MS Review 2

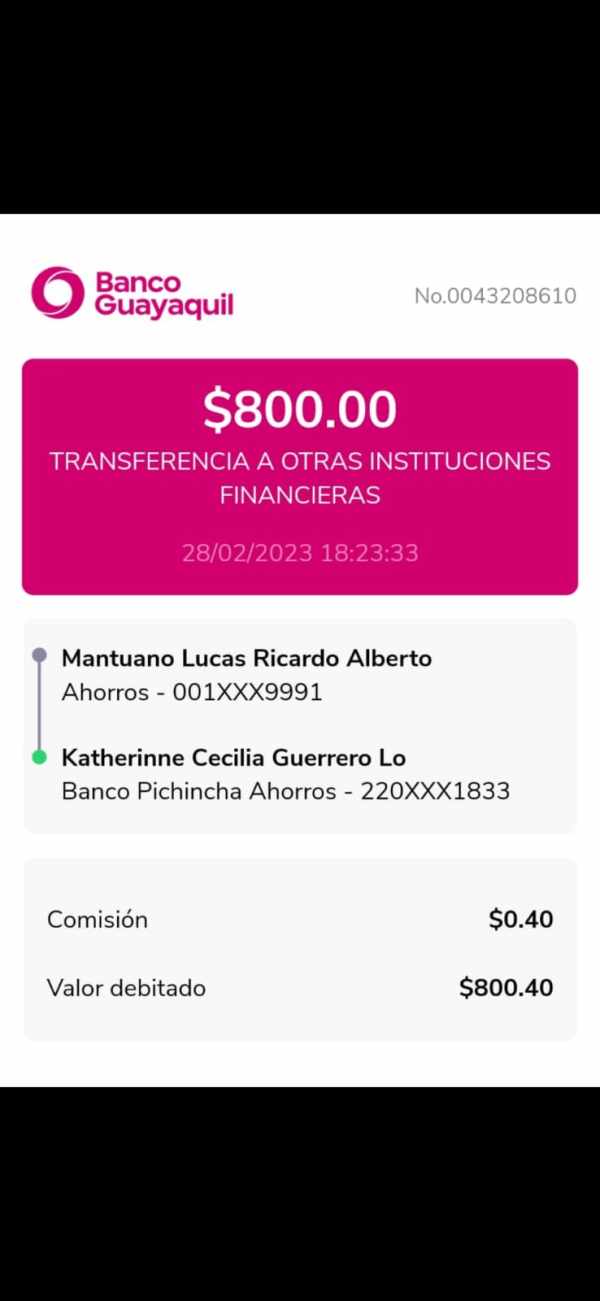

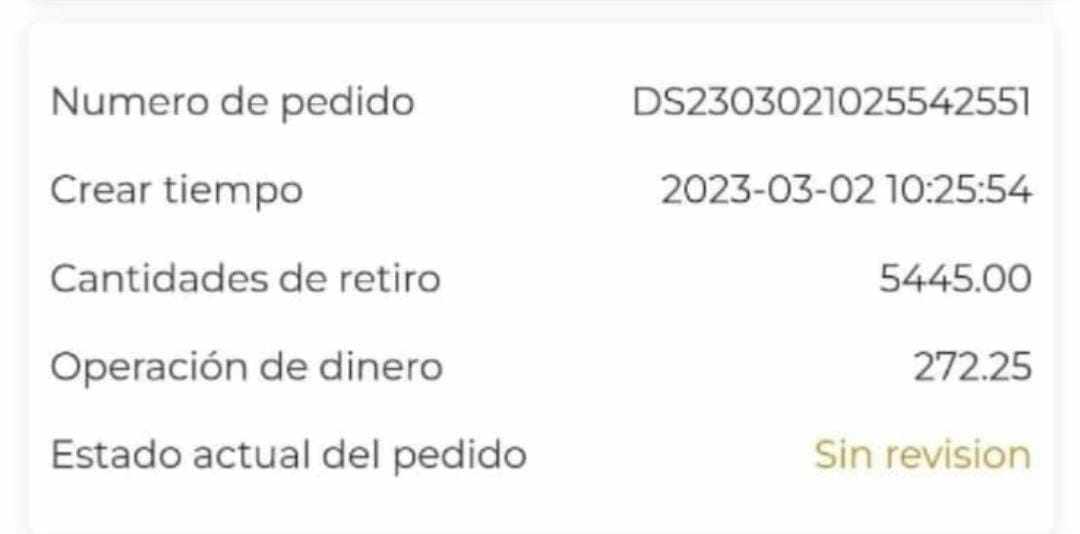

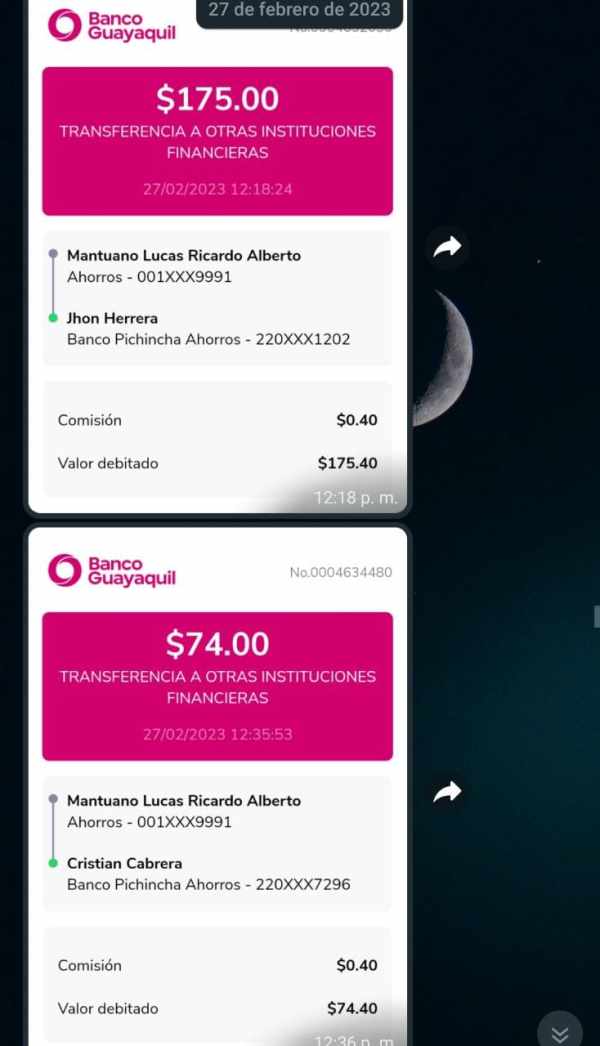

