GOLDEX Review 1

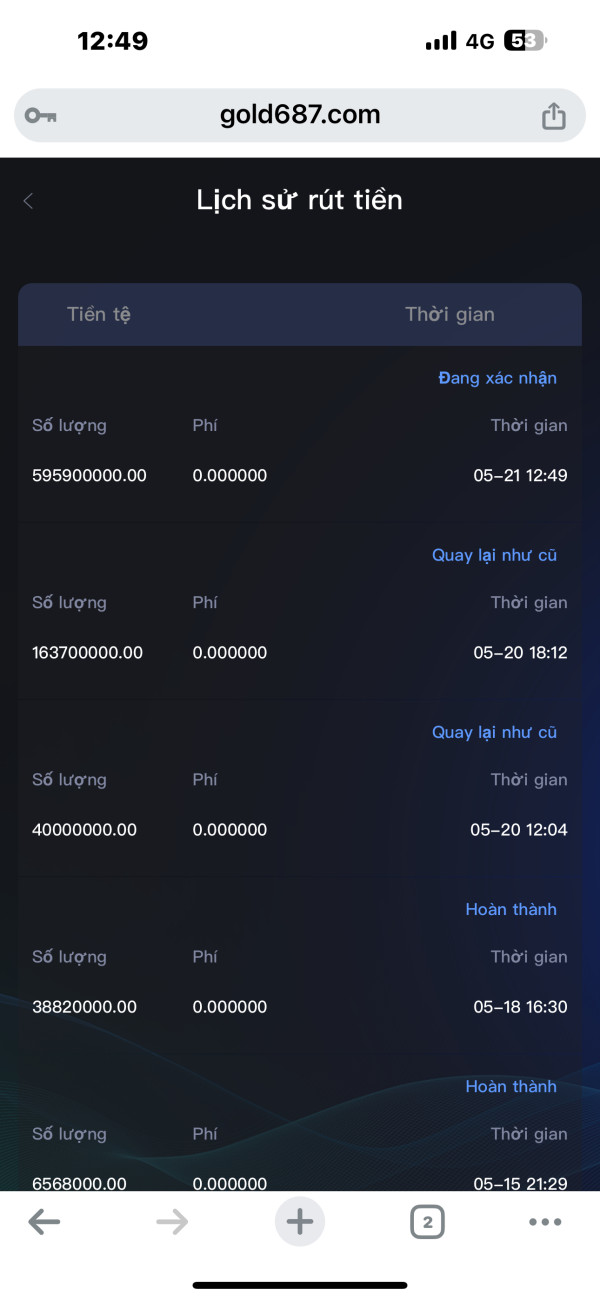

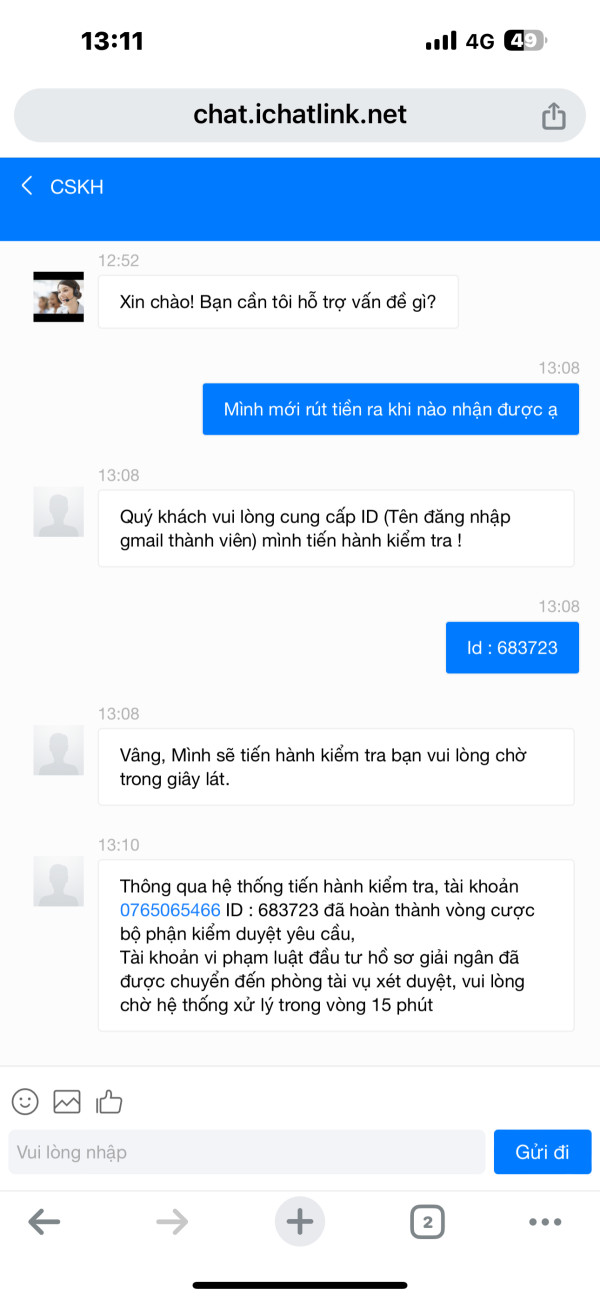

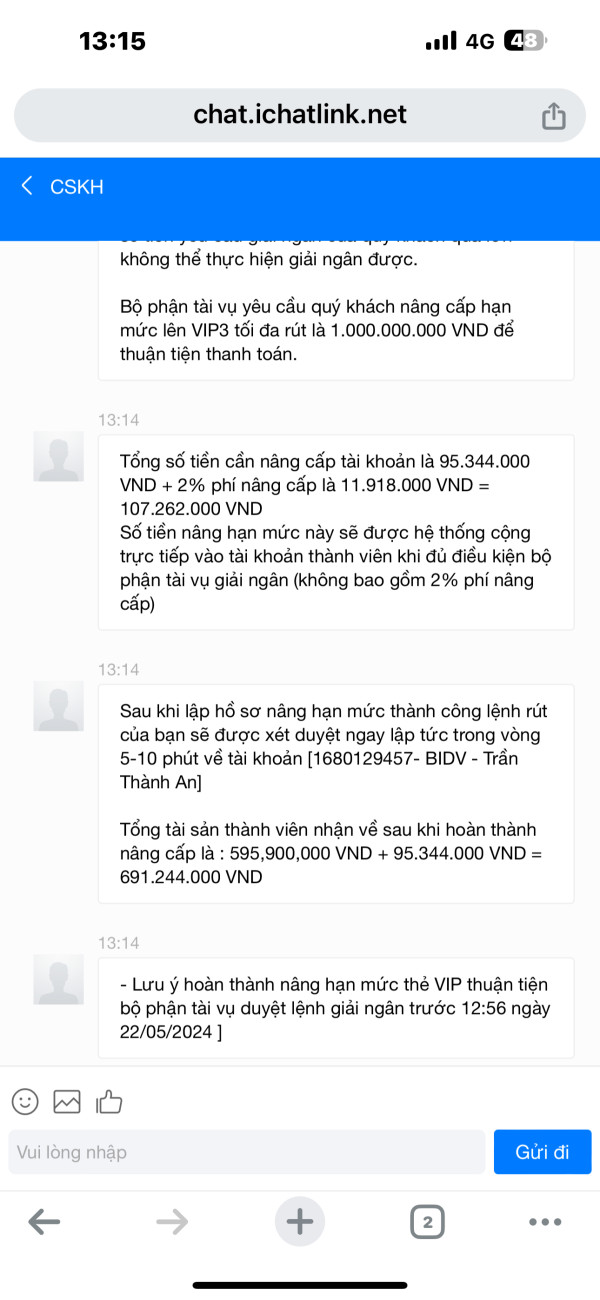

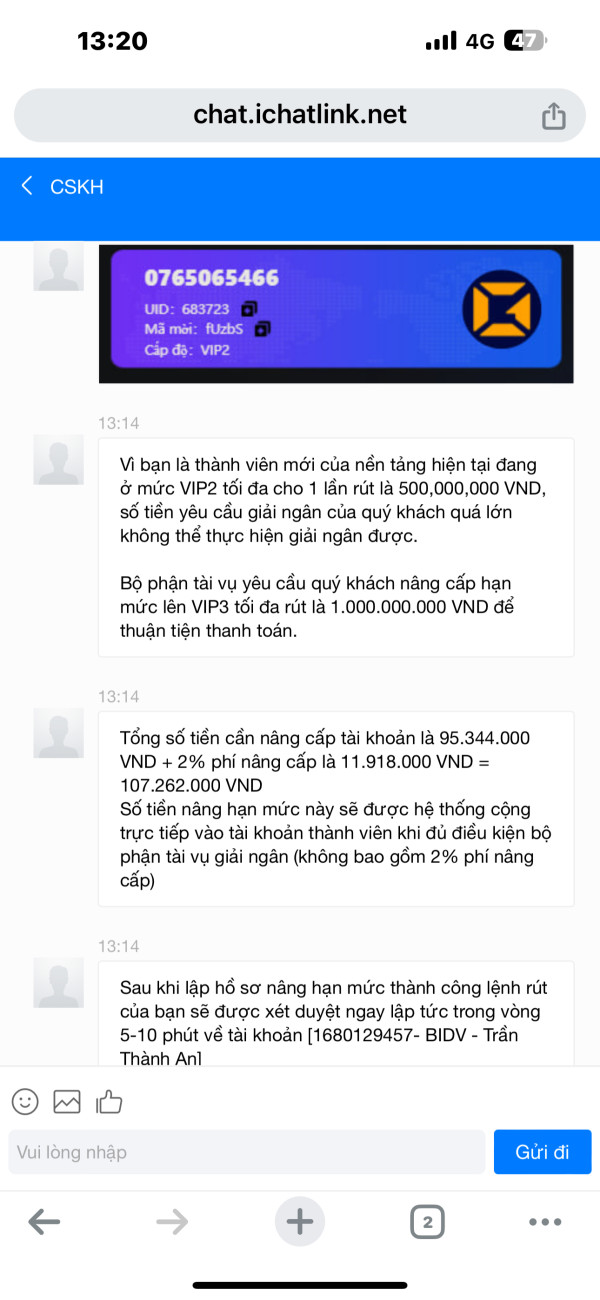

