Regarding the legitimacy of GMT Markets forex brokers, it provides ASIC and WikiBit, (also has a graphic survey regarding security).

Is GMT Markets safe?

Business

License

Is GMT Markets markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

FORTUNE PRIME GLOBAL CAPITAL PTY LTD

Effective Date: Change Record

2011-05-13Email Address of Licensed Institution:

linda.lin@fortuneprime.com.auSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

U 5 20 PROSPECT ST BOX HILL VIC 3128Phone Number of Licensed Institution:

0399175819Licensed Institution Certified Documents:

Is GMT Markets Safe or Scam?

Introduction

GMT Markets is an online forex and CFD trading platform that has positioned itself within the competitive landscape of the forex market. Established in 2011 and based in Australia, GMT Markets offers a variety of trading instruments including forex pairs, commodities, and cryptocurrencies. Given the increasing prevalence of online trading scams, it is crucial for traders to rigorously assess the credibility of any forex broker before committing their funds. This article aims to provide a comprehensive evaluation of GMT Markets, focusing on its regulatory status, company background, trading conditions, customer safety, client feedback, platform performance, and overall risk assessment. The analysis draws from multiple sources, including user reviews and regulatory databases, to present a well-rounded view of whether GMT Markets is safe or a potential scam.

Regulation and Legitimacy

Understanding the regulatory framework under which a broker operates is essential for assessing its legitimacy. GMT Markets claims to be regulated by the Australian Securities and Investments Commission (ASIC). However, there are conflicting reports regarding the validity of its license.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 400364 | Australia | Questionable |

ASIC is known for its stringent regulatory requirements, which include maintaining adequate capital reserves and ensuring client funds are held in segregated accounts. However, some sources suggest that GMT Markets may be operating under a clone license, raising concerns about its compliance with regulatory standards. This ambiguity leads to questions about the broker's operational integrity and whether GMT Markets is safe for traders.

The historical compliance record of the broker has also come under scrutiny, with reports of client complaints regarding withdrawal issues and lack of responsiveness from customer service. This history of regulatory uncertainty and client grievances suggests that potential traders should proceed with caution when considering whether GMT Markets is safe.

Company Background Investigation

GMT Markets operates under GMTK Global Pty Ltd, which has a history dating back to 2011. The company claims to have a team of experienced professionals in the finance and trading sectors. However, there is limited information available about the management team, which raises transparency concerns.

The company's ownership structure and operational practices are not clearly disclosed, making it difficult for potential clients to gauge the broker's reliability. Transparency in company operations is crucial for building trust, and the lack of detailed information about GMT Markets' management may lead traders to question whether GMT Markets is safe.

Furthermore, the company's operational address is listed as Melbourne, Australia, but some reports indicate that GMT Markets may also be linked to Belize, a jurisdiction often associated with less stringent regulatory oversight. This duality in operational locations further complicates the assessment of whether GMT Markets is safe for traders.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions they offer is vital. GMT Markets has set a minimum deposit requirement of $500, which is notably higher than the industry average of around $250. Traders should be aware of the overall fee structure, including spreads, commissions, and overnight interest rates.

| Fee Type | GMT Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

The spread for major currency pairs is reported to start at 1.5 pips, which is higher than many competitors. While the absence of commission fees may seem appealing, the overall cost of trading could still be higher due to the inflated spreads. Traders should be cautious and consider whether these trading conditions align with their trading strategies. The higher-than-average minimum deposit and spreads may lead some to question whether GMT Markets is safe for their trading activities.

Client Funds Safety

The safety of client funds is paramount when selecting a forex broker. GMT Markets asserts that it employs measures such as segregated accounts to protect client funds. Segregated accounts are designed to keep client money separate from the broker's operational funds, thus providing a layer of protection in case of insolvency.

However, there are concerns regarding the broker's investor protection policies, particularly given the regulatory uncertainties surrounding its ASIC license. The lack of a clear investor compensation scheme raises alarms about the safety of funds deposited with GMT Markets.