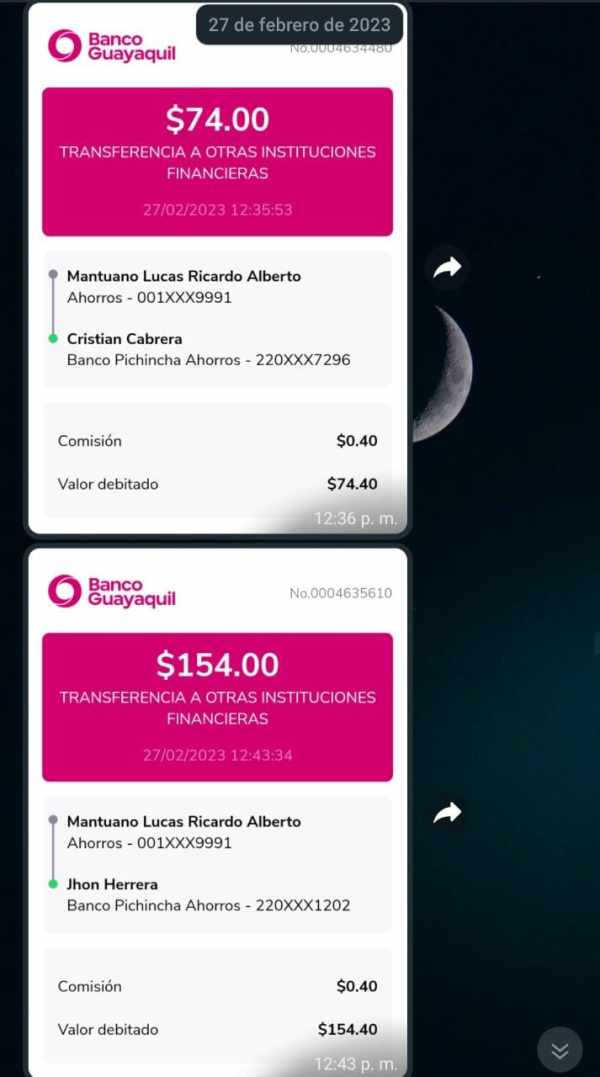

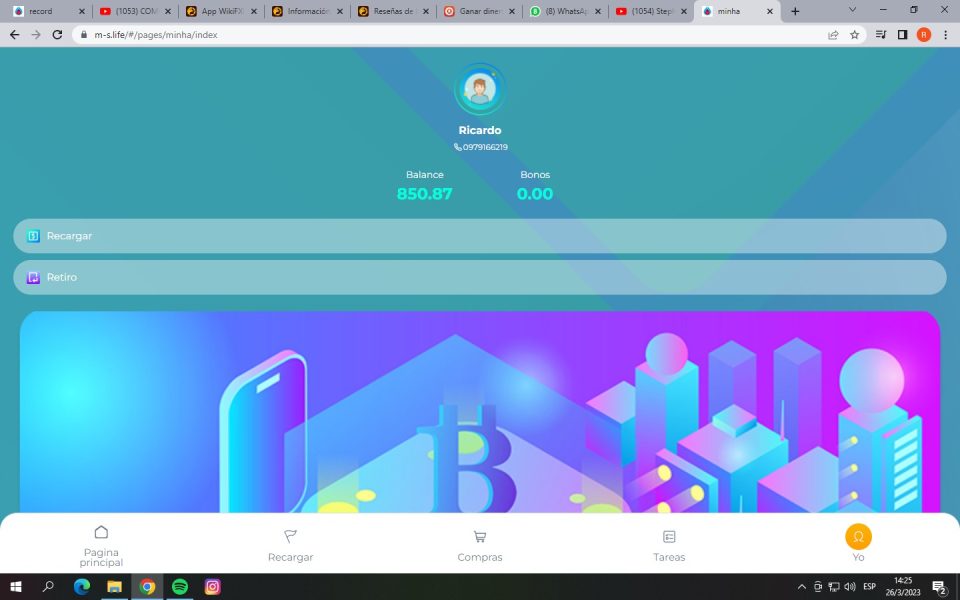

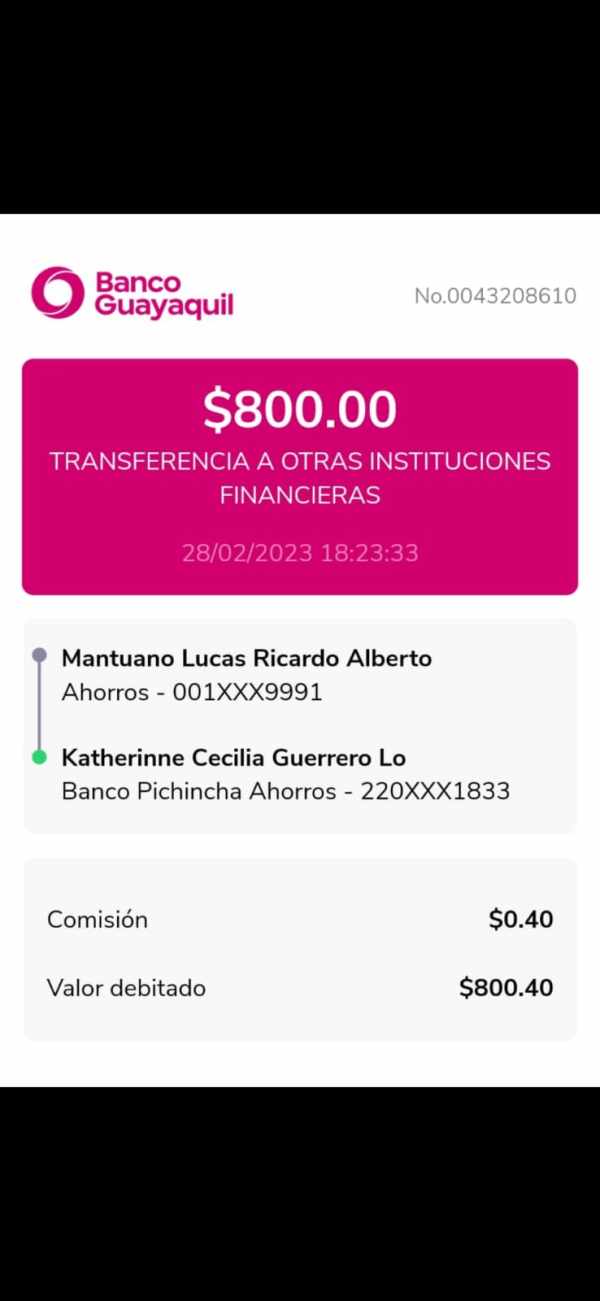

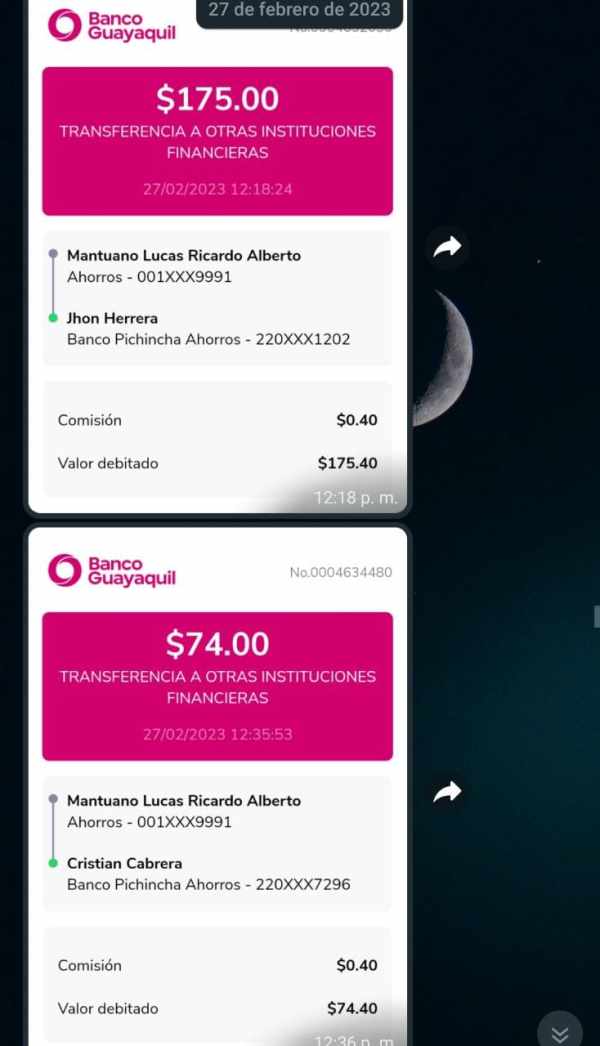