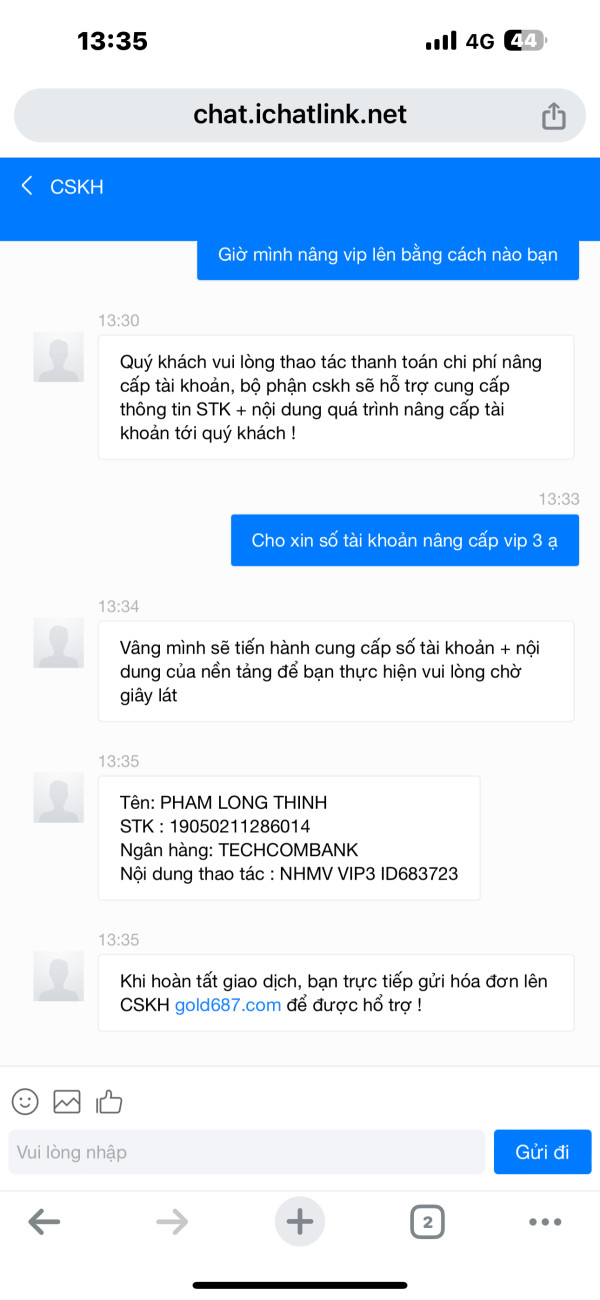

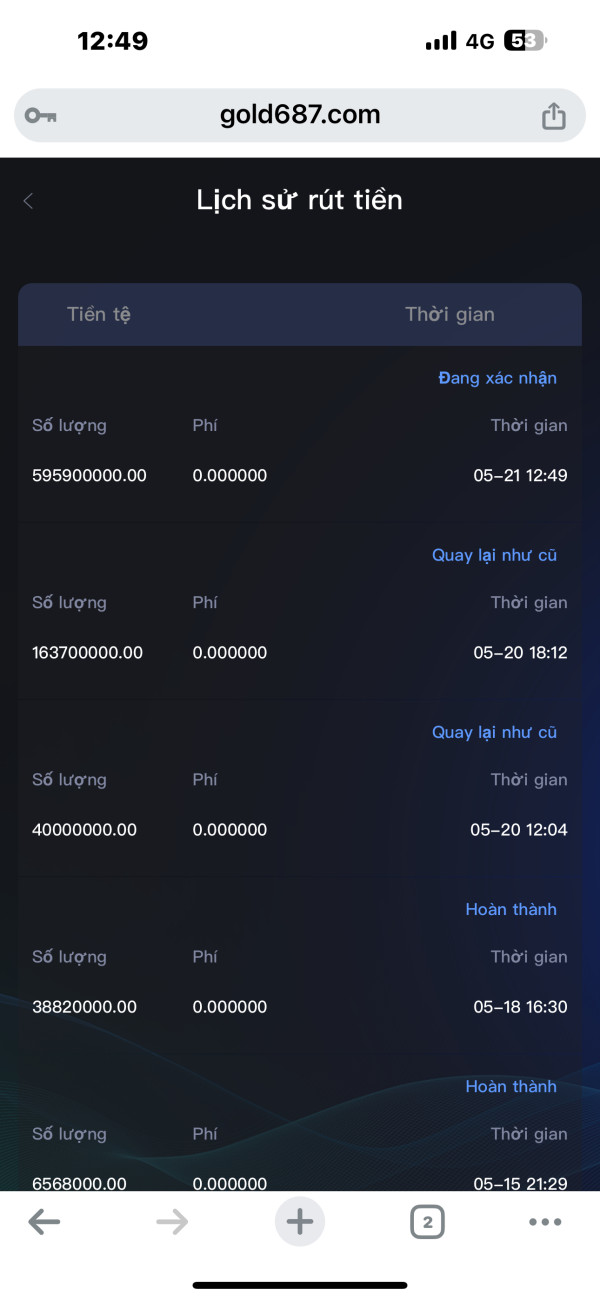

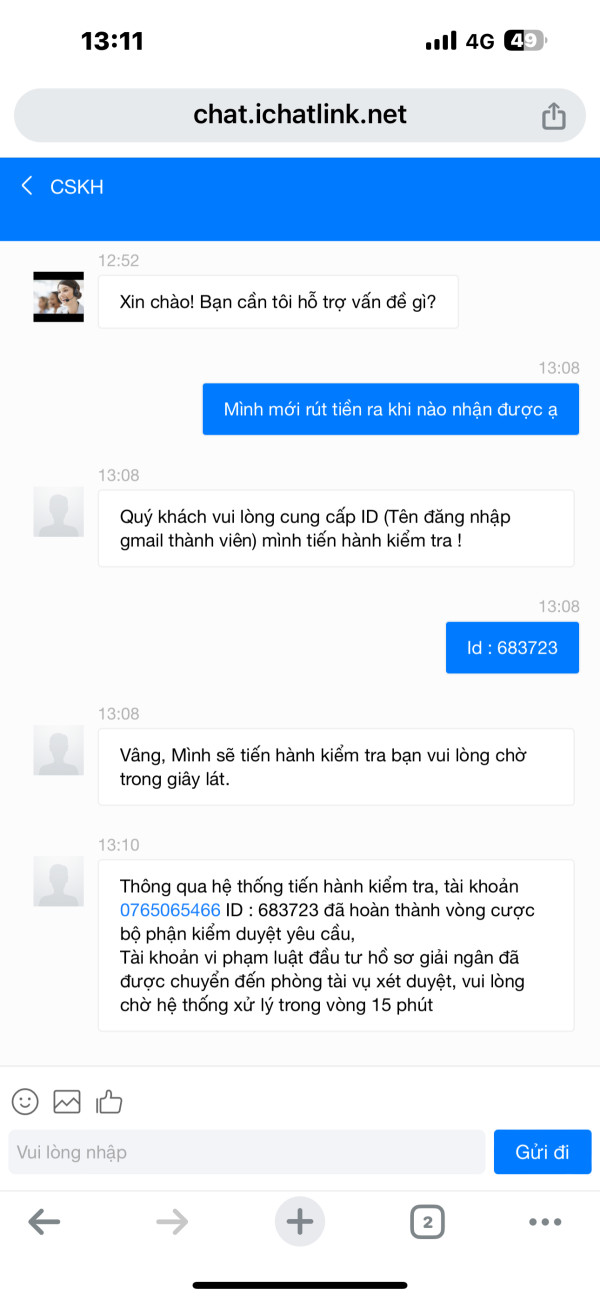

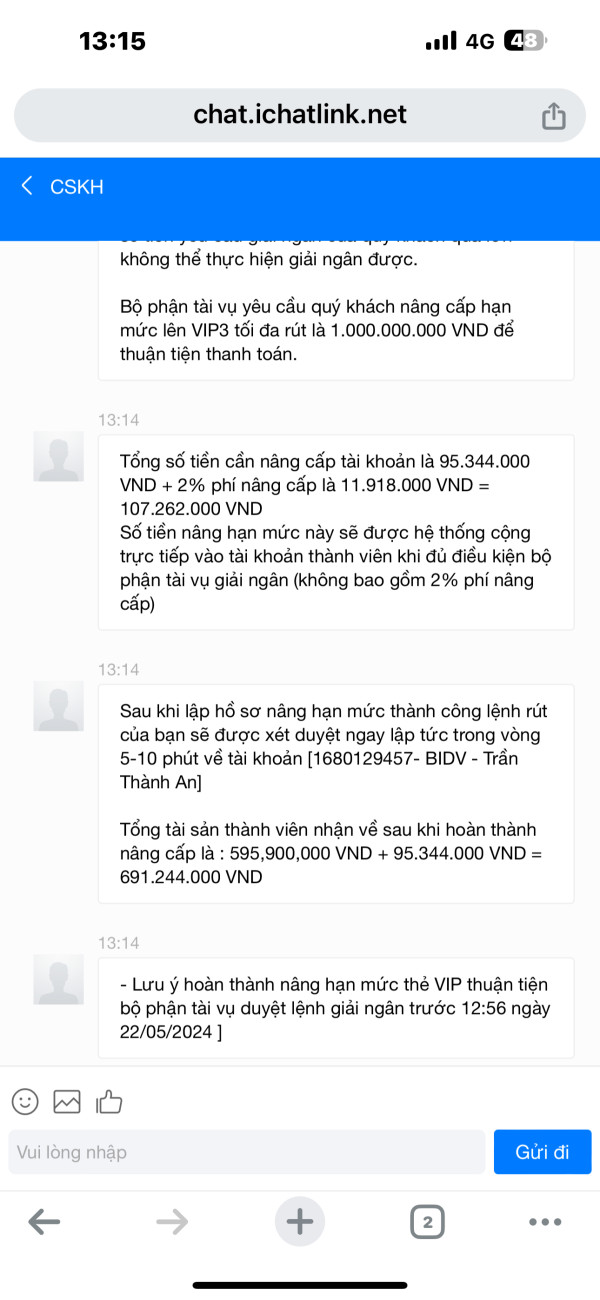

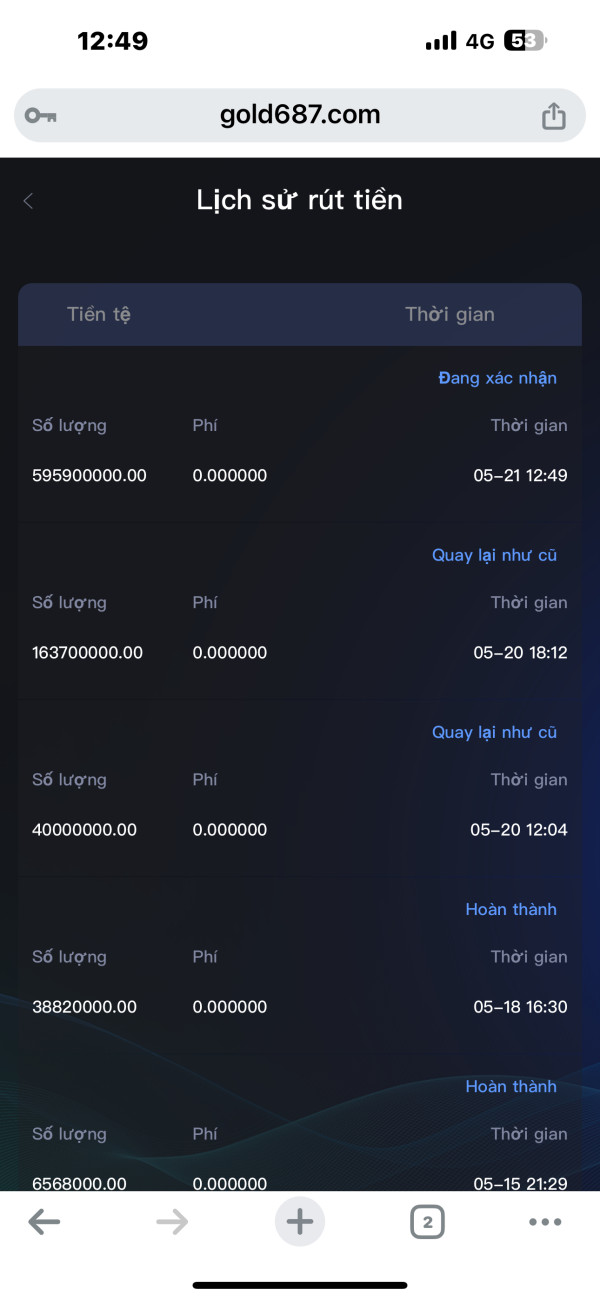

