MHF 2025 Review: Everything You Need to Know

Executive Summary

This mhf review presents a complete analysis of Monster Hunter Freedom. MHF is a gaming platform that has kept a dedicated user base for nearly 17 years since its first release. While detailed regulatory information and trading conditions remain hidden in available documentation, user feedback generally shows satisfaction with the gaming experience, leading to a neutral overall assessment.

Two key features distinguish MHF in the market. Its remarkable longevity with MHF1 having been available for almost 17 years, creating deep emotional connections among players, and its exceptional popularity in Japan where players commonly engage with the platform together on subway systems. The platform primarily attracts users who maintain high expectations for gaming experience quality and seek challenging, engaging gameplay environments.

According to user testimonials and gaming reviews, MHF has established itself as one of the greatest experiences available on portable gaming platforms. Some users have identified areas requiring improvement. The platform's sustained popularity over nearly two decades demonstrates its ability to retain user interest despite evolving market conditions.

Important Notice

Due to the absence of regulatory information in available sources, potential operational differences may exist across various regions. Users should exercise caution and conduct independent research regarding regulatory compliance in their respective jurisdictions before engaging with the platform.

This evaluation is based primarily on user feedback and gaming experience assessments rather than standard financial regulatory evaluation methodologies. The review synthesizes available information from gaming platforms and user testimonials to provide an objective analysis of the MHF platform's characteristics and user satisfaction levels.

Rating Framework

Broker Overview

Company Background and Establishment

Available documentation does not specify the exact establishment year or detailed company background for MHF. However, evidence indicates that MHF1 has been operational for approximately 17 years, suggesting the platform's establishment occurred in the mid-2000s. The platform appears to have originated with a focus on providing challenging gaming experiences, building upon earlier gaming concepts and expanding accessibility through portable platforms.

The business model specifics remain unclear in available documentation. User testimonials suggest the platform operates on a model that encourages community engagement and collaborative gameplay. The platform's sustained operation over nearly two decades indicates a stable underlying business structure, despite limited public information regarding corporate governance or ownership details.

Platform and Asset Information

Information regarding specific platform types and asset categories is not detailed in available materials. Available sources indicate the platform gained significant recognition through portable gaming systems, particularly achieving substantial popularity in Japanese markets where community-based gaming sessions became commonplace in public transportation settings.

Regulatory oversight information is not specified in available documentation. This represents a significant information gap for this mhf review. Users seeking detailed regulatory compliance information would need to conduct independent research or contact the platform directly for clarification regarding applicable oversight jurisdictions and compliance frameworks.

Regulatory Regions: Specific regulatory oversight regions are not identified in available materials, requiring further investigation for compliance verification.