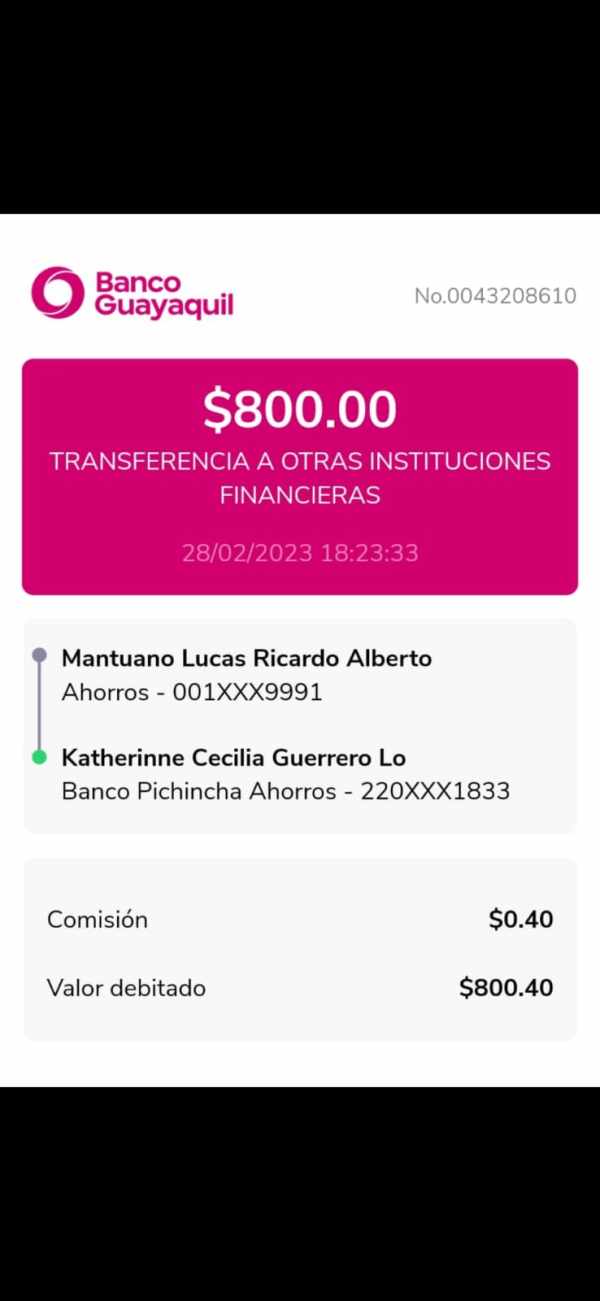

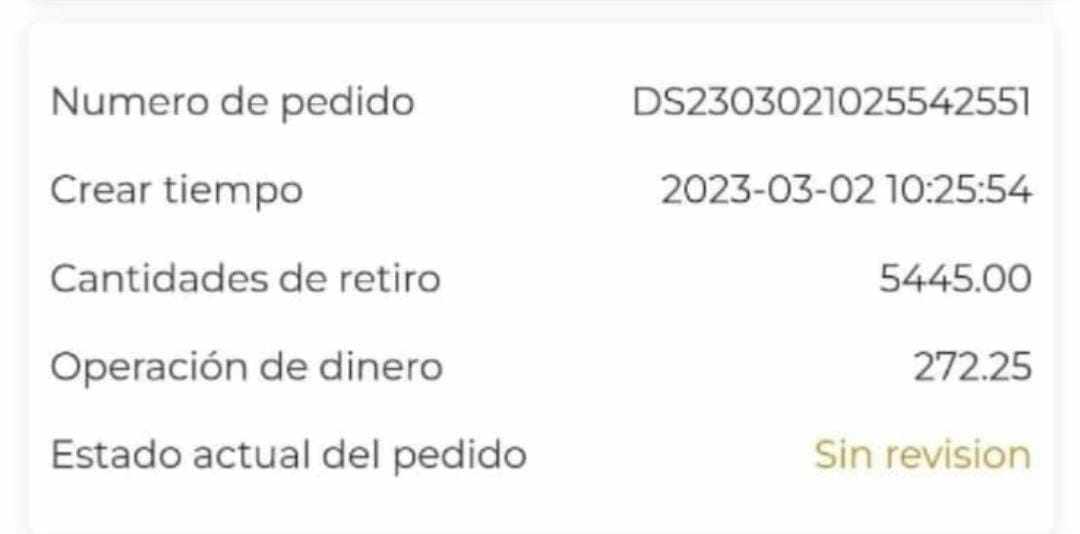

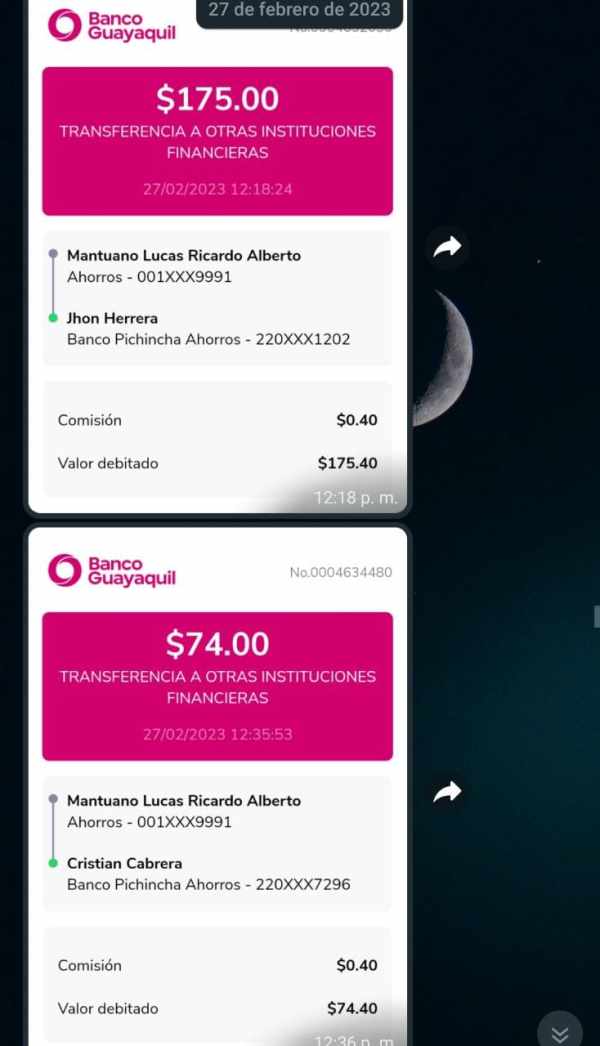

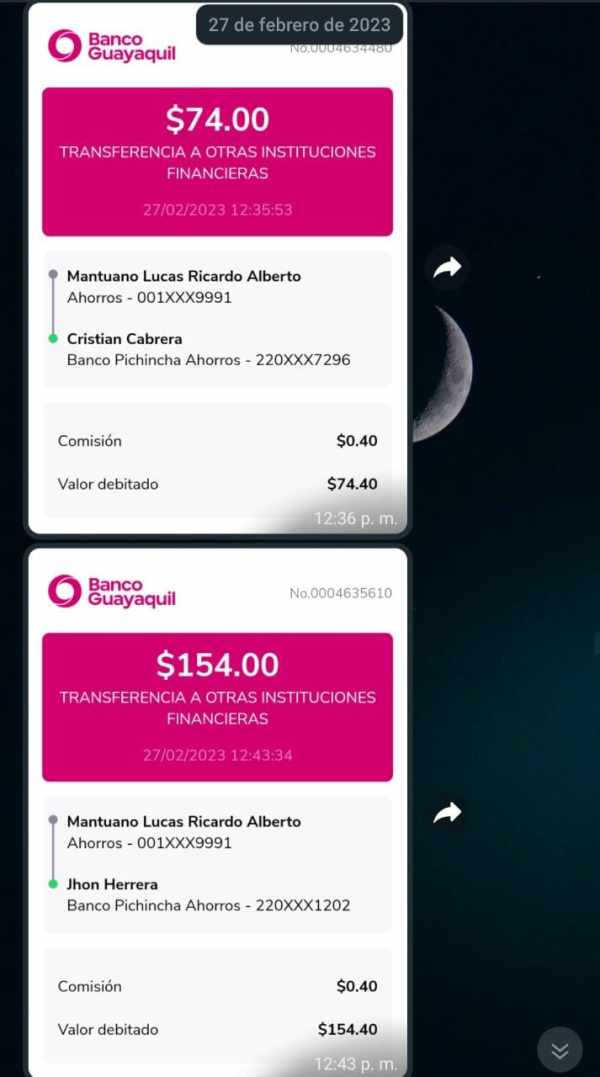