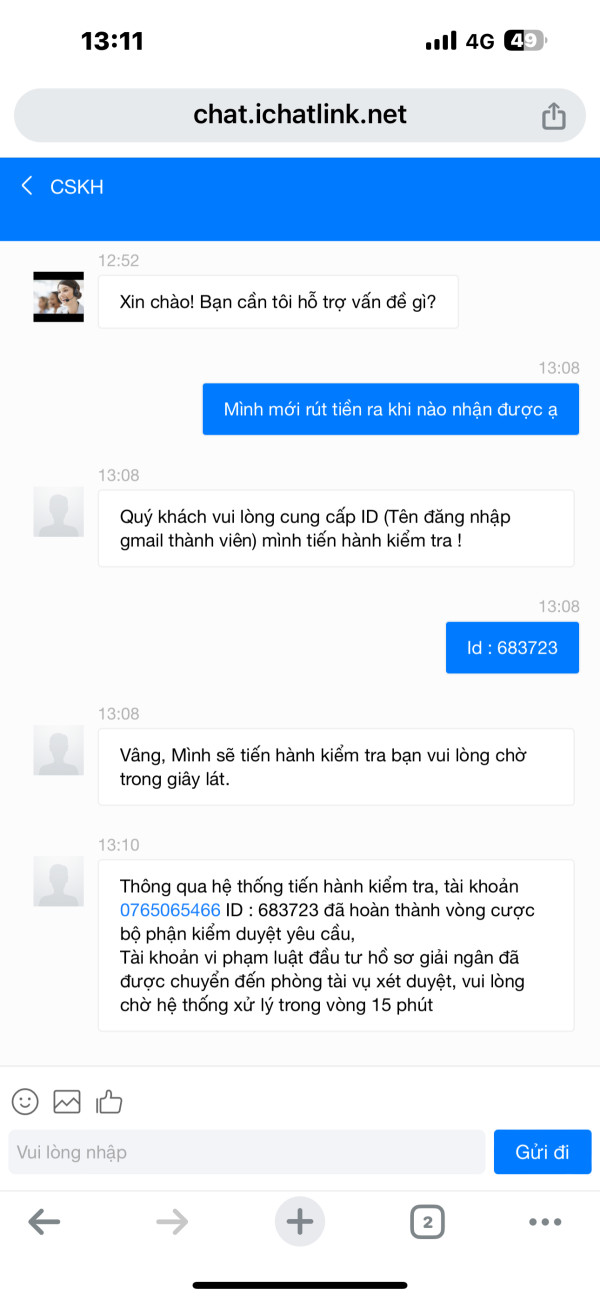

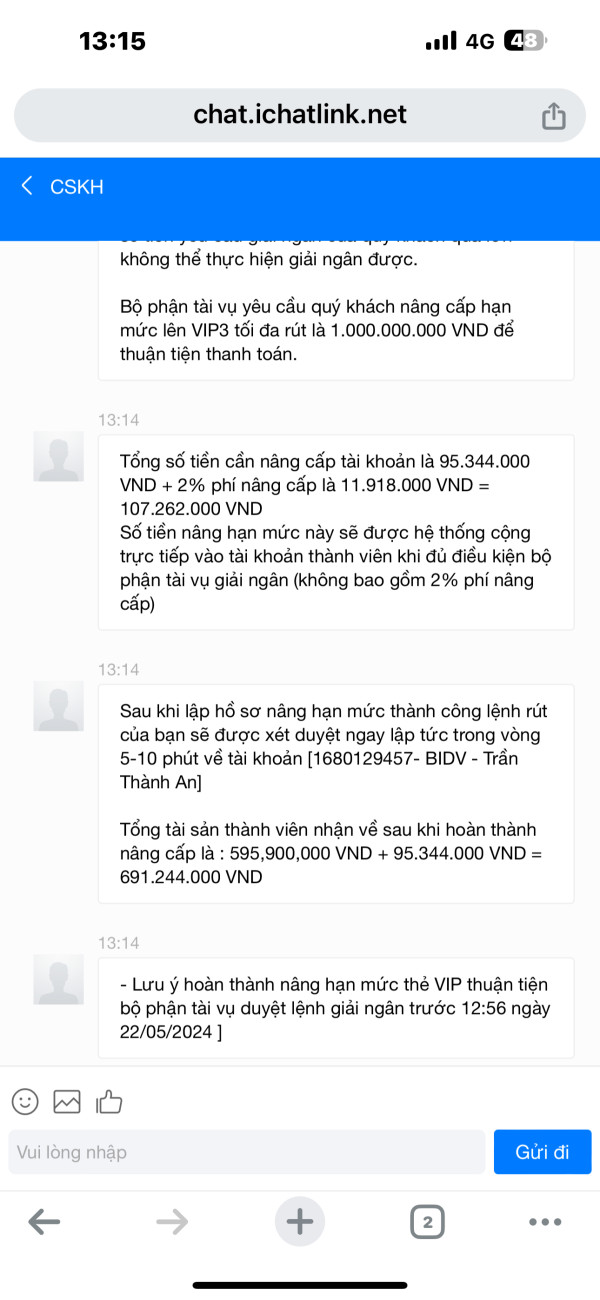

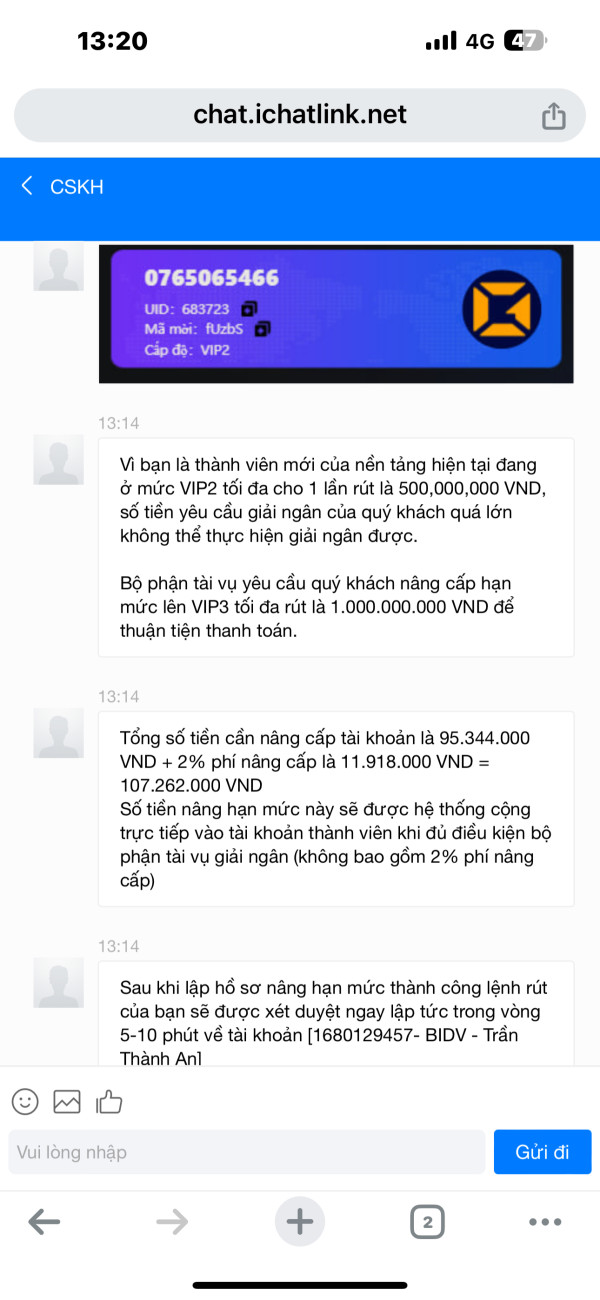

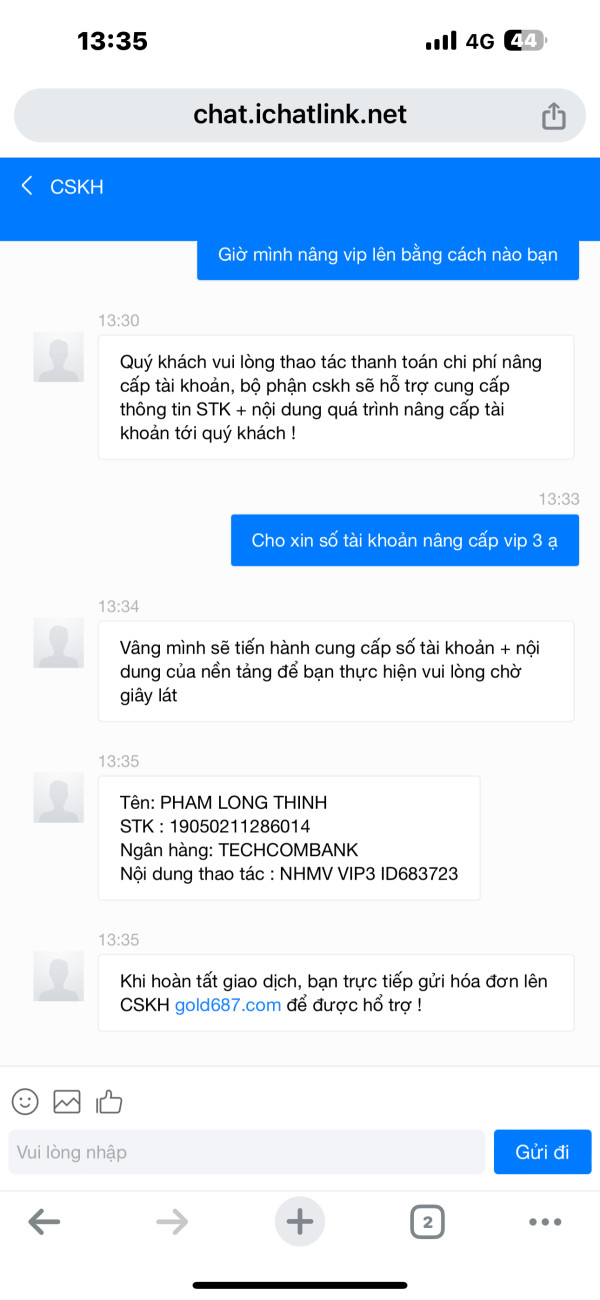

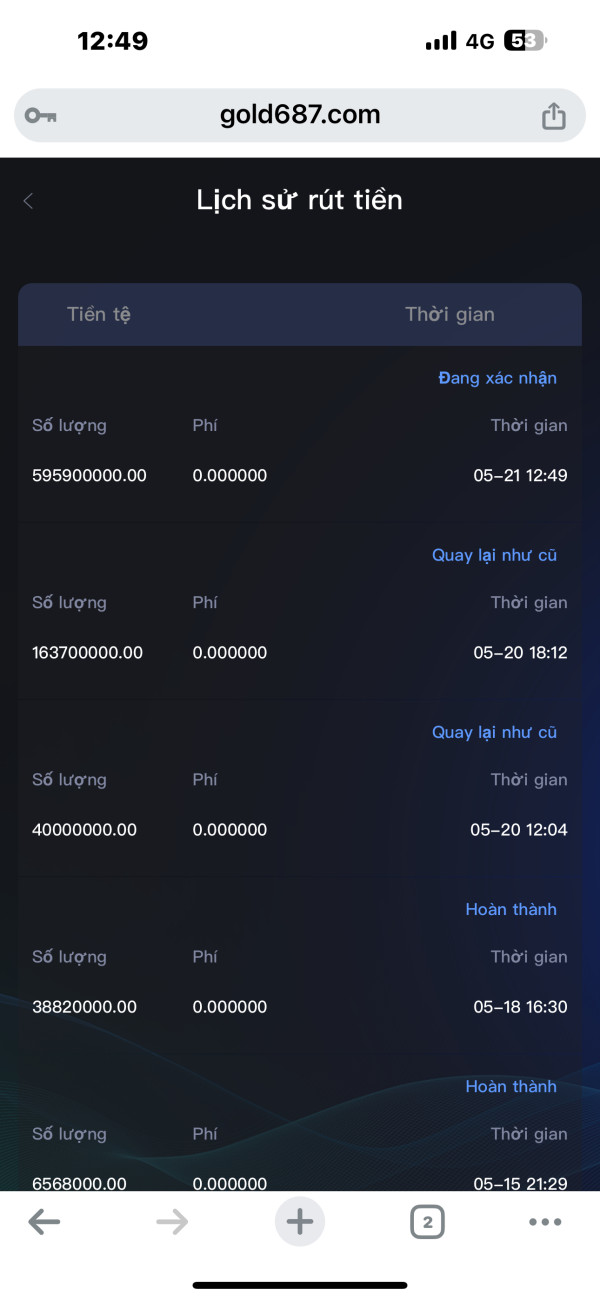

