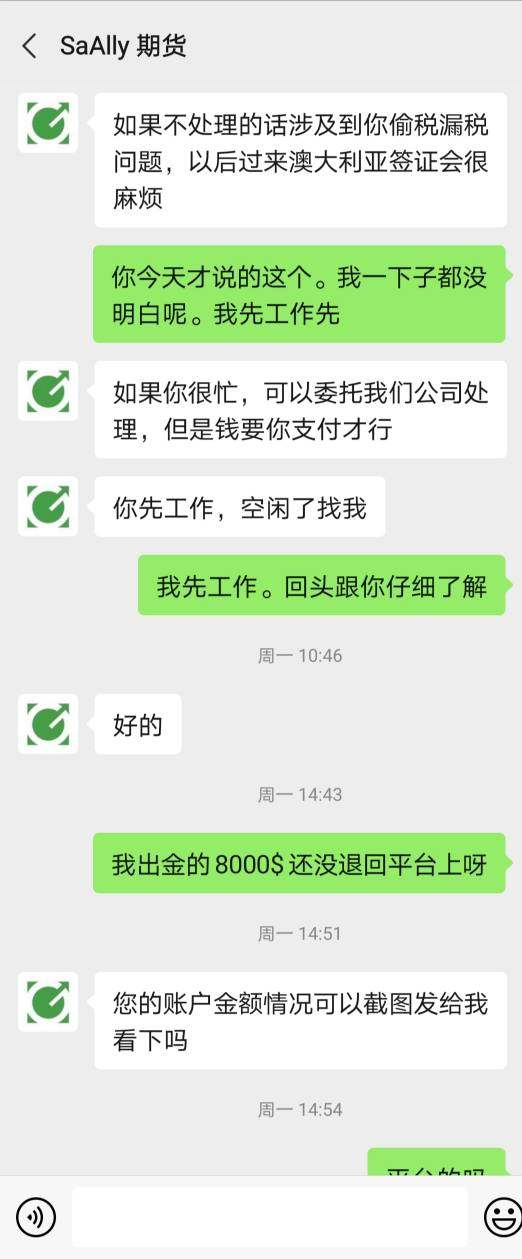

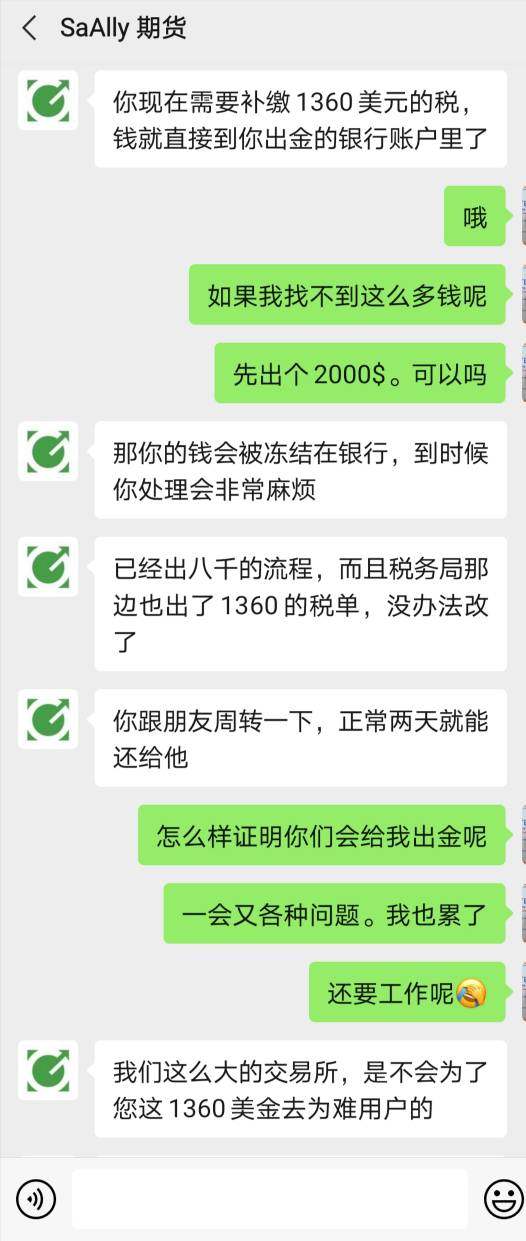

Withdrawal difficulties reported by users represent a critical customer service failure. These issues suggest problems with back-office operations and client fund management. Not being able to process client withdrawals efficiently is a fundamental failure that affects credibility and reliability.

Trading Experience Analysis

The trading experience at GMT Markets shows mixed results based on available info and user feedback. Specific details about platform stability, execution speed, and order processing aren't well documented. But user concerns about high fees suggest costs significantly impact the trading experience.

Platform functionality and user interface quality can't be fully assessed due to limited information. The lack of details about mobile trading, platform features, or technology represents a big information gap. This affects how well we can evaluate trading experience quality.

Market execution quality, including slippage, requotes, and order rejections, aren't documented anywhere. This gmt markets review finds that lack of transparency about execution stats makes it hard for potential clients to assess trading conditions.

Trust and Reliability Analysis

GMT Markets' ASIC regulation provides some trust and reliability foundation. License number 400364 ensures compliance with Australian financial rules. This includes client fund separation, financial reporting, and dispute resolution that protect traders.

But user feedback about withdrawal problems and high fees raises questions about reliability and client treatment. Multiple complaints about getting funds out suggest back-office issues that could hurt client trust. The broker's transparency about operations, fees, and trading conditions seems limited.

Company reputation and industry standing are hard to assess fully due to limited third-party reviews. The mix of regulatory compliance and user complaints creates a confusing picture about trustworthiness. This affects the broker's overall reliability in the competitive forex and CFD market.

User Experience Analysis

Overall user satisfaction with GMT Markets seems significantly hurt by operational issues. User feedback consistently highlights concerns about fee transparency and withdrawal processes. These directly impact client experience and satisfaction levels.

Registration and account verification seem to follow standard industry practices. But specific details about requirements and processing times aren't documented. Post-registration experiences suggest users face challenges with ongoing account management that affect satisfaction.

Interface design and platform usability can't be fully evaluated due to limited information about trading platforms and technology. This information gap prevents a thorough assessment of user interface quality and platform experience.

Common user complaints focus on high fees and withdrawal difficulties. These represent fundamental operational issues that significantly impact client satisfaction. These concerns suggest systematic problems with service delivery that affect client relationships and market positioning.

Conclusion

This comprehensive gmt markets review reveals a broker with mixed credentials in the competitive forex and CFD trading world. GMT Markets benefits from ASIC regulatory oversight and legitimate licensing. But significant operational challenges impact its market position and client satisfaction.

The broker might work for traders who prioritize regulatory compliance and accept higher costs and operational challenges. However, documented issues with high fees and withdrawal difficulties suggest most traders should carefully consider other options. Better alternatives offer improved cost structures and more reliable performance.

The main advantages include legitimate regulatory status and compliance with Australian financial standards. But the disadvantages of high fees, withdrawal difficulties, and limited transparency significantly impact competitive positioning. These issues hurt the overall value proposition for retail traders.