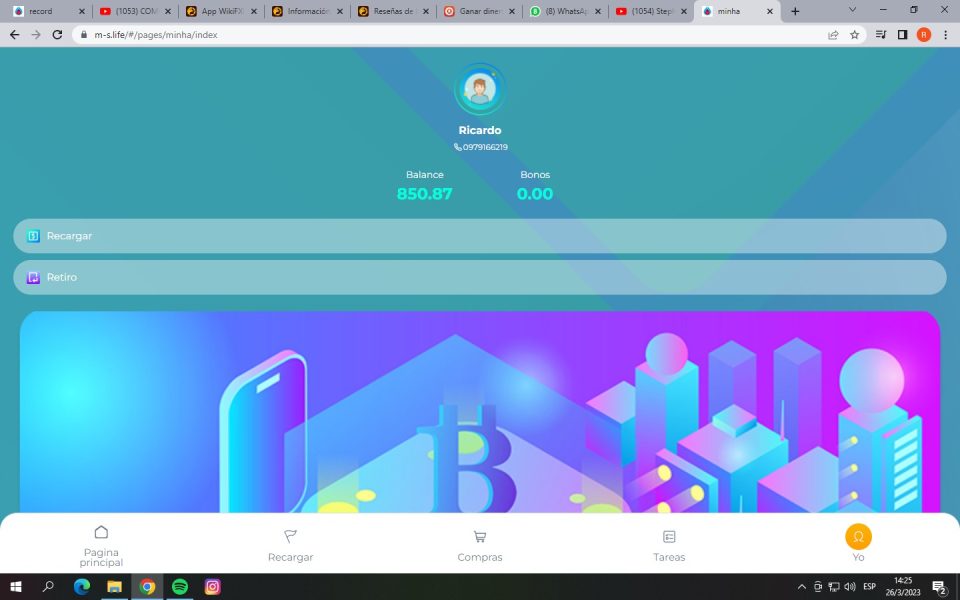

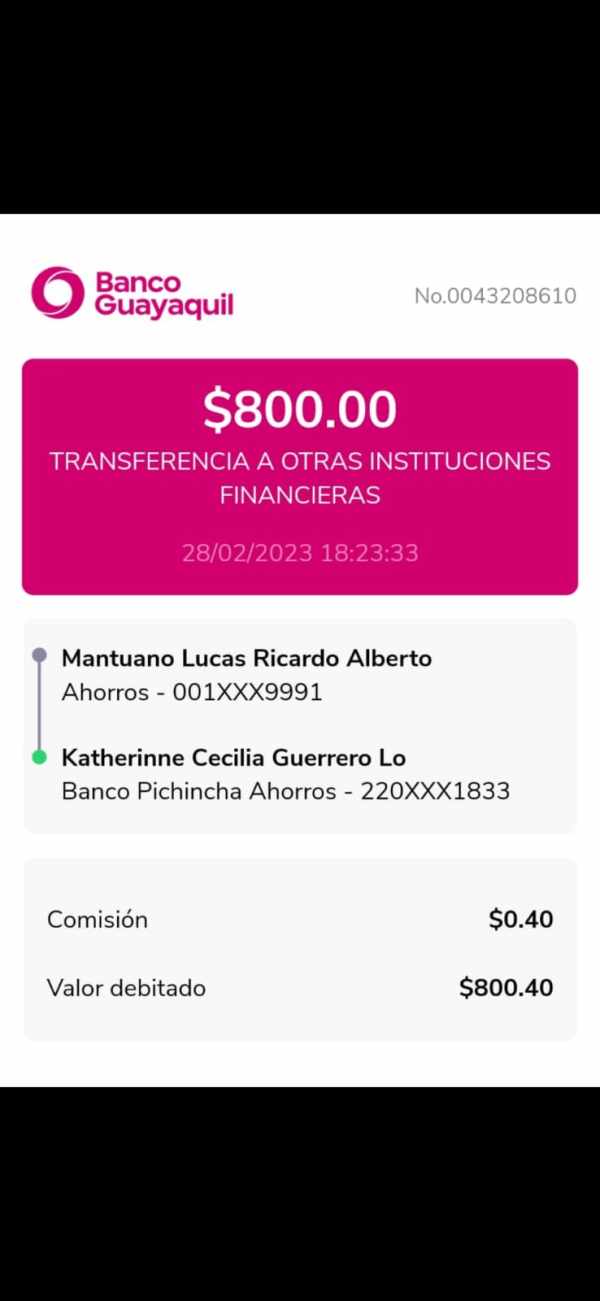

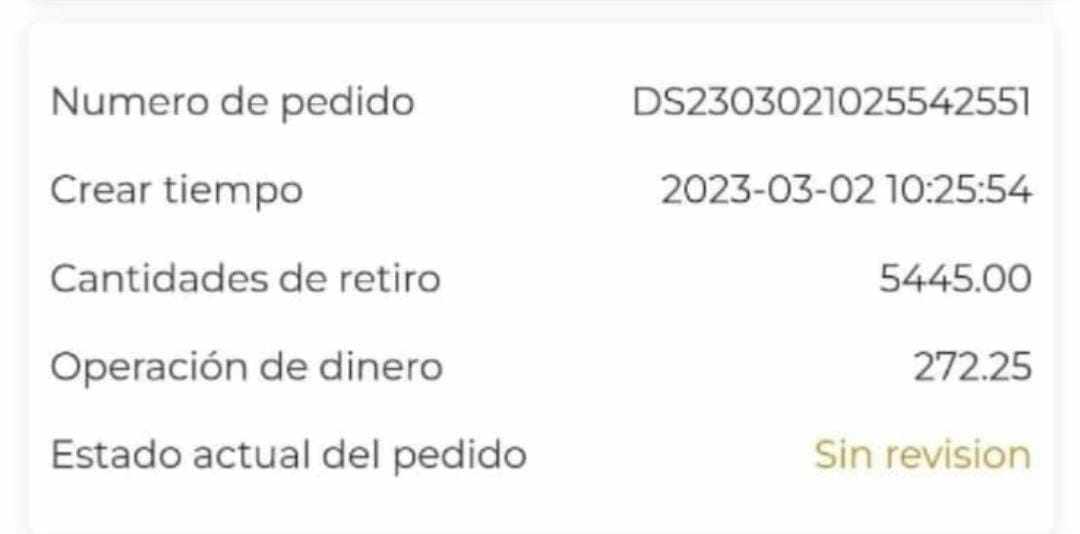