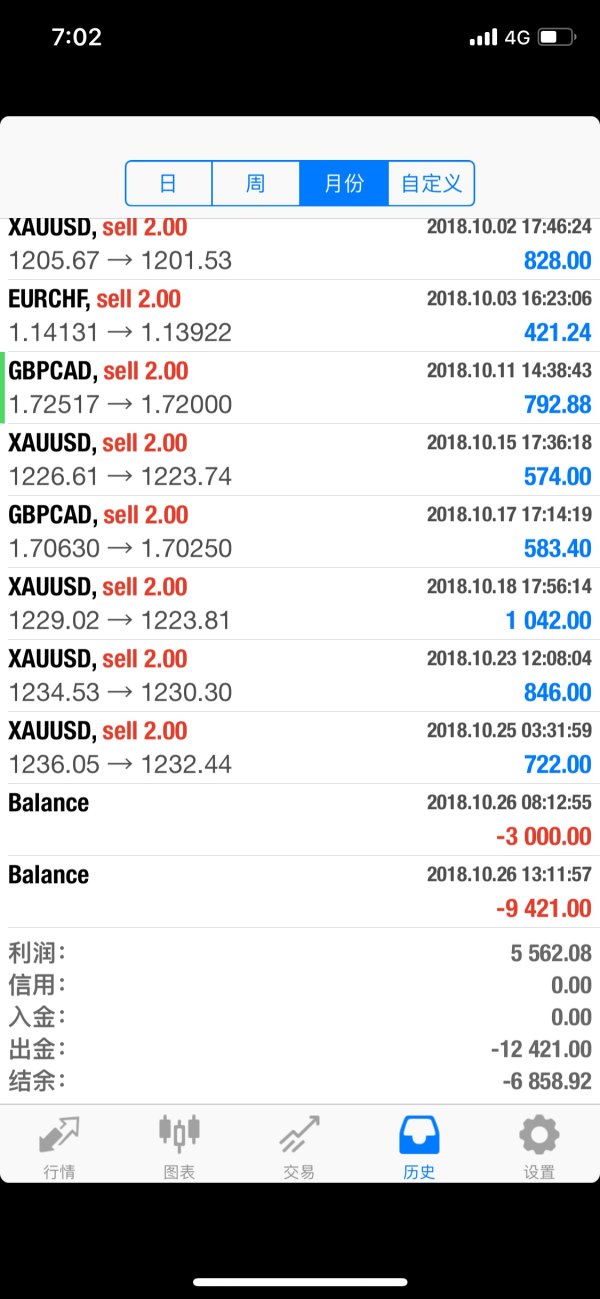

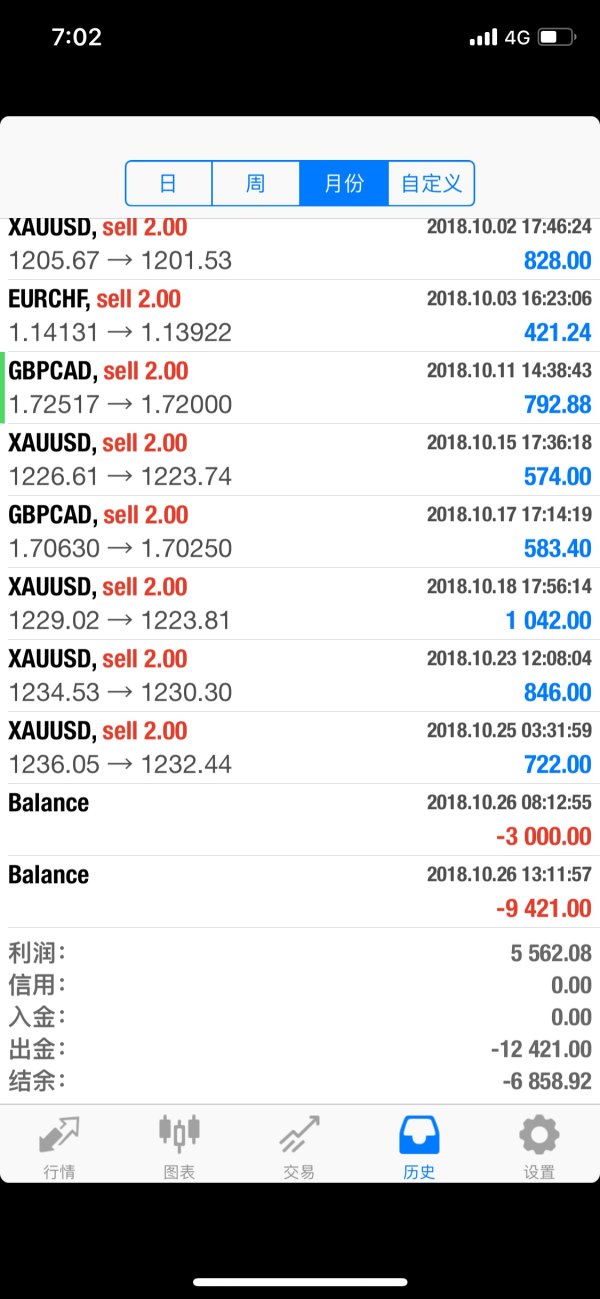

Deposit and Withdrawal Methods: Available sources do not specify supported deposit and withdrawal methodologies or processing procedures.

Minimum Deposit Requirements: Specific minimum deposit thresholds are not detailed in accessible documentation.

Bonuses and Promotions: Information regarding promotional offerings and bonus structures is not available in current materials.

Tradeable Assets: Detailed asset categories and trading instruments are not specified in available documentation sources.

Cost Structure: Comprehensive fee schedules and cost frameworks are not detailed in accessible materials, representing a significant information gap.

Leverage Ratios: Specific leverage offerings and risk parameters are not documented in available sources.

Platform Options: While portable gaming platform compatibility is mentioned, detailed platform specifications remain unclear.

Regional Restrictions: Specific geographic limitations are not detailed in current documentation.

Customer Service Languages: Supported communication languages are not specified in available materials. This mhf review notes strong Japanese market presence.

Detailed Rating Analysis

Account Conditions Analysis

Available documentation does not provide specific information regarding account types, structures, or opening procedures for MHF. The absence of detailed account condition information represents a significant limitation for potential users seeking to understand platform accessibility and requirements.

Minimum deposit requirements and account tier structures remain unspecified in accessible materials. This information gap prevents comprehensive assessment of platform accessibility for users with varying capital levels or investment objectives.

Account opening processes and verification procedures are not detailed in current sources. Users would need to contact the platform directly or conduct independent research to understand onboarding requirements and documentation needs.

