Is GOLDEX safe?

Business

License

Is Goldex Safe or Scam?

Introduction

Goldex is a trading platform that primarily focuses on physical gold investments, offering a unique marketplace for retail and institutional investors. Established in 2014 and headquartered in London, Goldex aims to simplify the process of buying and selling gold by providing users with access to competitive pricing through its mobile application. In an industry where trust and security are paramount, traders must exercise caution and thoroughly evaluate their brokers. This is especially true for platforms like Goldex, where the unregulated nature of the precious metals market raises concerns about safety and legitimacy. This article investigates Goldex's credibility by analyzing its regulatory status, company background, trading conditions, customer fund security, user experiences, and overall risk profile.

Regulation and Legitimacy

The regulation of a trading platform is a crucial factor in determining its safety and trustworthiness. Goldex operates in a sector that lacks centralized regulation, which can expose traders to higher risks. The absence of robust regulatory oversight can lead to concerns about the protection of client funds and the transparency of operations. Below is a summary of Goldex's regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | United Kingdom | Unregulated |

Goldex is not regulated by any prominent financial authority, which raises significant red flags. The lack of a regulatory framework means that there are fewer safeguards in place for investors. In contrast, regulated brokers are subject to strict compliance requirements, which help ensure fair trading practices and the security of client funds. The absence of such oversight at Goldex could lead to potential issues regarding the safety of investments and the handling of customer complaints.

Company Background Investigation

Goldex Technologies Limited was founded in 2014, with the vision of creating a transparent and user-friendly platform for gold investments. The company's management team comprises professionals with backgrounds in finance and technology, which may contribute to its operational capabilities. However, the lack of detailed information regarding the ownership structure and the history of the company's compliance raises concerns about transparency. While the company claims to prioritize customer security and ethical pricing, the absence of regulatory oversight may hinder its credibility.

In terms of operational transparency, Goldex provides limited information on its website regarding its corporate governance and internal controls. This lack of information can be a red flag for potential investors, as transparency is a key indicator of a trustworthy platform. A clear understanding of a company's ownership and management structure is essential for assessing its reliability.

Trading Conditions Analysis

Goldex offers a unique trading model that emphasizes competitive pricing for gold transactions. However, its fee structure may not be entirely straightforward. The overall trading costs can significantly impact a trader's profitability, and understanding these costs is crucial for making informed decisions. Below is a comparison of Goldex's core trading costs:

| Fee Type | Goldex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | 0.75% per transaction | 0.1% - 0.5% |

| Overnight Interest Range | N/A | Varies by broker |

Goldex charges a commission of 0.75% per transaction, which is relatively high compared to the industry average. This can be a potential drawback for frequent traders, as these fees can accumulate quickly. Moreover, the lack of transparency regarding spreads and overnight interest rates may leave traders uncertain about their total trading costs. This uncertainty could lead to unexpected financial implications, raising concerns about whether Goldex is truly safe for trading.

Client Fund Security

Client fund security is a paramount concern for any trading platform, and Goldex claims to implement several measures to protect its users' investments. The company states that it maintains a strict separation of client funds from its operational funds, which is a positive aspect in terms of safeguarding assets. However, it is essential to investigate the specifics of these security measures.

Goldex asserts that all client funds are held in trust accounts, which means that in the event of insolvency, clients' funds should be protected from creditors. This is an important feature that can enhance the safety of investments. Additionally, Goldex claims to provide secure storage options for physical gold, with insurance coverage in place to protect against theft or loss.

Despite these claims, the absence of regulatory oversight raises questions about the effectiveness of these security measures. Without a regulatory body to enforce compliance with industry standards, the actual implementation of these security protocols remains uncertain. Traders must weigh these factors carefully when considering whether to engage with Goldex, as the potential for fund security issues could pose a significant risk.