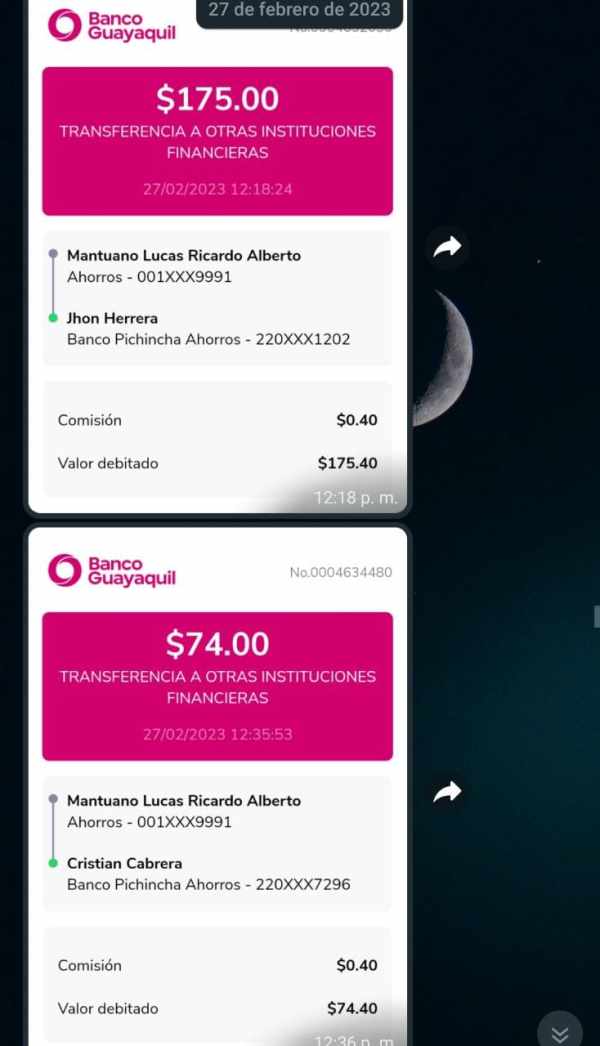

I have proof of the transfers and the site

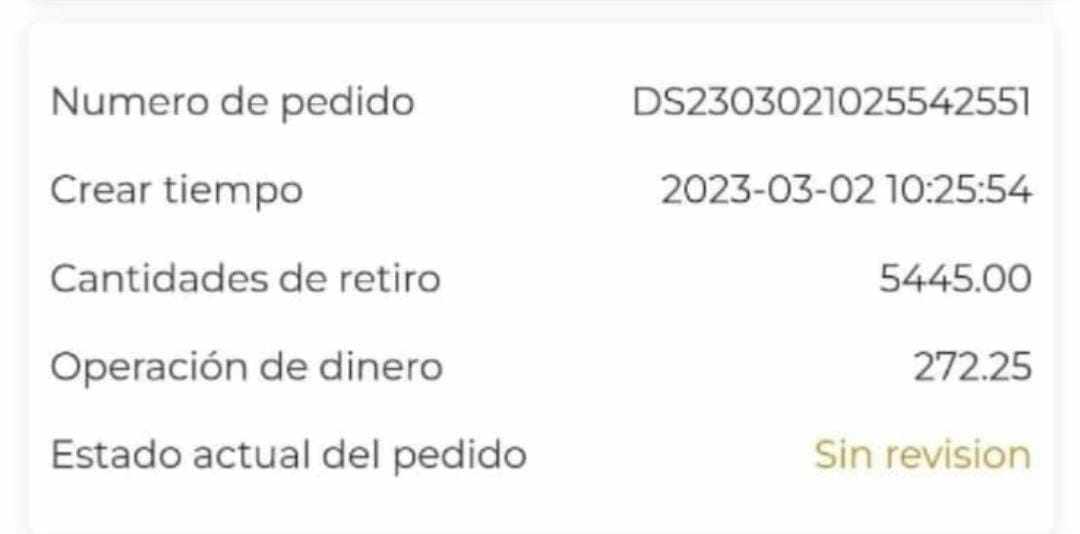

I applied for the withdrawal in October,2017. MS said that the withdrawal channel will be normal in mid-to-late April.But I haven’t received it yet. I will make an exposure on it.