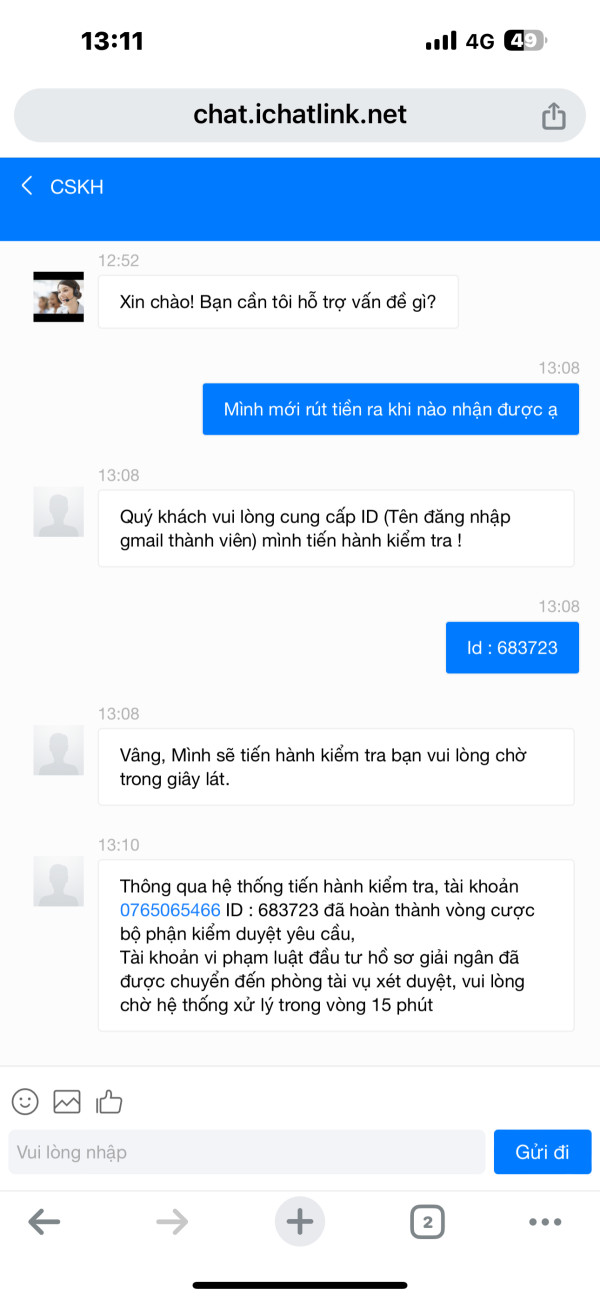

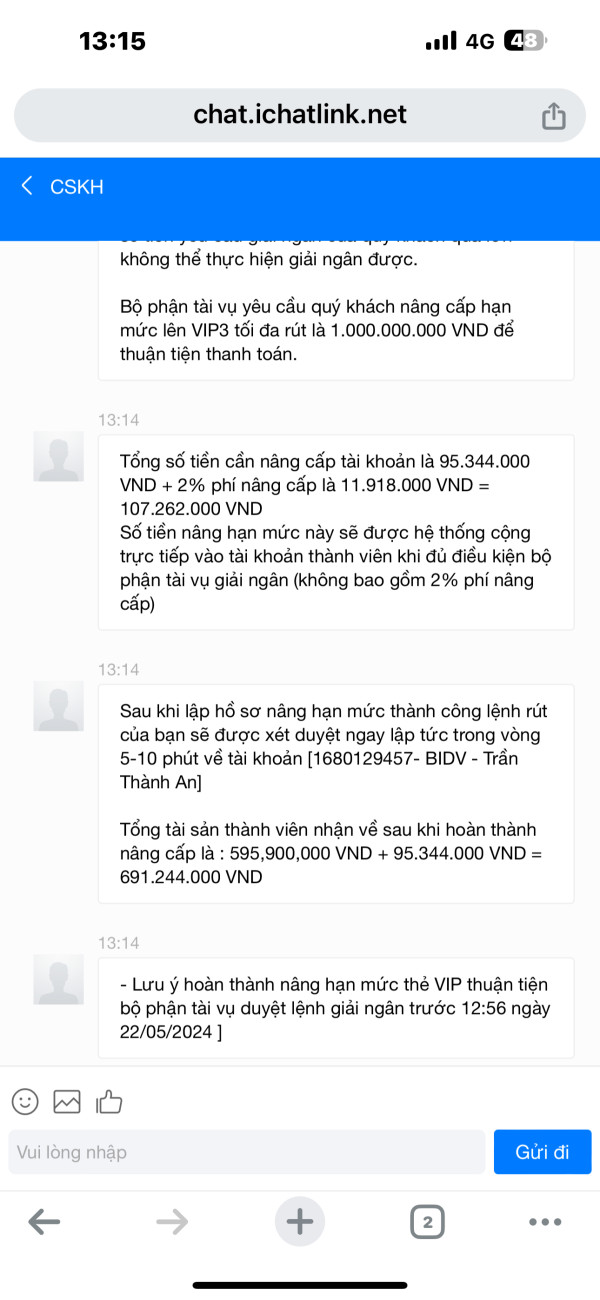

You have to upgrade to VIP to withdraw money

GOLDEX Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

You have to upgrade to VIP to withdraw money

Goldex is a foreign exchange broker that has gained attention in the trading community. The company presents itself as a specialized platform for forex and cryptocurrency derivatives trading. This comprehensive Goldex review aims to provide traders with a detailed analysis of the broker's offerings, performance, and overall reliability in the current market.