Special account features, including any provisions for specific user categories or regional requirements, are not documented in available materials. This mhf review notes that such information would be essential for users evaluating platform suitability for their specific circumstances and regulatory requirements.

Current documentation does not specify the range or quality of trading tools available through the MHF platform. This represents a significant information gap for users seeking to understand platform capabilities and analytical resources.

Research and analysis resources are not detailed in available materials. User feedback suggests satisfaction with overall platform experience, but specific analytical tools and market research capabilities remain undocumented.

Educational resources and user training materials are not specified in current sources. While user testimonials indicate successful platform utilization over extended periods, formal educational support structures remain unclear.

Automated trading support and algorithmic trading capabilities are not documented in available materials. Users requiring such functionality would need to conduct direct inquiries to determine platform compatibility with automated trading strategies.

Customer Service and Support Analysis

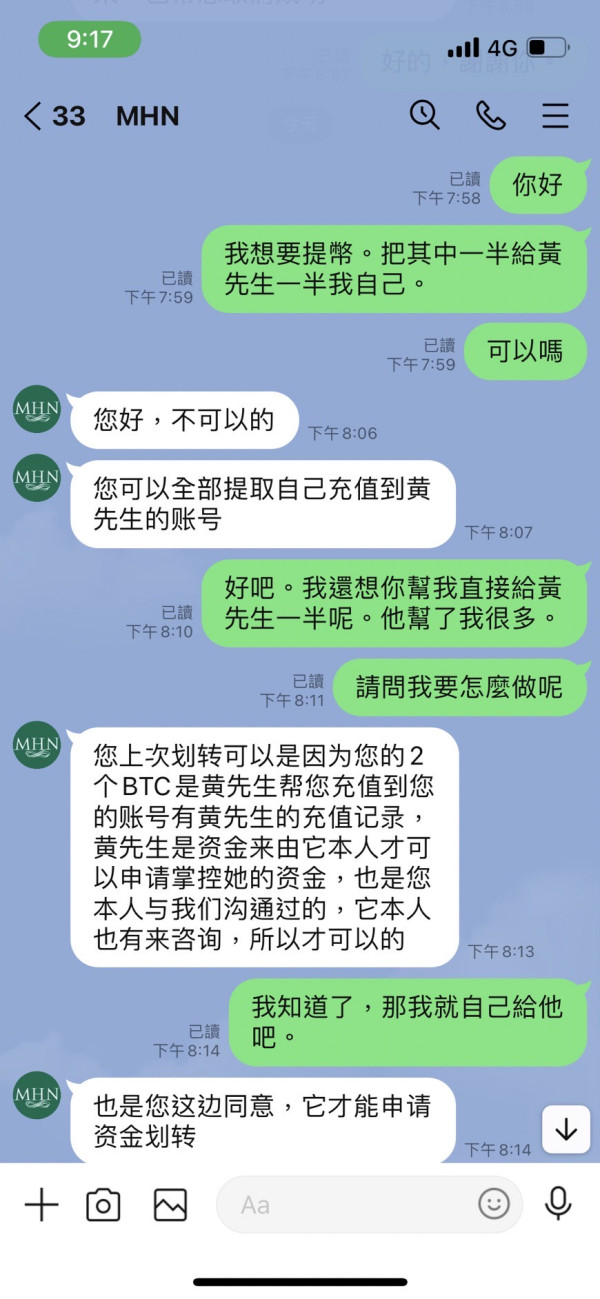

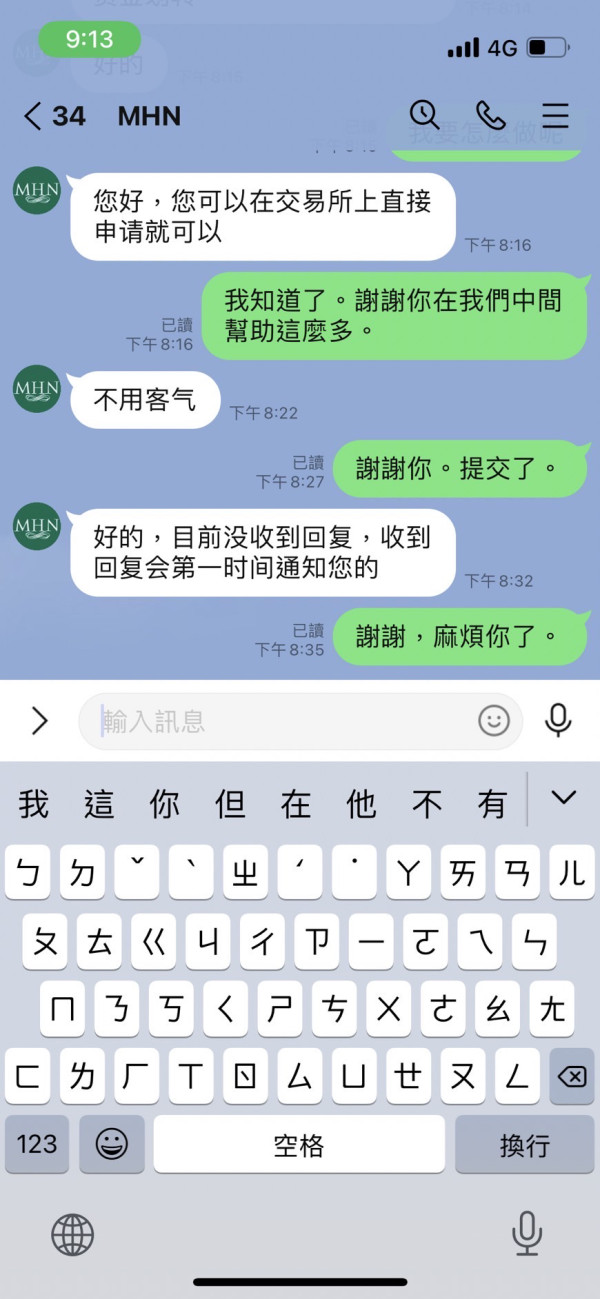

Available documentation does not provide specific information regarding customer service channels, availability, or response timeframes. This represents a notable limitation for users evaluating platform support quality and accessibility.

Response time metrics and service quality assessments are not detailed in current materials. While user feedback generally indicates satisfaction with platform experience, specific customer service performance data remains unavailable.

Multilingual support capabilities are not specified, though the platform's strong presence in Japanese markets suggests potential Japanese language support. Other language offerings remain undocumented in available sources.

Customer service hours and availability schedules are not detailed in accessible materials. Users requiring specific support timeframes would need to conduct independent verification of service availability.

Trading Experience Analysis

Platform stability and execution speed metrics are not documented in available materials. User testimonials suggest generally positive experiences, but specific performance data and technical specifications remain unavailable for comprehensive assessment.

Order execution quality and platform reliability information is not detailed in current sources. This represents a significant limitation for users evaluating platform suitability for their trading requirements and risk tolerance levels.

Platform functionality completeness and feature sets are not comprehensively documented. While user feedback indicates sustained satisfaction over extended periods, specific functional capabilities remain unclear in available materials.

Mobile platform experience and compatibility are referenced in user testimonials, particularly noting portable gaming system usage in Japanese markets. However, detailed mobile platform specifications and capabilities are not documented in accessible sources.