MS Forex Broker provides real users with * positive reviews, * neutral reviews and 2 exposure review!

I have proof of the transfers and the site

I applied for the withdrawal in October,2017. MS said that the withdrawal channel will be normal in mid-to-late April.But I haven’t received it yet. I will make an exposure on it.

This comprehensive ms review examines Microsoft's position in 2025. We focus on the technology giant's employee satisfaction metrics and organizational performance indicators that may interest potential investors and stakeholders in the financial markets. Based on available data from employee review platforms, Microsoft demonstrates relatively strong internal performance metrics. Employees rate the company 4.2 out of 5 stars on Glassdoor based on 62,174 reviews. The compensation and benefits package receives a solid 3.9 rating according to AmbitionBox evaluations.

However, this evaluation faces significant limitations. We lack specific trading-related information, regulatory details, or financial services offerings in the available data sources. The ms review reveals that while Microsoft maintains strong employee satisfaction and corporate governance standards, crucial information regarding trading conditions, regulatory compliance for financial services, and specific investment-related offerings remains unavailable in current public assessments. This creates challenges for potential forex traders and investors seeking comprehensive evaluation of Microsoft's financial services capabilities.

The analysis targets potential investors, forex traders, and financial market participants. These groups may be considering Microsoft-related investment opportunities or services, though the limited availability of trading-specific information necessitates cautious interpretation of findings.

This ms review analysis is based on publicly available employee feedback and corporate performance data. We gathered information from platforms such as Glassdoor and AmbitionBox. The evaluation methodology relies primarily on user-generated content and third-party assessments rather than direct regulatory filings or official trading platform documentation.

Readers should note that specific regulatory information, trading conditions, and financial services details are not comprehensively covered. The available source materials do not include this information. The assessment focuses on general corporate performance indicators and employee satisfaction metrics that may provide indirect insights into operational quality and organizational stability. Regional variations in services and regulatory compliance across different jurisdictions are not detailed in the current information set. This requires additional due diligence for location-specific considerations.

| Dimension | Score | Rating Basis |

|---|---|---|

| Account Conditions | Not Rated | Specific account terms and trading conditions not detailed in available sources |

| Tools and Resources | Not Rated | Trading tools and platform resources not specified in current data |

| Customer Service | Not Rated | Customer support specifics for trading services not documented |

| Trading Experience | Not Rated | Platform performance and execution details not available |

| Trust and Reliability | Not Rated | Financial services regulatory information not provided |

| User Experience | Not Rated | Trading platform usability not covered in source materials |

Microsoft's corporate profile in 2025 reflects a well-established technology company. The company shows strong employee satisfaction metrics, though specific details regarding establishment date for financial services, trading platform operations, or brokerage activities are not detailed in the available information sources. The company maintains a robust organizational structure with significant employee engagement. This is evidenced by comprehensive review data from major employment platforms. However, the specific business model related to forex trading, investment services, or brokerage operations requires additional investigation beyond the current data scope.

The available assessment data focuses primarily on Microsoft's general corporate performance and employee satisfaction. It does not cover specialized trading platform offerings or financial services capabilities. According to employee feedback aggregated across multiple platforms, the organization demonstrates consistent operational standards and maintains competitive compensation structures. The ms review indicates that while Microsoft shows strong internal performance metrics, the specific asset classes, trading instruments, or investment products offered through any potential trading platforms are not comprehensively documented in current public evaluations.

Primary regulatory oversight, licensing jurisdictions, and compliance frameworks specific to financial services operations are not detailed. The available source materials do not include this information, creating information gaps that require direct verification with official regulatory bodies and company disclosures for complete assessment.

Regulatory Coverage: Specific regulatory jurisdictions and licensing information for financial services operations are not detailed in available source materials. This requires direct verification with relevant financial authorities and official company documentation.

Deposit and Withdrawal Methods: Available payment processing options, transaction methods, and fund transfer capabilities are not specified in current data sources. This necessitates direct platform investigation.

Minimum Deposit Requirements: Entry-level investment thresholds and account funding minimums are not documented. The accessible review materials do not include this information.

Promotional Offers: Current bonus structures, incentive programs, and promotional campaigns for trading accounts are not detailed. Available information sources do not include these details.

Tradable Assets: Specific financial instruments, currency pairs, commodities, indices, and other investment products are not comprehensively listed. Current assessment data does not include this information.

Cost Structure: Trading spreads, commission rates, overnight financing charges, and fee schedules are not detailed in available source materials. This requires direct platform verification for accurate cost analysis.

Leverage Ratios: Maximum leverage offerings and margin requirements are not specified. Current review data does not include this information.

Platform Options: Trading software choices, mobile applications, and web-based interface details are not comprehensively covered. Available sources do not provide this information.

Geographic Restrictions: Regional availability and jurisdiction-specific limitations are not detailed. Current ms review materials do not include this information.

Customer Support Languages: Multi-lingual service availability is not specified. Accessible data sources do not provide this information.