The broker's standout feature is its proprietary trading platform called Goldex ActiveTrader. This platform offers advanced charting capabilities and sophisticated tools for cryptocurrency derivatives trading. According to available user feedback, Goldex has achieved a 4-star rating on Trustpilot. This rating indicates generally positive user experiences and satisfaction levels among its client base.

Goldex positions itself primarily toward investors seeking comprehensive forex trading opportunities alongside cryptocurrency derivative instruments. The platform appears to cater to traders who value advanced technical analysis tools. It also seeks to serve those who want exposure to both traditional forex markets and the growing crypto derivatives sector. However, potential users should note that specific regulatory information and detailed account conditions are not extensively documented in available public materials. This may require additional research before account opening.

Prospective traders should be aware that regulatory information for Goldex is not comprehensively detailed in available public sources. Users are strongly advised to verify the broker's regulatory status and compliance requirements applicable to their specific jurisdiction before proceeding with account registration or funding. Different regional entities may operate under varying regulatory frameworks. Traders should ensure they understand the legal implications of trading with Goldex in their respective locations.

This review is based on comprehensive analysis of user feedback, market research, and publicly available platform information. Our assessment methodology incorporates multiple data sources to provide a balanced perspective on the broker's performance and suitability for different trader profiles.

| Dimension | Score | Rating Basis |

|---|---|---|

| Account Conditions | Information not available | Specific account conditions not detailed in available sources |

| Tools and Resources | 8/10 | Goldex ActiveTrader offers advanced charting and crypto derivatives functionality |

| Customer Service and Support | 7/10 | Positive user feedback on Tripadvisor indicating good service and friendly staff |

| Trading Experience | Information not available | Specific trading experience details not mentioned in available sources |

| Trust and Reliability | Information not available | Regulatory information not comprehensively detailed in available sources |

| User Experience | 8/10 | 4-star Trustpilot rating and user recognition of service quality |

Goldex operates as a specialized foreign exchange broker with a particular focus on providing comprehensive forex trading services to retail and institutional clients. The company has positioned itself within the competitive forex brokerage landscape by emphasizing innovation in blockchain asset trading. It seeks to improve the overall industry ecosystem for digital asset transactions. While the specific founding year is not detailed in available sources, Goldex has established itself as a recognizable name among forex trading platforms.

The broker's primary business model centers around facilitating forex trading while incorporating cryptocurrency derivatives as a significant component of its offering. This dual approach allows Goldex to serve traders interested in both traditional currency pairs and the expanding digital asset markets. The company leverages extensive management experience and robust risk management systems to innovate within the financial services sector. It positions itself as a forward-thinking broker in an evolving market landscape.

Goldex's trading infrastructure is built around its proprietary platform, Goldex ActiveTrader, rather than the more commonly seen MetaTrader 4 or MetaTrader 5 platforms. This proprietary approach allows the broker to offer specialized features tailored to both forex and cryptocurrency derivatives trading. The platform supports trading in major forex pairs alongside various cryptocurrency derivative instruments. This provides traders with diversified market access through a single interface. However, specific regulatory oversight details are not comprehensively outlined in available public documentation. This represents an area where potential clients may need to conduct additional research.

Regulatory Framework: Available sources do not provide comprehensive details regarding Goldex's regulatory status or oversight by specific financial authorities. Prospective traders should independently verify regulatory compliance in their jurisdiction.

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal options is not detailed in current available sources. Traders should contact the broker directly for comprehensive funding method information.

Minimum Deposit Requirements: The minimum deposit threshold for account opening is not specified in available documentation. This information would typically be available during the account registration process or through direct broker contact.

Promotional Offers: Current bonus and promotional programs are not detailed in available sources. Traders interested in promotional offerings should verify current campaigns directly with Goldex.

Tradeable Assets: The platform primarily offers forex trading opportunities alongside cryptocurrency derivatives. This combination provides traders with access to traditional currency markets and emerging digital asset derivative products through the Goldex ActiveTrader platform.

Cost Structure: Specific information regarding spreads, commissions, overnight fees, and other trading costs is not comprehensively detailed in available sources. Cost transparency is crucial for traders. This information should be obtained directly from the broker.

Leverage Ratios: Available leverage ratios for different asset classes are not specified in current documentation. Leverage policies typically vary by instrument type and trader location.

Platform Options: Goldex primarily offers its proprietary Goldex ActiveTrader platform, which features advanced charting capabilities and specialized tools for cryptocurrency derivatives trading.

Geographic Restrictions: Specific regional limitations or restrictions are not detailed in available sources.

Customer Support Languages: The range of languages supported by customer service is not specified in current documentation.

This Goldex review highlights the importance of direct communication with the broker for detailed operational information not covered in public sources.

The evaluation of Goldex's account conditions presents certain challenges due to limited publicly available information regarding specific account types, their features, and associated requirements. Available sources do not provide comprehensive details about the variety of account options that may be offered to different trader segments. This makes it difficult to assess the broker's competitiveness in this crucial area.

Information regarding minimum deposit requirements across different account tiers is not specified in current documentation. This lack of transparency regarding entry-level investment requirements may pose challenges for potential clients attempting to evaluate the accessibility of Goldex's services compared to other brokers in the market. The account opening process details, including verification requirements, documentation needs, and timeline expectations, are similarly not detailed in available sources.

Specialized account features such as Islamic accounts, professional trader accounts, or institutional-grade services are not specifically mentioned in available documentation. These account types are increasingly important in the modern forex brokerage landscape. They cater to diverse religious, regulatory, and investment scale requirements.

The absence of detailed account condition information in this Goldex review reflects the need for prospective traders to engage directly with the broker's representatives to obtain comprehensive information about available account structures. This includes their respective benefits, limitations, and suitability for different trading strategies and experience levels.

Goldex demonstrates notable strength in its technological offerings, particularly through its proprietary Goldex ActiveTrader platform. This platform represents a significant investment in trading technology. It features advanced charting capabilities that cater to technical analysis requirements of both novice and experienced traders. The inclusion of specialized cryptocurrency derivatives functionality sets the platform apart from many competitors who focus exclusively on traditional forex instruments.