Trading environment characteristics and market access features are not specified in current documentation. This mhf review notes that such information would be essential for users evaluating platform suitability for their specific trading objectives and market access requirements.

Trust and Reliability Analysis

Regulatory credentials and oversight information are not specified in available documentation, representing a significant concern for users prioritizing regulatory compliance and oversight verification. Fund security measures and client protection protocols are not detailed in current materials.

This information gap prevents comprehensive assessment of platform safety and client asset protection capabilities. Company transparency and public disclosure practices are not documented in accessible sources.

Limited public information regarding corporate structure, governance, and operational procedures represents a notable limitation for trust assessment. Industry reputation and third-party evaluations are not comprehensively documented, though user testimonials spanning nearly 17 years suggest sustained user satisfaction and platform reliability over extended operational periods.

User Experience Analysis

Overall user satisfaction appears positive based on available testimonials, with users expressing appreciation for the gaming experience quality despite acknowledging certain platform limitations. User feedback indicates sustained engagement over extended periods, suggesting satisfactory user experience delivery.

Interface design and usability information is not detailed in current documentation. However, the platform's sustained popularity over nearly two decades suggests adequate user interface design and accessibility for its target user base.

Registration and verification process information is not specified in available materials. Users would need to conduct direct inquiries to understand onboarding procedures and account establishment requirements.

Common user complaints include acknowledgment of platform issues, as noted in gaming reviews, though specific concern categories are not detailed in available documentation. Some users have expressed disagreement with critical assessments, indicating varied user experience perspectives.

Conclusion

This mhf review concludes that while MHF demonstrates positive user experience feedback and sustained operational longevity over nearly 17 years, the absence of detailed regulatory information and trading condition specifications results in a neutral overall assessment. The platform appears most suitable for users who prioritize gaming experience quality and seek challenging, community-oriented gameplay environments.

Primary advantages include demonstrated user satisfaction and remarkable operational longevity, while significant disadvantages center on limited regulatory transparency and insufficient detailed operational information. Potential users should conduct independent research regarding regulatory compliance and platform specifications before engagement.