The evaluation of account conditions for Microsoft's potential trading services faces significant limitations. We lack sufficient data in available source materials. Specific account types, their distinctive features, and associated benefits are not detailed in current public assessments. The ms review cannot provide comprehensive analysis of account tier structures, premium service offerings, or specialized account categories such as Islamic trading accounts due to information gaps in accessible documentation.

Minimum deposit requirements across different account levels remain unspecified. Available sources do not include this information, preventing accurate assessment of entry barriers for potential traders. The account opening process, verification procedures, and documentation requirements are not detailed in current review materials. This creates challenges for prospective users seeking practical guidance on platform access.

User feedback regarding account setup experiences, approval timeframes, and initial funding processes is not available. The current data set does not include this information. Comparative analysis with industry standards for account conditions cannot be conducted without specific terms and conditions documentation. The absence of detailed account feature descriptions limits the ability to evaluate competitive positioning within the forex brokerage sector.

Assessment of trading tools and analytical resources faces substantial limitations. We lack specific information in available source materials. The variety and quality of trading instruments, charting capabilities, and technical analysis tools cannot be evaluated based on current data sources. Educational resources, market research provisions, and trader development programs are not detailed in accessible review materials.

Research and analysis capabilities, including market commentary, economic calendars, and expert insights, are not specified. Available documentation does not include this information. The ms review cannot assess the depth of educational content, webinar availability, or training materials due to information gaps in current sources. Automated trading support, expert advisor compatibility, and algorithmic trading capabilities remain unspecified.

Third-party tool integration, API access for custom solutions, and advanced trading features are not covered. Available assessment data does not include this information. User feedback regarding tool effectiveness, resource quality, and educational value is not documented in current review materials. This prevents comprehensive evaluation of the learning and analysis environment.

Customer service evaluation encounters significant data limitations. Specific support channel availability, response time metrics, and service quality indicators are not detailed in accessible source materials. The range of customer support options, including live chat, phone support, email assistance, and help desk capabilities, cannot be assessed based on current information.

Response time performance across different communication channels is not documented. Available review data does not include this information. Service quality metrics, problem resolution rates, and customer satisfaction scores specific to trading support are not provided in current assessment materials. Multi-language support capabilities and regional service availability remain unspecified in accessible documentation.

Customer service hours, weekend availability, and emergency support provisions are not detailed. Current sources do not include this information. User feedback regarding support experience, problem resolution effectiveness, and service representative expertise is not available in the current data set. Case studies of successful problem resolution or service quality examples cannot be provided due to information limitations in accessible materials.

Platform stability, execution speed, and overall trading environment assessment faces substantial limitations. We lack sufficient technical performance data in available sources. Order execution quality, slippage rates, and trade processing efficiency cannot be evaluated based on current information. Platform functionality, feature completeness, and trading interface quality are not detailed in accessible review materials.

Mobile trading experience, app performance, and cross-device synchronization capabilities are not specified. Available documentation does not include this information. The ms review cannot assess platform reliability during high-volatility periods or market event performance due to data limitations. Trading environment characteristics, including market depth, liquidity provision, and execution model details, remain unspecified.

User feedback regarding platform performance, execution satisfaction, and technical reliability is not documented. Current assessment materials do not include this information. Technical performance benchmarks, uptime statistics, and system stability metrics are not available in accessible sources. This prevents comprehensive evaluation of the trading technology infrastructure.

Regulatory compliance assessment encounters significant challenges. We lack specific licensing information, regulatory registration details, and oversight authority documentation in available sources. Fund security measures, client money protection protocols, and segregated account arrangements are not detailed in current review materials. Company transparency regarding financial reporting, audit procedures, and regulatory compliance status cannot be evaluated based on accessible data.

Industry reputation, regulatory standing, and professional recognition are not comprehensively covered. Available assessment sources do not include this information. Historical regulatory actions, compliance violations, or enforcement proceedings are not documented in current materials. Third-party security audits, certification standards, and data protection compliance are not specified in accessible information.

Client fund insurance, compensation schemes, and financial protection measures remain undetailed. Available sources do not include this information. User trust indicators, security breach history, and incident response procedures are not covered in current ms review materials. This limits comprehensive reliability assessment.

Overall user satisfaction metrics and experience quality indicators are not comprehensively detailed. Available source materials do not include this information. Interface design quality, navigation efficiency, and platform usability assessments cannot be conducted based on current data sources. Registration process complexity, account verification procedures, and onboarding experience details are not specified in accessible documentation.

Fund management experience, including deposit processing, withdrawal efficiency, and payment method satisfaction, is not covered. Available review materials do not include this information. Common user complaints, recurring issues, and satisfaction pain points are not documented in current assessment data. User demographic analysis and trader profile satisfaction cannot be evaluated due to information limitations.

Platform accessibility features, user interface customization options, and personalization capabilities are not detailed. Accessible sources do not include this information. Improvement recommendations based on user feedback cannot be provided due to insufficient experience data in current materials. The overall user journey assessment requires additional information beyond what is available in current review sources.

This comprehensive ms review reveals significant information limitations. These gaps prevent thorough evaluation of Microsoft's trading and financial services capabilities. While the company demonstrates strong employee satisfaction metrics with a 4.2/5 rating on Glassdoor, the absence of specific trading conditions, regulatory compliance details, and platform performance data creates substantial assessment challenges.

The evaluation suggests that potential forex traders and investors should exercise caution. They should conduct additional due diligence before engaging with any Microsoft-related trading services. The primary advantages identified include high employee satisfaction and organizational stability, while the main disadvantage lies in the lack of transparent, accessible information regarding trading operations and regulatory compliance. Further investigation through official channels and regulatory verification is recommended for comprehensive evaluation.

FX Broker Capital Trading Markets Review