Customer Experience and Complaints

Customer feedback is a critical component in assessing the reliability of a trading platform. Reviews of Goldex reveal a mixed bag of experiences. While some users appreciate the platform's ease of use and accessibility, others have raised concerns about the quality of customer support and the handling of complaints. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| High Fees | Medium | Limited explanation |

| Platform Stability Issues | High | Unresolved |

Many users have reported experiencing delays in withdrawing their funds, which can be a significant concern for traders. The slow response from customer support in addressing these issues further exacerbates the situation, leading to frustration among clients. Additionally, some traders have expressed dissatisfaction with the high fees associated with trading on the platform, indicating a lack of transparency in the fee structure.

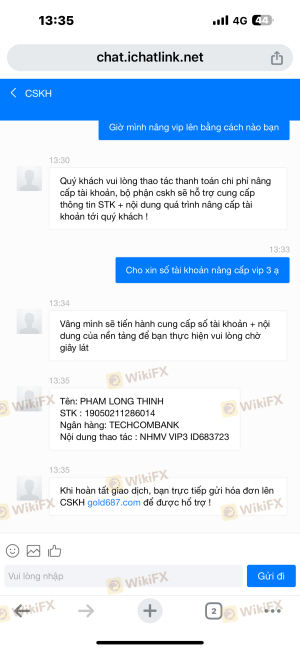

In one notable case, a user reported being unable to withdraw their funds after multiple requests, leading to concerns about the platform's reliability. Such incidents can tarnish a broker's reputation and raise questions about its overall safety. It is crucial for potential investors to consider these experiences when evaluating whether Goldex is a safe option.

Platform and Trade Execution

The performance of a trading platform is crucial for a seamless trading experience. Goldex's mobile application is designed to provide users with 24/7 access to the gold market, allowing for real-time trading. However, the platform's stability and execution quality have come under scrutiny. Users have reported instances of slippage and order rejections, which can hinder trading performance and lead to losses.

While Goldex aims to offer a user-friendly experience, any signs of platform manipulation or execution issues can significantly impact traders' trust. The lack of robust regulatory oversight further complicates this issue, as there is no independent body ensuring that the platform operates fairly and transparently. Traders must remain vigilant and consider these factors when assessing whether Goldex is truly safe for their trading activities.

Risk Assessment

Engaging with a trading platform like Goldex comes with inherent risks that traders must consider. Below is a summary of the key risk areas associated with using Goldex:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated platform increases risk |

| Fund Security Risk | Medium | Claims of fund protection but lacks oversight |

| Customer Service Risk | High | Reports of slow response and withdrawal issues |

The regulatory risk associated with Goldex is particularly concerning, as the absence of oversight can lead to potential issues regarding the safety of client funds. Additionally, while the company claims to implement security measures, the lack of external verification raises questions about their effectiveness.

Traders should consider implementing risk mitigation strategies, such as starting with a smaller investment and continuously monitoring their trading activities. Being aware of the risks involved can help traders make informed decisions and protect their investments.

Conclusion and Recommendations

In conclusion, the investigation into Goldex raises several concerns regarding its safety and reliability as a trading platform. The lack of regulatory oversight, combined with reports of customer service issues and high fees, suggests that traders should approach this platform with caution. While Goldex offers a unique marketplace for gold investments, the potential risks associated with its unregulated status cannot be overlooked.

For traders seeking safety and security, it may be prudent to consider alternative platforms that are regulated by reputable financial authorities. Some reliable alternatives include brokers with strong regulatory frameworks, transparent fee structures, and positive customer feedback. Ultimately, potential investors must weigh the evidence presented in this article and make informed decisions regarding their trading activities with Goldex.

In summary, while Goldex presents an innovative approach to gold trading, the absence of robust regulatory oversight and mixed customer experiences indicate that traders should remain vigilant. The question "Is Goldex safe?" remains open, and potential users should conduct thorough research and consider their risk tolerance before engaging with the platform.

Is GOLDEX a scam, or is it legit?

The latest exposure and evaluation content of GOLDEX brokers.

GOLDEX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GOLDEX latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.