Additionally, historical accounts of clients experiencing difficulties with fund withdrawals cast doubt on the broker's commitment to safeguarding client assets. These issues have led many potential clients to question whether GMT Markets is safe for their investment.

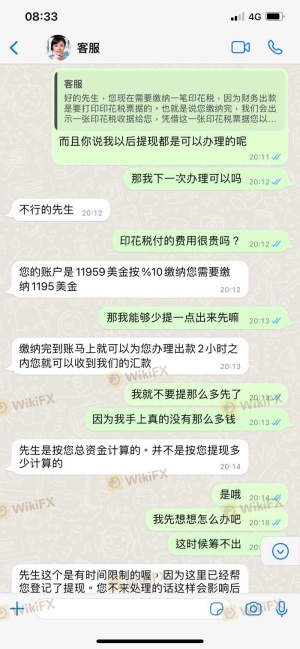

Customer Experience and Complaints

Customer feedback is a crucial indicator of a broker's reliability. Reviews of GMT Markets reveal a mixed bag of experiences, with some clients praising the trading platform while others report significant issues. Common complaints include difficulties in withdrawing funds, delayed responses from customer service, and high service fees.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Average |

| High Service Fees | Medium | Average |

For instance, several users have reported being unable to withdraw their capital, leading to frustrations and financial losses. Such experiences raise significant concerns about whether GMT Markets is safe for new traders. The overall trend of complaints suggests a need for potential clients to exercise caution and conduct thorough due diligence before engaging with this broker.

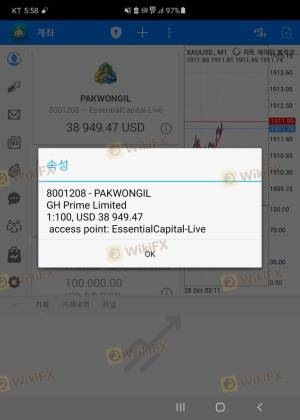

Platform and Trade Execution

The trading platform offered by GMT Markets is primarily MetaTrader 4 (MT4), a widely recognized and user-friendly platform. While MT4 is known for its reliability and extensive features, the performance of GMT Markets' execution quality has been called into question. Reports of slippage and order rejections have surfaced, which can adversely affect trading outcomes.

Traders should carefully evaluate the platform's performance and the broker's responsiveness to trading conditions. Any indications of platform manipulation or poor execution can be red flags, leading traders to reconsider whether GMT Markets is safe for their trading activities.

Risk Assessment

Using GMT Markets presents various risks that traders should be aware of. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Questionable ASIC license |

| Fund Security | High | Potential issues with fund withdrawals |

| Trading Costs | Medium | Higher spreads compared to industry average |

| Customer Service Reliability | Medium | Mixed reviews regarding support |

To mitigate these risks, traders are advised to conduct thorough research, consider starting with a demo account, and be cautious about the amount of capital they invest initially. Understanding the risks associated with using GMT Markets is essential for making informed trading decisions.

Conclusion and Recommendations

In conclusion, the evaluation of GMT Markets raises several red flags that suggest potential issues regarding its safety and reliability. While the broker claims to operate under ASIC regulation, doubts about the legitimacy of its license and reports of client complaints regarding fund withdrawals cast significant shadows on its credibility.

Given the mixed reviews and the higher-than-average trading costs, potential traders should approach GMT Markets with caution. It may be prudent to explore alternative brokers that offer better regulatory oversight and a more transparent operational structure. Brokers such as Pepperstone or IC Markets, which are well-regulated and have positive user feedback, could serve as safer alternatives for traders seeking reliable trading environments.

Ultimately, the question of whether GMT Markets is safe remains contentious, and potential clients should weigh all evidence before making any financial commitments.

Is GMT Markets a scam, or is it legit?

The latest exposure and evaluation content of GMT Markets brokers.

GMT Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GMT Markets latest industry rating score is 1.59, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.59 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.