The advanced charting features within Goldex ActiveTrader suggest a commitment to providing traders with sophisticated analytical tools necessary for informed decision-making in both forex and cryptocurrency markets. This technological foundation indicates that the broker recognizes the importance of robust trading infrastructure in today's competitive brokerage environment.

However, available sources do not provide comprehensive details regarding additional research and analysis resources that may be available to traders. Educational materials, market commentary, economic calendars, and fundamental analysis tools are not specifically mentioned in current documentation. Similarly, information about automated trading support, including Expert Advisor compatibility or algorithmic trading capabilities, is not detailed in available sources.

The focus on cryptocurrency derivatives functionality demonstrates Goldex's recognition of evolving market demands and trader interests in digital asset markets. This specialization may appeal particularly to traders seeking exposure to crypto markets through derivative instruments rather than direct cryptocurrency ownership.

Customer service quality appears to be a relative strength for Goldex, based on available user feedback from third-party review platforms. According to reports, users have expressed positive sentiments regarding service quality on Tripadvisor. They specifically note that staff members are friendly and helpful in their interactions with clients. This positive feedback suggests that the broker prioritizes customer relationship management and invests in training support staff to provide satisfactory service experiences.

However, comprehensive details regarding customer service infrastructure are not extensively documented in available sources. Information about specific support channels, such as live chat availability, telephone support hours, email response times, and help desk ticketing systems, is not detailed in current documentation. Understanding these operational aspects is crucial for traders who may require assistance during different market hours or in various time zones.

The availability of multilingual support, which is particularly important for international brokers serving diverse client bases, is not specifically mentioned in available sources. Similarly, information about 24/7 support availability, weekend service options, and holiday support schedules is not detailed in current documentation.

Response time expectations and service level agreements are not specified in available sources. This makes it difficult to assess the broker's commitment to timely issue resolution. The positive user feedback on Tripadvisor, while encouraging, represents a limited sample of customer experiences. It may not reflect the full spectrum of service quality across all client interactions and issue types.

The trading experience evaluation for Goldex centers primarily around its proprietary Goldex ActiveTrader platform, which features advanced charting capabilities designed to support sophisticated trading strategies. The platform's focus on both forex and cryptocurrency derivatives suggests an attempt to provide a comprehensive trading environment that addresses evolving market demands and trader preferences.

However, critical aspects of the trading experience remain unclear due to limited information in available sources. Platform stability and execution speed, which are fundamental to successful trading operations, are not specifically addressed in current documentation. These technical performance metrics are crucial for traders, particularly those employing scalping strategies or trading during high-volatility market conditions.

Order execution quality, including details about slippage rates, requote frequency, and execution methodology, is not detailed in available sources. This information gap represents a significant limitation for traders attempting to evaluate the broker's suitability for their specific trading styles and requirements.

Mobile trading capabilities, which have become essential in today's trading environment, are not specifically mentioned in available documentation. The availability and functionality of mobile applications for iOS and Android platforms would be important considerations for traders requiring market access while away from desktop environments.

This Goldex review indicates that while the broker offers advanced charting through its proprietary platform, comprehensive trading experience evaluation requires additional information. This should be obtained directly from the broker regarding technical performance, execution quality, and platform reliability metrics.

The assessment of Goldex's trustworthiness and reliability faces significant limitations due to the absence of comprehensive regulatory information in available sources. Regulatory oversight by recognized financial authorities represents a fundamental pillar of broker trustworthiness. The lack of detailed regulatory status information in public documentation creates uncertainty for potential clients evaluating the broker's credibility.

Specific information regarding client fund protection measures, such as segregated account policies, deposit insurance coverage, or compensation scheme participation, is not detailed in available sources. These protective mechanisms are crucial indicators of a broker's commitment to client fund security and regulatory compliance standards.

Company transparency metrics, including detailed corporate information, ownership structure, financial reporting, and operational history, are not comprehensively available in current documentation. This information gap makes it challenging for potential clients to conduct thorough due diligence regarding the broker's corporate governance and financial stability.

Industry reputation indicators, such as awards, recognition from trading publications, or endorsements from financial industry organizations, are not mentioned in available sources. Similarly, information about the broker's handling of negative events, regulatory actions, or client disputes is not documented in current sources.

The absence of detailed regulatory and transparency information in this analysis highlights the importance of independent verification by potential clients regarding Goldex's regulatory status. This includes fund protection measures and overall compliance with financial services regulations applicable to their specific jurisdiction.

User experience evaluation for Goldex reveals generally positive sentiment based on available feedback from third-party review platforms. The broker's achievement of a 4-star rating on Trustpilot suggests that a majority of users have had satisfactory experiences with the platform and services. This rating indicates that Goldex has managed to meet or exceed expectations for a significant portion of its user base.

The positive feedback pattern suggests that users appreciate aspects of the service delivery, though specific details about interface design, navigation ease, and overall platform usability are not comprehensively detailed in available sources. User interface quality and intuitive design are crucial factors in trading platform adoption and long-term user satisfaction.

Information regarding the registration and verification process experience is not detailed in current documentation. Account opening efficiency, document submission procedures, and identity verification timelines significantly impact initial user impressions and onboarding satisfaction. Similarly, funding and withdrawal experience details, including processing times and procedure complexity, are not specified in available sources.

The broker appears to target investors interested in both forex and cryptocurrency trading, suggesting a user base that values diversified market access through a single platform. This positioning may appeal to traders seeking exposure to traditional and digital asset markets without maintaining multiple broker relationships.

However, comprehensive user feedback analysis, including common complaints, feature requests, and improvement suggestions, is not extensively available in current sources. This limits the depth of user experience assessment in this review.

This comprehensive Goldex review reveals a broker that demonstrates certain strengths, particularly in technological innovation through its proprietary ActiveTrader platform and generally positive user satisfaction metrics. The 4-star Trustpilot rating and positive service feedback suggest that Goldex has succeeded in creating satisfactory experiences for many of its clients. This is particularly evident in customer service delivery and platform functionality.

However, significant information gaps regarding regulatory status, detailed account conditions, and comprehensive trading terms represent notable limitations for potential clients conducting due diligence. The absence of specific regulatory information, cost structures, and operational details in publicly available sources necessitates direct communication with the broker for complete evaluation.

Goldex appears most suitable for traders seeking exposure to both forex and cryptocurrency derivatives markets through a single platform. This is particularly true for those who value advanced charting capabilities and technological innovation. However, traders prioritizing regulatory transparency and detailed operational information may find the current level of public documentation insufficient for their evaluation needs.

The primary advantages include positive user service experiences and advanced platform technology, while the main limitations involve insufficient public disclosure of regulatory status and detailed trading conditions. Prospective clients should conduct thorough independent verification of regulatory compliance and operational terms before proceeding with account opening or funding decisions.

FX Broker Capital Trading Markets Review